Auto Insurance Rates by State in 2026

Auto insurance rates by state change based on weather, crime, traffic, and more. Florida has the highest average car insurance rates by state at $115 a month, due to hurricane risks and fraud. Hawaii has the lowest rates, with minimum coverage at $36 monthly. Auto insurance rates are also based on driving history.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Karen Condor is an insurance and finance writer who has degrees in both journalism and communications. She began her career as a reporter covering local and state affairs. Her extensive experience includes management positions in newspapers, magazines, newsletters, and online marketing content. She has utilized her research, writing, and communications talents in the areas of human resources, f...

Karen Condor

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated January 2026

Auto insurance rates by state are affected by local factors like weather, crime, and traffic, which can drastically increase coverage costs in some states.

- Florida has the most expensive auto insurance rates on average

- Louisiana, Colorado, and New York are also expensive states

- Cheaper states often have less traffic, crashes, and claims

If you recently moved to a new state, you may be surprised by the wide price differences. Our guide goes over the average cost of auto insurance you can expect to pay in different states, as well as the factors that affect your prices.

If you want to jump into finding affordable companies in your state, use our free quote tool. It will quickly help you find the best auto insurance providers in your area.

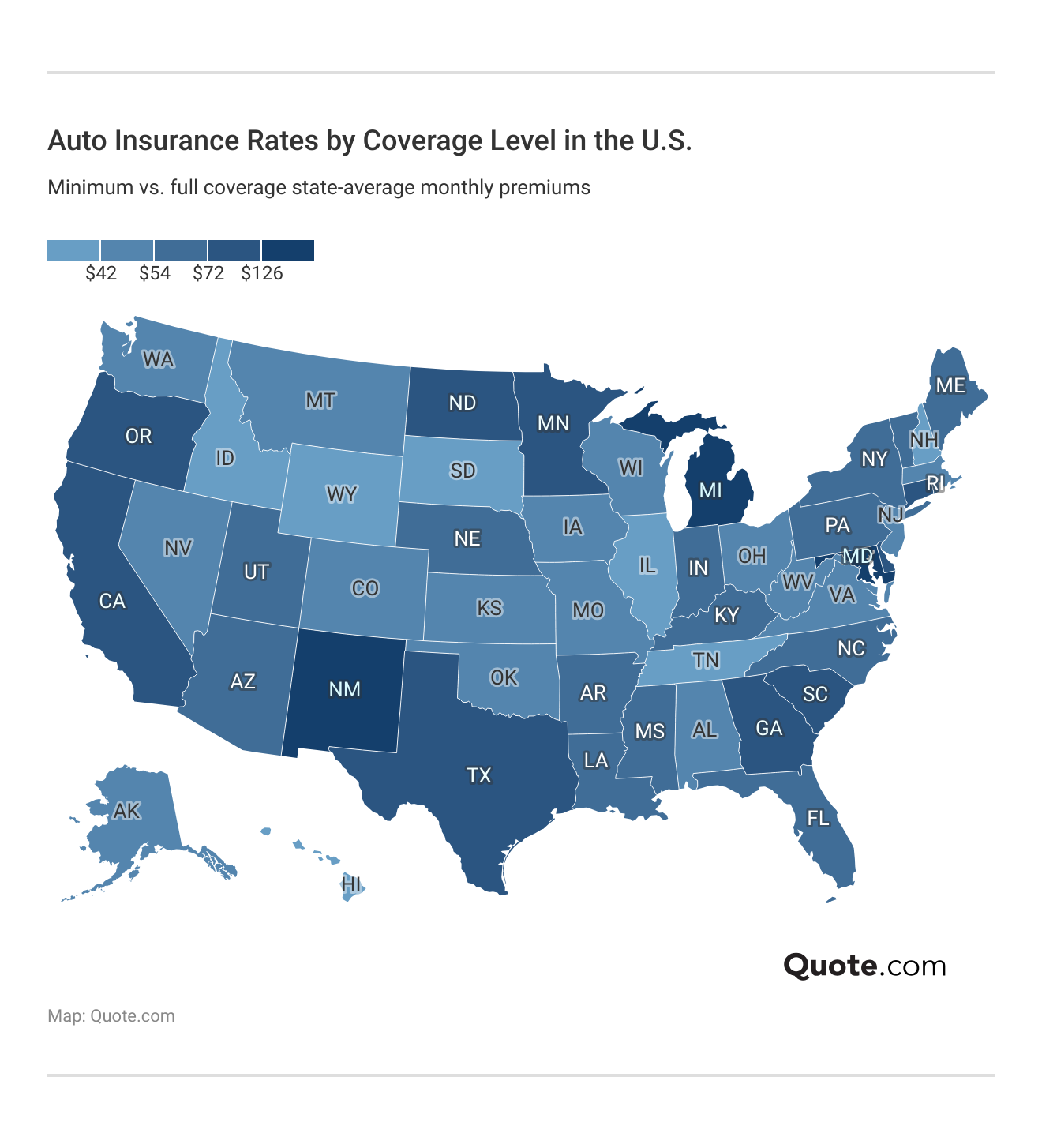

Comparing State Auto Insurance Rates

Where you live has a huge impact on what you’ll pay for car insurance coverage. Auto insurance requirements by state, weather risks, and living costs vary.

When you look at the most expensive car insurance by state, for example, a minimum coverage policy in Florida costs drivers an average of $115 a month. If you live in Hawaii, though, that same policy costs an average of $36 per month.

While it can be more challenging to find affordable auto insurance in expensive states, it is very important to carry the necessary coverage to protect yourself on the road.

Auto insurance is not only required in the majority of states, but it also protects you from financial losses in the event of an accident.

Full coverage is often the best choice for most drivers, as it includes collision and comprehensive insurance.

Collision insurance covers accidents with other vehicles and stationary objects, while comprehensive covers collisions with animals, vandalism, weather damage, and more.

Most Expensive States for Auto Insurance

