Medicare Part A (2026 Guide)

Medicare Part A is the hospital insurance portion of Original Medicare, and most seniors enroll automatically at age 65. It covers hospital stays, skilled nursing care, hospice, and some home health services. While premiums are usually $0, you'll still pay the Part A deductible when you use your benefits.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as ...

Justin Wright

Updated January 2026

Medicare Part A covers hospital stays, skilled nursing, hospice, and limited home healthcare. It’s available to seniors 65 and older and younger people with qualifying disabilities.

- Original Medicare plans include Part A and Part B medical insurance

- Medicare Part A costs $0 per month for most beneficiaries

- Coverage includes up to 60 days in a hospital with $0 coinsurance

Premiums are typically free if you or your spouse paid Medicare taxes for at least 10 years (or 40 quarters). However, beneficiaries are required to pay coinsurance and meet a deductible for every hospital stay. Medicare Savings Programs (MSPs) can help you cover insurance costs.

Most retirees automatically enroll in Part A with Social Security benefits, but consider comparing Medicare Part A, B, C, D, and Medigap plans to ensure you’re completely covered. Call (855) 634-0435 now to speak with a licensed insurance agent, or enter your ZIP code.

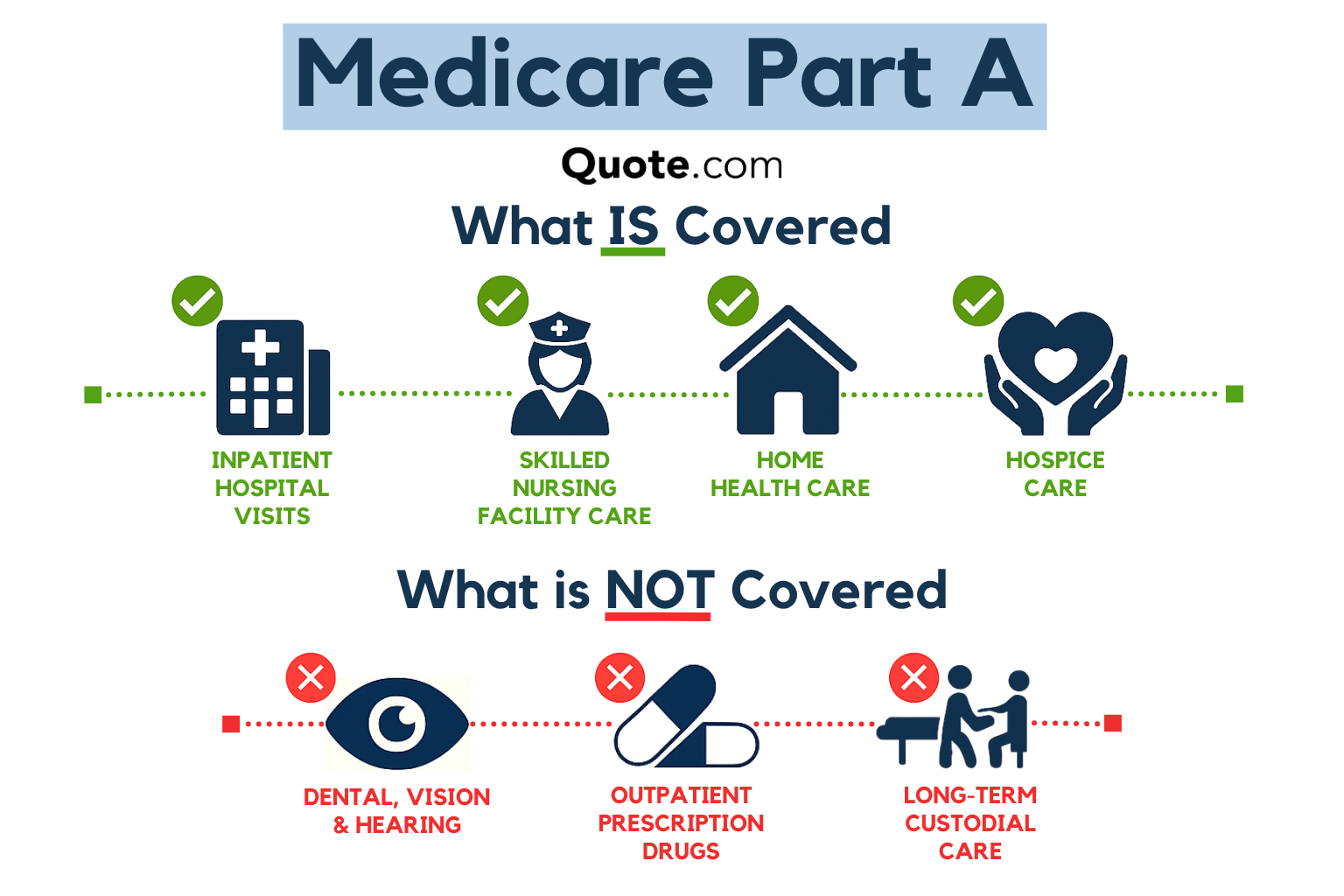

Medicare Part A Coverage

Medicare Part A benefits cover all inpatient care needs, from hospital stays to nursing care. It will also cover inpatient services if you’re admitted to a psychiatric hospital.

Who is eligible for Medicare? Most seniors are automatically enrolled with their Social Security benefits when they turn 65 and can immediately start using Medicare Part A benefits. Younger individuals with disabilities also qualify for Medicare benefits.

