Solar Panels: Lower Your Bills in 2026

Solar panels can lower electric bills by up to $1,764 per year by cutting how much electricity you pull from the grid. Federal and state tax credits can help lower the upfront cost of installing solar panels. Over time, solar panels may also increase your home’s value.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insurance...

Leslie Kasperowicz

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated January 2026

Homeowners can save with solar by installing a residential solar system that lowers electric costs and increases home value. So, how does solar power save you money?

- Solar panels help offset electricity costs, saving you $1,764 annually

- Incentives and tax credits can help reduce upfront solar panel costs

- Solar panel installation usually costs $13,000 to $28,000

Depending on where you live, how much energy you use, and the size of your system, homeowners can save $1,764 per year, with $0 installation options available under some plans.

Read More: Top 5 Questions About Going Solar

Over time, those savings can offset much or even all of the upfront cost of installing solar panels. Enter your ZIP code to compare free home insurance quotes from top providers near you.

How Solar Panels Lower Monthly Energy Bills

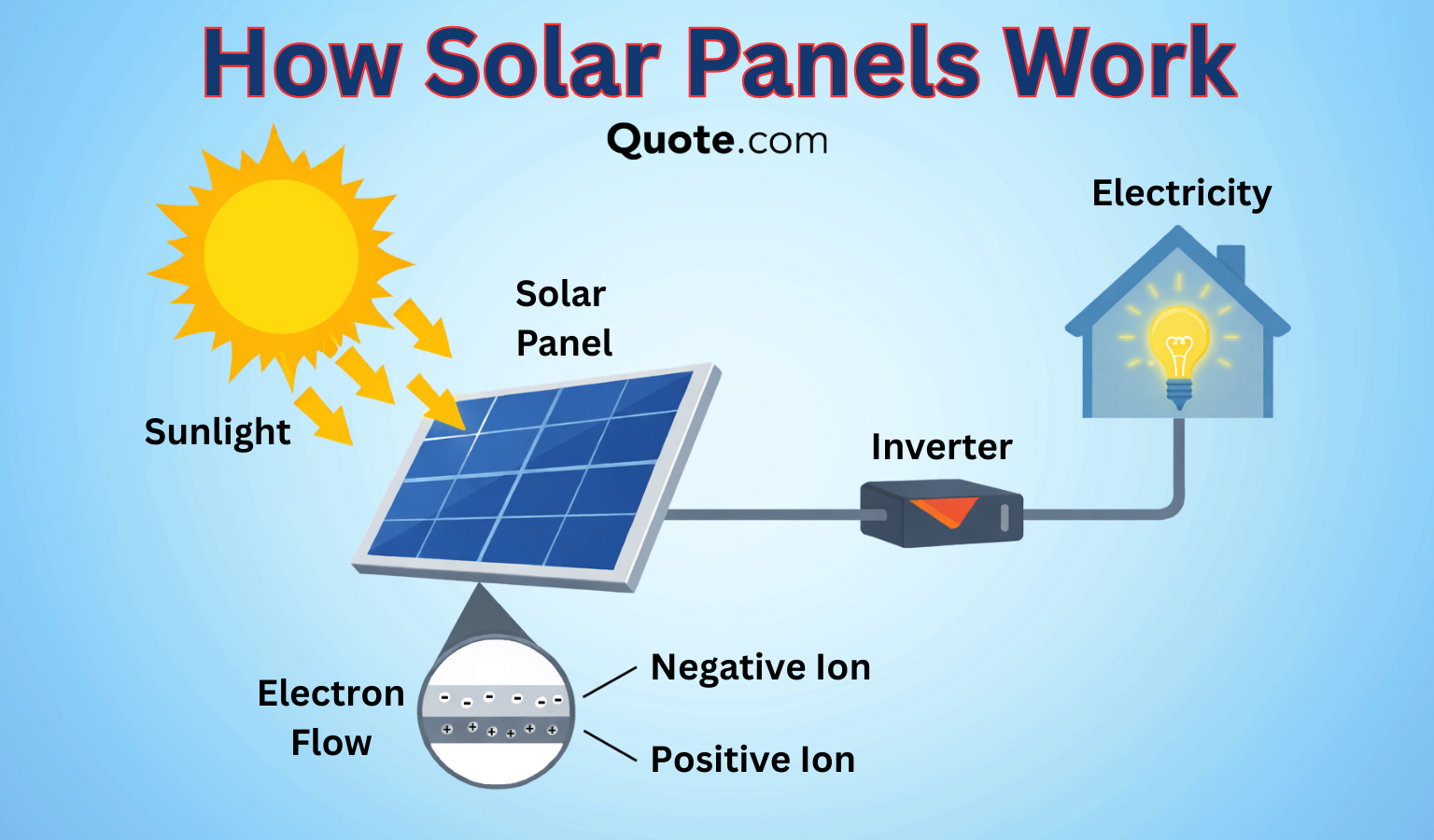

Solar panels produce electricity from sunlight using interconnected solar cells, also known as photovoltaics (PV) cells, reducing how much power your home needs to buy from the utility company.

Solar panels rely on PV cells containing semiconductor materials with loosely bound electrons. When the sun’s rays hit the panel, the electrons are set into motion, generating DC electricity.

Then, that electricity is converted into AC power by an inverter to run your home’s lights, appliances, and other systems.

Any excess electricity your system produces can be stored in a battery or sent back to the grid through net metering programs, helping lower your energy costs. Get a quote for home insurance today to get started.

