Comprehensive Auto Insurance in 2026

Comprehensive auto insurance covers your car against theft, vandalism, natural disasters, animal crashes, and fire. Compare rates starting at $35 a month from USAA. Comprehensive coverage is best for newer cars, high-risk weather zones, or drivers who want to be covered against unforeseen non-collision costs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Scott Young

Insurance Premium Auditor

With over a decade of experience in insurance premium auditing, audit department management, and business audit representation, Aaron has developed a deep understanding of audit regulations, compliance requirements, and industry best practices. As the Founder & CEO of AdvoQates, he specializes in representing businesses during their audits to ensure accurate, transparent, and fair assessments ...

Aaron Englard

Updated December 2025

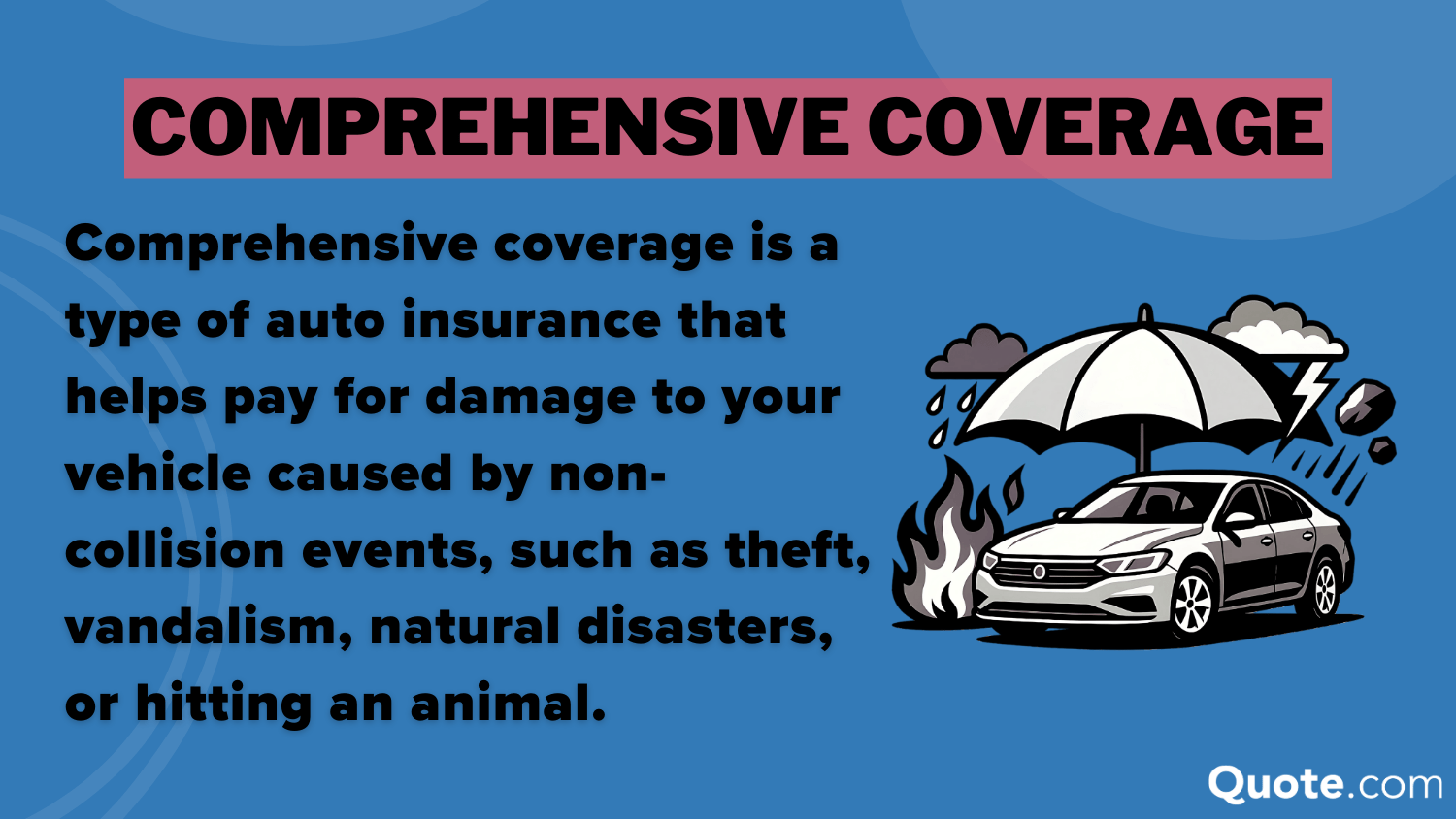

Buying auto insurance can be daunting, but learning about comprehensive auto insurance coverage is important to protect your vehicle and yourself on the road.

- Comprehensive insurance covers theft, vandalism, and weather damage

- It also covers repairs for animal collisions, like hitting a deer

- USAA offers cheap comprehensive auto insurance for $35 a month

Does auto insurance cover hitting a deer? Comprehensive car insurance kicks in against damage that isn’t collision-related, including hitting deer or large animals, weather damage, vandalism, fire, and theft.

Learn when comprehensive coverage is worth it and how it safeguards against non-collision damage versus collision coverage. USAA offers the most affordable comprehensive coverage at just $35 monthly.

