Best Auto Insurance for Hondas in 2025

State Farm, Allstate, and Nationwide offer the best auto insurance for Hondas, but drivers should compare quotes from multiple providers because Honda car insurance rates vary widely by model year and coverage. Safe drivers with clean records can get cheap Honda car insurance through usage-based programs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Schimri Yoyo

Updated October 2025

18,157 reviews

18,157 reviewsCompany Facts

Full Coverage for Hondas

A.M. Best Rating

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 11,640 reviews

11,640 reviewsCompany Facts

Full Coverage for Hondas

A.M. Best Rating

Complaint Level

Pros & Cons

11,640 reviews

11,640 reviews 3,071 reviews

3,071 reviewsCompany Facts

Full Coverage for Hondas

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviewsState Farm, Allstate, and Nationwide offer the best auto insurance for Hondas. State Farm has a superior A++ financial rating and offers up to 20% savings on Hondas with advanced safety systems.

Our Top 10 Company Picks: Best Auto Insurance for Hondas| Company | Rank | Safety Features | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 20% | A++ | Reliable Coverage | State Farm | |

| #2 | 20% | A+ | Deductible Rewards | Allstate | |

| #3 | 18% | A+ | UBI Discounts | Nationwide | |

| #4 | 18% | A | Families | American Family |

| #5 | 15% | A++ | Newer Hondas | Geico | |

| #6 | 15% | A | Custom Plans | Farmers | |

| #7 | 13% | A++ | Accident Forgiveness | Travelers | |

| #8 | 12% | A | Bundling Discount | Liberty Mutual |

| #9 | 10% | A+ | Digital Tools | Progressive | |

| #10 | 10% | A+ | Customer Support | Erie |

Allstate has the best rewards for safe drivers, with vanishing deductibles and accident forgiveness programs for claim-free Honda policyholders.

Nationwide is the best fit for drivers who qualify for its usage-based SmartDrive program or its mileage-based SmartMiles, which can cut your premiums by up to 40%.

- State Farm saves Honda drivers up to 30% using Drive Safe & Save UBI

- Allstate rewards safe drivers with $100 off their deductible at sign-up

- Erie has cheap Honda car insurance starting at $52 a month

Discover hidden savings and compare multi-policy discounts available for Honda owners when you use our free comparison tool to explore your options (Read More: Best Time to Buy a New Car).

Honda Auto Insurance Rates From Top Providers

If you see a higher price from brands like Allstate or Farmers, it might reflect broader agent support or broader policy options. However, State Farm sits in the middle and often pairs solid pricing with great discount programs for lower Honda car insurance rates.

Honda Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $84 | $178 | |

| $68 | $154 | |

| $52 | $120 |

| $79 | $165 | |

| $60 | $138 | |

| $91 | $187 |

| $64 | $142 |

| $72 | $158 | |

| $58 | $132 | |

| $66 | $145 |

Many different factors impact Honda insurance costs. Always get multiple auto insurance quotes to find the best company based on your model and driving record.

High-Risk Honda Insurance Rates

Honda insurance costs rise fast with violations, especially for younger drivers. A 16-year-old with one accident jumps to $1,500 per month, nearly $1,300 more than a 50-year-old with a clean record, who pays just $210 per month.

Honda Auto Insurance Monthly Rates by Driving Record| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| 16-Year-Old | $342 | $396 | $425 | $377 |

| 18-Year-Old | $288 | $335 | $361 | $312 |

| 25-Year-Old | $142 | $178 | $195 | $161 |

| 30-Year-Old | $119 | $152 | $168 | $134 |

| 40-Year-Old | $105 | $132 | $145 | $121 |

| 45-Year-Old | $103 | $128 | $141 | $117 |

| 50-Year-Old | $100 | $124 | $138 | $114 |

| 60-Year-Old | $97 | $119 | $133 | $110 |

| 65-Year-Old | $99 | $122 | $137 | $112 |

Any high-risk behavior that adds points to your license will increase Honda auto insurance rates. A single ticket at 18 jumps your monthly rate up by $330, and one DUI at 25 more than doubles it to $600 a month. Older drivers still see price bumps for violations, but not nearly as bad — at 60, a DUI adds $230 to monthly premiums.

