Best Auto Insurance for Military and Veterans in 2026

USAA, Liberty Mutual, and Nationwide have the best auto insurance for military and veterans, with minimum rates starting at $32 per month. Other top insurance companies for veterans, like Geico and State Farm, stand out with 25% usage-based discounts, 20% safe-driver perks, and big multi-vehicle savings.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Content Creator

Lia Vergin develops both video and written content across all lines of insurance, with a primary focus on auto, home, and life coverage. She is dedicated to helping consumers better understand and navigate their insurance options. Driven by a passion for saving money and finding great deals, she is committed to creating clear, engaging, and practical content that empowers readers to make confident...

Lia Vergin

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated December 2025

If you need the best auto insurance for military and veterans, shop with Liberty Mutual, Nationwide, and USAA.

- Amica offers highly-rated claims support tailored to military needs

- Nationwide offers up to 40% off for military drivers who try UBI

- USAA cuts premiums by 60% for vehicles in storage while deployed

With exclusive membership and a military discount of up to 30%, USAA remains the most reliable option for military personnel and veterans.

Nationwide provides flexible multi-vehicle options that help families stay organized during frequent duty station moves and can deliver up to 40% in telematics savings.

Top 10 Companies: Best Auto Insurance for Military & Veterans| Company | Rank | Claims Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 741 / 1,000 | A++ | Military Members | |

| #2 | 730 / 1,000 | A | Flexible Policies |

| #3 | 729 / 1,000 | A+ | Bundling Discounts | |

| #4 | 720 / 1,000 | A | Roadside Assistance |

| #5 | 718 / 1,000 | A+ | Customer Service | |

| #6 | 716 / 1,000 | A++ | Safe Drivers | |

| #7 | 702 / 1,000 | A | Family Coverage |

| #8 | 697 / 1,000 | A++ | Affordable Rates | |

| #9 | 693 / 1,000 | A+ | Local Agents | |

| #10 | 690 / 1,000 | A | Accident Forgiveness |

Liberty Mutual offers customizable policies for military members with new cars, adding teen drivers,

Unlock savings on the best auto insurance for veterans and military by entering your ZIP code into our free quote comparison tool.

Comparing Auto Insurance Rates for Veterans

Monthly car insurance costs for military members and veterans are cheapest with USAA and Geico.

Look for minimum coverage if you want the lowest rates. USAA starts at $32 per month (Read More: Average Cost of Auto Insurance).

Military & Veteran Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $65 | $122 |

| $87 | $228 | |

| $62 | $166 |

| $66 | $215 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $47 | $123 | |

| $32 | $84 |

Liberty Mutual and Allstate have the highest rates, showing that choosing a military-focused insurer like USAA can save you $40 or more each month.

Military auto insurance rates will vary based on age and driving history. Active members will also see their rates change after relocation orders are processed. Compare multiple insurance companies for military veterans to find the right policy.

How Age Affects Military Car Insurance Rates

Military and veteran auto insurance changes with age, and drivers under 25 pay the highest rates.

At this age, choosing the right company can mean saving more each month for groceries or additional family activities.

Military & Veteran Auto Insurance Monthly Rates by Age| Company | Age: 18 | Age: 25 | Age: 35 | Age: 45 |

|---|---|---|---|---|

| $231 | $59 | $55 | $65 |

| $318 | $102 | $95 | $87 | |

| $253 | $78 | $73 | $62 |

| $291 | $81 | $76 | $66 | |

| $387 | $98 | $91 | $76 | |

| $153 | $50 | $46 | $43 | |

| $398 | $119 | $110 | $96 |

| $239 | $82 | $77 | $63 | |

| $178 | $60 | $56 | $47 | |

| $125 | $46 | $43 | $32 |

Rates drop by 40% or more by the time military members turn 45, and rates will stay low if you can maintain a clean driving record.

Find out how the best auto insurance for good drivers reduces military and veteran auto insurance costs for young drivers.

Younger military drivers pay more due to limited history. Specifically, early career service members see higher accident odds.