See what you’ll pay with a free comprehensive car insurance quote by entering your ZIP code.

Understanding Comprehensive Auto Insurance

The comprehensive auto insurance meaning applies to vehicle damage that occurs outside of a collision with another vehicle. When animals or natural disasters damage your vehicle, comprehensive coverage steps in to help with repair costs.

This protection extends to incidents like theft, vandalism, falling objects, fire, floods, hail damage, and encounters with wildlife (such as hitting a deer).

Comprehensive Auto Insurance Coverage| Peril | Protection |

|---|---|

| Theft | Stolen-vehicle loss |

| Vandalism | Intentional acts, like keying or paint |

| Fire | Fire or explosion loss |

| Natural Disasters | Hail, flood, tornado, earthquake loss |

| Falling Objects | Tree, branch, or debris impact |

| Animal Collisions | Deer or animal-impact damage |

| Glass Damage | Windshield or window breakage |

| Weather Events | Storm, lightning, extreme weather |

| Riots / Civil Disturbance | Riot or disturbance damage |

| Fire Department | Reimburses fire-response service fees |

Comprehensive auto insurance covers windshield replacement and repairs after floods, hailstorms, and hurricanes, as well as animal collisions. Windshields may also be covered in cases of damage from falling objects, such as branches.

While not legally required in most states, comprehensive auto insurance coverage is often recommended for newer vehicles and is typically required by lenders if you’re financing or leasing your car.

