Top 8 Medicare Scams in 2026

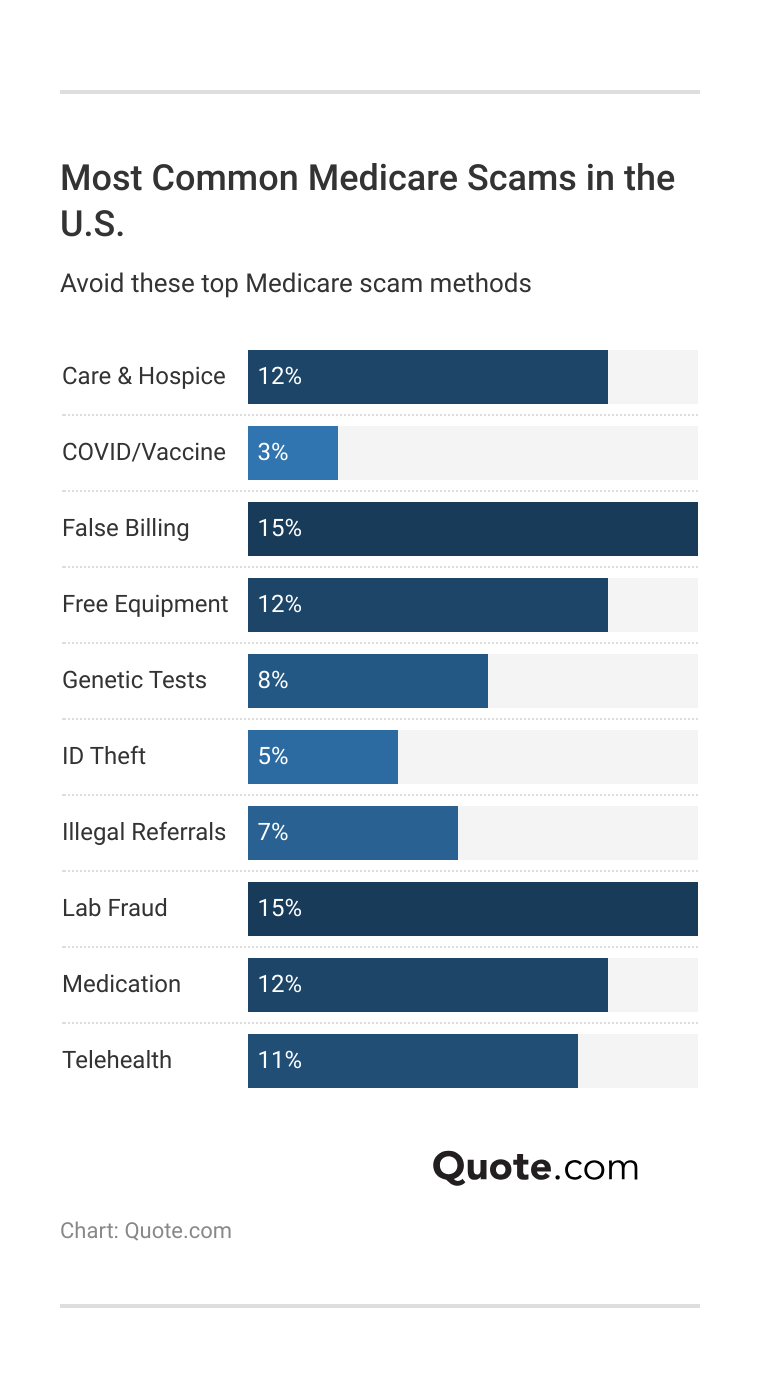

Medicare scammers use deceptive tactics like falsifying lab results or ordering unnecessary medical equipment. About 15% of Medicare scams involve fraudulent billing. To avoid Medicare scams, review your Medicare account often and never share personal information with unsolicited callers or emails.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Karen Condor is an insurance and finance writer who has degrees in both journalism and communications. She began her career as a reporter covering local and state affairs. Her extensive experience includes management positions in newspapers, magazines, newsletters, and online marketing content. She has utilized her research, writing, and communications talents in the areas of human resources, f...

