Best Auto Insurance for New Drivers in 2026

Liberty Mutual, Nationwide, and State Farm have the best auto insurance for new drivers. Car insurance for new drivers in their 20s starts at $99 a month, but teens pay more. Young drivers may consider UBI, like Geico DriveEasy, which cuts rates by 25%, or Travelers IntelliDrive, which lowers rates after 90 days.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding c...

Meggan McCain

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated December 2025

The best auto insurance for new drivers is offered by Nationwide, Liberty Mutual, and State Farm, all known for high claim satisfaction and safe-driving incentives.

- Nationwide SmartRide cuts rates up to 40% for beginners

- New drivers pay about $60 more per month than adults

- Clean records cut new driver rates by roughly 30%

Liberty Mutual is well-suited for new drivers because it offers accident forgiveness and allows you to stack discounts.

Nationwide is the best fit for young professionals in their 20s who qualify for pay-as-you-go discounts.

Top 10 Companies: Best Auto Insurance for New Drivers| Company | Rank | Claims Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 730 / 1,000 | A | Accident Forgiveness |

| #2 | 729 / 1,000 | A+ | Young Professionals | |

| #3 | 716 / 1,000 | A++ | Safe Drivers | |

| #4 | 716 / 1,000 | A+ | Reliable Coverage |

| #5 | 702 / 1,000 | A | Parents & Families |

| #6 | 697 / 1,000 | A++ | Low Rates | |

| #7 | 693 / 1,000 | A+ | 1st-Time Drivers | |

| #8 | 691 / 1,000 | A++ | Extra Support | |

| #9 | 690 / 1,000 | A | Student Drivers | |

| #10 | 673 / 1,000 | A+ | Tech Savvy |

State Farm is a good choice if you want steady pricing, strong A.M. Best ratings, and higher-than-average claims satisfaction.

Compare companies that have telematics savings, student programs, and helpful tools to make insurance more affordable for new drivers. Find the best car insurance for new drivers by entering your ZIP code into our free quote comparison tool.

Auto Insurance Costs for New Drivers

How much is insurance for a new driver per month? Minimum coverage costs around $150 per month, but Geico, State Farm, and Nationwide have cheap car insurance for new drivers.

This table shows the monthly average cost of auto insurance for an 18-year-old male. Young men under 21 pay some of the highest premiums.

New Driver Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $172 | $405 | |

| $148 | $362 |

| $165 | $398 | |

| $119 | $331 | |

| $183 | $432 |

| $139 | $349 | |

| $158 | $386 | |

| $128 | $314 | |

| $140 | $417 |

| $153 | $374 |

Full coverage costs rise sharply, from $314 to $432 per month. This increase reflects the higher claim risk linked to age and driving history.

Nationwide and State Farm have smaller increases across coverage types, raising full coverage rates only two times higher than minimum coverage.

Read More: Cheap Full Coverage Auto Insurance

New Driver Car Insurance for Teens vs. Adults

How much is insurance for a new driver under 18? Drivers between 16 and 18-years-old pay the most, with some companies charging over $250 a month.

Monthly rates for minimum coverage decline quickly for new drivers as they age. By age 22, premiums decrease by at least 50% after a few years of driving experience.

New Driver Auto Insurance Monthly Rates by Age| Company | Age: 16 | Age: 18 | Age: 20 | Age: 22 |

|---|---|---|---|---|

| $241 | $172 | $156 | $143 | |

| $218 | $148 | $137 | $126 |

| $229 | $165 | $151 | $139 | |

| $174 | $119 | $108 | $101 | |

| $257 | $183 | $169 | $155 |

| $203 | $139 | $128 | $118 | |

| $221 | $158 | $145 | $134 | |

| $184 | $128 | $118 | $110 | |

| $198 | $140 | $102 | $99 |

| $212 | $153 | $142 | $131 |

Nationwide and State Farm are affordable at $203 and $184 a month for 16-year-olds, while The Hartford has cheap car insurance for new drivers in their 20s starting at $99 per month.

