Best Auto Insurance for Infinitis in 2026

Liberty Mutual, Nationwide, and AAA lead with the best auto insurance for Infinitis. Infiniti car insurance starts at $115 monthly, and Geico and Allstate lower rates by 25% with bundling discounts. However, Infiniti G35 insurance runs higher, so compare auto insurance quotes online to find better rates.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson, a published insurance expert, is the fourth generation in her family to work in the insurance industry. Over the past two decades, she has gained in-depth knowledge of state-specific insurance laws and how insurance fits into every person’s life, from budgets to coverage levels. She specializes in autonomous technology, real estate, home security, consumer analyses, investing, di...

Melanie Musson

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as ...

Justin Wright

Updated March 2026

Liberty Mutual, Nationwide, and AAA offer the best auto insurance for Infinitis. Liberty Mutual is the best Infiniti car insurance company for drivers with new models.

- Infinitis are considered luxury cars and come with higher rates

- The cheapest Infiniti car insurance is $115 per month

- Nationwide offers a 40% usage-based discount to Infiniti drivers

Nationwide leads with the biggest discounts, offering up to 40% off for safe drivers who track their habits and 20% off for bundling Infiniti auto insurance with homeowners insurance coverage.

Infinitis require luxury car insurance, and our Infiniti insurance review found that these top ten companies provide the best tailored coverage for high-end vehicles.

Top 10 Companies: Best Auto Insurance for Infinitis| Company | Rank | Claim Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 730 / 1,000 | A | New Models |

| #2 | 729 / 1,000 | A+ | Usage Based | |

| #3 | 720 / 1,000 | A | Online App |

| #4 | 716 / 1,000 | A+ | Cheap Rates | |

| #5 | 697 / 1,000 | A++ | MBI coverage | |

| #6 | 693 / 1,000 | A+ | Deductible Rewards | |

| #7 | 691 / 1,000 | A++ | Claim Forgiveness | |

| #8 | 690 / 1,000 | A | Local Agents | |

| #9 | 673 / 1,000 | A+ | Loyalty Rewards |

Keep reading for more ways to compare insurance companies and save on Infiniti insurance, especially pricey Infiniti Q60 coupe car insurance coverage.

Unlock customized Infiniti policy options right now by entering your ZIP code into our free comparison tool.

Comparing Infiniti Insurance Rates

Why is Infiniti auto insurance so expensive? Since it’s considered a luxury vehicle, Infiniti owners face a wide range of pricing based on their provider and coverage needs.

Most companies offer minimum coverage rates between $150 and $160 a month. Read More: Best Auto Insurance For Luxury And Exotic Vehicles

Learn what factors impact Infiniti car insurance the most, like age, gender, and coverage level, so you can get better rates.

Infiniti Premiums for Minimum vs. Full Coverage Insurance

USAA’s $176 monthly full coverage rate is the lowest overall, but you’re only eligible for coverage if you’re a military member. State Farm is the cheapest for most drivers nationwide, but compare quotes online to find the right fit for you.

Infiniti Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $144 | $266 |

| $149 | $409 | |

| $173 | $326 | |

| $149 | $336 | |

| $163 | $238 |

| $158 | $250 | |

| $154 | $313 | |

| $139 | $220 | |

| $167 | $241 | |

| $152 | $176 |

A $150 gap exists between Allstate’s $409 full coverage monthly rate and Nationwide’s $250 per month rate, which totals $1,800 more per year for the same Infiniti.

When driving a luxury vehicle like an Infiniti, you will want to carry more than the state-required minimum liability coverage

Full coverage with collision and comprehensive coverage is a must since even a minor accident could cost over $3,000 in repair costs.