Karen Condor

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Medicare Broker

Adam Lubenow is a partner in his family business, Senior Advisor, which specializes in bringing clarity to the Medicare enrollment process and coverage options to ensure that clients are making informed decisions. Senior Advisors is licensed to help clients in over 40 states and has offices in Arizona and New Jersey. Prior to joining the family business, Adam spent his career with Verizon Busin...

Adam Lubenow

Updated January 2026

Top Medicare scams often target your personal information, including your Medicare and Social Security numbers.

- Common Medicare scams rely on misleading sales tactics

- Report suspected scams to 1-800-MEDICARE as soon as possible

- Protect yourself by regularly reviewing your Medicare statements

There are many forms of Medicare fraud, but most share a common goal: collecting your personal information or billing Medicare for services you never received.

Keep reading to learn about the most common Medicare scams and how to recognize them. The best way to protect yourself from Medicare fraud is to avoid unsolicited phone calls and emails from unknown sources.

8 Most Common Medicare Scams| Scam | Rank | Details |

|---|---|---|

| 🦽 Equipment | #1 | Free braces or chairs; false Medicare billing |

| 🧬 Genetic Testing | #2 | Fake DNA/cancer tests; unnecessary billing |

| 💉 COVID/Vaccine | #3 | Fake test or vaccines; steal Medicare number |

| 🎭 Fake Reps | #4 | Imposters pose as Medicare reps for info |

| 💻 Telehealth | #5 | Fake providers bill for care never provided |

| 💊 Drug Scams | #6 | Fake Part D plans steal Medicare or bank info |

| 🕵️♂️ Identity Theft | #7 | Stolen Medicare numbers used for false billing |

| 🏠 Care Fraud | #8 | Fake nurses bill Medicare for care not provided |

Our expert Medicare guide can help you understand everything you need to know about your healthcare coverage. Licensed insurance agents are on standby to answer your Medicare questions. Call (855) 634-0435 today for assistance.

Top Medicare Scams to Avoid

Medicare scams are an increasing issue, targeting seniors through Medicare spam calls, emails, and even door-to-door visits.

Even with a good understanding of Medicare basics, many people struggle to recognize Medicare fraud schemes before it’s too late.

Scammers often pose as legitimate providers or Medicare representatives to steal money, personal information, or benefits.

Knowing current Medicare scams can help you protect your health and your finances from Medicare scammers.

While there are many Medicare scams online, over the phone, and through the mail, most have the same aims.

We’ve listed the most common types of Medicare scams to watch for, so you can be prepared if you ever come across them.

#1: Free Medical Equipment

One of the most common Medicare scams offers “free” medical equipment such as braces, wheelchairs, or back supports.

Scammers claim your Medicare Part B benefits will cover the full cost, but they need your Medicare number to process the order.

Medicare only covers durable medical equipment prescribed by your doctor and provided through an approved supplier.

Michelle Robbins Licensed Insurance Agent

Once they have your information, they may bill Medicare for expensive equipment you never received or charge you for items you never ordered.

Although this type of scam is most often done over the phone, it’s also commonly used in Medicare scams by mail.

#2: Genetic Testing

You may receive calls or letters offering free DNA or cancer screening tests. Scammers claim these tests can detect diseases early and that Medicare Part A will pay for them.

In reality, most of these offers are fake. Scammers use them to collect personal data or send false claims to Medicare under your name. You should only take genetic or diagnostic tests ordered by your physician and performed by a trusted lab.

#3: COVID-19 Tests and Vaccines

Since the COVID-19 pandemic, fraudsters have taken advantage of confusion around testing and vaccination. They might offer home COVID-19 tests, vaccines, or “priority” vaccine appointments in exchange for your Medicare number or a fee.

