How to Buy Home Insurance in 2026

Choosing coverages and deductibles is the first step in how to buy home insurance. Home insurance rates on a $200,000 dwelling start as low as $84 a month. Your rates will be based on your home value, credit score, location, and more. Compare policies online to find the best homeowners insurance companies.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Copywriter

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, AllWom...

Rachel Bodine

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding c...

Meggan McCain

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated January 2026

The first step in how to buy home insurance is to determine what homeowners insurance coverage you need for your home.

- Dwelling coverage protects the structure of your home

- Home insurance discounts can save customers as much as 25%

- The best home insurance companies are State Farm and Nationwide

Then, you will want to pick deductibles, research companies, and get quotes before buying a home insurance policy. Following these steps will ensure that you get the best homeowners insurance rates.

To shop for affordable home insurance in your area, use our free quote tool. It will quickly compare top homeowners insurance companies in your area to find you the best deal.

6 Simple Steps to Buying Home Insurance

If you are trying to figure out how to get coverage by Googling or how to shop for homeowners insurance on Reddit, we have simple steps laid out for you to follow.

Buying home insurance is an important process. It is also a lender requirement, though it’s still a good idea to carry home insurance even if you own your home outright (Learn More: Is home insurance required?).

6 Steps to Buy Home Insurance| Step | What to Do | Why it Matters |

|---|---|---|

| #1 | Assess your coverage needs | Ensure proper coverage |

| #2 | Choose coverage & deductible | Balance coverage & risk |

| #3 | Research insurance companies | Find trusted insurers |

| #4 | Compare insurance quotes | Get best plan and price |

| #5 | Review programs & discounts | Can lower rate by 25% |

| #6 | Finalize and confirm policy | Confirm full protection |

Costs and coverage can vary widely, but following our six steps to buying home insurance will help you make a decision.

Read on for a complete breakdown of each step in buying home insurance, so you can get started on protecting your financial assets today.

Step #1: Assess Coverage Needs

Wonder how to shop for homeowners insurance? First, consider what type of home insurance coverage you need for your property. Dwelling insurance is a common homeowners insurance policy that covers the structure of your home.

Another common type is liability home insurance. Liability insurance covers injuries and damages that may happen to others on your property, such as if someone slips on your steps.

Most Common Types of Home Insurance| Coverage | What it Protects | Typical Limit |

|---|---|---|

| Dwelling | Structure of your home | Up to rebuild cost |

| Personal Property | Belongings inside home | 60% of dwelling coverage |

| Liability | Injuries or damage you cause | $100K–$500K |

| Loss of Use | Living costs after damage | 20% of dwelling coverage |

Personal property may also be purchased for your home. This type of home insurance will protect your belongings, such as your new couch or electronics.

The last common type of home insurance coverage you may want to consider is loss-of-use coverage. If your home is damaged and unlivable, it will help cover living costs, such as hotel expenses.