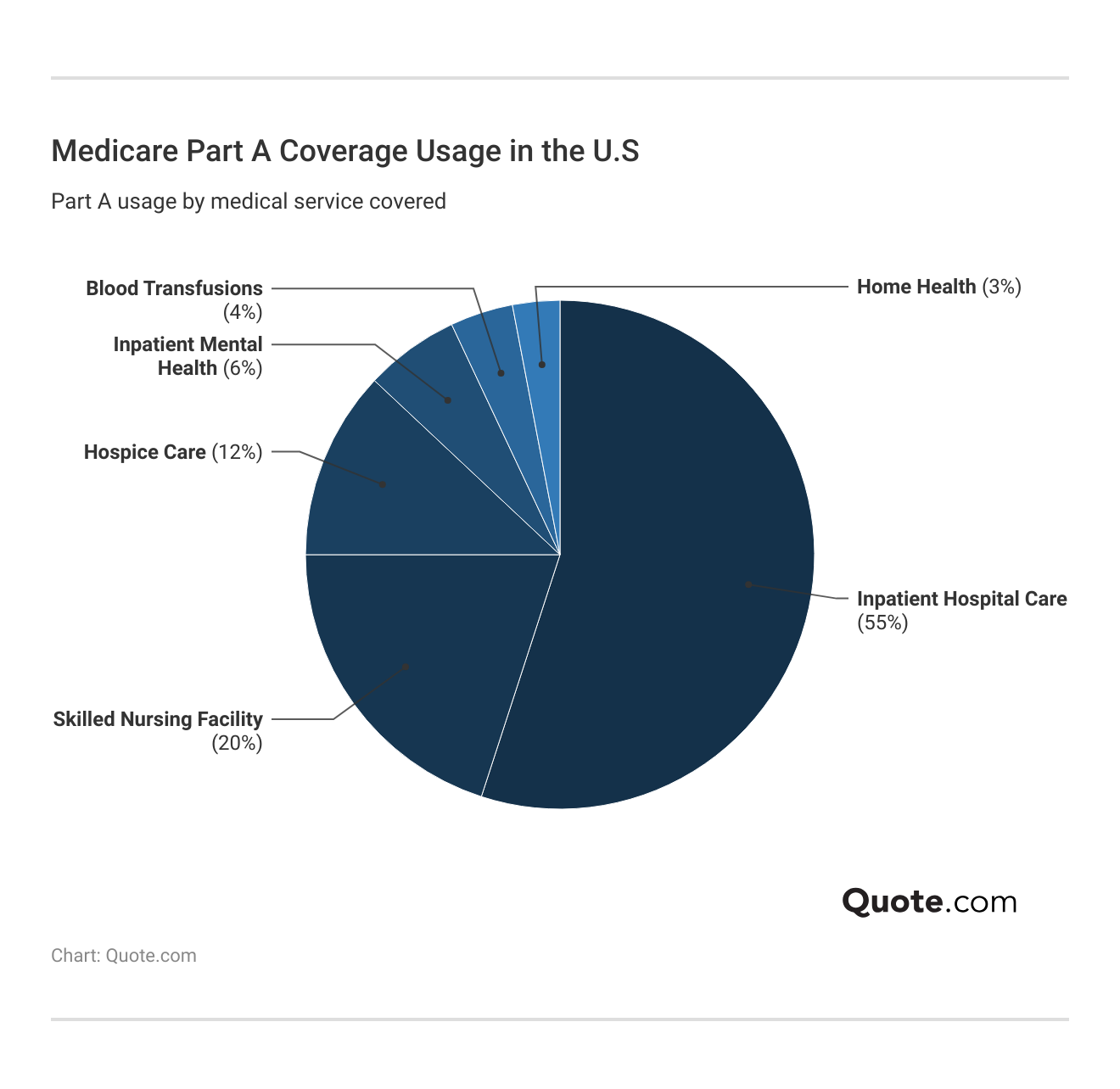

55% of beneficiaries use their Medicare Part A coverage for hospital visits, while 20% use it to help cover costs to stay in a skilled nursing facility. Many also use their Part A coverage to help pay for hospice costs and ensure comfortable end-of-life care.

Inpatient Hospital Stay

Inpatient hospital care is one of the most important parts of Medicare, and Medicare Part A covers up to 90 days in a hospital within a benefit period. The first 60 days require a $0 coinsurance, but you will have to pay $419 for days 61-90. This same coverage applies to inpatient psychiatric hospitals as well.

You are responsible for paying out of pocket for anything beyond 90 days. Medicare Part A does have a 60-day reserve over your lifetime, after paying an $838 coinsurance, but coverage ends after 120 consecutive days. However, benefits restart with each new hospital stay.

Learn More: What is Medicaid?

Skilled Nursing Facility

Medicare Part A also covers skilled nursing care at an in-network facility. To qualify, you must have a prior inpatient hospital stay of at least three days and need daily skilled outpatient care that can only be provided in a facility.

The first 20 days are covered without coinsurance, but days 21-100 require a $209.50 coinsurance. After 100 days, you’re responsible for all costs unless you have supplemental insurance.

Read More: Complete Guide to Health Insurance

Hospice Care

Medicare Part A hospice benefits kick in after a terminal diagnosis. Once you qualify, you’re eligible for two 90-day benefit periods followed by unlimited 60-day periods.

When hospice benefits kick in, Medicare pays for virtually all services related to your terminal illness.

Adam Lubenow Medicare Broker

You’ll typically pay nothing for hospice services, except a 5% coinsurance for inpatient respite care and up to $5 for each prescription for pain or symptom management. Learn more about Medicare Part D for prescription costs.

Home Health Services

Medicare Part A home health lets you get skilled care at home after a qualifying hospital or nursing facility stay, with no out-of-pocket cost for the service, but there are limitations.

Coverage only applies when you’re homebound and meet certain criteria, and is typically ordered by your doctor as part of a formal care plan. Care must be part-time or intermittent and all delivered through a Medicare-certified home health agency.

Learn More: What We Learned Analyzing 815 Insurance Companies

Get a Free Medicare Plan Review

Speak With a Licensed Insurance Agent Today

Secured with SHA-256 Encryption

What Medicare Part A Doesn’t Cover

Medicare Part A covers a wide variety of inpatient care services you would need in a hospital or nursing facility, but there is a long list of exclusions that your Original Medicare plan won’t pay for.