Insurance companies see younger drivers as long-term risks, so even small mistakes early on hit harder. If you’re just starting out, staying clean now can save you thousands over time. Find out what to do if you can’t afford your auto insurance before you cancel.

Free Auto Insurance Comparison

Compare Quotes from Top Companies and Save

Secured with SHA-256 Encryption

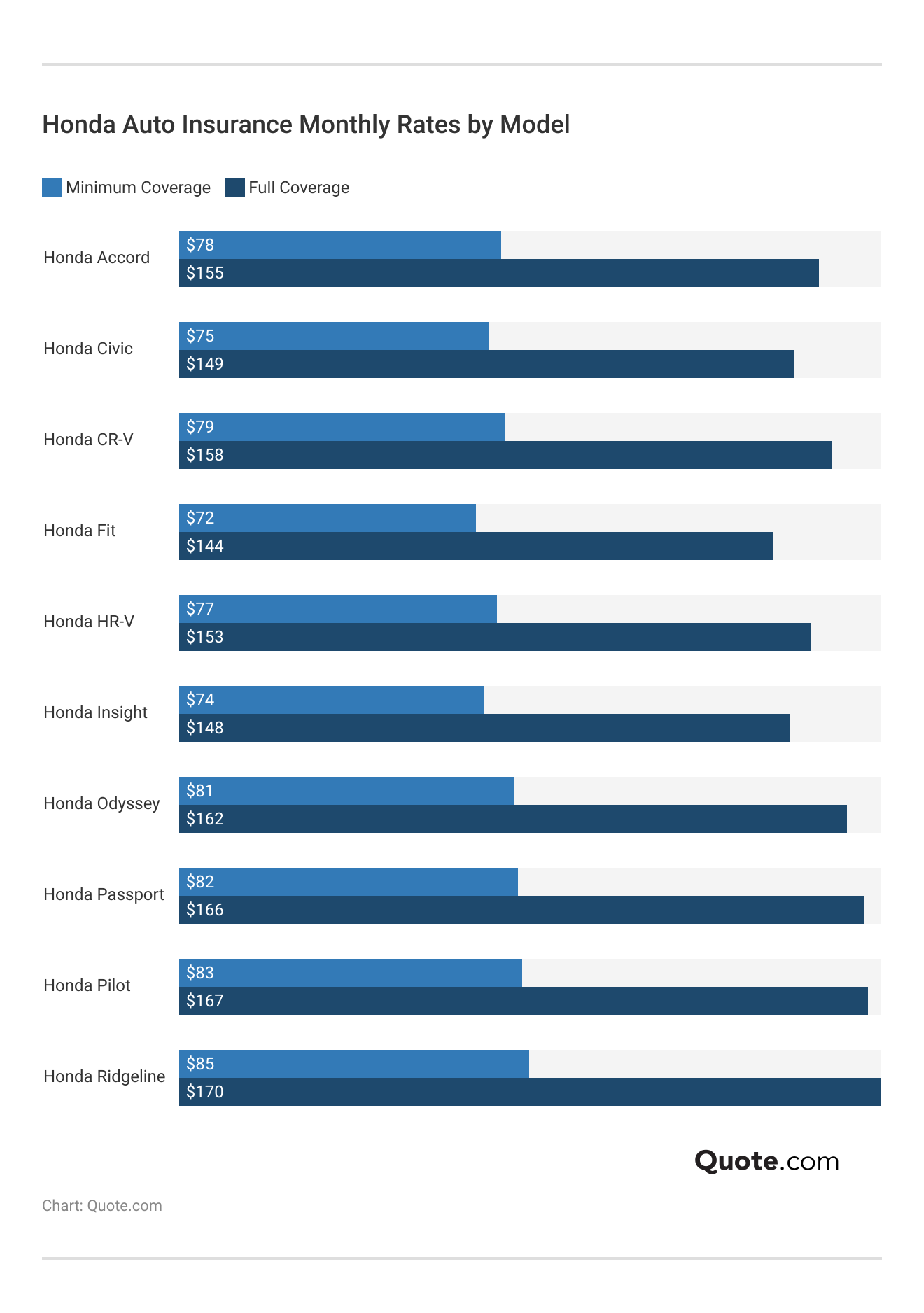

What You Drive Impacts Honda Auto Insurance Rates

Not all Hondas cost the same to insure. Insurers look at how expensive your model is to fix, how it’s usually driven, and how likely it is to be involved in a claim, especially when it comes to comprehensive auto insurance, which covers damage from things like theft, weather, and vandalism.

Larger models like the Ridgeline or Pilot often come with higher premiums since they can cause more damage and cost more to fix. On the other hand, smaller cars like the Fit or Civic tend to be cheaper to insure because they’re easier to repair and usually involved in fewer severe accidents.

If you drive something like the Odyssey, insurers also consider that it’s likely carrying more passengers, which means a higher chance of medical claims. However, insurance on Hondas drops by around $5 yearly, from $145 per month for newer vehicles all the way down to $100 for models ten years or older.

Honda Auto Insurance Rates by Model Year| Year | Minimum Coverage | Full Coverage |

|---|---|---|

| 2025 | $145 | $254 |

| 2024 | $140 | $245 |

| 2023 | $135 | $236 |

| 2022 | $130 | $228 |

| 2021 | $125 | $219 |

| 2020 | $120 | $210 |

| 2019 | $115 | $201 |

| 2018 | $110 | $193 |

| 2017 | $105 | $184 |

| 2016 | $100 | $175 |

A new Honda costs more to insure because its advanced driver-assistance systems and high-value parts require costly repairs after collisions, while an older model lacks newer tech like blind-spot sensors and automated braking. Decreases in car value, repair expenses, and claims all contributed to the $45 reduction overall on monthly premiums.