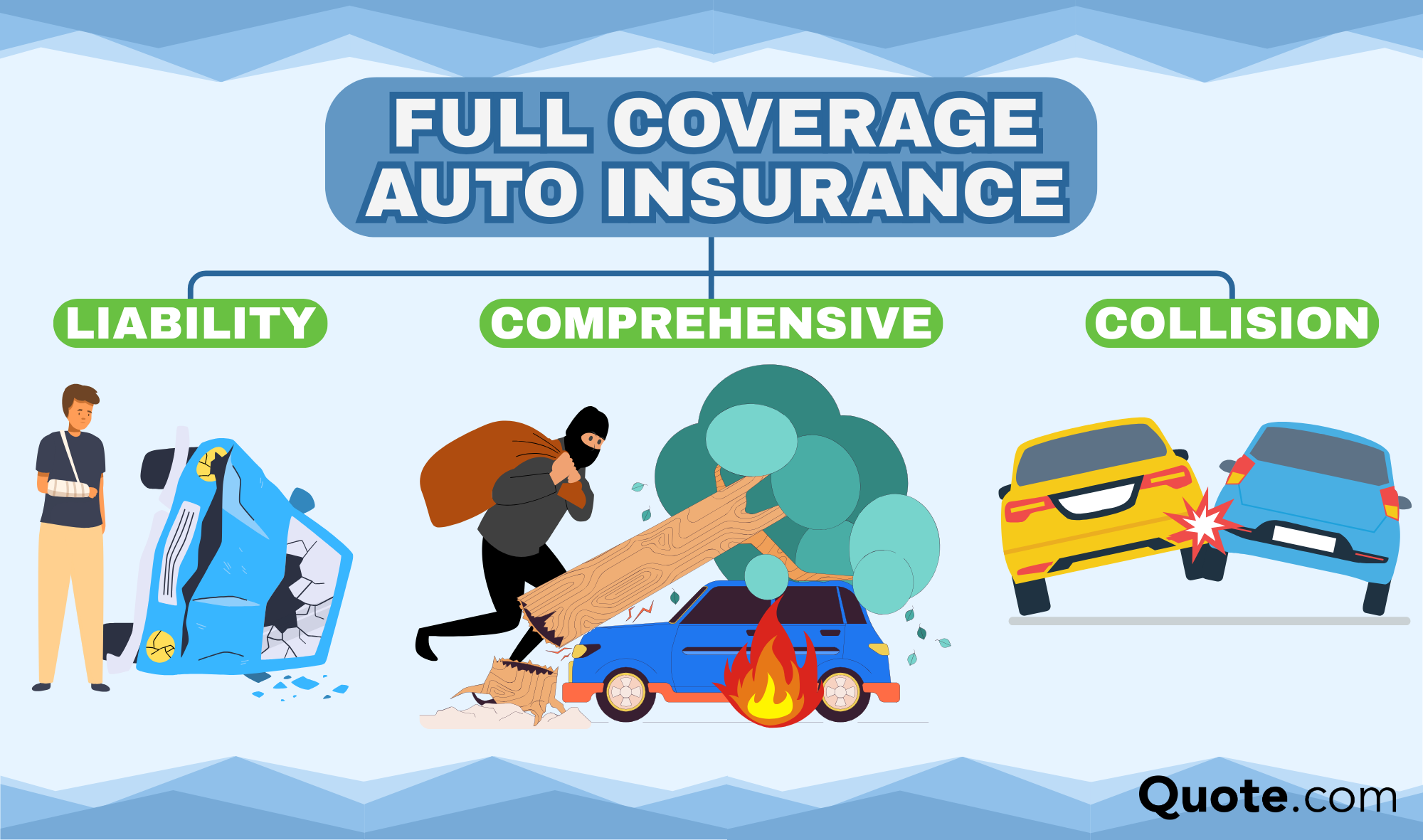

Comprehensive insurance gives you solid coverage for a lot of things, but it doesn’t cover accidents with other cars.

That’s where collision or full coverage auto insurance steps in to keep you fully protected.