How Much You Can Save With Solar Panels

A top question readers ask is, “How much can solar save me?” On average, U.S. homeowners can save $1,764 per year with solar panels, depending on system size, local electricity rates, sunlight exposure, and household energy use.

Home solar panel systems protect homeowners from rising electricity costs by locking in lower, more predictable rates over time.

Annual Savings from Installing Home Solar Panels| Category | Before Solar | After Solar | Change |

|---|---|---|---|

| Electric Bill | $2,000 | $221 | –$1,779 |

| Home Insurance | $1,200 | $1,215 | +$15 |

| Net Cost | $3,200 | $1,436 | –$1,764 |

Over a 25-30 year system lifespan, total savings can reach $7,000 to $30,000 or more, especially in areas with higher utility costs. Here’s what drives those savings:

- Lower Utility Bills: Solar panels offset how much electricity you buy from your utility company by generating power on-site.

- Protection From Rate Hikes: Generating your own electricity helps shield you from rising utility prices by reducing your reliance on the grid.

- Net Metering Credits: Many utilities offer credits for electricity sent back to the grid, which can lower your bill at night, on cloudy days, and during seasons with less sunlight.

- Tax Rebates & Incentives: Federal, state, and local programs can reduce upfront expenses and boost long-term savings through tax credits, rebates, and other incentives.

When you get solar energy quotes, installers usually look at your roof size, local sunlight, electricity usage, and available incentives. These same factors also affect how much your solar panels can lower your monthly energy bill after installation.

For many homeowners, solar panels pay for themselves in 7–10 years, after which the electricity they generate is essentially free.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

