Best Home Insurance for Landlords in 2026

Nationwide, Liberty Mutual, and State Farm have the best home insurance for landlords. Get landlord insurance for as low as $148 a month, with tailored rental property protection and dwelling coverage up to $1 million. Landlords can also save up to 20% through bundling and security system discounts.

Read more Secured with SHA-256 Encryption

Save Money by Comparing Insurance Quotes

Compare Free Home Insurance Quotes Instantly

Table of Contents

Table of Contents

Insurance Copywriter

Malory Will has an M.A. in English from Arizona State University. She has over four years of experience in writing for the insurance industry. With a background in health, auto, life, and homeowners insurance, Malory is passionate about making complex insurance topics clear and approachable. Her goal is to help readers make informed decisions with confidence.

Malory Will

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Scott Young

Mortgage Loan Originator

Steve Crowell is a New Hampshire based mortgage loan originator with Luminate Home Loans, Inc. After graduating from the University of New Hampshire in 2003 with a BS in Business and Economics and a BA in History, he went on to get his broker license in 2005. In 2021, he was recognized as a Luminate Home Loans “Circle of Excellence” top agent. Steve works as a trusted resource for clients w...

Steve Crowell

Updated October 2025

The best home insurance for landlords comes from Nationwide, Liberty Mutual, and State Farm. Nationwide earns the top spot for its strong coverage options, starting as low as $151 a month.

- Landlord home insurance rates start at $148 per month

- The best landlord insurance includes up to $1M in coverage

- Save up to 20% with security systems and multi-property discounts

Monthly premiums for landlord policies start at $148 with Geico, but costs vary based on dwelling value, landlord age, credit score, and landlord insurance provider.

Liberty Mutual stands out for instant quotes and 12% security discounts, while State Farm provides property management support, $1M dwelling coverage, and up to 20% in bundling savings.

Top 10 Companies: Best Home Insurance for Landlords| Company | Rank | Claims Satisfaction | Security Discount | Best for |

|---|---|---|---|---|

| #1 | 728 / 1,000 | 10% | Legal Coverage | |

| #2 | 717 / 1,000 | 12% | Instant Quotes |

| #3 | 710 / 1,000 | 9% | Property Management | |

| #4 | 706 / 1,000 | 15% | Rental Units | |

| #5 | 692 / 1,000 | 7% | Online Simplicity | |

| #6 | 692 / 1,000 | 5% | New Properties |

| #7 | 691 / 1,000 | 8% | Liability Protection | |

| #8 | 687 / 1,000 | 10% | Digital Claims | |

| #9 | 684 / 1,000 | 9% | Custom Policies | |

| #10 | 672 / 1,000 | 8% | Budget Flexibility |

By comparing quotes across providers, landlords can secure tailored protection for single properties, multi-unit rentals, or larger investment portfolios.

Secure the cheapest home insurance for landlords by entering your ZIP code into our free quote comparison tool.

The Best Home Insurance Rates for Landlords

Landlord insurance premiums rise steadily as coverage amounts increase. Some insurers keep rate jumps minimal across coverage levels, while others see more noticeable spikes at higher dwelling values.

Nationwide and State Farm offer cheap homeowners insurance for landlords, starting at $151. However, rates can increase by $200 monthly for higher levels of coverage.

Landlord Home Insurance Monthly Rates by Dwelling Coverage| Company | $200K | $300K | $500K | $1M |

|---|---|---|---|---|

| $155 | $181 | $222 | $350 | |

| $150 | $176 | $214 | $340 |

| $153 | $179 | $218 | $345 | |

| $148 | $172 | $210 | $330 | |

| $156 | $183 | $225 | $355 |

| $151 | $177 | $216 | $342 | |

| $149 | $174 | $212 | $335 | |

| $154 | $178 | $219 | $348 | |

| $152 | $175 | $215 | $338 | |

| $157 | $184 | $227 | $360 |

The differences become clearer at $1M in coverage. Geico remains the lowest at $330 per month, while Travelers climbs to $360, showing how provider choice can significantly impact costs for high-value landlord insurance for rental properties.

These rate structures also reflect how insurers approach landlord risk, balancing dwelling protection with liability and rental income safeguards.

Landlords should carry home insurance with at least $200K in dwelling coverage, strong liability protection, and loss of rental income coverage to stay fully protected.

