10 Best Auto Insurance Companies in Delaware for 2026

The best auto insurance companies in Delaware are Erie, AAA, and State Farm. DE car insurance rates start at $56 a month, but the top companies offer discounts up to 30%. Drivers can also lower their auto insurance rates in Delaware with usage-based programs and vanishing deductibles.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Karen Condor is an insurance and finance writer who has degrees in both journalism and communications. She began her career as a reporter covering local and state affairs. Her extensive experience includes management positions in newspapers, magazines, newsletters, and online marketing content. She has utilized her research, writing, and communications talents in the areas of human resources, f...

Karen Condor

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated November 2025

Erie, AAA, and State Farm are the best auto insurance companies in Delaware for roadside support and substantial driver discounts.

- The best car insurance companies in Delaware reward safe drivers

- Erie offers up to 25% off for bundling multiple policies

- AAA stands out for affordability and 24/7 roadside assistance

Erie wins as the overall best car insurance company in Delaware for its Rate Lock program, which helps keep premiums steady even after filing a claim.

AAA offers reliable 24/7 roadside assistance and helpful travel perks for frequent drivers who have higher annual mileage.

Top 10 Companies: Best Auto Insurance in Delaware| Company | Rank | Claims Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 706 / 1,000 | A+ | Customer Service |

| #2 | 676 / 1,000 | A | Roadside Assistance |

| #3 | 673 / 1,000 | A++ | Local Agents | |

| #4 | 643 / 1,000 | A++ | Budget Rates | |

| #5 | 636 / 1,000 | A+ | Deductible Savings | |

| #6 | 636 / 1,000 | A | Safe Drivers | |

| #7 | 633 / 1,000 | A++ | Policy Choices | |

| #8 | 632 / 1,000 | A+ | Drivewise Program | |

| #9 | 632 / 1,000 | A | Add-Ons |

| #10 | 625 / 1,000 | A+ | High-Risk Drivers |

State Farm rewards safe drivers with 30% discounts through its Drive Safe & Save program, which can be stacked with 17% multi-policy discounts for even greater savings.

Start saving on Delaware auto insurance today by entering your ZIP code into our free quote comparison tool.

Auto Insurance Costs in Delaware

Minimum coverage in Delaware can be affordable if your record is clean. Rates range from $56 to $70 per monthly, depending on mileage.

Full coverage costs more in Delaware due to weather-related risks, which increase the number of comprehensive claims in the state.

Delaware Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $68 | $152 |

| $76 | $169 | |

| $62 | $139 |

| $69 | $154 | |

| $56 | $125 | |

| $71 | $158 |

| $63 | $141 | |

| $61 | $135 | |

| $60 | $134 | |

| $65 | $144 |

Geico, Erie, and State Farm have the cheapest car insurance in Delaware for both types of coverage.

To stretch your budget, consider raising deductibles only if the risk aligns with your comfort level. Moving from a $500 to a $1,000 deductible can trim collision and comprehensive by about 8% to 15%.

How Driving Record Affects Delaware Car Insurance

One at-fault accident can often increase premiums by about 35% for several renewals. A DUI can double rates as some carriers tighten eligibility for a period.

Geico and State Farm remain the most affordable providers for high-risk drivers, with Erie also offering competitive rates after an accident or speeding ticket.

Delaware Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $68 | $103 | $154 | $77 |

| $76 | $89 | $164 | $75 | |

| $62 | $94 | $142 | $70 |

| $69 | $119 | $149 | $85 | |

| $56 | $81 | $130 | $65 | |

| $71 | $120 | $196 | $86 |

| $63 | $105 | $168 | $76 | |

| $61 | $107 | $177 | $77 | |

| $60 | $87 | $140 | $78 | |

| $65 | $134 | $169 | $79 |

Loyalty, low mileage, and good payer discounts can trim Delaware high-risk auto insurance by up to 20%. A state-approved defensive driving course can also cut premiums by 10% for three years.

Maintain continuous coverage and consider low-mileage or pay-per-mile options to shave off an additional 10%.

