Average Cost of Life Insurance in 2026

The average cost of life insurance varies by policy type and other factors. 20-year term life insurance rates start at $20 per month, while whole life insurance costs around $160 per month. To get affordable life insurance, consider your budget and coverage needs before buying a policy.

Read more Secured with SHA-256 Encryption

Compare Quotes From Top Companies and Save

Life insurance policies starting at less than $1/day

Table of Contents

Table of Contents

Insurance and Finance Expert

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life i...

Maria Hanson

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Insurance Claims Support & Senior Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she had similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Updated January 2026

The average cost of life insurance varies depending on the policy type, age, health, and more. A 20-year term life insurance policy may start as low as $20 per month.

- Term life policies are the cheapest, starting at $20 per month

- Whole life policies are more expensive at $380 a month

- Whole life costs more because it lasts your entire lifetime

Rates are higher when buying permanent life insurance and for customers with health conditions. One way you can save on life insurance is by purchasing a policy earlier in life, rather than waiting until a health condition or age increases rates.

Read on to learn more about what you can expect to pay for different life insurance policies, as well as how to save on the policy you choose.

Customers should consider both budget and life insurance coverage needs. You can quickly find affordable life insurance rates by using our free quote tool.

The Average Cost of Life Insurance

What you’ll pay for a life insurance policy depends partly on whether you choose a whole or term life insurance policy.

For example, whole life insurance rates are significantly higher than those of term life insurance, but policies do not expire after a set period, unlike term life insurance.

Term vs. Whole Life Insurance Monthly Rates Without Riders| Company | 20-Year Term | Whole Policy |

|---|---|---|

| $32 | $390 | |

| $36 | $455 | |

| $33 | $472 |

| $31 | $425 | |

| $34 | $410 | |

| $40 | $465 | |

| $39 | $475 | |

| $37 | $400 |

| $38 | $435 | |

| $30 | $380 |

The provider you go with will also have an effect on your life insurance rates for both whole and term life insurance policies.

So no matter which type of policy you choose, ensure you get quotes from economical companies to get the best deal on life insurance (Read More: Whole vs. Term Life Insurance).

One of the cheaper companies is Transamerica, with term life rates starting at $30 per month and whole life rates starting at $380. AIG and Prudential also offer life insurance rates that start on the lower end.

Companies that will be a little pricier for whole life insurance are Northwestern Mutual, Lincoln Financial, and New York Life. However, price is just one factor of buying a life insurance policy. Make sure to also look into a company’s customer service and reputation.

How Health Conditions Affect Life Insurance Rates

One of the biggest factors that will affect life insurance costs for both whole and term life policies is a customer’s health.

This is why insurance companies almost always request a physical exam be completed as part of a life insurance application.

While you can choose to get a no-exam life insurance policy at some companies, keep in mind that the cost will be much higher.

Jeff Root Life Insurance Agent

Insurance companies use several different health classes to assign a risk rating to customers, which will affect life insurance rates (Learn More: What We Learned Analyzing 815 Insurance Companies).

Essentially, the healthier you are, the lower your life insurance rates will be. This is because insurance companies are less concerned about paying out a death benefit soon after purchase.

Life Insurance Monthly Rates by Health Class & Policy Type| Health Class | Classification | 20-Year Term | Whole Policy |

|---|---|---|---|

| Preferred Plus | No health issues, optimal BMI, non‑smoker | $22 | $165 |

| Preferred | Minor health issues (slightly elevated BP), good lifestyle | $25 | $190 |

| Standard Plus | Moderate BP/cholesterol, occasional medication | $28 | $220 |

| Standard | Treated conditions like hypertension, slightly elevated BMI | $32 | $260 |

| Substandard (Table 2‑4) | Chronic issues (diabetes, mild obesity), high BMI | $50 | $375 |

| High Risk / Impaired | Serious conditions (heart disease, cancer history, insulin use) | $85 | $600+ |

Several health conditions can impact a customer’s life insurance class and costs, including high cholesterol and heart disease.

If you are deemed to be a high-risk or impaired health class, your rates will be much higher than those of a customer who is assigned a preferred plus health class.