Kristen Gryglik Licensed Insurance Agent

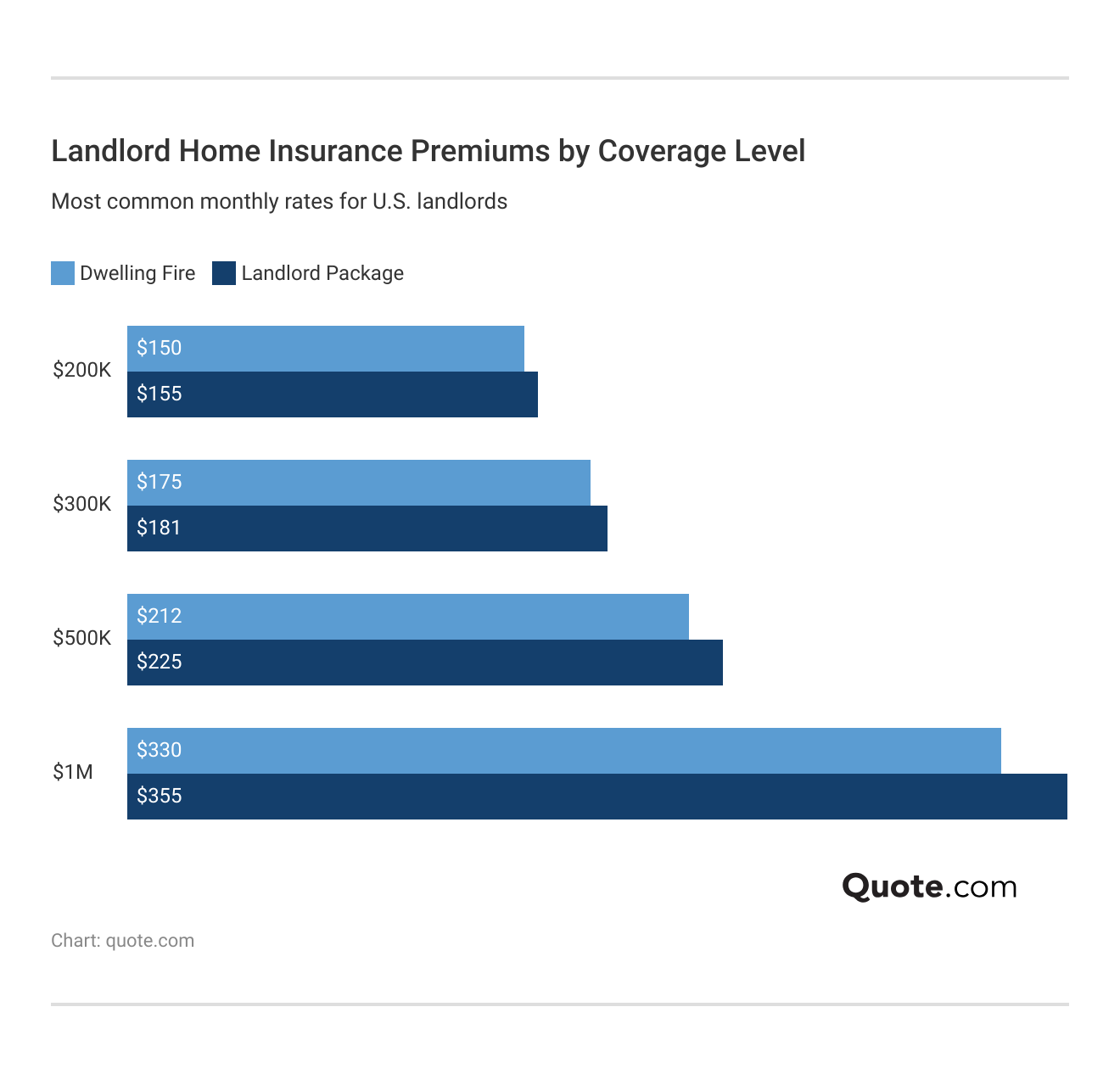

Premiums for landlord insurance rise with higher dwelling values, and the chart highlights how dwelling fire coverage compares with a full landlord package (Learn More: Understanding the 8 Types of Homeowners Insurance Policies).

Dwelling fire coverage is the cheaper option, focused on structural damage. Landlord packages include rental income protection and liability coverage, making them a more complete solution despite the higher monthly cost.

At lower coverage levels, the price gap between the two policies is small, with only a $5 monthly difference at $200K. However, that difference grows to $25 a month between dwelling fire and landlord packages for $1 million policies.