Florida is the most expensive state for auto insurance on average. The two biggest reasons for the high car insurance rates in Florida are hurricanes and fraud (Learn More: 10 Best Auto Insurance Companies in Florida).

Fraud drives up the cost of all auto insurance coverages for customers, and hurricanes will drive up the cost of comprehensive insurance.

10 States With the Most Expensive Auto Insurance| State | Rank | Rate/mo | Reason |

|---|---|---|---|

| Florida | #1 | $115 | High hurricane, fraud risk |

| Louisiana | #2 | $115 | Frequent claims, litigation |

| Colorado | #3 | $97 | Hail damage, rising repairs |

| New York | #4 | $94 | Dense traffic, theft |

| California | #5 | $85 | Accident, repair costs |

| Michigan | #6 | $84 | Expensive no-fault system |

| Nevada | #7 | $83 | Urban congestion, theft risk |

| Texas | #8 | $83 | Storms, high claim rates |

| Oklahoma | #9 | $80 | Severe weather, crash rates |

| New Jersey | #10 | $78 | Dense driving, lawsuits |

Some of the other top 10 states with the highest car insurance costs include Louisiana, Colorado, New York, and California. Each state has unique risks that contribute to the higher cost of auto insurance.

For example, New York has higher rates due to heavy traffic and theft, while Colorado has higher rates partly due to weather like hail damage. Some common factors you’ll see among the most expensive states include storms, fraud, and higher crash rates.

Cheapest States for Auto Insurance

In contrast to the most expensive states for auto insurance, the cheapest auto insurance states have fewer risks, which lowers the likelihood of claims.

The top 10 states with the lowest car insurance rates have milder weather, less traffic, and fewer annual accidents. Living in a state with cheaper average rates will make it easier to find affordable auto insurance for your car.

10 States With the Cheapest Auto Insurance| State | Rank | Rate/mo | Reason |

|---|---|---|---|

| Hawaii | #1 | $36 | Low accidents, strict insurance laws |

| Arkansas | #2 | $38 | Rural driving, low repair costs |

| Maine | #3 | $45 | Few claims, many insurers |

| Ohio | #4 | $45 | Safe drivers, low repair costs |

| Vermont | #5 | $45 | Sparse traffic, low population |

| New Hampshire | #6 | $48 | No-fault laws, few collisions |

| North Carolina | #7 | $50 | Regulated rates, low premiums |

| Idaho | #8 | $52 | Low traffic, few claims |

| Iowa | #9 | $52 | Low thefts, rare claims |

| Wisconsin | #10 | $52 | Mild weather, safe drivers |

Arkansas is one of the most affordable places when comparing the lowest car insurance rates by state, with minimum auto insurance averaging $38 per month (Read More: 10 Best Auto Insurance Companies in Arkansas).