How Credit History Influences DE Car Insurance

Delaware drivers with excellent credit pay about 25% less than drivers with lower credit scores.

With strong credit and a clean record, Geico often costs around $56 per month. If your score falls in the fair or poor range, premiums can increase by up to 40%.

Delaware Auto Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670–799) | Fair (580–669) | Poor (<580) |

|---|---|---|---|---|

| $68 | $75 | $92 | $129 |

| $76 | $84 | $103 | $145 | |

| $62 | $68 | $84 | $118 |

| $69 | $76 | $93 | $131 | |

| $56 | $62 | $76 | $106 | |

| $71 | $78 | $96 | $135 |

| $63 | $69 | $85 | $120 | |

| $61 | $67 | $83 | $116 | |

| $60 | $66 | $81 | $114 | |

| $65 | $72 | $88 | $123 |

If you pay your Delaware insurance bills on time, the good news is that scores can improve within six to twelve months if you trim balances and set autopay.

High credit scores, combined with a clean driving record, help keep auto insurance rates in Delaware low.

Read More: Best Auto Insurance for Good Drivers

How Age Impacts Car Insurance in Delaware

Getting minimum coverage in Delaware can feel pricey at first for teens, but costs drop as you accumulate miles and a clean driving record. At 18, you’ll probably pay about double what older drivers do in Delaware, since limited experience looks risky to insurers.

By your mid-twenties, prices typically fall by around 30% when steady, safe habits start to appear in your record.

Delaware Auto Insurance Monthly Rates by Age| Company | Age: 18 | Age: 25 | Age: 35 | Age: 45 |

|---|---|---|---|---|

| $198 | $110 | $92 | $68 |

| $234 | $133 | $118 | $76 | |

| $184 | $103 | $85 | $62 |

| $211 | $122 | $87 | $69 | |

| $166 | $85 | $78 | $56 | |

| $215 | $124 | $85 | $71 |

| $185 | $102 | $90 | $63 | |

| $205 | $89 | $86 | $61 | |

| $176 | $97 | $88 | $60 | |

| $216 | $116 | $74 | $65 |

Geico often ends up being the cheapest option, with minimum coverage costing around $56 per monthly for drivers who avoid tickets and claims.

Once you reach your 40s, insurance prices usually stay steady and are easier to manage. You can save another 10% to 20% by taking a defensive driving class or enrolling in a safe driver program.