Read More: How to Buy Auto Insurance

How To Save Money on Honda Car Insurance

If you’re driving a Honda, the right discount can shave $30 to $60 off your monthly rate. Whether it’s how you drive, how you pay, or the model you choose, each provider weighs your habits differently. Don’t skip these car insurance discounts you can’t miss.

Auto Insurance Discounts From Top Providers For Hondas| Company | Green Car | Military | Mutli- Policy | Pay-in- Full | Usage Based |

|---|---|---|---|---|---|

| 7% | 25% | 25% | 10% | 30% | |

| 5% | 12% | 25% | 20% | 30% | |

| 5% | 12% | 25% | 5% | 30% |

| 8% | 20% | 20% | 10% | 30% | |

| 5% | 15% | 25% | 10% | 25% | |

| 8% | 10% | 25% | 12% | 30% |

| 10% | 15% | 20% | 15% | 40% |

| 5% | 15% | 10% | 15% | 25% | |

| 5% | 25% | 17% | 15% | 30% | |

| 10% | 10% | 13% | 15% | 30% |

Nationwide’s 40% UBI discount is the highest available, but it only applies if you use its SmartRide program and show consistent low-risk driving. State Farm’s usage-based discount isn’t as big at 30% when you use Drive Safe & Save, but State Farm won’t raise your rates if you drive poorly.

There are a few more discounts and proven ways to lower your rates. These tips are especially for popular Honda models, like the CR-V, Accord, and lowering Honda Civic insurance costs:

- Bundling: Combine Honda car insurance with property insurance to unlock up to 25% in savings. Geico and Allstate offer steep discounts when you combine auto with renters or homeowners coverage.

- Pay In Full: Pay your full annual premium upfront and skip monthly installment fees. Companies like American Family and Travelers offer 15–20% off for paying in full.

- Deductibles: Increase your deductible from $500 to $1,000 to save an average of $150–$250 annually, especially if your Honda is older and you rarely file claims.

