Best No-Exam Life Insurance in 2026

State Farm, MassMutual, and Nationwide have the best no-exam life insurance. No-exam policies start at just $21 per month. You can save around 15% compared to exam-required options. Life insurance without a medical exam comes with fast approval, typically within a week, and no waiting period.

Read more Secured with SHA-256 Encryption

Compare Quotes From Top Companies and Save

Life insurance policies starting at less than $1/day

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Managing Editor

Aleksandra J. Churlinov holds a Bachelor of Arts in English Language and Literature and a Master of Science in Marketing Management. Over the past six years, Aleks has focused on the insurance sector, working on a range of content, including business, auto, and life insurance. In April 2025, she stepped into the role of Managing Editor, where she now leads a team of talented insurance writers. ...

Aleksandra J. Churlinov

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated October 2025

State Farm, MassMutual, and Nationwide have the best no-exam life insurance options that eliminate medical testing for faster approval.

- Policy limits of up to $1M are common in no-exam life insurance

- Eligible applicants ages 18 to 65 may qualify to apply online

- Some no-exam policies may require a health questionnaire

State Farm uses accelerated underwriting to cut approval times, and Nationwide includes living benefit riders for increased protection.

MassMutual offers no-exam life insurance online with up to $1 million in coverage, but each provider offers no-exam life insurance applications through online tools.

Top 10 Companies: Best No-Exam Life Insurance| Company | Rank | Claims Satisfaction | Approval Time | Best for |

|---|---|---|---|---|

| #1 | 699 / 1,000 | 6 days | Local Agents | |

| #2 | 673 / 1,000 | 2 days | Financial Strength | |

| #3 | 666 / 1,000 | 4 days | Flexible Policies | |

| #4 | 659 / 1,000 | 3 days | Quick Approval | |

| #5 | 657 / 1,000 | 7 days | Wealth Planning |

| #6 | 653 / 1,000 | 5 days | Low Rates | |

| #7 | 652 / 1,000 | 4 days | High Coverage | |

| #8 | 644 / 1,000 | 3 days | Health Programs | |

| #9 | 639 / 1,000 | 6 days | Long-Term Value | |

| #10 | 626 / 1,000 | 5 days | Online Access |

Backed by A.M. Best ratings of A+ or higher, these companies give you dependable coverage that you can get faster than exam-based plans.

Secure reliable no-exam life insurance with flexible term lengths by entering your ZIP code into our free comparison tool, and explore policies tailored to long-term protection.

Comparing Rates for No-Exam Life Insurance

Nationwide offers the most affordable 20-year term life insurance without a medical exam at $29 a month for $500,000 in coverage.

Protective Life and Pacific Life are close behind at $30 and $31 monthly, while John Hancock sits at $32 a month.

No-Exam Life Insurance Monthly Rates by Policy Type| Insurance Company | 20-Year Term | Whole Life |

|---|---|---|

| $32 | $76 | |

| $34 | $78 | |

| $36 | $80 | |

| $33 | $77 | |

| $29 | $73 | |

| $38 | $84 | |

| $31 | $75 |

| $30 | $74 | |

| $35 | NA | |

| $37 | $82 |

On the higher end, NYL runs $38 a month for the same coverage. Whole life premiums shift higher for that same 40-year-old male at $100,000 in permanent life coverage.

Whole life insurance with no medical exam costs more because it lasts for your whole life, compared to term policies, which usually last between 20 and 40 years.

Always compare the best life insurance companies offering no-exam policies. Choosing one company over another could cost you nearly $9 more per month.

Nationwide again comes in lowest at $73 a month for whole life insurance without a medical exam.

John Hancock and Mutual of Omaha sit mid-range at $76 and $77 monthly. Lincoln Financial costs $78 per month, and New York Life premiums reach $84 a month.

How Age Impacts No-Exam Life Insurance Premiums

If you’re a healthy non-smoker looking at $500,000 for 20 years, the price really depends on your age.