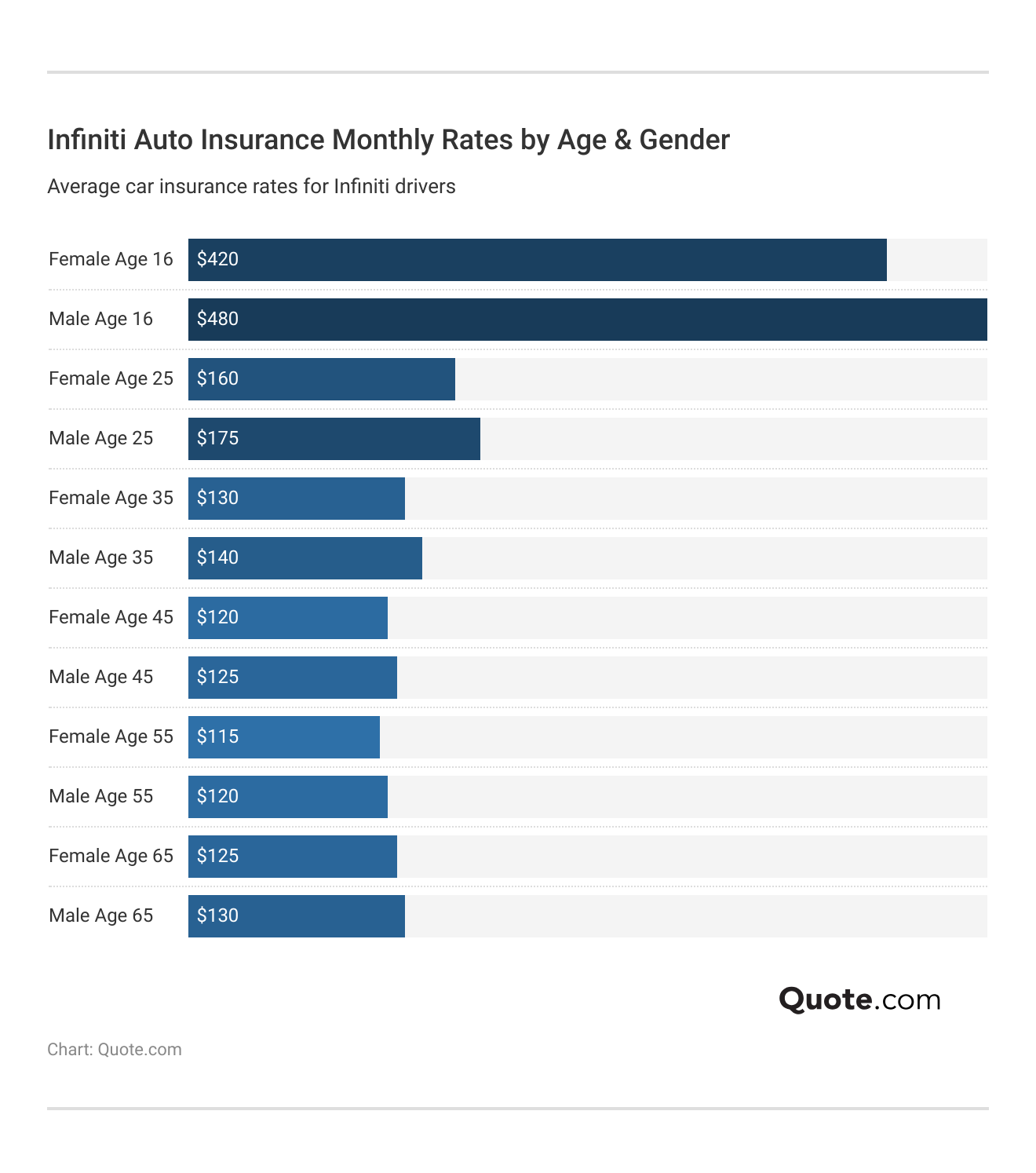

How Infiniti Insurance Rates Change With Age

Since younger drivers have less experience behind the wheel, Infiniti car insurance rates stay high until drivers turn 25.

For instance, teen drivers under 18 pay over $400 per month for minimum coverage. And if you’re under 25, expect a bump in your G35 insurance rates since insurers see more claims from young drivers.

And Infiniti insurance premiums fluctuate not just with age but with every driving misstep.

You can compare cheap auto insurance for teens to find better rates, but as long as you maintain a clean driving record, you can expect your Infiniti insurance to drop significantly after turning 25 and again after you turn 30.

How Your Driving Habits Impact Infiniti Insurance Prices

However, a single ticket bumps monthly costs by $40, a steep penalty of nearly $500 a year. And companies are much less forgiving after an accident, raising rates by $100 or more per month.

Infiniti Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $144 | $180 | $216 | $288 |

| $149 | $186 | $224 | $298 | |

| $173 | $216 | $260 | $346 | |

| $149 | $186 | $224 | $298 | |

| $163 | $204 | $245 | $326 |

| $158 | $198 | $237 | $316 | |

| $154 | $193 | $231 | $308 | |

| $139 | $174 | $209 | $278 | |

| $167 | $209 | $251 | $334 | |

| $152 | $190 | $228 | $304 |

State Farm has the best Infiniti auto insurance after an accident at $209 monthly, while a driver with one DUI in an Infiniti pays around $300 monthly.

Most providers double rates after a single DUI. If you’re a high-risk driver, learn proven hacks to save more money on car insurance fast.