Although landlord insurance packages may cost a bit more, but for owners of larger properties, the extra protection is often well worth the price.

Landlord Age Impact on Home Insurance Rates

Age has a clear impact on the cost of home insurance for landlords. Younger landlords in their 30s pay the highest monthly premiums, with rates starting at $160 with Geico and reaching up to $168 with Travelers.

By age 40, costs drop to their lowest point, with Geico, one of the best landlord insurance companies, offering rates at $148 per month. This age group typically receives the most favorable pricing from insurers.

Landlord Home Insurance Monthly Rates by Provider & Age| Company | Age: 30 | Age: 40 | Age: 50 | Age: 60 |

|---|---|---|---|---|

| $165 | $155 | $160 | $168 | |

| $162 | $150 | $155 | $163 |

| $164 | $153 | $158 | $166 | |

| $160 | $148 | $153 | $161 | |

| $167 | $156 | $162 | $170 |

| $163 | $151 | $157 | $165 | |

| $161 | $149 | $155 | $163 | |

| $165 | $154 | $160 | $168 | |

| $163 | $152 | $158 | $166 | |

| $168 | $157 | $163 | $171 |

Premiums begin to rise again for landlords in their 50s and 60s, as insurers factor in income stability and long-term property management concerns. For example, Geico increases from $148 at age 40 to $161 at age 60.

Knowing how rates change with age can help landlords plan ahead and choose the best homeowners insurance companies to lock in affordable coverage.

Landlord Credit Score Impact on Home Insurance Rates

Your credit score directly affects what you pay for home insurance for landlords. Excellent credit can keep rates between $148 and $157 a month, while poor credit can push them above $200.

Insurers use credit to measure financial reliability, and landlords with lower scores are seen as having a higher risk for missed payments or claims.

Landlord Home Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670–799) | Fair (580–669) | Poor (<580) |

|---|---|---|---|---|

| $155 | $168 | $189 | $215 | |

| $150 | $165 | $186 | $212 |

| $153 | $168 | $190 | $216 | |

| $148 | $162 | $182 | $207 | |

| $156 | $170 | $193 | $219 |

| $151 | $166 | $187 | $211 | |

| $149 | $163 | $184 | $209 | |

| $154 | $169 | $192 | $218 | |

| $152 | $167 | $188 | $213 | |

| $157 | $172 | $194 | $220 |

Geico charges $148 per month for landlords with excellent credit, but rates rise to $207 a month for bad credit. That jump is bigger with Liberty Mutual, where landlords with bad credit pay nearly $70 more per month for the same coverage.

This means maintaining good credit saves money each month and can cut annual costs by more than $700 compared to having poor credit.