This is because Arkansas has mostly rural roads, which reduces the risk of traffic accidents, and it has lower vehicle repair costs. Hawaii, Maine, and Ohio also have cheap coverage on average.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Car Insurance Rates are Calculated

Whether you are looking at Allstate or Geico car insurance rates by state, your location is just one of several factors that influence what you’ll pay for an auto insurance policy.

When you apply for car insurance, providers will also consider personal factors like your gender, driving record, credit score, and more. Each of these factors is used to calculate the risk you pose to an auto insurance company.

Top 5 Factors Affecting Auto Insurance Premiums| Factor | Rank | Reason |

|---|---|---|

| Driving Record | #1 | Accidents signal higher risk |

| Age & Experience | #2 | Younger drivers seen as riskier |

| Location | #3 | High-crime areas cost more to insure |

| Credit Score | #4 | Low credit suggests higher claim risk |

| Coverage Type | #5 | Broader coverage increases cost |

If you are deemed to be a higher-risk driver, you’ll have higher rates because insurance companies see you as more likely to file a claim.

Insurance companies in every state consider drivers with multiple claims, accidents, speeding tickets, or DUIs as high-risk. Drivers with points on their license have the most expensive car insurance by state.

On the other hand, if you are a low-risk driver, you’ll find it easier to get cheaper auto insurance rates as you present little risk of filing a claim (Read More: Best Auto Insurance for Good Drivers).

Read on for a more detailed explanation of the factors that affect your auto insurance rates, from your driving record to your credit score.

Driving History & State Auto Insurance Rates

Your past driving record is one of the first things insurance companies consider when setting rates for your policy. A poor driving history indicates that a driver is more likely to commit another driving offense or file a claim.

At auto insurance companies across the country, a past accident, ticket, or DUI on a driving record will usually raise monthly rates.

State-Average Auto Insurance Monthly Rates by Driving Record| State | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Alabama | $55 | $73 | $85 | $63 |