Term vs. Whole Life Insurance Monthly Rates by Health Condition & Gender| Health Condition | 20-Year Term (Female) | 20-Year Term (Male) | Whole Policy (Female) | Whole Policy (Male) |

|---|---|---|---|---|

| Excellent Health | $20 | $25 | $160 | $185 |

| Controlled High Blood Pressure | $25 | $30 | $185 | $210 |

| Mild Asthma | $26 | $32 | $190 | $215 |

| Type 2 Diabetes (Well-Managed) | $35 | $42 | $230 | $260 |

| High Cholesterol | $28 | $34 | $200 | $230 |

| Obesity (BMI 30-35) | $40 | $48 | $260 | $300 |

| History of Depression | $30 | $36 | $210 | $240 |

| Cancer Survivor (5+ yrs remission) | $50 | $60 | $320 | $370 |

| Heart Disease History | $70 | $85 | $400 | $450 |

| HIV Positive (medically controlled) | $90 | $110 | $500 | $550 |

The two health conditions that will make life insurance policies the most expensive are being HIV positive or having a history of heart disease.

On the other hand, controlled high blood pressure and mild asthma will raise life insurance rates the least, as they aren’t as serious medically.

How Age Affects Life Insurance Rates

Life insurance companies make money off the premiums paid to them, so it makes sense that the longer a policyholder has a policy, the less a life insurance company charges.

This is because the younger a customer gets a policy, the higher the likelihood is that the company won’t be paying out a large death benefit to life insurance beneficiaries anytime soon.

It's important to consider getting life insurance long before you think you'll need it, as you'll secure lower rates.

Daniel Walker Licensed Insurance Agent

When you look at whole life insurance rates by age, you will see that young customers will receive much lower rates than older customers.

The average cost of life insurance for seniors is the highest, with whole life insurance rates starting at $520 monthly.

Whole Life Insurance Monthly Rates by Age, Gender, & Smoking Status| Age & Gender | Non-Smoker | Smoker |

|---|---|---|

| 20-Year-Old Female | $110 | $150 |

| 20-Year-Old Male | $130 | $180 |

| 30-Year-Old Female | $145 | $195 |

| 30-Year-Old Male | $165 | $225 |

| 40-Year-Old Female | $220 | $295 |

| 40-Year-Old Male | $250 | $340 |

| 50-Year-Old Female | $350 | $470 |

| 50-Year-Old Male | $395 | $535 |

| 60-Year-Old Female | $520 | $700 |

| 60-Year-Old Male | $590 | $800 |

| 70-Year-Old Female | $750 | $1,020 |

| 70-Year-Old Male | $830 | $1,130 |

You will also find that, in addition to age, smoking status will influence rates, with smokers paying more monthly than non-smokers.

Whether you are trying to get lower whole or 30-year term life insurance rates by age, quitting smoking can help you score a better deal on life insurance policies.