Geico is the only other provider with cheap auto insurance for teens under $200 per month, and it offers the lowest minimum coverage rates across all age groups. Prices are approximately $119 per month at age 18 and drop to approximately $101 per monthly at age 22.

From ages 16 to 22, monthly minimum premiums drop by about $80, representing a roughly 36% decrease. Geico, State Farm, and Nationwide have the best car insurance for teens.

However, rates can remain high for young men because claim frequency is still highest before age 20. For 18-year-old males, monthly rates are $80 to $110 higher because insurers factor in their higher crash risk and limited driving experience.

Young vs. Older Drivers: Monthly Auto Insurance Cost Gap| Company | Age: 18 | Age: 40 | Difference |

|---|---|---|---|

| $172 | $82 | +$90 | |

| $148 | $72 | +$76 |

| $165 | $77 | +$88 | |

| $119 | $58 | +$61 | |

| $183 | $86 | +$97 |

| $139 | $67 | +$72 | |

| $158 | $74 | +$84 | |

| $128 | $62 | +$66 | |

| $140 | $70 | +$70 |

| $153 | $74 | +$79 |

Male drivers often see their rates decline steadily after age 21, provided they maintain a clean driving record and improve their credit. Find out how the best good driver auto insurance discounts support new drivers.

New drivers with clean records can reduce the time they pay high rates by almost 30% compared to those with violations.

How a Driving Record Affects New Driver Auto Insurance

Driving history is the primary factor in determining monthly premiums for new drivers. If you have an accident or speeding ticket, it can be hard to find the best car insurance for young drivers with full coverage at a low price.

A single mistake can quickly increase rates for young drivers nationwide. One accident can raise rates by about 40% immediately. Compare more high-risk auto insurance rates.

New Driver Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $172 | $245 | $301 | $214 | |

| $148 | $216 | $284 | $197 |

| $165 | $238 | $327 | $209 | |

| $119 | $187 | $294 | $168 | |

| $183 | $259 | $352 | $233 |

| $139 | $204 | $276 | $189 | |

| $158 | $229 | $318 | $205 | |

| $128 | $182 | $241 | $164 | |

| $140 | $248 | $339 | $221 |

| $153 | $223 | $311 | $198 |

If you have a clean driving record, your monthly costs stay lower. Geico offers the best overall rates, keeping monthly costs for those with a clean record closer to $119 rather than over $150.

For new drivers with high-risk records, minimum coverage is often the most affordable. Unfortunately, it can leave young drivers quickly facing repair bills that go beyond what the policy covers. Learn when full coverage auto insurance is better than minimum coverage.

How Credit Score Impacts New Driver Car Insurance

Having excellent credit can reduce monthly insurance costs for new drivers by about 30% compared with poor credit.

Penalties for minimum coverage are higher because insurers view limited financial history as a greater repayment risk, even if you have no tickets, accidents, or claims.

New Driver Auto Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670-799) | Fair (580-669) | Poor (< 580) |

|---|---|---|---|---|

| $172 | $186 | $214 | $247 | |

| $148 | $161 | $186 | $218 |

| $165 | $179 | $207 | $239 | |

| $119 | $131 | $156 | $182 | |

| $183 | $197 | $228 | $264 |

| $139 | $151 | $176 | $203 | |

| $158 | $171 | $198 | $227 | |

| $128 | $139 | $159 | $182 | |

| $140 | $189 | $217 | $251 |

| $153 | $165 | $192 | $221 |

Poor credit can raise minimum coverage costs above $220 a month, which can be tough on young drivers’ budgets, even if they have clean driving records.

Improving credit from fair to good can lower minimum premiums by about $25 each month.

Geico is the top overall choice, keeping minimum rates close to $119 and offering smaller credit-based increases than other companies for young male drivers.

Nationwide and State Farm do a better job of limiting credit penalties, keeping increases closer to 15% instead of much higher jumps for 18-year-olds.