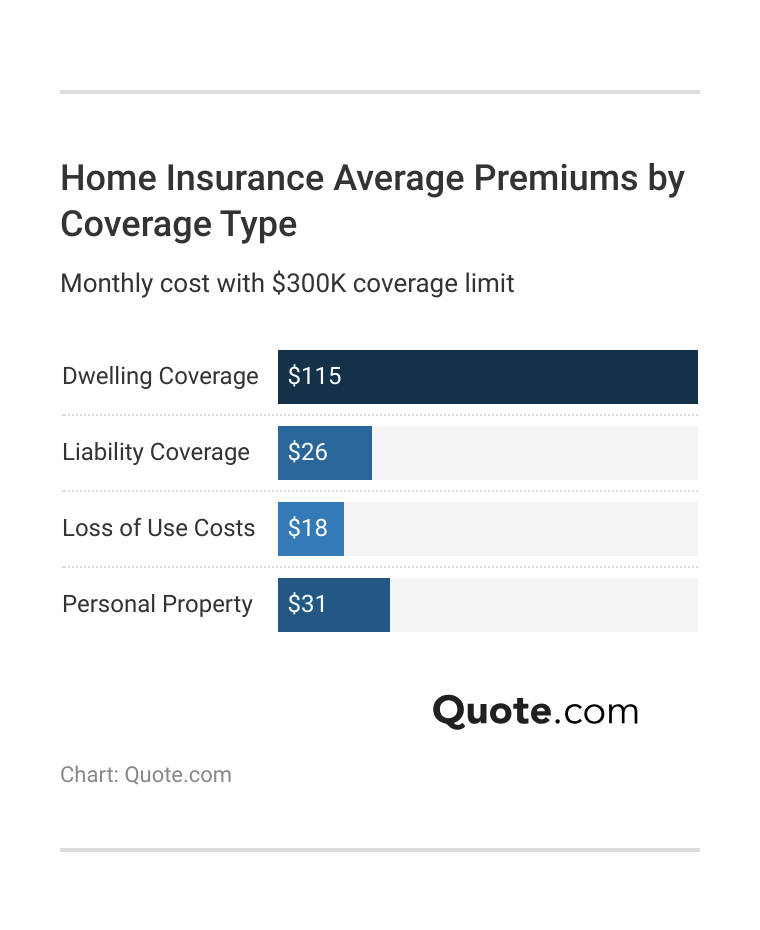

Loss-of-use coverage is generally affordable, with the average rate for a $300K home being $18 per month.

When you compare average home insurance rates by coverage, dwelling coverage is the most expensive insurance to purchase, but it is also one of the most important.

The cost of home insurance coverage varies depending on what coverage level you need. Coverages for a $ 300,000 home will cost more than those for a $100,000 home.

In addition to the value of your home, the rebuild cost of your home, and the overall value of your possessions will affect what coverage levels you need to purchase for your home.

Step #2: Choose Deductible

Once you’ve decided what home insurance coverage you want to carry on your home, you should consider what insurance deductibles you want for your coverage.

A deductible is the amount you agree to pay towards repairs in a covered claim with your home insurance company.

Common insurance deductibles you will see offered on home insurance policies are $500, $1,000, $2,500, and $5,000.

Higher deductibles mean lower home insurance rates, as you are taking on more financial responsibility in a claim.

Home Insurance Monthly Rates by Deductible| Company | $500 | $1K | $2.5K | $5K |

|---|---|---|---|---|

| $123 | $115 | $102 | $95 | |

| $119 | $111 | $99 | $92 |

| $116 | $108 | $96 | $89 | |

| $128 | $120 | $106 | $99 | |

| $122 | $114 | $101 | $94 |

| $125 | $117 | $104 | $96 | |

| $120 | $112 | $99 | $92 | |

| $127 | $119 | $106 | $98 | |

| $115 | $107 | $95 | $88 | |

| $118 | $110 | $97 | $90 |

While it can be tempting to choose the highest deductible to get the lowest rate, make sure you are comfortable with that much out-of-pocket risk.

If you don’t have the funds to pay a high deductible, it is best to go with a lower home insurance deductible, even though your monthly rates will be a little higher.

Step #3: Research Companies

The third step after determining what coverage and deductible you want for your home is to start researching the best homeowners insurance companies. You’ll want to look into providers’ reputations, financial stability, and customer service.

Some reputable rating sites to check include A.M. Best for financial strength, J.D. Power for claims satisfaction, and the NAIC, which tracks customer complaints.

10 Best Home Insurance Providers by Claims Satisfaction| Company | Rank |  | ||

|---|---|---|---|---|

| #1 | 643 / 1,000 | A++ | 0.84 | |

| #2 | 641 / 1,000 | A+ | 0.9 | |

| #3 | 638 / 1,000 | A | 0.26 |

| #4 | 634 / 1,000 | A++ | 0.75 | |

| #5 | 634 / 1,000 | A+ | 1.11 | |

| #6 | 631 / 1,000 | A+ | 1.02 | |

| #7 | 609 / 1,000 | A++ | 3.96 | |

| #8 | 609 / 1,000 | A | 1.32 | |

| #9 | 596 / 1,000 | A | 4.28 |

| #10 | 586 / 1,000 | A | 0.84 |

J.D. Power has rated State Farm as one of the best homeowners insurance companies, followed by Nationwide.