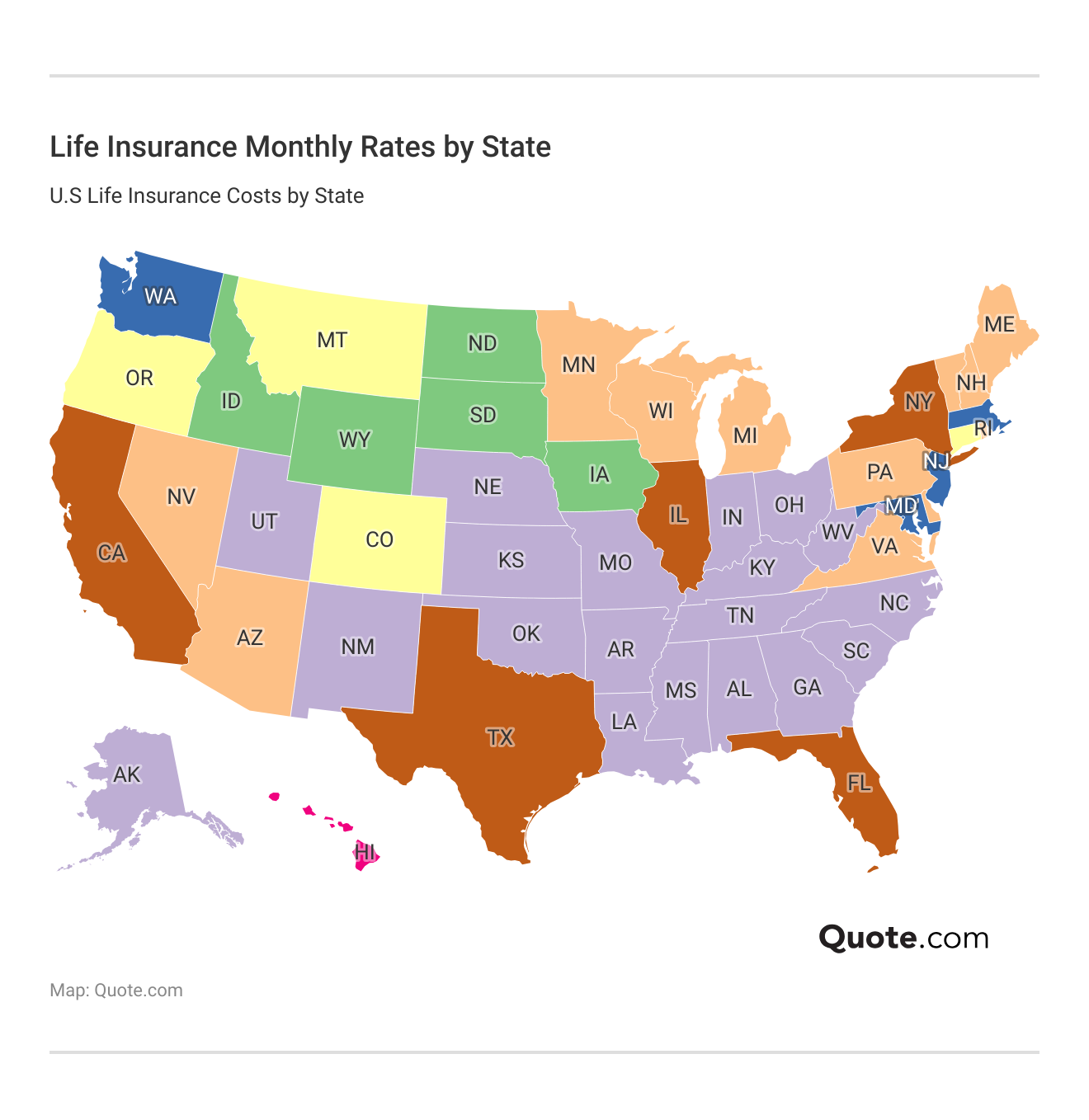

How Location Affects Life Insurance Rates

It may seem odd that location can also affect the cost of your life insurance. However, some states come with some higher risks to people’s health and lives.

Think violent crime, state health trends, wildfires, and more. Some states also just have higher costs of living in general, which can contribute to a higher cost of life insurance.

The most expensive states to buy life insurance policies in are Texas, California, New York, New Jersey, Illinois, and Florida.

However, if you live in more affordable states like Idaho or Wyoming, you may find that you can get cheaper life insurance quotes.

Read More: The Most Unhealthy City In America

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Getting the Right Life Insurance Coverage

To avoid spending more than you have to on a life insurance policy, it’s important to consider what essential expenses you would need covered by a life insurance policy.

For example, if you have children, you may want to make sure you have life insurance that will cover the cost of their education.

Determining Life Insurance Coverage Needs: Costs to Calculate| Expense | What to Consider |

|---|---|

| Final Expenses | Funeral, burial, medical bills, probate costs |

| Debt Repayment | Mortgage, student loans, car loans, credit cards |

| Income Replacement | Years of income needed to support dependents |

| Children’s Education | Tuition, books, living expenses |

| Spouse’s Retirement Fund | Contributions lost due to your passing |

| Emergency Fund Buffer | 6-12 months of living expenses |

| Existing Assets | Subtract savings, investments, existing life insurance |

| Employer Coverage | Check if employer life insurance is enough (1-2× salary) |

It is important to determine how much life insurance you need. First, make a list of the most essential expenses you need covered by a life insurance policy.

Then, you can start looking into what types of life insurance policies cover your needs. The average cost of life insurance is cheapest if you can get life insurance with a group plan through your employer.

