Cheap Auto Insurance for High-Risk Drivers in 2026

State Farm, Progressive, and AAA offer cheap auto insurance for high-risk drivers that starts at $65 a month. State Farm has the lowest rates, while Progressive offers a 30% defensive driving discount. AAA supports high-risk drivers with built-in roadside assistance and flexible coverage options.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding c...

Meggan McCain

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated January 2026

State Farm, Progressive, and AAA have cheap auto insurance for high-risk drivers, with State Farm providing the lowest rates starting at $65 a month.

- High-risk coverage can double or triple your standard rates

- State Farm offers the cheapest high-risk insurance at $65 per month

- Progressive and AAA offer extra discounts for defensive driving

Progressive stands out for its generous defensive driving discounts for those with DUIs or tickets, while AAA adds value with roadside assistance and flexible coverage.

This guide breaks down monthly rates, driving record impacts, and available discounts to help high-risk drivers find the cheapest car insurance rates.

Our Top 10 Company Picks: Cheap Auto Insurance for High-Risk Drivers| Company | Rank | Monthly Rates | Defensive Driving | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $65 | 15% | High-Risk Drivers | State Farm | |

| #2 | $75 | 30% | Defensive Driving | Progressive | |

| #3 | $81 | 14% | Roadside Assistance | AAA |

| #4 | $104 | 5% | Claims Service | American Family |

| #5 | $106 | 10% | Family Plans | Farmers | |

| #6 | $117 | 15% | Senior Discounts | Geico | |

| #7 | $129 | 10% | Accident Forgiveness | Nationwide |

| #8 | $150 | 10% | SR-22 Filings | The General | |

| #9 | $152 | 10% | Customer Service | Allstate | |

| #10 | $178 | 10% | Add-On Options | Liberty Mutual |

Finding coverage can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code to find the most affordable quotes in your area.

Cheap Auto Insurance for High-Risk Drivers

Car insurance rates for high-risk drivers can vary dramatically depending on the provider and the level of coverage selected.

For high-risk drivers, choosing the right insurer can lead to savings of over $1,300 annually (Learn More: Best Auto Insurance for Young Adults).

High-Risk Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $81 | $211 |

| $152 | $385 | |

| $104 | $276 |

| $106 | $275 | |

| $117 | $309 | |

| $178 | $447 |

| $129 | $338 |

| $75 | $200 | |

| $65 | $160 | |

| $150 | $607 |

Among the top ten companies, State Farm offers the lowest rate for minimum coverage at just $65 per month.

Progressive is also affordable, starting at $75 a month, and AAA starts at $81 monthly, which includes free roadside assistance for members.

The top three high-risk auto insurance companies offer a strong balance of price and value, particularly for drivers who need more protection after prior violations or claims.

On the higher end, Liberty Mutual and The General charge $178 and $150 per month, respectively, for minimum coverage.