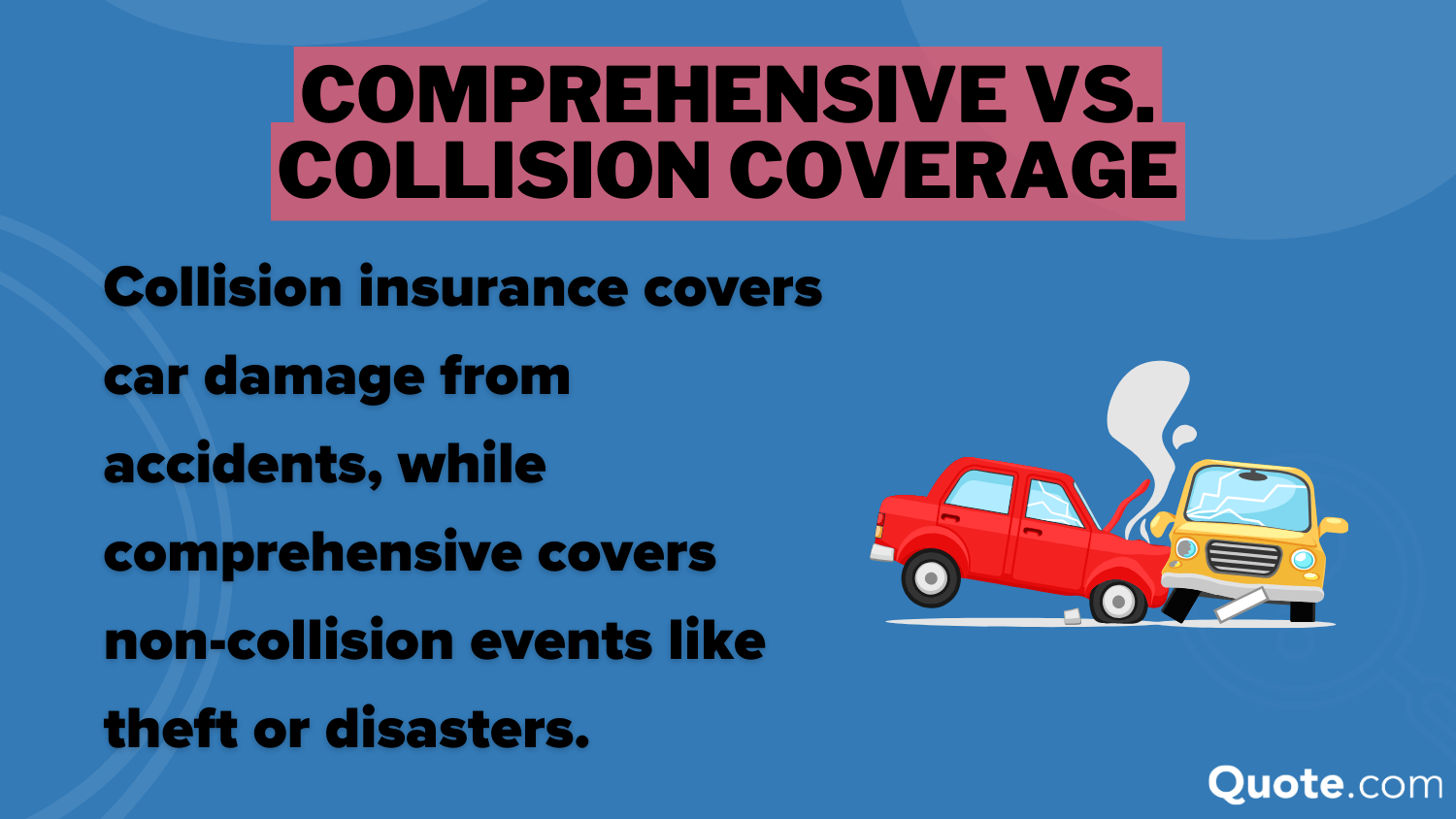

Comprehensive vs. Collision Auto Insurance Coverage Comparison

When comparing both coverages, comprehensive coverage protects against non-collision events like theft, weather damage, and animal collisions, while collision insurance covers damage from accidents involving other vehicles.

A comprehensive auto insurance deductible applies to non-collision claims, while collision typically requires a separate deductible for accident-related damages.

Comprehensive auto insurance is especially valuable for drivers who live in areas prone to storms, wildfires, or high theft rates. Collision coverage becomes more important if you regularly drive in heavy traffic or high-risk areas.

Adding both coverages can also help lower your long-term repair costs, since each policy type targets different kinds of damage. Many drivers choose both types of coverage because combining comprehensive and collision with a full coverage policy helps fill major protection gaps.

If you’re loaning or leasing a vehicle, your lender likely requires you to carry full coverage. People who got auto insurance right often choose it for complete protection, ensuring they’re covered for a wide range of risks.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cost of Comprehensive Insurance Coverage

The cost of comprehensive car insurance can be significantly different depending on the company you choose.

For instance, if you get comprehensive auto insurance with State Farm or USAA, it is much cheaper than companies like Allstate or Liberty Mutual.

Comprehensive Auto Insurance Monthly Rates by Provider| Insurance Company | Monthly Rate |

|---|---|

| $87 | |

| $40 | |

| $76 | |

| $43 | |

| $96 |

| $63 |

| $56 | |

| $47 | |

| $50 | |

| $35 |

If you’re searching for the cheapest car insurance, USAA and American Family offer some of the lowest monthly rates at $35 and $40, respectively.