Read More: State Farm vs. Farmers, Geico, Progressive, & Allstate Insurance Review

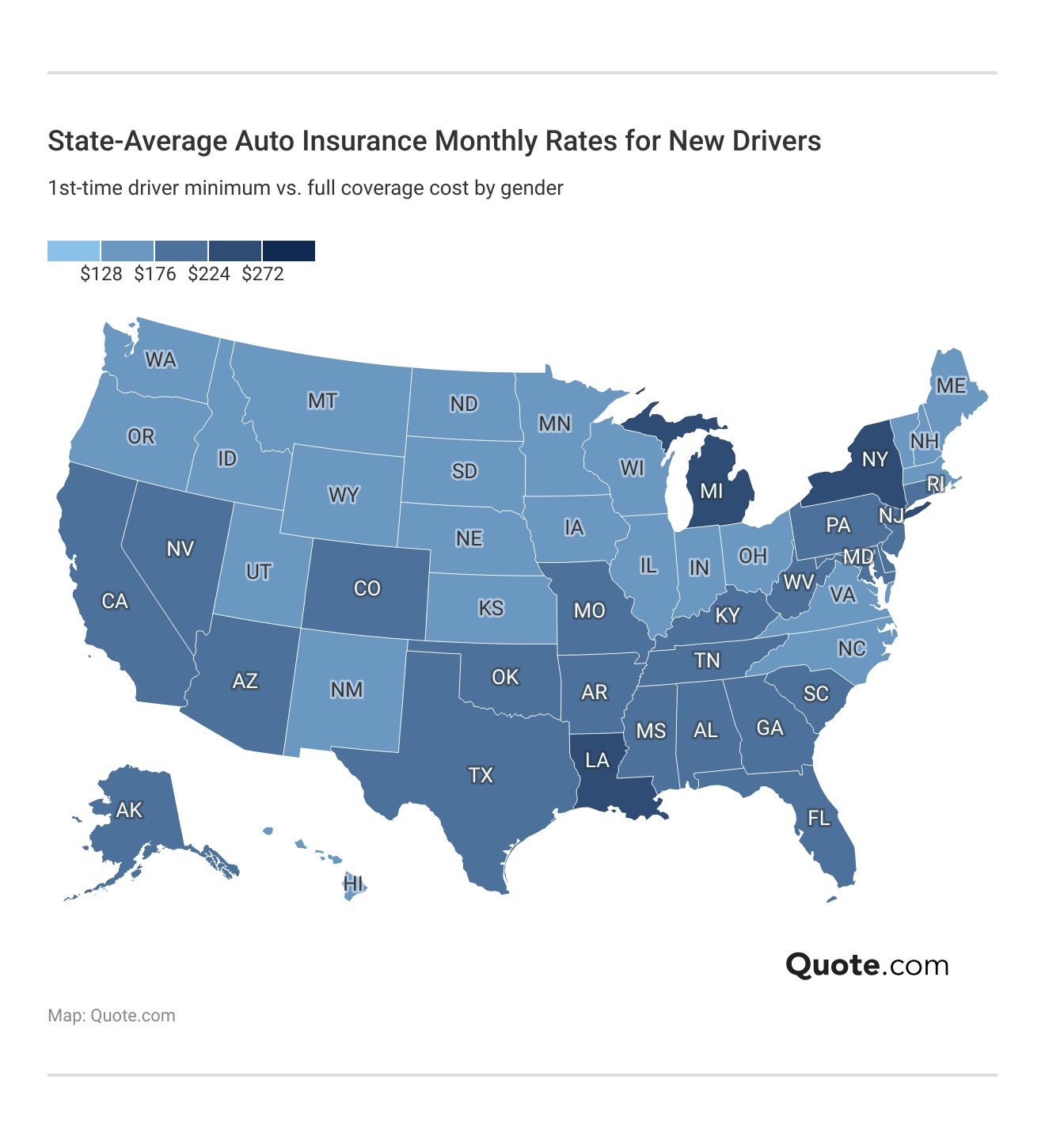

New Driver Auto Insurance Rates by State

State averages show that minimum coverage prices for new drivers vary widely by location and gender.