Learn More: How to File an Auto Insurance Claim & Win

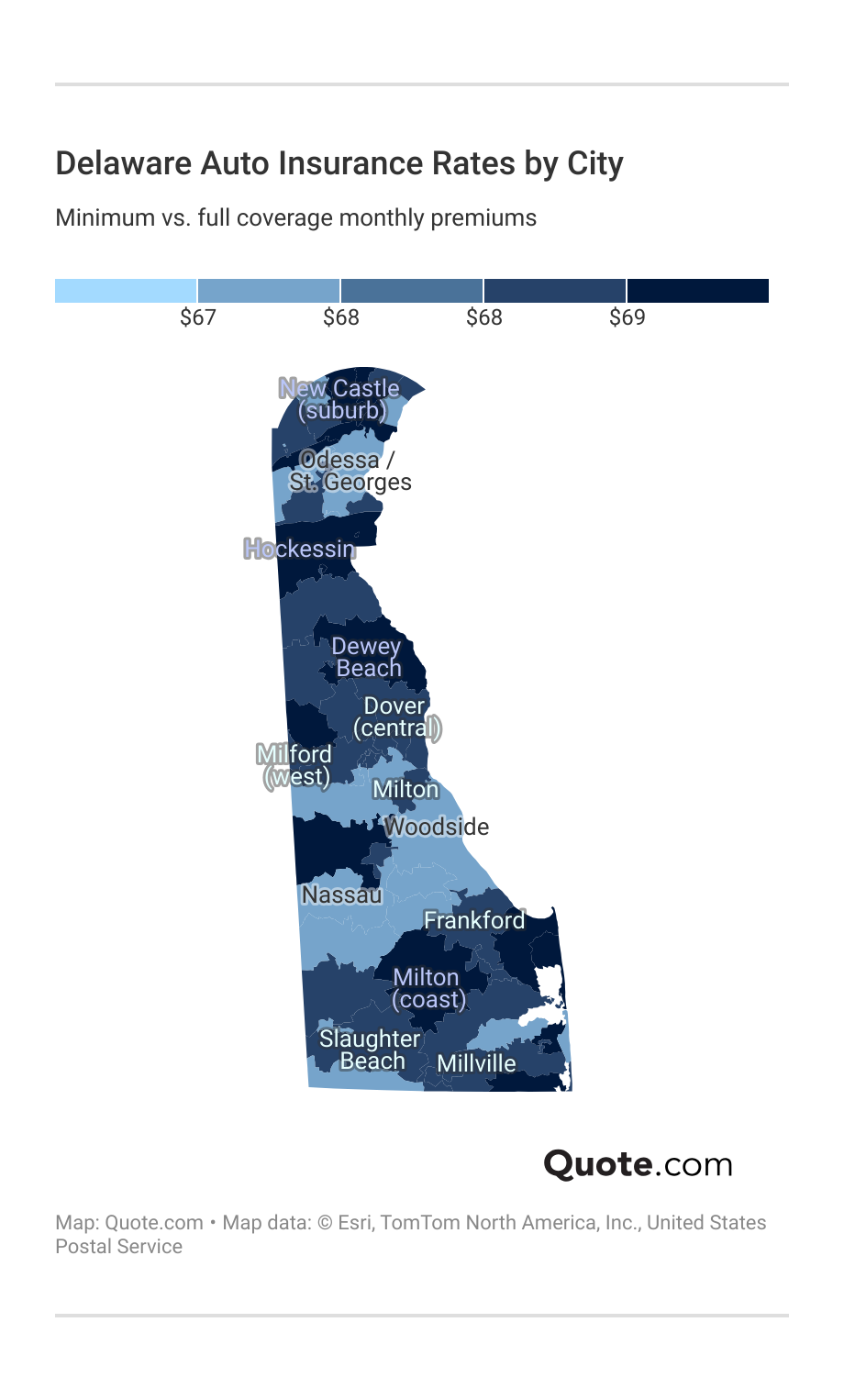

How Location Determines DE Auto Insurance Prices

Location plays a big role in what Delaware auto insurance companies charge each month.

Coastal towns like Milton or Dewey Beach typically cost more due to storm risks and higher repair expenses.

Inland areas, such as Woodside or Hockessin, tend to be cheaper since they experience fewer accidents and claims overall.

Hockessin, DE, stands out as one of the best spots for steady premiums thanks to safer roads and lower traffic.

Read More: Auto Insurance Rates by State

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Delaware Auto Insurance Requirements

Every driver in Delaware is required to have a basic level of car insurance to stay legal on the road.

These minimum coverage amounts help ensure that everyone involved in an accident has some financial protection.

- Bodily Injury Liability: $25,000 per person and $50,000 per accident to cover injuries to others.

- Property Damage Liability: $10,000 per accident for damage to someone else’s property.

- Personal Injury Protection (PIP): $15,000 per person and $30,000 per accident to help with medical costs and lost wages, no matter who’s at fault.

While this coverage meets Delaware’s legal minimum, many drivers choose to add more protection. Learn more in our guide to auto insurance requirements by state.

Extra coverage, like collision or uninsured motorist insurance, can give you peace of mind and help you avoid out-of-pocket costs after an accident.

Optional Delaware Auto Insurance Coverage

Different types of auto insurance in Delaware go beyond the state minimums to fully protect your vehicle.

Whether you drive long distances or stay local, the right coverage helps you handle accidents and repairs without major costs.

- Uninsured/Underinsured Motorist Coverage: Protects you if another driver causes an accident and doesn’t have enough insurance.

- Collision Coverage: Helps pay for repairs to your car after a crash with another vehicle or object.

- Comprehensive Coverage: Covers damage from non-collision events like theft, fire, vandalism, or natural disasters.

- Rental Reimbursement Coverage: Helps pay for a rental car while your vehicle is being repaired after a covered claim.