When looking into the best and worst homeowners insurance companies in your area, you can also read customer reviews on insurance comparison sites to see what customers think of claims filing, customer service, and rates.

Step #4: Compare Quotes

The next step in buying home insurance coverage is to start comparing homeowners insurance quotes (Learn More: How to Compare Home Insurance Quotes). There are several ways you can get home insurance quotes.

Some of your options include using quote comparison sites, using a home insurance broker, or using a bank lender.

Where to Buy Home Insurance| Source | How it Works | Best for |

|---|---|---|

| Insurance Company | Direct quote from insurer | Existing customers |

| Comparison Websites | View multiple quotes | Quick shopping |

| Independent Agent | Compare many insurers | Custom advice |

| Captive Agent | Sells for one company only | Dedicated 1:1 support |

| Bank or Lender | Add during loan | Easy home purchase |

You may also opt to get home insurance quotes directly from home insurance companies, although this is more time-consuming than using a quote comparison tool or independent agent, as you will have to enter your information multiple times.

When applying for home insurance quotes, you will need to provide basic information about your home to get an accurate quote.

What You Need to Get a Home Insurance Quote| Info Needed | Purpose | Tip |

|---|---|---|

| Property Address | Determines area risk factors | Needed for rate calculation |

| Home Type & Size | For rebuild cost & base rate | Include square footage |

| Build Year & Updates | Older homes may cost more | List upgrades (roof, plumbing) |

| Safety Features | May qualify for discounts | Smoke alarms, deadbolts, etc. |

| Claims History | Used for risk evaluation | A clean record = lower rates |

| Desired Coverage | Sets dwelling and item limits | Rebuild cost, not market value |

For example, home insurance companies will want your home address, details about your home’s build, your claims history, and more before they give you an estimated rate.

When comparing quotes, you may find that quotes can vary as much as 25% or more for the same coverage at different home insurance companies.

Home Insurance Monthly Rates by Dwelling Coverage| Company | $200K | $300K | $400K | $500K |

|---|---|---|---|---|

| $92 | $115 | $139 | $165 | |

| $88 | $111 | $136 | $161 |

| $85 | $108 | $132 | $156 | |

| $96 | $120 | $147 | $174 | |

| $91 | $114 | $138 | $164 |

| $93 | $117 | $141 | $168 | |

| $89 | $112 | $137 | $162 | |

| $95 | $119 | $144 | $170 | |

| $84 | $107 | $131 | $155 | |

| $87 | $110 | $134 | $159 |

The cost differences between companies are why comparing home insurance quotes is so important. Some of the cheaper companies on the market include affordable companies like State Farm.

Companies that may be a bit pricier for home insurance on average are Farmers and Mercury Insurance. If you are looking for the cheapest home insurance for first-time buyers, these companies may not offer the best rate for you.

Step #5: Review Discounts

One factor that affects home insurance rates is the discounts offered by insurance companies. If you qualify for discounts at a company, it could result in affordable home insurance at even some of the pricier companies.

Some common home insurance discounts offered by most home insurance companies include bundling, claims-free, green home, and home security discounts, which can save customers 10 to 25 percent on average.

Top Home Insurance Discounts by Savings| Company | Bundling | Claims-Free | Green Home | Home Security |

|---|---|---|---|---|

| 15% | 20% | 5% | 10% | |

| 10% | 22% | 5% | 12% |

| 12% | 18% | 5% | 9% | |

| 12% | 25% | 5% | 14% | |

| 14% | 20% | 5% | 9% |

| 10% | 15% | 5% | 8% | |

| 11% | 18% | 7% | 10% | |

| 16% | 21% | 6% | 11% | |

| 20% | 24% | 5% | 15% | |

| 13% | 16% | 4% | 7% |

Bundling discounts are often offered to customers who purchase home insurance along with another type of insurance, such as auto, from the same company (Read More: Best Auto and Home Insurance Bundles).