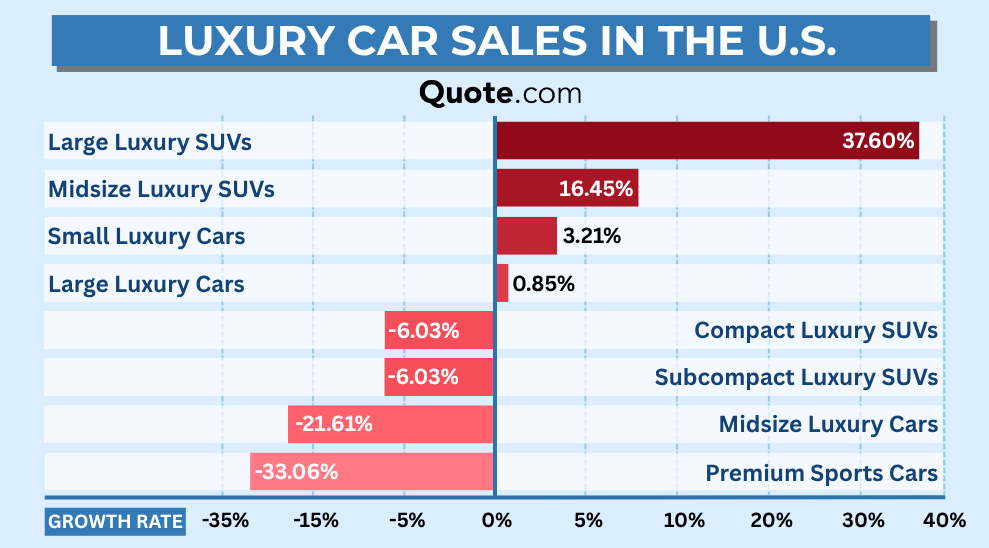

How Model Impacts Infiniti Insurance Costs

Not all Infiniti premiums are priced the same. Providers look at how often certain models get into accidents and what it costs to fix them.

For instance, since it’s the upgraded model, the monthly rate for Infiniti G37 insurance is slightly higher than the average Infiniti G35 insurance cost. Infiniti G37 convertible car insurance will cost even more since soft-top models are considered high-risk.

Infiniti Auto Insurance Monthly Rates by Model| Model | Minimum Coverage | Full Coverage |

|---|---|---|

| Infiniti EX | $130 | $224 |

| Infiniti FX | $134 | $233 |

| Infiniti G35 | $126 | $217 |

| Infiniti G37 | $131 | $223 |

| Infiniti I30 | $116 | $202 |

| Infiniti I35 | $119 | $206 |

| Infiniti M35 | $137 | $238 |

| Infiniti M37 | $140 | $245 |

| Infiniti Q50 | $148 | $259 |

| Infiniti Q60 | $154 | $269 |

| Infiniti Q70 | $146 | $256 |

| Infiniti QX30 | $144 | $251 |

| Infiniti QX50 | $151 | $262 |

| Infiniti QX56 | $157 | $272 |

| Infiniti QX60 | $155 | $268 |

| Infiniti QX70 | $158 | $275 |

| Infiniti QX80 | $166 | $286 |

Newer models tend to carry higher premiums due to costlier post-accident repairs. Coupes with power and performance tend to bring higher claim costs and more expensive repairs, which raises rates.

For example, Infiniti Q60 insurance and Infiniti G37 coupe car insurance will be higher, especially under comprehensive auto insurance policies that cover theft or weather damage.

Older models like the Infiniti I30 and I35 cost less to insure because they’re cheaper to replace and usually don’t need high-tech parts.

Kristine Lee Licensed Insurance Agent

Infiniti Q50 insurance and Infiniti M37 car insurance rates can cost more due to advanced tech like parking sensors and adaptive cruise control, which aren’t cheap to fix.

Smaller SUVs and crossovers, like the EX and FX lines, have lower rates since they’re more practical and still carry AWD systems. Both lines were discontinued in 2012, which makes Infiniti EX35 car insurance vs. Infiniti FX35 car insurance much cheaper than average.

Infiniti insurance rates drop as vehicles age, not just because of depreciation but also due to lower repair values and diminished replacement costs.

And because crossovers are becoming more popular with drivers, repair specialists and parts are easy to find. That’s why Infiniti EX37 car insurance and Infiniti FX37 car insurance rates are under $250 a month compared to the average Infiniti Q60 insurance cost.