| Alaska | $38 | $73 | $85 | $63 |

| Arizona | $73 | $86 | $100 | $74 |

| Arkansas | $70 | $81 | $95 | $70 |

| California | $85 | $104 | $122 | $90 |

| Colorado | $97 | $74 | $87 | $64 |

| Connecticut | $63 | $126 | $148 | $109 |

| Delaware | $59 | $139 | $163 | $120 |

| Florida | $115 | $93 | $109 | $80 |

| Georgia | $78 | $104 | $122 | $90 |

| Hawaii | $36 | $54 | $63 | $46 |

| Idaho | $52 | $44 | $51 | $38 |

| Illinois | $64 | $83 | $97 | $71 |

| Indiana | $57 | $71 | $83 | $61 |

| Iowa | $52 | $38 | $44 | $33 |

| Kansas | $73 | $62 | $73 | $54 |

| Kentucky | $77 | $93 | $109 | $80 |

| Louisiana | $115 | $78 | $92 | $68 |

| Maine | $45 | $74 | $87 | $64 |

| Maryland | $67 | $183 | $214 | $158 |

| Massachusetts | $63 | $81 | $95 | $70 |

| Michigan | $84 | $236 | $277 | $204 |

| Minnesota | $67 | $131 | $153 | $113 |

| Mississippi | $71 | $77 | $90 | $66 |

| Missouri | $70 | $80 | $94 | $69 |

| Montana | $66 | $61 | $71 | $53 |

| Nebraska | $67 | $57 | $66 | $49 |

| Nevada | $83 | $88 | $104 | $76 |

| New Hampshire | $48 | $73 | $85 | $63 |

| New Jersey | $78 | $183 | $214 | $158 |

| New Mexico | $62 | $81 | $95 | $70 |

| New York | $94 | $131 | $153 | $113 |

| North Carolina | $50 | $80 | $94 | $69 |

| North Dakota | $55 | $71 | $83 | $61 |

| Ohio | $45 | $64 | $75 | $55 |

| Oklahoma | $80 | $75 | $88 | $65 |

| Oregon | $61 | $109 | $128 | $94 |

| Pennsylvania | $63 | $87 | $102 | $75 |

| Rhode Island | $71 | $88 | $104 | $76 |

| South Carolina | $68 | $115 | $134 | $99 |

| South Dakota | $56 | $29 | $34 | $25 |

| Tennessee | $66 | $54 | $63 | $46 |

| Texas | $83 | $112 | $131 | $96 |

| Utah | $63 | $96 | $112 | $83 |

| Vermont | $45 | $62 | $73 | $54 |

| Virginia | $59 | $81 | $95 | $70 |

| Washington | $63 | $65 | $77 | $56 |

| West Virginia | $55 | $75 | $88 | $65 |

| Wisconsin | $52 | $68 | $80 | $59 |

| Wyoming | $58 | $35 | $41 | $30 |

| U.S. Average | $65 | $91 | $112 | $76 |

For example, in Alabama, drivers with a clean driving record will pay an average of $55 per month for minimum coverage. But if drivers have a DUI, the cost of minimum coverage rises to an average of $85 per month (Read More: Cheap Auto Insurance After a DUI).

How much your auto insurance will increase depends partly on your auto insurance provider. Some providers may offer accident forgiveness for a driver’s first at-fault accident, or charge less for a ticket than other companies.

Filing Auto Insurance Claims Raises Rates

If you live in an area that has a high number of claims filed each year, your auto insurance rates may be more expensive, even if you yourself haven’t filed a claim.

For example, the most expensive state on average for auto insurance, Florida, had 1.6 million auto insurance claims filed, with an average claim cost of $1,024,000 (Learn More: 10 Worst States for Filing Auto Insurance Claims).

Annual Accidents & Insurance Claims by State| State | Accidents | Traffic Deaths | Claims | Claim Cost |