Jeff Root Licensed Insurance Agent

USAA auto insurance for veterans stands out as one of the best because its monthly rates are typically lower than those of competitors.

USAA charges $100 less a month for 18-year-olds and offers the lowest rates overall to older veterans and military personnel.

Many other insurers sharply cut rates between ages 18 and 25, then continue trimming prices as drivers mature and their records stabilize.

AAA military auto insurance drops by over $150 per month for older drivers, and Geico cuts monthly rates by $100 after veterans turn 25.

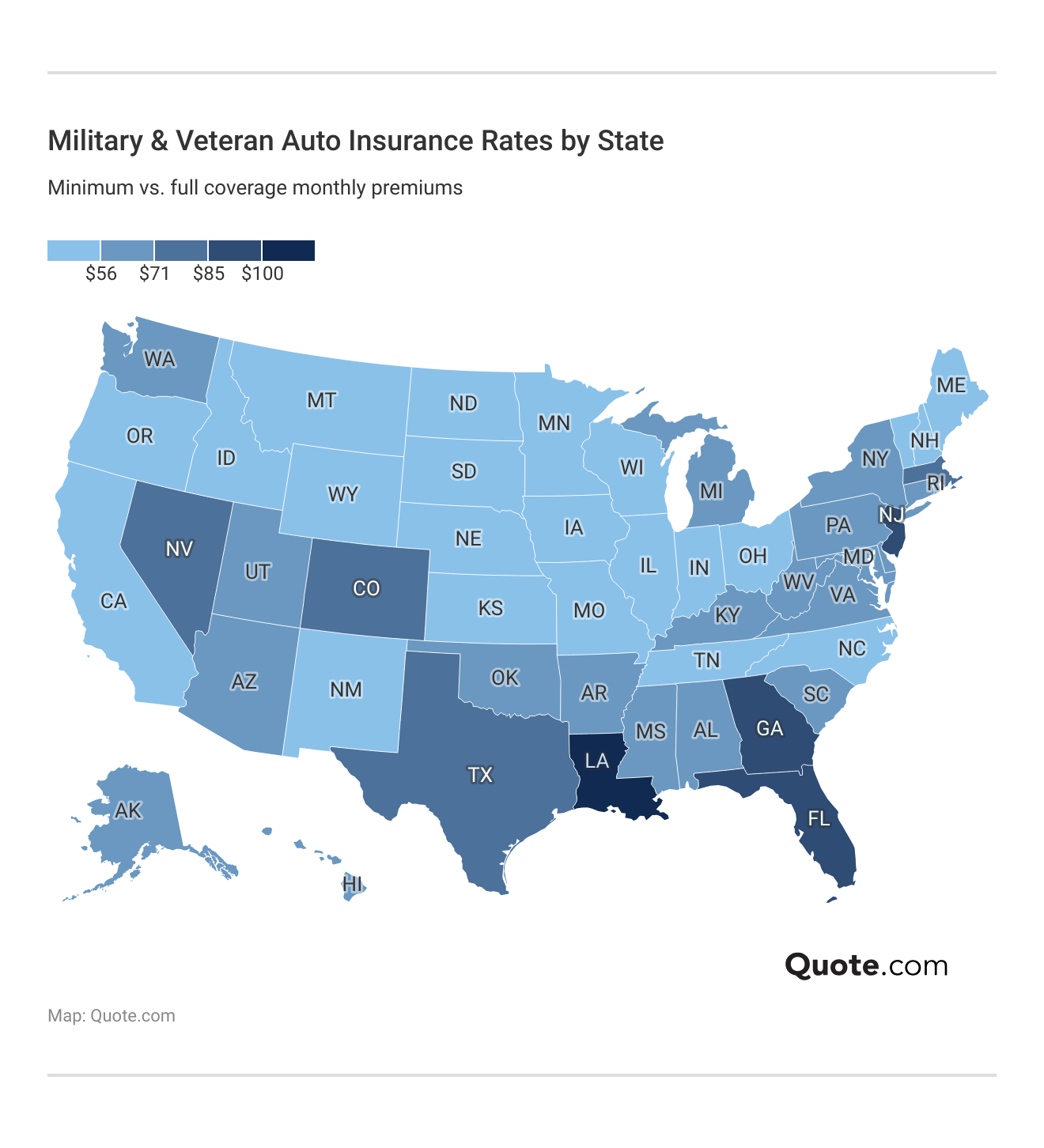

How Military Car Insurance Costs Vary Nationwide

Military drivers see their monthly insurance rates vary by state. Some states experience higher monthly premiums when adverse weather or heavy traffic increases accident rates.

States with lighter traffic and fewer claims typically have lower monthly costs, making it easier for military households to stay on top of expenses during frequent moves.

The best car insurance companies with national coverage, such as USAA and Geico, keep costs low by dispersing risk across all 50 states.

This also makes it easier for military personnel to keep coverage with the same company when they often relocate between states.

How Driving Record Affects Veterans’ Auto Insurance Rates

A clean record keeps military auto insurance rates predictable, though one accident can raise costs by more than 25% with some providers.

A DUI creates the biggest jump since insurers treat alcohol-related incidents as a sign of ongoing risk. That kind of violation can push your monthly car insurance bill up by more than 40%.

Military & Veteran Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $65 | $72 | $81 | $58 |

| $87 | $124 | $152 | $103 | |

| $62 | $94 | $104 | $73 |

| $66 | $99 | $123 | $81 | |

| $76 | $109 | $105 | $95 | |

| $43 | $71 | $117 | $56 | |

| $96 | $129 | $178 | $116 |

| $63 | $88 | $129 | $75 | |

| $47 | $57 | $65 | $53 | |

| $32 | $42 | $58 | $36 |

USAA stands out as the best because its pricing remains lower across all violations, providing military drivers with greater stability after a citation or claim.

State Farm is another insurer that won’t raise rates significantly after an accident or a DUI, keeping high-risk car insurance for military and veterans under $100 a month.