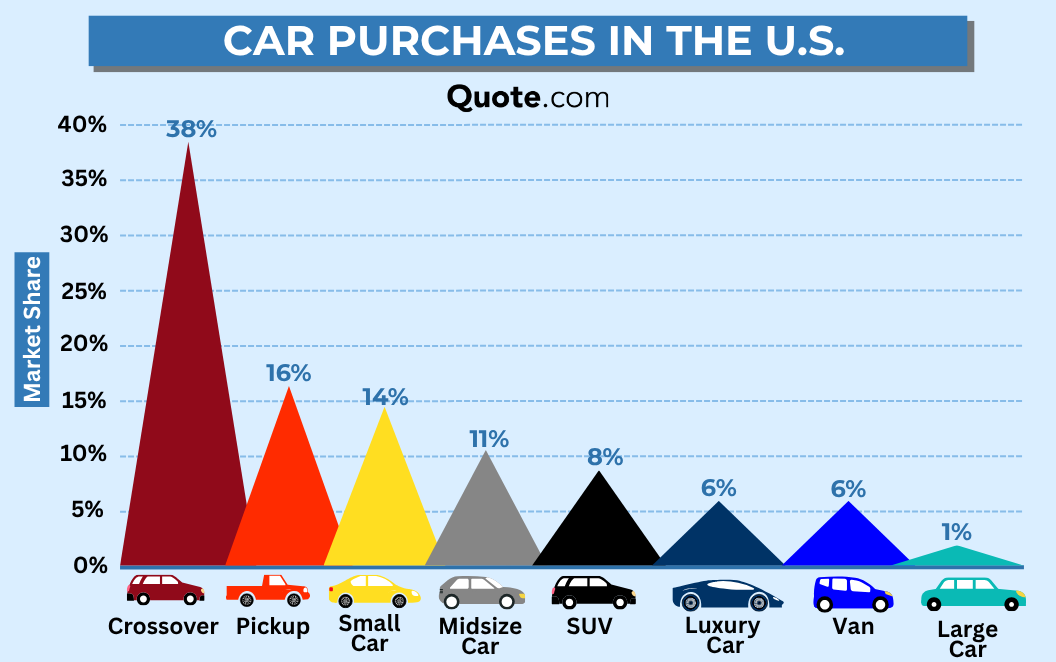

Luxury Infiniti QX60 Premiums Compared to Other Vehicles

As Infiniti car insurance costs fluctuate by model, it’s important to compare quotes to find the best deal.

Infiniti QX60 car insurance is priced higher than Audi Q7 and the Cadillac XT6 coverage at $268 a month.

Infiniti QX60 vs. Similar SUVs: Auto Insurance Monthly Rates| Vehicle | Minimum Coverage | Full Coverage |

|---|---|---|

| Infiniti QX60 | $155 | $268 |

| Acura MDX | $95 | $165 |

| Audi Q7 | $120 | $210 |

| Buick Enclave | $90 | $155 |

| Cadillac XT6 | $105 | $180 |

| Honda Pilot | $94 | $173 |

| Hyundai Palisade | $88 | $150 |

| Kia Telluride | $89 | $152 |

| Toyota Highlander | $85 | $145 |

| Volkswagen Atlas | $98 | $165 |

The Toyota Highlander and Buick Enclave cost less to repair, which is why they cost $100-$120 less per month to insure. Read More: Best Auto Insurance for Toyotas

The QX line is the most expensive to insure because large SUVs have more potential to cause serious damage in collisions. Infiniti QX80 car insurance is the highest at $286 a month for full coverage.

Infiniti QX30 car insurance comes with cheaper rates because it’s the smallest model in the line, but it’s still more expensive than other luxury vehicles like Acura and Audi.

Large luxury SUVs are popular among drivers because of their advanced safety tech and high crash-test ratings. Infiniti SUVs often qualify for anti-theft insurance discounts, lowering Infiniti QX56 car insurance by 35% with Liberty Mutual.

You can also lower your Infiniti QX60 and Infiniti QX60 hybrid car insurance costs with safe driving and electric vehicle (EV) discounts from Travelers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Infiniti Car Insurance Coverage

Carrying minimum liability will get you the cheapest car insurance for your Infiniti. However, your state laws may also require PIP, medical payments, or uninsured motorist coverage, which will increase rates.

Drivers who want to add roadside assistance or rental reimbursement to their Infiniti car insurance will also see a rate increase.

Auto Insurance Coverage Options for Infinitis| Coverage Type | Description |

|---|---|

| Liability | Covers injuries and property damage to others |

| Collision | Covers damage to your car in a crash |

| Comprehensive | Covers theft, fire, vandalism, etc. |

| Uninsured Motorist | Covers you if the other driver is uninsured |

| Medical Payments | Pays for your medical expenses |

| Personal Injury (PIP) | Covers medical + lost wages (some states) |

| Gap Insurance | Covers car loan balance if car is totaled |

| Roadside Assistance | Covers towing and minor roadside help |

| Rental Reimbursement | Covers rental car while yours is repaired |

However, Nationwide is known for its usage-based and multi-policy bundling discounts that offset high rates.