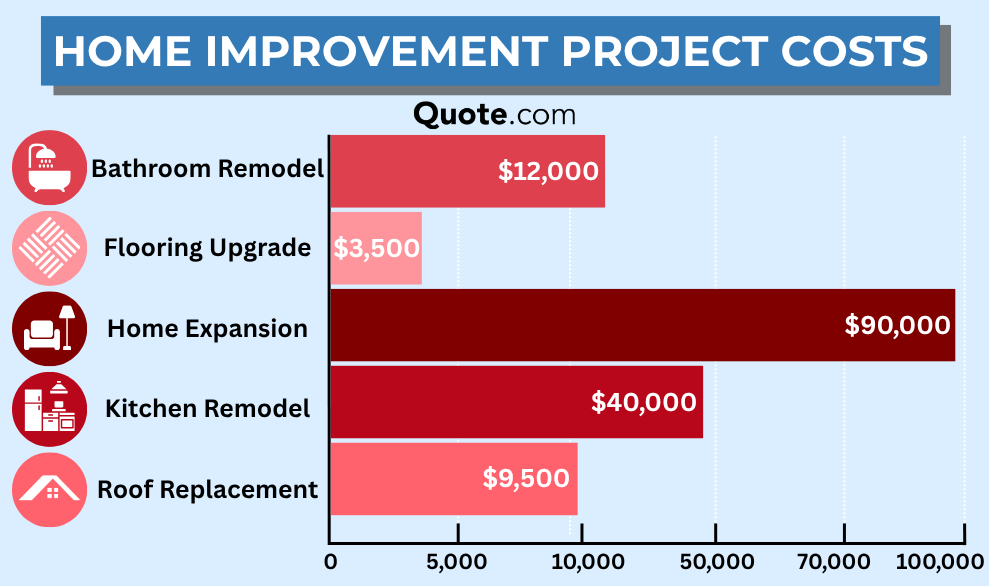

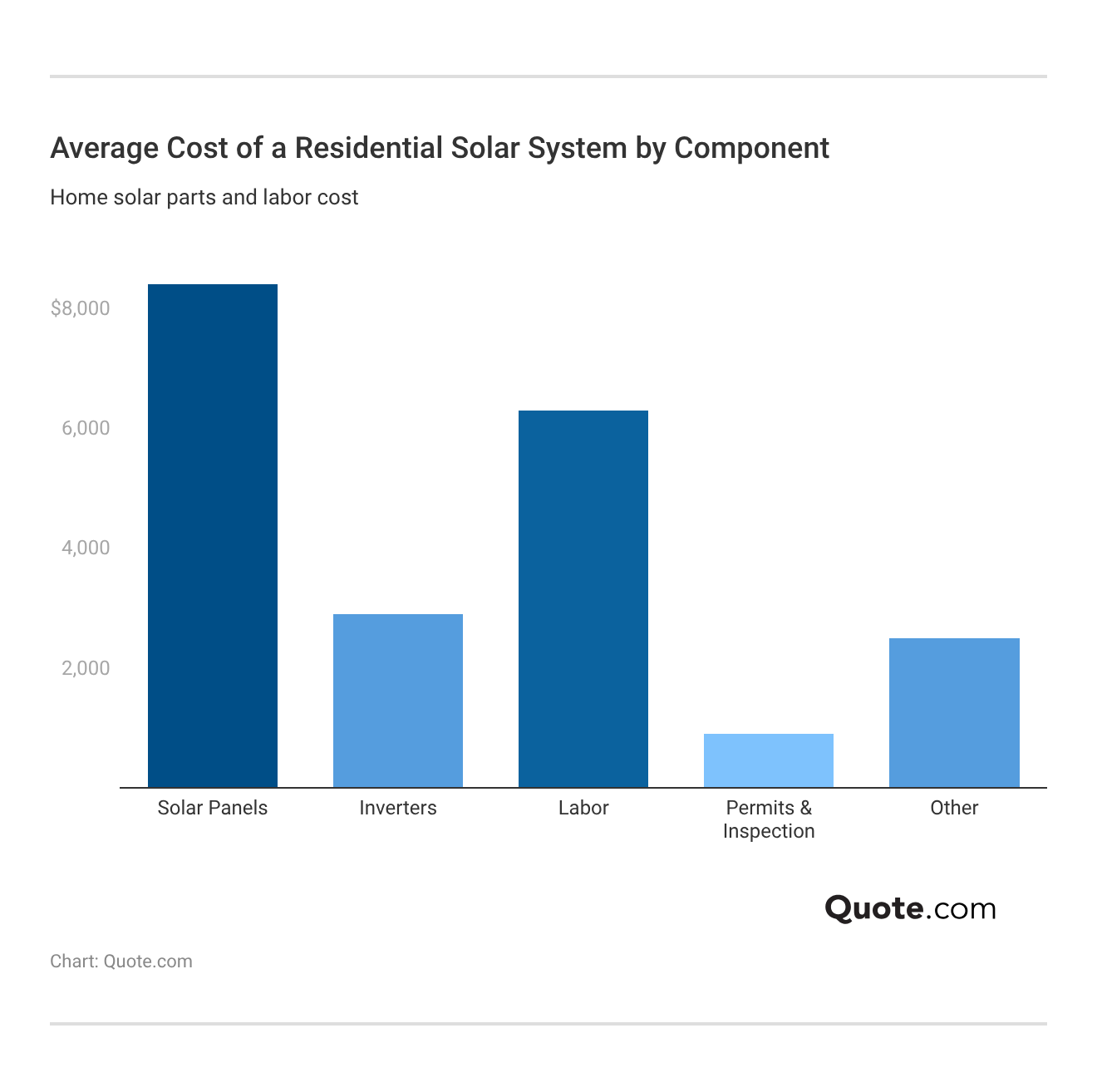

Average Cost of Solar Panel Installation

Installing solar panels typically costs between $13,000 and $28,000 before incentives. Most solar panel systems pay for themselves within 7 to 12 years, depending on energy usage, incentives, and local electricity rates.

Installing solar is also considered one of the best ways to increase home value, since many buyers are willing to pay more for homes with lower energy bills.

Final pricing depends on several variables, including:

- Household electricity usage

- Panel type and system size

- Roof size, condition, and orientation

- Local labor, permitting, and inspection costs

- Available state, local, and federal incentives

When you get a solar energy quote, installers typically calculate pricing by wattage rather than square footage, with average installed costs ranging from $2.87 to $3.85 per watt.

Net metering programs in many states allow homeowners to earn credits for excess electricity their system sends back to the grid. Solar panel installations can also increase home resale value, especially in markets where energy efficiency is a priority for buyers.

While DIY solar systems exist, we recommend professional installation to avoid costly mistakes. Financing options like solar loans, leases, and power purchase agreements can make upfront costs more manageable for homeowners who don’t want to pay cash.

Certified installers help prevent roof damage, ensure the system meets local building codes, and maximize eligibility for tax credits and rebates.

Solar Tax Credits and Rebates

Solar incentives play an important role in lowering the cost of installing a solar system, though federal rules have recently changed. The 30% federal solar tax credit for home-owned systems ended on December 31, 2025, meaning residential solar panels installed in 2026 or later no longer qualify.

Solar leases and PPAs can still offer benefits, since third-party owners can claim the federal credit through 2027 and may pass savings on to homeowners.

In addition to federal programs, there are still many state, local, and utility incentives. These may include upfront rebates, property or sales tax exemptions, and net metering programs that help reduce long-term energy costs.

When it Makes Sense to Go Solar