At 20, Protective Life is the cheapest at $21 a month, while New York Life costs at $28 per month.

No-Exam Life Insurance Monthly Rates by Age| Company | Age: 20 | Age: 30 | Age: 40 | Age: 50 |

|---|---|---|---|---|

| $22 | $27 | $32 | $74 | |

| $24 | $29 | $34 | $76 | |

| $26 | $30 | $36 | $80 | |

| $27 | $31 | $33 | $78 | |

| $23 | $28 | $29 | $72 | |

| $28 | $32 | $38 | $85 | |

| $22 | $26 | $31 | $71 |

| $21 | $25 | $30 | $70 | |

| $25 | $29 | $35 | $82 | |

| $29 | $33 | $37 | $84 |

By 40, Nationwide comes in with the cheapest rates compared to New York Life at $38 a month.

That $9 each month doesn’t sound huge, but it adds up to more than $2,000 over the life of the policy.

How Tobacco Use Impacts No-Exam Life Insurance Pricing

Non-smoker rates stay low since no-exam life insurance quotes are directly related to health and medical history.

Nationwide, Protective Life, and Pacific Life are the cheapest options, all with premiums around $30 per month.

No-Exam Life Insurance Monthly Rates by Tobacco Use| Company | Non-Smoker | Smoker |

|---|---|---|

| $32 | $73 | |

| $34 | $77 | |

| $36 | $69 | |

| $33 | $74 | |

| $29 | $70 | |

| $38 | $76 | |

| $31 | $71 |

| $30 | $68 | |

| $35 | $78 | |

| $37 | $72 |

On the higher end, State Farm runs $37 a month, and New York Life reaches $38 monthly. Smoking changes everything for that same $500,000 term.

Protective Life posts the lowest smoker premium at $68 a month, while Prudential tops the list at $78 a month.

Avoiding tobacco isn’t just healthier. It keeps no-exam life insurance far more affordable. Learn reasons to buy life insurance and how no-exam options save time.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How No-Exam Life Insurance Works

No-exam life insurance keeps things simple. Instead of scheduling bloodwork or a medical exam, you answer health questions online, then the insurer checks data like prescriptions, motor vehicle records, and applications to price your policy.

That process is called simplified underwriting, and it usually wraps up fast, sometimes in minutes, within a few days. If approved, coverage can start right away, so there’s less waiting and fewer hoops to jump through compared to traditional policies.

Most people pick term no-exam coverage for 10, 20, or 30 years, because it’s simple and cheap each month. Permanent no-exam policies can last a lifetime and build cash value, but they’re pricier and have lower limits.

Read More: How to Get Life Insurance Quotes

Types of No-Exam Life Insurance Coverage

Guaranteed issue is the easiest option, with no medical exam and no health questions, so approval is basically automatic within the eligible age range.

Expect higher monthly premiums, lower coverage amounts (often in the tens of thousands), and a graded death benefit during the first 2 to 3 years.

Simplified issue skips the exam and uses a short health questionnaire plus database checks, so decisions are quick and coverage can reach the mid to high six figures.

Accelerated underwriting goes further and can offer fully underwritten level rates without an exam for very healthy applicants using electronic data.

Group life insurance through an employer usually requires no medical exam since coverage is issued to the whole group.

Enrollment is simple during open enrollment, premiums come out of your paycheck, and you get basic limits with optional buy-up, though long-term coverage can be limited.

Discover more by reading our guide: Best Instant Life Insurance

Who Should Get No-Exam Life Insurance

Here’s a quick, friendly guide to who benefits most from no-exam life insurance. It skips medical exams and uses online forms plus data checks, so approvals move fast.

If convenience, timing, and simplified underwriting matter, these groups see the most upside:

People Who Need Coverage Quickly

New parents, new homeowners, and borrowers closing a loan get protection without delays. Decisions often arrive in days, or even minutes, so coverage starts sooner.

Individuals with Pre-Existing Health Conditions

Well-managed conditions like controlled blood pressure or mild diabetes often fit simplified or guaranteed-issue paths. Fewer medical hurdles mean faster, more predictable approvals.