Liberty Mutual is also highly rated for its new car replacement and tailored coverage for luxury vehicles like Infinitis, so it pays to shop around.

Tips to Save Money on Infiniti Auto Insurance

Saving money on your Infiniti insurance doesn’t mean stripping away vital coverage. Start using smart strategies that align with how you actually drive.

Take these steps to lower your costs and find out other ways you’re wasting money on your car. These little moves add up and give you more control over what you’re really paying to keep your Infiniti covered.

- Increase Your Deductible: If you’re okay with a higher deductible and paying more out-of-pocket for a claim, your monthly rate drops.

- Park in a Garage: Some providers offer discounts to drivers who park their Infiniti in a garage or covered spot to reduce the risk of damage and theft.

- Raise Your Credit Score: Pay bills on time, including your auto insurance premiums, to raise your credit score and lower your Infiniti insurance rates at your next renewal.

Companies that specialize in luxury auto insurance, like Liberty Mutual, will offer more competitive rates for things like new car replacement and agreed-value coverage.

Usage-based policies can lower Infiniti insurance premiums well below the market average. Nationwide’s 40% SmartRide UBI discount could reduce a $300 monthly Infiniti rate to $180.

State Farm offers a 30% UBI discount through Drive Safe & Save, which can trim Infiniti premiums by over $100 monthly for safe drivers.

Check out our definitive guide to usage-based car insurance to see how your safe driving habits, combined with these modern features, could lower your Infiniti insurance rate.

If you commute less than 10,000 miles per year, a usage-based policy could significantly lower what you pay without reducing your coverage.

Chris Abrams Licensed Insurance Agent

Not all drivers will qualify for usage-based coverage, especially if you have a high-risk record. But that doesn’t mean your Infiniti insurance rates have to stay high.

Drivers with luxury cars can also earn discounts for specialized features in their Infinitis, including airbags and advanced security systems.

Discounts That Lower Infiniti Car Insurance Rates

Discounts for safe driving or paying in full can sharply reduce Infiniti insurance costs. Travelers’ consistent 15% pay-in-full discount can benefit drivers who pay up front.

Nationwide gives safe drivers who sign up for usage-based insurance the biggest discount of 40%, while other top providers give up to 30% off (Learn More: Car Insurance Discounts You Can’t Miss).

Top Auto Insurance Discounts for Infiniti Drivers| Company | Anti-Theft | Bundling | Pay-in-Full | Usage Based |

|---|---|---|---|---|

| 8% | 15% | 15% | 30% |

| 10% | 25% | 10% | 30% | |

| 10% | 20% | 10% | 30% | |

| 25% | 25% | 10% | 25% | |

| 35% | 20% | 12% | 30% |

| 5% | 20% | 15% | 40% | |

| 25% | 17% | 15% | 25% | |

| 15% | 17% | 15% | 30% | |

| 15% | 13% | 15% | 30% | |

| 15% | 10% | 20% | 30% |

USAA combines a 30% military discount with a 20% discount for paying in full, giving qualified members a nearly 50% premium reduction on eligible Infiniti policies.

Understanding how these specific discounts work together is essential for getting the cheapest Infiniti auto insurance rates.