For homeowners evaluating whether solar makes financial sense, a quotation on solar energy helps estimate upfront costs, expected savings, and long-term return on investment based on household electricity usage and local rates.

You Have High Electricity Bills

If your monthly electricity bills stay high, solar energy can help you save sooner. Households with consistently high kilowatt-hour usage often qualify for larger solar systems to help lower electricity bills and boost monthly savings from day one.

On average, electricity rates in the U.S. continue to rise for all customer groups:

- Residential: 17.98 cents per kWh

- Commercial: 13.41 cents per kWh

- Industrial: 8.65 cents per kWh

- Transportation: 13.57 cents per kWh

These higher rates mean homeowners paying more per kilowatt-hour often see greater savings when they install a home solar system.

Homes that use more power often see a stronger return on investment because solar panels offset a larger share of energy costs right away.

Schimri Yoyo Licensed Agent & Financial Advisor

High electricity bills can also make you eligible for solar incentives, tax credits, or rebates to maximize your investment. This matters even more in areas with high utility rates or frequent price increases.

When you generate your own electricity, you rely less on the grid and gain better control over long-term energy expenses.

Newer homes tend to be larger than older homes and often include more energy-intensive features, such as multiple HVAC zones, smart devices, home offices, and electric vehicle chargers.

According to the U.S. Census Bureau, the median size of a new single-family home reached 2,300 square feet in 2022, roughly 20% larger than homes built in 1990. As square footage and electricity usage go up, monthly utility bills rise as well, making energy costs harder to manage over time.

Find the best residential solar system simply by comparing solar power quotes from top installers in your area.

You Qualify for Current Solar Incentives

Solar tax credits, rebates, and net metering programs can greatly reduce the upfront cost of installing solar panels.

Many solar incentives are time-limited, so acting now helps you lock in valuable benefits that increase long-term savings and improve overall system value.

Federal and state programs can cut installation costs by thousands of dollars to help you secure a wallet-friendly solar quote.