In many states, the minimum monthly rate for 18-year-olds ranges from $128 to $176. These differences come from local claim costs and coverage requirements.

Southern and western states typically have higher prices because they have more accidents and more uninsured drivers, which increases risk.

North Carolina is known for offering better value, with minimum coverage for 18-year-old males remaining close to $141 a month (Learn More: Auto Insurance Requirements by State).

State pricing swings reflect claim costs and laws more than drivers realize, often by 30% or more. For example, tort states raise liability payouts.

Michelle Robbins Licensed Insurance Agent

Across the country, 18-year-old male drivers typically pay about 5% to 10% more than women for minimum coverage.

This difference is primarily due to the higher risk associated with early driving habits, not to credit scores or car type.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Insurance Coverages for New Drivers

New drivers usually face more risks and have less money to spend. Choosing the right type of auto insurance can help you save and make sure you follow the law and your lender’s requirements.

- Collision Coverage: Helps pay for damage to your car after a crash with another vehicle, an object, or if your car rolls over.

- Comprehensive Coverage: Covers non-collision losses, including theft, vandalism, fire, and weather damage.

- Gap Insurance: Covers the difference between what you owe on your car loan and the car’s value if your car is totaled.

- Liability Coverage: Pays for injuries and property damage you cause to others if you are at fault in an accident.

- Medical Payments Coverage: Helps pay for medical expenses for you and your passengers, no matter who caused the accident.

- Uninsured Motorist Coverage: Helps with medical bills and repairs if you are hit by a driver who does not have insurance.

Most states only require liability coverage for new drivers, but your state may require uninsured motorist coverage. If you drive a new car, your auto loan may also require collision, comprehensive, and gap insurance.

For new drivers, these types of coverage help you stay legal, protect your car, and keep your finances stable as you gain more experience on the road.

Adding more coverage to a new driver’s car insurance policy will raise premiums, but adding a teen or young driver to an existing policy can help cut costs while getting them the coverage they need.

Explore the different types of auto insurance you might need as a new driver, and ask roommates or family members to add you to their coverage if you can’t afford the extra add-ons.

How New Drivers Save on Car Insurance

Discounts are especially important for new drivers, as they can help offset the high premiums associated with little to no driving experience. Bundling renters or homeowners insurance usually saves 20% to 25%.

Stacking and combining several discounts early on can lower your monthly rates as a new driver more quickly than switching insurers.

Top Auto Insurance Discounts for New Drivers| Company | Anti-Theft | Bundling | Good Driver | Usage-Based |

|---|---|---|---|---|

| 10% | 25% | 25% | 40% | |

| 25% | 25% | 25% | 20% |

| 10% | 20% | 30% | 30% | |

| 25% | 25% | 26% | 25% | |

| 35% | 25% | 20% | 30% |

| 5% | 20% | 40% | 40% | |

| 25% | 10% | 30% | $231/yr | |

| 15% | 17% | 25% | 30% | |

| 10% | 5% | 15% | 20% |

| 15% | 13% | 10% | 30% |

Usage-based insurance (UBI) programs reward safe driving habits and can cut monthly costs by up to 40%, so you do not have to wait years for rates to drop with age. Some UBI programs also offer dollar savings, such as $231 per year with Progressive Snapshot.

Nationwide auto insurance stands out by offering up to 40% SmartRide and SmartMile savings, helping new drivers with safe habits and low mileage get better rates.

Read More: Car Insurance Discounts You Can’t Miss

Other Ways to Reduce New Driver Auto Insurance Rates

In addition to standard discounts, new drivers can save money each month by adjusting their driving habits.

You can also choose different coverage options and set up your policy wisely from the start, with deductible options and family plans:

- Drive a Low-Risk Vehicle: These cars usually cost less to repair and are less likely to be involved in claims, which helps lower your rates.

- Drive Fewer Miles: The less you drive, the lower your risk, which can help reduce your insurance costs.