Have an eco-friendly home? To qualify for a green home discount with a home insurance provider, you may need to have your home certified by organizations like the Leadership in Energy and Environmental Design (LEED).

Insurance companies may also offer home security discounts to customers who install security systems, such as cameras and alarms.

Finally, claims-free discounts often require customers to have been claims-free for a set period of time to qualify. If you have filed a claim in the last few years, you probably won’t qualify.

Step #6: Finalize Policy

Once you’ve gotten your quote and reviewed discount options, it is time to finalize and purchase your home insurance policy. You will want to confirm the start date of your policy so it goes into effect before your old policy lapses.

You should also ensure your policy meets your lender’s coverage requirements. You can check the types of home insurance coverage you have by reviewing your declarations page.

Make sure to carefully review the exclusions in your home policy. Events like flooding may be excluded unless you purchase extra coverage.

Daniel Walker Licensed Insurance Agent

A declarations page summarizes your coverages, limits, deductibles, premiums, and more. You should keep this page as a quick reference to your home insurance policy.

Once you’ve signed any applicable papers and paid your first home insurance premium, your policy will go into effect, and your home will be officially protected by a home insurance company.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors Affecting Home Insurance Quotes

When you are shopping for home insurance, it is important to bear in mind that there are several factors that will impact the quotes you get.

For example, your credit score could impact what you pay for home insurance. If you have poor credit, improving your score before applying for home insurance could lower your rates.

Key Elements Shaping Home Insurance Premiums| Factor | Effect on Rate | Smart Tip |

|---|---|---|

| Home Value | Higher value = higher cost | Use rebuild, not market value |

| Deductible | Raise deductible, pay less | Pick what you can afford |

| Location | Local risks raise costs | Check local risks |

| Credit Score | Lower score = higher cost | Boost score before applying |

| Home Age | Older homes cost more | Update wiring/plumbing |

The age of your home is another common factor that affects home insurance quotes. Older homes are more prone to breakdowns and repairs, which raise insurance costs.

Wondering how to lower home insurance costs? Making repairs to your home, such as installing a new roof or pipes, could reduce rates.