People Who Dislike Medical Exams

No needles, labs, or office visits. Applications rely on health questionnaires and database checks, keeping the process straightforward from start to finish.

Busy Professionals and Frequent Travelers

Tight schedules pair well with fully online applications. Approval can happen from a laptop or phone without carving out time for appointments.

Seniors or Older Applicants

Guaranteed-issue options offer smaller benefit amounts with no health questions, creating a practical way to cover final expenses when traditional underwriting is tougher.

People With Modest Coverage Needs

Straightforward protection in the $250K to $500K range aligns well with no-exam term policies. Speed and simplicity take priority over the very lowest possible rate.

When fast, low-friction approval matters, and the coverage amount fits your goals, no-exam life insurance delivers simple, reliable protection without medical hoops.

Read More: What is permanent life insurance?

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ways to Save on No-Exam Life Insurance

Getting life insurance without a medical exam doesn’t mean you have to overpay for coverage.

A few smart moves can help you lock in better rates and still get quick approval, usually within 5-7 days.

- Bundle Policies: Combine life, home, or auto insurance to save up to 10%–15%.

- Skip the Cigarettes: Non-smokers often see 10%–20% lower premiums.

- Choose Term Coverage: Term life usually costs about 40% less than whole life.

- Pay Yearly: Annual payments can trim premiums by around 3%–5%.

- Shop Around: Comparing quotes may save $8–$15 per month on average.

Just a few smart choices and some quick comparisons can make a significant difference in your monthly budget.

Top no-exam life insurance providers like Nationwide, MassMutual, Protective Life, and Prudential make it easier to save a bit every month.

Nationwide offers around 10% off when you bundle life insurance with home or auto, rewarding customers who keep everything under one roof.

Top Discounts for No-Exam Life Insurance| Company | Bundling | Family History | Healthy Lifestyle | Non-Smoker |

|---|---|---|---|---|

| 7% | 5% | 7% | 10% | |

| 6% | 12% | 7% | 15% | |

| 10% | 6% | 7% | 15% | |

| 5% | 7% | 10% | 10% | |

| 8% | 5% | 7% | 12% | |

| 3% | 10% | 7% | 10% | |

| 6% | 10% | 8% | 10% |

| 15% | 18% | 12% | 15% | |

| 7% | 20% | 7% | 20% | |

| 6% | 15% | 10% | 8% |

MassMutual gives up to 10% in savings for non-smokers or those with strong family health histories, encouraging healthy habits that pay off.

Protective Life cuts costs by about 15% for applicants with solid health records or by bundling multiple policies in one account.

For bundling, Nationwide and Protective Life stand out most. They consistently give solid savings and fast approvals without the extra hassle.

Prudential provides up to 15% off for non-smokers and older applicants who want quick approval without a medical exam.

Learn More: Cheapest Life Insurance Companies

Top Life Insurance Providers With No Exam

No-exam life insurance offers fast and easy approval in just a few days instead of waiting weeks for traditional exam-based policies.