Medicare Part A Exclusions| Exclusions | Reasons |

|---|---|

| Custodial Long-Term Care | Not medically needed; non-skilled care |

| Dental Services | Not related to inpatient treatment |

| Vision Care | Routine exams & glasses not covered |

| Hearing Aids | Not essential inpatient treatment |

| Private Duty Nursing | Not standard for inpatient coverage |

| Overseas Care | International care not included |

| Cosmetic Surgery | Not medically needed for treatment |

| Care Outside the U.S. | Foreign care is rarely covered |

| Personal comfort items | Not medically required items |

| Blood Transfusions | First 3 pints are not covered |

You may only need one type of policy to fill in a specific gap in your Part A coverage. For instance, Medicare Part D specifically covers prescription drugs and can be used with Part A only, Original Medicare, or your existing health coverage.

You are responsible for finding the appropriate health insurance to cover the gaps. Some Medicare Advantage plans may include additional benefits that pay for these coverages, but many people turn to Medicare Supplemental Insurance (Medigap) to fill in the holes in their Part A policy.

Medicare Part A won’t cover everything — it’s called hospital insurance because it only covers inpatient care, and there are limits to this coverage.

Medicare Part A Pros & Cons| Feature | Pros | Cons |

|---|---|---|

| Inpatient Hospital Care | Covers hospital room, meals, services | Limited days; coinsurance may apply |

| Skilled Nursing Facility | Helps with rehab after hospital stay | Only after 3-day hospital admission |

| Hospice Care | Full support for terminal care needs | Must end curative treatments for care |

| Home Health Services | Covers part-time nursing or therapy | Only if medically necessary services |

| Automatic Enrollment | Auto-enroll with Social Security | May delay if still working employed |

| No Monthly Premium | Free with enough work credits | Premium if work credits are lacking |

| Nationwide Access | Accepted at most U.S. hospitals | No coverage outside the U.S. |

| Limited Out-of-Pocket Costs | Predictable costs with set limits | Doesn’t cover all medical expenses |

It covers hospital stays, but only 60 days are free, and skilled nursing care coverage is limited to 100 days until coinsurance payments are required. Other services are limited to medical necessity, typically post-op nursing care and rehabilitation.

If you stay in the hospital for a week, are discharged, and then readmitted a day later, you're required to pay another Medicare Part A deductible.

Michelle Robbins Licensed Insurance Agent

Medicare recipients are also limited to network-only providers, which means you could lose access to your family practitioner or preferred specialists.

Read More: Best Gastroenterologists That Accept Medicare

Medicare Part A Cost

Most seniors pay nothing for Medicare Part A coverage. Premiums are $0 per month, and cosinsurance costs only kick in after a set number of days.

Medicare Part A: Copay, Coinsurance, & Premium Breakdown| Feature | Copay | Coinsurance | Premium |

|---|---|---|---|

| Inpatient Hospital Stay | Days 1–60: $0 | Days 1–60: $0 Days 61–90: $419/day Days 91–150: $838/day | $0 with 40+ work quarters; up to $505/month otherwise |

| Skilled Nursing Facility | Days 1–20: $0 | Days 21–100: $219.50/day | Included in Part A |

| Hospice Care | $5 drug copay | $0 for care; 5% for respite care | Included in Part A |

| Home Health Services | $0 | $0 | Included in Part A |

| Psychiatric Inpatient | Days 1–60: $0 | Days 1–60: $0 Days 61–90: $419/day Days 91–150: $838/day | $0 with 40+ work quarters; up to $505/month otherwise |

| Blood Transfusion | You pay first 3 pints unless donated | $0 after 3 pints if hospital gets it free | Included in Part A |

If you don’t meet the minimum work requirements, you could pay up to $505 a month for coverage. You’re also responsible for paying the Medicare Part A deductible, which must be met at every hospital visit.