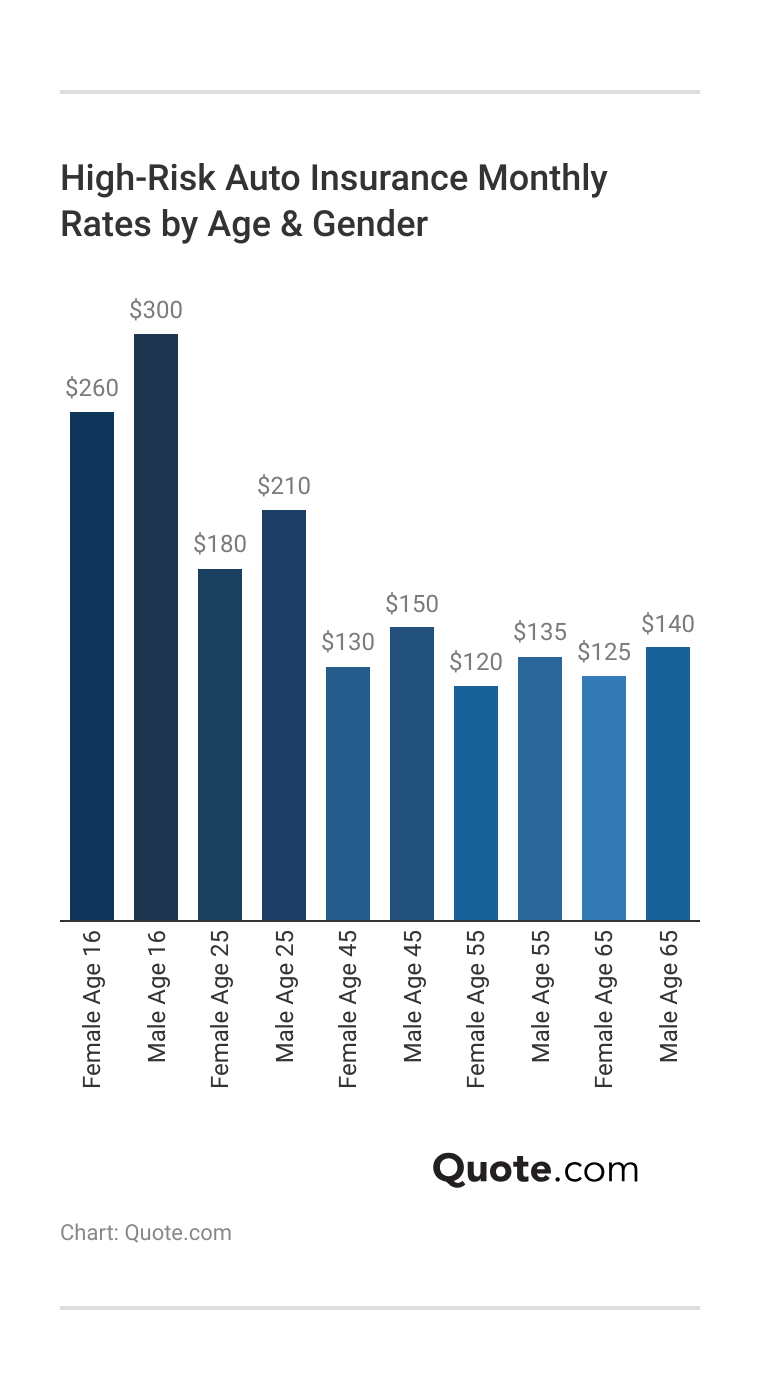

For instance, male drivers aged 16 pay $300 a month, while females of the same age pay $260 per month (Read More: Cheap Auto Insurance for Teens).

The chart also shows that premiums generally decrease with age, reaching the lowest levels for drivers in their 50s and 60s.

Cheapest Car Insurance With a DUI

After a DUI, auto insurance premiums rise sharply, but the right provider can make a big difference in affordability.

State Farm remains the most affordable at $115/month, followed by Progressive at $147 and American Family at $189.

Car Insurance Rates With a DUI Conviction| Insurance Company | Monthly Cost |

|---|---|

| $167 |

| $276 | |

| $189 |

| $196 | |

| $231 | |

| $318 |

| $242 |

| $147 | |

| $115 | |

| 282 |

On the high end, Liberty Mutual and The General charge $318 and $282 per month, respectively, nearly three times higher than State Farm. Comparing rates is essential after a DUI, as costs and forgiveness programs vary widely between insurers.

Even if you have a DUI, you can still explore ways to save. Browse our guide on the best low-mileage auto insurance discounts.

Cheapest Car Insurance After an Accident

State Farm offers the cheapest car insurance after an accident, with rates starting at just $57 monthly for one accident, $94 for two, and $138 for three, making it the most affordable option for high-risk drivers with a history of collisions.

AAA and Geico tie for second place after one accident at $71 a month, but Geico holds a slight edge over time with lower rates for two and three accidents.

