Best Life Insurance for Young Adults in 2026 (Just $10/mo!)

Fidelity Life, State Farm, and Nationwide have the best life insurance for young adults, with term policies starting at just $10 per month. Banner Life provides some of the lowest rates for 20- to 30-year term coverage, while Mutual of Omaha stands out for its quick, 24-hour approval process through accelerated underwriting.

Read more Secured with SHA-256 Encryption

Compare Quotes From Top Companies and Save

Life insurance policies starting at less than $1/day

Table of Contents

Table of Contents

Insurance Copywriter

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, AllWom...

Rachel Bodine

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated October 2025

Fidelity Life, State Farm, and Nationwide offer the best life insurance for young adults. Fidelity Life skips medical exams for qualified applicants through its RAPIDecision Program.

- Fidelity Life gives instant approval with no medical exam needed

- State Farm has term life insurance for young adults at $10 a month

- No exam underwriting up to $1M is common using EHR Rx MVR data

State Farm gives young adults many reliable options to choose from, between term plans and permanent policies, backed by its A++ A.M. Best financial strength rating.

Nationwide offers the best life insurance for young adults with kids. Its policies provide cash indemnity “living benefit” features through its Living Access Benefits suite.

Top 10 Companies: Best Life Insurance for Young Adults| Company | Rank | Claims Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 768 / 1,000 | A- | No Medical Exam | |

| #2 | 699 / 1,000 | A++ | Financial Stability | |

| #3 | 666 / 1,000 | A+ | Multi-Policy Savings | |

| #4 | 659 / 1,000 | A+ | Digital Simplicity | |

| #5 | 644 / 1,000 | A+ | Family Focused |

| #6 | 626 / 1,000 | A+ | Custom Options |

| #7 | 570 / 1,000 | A+ | Low Premiums |

| #8 | 565 / 1,000 | A | Discount Availability |

| #9 | 560 / 1,000 | A+ | Online Quotes | |

| #10 | 560 / 1,000 | A | Cash-Value Policy |

The best life insurance companies offer the lowest rates to applicants shopping for coverage before they turn 40 because young adults have fewer health risks.

See how much you could save on life insurance for young couples by entering your ZIP code into our free quote comparison tool.

Get Affordable Life Insurance for Young Adults

Term coverage is the cheapest life insurance for young people since it only lasts for a set period, like 20 years. Premiums start at $10 per month for $250,000 coverage.

Whole or permanent life lasts for your lifetime, builds cash value, and keeps level payments, but premiums run higher to fund investments and savings.

Young Adult Life Insurance Monthly Rates by Policy Type| Insurance Company | 20-Year Term | Whole Life |

|---|---|---|

| $14 | $126 |

| $11 | $119 |

| $16 | $135 | |

| $18 | $149 |

| $12 | $123 |

| $15 | $132 | |

| $13 | $128 | |

| $17 | $141 | |

| $19 | $145 |

| $10 | $115 |

Compared to term policies, whole life insurance costs hundreds more per month. Costs show 20-year terms with State Farm start at $10 per month, while whole life is $115 monthly.

Permanent life insurance premiums can reach as high as $149 a month with John Hancock, reflecting the provider’s focus on high policy limits and financial planning.

When deciding between whole and term life insurance, term policies are the most popular. Choose a term if you only need coverage to last as long as a mortgage or college loan.

The best whole life insurance for young adults offers lifetime protection with level premiums and predictable cash value growth.

How Age Impacts Life Insurance Rates

Buying life insurance young locks in cheaper monthly rates before age pushes premiums higher, and underwriting gets stricter.

Term life insurance for young adults stays cheap if you buy before you turn 30, and the best life insurance for someone in their 30s stays affordable.

Fidelity Life costs $16 to $19 per month. At 18, State Farm is $10 per month, and the same coverage at 24 is $13 per month.