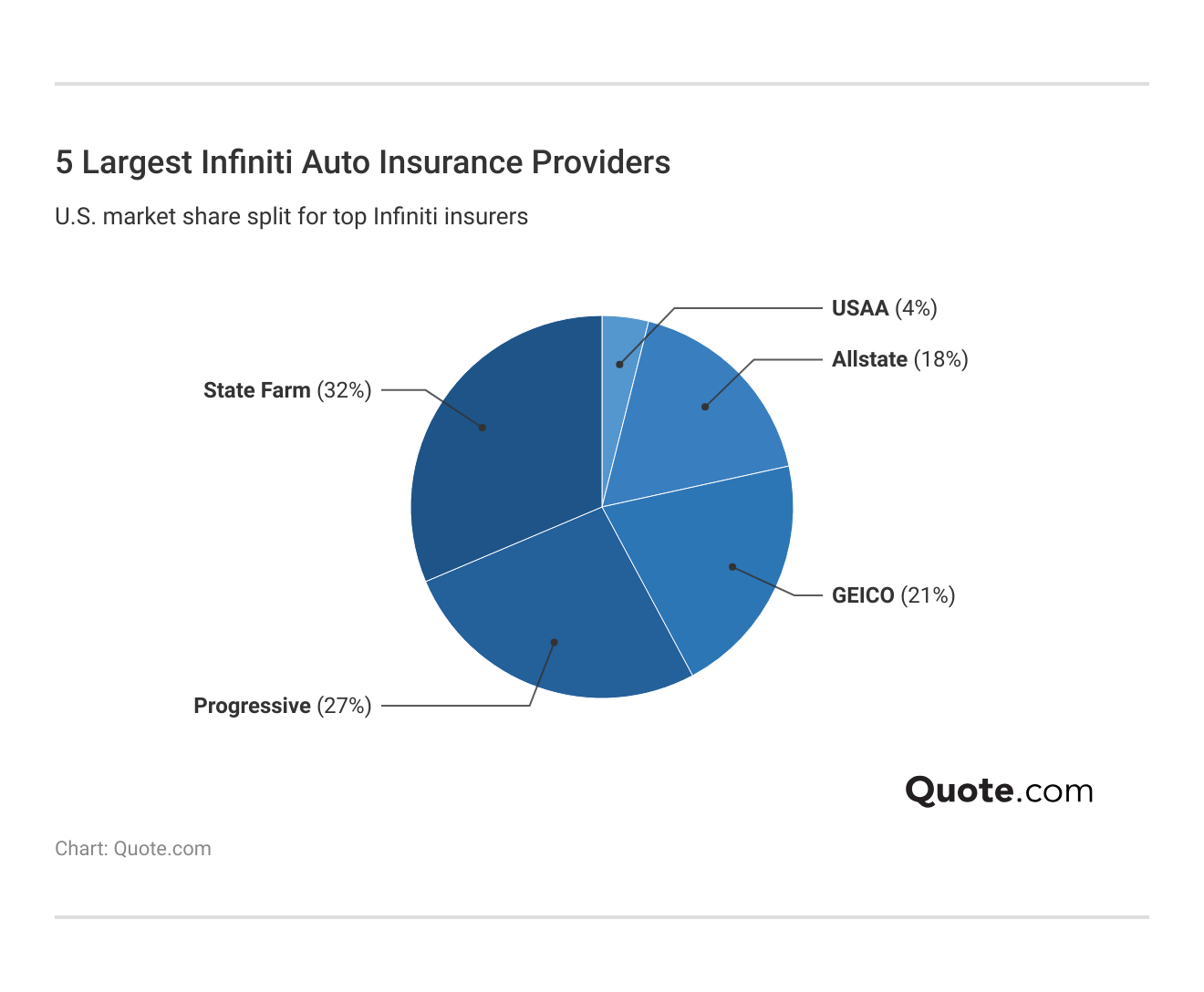

Top Auto Insurance Companies for Infinitis

Liberty Mutual, Nationwide, and AAA have the best auto insurance for Infinitis due to their competitive pricing and specialized discounts.

USAA is one of the cheapest Infiniti auto insurance companies, as well as one of the largest, along with Geico and Allstate.

These five providers write the most Infiniti car insurance policies, but cannot match the customer service and policy customization offered by our top three providers.

Infiniti drivers often face above-average premiums due to luxury repair costs, but comparing companies before you buy to find strategic savings can offset high monthly rates.

Comparing multiple quotes online helps identify which company offers the most value based on your driving habits, vehicle use, and available discount programs.

Explore expert tips on how to buy auto insurance for Infinitis and get started with our free quote comparison tool.

#1 – Liberty Mutual: Top Pick Overall

Pros

- Better Car Replacement: If a new Infiniti is totaled, Liberty Mutual replaces it with a newer model under its Better Car Replacement program.

- Multi-Policy Discount: Infiniti policyholders bundling Liberty Mutual renters or homeowners insurance receive the maximum 25% discount.

- 12-Month Rate Guarantee: Liberty Mutual locks in Infiniti premiums for 12 months under its Guaranteed Rate policy option.

Cons

- Low Customer Satisfaction: Liberty Mutual has more complaints than other Infiniti auto insurance companies. Learn more in our Liberty Mutual review.

- Costly Add-Ons: Better Car Replacement and OEM parts coverage add over $30 to monthly Infiniti premiums compared to base plans.

#2 – Nationwide: Best for Usage-Based Plans

Pros

- SmartRide Savings: Enrolling in Nationwide SmartRide UBI can reduce rates by up to 40% through monitored braking, mileage, and nighttime driving.

- OEM Endorsement Add-On: Nationwide allows Infiniti owners to add OEM parts coverage to ensure manufacturer-quality repairs post-collision.

- 20% Bundling Discount: Bundling Infiniti coverage with other policies yields a 20% discount. Compare savings in our Nationwide Insurance review.

