Best Auto Insurance for Good Drivers in 2026

Nationwide, USAA, and Liberty Mutual offer the best auto insurance for good drivers, with rates starting at $32 per month. These top companies provide up to 40% in safe driving discounts, and telematics programs such as Geico's DriveEasy and Allstate's Drivewise, rewarding low-risk drivers with lower rates.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Copywriter

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, AllWom...

Rachel Bodine

Managing Editor

Aleksandra J. Churlinov holds a Bachelor of Arts in English Language and Literature and a Master of Science in Marketing Management. Over the past six years, Aleks has focused on the insurance sector, working on a range of content, including business, auto, and life insurance. In April 2025, she stepped into the role of Managing Editor, where she now leads a team of talented insurance writers. ...

Aleksandra J. Churlinov

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated December 2025

The best auto insurance for good drivers comes from Nationwide, USAA, and Liberty Mutual, with rates starting as low as $32 per month.

- Full coverage for good drivers ranges from $84 to $248 per month

- Nationwide is the top pick for low rates and telematics rewards

- Telematics and safe driving save up to 40% for good drivers

Nationwide is best overall for low rates, with up to 40% in safe driving discounts and strong telematics rewards.

USAA is the top choice for military families, and Liberty Mutual offers a wide range of policy options as well as savings on bundling.

Top 10 Companies: Best Auto Insurance for Good Drivers| Company | Rank | Claims Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 728 / 1,000 | A | Bundled Savings | |

| #2 | 726 / 1,000 | A++ | Accident Free | |

| #3 | 717 / 1,000 | A | Rate Stability |

| #4 | 710 / 1,000 | A++ | Clean Records | |

| #5 | 706 / 1,000 | A | Driver Rewards | |

| #6 | 704 / 1,000 | A+ | Member Benefits |

| #7 | 692 / 1,000 | A++ | Low Risk | |

| #8 | 691 / 1,000 | A+ | Bonus Savings | |

| #9 | 672 / 1,000 | A+ | Smart Tracking | |

| #10 | 684 / 1,000 | A++ | Careful Drivers |

These providers offer the best mix of cost, coverage, and perks for clean-record drivers. Start comparing rates from the best car insurance companies for safe drivers below.

Finding cheap car insurance for good drivers is as simple as entering your ZIP code into our free quote comparison tool.

Compare Car Insurance Rates for Good Drivers

USAA and Geico provide low rates, but Nationwide, USAA, and Liberty Mutual stand out as the best car insurance for good drivers by delivering cheap monthly premiums.

Nationwide is a top pick for its affordability, up to 40% SmartRide discounts, and reliable service (Read more: Liberty Mutual vs. Nationwide Auto Insurance).

Good Driver Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $65 | $122 |

| $87 | $228 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 | |

| $32 | $84 |

USAA, available only to military families, offers the lowest full coverage rate at $84 per month, with up to 60% in deployment savings and top customer satisfaction ratings.

For eligible drivers, USAA offers affordable car insurance with a spotless driving record, combining low rates, excellent service, and strong benefits.

Good drivers who maintain clean records can maximize their insurance savings by enrolling in telematics monitoring programs.

Jeff Root Licensed Insurance Agent

Liberty Mutual is slightly more expensive, at $248 per month, and offers customizable coverage, up to 30% off with RightTrack, and strong bundling discounts.

In addition to savings, good drivers get long-term value, innovative tools, and flexible protection.

How Age Impacts Car Insurance Costs for Good Drivers

Nationwide, USAA, and Liberty Mutual offer top auto insurance for good drivers, delivering more value than cheaper options based on the average cost of auto insurance.

Nationwide offers reliable service and rates dropping from $135 per month at age 18 to $63 per month by age 45, making it one of the best auto insurance for new drivers.

Good Driver Auto Insurance Monthly Rates by Age| Company | Age: 18 | Age: 25 | Age: 35 | Age: 45 |

|---|---|---|---|---|

| $105 | $59 | $53 | $65 |

| $165 | $102 | $94 | $87 | |

| $175 | $98 | $82 | $76 | |

| $85 | $50 | $45 | $43 | |

| $185 | $119 | $104 | $96 |

| $135 | $81 | $68 | $63 | |

| $145 | $77 | $61 | $56 | |

| $100 | $60 | $49 | $47 | |

| $115 | $62 | $57 | $53 | |

| $75 | $46 | $34 | $32 |

USAA offers the lowest rates at $75 per month for 18-year-olds, ideal for drivers under 25. Liberty Mutual stands out at $185 per month with flexible coverage and bundling.