Young Adult Life Insurance Monthly Rates by Age| Company | Age: 18 | Age: 20 | Age: 22 | Age: 24 |

|---|---|---|---|---|

| $14 | $15 | $16 | $17 |

| $11 | $12 | $13 | $14 |

| $16 | $17 | $18 | $19 | |

| $18 | $19 | $20 | $21 |

| $12 | $13 | $14 | $15 |

| $15 | $16 | $17 | $18 | |

| $13 | $14 | $15 | $16 | |

| $17 | $18 | $19 | $20 | |

| $19 | $20 | $21 | $22 |

| $10 | $11 | $12 | $13 |

Lock coverage early to keep monthly premiums low and to protect insurability before health changes make approval harder.

Midrange options include American Family from $14 a month at 18 to $17 monthly at 24, and Nationwide $13–$16 monthly.

Tobacco Use Impacts Life Insurance Rates for Young Adults

Tobacco use pushes young adults into a smoker risk class, which raises whole life premiums sharply each month.

Even when you compare the best whole life insurance for 18-year-olds, smoking raises monthly costs.

The same holds for whole life insurance for 20-year-olds, where smoker rates are markedly higher.

Young Adult Whole Life Insurance Monthly Rates by Tobacco Use| Insurance Company | Non-Smoker | Smoker |

|---|---|---|

| $118 | $235 |

| $113 | $225 |

| $127 | $245 | |

| $139 | $260 |

| $123 | $240 |

| $116 | $230 | |

| $132 | $250 | |

| $141 | $255 | |

| $149 | $265 |

| $109 | $220 |

Fidelity Life moves from $127 per month to $245 per month when tobacco is involved, which is a steep jump.

Insurers verify nicotine through applications and cotinine tests, so vaping and nicotine replacement often still count as tobacco use.

Quitting and requesting reconsideration can lower premiums per month, and buying young while nicotine-free keeps lifetime costs down. Many carriers require at least 12 nicotine-free months and a clean test before non-smoker rates are considered.

Read More: Complete Guide to Health Insurance

How Health Impacts Life Insurance Premiums for Young People

Health still plays a huge part in determining life insurance rates at all ages, and those with no long-term conditions and a good medical history get the lowest rates.

Someone in good health could see premiums as low as $24 a month with State Farm, while coverage for heart conditions might reach up to $49 per month through Prudential.

Life Insurance Monthly Rates for Young Adults by Health Condition| Company | Cancer History | Diabetes | Heart Disease | Obesity |

|---|---|---|---|---|

| $39 | $28 | $43 | $34 |

| $36 | $25 | $40 | $31 |

| $41 | $30 | $45 | $36 | |

| $44 | $32 | $48 | $38 |

| $37 | $26 | $41 | $32 |

| $42 | $29 | $44 | $35 | |

| $38 | $27 | $42 | $33 | |

| $43 | $31 | $46 | $37 | |

| $45 | $33 | $49 | $39 |

| $35 | $24 | $39 | $30 |

Fidelity Life and Mutual of Omaha make things easy by keeping rates affordable and offering the best instant life insurance to get young adults covered.

Liberty Mutual and Nationwide also stand out with flexible $200,000 plans that fit comfortably into your budget and give you reliable coverage while you’re still young.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ways Young Adults Can Save on Life Insurance

Getting life insurance early means locking in cheaper rates now and building reliable protection that fits your lifestyle as things change.

Saving on life insurance as a young adult is all about finding smart ways to pay less while staying covered. Here are five easy ways to keep your insurance rates low.

- Term Life Coverage: Simple and affordable for 10–30 years, perfect if you just want basic protection right now.

- Group Life Insurance: Usually offered through work, it’s cheap and doesn’t require a medical exam.

- No-Exam Life Insurance: Quick approval for healthy people who want coverage fast without extra hassle.

- Convertible Term Policy: Start with low-cost term life and switch to permanent coverage later when your income grows.

- Bundled Life and Auto Policy: Combine both with one company and save up to 15% on your total costs.