Life Insurance Coverage Options: Key Details & Monthly Rates| Policy | How It Works | Premium |

|---|---|---|

| Term Life | Coverage lasts for a set period (typically 10 to 30 years); no cash value and low cost. | $35 |

| Whole Life | Lifetime coverage with fixed premiums and a guaranteed cash value component. | $350 |

| Universal Life | Lifetime coverage with flexible premiums and a cash value that grows at a set rate. | $270 |

| Variable Life | Lifetime coverage; cash value is invested in market subaccounts values may rise or fall. | $425 |

| Variable Universal Life | Combines flexible premiums with investment based cash value growth potential. | $375 |

| Group Life | Employer provided term policy; limited coverage, typically not portable. | $25 |

| Final Expense | Small permanent policy designed to cover funeral and burial costs. | $50 |

Term life and final expense insurance have the next lowest rates (Learn More: How to Get the Best Plan Possible for the Lowest Premium).

Permanent policies, like universal and whole life, cost more but offer more flexibility, including investments.

If you need multiple expenses covered, then you’ll likely need to purchase a more expensive policy.

However, those with fewer expenses can look into life insurance policies that only have coverage for specific needs, such as final expense life insurance coverage for funeral and burial costs.

How to Save Money on Life Insurance

Ensuring you don’t purchase a policy with unnecessary coverage can help you save on life insurance costs.

The last thing you want is to overpay for unnecessary coverage on a policy. Other ways to save on life insurance include:

- Buying Life Insurance Younger: Life insurance policies are cheaper the younger you buy them, so it may be prudent to shop for a life insurance policy a decade or two earlier than you think you’ll need it.