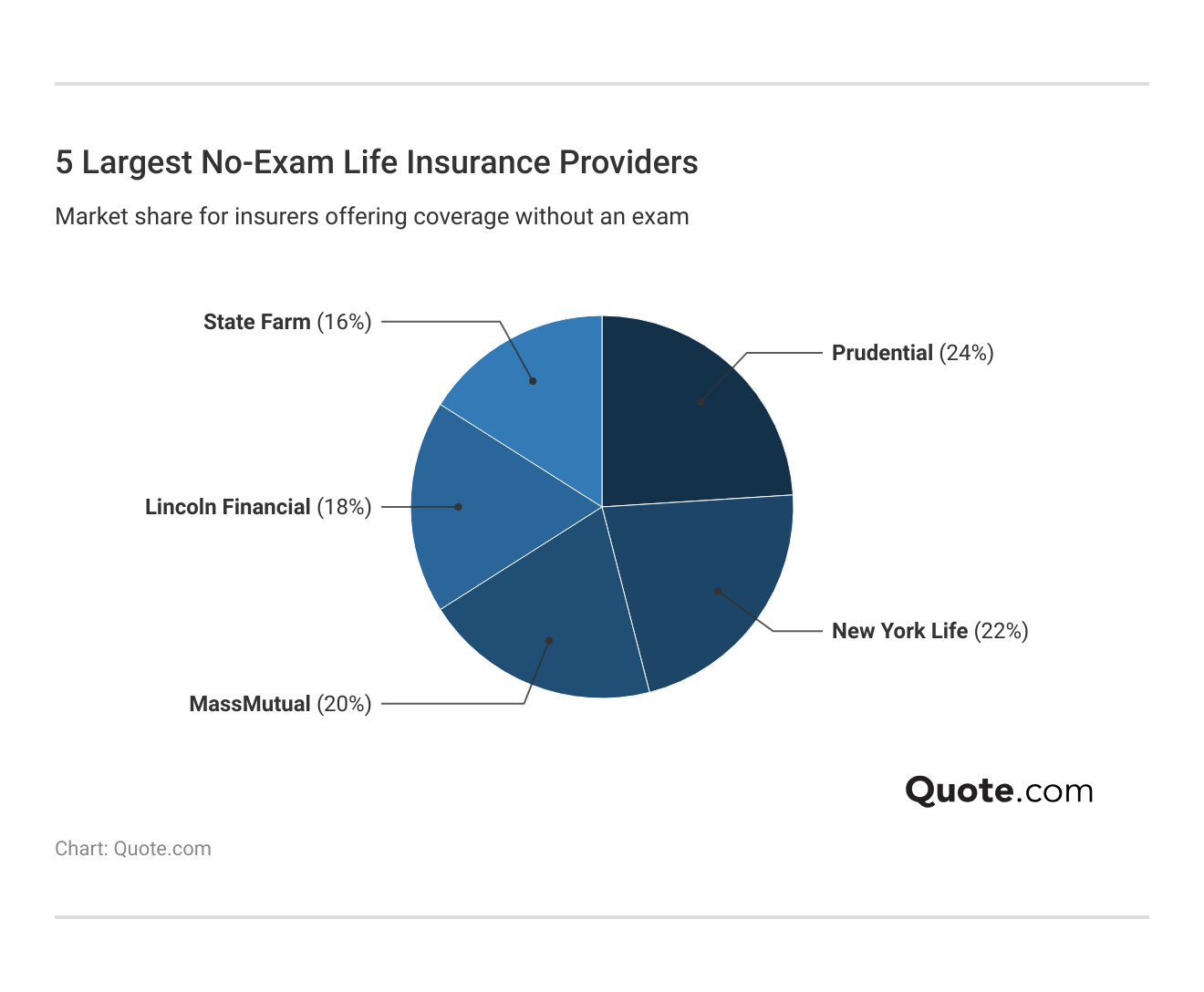

Prudential sits on top with 24% of the market, and New York Life follows close at 22%. Discover how much life insurance you need from group policy choices.

Whether it’s Prudential with the biggest slice or State Farm with a steady share, these providers control where most policies go.

What this really shows is that most people buying no-exam life insurance are choosing from this group.

If you’re shopping for the best no-exam life insurance, odds are you’ll end up comparing quotes from at least one of them.

We dug into the best companies offering no-exam life insurance so you know which ones are worth checking out and which trade-offs to consider.

#1 – State Farm: Best for Fast-Track Approvals

Pros

- Quick Turnaround: State Farm’s no-exam life insurance often gets approved in just two to three days, much faster than the weeks-long wait that comes with exam-based plans.

- Top-Tier Stability: With an A++ rating from A.M. Best, State Farm gives buyers confidence that their no-exam life insurance policy is backed by a stable company.

- Family History Savings: Eligible applicants can trim up to 15% off if they have a clean family medical record. See how State Farm auto insurance relates to no-exam life insurance.