Car Insurance Monthly Rates by Number of Accidents| Insurance Company | One Accident | Two Accidents | Three Accidents |

|---|---|---|---|

| $71 | $109 | $161 |

| $124 | $201 | $287 | |

| $94 | $141 | $211 |

| $109 | $174 | $252 | |

| $71 | $117 | $179 | |

| $129 | $205 | $291 |

| $88 | $139 | $204 |

| $98 | $152 | $218 | |

| $57 | $94 | $138 | |

| $179 | $262 | $348 |

In contrast, The General and Liberty Mutual are the most expensive, charging up to $348 and $291 per month for drivers with three accidents.

Choosing the best car insurance for multiple accidents is critical, as rates can more than triple depending on your provider. To better understand your options after an accident, check out our guide on liability vs. full coverage auto insurance.

Cheapest Car Insurance With Bad Credit

Bad credit can significantly increase auto insurance costs, but some companies offer more affordable options for high-risk drivers.

State Farm stands out as the cheapest provider for drivers with bad credit, offering minimum coverage at just $134 per month.

Car Insurance Rates by Credit Score| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $84 | $110 | $165 |

| $140 | $176 | $238 | |

| $102 | $128 | $185 |

| $108 | $135 | $201 | |

| $76 | $98 | $151 | |

| $134 | $167 | $249 |

| $93 | $115 | $179 |

| $89 | $112 | $172 | |

| $72 | $93 | $134 | |

| $152 | $189 | $267 |

Geico follows closely at $151 per month, while AAA takes third place at $165 monthly, still offering competitive rates compared to most.

On the other end, The General and Liberty Mutual are the most expensive, making it even more important for drivers with poor credit to shop around.

Choosing an insurer that weighs credit less heavily can make a major difference in long-term affordability. If you have bad credit, you can still lower your premium. Read our guide on the best anti-theft auto insurance discounts to find out how.

Cheapest Car Insurance With a Ticket

High-risk drivers with traffic tickets can still find affordable insurance, especially from companies that offer leniency on minor violations.

State Farm is the cheapest high-risk car insurance company overall and the most cost-effective choice for repeat offenders.

Car Insurance Monthly Rates by Number of Tickets| Insurance Company | One Ticket | Two Tickets | Three Tickets |

|---|---|---|---|

| $58 | $89 | $130 |

| $103 | $158 | $221 | |

| $73 | $113 | $161 |

| $95 | $144 | $204 | |

| $56 | $91 | $135 | |

| $116 | $177 | $247 |

| $75 | $118 | $167 |

| $74 | $115 | $164 | |

| $53 | $82 | $120 | |

| $151 | $219 | $305 |

Geico comes in second with $56 monthly after one ticket, while AAA follows closely at $58 per month, both offering competitive rates for drivers looking to rebound from minor infractions.

When broken down by ticket type, State Farm and Geico continue to offer the lowest rates, with State Farm averaging just $53–$64 a month across common violations like speeding, red light tickets, and failure to yield.

Car Insurance Monthly Rates by Type of Traffic Ticket| Company | Speeding | Red Light | Failure to Yield | Stop Sign |

|---|---|---|---|---|

| $58 | $66 | $71 | $69 |

| $103 | $117 | $125 | $121 | |

| $73 | $82 | $88 | $85 |

| $95 | $108 | $115 | $112 | |

| $56 | $64 | $69 | $67 | |

| $116 | $132 | $141 | $138 |

| $75 | $86 | $92 | $90 |

| $74 | $83 | $89 | $87 | |

| $53 | $60 | $64 | $62 | |

| $151 | $174 | $186 | $181 |

Geico trails slightly behind, ranging from $56 to $69 monthly, depending on the violation. The General and Liberty Mutual have the steepest rates, climbing to $305 per month after three tickets, and well over $170 a month for just a single moving violation.

This shows how crucial it is for ticketed drivers to compare by both frequency and type of infraction.