Compare car insurance companies that provide good driving discounts and other perks such as telematics, bundling, and accident forgiveness.

Location Is a Key Factor in Good-Driver Rates

Car insurance rates vary by state and gender. In Washington, men pay $86 per month and women $82, showing how location affects the best car insurance for low-risk drivers.

Florida has some of the highest rates, with males at $128 and females at $121, making it key to compare the best auto insurance companies in Florida for better deals.

Good drivers in California pay around $104 per month for males and $98 for females, on average, with many receiving a good driver discount to help lower rates.

Nebraska has the lowest rates at $60 per month for males and $57 for females, which shows how local factors like traffic and accidents can impact your insurance rates.

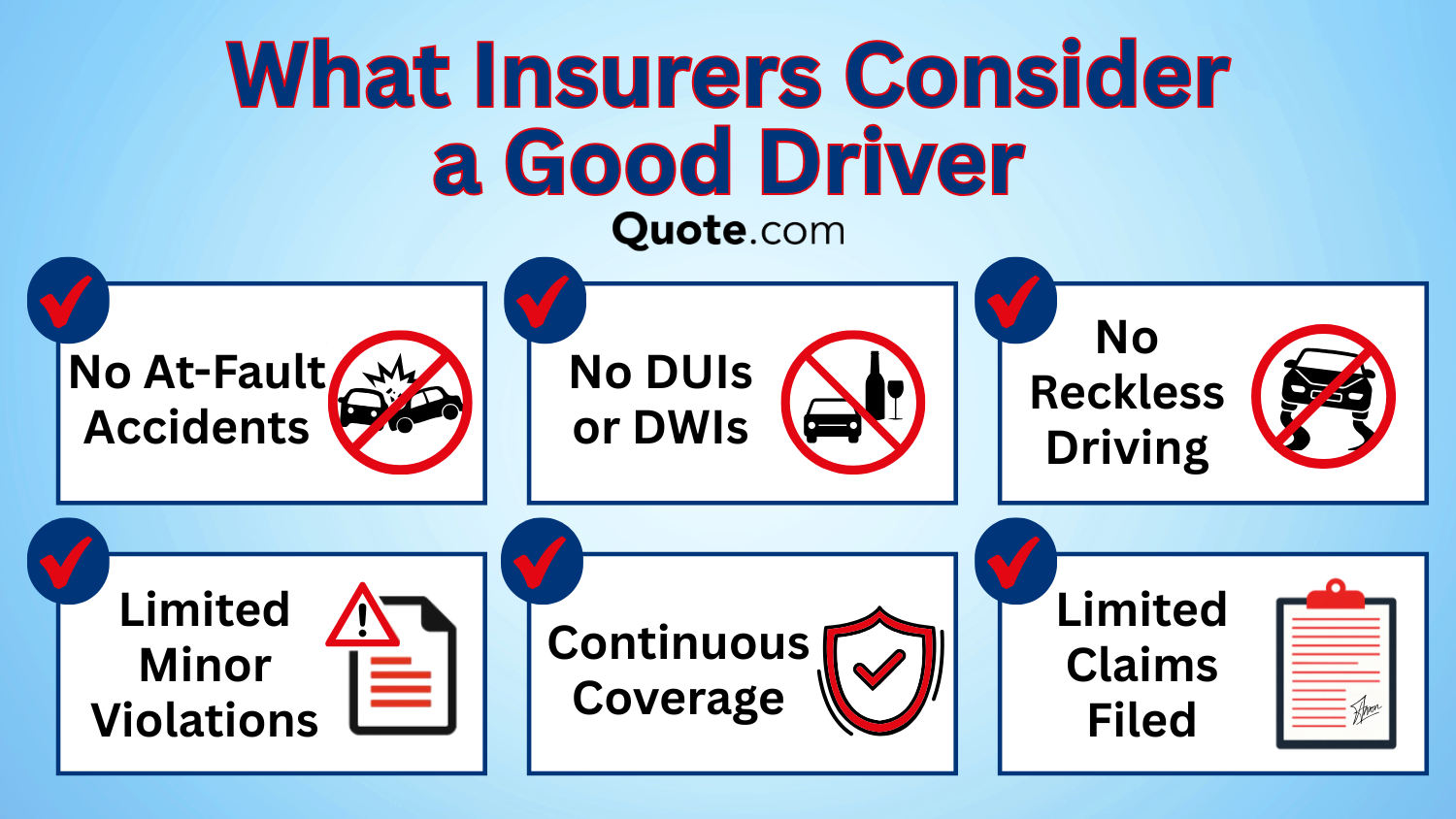

How Driving History Affects Your Insurance Price

Nationwide, USAA, and Liberty Mutual offer strong value, with USAA providing some of the cheapest insurance for high-risk drivers at $58 per month.

With top service and military perks, USAA is a strong choice for both safe and high-risk drivers seeking affordable coverage.

Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $65 | $72 | $81 | $58 |

| $87 | $124 | $152 | $103 | |

| $76 | $109 | $105 | $95 | |

| $43 | $71 | $117 | $56 | |

| $96 | $129 | $178 | $116 |

| $63 | $88 | $129 | $75 | |

| $56 | $98 | $75 | $74 | |

| $47 | $57 | $65 | $53 | |

| $53 | $76 | $112 | $72 | |

| $32 | $42 | $58 | $36 |

Nationwide, starting at $63 monthly, includes accident forgiveness, telematics rewards, and insurance reduction for non-DUI.

Liberty Mutual offers flexible coverage options and bundling, good drivers can expect to pay anywhere from $96 to $178 per month for auto insurance from the insurer.

Credit Impacts Auto Insurance Rates for Good Drivers

Good drivers with clean records who drive safely also fare best by combining strong credit and using usage-based programs, insurer discounts, if applicable.