Cons

- Above-Average Pricing: A 40-year-old non-smoker pays about $37 per month for State Farm’s no-exam life insurance, which is noticeably higher than Nationwide’s $29 rate.

- Strict Health Screening: State Farm only issues no-exam life insurance to applicants with very strong health profiles.

#2 – MassMutual: Best for Higher Coverage Limits

Pros

- Big Coverage Options: MassMutual insurance makes it possible to secure up to $1 million in no-exam life insurance, a ceiling most competitors don’t offer.

- Non-Smoker Discounts: Healthy applicants can save as much as 15% on no-exam life insurance premiums, keeping long-term costs in check.

- Smooth Digital Process: The online-first application system means no-exam life insurance buyers avoid piles of paperwork and get decisions more quickly.

Cons

- Tight Eligibility: MassMutual tends to approve no-exam life insurance only for people in excellent health, so moderate-risk applicants often get filtered out.

- Higher Whole Life Rates: A permanent no-exam life insurance policy averages around $77 per month, making it less competitive than Nationwide or Protective Life.

#3 – Nationwide: Best for Affordable Monthly Rates

Pros

- Lowest Pricing at 40: For a 40-year-old non-smoker, Nationwide’s no-exam life insurance is just $29 a month for a $500,000 term.

- Added Living Benefits: Nationwide includes features like accelerated death benefit riders, giving no-exam life insurance buyers flexibility if a serious illness occurs.

- Financially Solid: Nationwide holds an A+ rating from A.M. Best, indicating that it is a stable company. Discover tips in a clear Nationwide auto insurance today.

Cons

- Age Caps: Nationwide limits who can qualify for no-exam life insurance based on age, so older applicants may be out of luck.

- Smokers Pay Way More: Rates jump from $29 to $70 a month if you smoke, nearly triple the cost.

#4 – Mutual of Omaha: Best for Average Health Applicants

Pros

- More Flexible: Unlike stricter insurers, Mutual of Omaha insurance will issue no-exam life insurance even if you’ve got manageable health conditions like mild blood pressure issues.

- Healthy Lifestyle Savings: If you keep active and healthy, you can score up to 10% off your no-exam life insurance.

- Reasonable Pricing: Whole life no-exam life insurance costs around $77 a month, putting it in the mid-range compared to cheaper Nationwide and pricier NYL.

Cons

- Lower Maximum Benefits: Mutual of Omaha caps no-exam life insurance coverage at lower amounts than MassMutual or Nationwide.

- Longer Approval Times: Applications may take more time to review, meaning no-exam life insurance decisions aren’t as fast as what State Farm delivers.

#5 – Pacific Life: Best for Income-Based Eligibility

Pros

- Income-Focused Approval: Pacific Life Insurance weighs applicant income heavily, allowing higher earners to secure no-exam life insurance faster.

- Affordable Term Option: A 40-year-old non-smoker pays about $31 a month for no-exam life insurance, keeping policies accessible for middle-income buyers.

- Non-Smoker Discounts: Applicants without a tobacco history can save roughly 10%, lowering total costs over the course of a 20-year term.

Cons

- Strict Applicant Standards: Pacific Life is selective, approving no-exam life insurance mainly for people with clean health histories and stable backgrounds.

- Costly for Seniors: Premiums often exceed $85 per month for older applicants, making Pacific Life’s no-exam life insurance less attractive for those in their 60s or 70s.

#6 – Protective Life: Best for Discount Stacking

Pros

- Affordable Rates: Protective Life offers 20-year term no-exam life insurance at $30 per month, making it one of the lowest-priced options.

- Family History Savings: Customers can cut up to 18% off no-exam life insurance premiums with family history discounts.

- Non-Smoker Perks: Up to 15% savings apply to non-smokers buying no-exam life insurance. Find out how the average cost of life insurance shifts with no exam options.

Cons

- Higher Whole Life: Protective Life’s whole life no-exam life insurance is $74, more expensive than Nationwide at $73.