Learn More: Cheap Auto Insurance for High-Risk Drivers

How Credit Score Impacts Veteran Car Insurance

Once your credit score falls below 650, insurance companies consider you more likely to miss payments and increase your monthly costs.

A significant drop can increase auto insurance premiums for veterans by more than 40%. You can slow those increases by keeping payments on time, which helps rebuild the trust insurers place in you when setting prices.

Military & Veteran Auto Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670–799) | Fair (580–669) | Poor (<580) |

|---|---|---|---|---|

| $65 | $72 | $88 | $124 |

| $87 | $96 | $118 | $165 | |

| $62 | $68 | $84 | $118 |

| $66 | $73 | $89 | $125 | |

| $76 | $84 | $103 | $144 | |

| $43 | $47 | $58 | $82 | |

| $96 | $106 | $129 | $182 |

| $63 | $69 | $85 | $120 | |

| $47 | $52 | $63 | $89 | |

| $32 | $35 | $43 | $61 |

Again, USAA remains the most affordable provider for military and veterans with bad credit, only increasing rates by $30 a month.

Amica also has great prices. Although its initial premiums are higher, it charges less than Allstate and Farmers for military drivers with fair or bad credit.

Read More: Cheap Auto Insurance for Disabled Veterans

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Get the Right Coverage for Military & Veterans

Military and veteran drivers often need coverage that accommodates the realities of frequent moves, deployments, and changing driving routines.

Here are the top five coverage options that many military households rely on the most:

- Collision Coverage: Helps cover repair costs if your vehicle is damaged after hitting another car or a solid object.

- Comprehensive Coverage: Covers damage from things like weather events, theft, vandalism, or other non-collision issues.

- Deployed Vehicle Protection: Let military and veterans pause or reduce certain coverages when your vehicle is safely stored during deployment.

- Liability Coverage: Protects military and veterans financially if you cause injuries or property damage in an accident.

- Uninsured Motorist Coverage: Protects military and veterans when another driver causes an accident but does not have enough insurance.