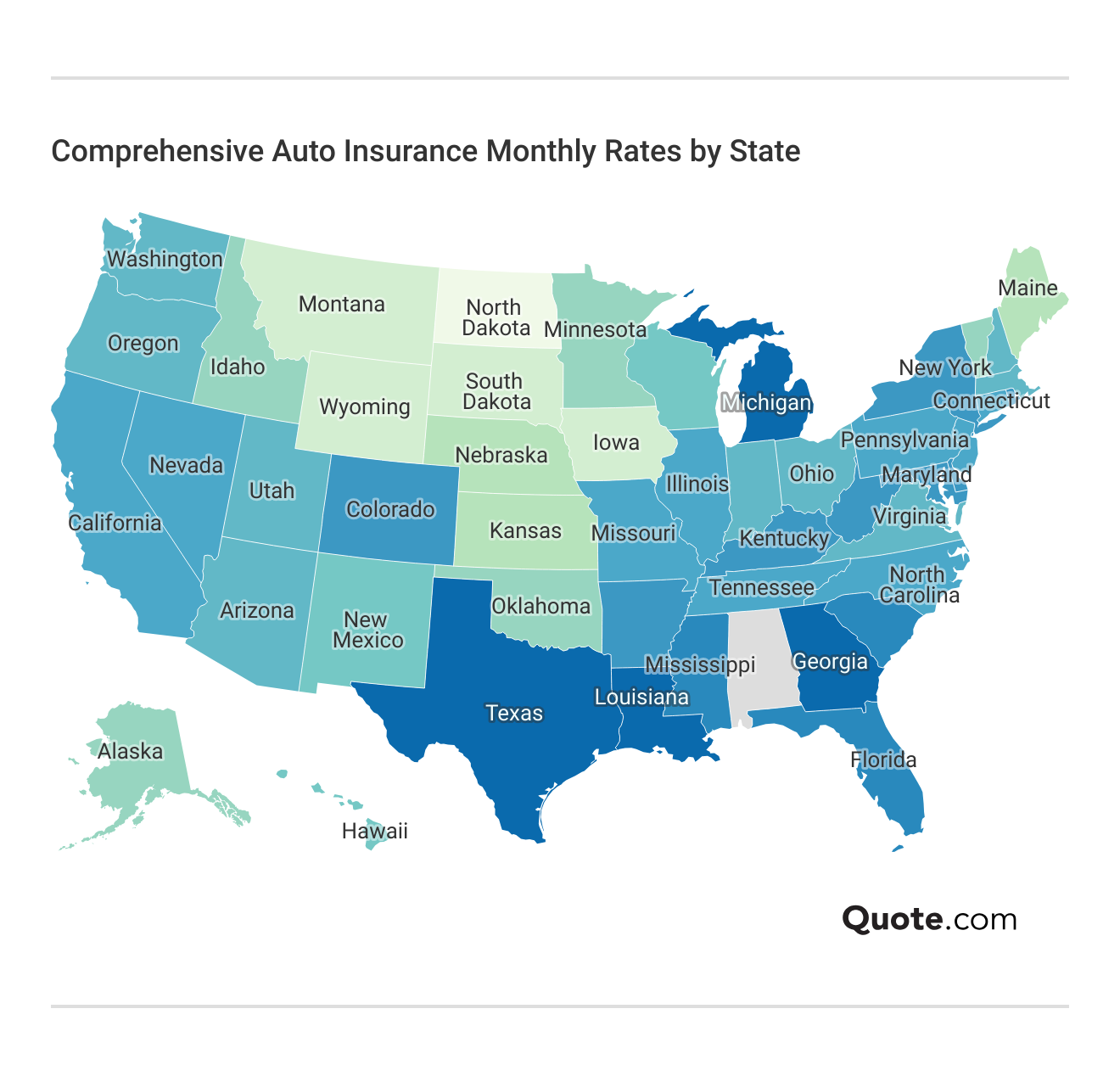

Comparing rates by provider and state is key to finding the best value for your comprehensive coverage.