- Roadside Assistance: Offers towing, battery jump-starts, and other emergency help when your car breaks down.

Adding comprehensive coverage is especially important for Delaware drivers because the state faces frequent weather-related risks like coastal flooding, hailstorms, and hurricanes.

Comprehensive car insurance pays for damage caused by non-collision events, including floods, falling branches, and storm debris.

Without this coverage, you’d have to pay out of pocket for damages that can easily reach thousands of dollars.

Since Delaware’s unpredictable coastal weather can strike year-round, protect your vehicle from severe storms and natural disasters.

Ways to Save on Auto Insurance in Delaware

Drivers can still lower their insurance costs, even in high-risk states like Delaware. Safe driving habits and low mileage can go a long way to lower rates.

Here are a few effective ways you can get cheaper auto insurance rates in Delaware:

- Increase Your Deductible: Choosing a higher deductible can lower your monthly premium, though you’ll pay more out of pocket if you file a claim.

- Maintain Good Credit: A strong credit score can lead to lower insurance rates since many companies use it to assess risk.

- Reduce Your Mileage: Delaware drivers with fewer than 10,000 miles per year can qualify for pay-as-you-go car insurance and low-mileage discounts.

- Take Advantage of Discounts: Ask your insurer about available discounts, such as those for defensive driving courses, low annual mileage, or car safety features like anti-theft systems.

Saving on car insurance in Delaware is easier when you understand how your driving habits affect your rates.

Low-mileage drivers, carpoolers, and those who avoid late-night driving can all get cheaper rates by reducing their risk of claims.

List of Delaware Auto Insurance Discounts

If you are shopping for discounts in Delaware, here is a short list that matters. Liberty Mutual gives up to 35% off with anti-theft gear.

Nationwide and Allstate can hit 40% with usage-based driving apps that reward smooth habits.

Top Auto Insurance Discounts in Delaware| Company | Anti-Theft | Bundling | Multi-Vehicle | Usage-Based |

|---|---|---|---|---|

| 8% | 15% | 25% | 30% |

| 10% | 25% | 10% | 40% | |

| 15% | 25% | 10% | 30% |

| 10% | 20% | 12% | 30% | |

| 25% | 25% | 25% | 25% | |

| 35% | 25% | 25% | 30% |

| 5% | 20% | 15% | 40% | |

| 25% | 10% | 12% | $231/yr | |

| 15% | 17% | 20% | 30% | |

| 15% | 13% | 8% | 30% |

Geico offers steady value with 25% discounts on bundling, multi-vehicle, and usage-based options. Bundling home and auto insurance often results in savings of 15% to 25% on its own.

Find the best auto and home insurance bundles for Delaware families and enjoy combined savings with one easy monthly payment.

Mix tech rewards with loyalty and solid payment history to get the best auto insurance rates in Delaware.

For example, signing up for a telematics-based usage program can result in total savings of over 40%.

Delaware drivers can save with usage-based programs like SmartRide and DriveEasy, which reward safe, consistent driving.

Jeff Root Licensed Insurance Agent

Even if you don’t qualify for telematics or safe driving discounts, you can still save money on Delaware car insurance coverage.

Comparing quotes and discount offerings from multiple companies will ensure you don’t miss out on the biggest possible savings.