Getting the best life insurance for young adults is a lot easier when you know how to save with the right life insurance discounts, especially by bundling.

For example, bundling your life insurance with your auto policy can help you reduce both premiums and save more every month.

State Farm and Nationwide give bundling discounts when you add life coverage to your auto. The break usually shows up on the auto bill, so young adult can save since their total monthly spend can drop.

Most companies reward things like good health, active lifestyles, or family history with savings between 5% and 20%, depending on how well you qualify.

Top Life Insurance Discounts for Young Adults| Company | Bundling | Family History | Good Health | Healthy Lifestyle |

|---|---|---|---|---|

| 5% | 5% | 10% | 7% |

| 5% | 10% | 12% | 7% |

| 4% | 8% | 10% | 6% | |

| 7% | 5% | 20% | 7% |

| 5% | 8% | 12% | 6% |

| 5% | 7% | 10% | 10% | |

| 8% | 5% | 14% | 7% | |

| 10% | 10% | 11% | 7% | |

| 7% | 20% | 14% | 7% |

| 6% | 15% | 12% | 10% |

Fidelity Life and Liberty Mutual also reward good health, offering around 10% off for young adults who take care of themselves. State Farm and Prudential go even higher, offering discounts of up to 20% for those with strong family health histories and healthy daily habits.

Find out how to get life insurance quotes quickly and compare trusted companies that make protecting your future simple and affordable.

Top 10 Best Life Insurance for Young Adults

Finding the best life insurance for young people is really about getting coverage that fits your life and budget without the stress.

These top companies make it easy for young adults to find affordable plans, flexible options, and the kind of protection that actually makes sense for where you are right now.

#1 – Fidelity Life: Top Overall Pick

Pros

- Super Quick Coverage: Fidelity Life makes it easy for young adults to get insured fast through its RapidDecision program, sometimes in just one day.

- Skip the Doctor Visits: Young adults who are healthy can qualify for coverage without having to take a medical exam (Read More: The Millennial’s Guide to Health Insurance).

- Plenty of Term Choices: You can choose from 10-, 20-, or 30-year term plans, so young adults can find one that fits their lifestyle and budget.

Cons

- Whole Life Is Pricier: Whole life plans can feel a little expensive for young adults who are just getting their finances in order.

- Website Feels Dated: The best online life insurance tools could be smoother for young adults who prefer doing everything on their phone or laptop.

#2 – State Farm: Best for Financial Stability

Pros

- Top-Rated for Stability: State Farm’s A++ rating from A.M. Best gives young adults confidence that their policy will always be backed by solid financial strength.

- Low-Cost Term Rates: Term life plans start at around $10 a month for $200,000 in coverage. Compare more quotes in our State Farm review.

- Helpful Local Agents: Young adults who like talking to a real person can work with over 19,000 agents across the country.

Cons

- Less Online-Friendly: You can’t finish everything online, which might bug young adults who prefer a quick, digital experience.

- Fewer Add-Ons: Not every plan has flexible rider options that could help young adults cover things like student loans or extra expenses.

#3 – Nationwide: Best for Multi-Policy Savings

Pros

- Bundle Multiple Policies: Nationwide offers 8% off life insurance and additional auto or home insurance discounts when bundling policies. Learn how in our Nationwide review.

- Access While You’re Alive: Young adults can use part of their policy early if they’re seriously ill, thanks to Living Access Benefits.

- Plenty of Policy Options: Offers both term and whole life plans ranging from $200,000 to $500,000, which fit most young adults’ budgets and goals.

Cons

- Slightly Higher Costs: Some young adults may pay a little more per month compared to the cheapest options out there.

- Takes Time to Process: Applications can move more slowly for young adults hoping for same-day approval.

#4 – Mutual of Omaha: Best for Digital Simplicity

Pros

- Personal Help Online: Young adults often appreciate how supportive Mutual of Omaha’s customer service is, especially if it’s their first policy.