|---|---|---|---|---|

| Alabama | 520K | 10,196 | 168K | $53,760 |

| Alaska | 60K | 8,219 | 28K | $13,160 |

| Arizona | 730K | 10,000 | 280K | $106,400 |

| Arkansas | 350K | 11,667 | 125K | $45,000 |

| California | 3.5M | 8,861 | 1.9M | $1,026,000 |

| Colorado | 480K | 8,276 | 360K | $270,000 |

| Connecticut | 290K | 8,056 | 140K | $67,200 |

| Delaware | 150K | 15,152 | 65K | $27,950 |

| Florida | 2.5M | 11,521 | 1.6M | $1,024,000 |

| Georgia | 850K | 7,944 | 790K | $734,700 |

| Hawaii | 120K | 8,571 | 65K | $35,100 |

| Idaho | 230K | 12,105 | 110K | $52,800 |

| Illinois | 950K | 7,540 | 800K | $672,000 |

| Indiana | 690K | 10,147 | 520K | $390,000 |

| Iowa | 300K | 9,375 | 200K | $134,000 |

| Kansas | 310K | 10,690 | 200K | $130,000 |

| Kentucky | 440K | 9,778 | 420K | $403,200 |

| Louisiana | 450K | 9,783 | 420K | $390,600 |

| Maine | 160K | 11,429 | 85K | $45,050 |

| Maryland | 490K | 8,033 | 430K | $378,400 |

| Massachusetts | 680K | 9,855 | 470K | $324,300 |

| Michigan | 830K | 8,300 | 710K | $610,600 |

| Minnesota | 640K | 11,228 | 380K | $224,200 |

| Mississippi | 340K | 11,333 | 230K | $156,400 |

| Missouri | 670K | 10,807 | 540K | $437,400 |

| Montana | 120K | 10,909 | 90K | $67,500 |

| Nebraska | 160K | 8,000 | 130K | $105,300 |

| Nevada | 270K | 8,438 | 260K | $249,600 |

| New Hampshire | 140K | 10,000 | 110K | $86,900 |

| New Jersey | 800K | 8,989 | 720K | $648,000 |

| New Mexico | 200K | 9,524 | 170K | $144,500 |

| New York | 1.1M | 5,641 | 1.1M | $1,100,000 |

| North Carolina | 840K | 7,851 | 850K | $858,500 |

| North Dakota | 90K | 11,539 | 60K | $40,200 |

| Ohio | 900K | 7,692 | 820K | $746,200 |

| Oklahoma | 380K | 9,500 | 350K | $322,000 |

| Oregon | 340K | 7,907 | 330K | $320,100 |

| Pennsylvania | 1.0M | 7,752 | 880K | $774,400 |

| Rhode Island | 120K | 10,909 | 85K | $60,350 |

| South Carolina | 520K | 10,000 | 510K | $499,800 |

| South Dakota | 90K | 10,000 | 70K | $54,600 |

| Tennessee | 700K | 10,000 | 700K | $700,000 |

| Texas | 3.2M | 10,848 | 2.4M | $1,800,000 |

| Utah | 240K | 7,273 | 220K | $202,400 |

| Vermont | 80K | 12,308 | 50K | $31,500 |

| Virginia | 780K | 9,070 | 620K | $496,000 |

| Washington | 750K | 9,615 | 510K | $346,800 |

| West Virginia | 150K | 8,333 | 120K | $96,000 |

| Wisconsin | 650K | 11,017 | 450K | $310,500 |

| Wyoming | 90K | 15,517 | 50K | $28,000 |

Hawaii, on the other hand, had 65,000 claims filed, with the average claim cost only being $35,100. The huge discrepancy between the two states in the number of claims and claim costs is part of the reason Hawaii is so much cheaper for auto insurance policies.

Likewise, drivers with fewer claims on their driving record will pay less for auto insurance than drivers with multiple claims, regardless of the state they live in. One of the most common types of claims that may be on a driver’s record is a collision claim.

Most Common Auto Insurance Claims in the U.S.| Coverage Type | Share | Cost Per Claim | Description |

|---|---|---|---|

| Collision | 30% | $4.5K | Vehicle impact |

| Property Damage | 25% | $4.2K | Others’ property |

| Comprehensive | 15% | $2.5K | Theft, weather, fire |

| Bodily Injury | 12% | $20K | Injuries to others |

| Personal Injury | 8% | $8K | Medical, passengers |

| Uninsured Motorist | 6% | $15K | Uninsured driver hit |

| Medical Payments | 3% | $2.5K | Medical, any fault |

| Other Types | 1% | $1K | Rental, roadside |

Collision claims account for 30% of all auto insurance claims, and the average cost of a collision claim is $4,500. Property damage and comprehensive claims are the two next most common claims.

The most expensive type of claim, however, is an auto insurance claim for bodily injury, which costs insurance companies an average of $20,000. If you have an expensive claim history, you will probably pay more for coverage than someone with a small, inexpensive claim on their record.

Read More: How to File an Auto Insurance Claim & Win

Credit Score & State Car Insurance Rates

If you have a great credit score, you likely already have lower auto insurance rates. Insurance companies look at customers’ credit scores to determine reliability.

Customers with poor credit scores are more likely to miss payments, resulting in auto insurance cancellation, than customers with high credit scores.

State-Average Auto Insurance Monthly Rates by Credit Score| State | Excellent (800+) | Good (670–799) | Fair (580–669) | Poor (<580) |