Read More: How to File a Home Insurance Claim After a Wildfire

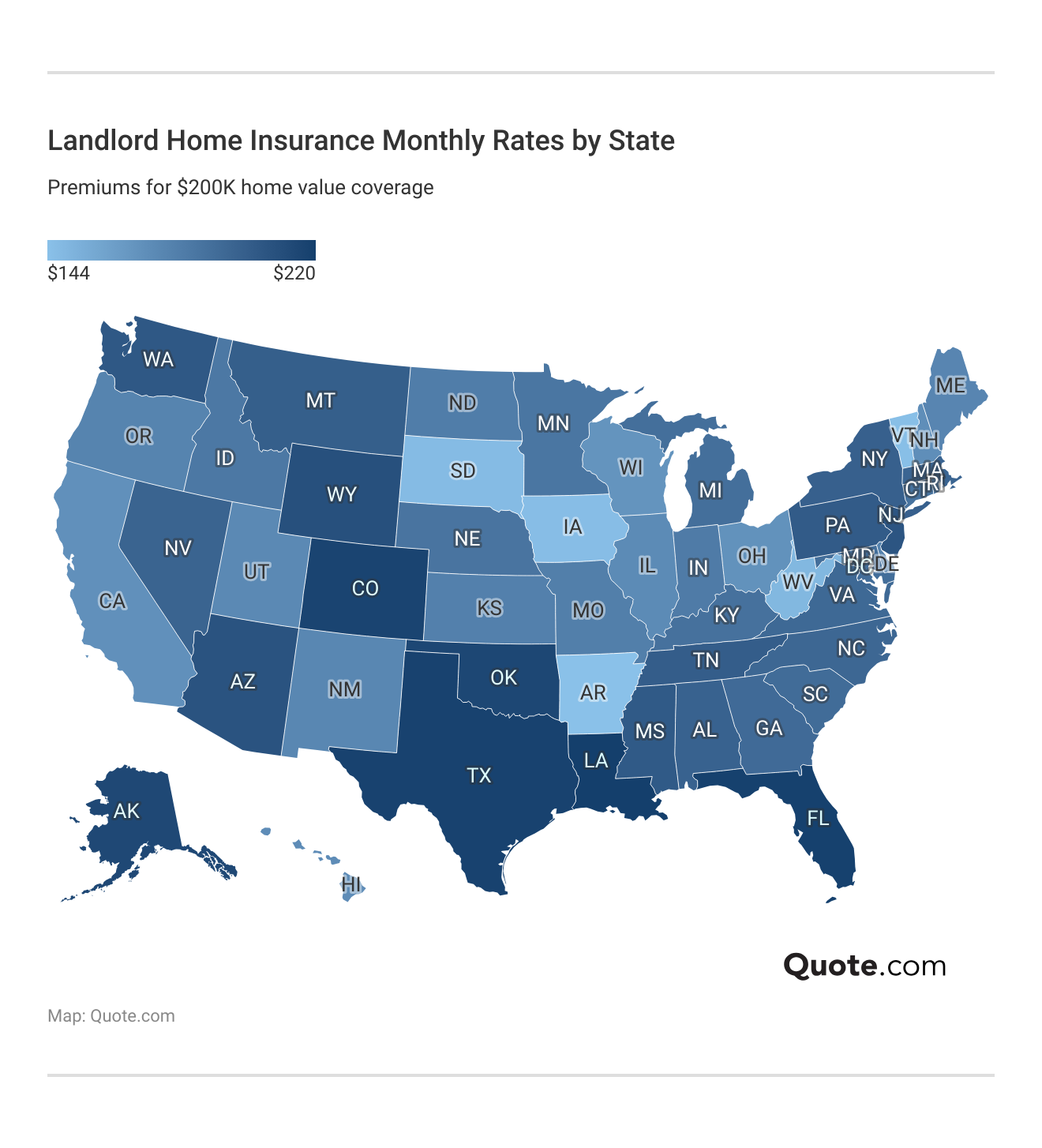

Location Impact on Home Insurance Costs for Landlords

Areas with high risks of hurricanes, floods, or severe weather drive up landlord costs because rental properties are more likely to face damage and claims.

Meanwhile, states with fewer natural disasters and lower liability risks keep rates lower, giving landlords in those regions cheaper options.

Monthly premiums for $200K in coverage start as low as $144 in states like South Dakota and Iowa and climb above $220 a month in states such as Texas, Florida, and Louisiana.

For property owners managing rentals in high-risk states, these higher costs make it even more important to compare insurers and take advantage of discounts to control expenses.

Learn how to estimate home insurance costs based on where you live for more accurate quotes.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Home Insurance Policy Options for Landlords

Home insurance for landlords is designed specifically for rental properties, offering protection beyond a standard homeowners policy.

Since landlords face risks tied to both the building itself and tenant-related issues, these policies include several important coverages.

- Dwelling Coverage: Protects the rental home itself, paying for repairs or rebuilding if it is damaged by fire, wind, or other covered events.

- Liability Coverage: Covers legal fees and medical expenses if a tenant or visitor is injured on the rental property.

- Loss of Rental Income: Reimburses landlords if the property becomes uninhabitable after a covered claim and tenants cannot pay rent.

- Landlord’s Personal Property: Protects items the landlord owns in the rental, such as appliances, tools, or maintenance equipment.

- Optional Add-Ons: Extra coverage for risks like vandalism, theft, or floods can be added to strengthen landlord protection.

By choosing the right home insurance coverage for their properties, landlords can safeguard their rental homes, reduce financial risks, and ensure a steady income even when unexpected events occur.

Whether you rent out multiple properties or rent out a room in your home, shop around with multiple companies to find the best landlord insurance provider with the right policy for you.

Ways to Save on Home Insurance for Landlords

Homeowners insurance for landlords can be costly, but insurers reward owners who lower the risk with discounts for specific features.

Typical discounts on home insurance for landlords include bundling policies, installing security systems, energy-efficient upgrades, and insuring newly built properties. These savings help lower monthly premiums without cutting into important coverage.