- Cash Value Growth: Whole life plans let young adults grow savings over time. Find easy coverage in our Mutual of Omaha life insurance review.

- Early Access Benefit: The Accelerated Death Benefit helps young adults use part of their policy if they face a serious health condition.

Cons

- Fewer Term Choices: The term options are more limited, which might not fit every young adult’s coverage needs.

- Medical Exam May Be Needed: Approval can take longer for young adults since some plans still require health checks.

#5 – John Hancock: Best for Family Focused

Pros

- High Coverage Options: Whole life policies can go above $500,000, great for young adults thinking long-term finances. Learn how a life insurance annuity adds value.

- Earn Rewards for Staying Active: John Hancock’s Vitality program gives young adults perks like Amazon gift cards and discounts for living a healthy lifestyle.

- App That Tracks Progress: The Vitality app helps young adults stay on track with fitness goals while saving money on premiums.

Cons

- Premiums Can Go Up: If young adults don’t keep up with their health goals, they could miss out on the best discounts.

- Lots of Plans to Sort Through: With so many choices, it might take young adults a little time to figure out what fits best.

#6 – Prudential: Best for Custom Options

Pros

- Plenty of Coverage Flexibility: You can pick anywhere from $200,000 to over $1 million in protection. Learn more in our Prudential Insurance review.

- Helps Build Real Value: Prudential gives young adults room to grow their money with investment-style life insurance.

- Trusted and Established: With an A+ A.M. Best rating, Prudential has a long history of keeping promises, which gives young adults extra peace of mind.

Cons

- Can Be Pricey: Monthly premiums for young adults tend to be higher than average, especially for policies tied to investments.

- Lots of Fine Print: The policy options can get confusing for young adults who want something simple and easy to manage.

#7 – Banner Life: Best for Low Premiums

Pros

- Low Rates That Last: Banner Life keeps things budget-friendly for young adults, with term life plans starting around $11 a month.

- Long-Term Options: You can choose from 10 to 40 years of coverage, which gives young adults more flexibility. Check out the types of life insurance that best suit young adults.

- Transparent Pricing: Banner Life explains how health and lifestyle affect premiums, making it easier for young adults to understand what they’re paying for.

Cons

- Few Permanent Options: Since Banner focuses mainly on term policies, young adults don’t get as many lifelong coverage choices.

- Takes a Bit Longer to Approve: Medical exams and underwriting can delay approval for young adults who need coverage right away.

#8 – American Family: Best for Discount Availability

Pros

- Bundle and Save: Young adults can save up to 10% when combining life insurance with car or home policies. Get more details in our American Family insurance review.

- Flexible Policy Options: American Family has term, whole, and universal plans that fit young adults juggling goals like buying a home or raising kids.

- Affordable Rates: With prices starting near $14 a month, young adults can get coverage that protects their growing responsibilities without stretching their budget.

Cons

- Not in Every State: Coverage options vary, so young adults who relocate might need to adjust or reapply.

- Old-School Website: The online tools could use an upgrade for young adults who want to manage everything on their phone.

#9 – Progressive: Best for Online Quotes

Pros

- Fast Online Quotes: Get instant life insurance quotes on Progressive’s website or read our Progressive insurance review to compare plans.

- Partnered Coverage Options: Since Progressive works with companies like Fidelity Life and Protective, young adults get access to reliable insurers all in one place.

- Customizable Policies: You can find plans between $100K and $1 million and tweak terms or add riders to fit your life goals.

Cons

- Third-Party Process: Claims and service usually go through partner companies, which might be confusing for young adults who prefer one direct contact.

- Doesn’t Underwrite Its Own Policies: Progressive works as a middleman, so young adults don’t get that same “one-stop” experience other insurers provide.

#10 – Liberty Mutual: Best for Building Cash Value

Pros

- Great for Building Cash Value: Liberty Mutual’s whole life plans let young adults build savings while locking in stable rates for life.