Medicare covers approved COVID-19 tests and vaccines at no cost when obtained through authorized providers. If someone asks for payment or personal information, it’s a scam to get access to your Medicare Parts A, B, C, and D benefits.

#4: Fake Medicare Representatives

Scammers often pose as Medicare agents calling to “verify” your coverage, teach you how to sign up for Medicare, or issue a new card.

They may also claim you need to pay a fee for an updated Medicare ID or to reactivate your account.

This is one of the most common Medicare scams by phone, and you may get multiple calls from different numbers.

Know that a Medicare agent will never call or visit you uninvited to ask for personal details or payments.

Hang up immediately and contact Medicare directly at 1-800-MEDICARE to confirm any official communications.

#5: Telehealth Bills

Telehealth became popular after the COVID-19 pandemic, and so did telehealth fraud. Medicare scammers may bill you for telehealth visits that never happened or trick you into participating in unnecessary appointments just to charge the program.

Keep track of your telehealth appointments and check your Medicare Summary Notice for any services you don’t recognize. This is good advice for any health insurance plan. Check our complete health care guide for more information.

#6: Prescription Drug Scams

Fraudsters might advertise cheap prescription drugs or online pharmacies that don’t require a prescription to get access to your Medicare Part D information.

These sites can steal your information or send counterfeit medications. Others may offer “discounts” that require you to share your Medicare or Social Security number.

To avoid these scams, you should only use licensed pharmacies and trusted Medicare-approved drug plans. Never buy prescriptions from unsolicited offers.

Enticing people with cheap prescription drugs is one of the most common online Medicare scams, so make sure to speak with your doctor before trying to purchase a new medication.

#7: Identity Theft

Some scammers target seniors simply to steal their Medicare numbers or Social Security information. Once they have it, they can file false claims, open credit accounts, or sell your identity on the black market.

While this type of fraud happens through Medicare scam phone calls and physical mail, it’s one of the more common types of email Medicare scams.

Treat your Medicare card like a credit card. Keep it safe and never share your number unless you initiated the contact.

Melanie Musson Published Insurance Expert

Scammers often target Medicare members during the Special Enrollment Period (SEP) for Medicare, where people may be confused about how to sign up.

If you need help, genuine Medicare representatives are available. Call (855) 634-0435 to speak to someone now.

#8: Home Care Fraud

Fraudulent home health agencies may offer in-home care or therapy you don’t need, then bill your Medicare coverage for fake services.

In some cases, dishonest providers may even convince you to sign blank forms that they later use to falsify claims. Make sure to only accept home care services ordered by your doctor and from agencies certified by Medicare.

Get a Free Medicare Plan Review

Speak With a Licensed Insurance Agent Today

Secured with SHA-256 Encryption

How to Spot a Medicare Scam

Medicare scams can be surprisingly convincing, often disguised as legitimate calls, emails, or mail from trusted sources.

One of the biggest Medicare scam warning red flags is unsolicited contact.

Warning Signs of a Medicare Scam| ⚠️ Sign | ❓ What It Means |

|---|---|

| 🔒 Calls asking for Medicare or SSN | Identity theft attempt |

| ❌ Bills for services you didn’t receive | Phantom billing scam |

| ⏰ Pressure to act immediately | High-pressure sales scam |

| 🎁 “Too good to be true” offers | Free equipment services fraud |

| 📧 Emails/texts with links | Phishing attempt to steal data |

If someone claims to be from Medicare or a health care provider and asks for personal information, it is most likely a scam. However, there are some more key signs to look out for.

Scammers may say you need to “verify” your identity, confirm coverage, or pay for a new Medicare card.

Other warning signs include offers that seem too good to be true, like free medical equipment, genetic tests, or special Medicare savings programs.

You should also be cautious if you notice unfamiliar charges or services on your Medicare Summary Notice or Explanation of Benefits. Fraudsters may bill Medicare for services or equipment you never received.