Top Home Insurance Discounts for Landlords| Company | Bundling | Green Home | New Home | Security System |

|---|---|---|---|---|

| 15% | 5% | 5% | 8% | |

| 10% | 5% | 6% | 5% |

| 12% | 5% | 8% | 15% | |

| 18% | 6% | 4% | 7% | |

| 14% | 5% | 5% | 12% |

| 11% | 7% | 7% | 10% | |

| 16% | 6% | 9% | 8% | |

| 19% | 6% | 6% | 10% | |

| 20% | 5% | 6% | 9% | |

| 13% | 4% | 4% | 9% |

The biggest savings come from bundling discounts, with State Farm offering up to 20%, followed closely by Safeco at 19% and Geico at 18%.

Discounts for security systems are also significant, with Farmers giving landlords up to 15% off and Liberty Mutual offering 12%, rewarding owners who invest in added protection.

Landlords with new or recently renovated properties can qualify for additional savings of up to 10%, particularly with Progressive and American Family. Energy-efficient or green home improvements can also reduce premiums, with most insurers offering 4% to 7% savings in this category.

Beyond discounts, landlords can take practical steps to keep insurance costs down. These strategies focus on reducing property risks and maintaining stable coverage at lower monthly premiums.

- Choose a Higher Deductible: Selecting a higher deductible reduces monthly landlord home insurance costs, especially if you only file claims for major damages rather than minor repairs.

- Keep Claims History Clean: Avoid filing small claims and handle minor fixes out of pocket, since frequent claims can cause insurers to raise your landlord insurance premiums.

- Upgrade Property Safety: Improvements like fire-resistant roofing, storm shutters, and water leak detectors lower the chance of damage, making your rental property safer and less costly to insure.

- Regularly Update Property Values: After renovations or market changes, reassessing your rental property’s value ensures you’re not paying for more coverage than you need.

- Maintain Rental Properties Well: A properly maintained rental home faces fewer risks of accidents or damage, and insurers often reward landlords who show consistent upkeep with better rates.

Smaller but still valuable savings come from green home upgrades and loyalty reward programs, which typically lower rates by 5% to 12% depending on the insurer.

By combining discounts with smart property management strategies, landlords can cut insurance costs while still keeping strong protection in place for both their rental homes and their income.

Read More: How much homeowners insurance do you need?

Top Home Insurance Companies for Landlords

Knowing the advantages and disadvantages of each insurer is key to finding the right landlord home insurance. The top companies differ in rates, discounts, and coverage features, so landlords should compare carefully before choosing.

See how each provider stands out so you can select the best fit for your rental property needs (Read More: Is home insurance required?)

#1 – Nationwide: Top Overall Pick

Pros

- Legal Coverage Strength: Nationwide offers strong legal protection, helping landlords handle tenant disputes and liability claims.

- Affordable Minimum Rates: Nationwide landlord insurance starts at $151 per month for $200K coverage, keeping costs manageable.

- Top Claims Satisfaction: Its claims satisfaction score of 728/1,000 gives landlords confidence that payouts will be handled quickly and fairly. Our Nationwide insurance review shows why it ranks well for claims.

Cons

- Average Security Discount: Nationwide provides only a 10% security discount, leaving landlords with fewer savings compared to Farmers.

- Slightly Higher Large Premiums: At $342 a month for $1M in coverage, Nationwide is still competitive but slightly higher than Geico’s $330 monthly rate for landlords insuring high-value rentals.

#2 – Liberty Mutual: Best for Instant Quotes

Pros

- Quick Policy Setup: Instant quotes make it easy for landlords to insure new rental units. Check our Liberty Mutual insurance review to see how quickly it provides a quote.

- Minimum Rate Value: Coverage for landlords starts at $156 per month for $200K, balancing price with quick coverage.

- Security Savings Boost: Liberty Mutual landlord insurance offers up to 12% off with security systems, which rewards landlords who install monitored protection systems.

Cons

- High Large Premiums: At $355 a month for $1M, Liberty Mutual becomes costly for landlords insuring high-value properties.

- Weak Loyalty Discount: With only a 6% loyalty discount, landlords receive fewer long-term benefits compared to other providers.

#3 – State Farm: Best for Property Management

Pros

- Property Support Options: State Farm landlord insurance policies are tailored for tenant-related risks and liability needs. Our State Farm insurance review details why it ranks high with homeowners.