Medicare Costs: Copay, Coinsurance, & Premiums| Feature | Copay | Coinsurance | Premium |

|---|---|---|---|

| Definition | Set fee per service / Rx | Percent of cost after deductible | Monthly fee for Medicare |

| When Charged | Paid at service or refill | Charged after deductible | Paid monthly, care or not |

| Medicare Parts | Part C and Part D | Part A, Part B, & some D | Part A (if due), B, C, D |

| Typical Cost | Ex: $25 doctor visit | Ex: 20% of $1k = $200 | Ex: $185/mo for Part B |

| Cost Predictability | Same fee for each service | Cost depends on service | Fixed, predictable cost/mo |

| Varies by Plan | Varies by C or D plan | Varies by plan, often with C | Varies by plan & income |

There are many ways to finance what health insurance won’t cover, so it’s recommended that you still sign up for Part A as soon as you’re eligible. It’s the most affordable option for seniors, especially those with pre-existing conditions.

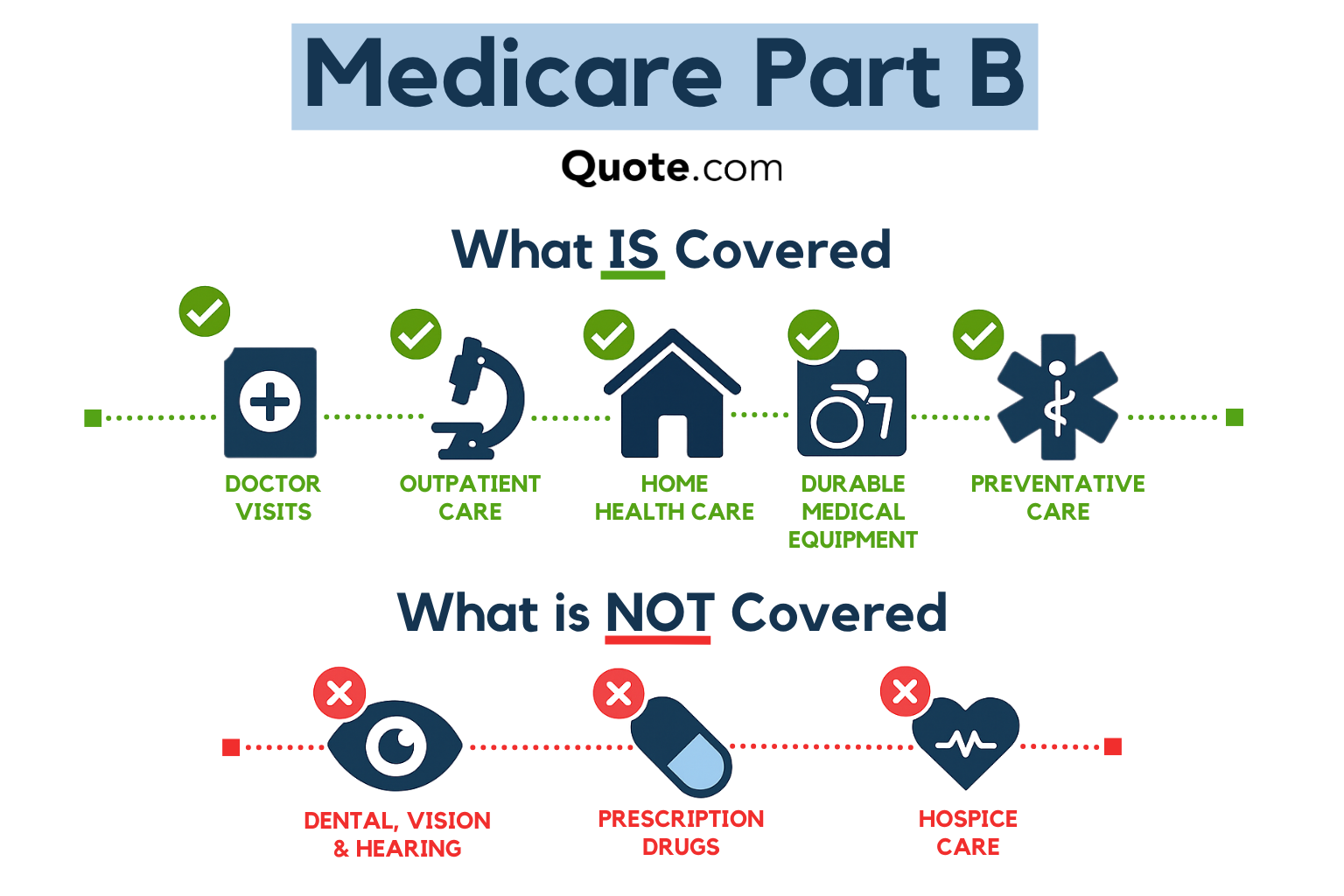

Medicare Part A vs. Medicare Part B

What is the difference between Plan A and B? Medicare Part A covers inpatient care, like hospitals, while Medicare Part B covers outpatient care, including doctor visits and medical supplies. Parts A and B work together as two halves of Original Medicare, covering different parts.

Medicare Part B generally covers 80% of approved outpatient costs after you meet the annual deductible. Part A typically covers 100% of approved inpatient hospital costs for the first 60 days of each benefit period after you pay the Part A deductible.

How much does Medicare Part B cost? Part B premiums are $185 per month.

What does Medicare Part B not cover? It won’t pay for the hospital coverage Part A covers, and it doesn’t cover prescription drugs or dental care.

In that case, do you really need Medicare Part B? It is recommended to get both, as each plan can sometimes overlap. For example, while Part A covers hospital stays, Part B covers the ambulance you might take to get there.

Since neither Part A nor Part B covers everything, many people turn to Medicare Advantage plans (Medicare Part C), which package these benefits together and help fill in coverage gaps.

If you have questions about Medicare Part A, B, and C, call (855) 634-0435 now for help.

Get a Free Medicare Plan Review

Speak With a Licensed Insurance Agent Today

Secured with SHA-256 Encryption

Medicare Part A Eligibility