Cons

- Delayed Discount Activation: Infinitis must be driven safely for multiple weeks before full SmartRide savings apply.

- Limited Rental Coverage: Nationwide’s standard policy offers basic rental car reimbursement, which may not fully cover Infiniti rental class costs.

#3 – AAA: Best for Online App Experience

Pros

- Highly-Rated App: Drivers consistently praise the app’s interface updates across devices, making it easier to manage policies and roadside assistance services.

- Roadside Assistance: Infinitis insured through AAA Plus receive towing up to 100 miles, complimentary battery replacement, and locksmith access

- Trip Interruption Coverage: AAA covers up to $1,000 in lodging and meals if an Infiniti breaks down 100+ miles from home. See more in our AAA insurance review.

Cons

- Bundling Discount Cap: Infiniti drivers can only receive a maximum 15% discount when bundling AAA auto with home or renters insurance.

- Membership Required: AAA policies for Infinitis require an active membership, adding $64-$124 annually in non-insurance fees.

#4 – State Farm: Best for Cheap Rates

Pros

- Competitive Rates: Cheapest Infiniti auto insurance company in most states. Minimum coverage starts at $116 monthly.

- Drive Safe & Save: Lower premiums by up to 30% by enrolling in the Drive Safe & Save UBI. Find more coverage perks in our State Farm review.

- Rental Reimbursement Coverage: Infiniti policies include optional rental reimbursement for $16 monthly, covering up to $500 in rental costs.

Cons

- Bundling Requirement: Policyholders must also insure a home or condo to access the full 17% bundling discount for Infinitis.

- High-Risk Non-Renewal: State Farm may not renew all policies in states with increased risks for wind or wildfire damage.

#5 – Geico: Best for Mechanical Breakdown Insurance

Pros

- Safety Features Discount: Infinitis equipped with anti-theft and stability systems qualify for Geico’s 25% vehicle safety discount.

- Mechanical Breakdown Insurance (MBI): Geico offers Infiniti models newer than 15 months MBI coverage for the drivetrain and engine at $8 per month.

- Highest Financial Rating: With the A++ A.M. Best rating, Geico ensures reliable claims payouts on Infiniti accident repairs.

Cons

- No OEM Part Coverage: Infinitis repaired through Geico’s network may not receive manufacturer-original parts unless policyholders opt out.

- Limited Agent Access: Geico does not provide in-person claim support. Find everything you need to know about Geico in our guide.

#6 – Allstate: Best for Deductible Rewards

Pros

- Deductible Rewards: Earn $100 off Infiniti insurance deductibles every year drivers remain claim-free, up to a $500 total reduction.

- New Car Replacement: Allstate’s optional new car replacement coverage applies to qualifying Infinitis less than two years old and under 15,000 miles.

- Claims Satisfaction Guarantee: If dissatisfied with a claim payout on an Infiniti policy, drivers may qualify for a full refund of their premium.

Cons

- Low Initial Discount Availability: Some Infiniti drivers may not be eligible for Allstate’s biggest discounts. Learn how to qualify in our Allstate review.

- Not Easy to Shop With: Customer satisfaction ratings are low when it comes to online shopping with Allstate compared to other Infiniti car insurance companies.

#7 – Travelers: Best for Accident Forgiveness

Pros

- Responsible Driver Plan: Infiniti owners with 36 months of clean driving can add accident forgiveness for $10 per month.

- Early Quote Discount: Infinitis quoted more than eight days before the policy start can save up to 10% under Travelers’ Early Quote discount.

- Exceptional Financial Strength: Backed by an A++ A.M. Best financial rating, Travelers offers Infiniti owners reliable claims payouts.

Cons

- Trip Interruption Exclusion: Travelers does not include lodging or meal reimbursement for an Infiniti breaking down far from home. Compare coverage in our Travelers review.

- Bundling Limit: Travelers offers only up to 13% off for bundling Infiniti coverage with home insurance, below competitors’ 20%–25%.

#8 – Farmers: Best for Local Agents

Pros

- Local Expertise: Infiniti owners have access to local agents who are trained in luxury auto insurance coverage options and claims.

- Signal App Discounts: Infiniti drivers using the Farmers’ Signal app for safe driving can earn up to 30% off based on real-time behavior scoring.

- 20% Multi-Line Discount: Bundle Infiniti auto coverage with a home policy to save up to 20%. Read everything you need to know about Farmers Insurance.

Cons

- High Premiums: Infiniti car insurance costs more with Farmers than with any other provider on this list. Full coverage starts at $272 a month.

- Less Streamlined Mobile Tools: Its website and mobile app are not as user-friendly as the digital tools offered by other top Infiniti insurance companies.