How Medicare Scammers Contact People| Contact Method | Scam Example |

|---|---|

| 📞 Phone Call | Fake Medicare calls asking for your info |

| 📧 Email Scam | Phishing emails with logos asking for info |

| 💬 Text Message | Text links to fake sites for Medicare info |

| 🚪 Home Visit | Scammers offer tests for Medicare info |

| 📬 Mail Scam | Fake bills or notices that appear official |

High-pressure tactics, threats of losing coverage, or promises of faster service for a fee are also strong indicators of a scam.

If something feels off, whether it’s a suspicious email, a pushy salesperson, or a charge you don’t recognize, it’s best to pause and verify the information directly with Medicare before taking any action.

Reporting Medicare Scams

If you suspect you’ve been targeted by a Medicare scam or notice suspicious charges on your account, it’s important to report it right away. Medicare scam reporting is one of the best ways to help reduce the ways scammers can attack people on Medicare.

You can learn more about the various places to report in our Medicare guide, but the list below covers most bases:

How to Report Medicare Scams| Who to Contact | How to Reach |

|---|---|

| Licensed Medicare Agent | Call (855) 634-0435 for help |

| Senior Medicare Patrol | Local SMP office (fraud help) |

| Federal Trade Commission | (877) FTC-HELP or FTC website |

| State Attorney General | Contact office (varies by state) |

| Inspector General (OIG) | (800) HHS-TIPS or OIG website |

When filing a report, gather as much information as possible. Get the caller’s name or phone number, the date and time of contact, and any suspicious billing details.

Keep copies of your Medicare Summary Notices (MSNs), statements, or emails that may serve as evidence. Reporting scams not only helps protect your own benefits but also assists authorities in preventing others from becoming victims.