To qualify for Medicare Part A, most people become eligible at age 65. Most retirees are automatically enrolled if they’re already receiving Social Security benefits, but others may need to apply through the Social Security Administration to activate their coverage.

People under 65 may also qualify if they’ve received Social Security Disability Insurance (SSDI) for 24 months, or if they have End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS).

Part A is premium-free if you or your spouse worked and paid Medicare taxes for at least 40 quarters (10 years). If you don’t meet the work requirement, you can still buy Part A by paying a monthly premium, which is based on how long you or your spouse worked.

Learn More: Comparing Insurance Plans That Work for You

Medicare Part A Enrollment

Most seniors are automatically enrolled in Medicare Part A when they turn 65 and start receiving Social Security benefits. However, eligibility officially starts three months before your 65th birthday, so you can sign up for Medicare early during the Initial Enrollment Period (IEP).

Medicare Enrollment Periods: Dates & Options| Enrollment Period | When It Happens | What You Can Do |

|---|---|---|

| Initial Enrollment Period (IEP) | 3 months before to 3 months after your 65th birthday | Enroll in Part A or B |

| General Enrollment Period (GEP) | January 1 – March 31 each year | Enroll with possible penalty |

| Special Enrollment Period (SEP) | While working or within 8 months of losing group coverage | Enroll without late penalty |

| Medicare Advantage Open Enrollment | January 1 – March 31 each year | Switch or drop Advantage plan |

| Automatic Enrollment | At age 65 if receiving Social Security/RRB | Automatically enrolled in Part A |

If you’re already receiving Social Security, Medicare Part A enrollment usually happens automatically, but you should still review your coverage to confirm your start date and benefits.

Once you turn 65 and meet Medicare Part A eligibility requirements, take the following steps to get the coverage you need:

- Gather Required Documents: Have your Social Security number, birth certificate, proof of legal residency, and any current health insurance information.

- Apply Online: Enroll online with the Social Security Administration (SSA) or by calling (855) 634-0435 to speak with a licensed insurance agent.

- Choose Your Coverage: Decide whether to enroll in Part A only or in both Part A and Part B.