Top 10 Car Insurance Companies in Delaware

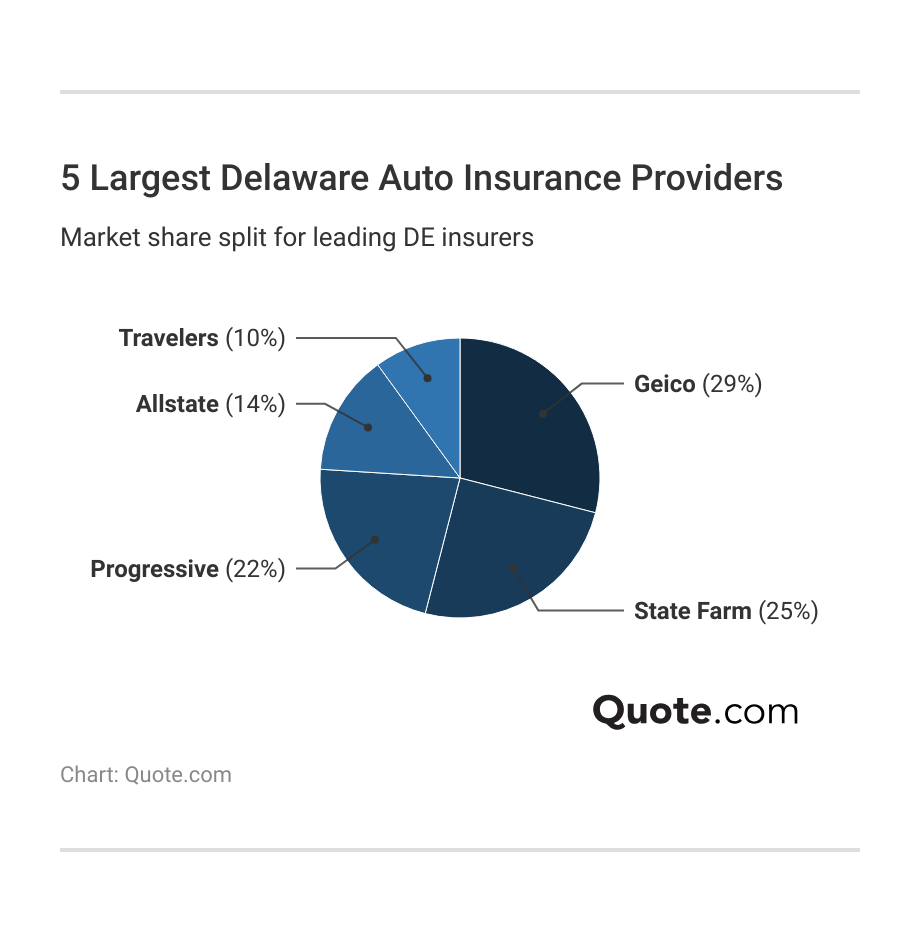

Geico, State Farm, and Progressive are the largest auto insurance companies in Delaware, with Geico leading by just four points over State Farm.

However, only State Farm made it into the top three Delaware auto insurance companies due to its high customer satisfaction ratings.

Progressive Insurance in Delaware has claims satisfaction ratings well below average, yet drivers still choose it for its Snapshot program, which rewards drivers for smooth braking and low mileage.

Allstate’s accident forgiveness softens first mistakes, and Travelers Insurance in Delaware uses IntelliDrive usage-based insurance to track safe driving. Read More: State Farm vs. Farmers, Geico, Progressive, & Allstate Auto Insurance

#1 – Erie: Best for Customer Service

Pros

- Steady Prices: Erie keeps Delaware drivers happy with rates that barely change, even after small claims or renewals. Check out our Erie insurance review.

- Rate Lock Advantage: The Rate Lock feature helps Delaware policyholders keep the same premium unless they make big coverage changes.

- Strong Reputation: With an A+ from A.M. Best, Erie gives Delaware drivers solid peace of mind and financial confidence.

Cons

- Limited Reach: Erie’s Delaware coverage area is smaller, so drivers outside bigger towns may have fewer local agent options.

- Older Online Tools: Some Delaware drivers say Erie’s website and app feel a little outdated compared to smoother, more modern options.

#2 – AAA: Best for Roadside Assistance

Pros

- 24/7 Help Anywhere: Delaware drivers love AAA for its fast roadside service, whether it’s a dead battery or a flat tire.

- Membership Perks: Delaware members can save 15% to 25% by bundling auto with home or renters insurance. Uncover insights in our AAA insurance review.

- Customer Loyalty: AAA keeps Delaware drivers coming back, with a renewal rate above 90% thanks to trusted service and travel extras.

Cons

- Annual Fee: Delaware drivers must pay an extra $60 to $120 each year to keep their AAA membership active.

- Higher Young Driver Rates: AAA’s Delaware rates for new or teen drivers can be 20% higher than competitors like Geico.