You Plan to Stay in Your Home Long-Term

Solar panels offer the most value if you plan to stay in your home for several years. The longer you live there, the more time you have to benefit from lower electric bills and the added value a solar system can bring to your property.

Reviewing solar electricity quotes can help you understand how long it may take to break even and start seeing meaningful savings. Long-term ownership lets savings grow year after year as utility rates increase.

Homes with solar panels can also be more appealing to buyers, which may help support resale value down the road. When systems are properly installed and insured, modern solar setups can also have a neutral or even positive effect on the cost of home insurance.

How Solar Panels Affect Home Insurance

So, will installing solar panels cause your home insurance rates to go up? Rates won’t always go up after a solar panel installation, but it depends on factors like home value, how the system is installed, and whether your insurer considers the panels a convered structure.

In some cases, adding solar panels may slightly raise premiums because they increase replacement costs. In others, rates may stay the same if the system is included in your existing coverage.

Solar Panels Can Increase Home Insurance Rates

If you install solar panels and they add value to your home, your insurance premium might go up. Solar panels usually add $10,000 to $30,000 or more to the cost to rebuild your home, which may require higher dwelling coverage limits.

If your current policy doesn’t already cover them, your insurer may ask you to raise your coverage limits, which could mean a higher premium.

If your rates do go up, it’s usually a small increase of around $15 per year, not per month.

Roof-mounted panels that are permanently attached are often considered part of the home’s structure. If they aren’t already included in your policy, you’ll likely need to add the right type of home insurance for the panels. Insurers may also factor in added risk, such as roof penetrations or potential fire or electrical issues, which are rare but still considered.

Solar Panels Can Decrease Home Insurance Rates

Homeowners who install solar panels may not experience higher home insurance rates if:

- The solar panels don’t significantly raise your home’s replacement cost.

- The panels are already added to your dwelling coverage.

- You have a ground-mounted system not attached to your house.

- A solar company leases or owns the panels, not you.

In rare instances, a solar panel system can lower your home insurance rates by stabilizing your home’s value and qualifying you for safety-related discounts. This may also happen if you bundle or update your coverage at the same time as the installation.

However, even if your premiums don’t change, you should still notify your insurance company if you install solar panels to see how much home insurance you need. If you don’t, the panels may not be covered under your policy, and any roof or fire damage claims could get denied.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Home Insurance Coverage for Solar Panels