Read More: Best Auto Insurance for Good Drivers

Cheapest Car Insurance With a Reckless Driving Conviction

Reckless driving convictions can cause major spikes in insurance premiums, but some providers still offer manageable rates for high-risk drivers.

State Farm is the cheapest option, with monthly rates at just $124, followed by Progressive at $142 and AAA at $158.

Car Insurance Rates With a Reckless Driving Conviction| Insurance Company | Monthly Cost |

|---|---|

| $158 |

| $243 | |

| $186 |

| $194 | |

| $217 | |

| $298 |

| $223 |

| $142 | |

| $124 | |

| $266 |

These three companies offer the most affordable coverage for drivers recovering from serious violations.

In contrast, Liberty Mutual and The General charge some of the highest rates, making it even more important to compare quotes if you have a reckless driving charge on your record.

Learn More: When Animals or Natural Disasters Damage Your Vehicle

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Coverages High-Risk Drivers Should Consider

For high-risk drivers, having the right auto insurance coverage is essential, not just to meet state requirements but to protect against the financial risks that come with a higher likelihood of accidents or claims.

High-risk drivers should start with required liability coverage, then consider adding collision and comprehensive if their vehicle is financed or hard to replace out of pocket.

Michelle Robbins Licensed Insurance Agent

Because insurers view high-risk drivers as more likely to file claims, securing adequate coverage is a key part of regaining financial and legal stability on the road. Important types of coverage for high-risk drivers include:

- Collision Coverage: Collision auto insurance pays for repairs to your own vehicle after an at-fault accident.

- Comprehensive Coverage: Comprehensive auto insurance covers damage from non-collision incidents like theft, vandalism, or weather.

- Liability Insurance: This covers injuries and property damage you cause to others, but it only meets the state minimum legal requirement, and is not enough on its own.

- SR-22 or FR-44 Certification: Not technically a coverage type, but a filing often required for high-risk drivers after a DUI or license suspension to prove financial responsibility.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re hit by someone without enough insurance, which can be valuable if you’re already considered high-risk.

Choosing the right combination of coverage ensures that high-risk drivers are protected from large out-of-pocket expenses and potential legal consequences.

While it may cost more upfront, full coverage can provide peace of mind and financial protection that far outweighs the risk of going underinsured.

How High-Risk Drivers Save Money

High-risk drivers looking to cut their insurance costs have several effective options that don’t depend on driving history (Read More: How to Get Multiple Auto Insurance Quotes).

By taking these proactive steps, high-risk drivers can begin rebuilding trust with insurers, lower their overall costs, and work toward qualifying for better rates in the future.

- Choose a Low-Risk Vehicle: Driving a car with strong safety ratings and lower repair costs can result in cheaper insurance.

- Complete a Defensive Driving Course: This shows insurers you’re committed to safer driving and can reduce your risk profile.

- Improve Your Credit Score: Better credit can lead to lower premiums since many insurers consider credit history when pricing policies.

- Maintain Continuous Coverage: Keeping an active policy helps avoid rate hikes due to insurance lapses (Learn More: Driving Without Auto Insurance).

- Raise Your Deductible: Increasing your deductible lowers your monthly premium if you’re confident in avoiding frequent claims.

High-risk drivers can still find ways to lower their auto insurance premiums by taking advantage of no-down-payment car insurance and discounts offered by top providers.

Progressive stands out with a 30% discount for completing a defensive driving course, which is especially beneficial for drivers with prior violations looking to rebuild their driving record.

Top Auto Insurance Discounts for High-Risk Drivers| Company | Anti-Theft | Claims-Free | Defensive Driving | Safety Features | UBI |

|---|---|---|---|---|---|

| 8% | 20% | 14% | 15% | 30% |

| 10% | 10% | 10% | 20% | 30% | |

| 25% | 15% | 5% | 18% | 30% |

| 10% | 9% | 10% | 15% | 30% | |

| 25% | 12% | 15% | 15% | 25% | |

| 35% | 8% | 10% | 12% | 30% |

| 5% | 14% | 10% | 18% | 40% |

| 25% | 10% | 30% | 10% | $231/yr | |

| 15% | 11% | 15% | 20% | 30% | |

| 15% | 10% | 10% | 18% | 10% |

Geico and State Farm both offer up to 15% off for defensive driving as well, and also provide strong safe-driver and safety feature discounts. State Farm offers 20% off for each.