#3 – State Farm: Best for Local Agents

Pros

- Great Bundle Discounts: State Farm car insurance in Delaware offers drivers who combine home, renters, or life insurance up to 17% off.

- Drive Safe & Save: This program helps Delaware customers earn up to 30% off by driving smoothly and avoiding risky habits.

- Strong Local Presence: With agents across the state, Delaware drivers receive personal service and quick help with claims. Dive into our State Farm insurance review.

Cons

- Slow Online Claims: Some Delaware customers say State Farm’s online claim system feels slower compared to more digital-first insurers.

- Fewer Extra Perks: Delaware drivers looking for special add-ons like accident forgiveness may need to look elsewhere.

#4 – Geico: Best for Budget Rates

Pros

- Lowest Rates Around: Geico tops Delaware’s list for affordability, with minimum coverage starting at about $56 per month. Read more in our Geico insurance review.

- Tech-Friendly Savings: The DriveEasy app tracks driving habits and helps Delaware drivers earn up to 25% off for safe driving.

- Extra Protection Options: Delaware drivers can add mechanical breakdown coverage, perfect for keeping newer cars running longer.

Cons

- No Local Offices: Most Delaware Geico customers handle claims online or by phone, which may not suit everyone.

- Premium Bumps After Claims: Delaware drivers with an accident or ticket may see their rates rise by 15% to 25% at renewal.

#5 – Nationwide: Best for Deductible Savings

Pros

- SmartRide Discounts: Delaware drivers using Nationwide’s SmartRide app can save up to 40% on rates for safe driving.

- Bundle and Save: Delaware customers who combine auto, home, or pet insurance can save 20% or more. Additional information in our Nationwide insurance review.

- Accident Forgiveness: Nationwide keeps Delaware rates steady after your first at-fault accident, a big help for long-time customers.

Cons

- Higher Starting Rates: Delaware drivers pay slightly more upfront, with full coverage averaging around $141 monthly.

- App Issues: Some Delaware users report that SmartRide’s tracking can lag, occasionally missing trips or safe-driving data.

#6 – Farmers: Best for Safe Drivers

Pros

- Flexible Policy Options: Farmers gives Delaware drivers freedom to build policies around their needs, from classic cars to high-mileage vehicles.

- Signal App Savings: The Signal program tracks safe driving and can earn Delaware users up to 30% off their premiums. Get further details in our Farmers Insurance review.

- Solid Claim Support: Delaware drivers rate Farmers high for personalized claims help and fast follow-ups through local agents.

Cons

- Slightly Pricier Start: Farmers’ Delaware rates tend to start 5%–10% higher than more budget-focused companies like Geico.

- Limited Discounts: Compared to Nationwide or Liberty Mutual, Delaware customers get fewer automatic savings options without bundling.

#7 – Travelers: Best for Policy Choices

Pros

- Strong Safe Driver Rewards: Travelers’ IntelliDrive program gives Delaware drivers up to 30% off for smooth braking and consistent driving habits.

- Extensive Coverage Choices: Delaware customers can add new car replacement and gap coverage for newer vehicles. Find out more in our Travelers insurance review.

- Trusted History: With over 150 years in business, Travelers car insurance offers Delaware drivers confidence in long-term service and stability.

Cons

- Average App Performance: Some Delaware customers say the IntelliDrive app can lag during trip tracking or data syncing.

- Higher Base Costs: Travelers’ Delaware rates for minimum coverage often run 10% above more affordable providers.

#8 – Allstate: Best for Drivewise Program

Pros

- Drivewise Savings: Delaware drivers using Allstate’s Drivewise program can save up to 40% on costs with safe-driving data.

- Accident Forgiveness Perk: Allstate protects Delaware drivers from rate hikes after their first at-fault crash. Explore our review of Allstate insurance.

- Wide Agent Access: Delaware residents can easily contact local Allstate agents for policy updates and claims assistance.

Cons

- High Premiums for New Drivers: Younger policyholders in Delaware may see higher-than-average starting rates.

- Usage App Sensitivity: Drivewise in Delaware can penalize harsh braking or nighttime trips, reducing potential savings.