- Receive Your Medicare Card: After processing (usually within 30 days), your card will arrive in the mail showing your Part A start date.

Enrolling during your Medicare Initial Enrollment Period helps you avoid late penalties and ensures your Medicare coverage starts as soon as you’re eligible.

If you wait to get coverage, then sign up during a General Enrollment Period (GEP), but you could pay a penalty if you wait too long. Special Medicare Part A enrollment periods are reserved for those who receive disability benefits or a terminal diagnosis.

Everything You Need to Know About Medicare Part A

If you’re wondering how Medicare works, Medicare Part A is your hospital insurance, covering inpatient stays, skilled nursing care, hospice, and limited home healthcare.

While it’s premium-free for most who paid Medicare taxes during their working years, it does have limits, such as caps on covered days and in-network doctors and facilities (Learn More: Best Endocrinologists That Accept Medicare).

Medicare Part A Overview| Coverage | Details | Eligibility |

|---|---|---|

| Inpatient Hospital Care | Room, meals, nursing, and drugs | Age 65+ or disability with work record |

| Skilled Nursing Facility | Care after 3-day hospital stay | After hospital stay and doctor order |

| Hospice Care | End-of-life comfort and support | Terminal illness, 6-mo expectancy |

| Home Health Services | Part-time nursing or therapy | Doctor-ordered & medically needed |

| Psychiatric Inpatient Care | Psychiatric hospital (190 days) | Must qualify for Medicare Part A |

| Blood Transfusions | First 3 pints unless donated | Must qualify for Medicare Part A |

If you don’t meet the work requirement, you may still qualify by paying a monthly premium, but Medicare Part A costs can reach $505 a month. Speaking with a licensed insurance agent can help you compare all your options and find the right balance of cost and coverage. Call (855) 634-0435 to get started now.

Frequently Asked Questions

What is Medicare Part A?

Medicare Part A coverage is known as hospital insurance since it covers most inpatient care services, including surgery, hospital stays, skilled nursing care, and hospice care.

Is Medicare Part A free?

Is Medicare Part A free at age 65? Medicare Part A premiums are $0 for retirees who paid Medicare taxes for at least 10 years, or 40 quarters.

Who is eligible for free Medicare Part A?

Seniors over 65 and younger people with qualifying disabilities will have $0 premiums as long as they paid Medicare taxes while employed for at least 10 years. Call (855) 634-0435 to speak with a license agent about your eligibility.

How much is Medicare Part A if you never worked?

Medicare Part A costs will vary based on how long you worked. Most people who worked and paid Medicare taxes for at least 10 years will pay $0 or a reduced rate. If you never worked, you may still be eligible for $0 premiums based on your spouse’s employment history. Read our guide to find out how much Medicare costs near you.

How do I sign up for Medicare Part A?

The initial enrollment period for Medicare Part A, B, C, and D starts three months before your 65th birthday. If you aren’t automatically enrolled as part of your Social Security benefits, you can sign up for Medicare Part A online with your Social Security number, birth certificate, proof of legal residency, and current medical records.

Does Medicare Part A cover surgery?

Yes, Medicare Part A covers surgeries and some rehabilitation costs after surgery.

Does Medicare Part A cover doctors in a hospital?

Yes, care provided in a hospital is covered by Medicare Part A benefits.

Does Medicare Part A pay 100% of hospital stays?

Medicare Part A only covers 100% for a limited number of days before requiring copays and coinsurance, while Part B only pays up to 80%. Many seniors opt for Medicare Advantage or MediGap plans to cover what Medicare doesn’t.

Does Medicare Part A cover ambulance rides?

No, Medicare Part A does not cover ambulances.

When should I get Medicare Part A?

You should sign up for Medicare as soon as you’re eligible. Medicare eligibility kicks in three months before your 65th birthday.

What is the difference between Medicare Part A and B coverage?

Do I need both Medicare Part A and B?

Do I need Medicare Part A if I have insurance?

Why would a person not have Medicare Part A?

What is the best Medicare plan that covers everything for seniors?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.