#9 – Progressive: Best for Loyalty Rewards

Pros

- Loyalty Perks: Infinitis insured for more than five years with Progressive receive accident forgiveness and minor claims protection automatically.

- Name Your Price Tool: Progressive allows Infiniti owners to adjust deductibles and liability limits to match their exact monthly budget.

- Snapshot Program: Infiniti drivers can earn up to 30% off with Progressive Snapshot, which tracks braking, speed, and time-of-day driving.

Cons

- Bundling Cap: Progressive’s bundling discount for Infinitis maxes out at 10%, lower than State Farm, Allstate, and AAA. Find everything you need to know about Progressive.

- Rate Spikes Post-Claim: Despite telematics or loyalty rewards, Infinitis with at-fault accidents may see rate increases of over $150 per month.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pick the Best Infiniti Insurance Provider

Liberty Mutual, Nationwide, and AAA have the best auto insurance for Infinitis based on claim support and luxury auto specialization (Learn More: Best Auto Insurance Companies for Claims Handling).

However, the right provider for you might look a little different. If you need a specific type of Infiniti car insurance, try comparing companies based on the following:

- Certified Repair Shops: The best car insurance companies for Infinitis will have a list of certified repair shops that specialize in luxury repairs with long-term guarantees.

- High Liability Limits: Look for insurers that provide higher policy limits that match the value of your Infiniti.

- Special Use Policies: If you only drive your Infiniti occasionally or store it in a special garage, find companies that reward these habits with discounts or cheaper policies.

You should also consider Infiniti car insurance companies that offer OEM parts and diminished value protection, like Nationwide and Liberty Mutual.

If you’re ready to start shopping for Infiniti auto insurance, enter your ZIP code into our comparison tool to get free quotes from providers in your area.

Frequently Asked Questions

Who offers the best auto insurance for Infinitis?

Liberty Mutual, Nationwide, and AAA have the best car insurance for Infinitis, based on high customer service ratings and customizable policies that include new car replacement and OEM coverage. Learn how to compare auto insurance companies to find the best provider for you.

Are Infinitis expensive to insure?

Infiniti car insurance is more expensive, averaging over $250 per month for full coverage. Why is Infiniti auto insurance so high? Premiums increase due to luxury parts, higher theft risk, and advanced electronics. Many models include high-end features like lane-assist and adaptive cruise, increasing claim payouts.

Is $200 a month for Infiniti auto insurance bad?

No, $200 a month is cheaper than average for full coverage. Infiniti car insurance reviews find USAA to be the cheapest, with full coverage policies starting at $176 per month, but it’s only available to military members and their families. Enter your ZIP code to compare Infiniti auto insurance costs near you.

What is a good monthly payment for Infiniti auto insurance?

A good monthly payment for Infiniti car insurance ranges between $132 and $164, depending on your model year and driving record. If your rate exceeds your budget, it’s important to know what to do if you can’t afford your auto insurance.

Is it possible to get a better deal on your Infiniti insurance?

Yes, using usage-based programs like State Farm’s Drive Safe & Save or Nationwide’s SmartRide can reduce Infiniti premiums by up to 30%–40%.

Which company has the most affordable Infiniti auto insurance?

USAA has the most affordable Infiniti car insurance with full coverage starting at $152 per month, plus a 30% military discount and a 20% pay-in-full discount.

Which company has better Infiniti auto insurance coverage, Geico or Progressive?

Geico offers larger safety discounts for Infinitis, while Progressive’s Snapshot program can save drivers up to $231 annually through safe driving behavior.

How much does Costco charge for Infiniti insurance?

Costco, via CONNECT, varies by state, but Infiniti insurance rates through them can be 5%–10% lower for members when bundled with home coverage.

Why is Infiniti better than Nissan for auto insurance?

Infiniti is not better than Nissan for car insurance. Nissans typically cost less to insure due to cheaper parts and lower repair severity. See our guide to the best auto insurance for Nissans for a quote comparison.

Why did my Infiniti auto insurance go up $40 a month?

Your Infiniti car insurance likely went up $40 due to a ticket, added driver, policy lapse, or insurer rate increases tied to inflation or traffic trends in your city. Always compare auto insurance quotes by ZIP code to see how rates change in your area.

Does my credit score affect my Infiniti auto insurance?

Why is Infiniti M35h insurance so expensive?

How can I save money on Infiniti auto insurance?

What are the average auto insurance rates for the Infiniti Q60 Luxe?

How much is Infiniti G35 insurance for an 18-year-old?

What factors impact my Infiniti Q50 insurance cost?

Can I purchase an Infiniti without auto insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.