#9 – Liberty Mutual: Best for Add-Ons

Pros

- Big Anti-Theft Savings: Liberty Mutual offers Delaware drivers up to 35% off anti-theft systems —the highest statewide.

- Strong Bundling Incentives: Delaware customers can save 25% by bundling auto, home, renters, or motorcycle insurance.

- 24/7 Support: Delaware policyholders benefit from around-the-clock claims help and nationwide repair partnerships. Learn more in our Liberty Mutual insurance review.

Cons

- Premium Fluctuations: Liberty Mutual’s Delaware rates can shift more than 10% year to year based on market and claim trends.

- Limited Low-Mileage Options: Delaware drivers who drive fewer miles may not see additional savings without enrolling in a telematics program.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Getting the Best Auto Insurance in Delaware

Erie, AAA, and State Farm stand out as the best auto insurance companies in Delaware for stability, customer support, and real savings opportunities.

Erie’s Rate Lock helps keep your premium steady after a claim, unless you change your vehicle, driver, or garaging ZIP code.

AAA offers 24/7 roadside assistance with towing that can cover distances of 100 to 200 miles, depending on the membership tier, as well as travel perks.

State Farm pairs Drive Safe & Save with multi-policy discounts of 10% to 20% for families.

A certified defensive driving course in Delaware can cut your car insurance costs by about 10% for three years.

Melanie Musson Published Insurance Expert

Add a state-approved defensive driving credit worth about 10% for three years and a telematics or low mileage plan to push total savings past 40%. Learn more in our guide to the best defensive driving insurance discounts.

Compare the cheapest car insurance in Delaware by entering your ZIP code into our free quote comparison tool.

Frequently Asked Questions

Which company offers the best Delaware car insurance?

Erie is the best choice for Delaware drivers wanting stable pricing, thanks to its Rate Lock feature that prevents premium increases.

Which insurance company is the top choice for Delaware residents?

Geico is considered the top choice for Delaware residents due to its low monthly rates, strong digital tools, and wide availability across the state.

Which car insurance company in Delaware has the best reputation?

State Farm holds the best reputation in Delaware for dependable claims handling, strong financial stability, and personalized local agent support. Compare State Farm and Progressive auto insurance options in Delaware.

Does credit score affect car insurance rates in Delaware?

Yes, Delaware insurers use credit scores to assess risk, meaning higher scores often lower monthly premiums by up to 25%.

What car insurance companies in Delaware do not check credit score?

NJM is one of the few Delaware insurers that may offer policies without credit checks, unlike major carriers like Geico.

How do you increase your credit score by 100 points for better Delaware insurance rates?

Pay bills on time, keep credit usage under 30%, and avoid new accounts to improve scores and qualify for lower rates.

How do you get the best deal on car insurance in Delaware?

Compare multiple quotes, take defensive driving courses, and bundle policies to save up to 30% on Delaware auto insurance. Discover how to get multiple auto insurance quotes and bundle home and auto for big Delaware savings.

Is NJM better than State Farm car insurance in Delaware?

State Farm is better for Delaware drivers who want access to local agents and more coverage options, including rideshare coverage and telematics, which is not available with NJM.

Is NJM or Geico auto insurance cheaper in Delaware?

Geico is usually cheaper for Delaware drivers, offering lower monthly rates and savings through its DriveEasy telematics program. Get matched with the best auto insurance companies in Delaware by entering your ZIP code into our simple quote finder tool.

What are the disadvantages of Geico car insurance in Delaware?

Geico is the cheapest car insurance in Delaware, but it doesn’t use agents, which can be an issue if you ever need to file a claim. It’s part of the reason Geico’s claim satisfaction is lower than that of the best car insurance companies in Delaware.

Who is eligible for USAA car insurance in Delaware?

What is the 2/2/2 credit rule for Delaware drivers?

How quickly can I raise my credit score from 500 to 700 in Delaware?

What is the 15/3 credit card trick for improving Delaware insurance rates?

Is Costco car insurance available in Delaware?

Which Delaware insurance company denies the most claims?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.