These programs track driving habits like speed, braking, and mileage to offer discounts, helping good drivers with strong credit lower their monthly rates.

Good Driver Auto Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670–799) | Fair (580–669) | Poor (<580) |

|---|---|---|---|---|

| $65 | $78 | $102 | $138 |

| $87 | $104 | $138 | $185 | |

| $76 | $92 | $121 | $164 | |

| $43 | $52 | $74 | $112 | |

| $96 | $118 | $152 | $199 |

| $63 | $75 | $98 | $132 | |

| $56 | $69 | $93 | $128 | |

| $47 | $56 | $72 | $101 | |

| $53 | $67 | $92 | $131 | |

| $32 | $39 | $52 | $71 |

USAA, Nationwide, and Liberty Mutual offer good drivers affordable rates and valuable savings (Learn more: Farmers vs. USAA Auto Insurance).

USAA offers rates from $32 per month, while Nationwide and Liberty Mutual provide up to 40% savings for safe driving.

In addition to credit scores, other things impact your auto insurance rate, such as annual mileage, claims history, and participation in usage-based or telematics programs.

Good drivers with clean records and safe habits are often rewarded with the most competitive rates across all coverage levels.

Insurers favor low-mileage, low-risk drivers who participate in telematics programs like SmartRide, RightTrack, Drivewise, and Geico DriveEasy to get customized discounts.

Geico DriveEasy reviews show the program rewards safe driving with lower premiums, making it a smart way to save through real-time tracking.

You also may lower premiums by buying auto insurance along with your homeowner, renters, or life policy and keeping a good credit score.

Together, these are factors that provide the aging responsible driver with various opportunities to reduce expenses while maintaining quality coverage.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Recommended Coverage for Good Drivers

Good driving definitely pays off, as there are reduced premiums, special discounts, and you will be eligible for the best insurance policies.

But safe driving alone isn’t enough. To truly protect yourself on the road, you need the right coverage that goes beyond the basics.