- Easy Discounts: Young adults can bundle life insurance with auto or renters coverage and save anywhere from 5% to 12% overall.

- Trusted Company Name: Liberty Mutual has more than a century of experience and an A rating from A.M. Best. Get more in details in our Liberty Mutual review.

Cons

- Higher Starting Premiums: Rates can start higher than some smaller competitors, which might not suit young adults on tight budgets.

- Less Flexibility: Liberty Mutual’s life insurance plans don’t have as many customization options as newer online-focused companies.

Choosing Life Insurance for Young Adults

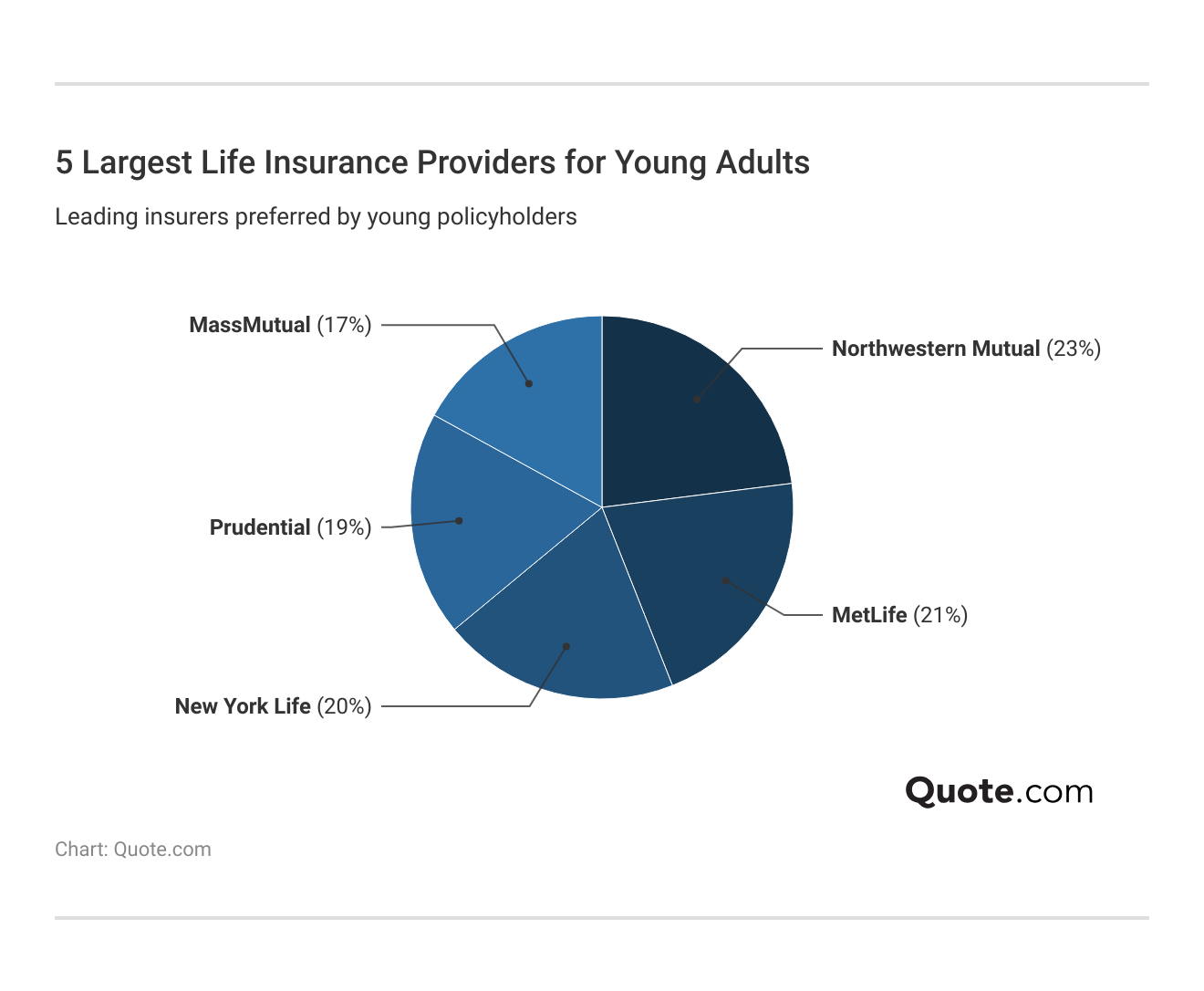

Northwestern Mutual takes the top spot with 23% of the market, followed by MetLife at 21%, New York Life at 20%, Prudential at 19%, and MassMutual at 17%.

Companies like Fidelity Life, State Farm, and Nationwide stand out for offering flexible term plans ranging from $200,000 to $500,ooo.

They also have living benefit add-ons and whole life options that grow cash value and savings over time.

Fidelity Life’s RapidDecision program offers quick approval with no medical exam for eligible applicants.

Getting life insurance young helps you save big and build value over time. For example, term plans usually cost less in your 20s.

Melanie Musson Published Insurance Expert

State Farm provides both term and whole coverage supported by an A++ (A.M. Best) financial strength rating.

Nationwide’s Living Access Benefits lets policyholders access part of their death benefit early if needed for serious illness or injury.

Get personalized life insurance quotes for young adults in minutes by entering your ZIP code into our comparison tool.

Frequently Asked Questions

Who has the best life insurance for young adults?

Fidelity Life, State Farm, and Nationwide have the best life insurance for young adults and young couples, with high claims satisfaction among beneficiaries.

Should a 25-year-old get life insurance?

Yes, because getting life insurance at 25 is very affordable, as rates are much lower at a younger age. The best life insurance for 25-year-olds is usually cheaper per month than comparable whole life coverage for older applicants. Learn why single premium life insurance fits 25-year-olds wanting simple protection.

Is it good to get life insurance in your 20s?