|---|---|---|---|---|

| Alabama | $55 | $66 | $87 | $122 |

| Alaska | $38 | $45 | $59 | $83 |

| Arizona | $73 | $86 | $112 | $156 |

| Arkansas | $70 | $82 | $106 | $147 |

| California | $85 | $99 | $129 | $179 |

| Colorado | $97 | $114 | $149 | $204 |

| Connecticut | $63 | $74 | $97 | $135 |

| Delaware | $59 | $69 | $92 | $129 |

| Florida | $115 | $136 | $178 | $243 |

| Georgia | $78 | $92 | $121 | $166 |

| Hawaii | $36 | $42 | $56 | $78 |

| Idaho | $52 | $61 | $80 | $109 |

| Illinois | $64 | $75 | $100 | $142 |

| Indiana | $57 | $67 | $89 | $125 |

| Iowa | $52 | $61 | $82 | $113 |

| Kansas | $73 | $86 | $113 | $157 |

| Kentucky | $77 | $89 | $117 | $165 |

| Louisiana | $115 | $133 | $174 | $244 |

| Maine | $45 | $53 | $68 | $95 |

| Maryland | $67 | $78 | $103 | $144 |

| Massachusetts | $63 | $74 | $97 | $136 |

| Michigan | $84 | $99 | $130 | $183 |

| Minnesota | $67 | $78 | $102 | $143 |

| Mississippi | $71 | $83 | $108 | $151 |

| Missouri | $70 | $82 | $106 | $150 |

| Montana | $66 | $77 | $100 | $142 |

| Nebraska | $67 | $78 | $103 | $144 |

| Nevada | $83 | $97 | $126 | $177 |

| New Hampshire | $48 | $56 | $73 | $103 |

| New Jersey | $78 | $91 | $119 | $168 |

| New Mexico | $62 | $73 | $96 | $136 |

| New York | $94 | $111 | $144 | $199 |

| North Carolina | $50 | $58 | $76 | $108 |

| North Dakota | $55 | $65 | $85 | $119 |

| Ohio | $45 | $53 | $69 | $96 |

| Oklahoma | $80 | $94 | $125 | $176 |

| Oregon | $61 | $71 | $95 | $136 |

| Pennsylvania | $63 | $74 | $97 | $138 |

| Rhode Island | $71 | $83 | $108 | $152 |

| South Carolina | $68 | $79 | $104 | $145 |

| South Dakota | $56 | $66 | $86 | $121 |

| Tennessee | $66 | $78 | $101 | $142 |

| Texas | $83 | $96 | $127 | $177 |

| Utah | $63 | $73 | $97 | $136 |

| Vermont | $45 | $52 | $69 | $96 |

| Virginia | $59 | $69 | $92 | $131 |

| Washington | $63 | $74 | $98 | $137 |

| West Virginia | $55 | $65 | $86 | $120 |

| Wisconsin | $52 | $61 | $81 | $114 |

| Wyoming | $58 | $68 | $90 | $125 |

| U.S. Average | $65 | $75 | $100 | $140 |

For example, in California, a driver with an excellent credit score pays an average of $85 per month. A driver with a poor credit score, however, pays an average of $179 per month. That’s a $94 difference per month.

Because a credit score is such an important factor in the cost you pay for auto insurance coverage, improving your credit score can help make coverage more affordable (Read More: Hacks to Save Money on Auto Insurance).

Choice of Coverage Impacts Car Insurance Costs

The amount of coverage you choose directly affects your auto insurance premiums. Most states require, at a minimum, bodily injury and property damage liability insurance.

Some states may also require drivers to pay for uninsured or underinsured motorist insurance and some type of medical coverage (MedPay or PIP), which may raise the average cost of car insurance by state.

Types of Auto Insurance Coverage| Policy Type | What it Covers | Scenario |

|---|---|---|

| Collision | Damage to your vehicle | You hit a pole |

| Comprehensive | Theft or non-crash damage | Storm damages your car |

| Gap Insurance | Loan balance after total loss | Car totaled, loan remains |

| Liability | Damage or injuries you cause | You hit another car |

| Medical Payments | Medical costs for passengers | Passenger needs ER care |

| Personal Injury Protection | Medical bills and lost income | You’re injured in a crash |

| Rental Reimbursement | Rental car while repairing | You need a rental car |

| Rideshare Coverage | Accidents during rideshare use | Waiting for a ride request |

| Roadside Assistance | Towing or roadside help | Car won’t start on roadside |

| Underinsured Motorist | Costs beyond other limits | Other policy limits too low |

| Uninsured Motorist | Injuries from uninsured drivers | Uninsured driver hits you |

If you have a lease on your vehicle, then you will also be required by your lender to carry collision and comprehensive insurance.

Beyond that, it is up to you whether you want to purchase additional types of auto insurance coverage for your vehicle.

Older vehicles that are fully paid off and depreciated in value may just need a minimum coverage policy.

Dani Best Licensed Insurance Producer

Because each optional coverage you add onto your policy will increase your monthly premium, make sure to familiarize yourself with the different types of auto insurance and consider if they are necessary for your vehicle.

For example, you may want to pay more to add on roadside assistance if you have an older vehicle that frequently breaks down.

Other Demographic Factors That Impact Car Insurance Costs

Your gender may also play a small role in the cost of auto insurance. Some insurance companies will charge male drivers more, for example, if male drivers are shown to have filed more claims with the company.

Not all states allow auto insurance companies to use gender as a basis for rate determination, but even in the states that do, the cost differences are usually slight.