These types of auto insurance provide military and veteran drivers with dependable protection and practical support amid the often hectic routine of military life.

You may also want to add roadside assistance or rental reimbursement coverage if you drive often, as these types of coverage can help you get back on the road after a flat tire, breakdown, or claim.

How Military Members Save on Car Insurance

The easiest way to save money on auto insurance for military and veterans is with military-exclusive discounts.

Military discount savings can be stacked with other discounts, and savings can add up quickly.

The Geico military discount of 15% is competitive, but Nationwide, State Farm, and Allstate all offer 25% off. USAA has the biggest military insurance discount at 30%.

Some insurers also bring monthly rates down when drivers bundle their policies, which really helps military households stay steady during moves or deployment-related income changes.

Top Auto Insurance Discounts for Military & Veterans| Company | Bundling | Military Discount | Multi- Vehicle | Usage- Based |

|---|---|---|---|---|

| 15% | 10% | 25% | 30% |

| 25% | 25% | 10% | 40% | |

| 25% | 12% | 23% | 20% |

| 30% | 15% | 25% | 20% | |

| 20% | 20% | 12% | 30% | |

| 25% | 15% | 25% | 25% | |

| 25% | 10% | 25% | 30% |

| 20% | 25% | 15% | 40% | |

| 17% | 25% | 20% | 30% | |

| 10% | 30% | 10% | 30% |

Others lean on usage-based programs that track driving and are helpful for service members who don’t drive often.

Stacking a multi-vehicle deal with a usage-based auto insurance program can push savings beyond 40%, making a noticeable dent in monthly expenses.

Veteran drivers may also benefit from flexible discount options, as their driving patterns change after leaving active duty.

This helps insurers align veterans’ rates with how often and when they actually drive, ensuring the policy reflects their current habits.

Other Ways to Lower Military Auto Insurance Rates

Veterans can often reduce their auto insurance premiums by making simple adjustments to how they use and manage their coverage.

These simple steps make it easier for veterans to keep their auto insurance premiums affordable year-round:

- Choosing a higher deductible reduces monthly premiums but raises out-of-pocket costs after a claim.

- Driving less, especially during deployments, will reduce your risk of traffic-related accidents and lower your rates.

- Dropping add-ons you don’t use or dropping full coverage on an older car can cut rates in half.

- Storing your vehicle on base can cut the auto insurance premium.

Comparing quotes online after moving, buying a new car, or before storing your vehicle for deployment will ensure you aren’t overpaying for coverage.

Insurance comparison sites like this one make it easy to compare multiple providers in one place.