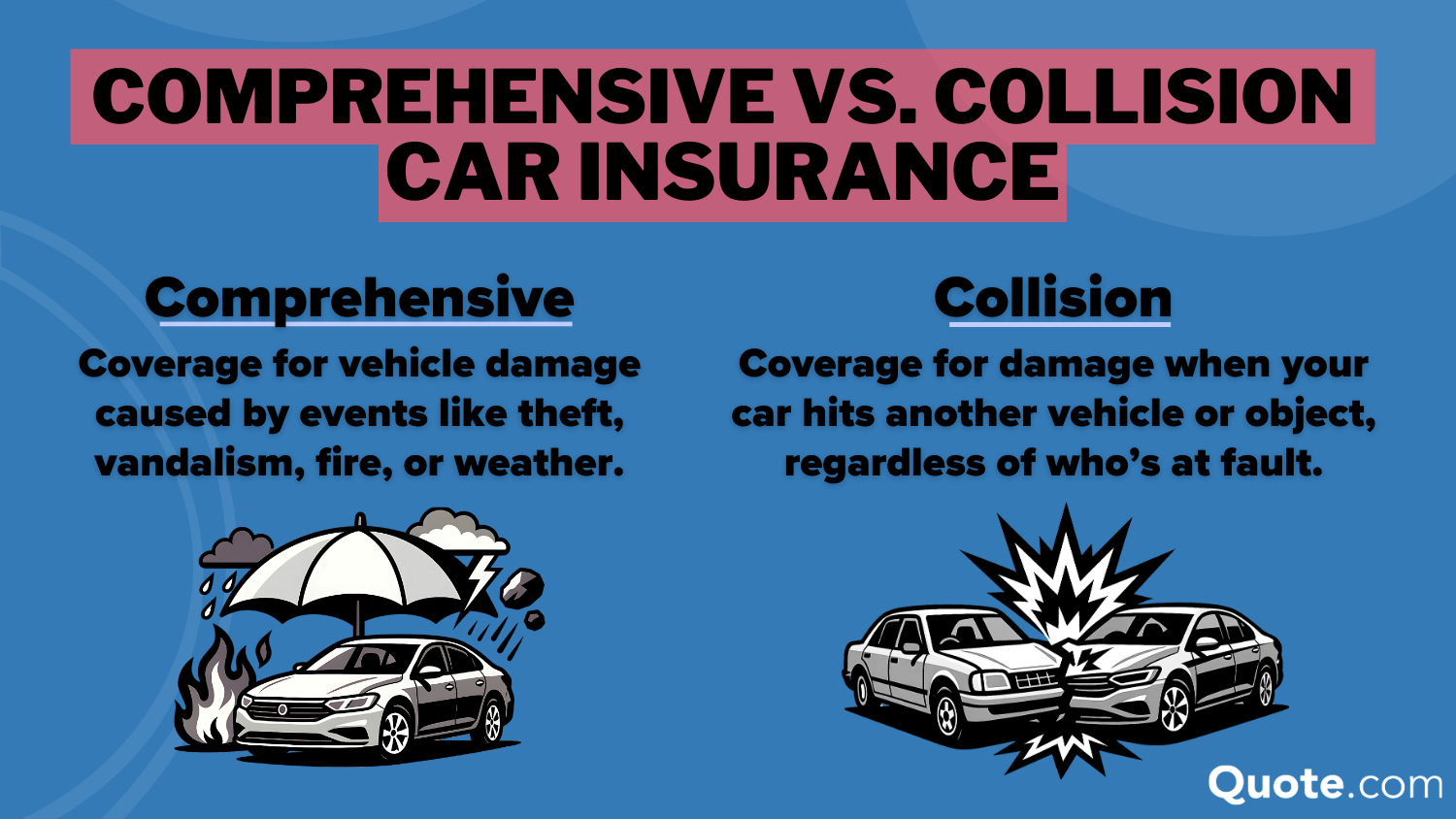

- Liability Coverage: Covers bodily injury and property damage you cause to others in an at-fault accident. Required in most states and foundational to any auto policy.

- Collision Coverage: Covers repairing or replacing your car after an accident, no matter who is at fault, useful even for drivers with a clean record.

- Comprehensive Coverage: Protects against non-collision damage such as theft, vandalism, weather events, and animal strikes.

- Accident Forgiveness: At-fault accidents & insurance rates show this feature stops premium hikes after a first at-fault accident for clean-record drivers.

Even the safest drivers can face unexpected events like weather damage, theft, vandalism, or accidents caused by others.

These types of incidents may not only require expensive repairs, even if the accident wasn’t your fault. Safe drivers shop around for the best car insurance coverage available for their vehicle.

Selecting the right coverage, like comprehensive, collision, and uninsured motorist, protects your clean record and shields you from unexpected costs.

These coverages protect good drivers from out-of-pocket costs and help maintain lower premiums.