- Low Coverage Rates: Minimum landlord insurance costs start at $152 per month for $200K, with up to 20% in bundling discounts.

- Large Agent Network: State Farm has one of the largest agent networks in the U.S., making it easier for landlords with properties across states.

Cons

- Limited Online Tools: Digital options are less advanced, which can affect landlords managing rentals remotely.

- Higher Large Rates: At $338 per month for $1M coverage, State Farm landlord insurance is more expensive than Geico.

#4 – Farmers: Best for Rental Units

Pros

- Multi-Unit Coverage: Farmers landlord insurance works best for insuring multiple rental units under one policy. Our Farmers Insurance review explains how this policy works.

- Competitive Entry Rates: Farmers starts at $153 per month for $200K coverage, which is budget-friendly for new landlords entering the rental property market.

- Top Security Savings: With up to 15% discounts for security systems, Farmers rewards landlords who take proactive steps to protect rental homes from break-ins and damage.

Cons

- Lower Claims Score: Farmers scores 706/1,000 for claims satisfaction, which is below several competitors, raising concerns for landlords who rely on smooth claims handling.

- Costlier Large Policies: At $345 per month for $1M coverage, Farmers landlord insurance can increase costs for high-value rentals.

#5 – Geico: Best for Online Simplicity

Pros

- Digital Policy Tools: Geico makes it easy for landlords to manage insurance online. Explore the Geico insurance review to see options for luxury properties.

- Lowest Minimum Rates: Geico has the cheapest landlord insurance, starting at $148 per month for $200K coverage, making it the best choice for landlords on a budget.

- Affordable Large Coverage: At $330 per month for $1M coverage, Geico landlord insurance is the most affordable provider with high-value rentals.

Cons

- Small Security Discount: Geico only offers a 7% discount for security systems, leaving landlords with fewer savings than Farmers or Liberty Mutual.

- Limited Local Support: With its online-first model, landlords wanting in-person service may find Geico less convenient compared to State Farm or Nationwide.

#6 – American Family: Best for New Properties

Pros

- New Home Savings: American Family landlord insurance offers up to 10% off for newly built or recently renovated properties.

- Portfolio Coverage Ease: Ideal for landlords managing multiple rentals under one home insurance policy. Our American Family Insurance review shows why many trust its property protection.

- Budget-Friendly Rates: Minimum coverage for landlords begins at $150 per month for $200K coverage, keeping costs lower than most competitors.

Cons

- Low Security Discount: At just 5%, AmFam offers one of the smallest security discounts, limiting landlords’ ability to save with upgraded property protection.

- Claims Score Lag: At 692/1,000, American Family ranks below top competitors, which could affect landlords needing reliable claims support.

#7 – Allstate: Best for Liability Protection

Pros

- Strong Liability Cover: Allstate protects landlords from tenant injury lawsuits and related claims. Check the Allstate insurance review to see how it compares on premium costs.

- Competitive Entry Rates: Starting at $155 per month for $200K coverage, Allstate landlord insurance balances price and strong coverage.

- Bundling Discount Option: Landlords can save up to 15% by bundling their landlord policies with auto or life insurance, increasing affordability.

Cons

- High Large Premiums: At $350 per month for $1M coverage, Allstate costs more than competitors like Geico or Nationwide for landlords.

- Average Claims Score: With 691/1,000 for claims satisfaction, Allstate falls slightly behind competitors, which may impact landlord trust in claim reliability.

#8 – Safeco: Best for Digital Claims

Pros

- Online Claims Ease: Safeco simplifies the process for landlords filing and tracking claims. Read our Safeco insurance review to see how easy to file claims.

- Competitive Base Rates: Minimum landlord coverage starts at $154 per month for $200K, keeping Safeco affordable for smaller properties.

- Bundling Discount Value: With up to 19% savings, landlords benefit significantly when combining multiple Safeco policies.

Cons

- Limited Agent Access: Safeco’s smaller agent network may not be ideal for landlords managing multiple rentals who prefer in-person help.

- Higher Large Rates: At $348 for $1M coverage, Safeco costs more than cheaper competitors like Geico or Nationwide.

#9 – Travelers: Best for Custom Policies

Pros

- Custom Coverage Flex: Travelers lets landlords add endorsements for theft, vandalism, and equipment breakdowns. Our Travelers insurance review breaks down what makes their policies stand out.