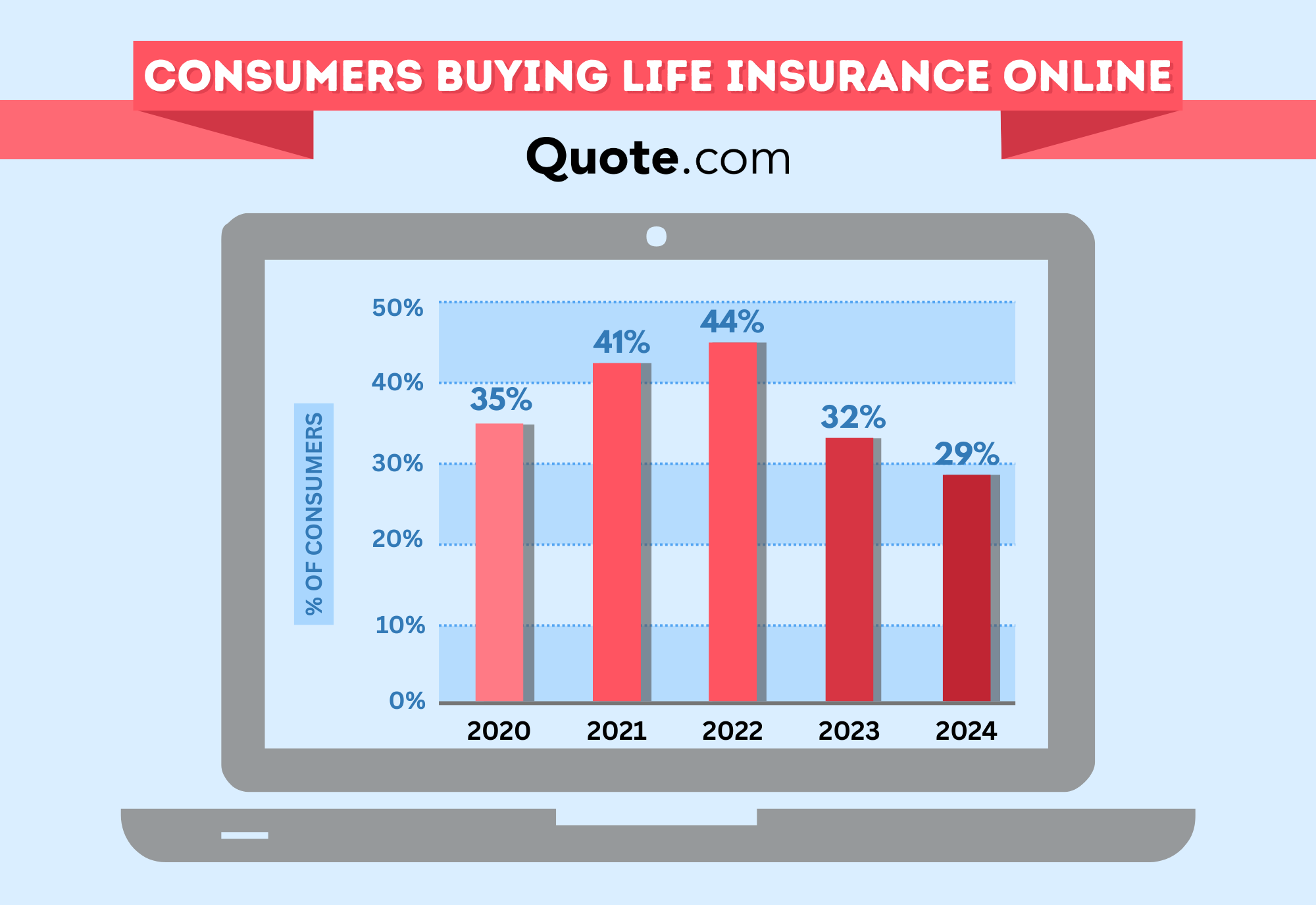

- Getting Online Quotes: Getting life insurance quotes online can help you find a cheaper company, and not enough potential customers take advantage of this.

- Improving Your Health: Customers with poor health pay more for life insurance, so improving your health before buying a policy can lower rates.

Shop among a few different life insurance companies with a life insurance cost calculator to see which offers the best deal on the policy you want.

Using insurance comparison websites is the easiest way to compare multiple providers at once. Less than 30% of life insurance shoppers compare and buy online, which means they miss out on valuable savings.

It is helpful to choose one or two affordable companies by online comparison shopping before committing to a life insurance policy.

To take advantage of online savings with life insurance, you can enter your ZIP code in our free tool. It will help you compare life insurance quotes from popular companies to see which has the best deal for your needs.

Frequently Asked Questions

How much is life insurance per month?

Term life insurance rates can start as low as $20 per month, while rates for a whole life insurance policy start at $160 per month. Of course, you will see variations in whole and term life insurance rates by age charts, as well as health conditions, so compare providers online before you buy.

How much does a $1,000,000 life insurance policy cost?

A million-dollar policy will be more expensive than a lower payout policy. A 20-year term life insurance policy that pays out a $500,000 benefit starts at $30 per month, so you can expect a million-dollar policy to be double that (Read More: Cheapest Million-Dollar Life Insurance Policies).

Is $40 a month a lot for life insurance?

No, $40 a month is not a lot for life insurance. Whole life policies are generally over $100 a month, although you may be able to get cheaper rates if you are buying a term life insurance policy.

Do you pay taxes on life insurance?

Wondering is inherited money taxable? The average life insurance policy payout is usually not taxable, but it is important to check the fine print of a policy to be sure (Learn More: The Ultimate Insurance Cheat Sheet).

What’s better, whole or term life insurance?

Both have their pros and cons. Term life insurance is cheaper and best suited for those seeking temporary coverage, such as until their dependents are older. Whole life insurance is more expensive, but lasts the duration of a customer’s life.

Can you have multiple life insurance policies?

Yes, you may have more than one life insurance policy. Shop for life insurance coverage today with our free tool.

Who is the most trustworthy life insurance company?

One of the best life insurance companies, offering affordable rates and great customer service, is State Farm.

Does life insurance go through probate?

Life insurance does not go through probate if there are no issues with the named beneficiaries on a policy.

Can the IRS take life insurance from a beneficiary?

Generally, the IRS can’t take life insurance death benefits from a beneficiary if the policyholder owed taxes.

Is life insurance a good investment?

Yes, life insurance is a good investment for most people, especially if there is a tax-deferred cash or investment component to a policy (Read More: One Quote That Convinced Me to Get Life Insurance).

How much is life insurance for a 55-year-old?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.