Stacking two or more of these discounts can help Honda drivers save $300 to $600 per year on average, especially when paired with a clean driving record.

Getting Essential Coverage to Protect Your Honda

Liability coverage is legally required in most states and protects you if you damage someone else’s car or cause injuries, but you need collision insurance to fix or replace your Honda, and comprehensive insurance covers when animals or natural disasters damage your vehicle.

Auto Insurance Coverage Options for Hondas| Coverage | What It Covers |

|---|---|

| Liability | Injuries and damages to others' property |

| Collision | Damage to your vehicle in a collision |

| Comprehensive | Non-collision damage (e.g., theft, fire) |

| Uninsured/Underinsured | Damage from uninsured drivers |

| Medical Payments (MedPay) | Medical expenses after an accident |

| Personal Injury Protection | Medical costs and lost wages |

| Roadside Assistance | Breakdowns or emergencies, including towing |

| Rental Reimbursement | Rental car during repairs |

| Gap Insurance | Difference between a lease or loan and car value |

If you drive a new Honda, you may also want to add gap insurance to cover you in case your vehicle is totaled in a collision or claim.

If your Honda is financed or leased, gap insurance is one of the most overlooked coverages that can save you thousands after a total loss.

Jeff Root Licensed Insurance Agent

Honda car insurance rates can vary significantly depending on the type and level of coverage you choose. Carrying only state-minimum liability policies can lower your Honda insurance cost, but may leave you financially vulnerable after an accident.

Free Auto Insurance Comparison

Compare Quotes from Top Companies and Save

Secured with SHA-256 Encryption

The 10 Best Honda Auto Insurance Companies

How can I lower my Honda insurance rates? Shop with State Farm, Allstate, and Nationwide, which have the best auto insurance for Hondas, with low rates and competitive discounts.

Another company might have a better policy for you, especially if you’re a military veteran or need customized equipment protection. Our guide on how to compare auto insurance companies will help you pick the right provider.

#1 – State Farm: Top Overall Pick

Pros

- Rental Reimbursement Coverage: Covers up to $500 for rental if your Honda is in the shop after a covered loss.

- Drive Safe & Save UBI: Honda drivers can save up to 30% based on real-time driving behavior. Read our State Farm auto insurance review to learn why it’s ideal for new vehicles.

- 17% Bundling Discount: Combining Honda auto insurance with home insurance reduces the total premium cost.

Cons

- No Loan/Lease Payoff Coverage: Honda owners with financing receive no gap protection on depreciation.

- Limited Accessory Coverage: State Farm lacks trail-use or off-road parts protection for modified Hondas.

#2 – Allstate: Best for Deductible Rewards

Pros

- Deductible Rewards: Honda drivers instantly earn $100 off the collision deductible upon sign-up.

- New Car Replacement: Allstate replaces a totaled Honda under 2 years old with a brand-new model. Take a look at our Allstate insurance review before picking a plan.

- Drivewise UBI Discount: Up to 40% off Honda premiums with good braking, mileage, and drive-time patterns.

Cons

- Bundling Required: Without bundling multiple lines of insurance, Honda owners won’t qualify for Allstate’s lowest rate tier.

- Repair Limitations: Allstate requires Hondas to be repaired only at in-network body shops.

#3 – Nationwide: Best for UBI Discounts

Pros

- SmartRide UBI Program: Honda drivers receive up to 40% savings for low mileage and safe habits tracked through its usage-based plan.

- SmartMiles Pay-As-You-Go: Nationwide rewards low-mileage Honda drivers with cheaper rates, tracking only their monthly driving distance to set premiums.

- Multi-Policy Discount: Bundling Honda auto with home insurance lowers premiums by 20%.

Cons

- Limited Quote Speed: Honda drivers may experience slower online quotes compared to digital-first carriers.

- Regional Restrictions: SmartRide and SmartMiles are not available for Hondas in all ZIP codes. To compare options, start with our Nationwide insurance review.