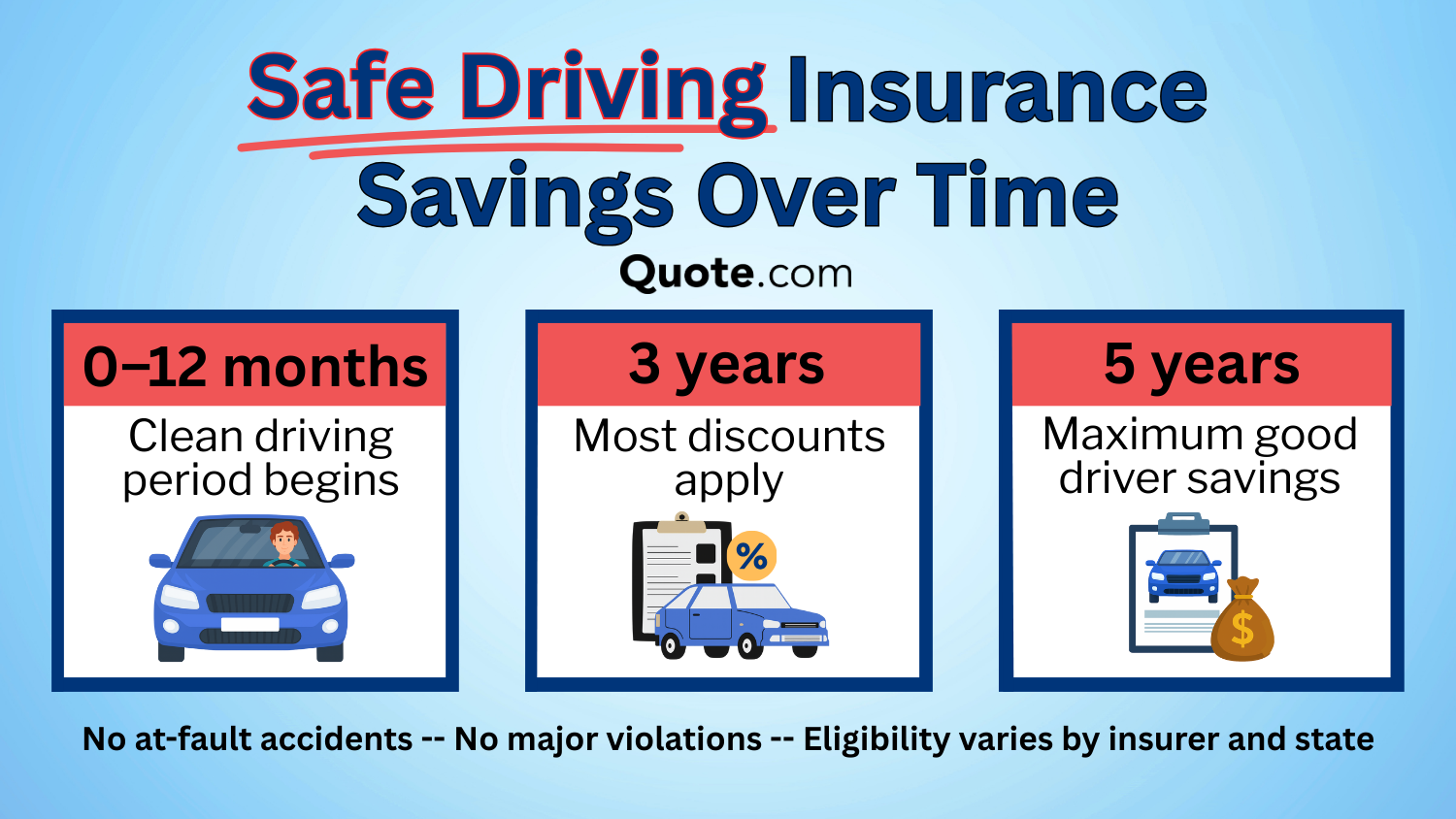

How Good Drivers Save on Auto Insurance

Good drivers can unlock meaningful savings through a variety of insurance discounts for good drivers tied to safe habits and low-risk behavior.

Carriers often give discounts to people without accidents, without tickets, who have taken defensive driving or are safe drivers.