These companies reward consistent safe driving behavior and the use of safety technology, which can lead to significant long-term savings.

Other discounts also make a meaningful impact. Geico and Progressive offer 25% off for anti-theft systems, helping high-risk drivers lower premiums simply by upgrading their vehicle security.

Liberty Mutual offers the highest anti-theft discount at 35%, although its base premiums are much higher. Check out more details about the best car insurance discounts you can’t miss.

High-risk drivers can lower their insurance by comparing quotes, taking a defensive driving course, and avoiding lapses in coverage.

Brad Larson Licensed Insurance Agent

By combining multiple discounts, such as claims-free status, use of vehicle safety features, or enrolling in usage-based programs, high-risk driver can offset the elevated costs of their higher-risk profile and work toward more affordable premiums over time.

Read More: Cheap Auto Insurance for Low-Income Drivers

Cheapest High-Risk Auto Insurance Companies

State Farm, Progressive, and AAA rank as the top three providers offering the lowest rates for high-risk drivers. Review the list below to find the best insurance for high-risk drivers.

If you can’t find car insurance due to your driving record, read our guide on what to do when you’re denied insurance coverage.

#1 – State Farm: Top Overall Pick

Pros

- Cheapest for High-Risk Drivers: State Farm offers the lowest rate at just $65 a month, making it the most affordable option for drivers with tickets, accidents, or a DUI on their records.

- Safe Driving Support: High-risk drivers can save an additional 15% by completing a state-approved defensive driving course.

- Top Financial Strength: A++ A.M. Best rating gives high-risk drivers confidence in claims reliability. See our State Farm car insurance review for more ratings.

Cons

- Limited Digital Tools: State Farm’s online features may feel outdated for tech-savvy high-risk drivers.

- Lower Customization: High-risk drivers may find fewer flexible policy options at the $65 a month minimum level.

#2 – Progressive: Best Defensive Driving Discounts

Pros

- Strong Discounts: Progressive offers a generous 30% discount to high-risk drivers who qualify for its defensive driving and usage-based programs.

- Affordable Rates: Minimum coverage for high-risk drivers starts at just $75 per month, which is significantly lower than the national average for drivers DUIs.

- Usage-Based Options: Progressive’s usage-based Snapshot tracks real-time driving behavior and rewards high-risk drivers with lower rates after just 30 days of safe driving.

Cons

- Rate Spikes After Claims: High-risk drivers may face steep increases after an accident. Learn everything you need to know about Progressive Insurance.

- Limited Agent Availability: High-risk drivers who prefer in-person support might find it harder to access.

#3 – AAA: Cheapest for Roadside Assistance

Pros

- Roadside Help: AAA automatically includes 24/7 roadside assistance with its high-risk auto policies.

- Defensive Driving Rewards: High-risk drivers can save 14% by completing a defensive driving course.

- Competitive Rates: Minimum coverage starts at $81 a month, which is affordable considering the bundled perks and broad acceptance of high-risk applicants.

Cons

- Membership Required: As mentioned in our AAA auto insurance review, high-risk drivers must pay annual fees to access auto insurance coverage.

- Limited Availability: Some high-risk drivers in rural areas may not have access to full AAA services.

#4 – American Family: Best Claims Service

Pros

- Reliable Claims Process: American Family consistently scores well in J.D. Power surveys, providing dependable support to high-risk drivers with prior accidents.

- Competitive Minimum Rates: Minimum coverage starts at $104 a month, and AmFam does insure drivers with multiple tickets, at-fault crashes, or DUIs on their record.