- Keep Continuous Coverage: If your coverage lapses, you could face higher rates when you start a new policy.

- Pick a Higher Deductible: This means you’ll pay more if you have a claim, but your monthly premiums will be lower right away.

- Stay on a Family Policy: This lets you access multi-car and loyalty discounts that aren’t available with your own policy.

New drivers in their teens can also start building their credit early by paying bills on time, including insurance payments. A better credit score can help you avoid extra charges on your insurance.

Insurance comparison websites like Quote.com can help you compare car insurance based on age, credit score, and driving history to help you find the best auto insurance for new drivers.

Comparing new driver car insurance online first gives you the chance to see how local providers treat first-time drivers and which can offer you the best coverage at the right price.

By following these tips, new drivers can spend less time paying high rates and see their insurance costs decline faster as they gain experience.

Top Insurance Companies for New Drivers

Finding the best car insurance companies for new drivers typically requires considering price, online convenience, financial stability, and discounts.

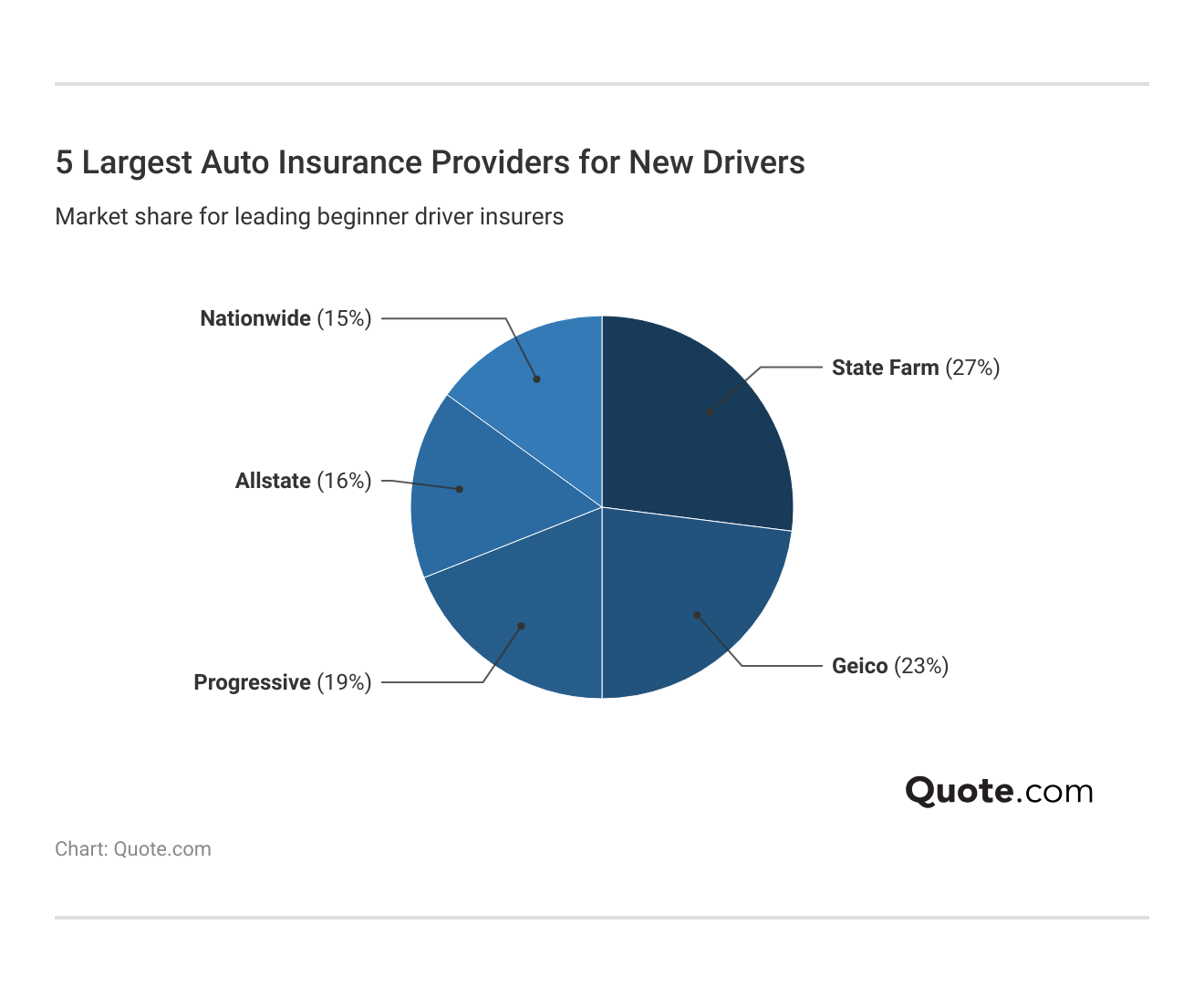

State Farm is a top choice, with a 27% market share, because it offers a wide range of programs for young and inexperienced drivers.

Geico and Progressive are close behind, thanks to competitive pricing and technology that attract cost-conscious first-time drivers nationwide.

Nationwide and Allstate also play a big role, offering competitive discounts and a helpful onboarding experience for new drivers.

#1 – Liberty Mutual: Top Overall Pick

Pros

- First Accident Protection: Liberty Mutual helps new drivers avoid large rate increases after their first at-fault accident.

- Strong Vehicle Safety Discounts: New drivers can receive up to 35% off their monthly premiums for vehicles equipped with anti-theft technology.

- Stackable Discounts: New drivers can combine savings from bundling and telematics programs. Find more information in our Liberty Mutual insurance review.

Cons

- Higher Starting Prices: Before discounts, new drivers often pay around $183 per month.