Top Auto Insurance Discounts for Good Drivers| Company | Accident-Free | Clean Record | Defensive Driving | Safe Driver |

|---|---|---|---|---|

| 15% | 10% | 14% | 10% |

| 25% | 15% | 10% | 18% | |

| 20% | 12% | 10% | 20% | |

| 22% | 12% | 15% | 15% | |

| 20% | 10% | 10% | 20% |

| 20% | 12% | 10% | 12% | |

| 10% | 20% | 30% | 10% | |

| 17% | 10% | 15% | 20% | |

| 13% | 10% | 20% | 15% | |

| 10% | 8% | 5% | 10% |

Allstate offers a 25% accident-free discount, while Geico provides a 15% defensive driving discount for completing a safety course.

Farmers and Liberty Mutual offer 20% savings for safe drivers, making them great choices for those with low-risk habits and long-term premium savings.

Maximizing car insurance discounts starts with smart, low-mileage driving. Drivers logging 5,000 to 7,000 miles per year are seen as lower risk and often get the best rates.

Reduced mileage and safe driving habits can qualify drivers for a good driver car insurance discount, helping lower monthly premiums.

- Limit Your Mileage: Drivers under 10,000 miles a year get lower rates, with the cheapest for 5,000–7,000 miles.

- Install Safety Systems: Adding GPS trackers or alarm systems can lower premiums and help you get the best car insurance for safe drivers with tracking.

- Avoid Vehicle Mods: Performance or appearance modifications can raise premiums and can increase your risk as a driver in the eyes of your insurance company.

- Enroll in Telematics: Some insurers offer a good driver’s discount for safe habits like avoiding speeding and hard braking.

Equipping your car with safety features like immobilizers, GPS trackers, or alarms can help reduce the risk of theft or damage, which may lower the cost of full coverage insurance.

Avoiding performance or cosmetic modifications can also help keep premiums down; upgrades generally jack up the cost of repairs and replacements.

Signing up for telematics programs, which track driving behavior like braking, speed, and nighttime activity, also allows insurers to see just how safely you drive.

Demonstrating low-risk behavior may qualify you for personalized savings, lowering monthly premiums while keeping strong, reliable coverage.

Top 10 Insurance Companies for Good Drivers

The top five providers of comprehensive auto insurance for good drivers, State Farm, Geico, USAA, Allstate, and Progressive, offer competitive rates and strong discounts.

At 25% market share, State Farm leads the count, followed by Geico at 22%, Progressive at 20%, Allstate at 18% and USAA at 15%, showing how they tend to be favored by safe drivers.

Top car insurance companies for good drivers, such as these providers, present a variety of incentives, such as telematics savings, accident forgiveness, and loyalty rewards.

These car insurance discounts for good drivers help lower premiums while keeping strong coverage, making it easier for safe drivers to get affordable, high-quality protection.

#1 – Nationwide: Top Pick Overall

Pros

- Bundled Policy Savings: Good drivers can lower their total insurance costs by combining auto and home policies with Nationwide. Explore our Nationwide auto insurance review.

- Accident Forgiveness: Nationwide offers accident forgiveness with car insurance for good drivers, protecting them from premium increases after their first at-fault accident.

- Flexible Coverage Add-Ons: Good drivers may qualify for car insurance’s free policy add-ons for good drivers, like roadside assistance or gap insurance.

Cons

- Credit-Based Pricing: Rates for good drivers with poor credit can reach up to $132 per month, reducing affordability.

- Discount Complexity: Some good drivers report difficulty understanding which specific discounts apply and how to qualify.

#2 – USAA: Best for Accident Free

Pros

- Accident-Free Stability: Good drivers maintain low premiums even after minor incidents, with rates around $42 per month after one accident.

- Lowest Monthly Rates: Good drivers with clean records pay as little as $32 per month, among the cheapest available. Get a complete view in our USAA insurance review.

- Military-Specific Benefits: Good drivers benefit from the best usage-based auto insurance for military disciplined drivers with exclusive discounts.

Cons

- Fewer Custom Options: Good drivers may find fewer add-on coverages than with larger national insurers.

- Limited Discount Variety: USAA offers fewer standalone discounts compared to competitors with large telematics programs.

#3 – Liberty Mutual: Best for Rate Stability

Pros

- Long-Term Consistency: Good drivers are rewarded with long-term rates, with clean record rates at $96 per month, reducing unexpected rate increases.