Drivers in states with more weather-related risks may see higher rates regardless of driving experience or discounts.

Always compare quotes online before you buy to see which providers have the best rates near you.

Learn More: Does auto insurance cover vehicle theft?

When to Consider Comprehensive Coverage

If you have a newer or high-value car, live in an area prone to natural disasters, or want stronger protection from theft or weather damage, comprehensive auto insurance is usually worth it.

Full coverage typically includes comprehensive and collision insurance, along with your state’s required liability coverage. Together, these coverages offer strong financial protection and help you avoid high out-of-pocket costs after an unexpected event.

Comprehensive insurance helps pay for damage from events you can’t control, like fire, hail, theft, and falling objects, while collision helps cover repairs if your car’s damaged in a crash, no matter who’s at fault.

Some car owners have shared their opinions on the necessity of comprehensive auto insurance on Reddit.

Comment

byu/Red318 from discussion

inAusFinance

It just shows that failure to buy comprehensive car insurance can cost you an arm and a leg in terms of repairs and leave you wishing you had.

To save some cash on your premiums, consider tips to pay less for car insurance, such as bundling policies or increasing your deductible.

Evaluate your car's value and repair costs to ensure comprehensive coverage is cost-effective.

Schimri Yoyo Licensed Agent & Financial Advisor

However, if your car is old and low in value, comprehensive coverage may not be worth the cost. To avoid overpaying, be aware of ways you’re wasting money on your car, such as paying for extra coverage on a car that is not worth much.

But for newer vehicles or those in high-risk areas, comprehensive car insurance is invaluable.

With rates as low as $35 monthly from USAA, comprehensive coverage is often more affordable than expected.

Use our free comparison tool to see what comprehensive auto insurance rates look like in your area.

Frequently Asked Questions

What is comprehensive auto insurance?

Comprehensive auto insurance covers damage to your vehicle from non-collision events like theft, vandalism, fire, or natural disasters. To find the best protection at a competitive rate, it’s smart to get multiple auto insurance quotes before choosing a policy.

Is it worth having comprehensive insurance on an old car?

Generally, not when your car’s value is less than 10 times the premium. For older vehicles with limited value, comprehensive coverage may cost more than the potential payouts for damages.

Will your car insurance go up if you make a comprehensive claim?

Possibly, but typically less than with collision claims. Compare auto insurance companies to find those that don’t raise rates for comprehensive claims.

Is it better to have collision or comprehensive?

Both serve different purposes. Ideally, get both for complete protection. When comparing comprehensive versus collision auto insurance, remember that comprehensive coverage is for non-collision events, while collision coverage applies to accidents.

At what point is comprehensive insurance not worth it?

When your car’s value drops below $3,000-$4,000, or when premiums exceed 10% of its value, comprehensive insurance may no longer be cost-effective.

Can you drive any car with comprehensive?

No. Comprehensive insurance only covers the specific vehicle listed on your policy, not any car you happen to drive. Find your cheapest auto insurance quotes by entering your ZIP code into our free comparison tool.

What is an example of a comprehensive accident?

A comprehensive accident would include your car being damaged by hail during a storm, stolen from a parking lot, vandalized, hit by a falling tree branch, or damaged when you collide with a deer. What does fully comprehensive coverage include? Theft, vandalism, fire, natural disasters, animal collisions, falling objects, glass damage, and weather events.

Does comprehensive insurance cover engine failure?

No. Engine failure is typically considered a mechanical breakdown or wear and tear, which isn’t covered. Consider what to do if you can’t afford your auto insurance.

Is hitting an object a collision or a comprehensive event?

Hitting a stationary object (pole, fence, etc.) is covered under collision insurance. Comprehensive coverage only if the object falls onto your car. Explore your auto insurance options by entering your ZIP code into our free comparison tool today.

Does comprehensive insurance cover medical bills?

No. Comprehensive coverage only covers damage to your vehicle. Medical expenses require medical payments, personal injury protection, or health insurance coverage.

How much is comprehensive car insurance?

What’s the difference between full coverage vs. comprehensive and collision insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.