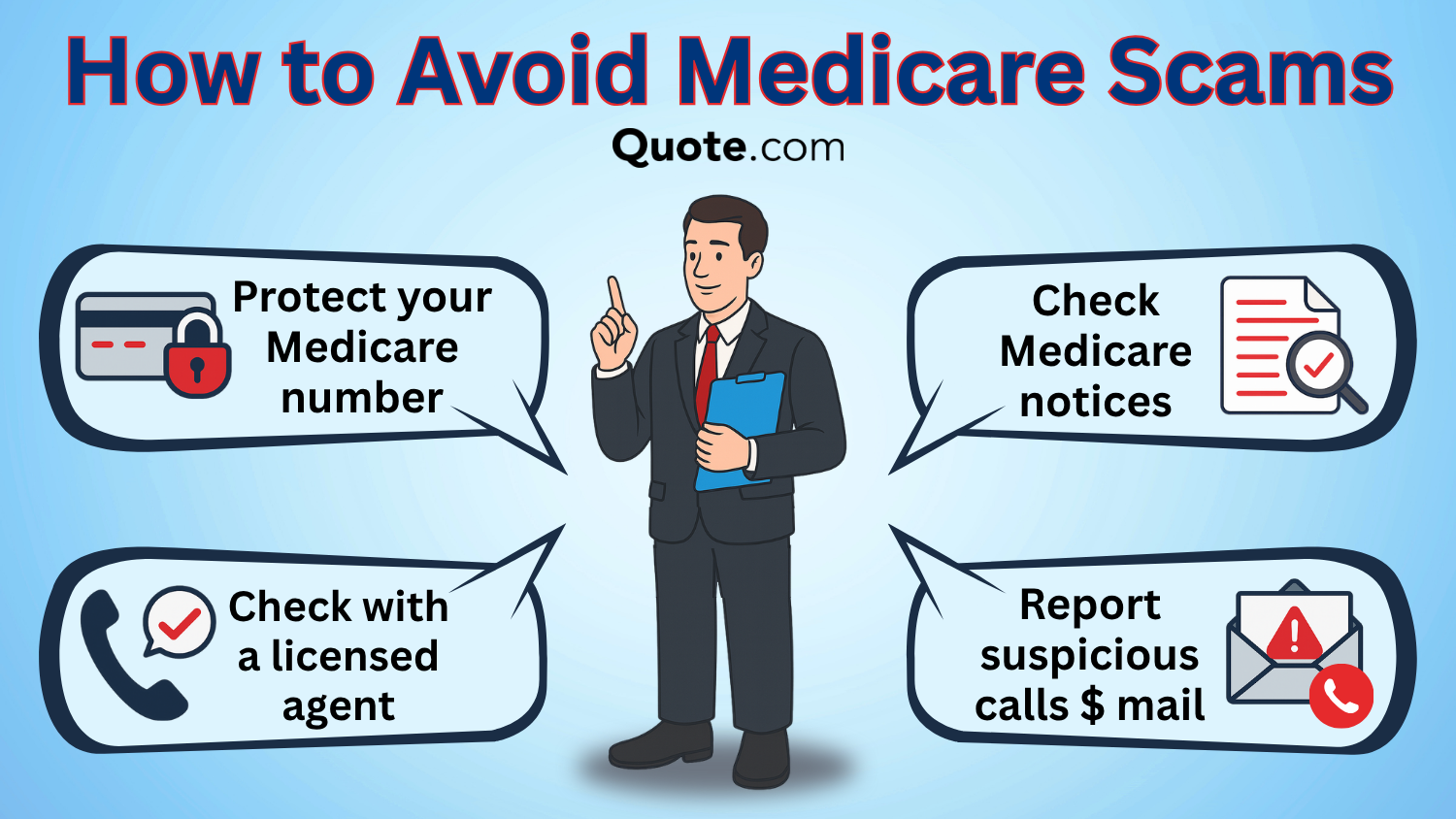

Protect Yourself from Medicare Scams

The best defense against Medicare scams is staying informed and cautious with your personal information.

Never share your Medicare or Social Security number with anyone who contacts you unexpectedly by phone, email, or door-to-door visit.

Medicare will never call to ask for personal details or payments, so treat any such request as suspicious. It’s also wise to regularly review your Medicare Summary Notices (MSNs) or Explanation of Benefits (EOBs) to make sure the services and charges listed are accurate.

If you spot something you don’t recognize or that seems suspicious, call 1-800-MEDICARE and report it immediately.

Tips to Avoid Medicare Scams| Do | Don’t |

|---|---|

| Protect your Medicare number | Share your Medicare or SSN |

| Review your Medicare notices | Share your info for “free” offers |

| Call (855) 634-0435 to confirm | Pay for a Medicare card (it’s free!) |

| Report suspicious calls or mail | Trust caller ID (this can be faked) |

Always use trusted doctors, pharmacies, and medical equipment suppliers, and avoid clicking on links in unsolicited emails or texts about Medicare coverage and eligibility.

When disposing of old statements or personal documents, shred them to prevent identity theft. Staying alert and verifying any unexpected offers or communications can help you protect your coverage and peace of mind.

Get a Free Medicare Plan Review

Speak With a Licensed Insurance Agent Today

Secured with SHA-256 Encryption

Recovering After a Medicare Scam

If you discover that you’ve fallen victim to a Medicare scam, it’s important to act quickly to limit any potential damage.

Start by contacting Medicare to report the fraud and request a new Medicare card with a different number. If you have Medicare Part C, you should also contact your insurance provider if you experience Medicare Advantage scams.

If your personal or financial information has been stolen, consider placing fraud alerts on your credit reports through Equifax, Experian, and TransUnion to help protect your identity.

Travis Thompson Licensed Insurance Agent

Review your Medicare Summary Notices (MSNs) carefully and flag any charges or services you don’t recognize. You should also contact the Federal Trade Commission (FTC) through reportfraud.ftc.gov to document the scam and receive personalized recovery steps.