State-Average Annual Auto Insurance Premiums by Gender| State | Female | Male | Difference |

|---|---|---|---|

| Alabama | $600 | $600 | $0 |

| Alaska | $612 | $600 | $12 |

| Arizona | $696 | $708 | $12 |

| Arkansas | $672 | $672 | $0 |

| California | $864 | $864 | $0 |

| Colorado | $624 | $612 | $12 |

| Connecticut | $1,044 | $1,044 | $0 |

| Delaware | $1,152 | $1,152 | $0 |

| Florida | $768 | $768 | $0 |

| Georgia | $852 | $864 | $12 |

| Hawaii | $444 | $444 | $0 |

| Idaho | $372 | $360 | $12 |

| Illinois | $696 | $684 | $12 |

| Indiana | $588 | $588 | $0 |

| Iowa | $312 | $312 | $0 |

| Kansas | $516 | $516 | $0 |

| Kentucky | $768 | $768 | $0 |

| Louisiana | $636 | $648 | $12 |

| Maine | $540 | $612 | $72 |

| Maryland | $1,524 | $1,512 | $12 |

| Massachusetts | $672 | $672 | $0 |

| Michigan | $1,968 | $1,956 | $12 |

| Minnesota | $1,080 | $1,080 | $0 |

| Mississippi | $636 | $636 | $0 |

| Missouri | $660 | $660 | $0 |

| Montana | $504 | $504 | $0 |

| Nebraska | $468 | $468 | $0 |

| Nevada | $732 | $732 | $0 |

| New Hampshire | $588 | $600 | $12 |

| New Jersey | $1,524 | $1,512 | $12 |

| New Mexico | $600 | $672 | $72 |

| New York | $1,104 | $1,080 | $24 |

| North Carolina | $672 | $660 | $12 |

| North Dakota | $576 | $588 | $12 |

| Ohio | $516 | $528 | $12 |

| Oklahoma | $612 | $624 | $12 |

| Oregon | $912 | $900 | $12 |

| Pennsylvania | $720 | $720 | $0 |

| Rhode Island | $732 | $732 | $0 |

| South Carolina | $948 | $948 | $0 |

| South Dakota | $240 | $240 | $0 |

| Tennessee | $480 | $444 | $36 |

| Texas | $900 | $924 | $24 |

| Utah | $792 | $792 | $0 |

| Vermont | $504 | $516 | $12 |

| Virginia | $672 | $672 | $0 |

| Washington | $540 | $540 | $0 |

| West Virginia | $636 | $624 | $12 |

| Wisconsin | $540 | $564 | $24 |

| Wyoming | $288 | $288 | $0 |

| U.S. Average | $744 | $732 | $12 |

For example, in Alaska, the average cost difference between male and female drivers is only $12 a year. That means female drivers only pay an average of $1 more per month than male drivers (Read More: Best Auto Insurance Companies in Alaska).

Maine has one of the largest price differences between male and female drivers, with male drivers paying an average of $72 per year. This amounts to an extra $6 per month for male drivers.

How to Get Lower Auto Insurance Rates

Whether you live in one of the most expensive states or one of the cheapest states for auto insurance, make sure to look into auto insurance discounts to maximize your savings potential.

Most auto insurance companies offer discounts in three different categories: vehicle discounts, driver discounts, and personal discounts.

Most Common Auto Insurance Discounts| Vehicle Discounts | Driver Discounts | Personal Discounts |