Top Insurance Companies for Military Veterans

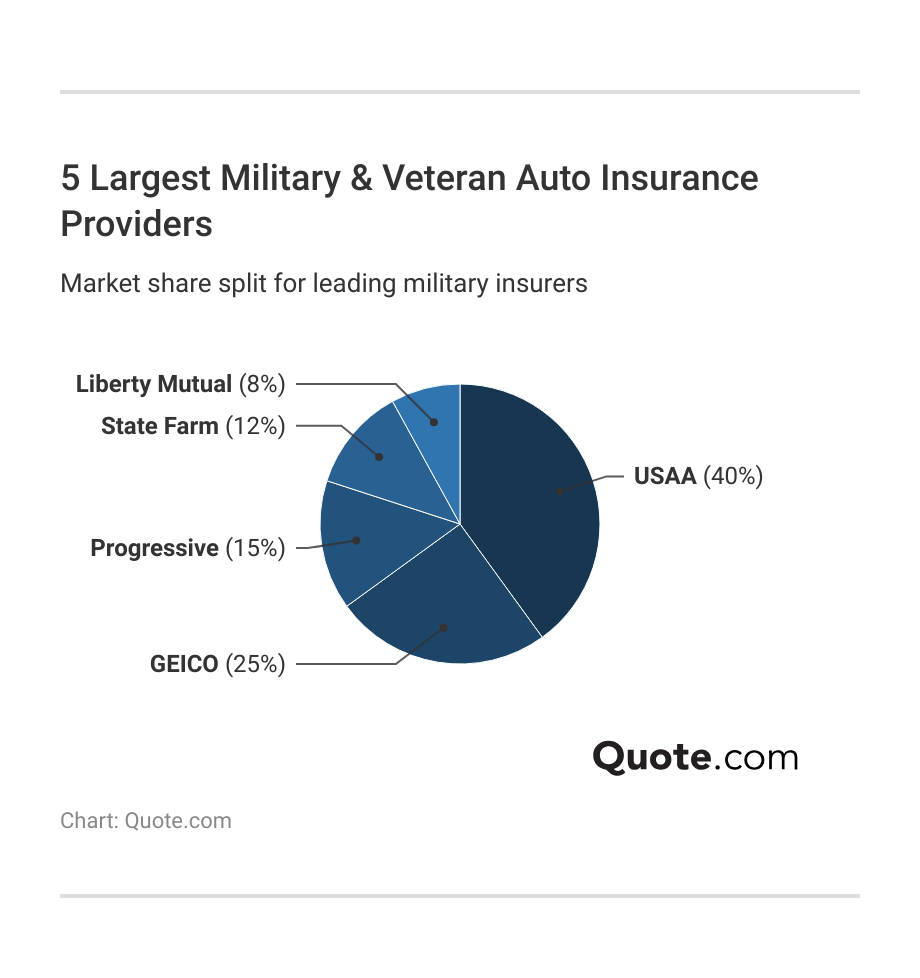

Military drivers should compare market share data because it shows which insurers lead in support for veterans across the country.

USAA holds the largest market share at 40%, giving military personnel and veterans access to insurance coverage and financial services across the country.

Geico holds a big portion due to its cheap rates and competitive military car insurance discount. State Farm offers steady nationwide support with a wide network of local agents familiar with the unique insurance needs of veterans and military families.

Liberty Mutual may not be the largest auto insurance company for military and veterans, but it does have the highest claims satisfaction in states where it’s available.

#1 – USAA: Top Pick Overall

Pros

- Lowest Average Prices: USAA auto insurance for veterans and military offers monthly rates that stay 20% to 45% below national levels across most coverage types.

- Deployment Flex Options: Military and veterans can pause selected coverage during long deployments, which cuts stored vehicle costs by up to 60%.

- Superior Financial Strength: Military and veterans benefit from an A+++ rating that supports faster claim payments. Learn more in our USAA insurance review.

Cons

- Limited Membership: USAA restricts access, which prevents many extended family members of military and veterans from using its strongest rate programs.

- Few Local Offices: USAA has limited walk-in locations, which can frustrate military and veterans who prefer face-to-face help.

#2 – Liberty Mutual: Best for Flexible Policies

Pros

- Stackable Discount Options: Liberty Mutual allows military and veterans to combine bundle savings and vehicle savings. Learn more about Liberty Mutual review.

- Strong Coverage Additions: Military and veterans gain access to features like accident forgiveness, which prevent rate spikes that normally exceed 20%.

- Wide National Reach: Liberty Mutual provides service in every state, which supports military and veterans who often relocate across the country.

Cons

- Higher Starting Rates: Liberty Mutual begins with premiums that run 18% above national averages for military and veterans before savings apply.

- Inconsistent Renewal Changes: Military and veterans may see premium shifts that reach 12% due to local underwriting trends, which creates uncertainty.

#3 – Nationwide: Best for Bundling Discounts

Pros

- Usage Tracking Value: Nationwide gives military and veterans strong savings through its usage program, which can lower monthly bills by as much as 40%.

- Vehicle Bundle Advantage: Military and veterans with more than one vehicle often save an additional 25%. Find more information in our Nationwide insurance review.

- Predictable Rate Patterns: Nationwide limits premium increases for military and veterans to levels near 6%, which creates dependable long-term planning.

Cons

- Sensitive Tracking Scores: Usage data can lower benefits for military and veterans who experience frequent base traffic stops, which may raise premiums by 8%.