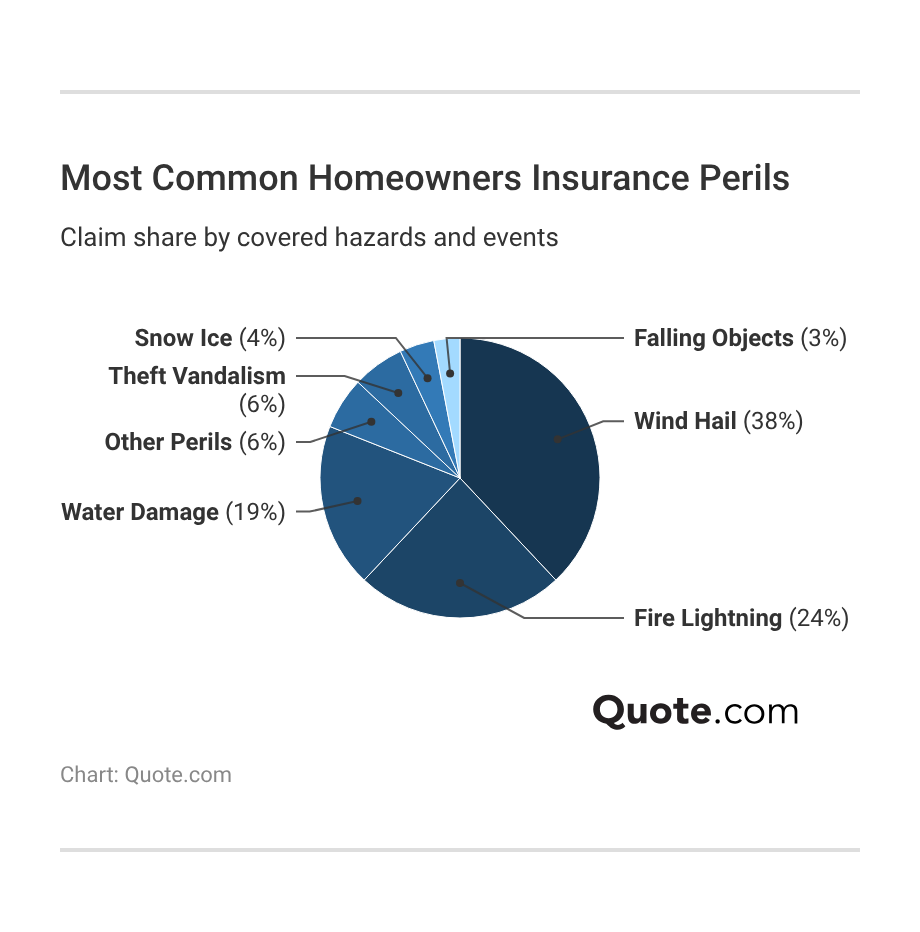

In most cases, standard home insurance policies cover residential solar panels when the loss is caused by a covered peril. Homeowners often review quotes on solar panel installation before they buy, but it’s just as important to understand how those systems are protected after they’re installed.

Panels permanently attached to the roof are usually considered part of the dwelling. Ground-mounted systems often fall under other structures coverage and may have lower limits.

Most Common Types of Home Insurance| Coverage | What it Protects | Typical Limit |

|---|---|---|

| Dwelling | Structure of your home | Up to rebuild cost |

| Personal Property | Belongings inside home | 60% of dwelling coverage |

| Liability | Injuries or damage you cause | $100K–$500K |

| Loss of Use | Living costs after damage | 20% of dwelling coverage |

Homeowners insurance coverage typically protects solar panels from damage caused by fire, wind, hail, and theft. How claims are paid can vary by policy. Some insurers cover solar panels at replacement cost, while others use actual cash value, which factors in depreciation.

When filing a claim, homeowners should document the damage, keep installation records, and contact their insurer as soon as possible to avoid delays or coverage issues.

Coverage may also depend on proper installation and meeting local building codes. Higher-value solar panel systems may need a policy endorsement to ensure full protection. Solar batteries and energy storage systems can have separate coverage requirements as well.

Since coverage limits and terms vary by insurer, homeowners should review their policy and confirm solar panel coverage details with their insurance provider after installation.

Once you’re ready, start comparing homeowners insurance quotes with our free comparison tool.

Solar Financing and No-Money-Down Options

Homeowners have several financing options to choose from when going solar. Common solar financing options include:

- Solar leases with predictable monthly payments

- Power Purchase Agreements (PPAs) that charge for energy produced

- Solar loans or outright purchases

Leasing and PPAs can reduce upfront costs, but they limit ownership benefits. Homeowners who purchase their solar panels can claim available tax credits, increase home resale value, and eventually produce electricity at little to no cost.

A solar energy quotation can help outline overall system costs and financing terms. Once financing is settled, consider comparing solar companies like Horizon Solar Power or Baker Electric to find the best mix of price, equipment, warranties, and customer service for your home.

Solar Panel Lifespan and Performance

Most residential solar panels last around 20 to 30 years. They don’t stop working all at once. Instead, they gradually lose efficiency over time.

On average, a solar energy system still produces at least 80% of its original output after 25 years, with performance dropping by about 1-2% each year.

In real-world installations, most long-term issues come from components like inverters, not the panels, which is why good system design and strong warranties matter.

Daniel S. Young Managing Editor

Modern solar panels are built to handle wind, snow, rain, and moderate hail. Many panels are also tested to meet strict industry standards for impact and pressure.

That durability makes solar panels a reliable, long-term investment for homeowners seeking consistent energy savings over time.

Learn More: How to Compare Solar Panel Quotes

Roof Compatibility and Installation Safety

Before installation, professionals evaluate your roof’s age, slope, structural strength, and sun exposure. Roofs near the end of their lifespan may need replacement before solar panels are installed to avoid costly removal and reinstallation later.

Most installers also check local building codes and permit requirements to ensure the system meets safety standards.