|---|---|---|

| Active Disabling Device | Claim Free | Emergency Deployment |

| Adaptive Cruise Control | Continuous Coverage | Family Legacy |

| Adaptive Headlights | Defensive Driver | Family Plan |

| Anti-Lock Brakes | Driver's Education | Federal Employee |

| Audible Alarm | Driving Device/App | Further Education |

| Automatic Braking | Early Signing | Good Student |

| Blind Spot Warning | Full Payment | Homeowner |

| Daytime Running Lights | Good Credit | Life Insurance |

| Economy Vehicle | Loyalty | Married |

| Electronic Stability Control | Multiple Policies | Membership/Group |

| Farm/Ranch Vehicle | Multiple Vehicles | Military |

| Forward Collision Warning | New Customer/New Plan | New Address |

| Garaging/Storing | Occasional Operator | New Graduate |

| Green/Hybrid Vehicle | Online Shopper | Non-Smoker/Non-Drinker |

| Lane Departure Warning | On-Time Payments | Occupation |

| Newer Vehicle | Paperless/Auto Billing | Recent Retirees |

| Passive Restraint | Paperless Documents | Stable Residence |

| Utility Vehicle | Roadside Assistance | Student Away |

| Vehicle Recovery | Safe Driver | Student or Alumni |

| VIN Etching | Seat Belt Use | Volunteer |

If you are struggling to afford your car insurance, taking advantage of all the discounts at your provider may help lower costs (Read More: 17 Car Insurance Discounts You Can’t Miss).

Some discounts may be automatically applied to your insurance policy, such as vehicle safety discounts, while others you may need to apply for.

For example, driving device and app discounts require customers to sign up for the company’s program and demonstrate safe driving skills before a discount is issued.

These discounts can be well worth a driver’s time, though, as savings can be as high as 40% at some companies (Learn More: The Definitive Guide to Usage-Based Auto Insurance).

Top Usage-Based Auto Insurance (UBI) Programs| Company | Program | Savings | System |

|---|---|---|---|

| Drivewise® | 40% | Mobile App | |

| KnowYourDrive | 20% | Mobile App |

| TrueRide® | 30% | Mobile App | |

| YourTurn® | 30% | Mobile App |

| RightTrack® | 30% | Plug-in Device |

| SmartRide® | 40% | Mobile App or Plug-in | |

| Snapshot® | 30% | Mobile App | |

| Drive Safe & Save™ | 30% | Mobile App or Plug-in | |

| TrueLane® | 25% | Mobile App |

| IntelliDrive® | 30% | Mobile App |

Just make sure to read the fine print of a company’s driving app program, as some companies may increase rates if drivers score poorly for unsafe driving behaviors like speeding or hard braking.

Shopping around at different auto insurance providers can also help you save on insurance in your state. Enter your ZIP in our free quote tool to get started on finding the cheapest auto insurance rates by state.

Frequently Asked Questions

Which state has the highest car insurance rates?

Florida has the highest auto rates when looking at auto insurance premiums by state, with minimum coverage averaging $115 per month.

What states have the lowest auto insurance rates?

Hawaii, Arkansas, and Maine are the three cheapest states for auto insurance when you compare vehicle insurance rates by state. Hawaii’s minimum coverage averages $36 per month.

What is a tort state?

A tort state is one in which the at-fault driver is responsible for the accident costs of other parties, such as vehicle repairs and medical bills (Learn More: At-Fault Accident: What it Means & How it Affects Insurance Rates).

Is $200 a month expensive for car insurance?

Whether $200 a month is expensive for car insurance depends on several factors. It is pricey for a minimum coverage rate, but this could be a normal minimum coverage rate if a driver has a poor driving record, has an expensive car, or lives in a high-risk area.

The best way to find out if your rate of $200 a month is a normal rate or not is to get several auto insurance quotes and compare them. You can enter your ZIP in our free tool to get started.

Which U.S. state does not require car insurance?

New Hampshire does not require drivers to carry auto insurance, but drivers must provide proof that they can financially cover accidents.

How much auto insurance coverage should I have?

You should always have the minimum auto insurance required by your state. If you have a leased vehicle, you will need to carry full coverage auto insurance. Even if you aren’t required to carry full coverage, most drivers should have this coverage, as it provides the best financial protection.

What factors affect car insurance rates?

Factors that affect car insurance rates by state include age, gender, driving record, location, credit score, and coverage choices.

Can my credit score affect my car insurance?

Yes, your credit score does affect your car insurance rates. The U.S. average rate for a driver with an excellent credit score is $65 per month, but a driver with a poor credit score has an average rate of $140 per month.

How much liability insurance should I carry on my car?

You should carry at least the minimum liability auto insurance required in your state. If your state’s requirements are low, then you may want to raise your liability insurance rates.

Is there really a way to get cheaper auto insurance?

Yes, most drivers can secure cheaper auto insurance by shopping around for quotes. Enter your ZIP code to get free quotes now. Drivers can also work on improving their driving record or credit score to lower rates.

Who is #1 in auto insurance by state?

Who is cheaper than State Farm?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.