- Reduced Local Discounts: Nationwide offers fewer location-based savings for military and veterans, which can limit opportunities in states with higher costs.

#4– AAA: Best for Roadside Assistance

Pros

- Strong Membership Benefits: AAA provides military and veteran roadside help and travel savings (Learn More: Roadside Assistance Coverage).

- Dependable Repair Network: Military and veterans gain access to preferred repair shops that offer labor savings of up to 15%.

- Consistent Claims Handling: AAA maintains steady claim timelines that support military and veterans.

Cons

- Limited Digital Tools: AAA offers fewer modern app features for military and veterans. Find out more in our AAA insurance review.

- Membership Requirement: Military and veterans must purchase a membership that adds an extra yearly cost that some families prefer to avoid.

#5 – Amica: Best for Customer Service

Pros

- Reliable Claims Times: Amica delivers military and veteran claim results faster than many carriers, with completion times improving by nearly 18% each year.

- High Claims Satisfaction: Military and veterans benefit from Amica’s service ranking among the highest in the national surveys. See more in our Amica insurance review.

- Strong Optional Coverage Choices: Amica offers military and veterans rare features such as full glass coverage, which can reduce annual repair costs by 22%.

Cons

- Limited Discounts: Amica provides fewer savings programs for military and veterans, which leaves average discounts lower than those of other companies.

- Higher Rate Growth: Amica increases auto insurance rates for veterans by 14% or more after an accident.

#6 – State Farm: Best for Safe Drivers

Pros

- Consistent Low Rates: State Farm offers military and veteran premiums that average 14% lower than many comparable national carriers.

- Strong Vehicle Savings: Military and veterans with multiple cars receive valuable price reductions that reach 24% which helps larger households.

- Reliable Claims Processing: State Farm handles claims for military and veterans with cycle times that improve by 12% each year. Explore our State Farm insurance review.

Cons

- Fewer Military Programs: State Farm offers fewer specialized protections for military and veterans, which limits support during long assignments.

- Strict Discount Rules: Some savings require long periods of clean driving, which military and veterans cannot always maintain with frequent relocations.

#7 – American Family: Best for Family Coverage

Pros

- Competitive Vehicle Pricing: American Family gives military and veterans valuable vehicle discounts that can lower yearly bills by almost 23%.

- Supportive Local Agents: Military and veterans often appreciate the guidance from American Family agents.

- Strong Payment Flexibility: American Family allows military and veterans to adjust payment schedules. Dive more into our American Family insurance review.

Cons

- Limited National Reach: American Family is not available in some states, which creates gaps for military and veterans who often move.

- Higher Full Coverage Rates: Premiums for full protection may exceed national averages by nearly 10% for military and veterans.

#8 – Geico: Best for Affordable Rates

Pros

- Very Low Average Prices: Geico gives military and veterans some of the most affordable premiums, which often fall 20% below many national carriers.

- Easy Digital Management: Military and veterans can update policies through a simple online system. Read more in our Geico insurance review.

- Strong Safe Driver Savings: Geico offers military discounts that grow up to 25% after consistent accident-free periods.

Cons

- Less Personalized Help: Geico has fewer in-person resources, which may frustrate military and veterans who value face-to-face support.

- Telematics Sensitivity: Usage tracking may reduce savings for military and veterans who drive on crowded bases, which lowers program benefits.

#9 – Allstate: Best for Local Agents

Pros

- Strong Usage Program Savings: Allstate offers military and veteran usage rewards that cut monthly premiums by as much as 40%. Learn more in our Allstate insurance review.

- Reliable Repair Guarantees: Military and veterans receive quality repair support backed by shop guarantees that can reduce repeat repair expenses by 15%.

- High Policy Customization: Allstate allows military and veterans to tailor coverage, reducing unnecessary costs by removing features they no longer need.

Cons

- Higher Base Premiums: Allstate starts with prices 15% higher than competitors’ for military and veterans.