- Flexible Coverage: Personalized policies help keep rates stable and reward you for good driving habits. Don’t pay extra for any add-ons.

- Safe Driver Rewards: Programs like RightTrack help good drivers maintain or lower rates by rewarding consistent safe driving. See our Liberty Mutual insurance review.

Cons

- Limited Telematics Impact: Even with RightTrack, the discount cap won’t lower some very high base rates for good drivers.

- Credit Sensitivity: Rates jump to $199 per month for poor credit, making stability less beneficial for good drivers with lower scores.

#4 – State Farm: Best for Clean Records

Pros

- Low Clean Record Rates: Good drivers with clean records can pay as little as $47 per month, making State Farm one of the most affordable options.

- Drive Safe & Save Program: Good drivers may lower their rates through State Farm’s telematics program that provides discounts for safe driving.

- Local Agent Support: Good drivers benefit from State Farm’s personalized service and large local agent network. Read our State Farm auto insurance review for more.

Cons

- Limited Discount Ceiling: Good drivers may find savings smaller compared to insurers offering larger telematics discounts.

- Accident Forgiveness Limits: Good drivers don’t automatically receive accident forgiveness, which can lead to rate increases after a claim.

#5 – Farmers: Best for Driver Rewards

Pros

- Signal Telematics App: Good drivers can use the Farmers’ Signal app to track their driving habits and may receive discounts for safe behavior.

- Safe Driver Discounts: Good drivers who maintain clean records receive up to 20% off, helping lower costs over time. Read full details in our Farmers insurance review.

- Mid-Range Premiums: Good drivers pay around $76 per month for minimum coverage and $198 per month for full coverage, moderate compared to competitors.

Cons

- Limited UBI Savings: Farmers’ telematics program offer less room for reward when compared to top insurers compared to top programs like Nationwide’s SmartRide.

- Higher Full Coverage Costs: At $198 per month, full coverage may be expensive for good drivers compared to Geico or USAA.

#6 – AAA: Best for Member Benefits

Pros

- Membership Rewards: Good drivers can earn valuable rewards like travel discounts and shopping through AAA’s loyalty program, which extends far beyond just insurance.

- Bundling Perks: Customers can bundle auto and home policies for even greater cost savings, a suitable option for good drivers with a lot to protect.

- Accident-Free Discount: Offers up to 15% off for a clean record, rewarding good drivers for safe, claim-free habits. Find additional info in our AAA auto insurance review.

Cons

- Membership Required: Insurance is tied to AAA membership, which adds an extra annual cost, even for drivers only seeking auto coverage.

- Regional Variability: AAA is made up of regional clubs, meaning benefits, discounts, and even service quality can vary depending on location, a downside for consistency.

#7 – Geico: Best for Low Risk

Pros

- Usage-Based Savings: Through Geico’s DriveEasy program, drivers can earn additional discounts for safe driving habits, such as braking and speed.

- Quick Quote Process: Easy-to-use online tools that allow good drivers to compare rates and purchase coverage the same day. Check out our Geico insurance review for insights.

- Strong Defensive Discount: Learn how to save up to an extra 15% on your insurance policy when you qualify for good driving discounts.

Cons

- Rate Spikes Possible: Premiums can increase significantly after a single violation, even for good drivers with otherwise clean records.

- No Local Agents: Good drivers who prefer personalized support may miss having a dedicated local representative.

#8 – Allstate: Best for Bonus Savings

Pros

- Safe Driver Bonus: Allstate rewards consistently good drivers with additional perks and savings, including cashback through its safe driving bonus check.

- Driving Course Discount: Earn 10% off by completing approved defensive driving courses, a smart option for good drivers. Learn more in our Allstate insurance review.

- Loyalty Incentives: Good drivers who remain with Allstate can earn more money off their coverage by sticking with the insurer and bundling policies.

Cons

- Strict Eligibility: Some discounts for good drivers (like Safe Driving Bonus) are only available in select states or require added policy features.

- Limited Bundling Value: Price Increases: Good drivers with a minor incident may still see rate increases, reducing the benefit of their previous clean record.

#9 – Progressive: Best for Innovative Tools

Pros

- Snapshot Program Savings: Good drivers can earn personalized discounts with Progressive’s Snapshot app. See our Progressive auto insurance review for more.