- Approval Limits: No-exam life insurance at Protective Life favors average health, leaving out higher-risk applicants.

#7 – Lincoln Financial: Best for Stable Health Profiles

Pros

- Mid-Range Pricing: Lincoln Financial’s 20-year term no-exam life insurance is $34 monthly, balancing affordability and access.

- Non-Smoker Discounts: Up to 15% off is available on no-exam life insurance for non-smokers. Find no-exam life insurance savings using the best insurance comparison sites.

- Health-Based Access: No-exam life insurance approvals are smoother for applicants with stable health histories.

Cons

- Pricey Whole Life: Lincoln Financial’s whole life no-exam life insurance runs about $78 a month, which is a bit steeper than Protective Life’s $74 option.

- Smaller Market Slice: Lincoln Financial doesn’t have as big a footprint in no-exam life insurance, especially when you compare it to Prudential’s 24% share.

#8 – John Hancock: Best for Faster Issuance

Pros

- Competitive Rates: John Hancock offers 20-year term no-exam life insurance at $32, cheaper than State Farm at $37.

- Quick Approvals: Buyers often secure no-exam life insurance faster through John Hancock’s streamlined process.

- Financial Strength: With an A.M. Best A+ rating, John Hancock backs its no-exam life insurance with solid reliability. Learn how a life insurance annuity adds financial strength.

Cons

- Higher Whole Life: Whole life no-exam life insurance sits at $76, more than Nationwide at $73.

- Limited Discounts: Savings on no-exam life insurance max out at 10%, well below Prudential’s 20%.

#9 – New York Life: Best for Low-Risk Applicants

Pros

- Large Market Share: New York Life controls 22% of the no-exam life insurance market, proving wide consumer trust.

- Clean Profile Focus: No-exam life insurance is well-suited for applicants with low-risk health histories.

- Non-Smoker Discounts: Up to 10% savings are available on no-exam life insurance for non-smokers. Discover how term life insurance compares to no-exam life insurance.

Cons

- Expensive Premiums: New York Life’s 20-year term no-exam life insurance costs $38 monthly, the highest among top providers.

- Costly Whole Life: At $84 monthly, whole life no-exam life insurance is the most expensive compared to rivals.

#10 – Prudential: Best for Flexible Risk Acceptance

Pros

- Affordable Term: Prudential insurance offers 20-year term no-exam life insurance at $35, cheaper than NYL at $38.

- Non-Smoker Savings: Up to 20% discounts apply to non-smokers, the highest savings in no-exam life insurance.

- Broader Eligibility: Applicants with controlled conditions may still qualify for Prudential’s no-exam life insurance.

Cons

- Higher Whole Life: Whole life no-exam life insurance costs $78 monthly, more than Protective Life at $74.

- Expensive Smoker Rates: Smoker premiums reach $78 monthly, compared to Protective Life at $68.

The Best No-Exam Life Insurance for High-Risk

Finding the right no-exam life insurance provider doesn’t have to be complicated or time-consuming.

Comparing rates, approval times, and company reliability can help you land quick coverage without all the extra steps. Here’s what to keep an eye on:

- Monthly Rates: Shop around and compare prices so you get the best deal without giving up key coverage.

- Financial Strength: Check A.M. Best ratings to make sure the company’s solid and can pay out claims when needed.

- Coverage Limits: See how much coverage you can actually get — most no-exam plans top out between $500,000 and $1 million.

- Approval Speed: Go with providers that approve policies fast, usually within a day or two online.

- Discounts: Look for bundle deals, like adding life and auto insurance together, to save a little more each month.

When it comes down to it, finding no-exam life insurance is about making smart choices. Compare rates, check company ratings, and review coverage details.

State Farm is a go-to for high-risk applicants who still want quick life insurance approval. Study risk factors tied to no-exam options vs other types of life insurance.

MassMutual works great for drivers with solid health who just need higher coverage up to $1 million without all the red tape.