- Accident Forgiveness: After three years with no additional violations, high-risk drivers may qualify for accident forgiveness, helping protect long-term rates.

Cons

- Small Defensive Driving Discount: At just 5%, high-risk drivers won’t see major savings here.

- Availability Issues: AmFam car insurance for high-risk drivers is not available in every state. Read our American Family Insurance review to see if it’s in your state.

#5 – Farmers: Cheapest for Family Plans

Pros

- Family Discounts: High-risk drivers with teens or young family members on the same plan can save up to 20% with bundles and multi-vehicle policies.

- Wide Network: Farmers maintains a strong agent network, offering personalized support for high-risk drivers who need SR-22 filings.

- Custom Coverage: Farmers offers tiered coverage that allows high-risk drivers to customize their protection (Learn More: Everything You Need to Know About Farmers).

Cons

- Slightly Higher Base Rate: At $106 per month, high-risk drivers may pay more than competitors.

- Low Discount Cap: Farmers only offers a 10% defensive driving discount to high-risk drivers.

#6 – Geico: Cheapest for Senior Drivers

Pros

- Cheap Senior Rates: High-risk drivers over 60 qualify for additional discounts that can lower their rates with Geico.

- Strong Digital Tools: The Geico mobile app allows high-risk drivers to track their policies, request roadside assistance, and file claims with minimal hassle.

- Safe Driving Discount: Geico, one of the top high-risk insurance companies, offers a 15% discount after completing a driver improvement course and keeping a clean record.

Cons

- Minimal Local Agent Help: High-risk drivers preferring personal service may find limited options.

- Strict Underwriting: Some high-risk drivers may be denied coverage based on prior infractions. Read everything you need to know about Geico to determine your policy options.

#7 – Nationwide: Cheapest for Accident Forgiveness

Pros

- Accident Forgiveness Perk: Nationwide’s optional program allows high-risk drivers to avoid premium hikes after their first at-fault accident.

- SmartRide Program: Nationwide’s usage-based discount can help high-risk drivers earn up to 40% off for improving real-time driving habits.

- Low-Mileage Discounts: High-risk drivers who work from home or drive less than 10,000 miles can get lower rates with the SmartMiles pay-as-you-go program.

Cons

- Above-Average Premiums: $129 a month may be steep for some high-risk drivers compared to rivals. See more quotes in our Nationwide auto insurance review.

- Limited Discount Stackability: High-risk drivers may not combine all available discounts easily.

#8 – The General: Cheapest for SR-22 Filings

Pros

- SR-22 Filings: The General will underwrite and file SR-22 auto insurance for high-risk drivers with multiple DUIs or accidents.

- Simple Approval: The General specializes in insuring drivers with multiple violations or recent license reinstatements.

- Quick Quotes: High-risk drivers can get insured in minutes, a major plus when SR-22 documentation or proof of insurance is needed fast.

Cons

- High Base Rates: $150 per month is among the highest for high-risk drivers seeking minimum coverage. Compare more rates in The General auto insurance review.

- Limited Coverage Options: High-risk drivers won’t find much flexibility or add-ons beyond basic policies.

#9 – Allstate: Best Customer Service

Pros

- Strong Customer Support Network: Allstate’s local agent network helps high-risk drivers navigate complex policy issues or file claims after past accidents.

- Bundling Options: High-risk drivers can reduce their high-risk car insurance costs by bundling with renters or homeowners insurance.

- Drivewise Rewards: Allstate’s app-based tracking can gradually lower rates for high-risk drivers demonstrating safe behaviors over time.

Cons

- Higher Premiums: High-risk drivers pay a steep $152 a month for minimum coverage.

- Strict Discount Requirements: High-risk drivers may not qualify for all incentives right away. Learn how to qualify in our Allstate auto insurance review.

#10 – Liberty Mutual: Cheapest for Add-On Coverage Options

Pros

- Wide Range of Add-Ons: Liberty Mutual offers custom coverage options for high-risk drivers, like new car replacement, accident forgiveness, and roadside assistance.