The Senior Medicare Patrol (SMP) program can also be an invaluable resource, offering free one-on-one assistance to help you resolve billing issues, understand your benefits, and prevent future scams.

Read More: What is Medicare Advantage?

Medicare Scams You Should Avoid

Navigating Medicare can be confusing, but you don’t have to do it alone. Always rely on trusted sources such as Medicare.gov, licensed insurance agents, or verified senior advocacy organizations for accurate information.

Staying alert and informed is the best way to protect your benefits. Whether you have Medicare Advantage vs. Original Medicare, finding help is simple.

If you want to compare the cost of your Medicare coverage to other plans, speaking with a licensed insurance agent can help.

We have licensed agents ready to speak with you. Call (855) 634-0435 to get the help you need.

Frequently Asked Questions

What is a Medicare scam?

A Medicare scam is a fraudulent attempt to steal your personal information, Medicare number, or money by pretending to be a legitimate representative or provider. Scammers often use phone calls, emails, or mail to trick you into giving out sensitive details or paying for fake services. You may also see Medicare scam text messages sending fraudulent links to your phone.

What Medicare scams are going around right now?

Scammers are offering “free” medical tests or equipment and then billing the Medicare program for those services, even when the beneficiary never requested or received them.

They also pose as Medicare or government officials in phone calls, texts, or emails asking for your Medicare number or other personal info under false pretenses (such as a “new Medicare card”).

What are the biggest Medicare scams targeting seniors today?

One of the major scams involves the misuse of durable medical equipment (DME) and genetic testing fraud. Companies bill Medicare for equipment or tests never delivered or needed.

Another large-area scam is impersonation: scammers pretend to be from Medicare, threaten to cancel benefits, or claim you must “update” your card to get full coverage, pressuring seniors to share sensitive information.

Does Medicare send mail?

Yes, Medicare does send official mail, such as Medicare Summary Notices, information about plan changes, and policy updates. However, official mail will always come from the Centers for Medicare & Medicaid Services (CMS) and will never ask for payment or personal details to keep your coverage active.

How do I stop a Medicare scam?

If you suspect a scam, contact Medicare right away to report it and review your account for suspicious charges. You should also report the incident to the Federal Trade Commission (FTC) at reportfraud.ftc.gov and consider requesting a new Medicare card.

Does Medicare ever call to update your information?

No, Medicare will not call you out of the blue to ask for your Medicare number, Social Security number, bank account number, or card number, or to verify it.

Legitimate communications from Medicare are usually by mail or initiated by you through their website or official phone number.

What can scammers do with your Medicare card number?

If you find yourself saying, “I gave my number to a Medicare scammer. What will they do with it?” There are a few answers. A scammer can use your Medicare number to file false claims for medical equipment, tests, or services you never received. They may also use it for identity theft or sell the information to others committing health care fraud.

Does Medicare call you at home?

Medicare rarely makes phone calls and will never ask for your Medicare number, Social Security number, or bank information over the phone. The only exception is if you’ve already spoken with Medicare or requested a callback.

If you’re receiving spam calls from potential scammers and want to know how to stop Medicare phone calls from fake representatives, speak to your phone service provider.

How do you pay for health care expenses that Medicare doesn’t cover?

Figuring out how to finance what your health insurance won’t cover can be stressful, but Medicare recipients have options.

You can cover out-of-pocket costs through a Medigap (Medicare Supplement) plan, which helps pay deductibles, copays, and coinsurance. Some people also use Medicaid, employer coverage, or savings accounts to manage these additional expenses.

Is Medicare issuing new cards?

Medicare is not currently issuing new cards. Any messages claiming you need to update or replace your card for a fee are scams — your current Medicare card remains valid unless you request a replacement directly from Medicare.

Why am I getting so many phone calls about Medicare?

How much does Medicare cost?

Who is eligible for Medicare?

What are Medicare Advantage plans?

What is Medicaid?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.