Yes, getting coverage in your 20s is smart because the best life insurance for 20-year-olds typically has the lowest monthly rates. Buying now locks in long-term affordability and secures coverage before health changes or major life events push costs higher.

Should a 27-year-old have life insurance?

A 27-year-old should consider getting coverage similar to the best life insurance for 25-year-old options if they have dependents, debt, or financial goals to protect. Monthly term rates often start around $15 to $20 for $200,000 in coverage.

What is the 3-year rule for life insurance?

The three-year rule generally means that if the insured transfers ownership of a policy and dies within three years, the policy’s payout may still be taxed as part of their estate. This IRS rule mainly applies to estate planning situations, not typical policyholders.

What happens if I outlive my life insurance?

If someone outlives their term life insurance, the coverage ends, and no payout is given. However, some insurers offer renewal or conversion options, allowing the policyholder to extend coverage or switch to a permanent life insurance plan at higher monthly rates.

How much a month is a $500,000 whole life insurance policy?

A $500,000 whole life insurance policy usually costs between $300 and $500 per month for a healthy young adult. Prices vary based on age, gender, and health, but whole life plans stay fixed.

Can I borrow money from my life insurance?

Yes, borrowing is possible only from a whole or universal life insurance policy, not term life. Policyholders can borrow against the cash value that builds over time, typically at interest rates between 5% and 8%, without affecting the death benefit unless the loan remains unpaid.

At what age does life insurance not make sense?

Life insurance may not make sense after age 70 or 75 if there are no dependents or outstanding debts. At this stage, monthly premiums can become very expensive, and the financial need for coverage is often reduced.

What are the tax implications of life insurance?

Life insurance payouts are generally tax-free to beneficiaries. However, if a policy is part of a taxable estate or surrendered for cash, some of the gains may be subject to income or estate taxes under IRS rules. Understand tax breaks using the ultimate insurance cheat sheet.

What are the downsides of whole life insurance?

What is Ladder Life Insurance?

What is the 7-year rule for life insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.