#4 – American Family: Best for Families

Pros

- Generational Discounts: Honda policies passed to teen drivers receive legacy rewards and loyalty discounts.

- Multi-Policy Discount: Honda-driving households bundling auto and renters insurance can save up to 25%.

- KnowYourDrive Program: Telematics-based discount of up to 20% for low-risk Honda drivers.

Cons

- Availability Issues: Not all policy coverage features are available to Honda drivers in every state.

- Digital Tools Are Basic: American Family’s app lacks advanced policy management for Honda owners. See how it stacks up in our American Family Insurance vs. Travelers guide.

#5 – Geico: Best for Newer Hondas

Pros

- Mechanical Breakdown Insurance: Covers major Honda components for up to seven years or 100,000 miles.

- Multi-Policy Discount: Honda auto insurance bundled with renters or condo insurance offers 25% off annual rates.

- Military Discount: Active-duty Honda drivers save up to 15%, especially on multiple vehicles. Explore everything you need to know about Geico in one quick guide.

Cons

- More Customer Complaints: Hondas insured with Geico may face more customer service issues than competitors.

- No Loan/Lease Payoff: Hondas with outstanding loans do not get gap coverage for the owed balance after a total loss.

#6 – Farmers: Best for Custom Plans

Pros

- Customized Equipment Coverage: Farmers provides add-on protection for Honda lift systems, winches, and off-road upgrades.

- Bundling Discount: Combine Honda car insurance with homeowners or renters insurance for up to 20% off your rates.

- Accident Forgiveness: If you’re accident-free for three years after your first at-fault Honda accident, your rate won’t increase.

Cons

- No Vanishing Deductible Program: Honda drivers won’t get annual deductible reductions for safe driving.

- Limited Online Tools: Honda drivers must contact agents directly for most policy changes or claims. Let’s go over everything you need to know about Farmers Insurance.

#7 – Travelers: Best for Accident Forgiveness

Pros

- Premier Responsible Driver Plan: Waives surcharge for one at-fault Honda accident every 36 months.

- Bundling Discount: Combining Honda auto insurance with a homeowners policy reduces total premiums by 13%.

- New Car Replacement Coverage: Replace a totaled Honda with a brand-new model of the same make and trim if it is under five years old.

Cons

- No Mechanical Coverage: Travelers does not offer extended warranty-type plans for aging Honda parts.

- App Lacks Functionality: Honda drivers may find digital tools limited compared to top tech-forward providers. Check out our Travelers auto insurance review to see if it fits you.

#8 – Liberty Mutual: Best for Multi-Policy Discounts

Pros

- Bundling Discount: Liberty Mutual offers one of the highest bundling savings for Honda policies at 25%.

- 12-Month Rate Guarantee: Honda owners lock in premiums for a full year, protecting against sudden hikes. Get all the details in our Liberty Mutual insurance review.

- Better Car Replacement: Replaces a totaled Honda with a newer model one year ahead with fewer miles.

Cons

- No Mechanical Breakdown Coverage: Hondas beyond factory warranty don’t qualify for extended repair protection.

- Limited Off-Roading Support: This does not offer custom coverage for Honda trail or rock-crawling use.

#9 – Progressive: Best for Digital Tools

Pros

- Name Your Price Tool: Honda drivers can choose an auto insurance plan online based on their budget.

- Snapshot Discount Program: Up to 30% savings for Honda drivers who track their habits. We explain everything you need to know about Progressive before you buy.

- Loan/Lease Payoff Coverage: Progressive’s gap insurance covers the financed Honda’s remaining loan balance.

Cons

- Limited Off-Road Coverage: Progressive does not offer specialized protection for Hondas used in trail or rock-crawling activities.

- Telematics Penalty: Snapshot may raise rates for Honda drivers with harsh braking or high mileage.

#10 – Erie: Best for Customer Support

Pros

- Customer Satisfaction: Erie is a top performer when it comes to claims support and customer service.