- Frequent Renewal Changes: Military personnel and veterans may experience premium adjustments at renewal, making long-term planning more difficult.

#10 – Farmers: Best for Accident Forgiveness

Pros

- Strong Optional Features: Farmers gives military and veterans access to policy upgrades that can lower long-term repair costs by nearly 20%.

- Accident Forgiveness Benefit: Military and veterans may avoid premium increases after a first accident. Find insights in our Farmers auto insurance review.

- Reliable National Support: Farmers operates across the country, which helps military and veterans stay covered during frequent relocations between different states.

Cons

- Higher Pricing Trends: Farmers carry starting rates that sit 12% above national averages for military and veterans.

- Telematics Variability: Usage program scores can shift quickly for military and veterans, which may cause monthly swings of up to 8%.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Buying Military & Veterans’ Car Insurance

USAA, Liberty Mutual, and Nationwide have the best auto insurance for military and veterans. USAA stays the favorite among most military drivers because its deployment features reduce stored-vehicle costs by up to 60%.

It’s also the cheapest insurance company at $32 a month (Read More: How to File an Auto Insurance Claim & Win).

Military families need insurers that adjust quickly to PCS moves and vehicle storage needs. For example, some waive mid-term fees.

Melanie Musson Published Insurance Expert

Military families who move every two years often prefer insurers that reduce policy change hassles by about 30% and maintain claim satisfaction scores above 85%.

Compare the best insurance for veterans and military by entering your ZIP code into our free quote comparison tool.

Frequently Asked Questions

What insurance company is best for veterans?

Veterans often find the best rates and benefits with insurers offering military-specific discounts, with USAA, Geico, and Armed Forces Insurance commonly delivering the lowest monthly premiums and strong deployment-friendly policy options.

What is the best car insurance for disabled veterans?

The best disabled veteran car insurance usually comes from USAA and Geico, offering lower monthly rates, adaptive-equipment coverage, and savings through disabled veteran car insurance discounts. Explore how tips to pay less for car insurance improve savings for veterans.

Is it true that veterans can get cheaper car insurance?

Yes, veterans frequently qualify for cheaper monthly rates because many insurers provide military discounts, safe-driver rewards, and stored-vehicle reductions during deployments. See top rates for the best auto insurance for military and veterans by entering your ZIP code.

Can I get military auto insurance if my dad was a veteran?

Most insurers allow anyone to purchase coverage regardless of a parent’s service, but USAA eligibility extends only to children of USAA members, not simply to children of veterans.

Is veterans’ auto insurance for $29 a month full coverage?

Veterans’ auto insurance for $29 a month typically applies only to minimum-coverage policies. Full coverage auto insurance plans cost more due to added protections like collision and comprehensive.

What insurance benefits can I get if my grandfather was in the military?

Most major insurers do not offer benefits based solely on a grandparent’s service, but USAA may allow eligibility if the grandparent was a USAA member and membership passed through each generation without interruption.

Can grandparents put grandchildren on their car insurance?

Grandparents can add grandchildren to their policy if the grandchild lives in the same household and regularly uses the insured vehicle, which most insurers require for accurate rating and liability coverage.

Is USAA really cheaper for veterans?

USAA often offers some of the lowest monthly premiums for eligible veterans due to its military-only membership structure and consistently strong pricing advantages across most states. Unlock the best auto insurance rates for military and veterans by entering your ZIP code.

Do all veterans qualify for USAA car insurance?

Not all veterans qualify. Only those with honorable or general-under-honorable-conditions discharges are eligible, and eligibility does not automatically extend to all family members. If you don’t qualify, compare State Farm vs. Farmers, Geico, Progressive, and Allstate to find affordable auto insurance for veterans.

Why does USAA auto insurance for veterans have an F rating?

USAA has an F rating from the Better Business Bureau because of unresolved customer complaints, but BBB scores do not reflect financial strength, and USAA continues to earn excellent A.M. Best ratings.

What proof do I need to join USAA?

Can I join USAA if my father served but is deceased?

Does USAA have good car insurance rates?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.