When installed correctly, solar panels don’t cause leaks or structural damage. In some cases, they can even help protect roofing materials by reducing direct exposure to harsh weather.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Types of Solar Panels for Residential Use

Most homes use one of the following panel types:

- Monocrystalline panels, which are highly efficient and require less roof space

- Polycrystalline panels, which are more affordable but slightly less efficient

- Thin-film panels, typically used for specialty or commercial applications

The best solar panels to get depends on budget, roof constraints, and energy goals. Get a home insurance quote that includes your solar panels and take the first step toward lowering your energy bills.

Frequently Asked Questions

Is installing solar panels worth it?

For many homeowners, solar panels are a smart long-term investment. They reduce monthly electricity costs, increase property value, protect against rising energy prices, and lower environmental impact. Choosing from the best solar panel brands can further improve performance and long-term savings.

With financing options and incentives widely available, solar energy is more accessible than ever. Reviewing a solar quote can help homeowners understand upfront costs, available incentives, and potential long-term savings.

How much does it cost to install solar panels?

Installing solar panels on your home can cost you anywhere from $13,000 to $28,000, though the price may vary depending on your state and the credits you qualify for. While the upfront cost can feel significant, many homeowners are able to save money with solar power over time through lower monthly electricity bills and long-term energy savings.

How much can solar energy save you?

How much does solar energy save you? Solar panels can save you up to $1,764 per year in several ways. They lower monthly electricity bills by reducing how much power you buy from the utility company.

With rising energy costs considered one of the major threats to U.S. homeowners, solar panels help stabilize expenses by providing more predictable long-term energy costs.

Solar panels can also help protect your roof from weather damage, and they often increase home resale value by making your property more attractive to buyers.

How does solar power save money?

Solar power saves you money by lowering your monthly electricity bills, reducing reliance on utility companies, and protecting you from rising energy rates. Quotes for solar panels often outline projected savings from net metering credits, available incentives, and increased home value over time.

How long does it take for solar panels to pay for themselves?

Solar typically pays for itself in 7 to 15 years, but payback can be as fast as 2 to 4 years in strong incentive markets with favorable net metering and high electricity rates.

Does my homeowners insurance cover solar panels?

Most homeowners insurance policies cover permanently installed solar panels as part of your dwelling, similar to a roof or other attached structure. Coverage usually includes common risks like fire, wind, and theft, but limits can apply.

Since solar panels are one of the best ways to increase home value, you may need to raise your dwelling coverage to make sure the system is fully protected. Confirm your solar panel coverage with your insurance provider after installation.

Get a home insurance quote today to confirm your coverage reflects your solar upgrade.

Why is my electric bill so high if I have solar panels?

Even with solar panels, your electric bill can still be high if your system doesn’t produce enough energy to match your usage. This often happens when household electricity use is higher than expected, sunlight is limited because of weather or shading, or the system is too small for your home’s needs.

You may also see charges from your utility for grid connection fees, electricity used at night, or power pulled from the grid during times when your panels aren’t generating energy. A quote for solar power can help homeowners anticipate these ongoing costs by estimating how much electricity will still come from the grid.

What types of solar panels are available for homes?

Most homes use monocrystalline or polycrystalline panels. Monocrystalline panels are more efficient but cost more, while polycrystalline panels are more affordable with slightly lower efficiency. Thin-film panels exist but are less common for residential rooftops.

How many solar panels does a home need?

The number of panels required depends on energy usage, panel wattage, roof space, and sunlight exposure. A typical 5kW residential system produces about 5,000 watts and usually requires around 20 panels rated at 250 watts each. Higher-efficiency panels can reduce the total number needed.

Solar panel quotes typically reflect these variables, helping homeowners understand how higher-efficiency panels can reduce the total number needed while still meeting energy demands.

Compare Solar Electricity Quotes: SolarCity vs. SunRun

How long do solar panels last?

A typical lifespan is around 25 years, and many panels continue producing beyond that, but at reduced output. A quote on solar energy often includes performance expectations, showing that panels are commonly designed to retain about 80% output over their life while declining roughly 1–2% per year.

What are the best solar companies?

How do solar panels perform in different climates?

Do solar batteries provide backup power and energy storage for homes?

Can solar panels power my entire home off the grid?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.