No-Exam Life Insurance: Risk Levels Accepted by Provider| Company | Risk | Details |

|---|---|---|

| Moderate | Quick approval | |

| Moderate | Stable health | |

| Low | Healthy only | |

| Moderate | Lower benefits | |

| Low | Age limited | |

| Low | Clean profile | |

| Low | Income based |

| Moderate | Average health | |

| Moderate | Controlled issues | |

| Low | Strict approval |

Nationwide stands out for its flexible rates, starting near $29 a month, which helps drivers with past accidents or tickets save money.

All three give peace of mind to people whose driving history might raise eyebrows, proving you can still get great coverage without jumping through hoops.

Many no exam applicants qualify for $500k coverage amounts depending on age and health. Healthy non-smokers see the best rates.

Kristen Gryglik Licensed Insurance Agent

Prudential and Protective Life, on the other hand, offer discounts of up to 20%. These small monthly differences, such as $9, can result in savings of over $2,000 across a 20-year term.

Find the best no-exam life insurance rates by entering your ZIP code into our free quote comparison tool.

Frequently Asked Questions

Who has the best life insurance without a medical exam?

State Farm, MassMutual, and Nationwide are often cited as top options for life insurance without a medical exam. Term policies start around $29 per month, depending on age, health, and coverage amount.

What makes MassMutual stand out for no-exam life insurance?

MassMutual offers up to $1 million in no-exam coverage, which is great for healthy applicants wanting higher limits without the medical wait.

Why is Nationwide a top pick for affordable no-exam life insurance?

Nationwide starts around $29 per month and suits high-risk drivers. Its fast online process and flexible plans make applying easy. Discover approval rules for no-exam whole vs. term life insurance options.

Is State Farm good for high-risk drivers applying for no-exam life insurance?

Yes, State Farm often approves high-risk drivers with clean health records. Most applicants get covered in under a week at solid rates. Get rates on the best no-exam life insurance today by entering your ZIP code into our free quote comparison tool.

Is no-exam life insurance worth it?

No-exam life insurance can be worth it for applicants needing quick approval or who may not qualify for traditional underwriting, though premiums are usually higher, averaging $29 to $38 per month for a 20-year term policy.

Can you get whole life insurance without an exam?

Yes, some providers like Nationwide and MassMutual offer whole life insurance without an exam. Premiums start near $73 per month for lower coverage amounts, but costs rise significantly with larger benefit options.

Can I be denied no-exam life insurance?

Denial is possible since most no-exam life insurance policies still use simplified underwriting, which checks prescription history, medical records, and driving reports; only guaranteed issue policies avoid these checks entirely (Read More: What to Do When You’re Denied Insurance Coverage).

What life insurance doesn’t ask questions?

Guaranteed issue life insurance does not require health questions or exams, though coverage amounts are typically capped at around $25,000, and monthly premiums are higher than standard no-exam life insurance policies.

Can I cash out a life insurance policy?

Yes, permanent life insurance policies like whole life or universal life build cash value that can be withdrawn or borrowed against. Term life policies do not offer cash-out options.

At what point is life insurance not worth it?

Life insurance may not be worth it if there are no dependents relying on income, debts are minimal, and savings or assets can cover final expenses, making monthly premiums an unnecessary cost.

How much a month is a $500,000 whole life insurance policy?

Is AARP life insurance good?

What is the catch for no-exam life insurance?

What life insurance company denies the most claims?

How much does a $500k life insurance policy with no medical exam cost?

What is the monthly cost of a $250k life insurance no-exam policy?

What is life insurance with no medical exam and no waiting period?

What is the cheapest life insurance for applicants over 50 with no medical exam?

What is the best life insurance for seniors over 60 with no medical exam?

Can you get life insurance with a pre-existing condition?

How long does a no-exam life insurance policy last?

Can you add riders to a no-exam life insurance policy?

How do I avoid a medical exam for life insurance?

Can you borrow from a no-exam life insurance policy?

What does a no-exam term life insurance policy provide?

What is the cheapest life insurance with no medical exam available?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.