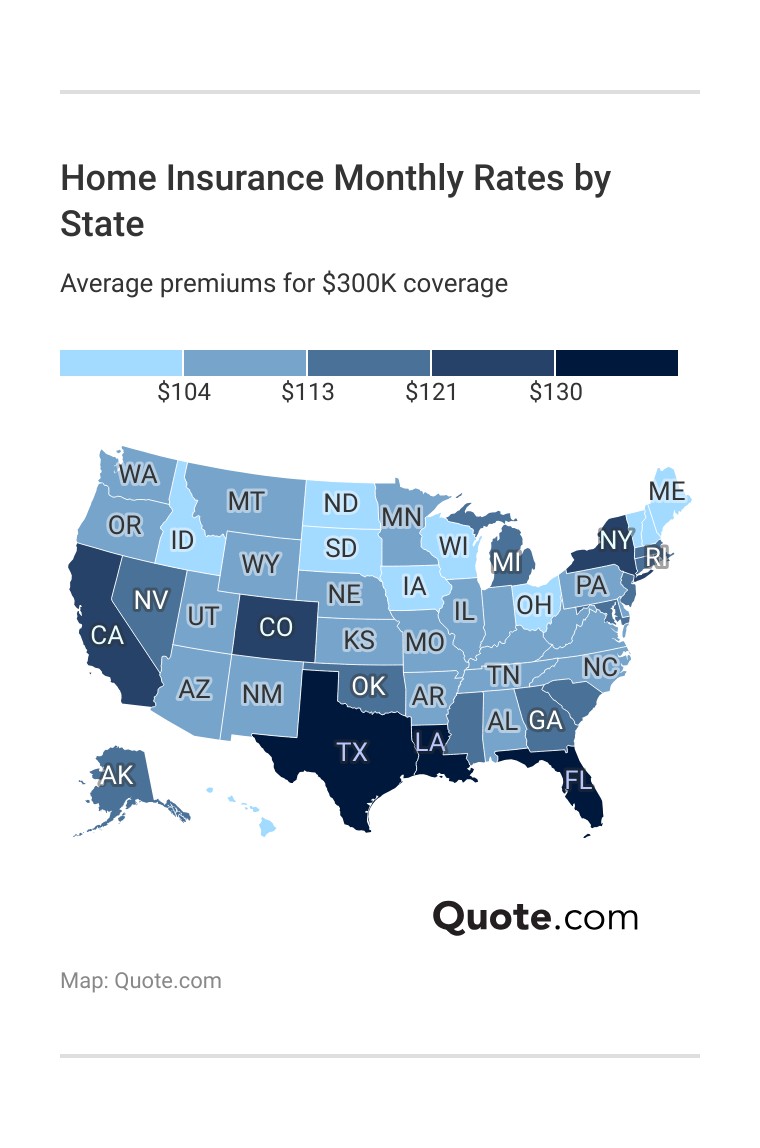

Another factor that affects whether you can get affordable home insurance is where you live.

Some states will have more expensive rates on average due to living costs, natural disasters, crime, and other relevant factors.

When you compare home insurance rates by state, Louisiana and Florida are some of the most expensive states for homeowners insurance.

California also has expensive rates, in part due to the wildfire risks in the state. Cheaper states for home insurance include states like Hawaii and Ohio.

Buying the Best Home Insurance

The steps of buying home insurance are the same whether you are looking into how to shop for homeowners insurance in Florida or California.

You will need to determine your coverage and deductible amounts before researching companies, then start comparing quotes and discounts to lock in the best homeowners insurance rates.

Ensure you have proper coverage, as historic homes and condos require different types of homeowners insurance.

Kristine Lee Licensed Insurance Agent

Following these basic steps ensures you get the protection you need for your home and pay a fair price for home insurance. However, getting quotes from the cheapest home insurance companies is a good place to start.

If you’re wondering how to buy home insurance online, enter your ZIP code in our free tool. It will help you find the most affordable providers, whether you are looking for the best homeowners insurance in Wisconsin, Utah, or anywhere.

Frequently Asked Questions

What is the first step when buying homeowners insurance?

The first step in buying homeowners insurance is to decide what coverages you want. The most common home insurance types are dwelling, liability, personal property, and loss-of-use coverage.

How long does it take to buy a home insurance policy?

It depends on the home insurance company. While you can get a quote quickly, it may take a few days to a few weeks to finalize the purchase of your insurance policy.

Can you switch insurers mid-term?

Yes, you can switch home insurance companies mid-term, but you may have to pay an early cancellation fee. If you are looking for a new home insurance provider, enter your ZIP in our free tool.

How much is homeowners insurance on a $200,000 home?

Home insurance for a $200,000 home averages $84 per month. If you have a higher-value home, your insurance will cost more (Read More: Best Home Insurance for High-Value Properties).

What if your lender requires specific home insurance coverage?

If your lender requires you to carry specific coverage, you must ensure your insurance policy meets those requirements. If it doesn’t, you may be forced to buy home insurance that meets the requirements through your lender.

Can you buy home insurance before closing on a home?

Yes, you can buy home insurance before finalizing your home purchase. In fact, getting home insurance before closing is often a requirement.

What is the best way to get home insurance?

The best way to buy homeowners insurance is by comparing rates online from multiple companies. This way, you can compare providers side-by-side based on your budget and coverage requirements. Use our free quote tool to start comparing companies today.

What is the 80% rule in home insurance?

The 80% rule means that you should carry home insurance that will cover 80% of your home’s replacement value. Carrying less than that could leave you unable to pay for your home’s repairs or replacement after serious damage (Learn More: How much homeowners insurance do you need?).

Is it better to have a $500 home insurance deductible or $1,000?

It depends on how much you are comfortable paying out of pocket for a claim and what you want to pay for home insurance. Average rates for a $500 deductible start at $115 per month, while average rates for a $1,000 deductible start at $107 per month.

What is a normal deductible for home insurance?

The most common deductibles you will see for home insurance are $500, $1,000, $2,500, and $5,000.

What are the three types of homeowners insurance?

What does homeowners insurance not cover?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.