- Safe Driving Discount: Offers up to 20% off for high-risk drivers who complete approved safety programs and maintain a clean record for 3+ years.

- SR-22 Filing Support: Liberty Mutual helps high-risk drivers file SR-22 forms quickly, making it easier to meet state requirements after license suspension.

Cons

- Most Expensive Option: At $178 a month, high-risk drivers pay the highest minimum coverage rate.

- Complicated Quotes: High-risk drivers may find it harder to compare pricing due to policy variables. Learn how it works in our Liberty Mutual review.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Finding Affordable High-Risk Auto Insurance

Comparing cheap auto insurance options for high-risk drivers is the key to finding the right balance between affordability and protection.

Top providers like State Farm, Progressive, and AAA offer competitive rates, starting as low as $65 per month. Learn more about how to compare auto insurance companies.

These insurers make it possible for high-risk drivers to lower their costs while maintaining essential protection, including roadside assistance, even after tickets, accidents, or a DUI.

To find out if you can get cheaper high-risk auto insurance rates, enter your ZIP code into our free quote tool to instantly compare prices from various companies near you.

Frequently Asked Questions

Who has the cheapest car insurance for high-risk drivers?

State Farm currently offers the cheapest high-risk car insurance, with minimum coverage starting at just $65 per month. It’s especially affordable for drivers with tickets, accidents, or even a DUI on their record.

Read More: What to Do If You Can’t Afford Your Auto Insurance

Who has the cheapest insurance for a bad driving record?

State Farm and Progressive are the most budget-friendly options for drivers with bad driving records. Progressive offers rates as low as $75 a month and provides strong safe-driving discounts to help lower costs. Start saving on your auto insurance by entering your ZIP code and comparing quotes.

Is USAA good for high-risk drivers?

USAA is generally not the best fit for high-risk drivers, as it tends to focus on drivers with clean records and good credit. Additionally, USAA is only available to military members, veterans, and their families, limiting its accessibility.

Learn More: USAA Auto Insurance Review

Why is insurance cheaper with two drivers?

Insurance can be cheaper with two drivers if both have clean driving records, as it reduces the individual risk and spreads it across multiple insured drivers. Insurers may also offer multi-driver or household discounts, lowering overall premiums.

Who has the best auto insurance?

The best car insurance for high-risk drivers depends on the situation, but State Farm, Progressive, and AAA rank highest due to their competitive pricing, strong discounts, and flexible coverage for drivers with past violations.

What is the best way to get cheap auto insurance?

The best way to get cheap car insurance is to compare quotes from multiple providers, use available discounts like defensive driving or anti-theft systems, and consider only the coverage you need based on your driving profile.

Read More: 26 Hacks to Save More Money on Car Insurance

What insurance provider is the cheapest?

State Farm is currently the cheapest provider for high-risk drivers, offering minimum liability insurance at $65 per month, followed by Progressive at $75 and AAA at $81. Compare State Farm vs. Farmers, Geico, Progressive, and Allstate auto insurance for more quotes.

How long are you considered a high-risk driver?

Most drivers are considered high-risk for three to five years after a major violation like a DUI, accident, or multiple tickets. However, the exact time frame depends on your insurer, state laws, and how clean your driving record remains over time.

Which insurance type is cheaper?

Minimum liability coverage is the cheapest type of car insurance, as it only includes the state-required amount to cover others’ injuries or property damage, not your own vehicle repairs or medical costs.

Read More: 17 Tips to Pay Less for Car Insurance

What driver is most at risk?

Drivers with a history of DUIs, multiple speeding tickets, or at-fault accidents are considered the most at risk. Young, inexperienced drivers also fall into this category due to their limited time on the road.

What insurance is cheaper than USAA?

Does Allstate accept high-risk drivers?

What is the cheapest category for car insurance?

How much is high-risk insurance a month?

What is high-risk insurance called?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.