- User-Friendly App: The Snapshot mobile app offers an easy way for good drivers to monitor habits and improve performance for additional discounts.

- Custom Rate Adjustments: Progressive’s tracking program helps good drivers get good rates for car insurance, dropping costs from $75 to under $60 per month.

Cons

- Inconsistent Discount Results: Frequent or risky-hour driving can raise rates, even under high-risk auto insurance for good drivers.

- Initial Setup Effort: Good drivers must install a plug-in device or enable constant app tracking, which can be inconvenient for some users.

#10 – Travelers: Best for Accident Forgiveness

Pros

- Solid Mid-Tier Pricing: Good drivers pay $53 per month for minimum and $141 per month for good cheap full coverage car insurance.

- Low Violation Impact: With a single ticket, rates only increase to $72 per month, less steep than competitors for good drivers with minor infractions.

- Strong Telematics Option: IntelliDrive program tracks driving behavior and rewards good drivers for safe habits over time. Find the full list in our Travelers auto insurance review.

Cons

- Average Customer Support: Service quality is rated average, which could be a drawback for good drivers needing consistent support.

- Fewer Loyalty Perks: Travelers lacks long-term loyalty rewards found with companies like Nationwide, which benefit good drivers who stay claim-free.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Find the Best Coverage for Good Drivers

Nationwide and Liberty Mutual offer the best auto insurance for good drivers, with rates from $63 to $178 and perks like accident forgiveness, telematics, and bundling.

The auto insurance guide highlights USAA, Nationwide, and Liberty Mutual among some of the best choices for good drivers who want excellent coverage and long-term savings.

If you’re looking for the cheapest car insurance for good drivers, enter your ZIP code into our free quote comparison tool to compare rates from top insurers in your neighborhood.

Frequently Asked Questions

Does being a good driver help new drivers get cheaper auto insurance?

Maintaining a clean record helps new drivers qualify for discounts and accident forgiveness, lowering premiums and making them eligible for good insurance companies for first-time drivers.

Is Liberty Mutual vs. Allstate better for good driver discounts?

Liberty Mutual offers up to 30% off with its RightTrack program, while Allstate provides up to 25% off for accident-free driving and savings for defensive driving courses.

Good drivers can start comparing affordable insurance options by entering their ZIP code into our free quote comparison tool today.

What discounts are available with the best auto insurance for teenage drivers?

The best insurance companies tend to offer cheap auto insurance for teens through discounts for good grades, safe driving, and low mileage, helping them lower premiums and build a strong insurance history.

Who offers better rewards for safe driving when looking at Geico vs. AAA?

Geico rewards safe habits through its DriveEasy app while AAA has similar programs in select locations with results that vary based on the local club.

How do I find the cheapest auto insurance for a good driver?

Compare insurance quotes for good drivers from top insurers like USAA, Nationwide, and Liberty Mutual to find the cheapest auto insurance. Use online tools and take advantage of safe driving and bundling discounts.

Does the best auto insurance for drivers with accidents offer discounts?

Yes, the best auto insurance for drivers with accidents often includes discounts like safe driving recovery programs, usage-based savings, and multi-policy discounts, many of which are explained in the definitive guide to usage-based auto insurance.

What is the best auto insurance drivers with points can qualify for?

The best insurance for drivers with points can qualify for often comes from insurers like Progressive, Geico, and Nationwide, which are more forgiving of minor violations and offer accident forgiveness or usage-based discounts.

In terms of monthly rates for clean records, how do Geico vs. USAA compare for good drivers?

USAA is once again the cheapest in our example, at $32 per month, but Geico’s rates are competitive for non-military drivers as well.

Who should join a good driving insurance program?

Good drivers with no recent accidents or violations benefit most from these programs, which help distinguish them from high-risk auto insurance categories and offer significant savings through personalized rate adjustments.

Can good drivers save more with the best car insurance with good credit and low mileage?

Absolutely. Good drivers with good credit who also drive fewer miles can unlock additional savings on the best car insurance with good credit through low-mileage and usage-based discounts.

How do car insurance companies driving behavior discounts benefit good drivers?

Can I combine the Geico good driver plan with other discounts?

What’s the better option for telematics savings between Geico vs. Nationwide for good drivers?

How do I find an affordable auto insurance policy that offers good driver discounts?

Can I still qualify for affordable good car insurance if I had a minor accident years ago?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.