- Reasonable Entry Rates: Travelers landlord insurance starts at $157 per month for $200K coverage, making it an accessible choice.

- Bundling Discount Help: Landlords can save up to 13% when bundling, adding value for those with multiple policies.

Cons

- Higher Starting Costs: At $157 per month, Travelers is pricier than Geico’s $148 for landlords with the same minimum coverage.

- Weak Security Savings: With only a 9% discount, Travelers offers less incentive for landlords to add property security systems.

#10 – Progressive: Best for Budget Flexibility

Pros

- Flexible Policy Options: Progressive gives landlords customizable coverage and payment plans. Delve into our guide, Progressive insurance review, to see how it handles customizable coverage.

- Low Minimum Rates: Landlord coverage begins at $149 per month for $200K coverage, making it competitive for cost-focused property owners.

- Good Bundling Value: Progressive landlord insurance provides up to 16% off for bundling, giving landlords more ways to lower costs.

Cons

- Moderate Large Rates: At $335 for $1M coverage, Progressive is more expensive than Geico for landlords with high-value properties.

- Lowest Claims Score: Progressive ranks lowest of the group at 672/1,000, raising concerns for landlords who prioritize strong claims support.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Find the Best Home Insurance for Landlords

The best home insurance for landlords should protect your rental property fully without costing more than necessary. Nationwide stands out for landlords who want legal coverage included in their policies, helping with tenant disputes and liability issues.

Geico appeals to budget-conscious landlords with the lowest minimum rates at $148 per month for $200K in coverage, while State Farm provides peace of mind with strong property management support and discounts of up to 20% for bundling policies.

To choose the right landlord policy, start by deciding how much coverage you need for the dwelling, liability, and lost rental income. Then, compare homeowners’ insurance quotes online to see which company offers the best mix of price and features for your property.

Protecting your home doesn’t have to be expensive. Enter your ZIP code into our free tool to find affordable homeowners insurance today.

Frequently Asked Questions

What insurance is best for landlords?

The best homeowners insurance for landlords is a dedicated landlord policy that covers the dwelling, liability, and lost rental income. Unlike standard homeowners insurance, it is built to protect rental properties and landlord risks.

Who is the best landlord insurance provider?

Top companies for home insurance for landlords include Nationwide, Liberty Mutual, and State Farm. Nationwide is strong for legal coverage, Liberty Mutual offers instant landlord insurance quotes, and State Farm provides up to 20% bundling discounts.

How much insurance should a landlord have?

Landlords should have enough insurance to fully cover the replacement cost of the property, liability protection of at least $300,000, and loss of rental income to ensure financial security in case the home becomes uninhabitable.

Who has the cheapest home insurance for landlords?

Geico provides the cheapest home insurance for landlords, with minimum coverage starting at $148 per month for $200K in coverage. Progressive and American Family also offer affordable entry-level rates. Compare State Farm vs. Farmers, Geico, Progressive, and Allstate for more quotes.

Is landlord insurance cheaper than regular homeowners insurance?

Home insurance for landlords is usually more expensive than homeowners insurance. Insurers charge more because rentals carry higher risks, including tenant damage and landlord liability.

How much is home insurance for landlords?

On average, home insurance for landlords costs $148 to $220 per month, depending on property value, state, landlord age, and credit score. Secure cheap insurance for your home by entering your ZIP code into our free quote comparison tool.

What does home insurance for landlords cover?

What cover do I need with home insurance for landlords? Most landlords need dwelling protection, liability coverage, loss of rental income, and coverage for landlord-owned items like appliances or maintenance tools. Optional extras may include vandalism, theft, or flood coverage.

Do landlords need home insurance for rental properties?

Yes, landlords need home insurance for rental properties because homeowners insurance does not cover rentals. Without landlord insurance, damages or lawsuits tied to tenants are often excluded.

Learn More: Does homeowners insurance cover wildfires?

How can landlords save on home insurance?

Landlords can save on home insurance by bundling policies, installing security systems, making property safety upgrades, and avoiding small claims. Providers like State Farm and Safeco offer discounts of up to 20%.

What will I most likely need to insure as a landlord?

Landlords are responsible for insuring the property’s structure and protecting themselves against liability and loss of income if the rental property is unlivable after a claim.

Who should pay landlord insurance?

How much rental insurance should I require as a landlord?

What is the difference between landlord insurance and rental property insurance?

Do I need landlord insurance if I have an LLC?

Is it hard to get landlord insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.