- Rate Lock Program: Keeps Honda premiums fixed unless policy or driver changes (Learn More: Erie Auto Insurance vs. MetLife).

- New Vehicle Protection: Replaces total-loss Hondas with the same-year, same-make model if under two years old.

Cons

- Limited National Reach: Erie is only available in select states, restricting Honda coverage availability.

- Basic Digital Tools: Erie lacks some of the digital and online perks that larger Honda auto insurance companies offer.

How to Pick the Best Honda Auto Insurance Company

State Farm, Allstate, and Nationwide offer the best auto insurance for Hondas. State Farm gives Honda drivers access to a 30% Drive Safe & Save discount and boasts a 0.61 complaint index, the lowest among major insurers.

Honda insurance prices vary based on driver age, vehicle year, and driving record. To get the best deal near you, compare multiple Honda insurance quotes online and match discount programs to your driving habits. Find the right coverage for your car when you use our free comparison tool.

Frequently Asked Questions

What is the cheapest insurance for Hondas?

Erie has cheap Honda car insurance, starting at $52 per month, but it’s only available in 12 states. State Farm and Geico have the next cheapest rates in more states, starting at $58 a month.

Which is the best company to insure a Honda?

State Farm is the best company to insure your Honda car due to its 30% Drive Safe & Save discount and a 0.61 NAIC complaint index, the lowest among top insurers.

Read More: State Farm vs. Farmers, Geico, Progressive, Allstate Insurance

Is Geico or Progressive better for Honda auto insurance?

Geico is better if you want mechanical breakdown insurance for Hondas under seven years or 100,000 miles, while Progressive offers stronger savings for multi-vehicle households. Is Allstate cheaper than Geico for a Honda? Geico is usually cheaper, especially when you qualify for a 25% bundling discount.

Is AAA auto insurance worth it for Honda?

AAA auto insurance is worth it for Honda owners who need built-in roadside assistance and travel benefits, but monthly premiums are often 10–15% higher than other providers, as shown in our AAA auto insurance review.

What is the cheapest Honda car insurance for seniors over 60?

The cheapest Honda car insurance for seniors over 60 averages $200 per month, and insurers like Liberty Mutual offer discounts for driving under 7,500 miles annually. Enter your ZIP code to see who has the cheapest insurance near you.

Is insurance high for Hondas?

Are Hondas more expensive to insure? No, insurance isn’t high for Hondas. Models like the Civic and CR-V average $149 to $158 per month, partly due to their strong safety ratings and lower theft rates, but using hacks to save more money on car insurance can bring those costs down even further.

How much does Honda auto insurance generally cost per month for full coverage?

Honda full coverage insurance typically costs between $144 and $ 170 a month, depending on the model year, driving record, and coverage limits. How do you get lower auto insurance for Hondas? Join UBI programs like Nationwide SmartRide (up to 40% off), raise your deductible, bundle policies, and pay in full to avoid installment fees.

How much is insurance on a Honda Civic?

Honda Civic insurance costs average $149 per month for full coverage, with rates influenced by high-tech features like lane assist and collision sensors that increase repair costs. What is the cheapest insurance for a Honda Civic? Erie has the best minimum rates starting at $52 per month and full coverage around $120 monthly.

What factors influence Honda auto insurance rates?

Costs vary based on age, driving history, ZIP code, model year, annual mileage, and whether you carry extras like gap insurance or roadside assistance. Hondas are among the least expensive to insure in their class due to moderate repair costs and strong IIHS safety ratings, which lowers the risk for insurers.

Find out what the Insurance Institute for Highway Safety does and how it impacts your car’s safety rating.

Which auto insurance provider has the highest customer satisfaction rating for Honda?

What is Honda’s most trusted insurance company? State Farm has the highest customer satisfaction for Honda drivers, with a 0.61 NAIC complaint index, strong J.D. Power and A.M. Best rankings, and popular programs like Drive Safe & Save.

How can Honda owners choose the best car insurance for claims?

What are the main coverage options available for Honda auto insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.