- Complex Policy Options: Liberty Mutual’s customizable policies can overwhelm new drivers looking for simple, first-time coverage.

#2 – Nationwide: Best for Young Professionals

Pros

- SmartRide Rewards Behavior: New drivers can save up to 40% on their bills by showing safe driving habits with Nationwide’s app.

- SmartMiles Low-Mileage Rewards: New drivers on the road less than 10,000 miles a year can qualify for cheaper insurance through Nationwide SmartMiles policies.

- Smaller Credit Penalties: New drivers with fair credit typically pay about $176 per month, rather than more than $200. See more details in our Nationwide insurance review.

Cons

- Thin Anti-Theft Savings: New drivers can get up to 5% off when their vehicle is equipped with security features.

- App Participation Required: To maximize savings, new drivers must keep the SmartRide app active and continuously track their driving.

#3 – State Farm: Best for Safe Drivers

Pros

- Drive Safe & Save Savings: Careful new drivers can save nearly 30% by using monitored driving data. Learn how to qualify in our State Farm insurance review.

- Fast Price Drops With Age: As new drivers get older and avoid claims, their premiums often drop to about $110 per month by their early twenties.

- Strong Financial Backing: State Farm’s A++ rating gives new drivers confidence when planning long-term policies.

Cons

- Smaller Bundling Upside: New drivers can get up to 17% off with multi-policy discounts.

- Slower Telematics Gains: Usage-based savings increase more slowly for new drivers here than with other companies.

#4 – The Hartford: Best for Reliable Coverage

Pros

- Stable Pricing Patterns: With The Hartford, new drivers are less likely to see sudden price increases after minor claims or tickets.

- Usage-Based Savings: New drivers can save up to 20% with safe driving habits. See more discounts in our review of The Hartford insurance.

- Solid Financial Strength: The Hartford’s A+ rating gives new drivers confidence that their claims will be paid.

Cons

- AARP Requirement: Teens and young drivers cannot buy The Hartford insurance unless someone in their family is an AARP member.

- Higher Entry Costs: Minimum coverage for new drivers often exceeds $176 per month.

#5 – American Family: Best for Parents and Families

Pros

- Policy Advantages: When new drivers join their parents’ policies, they can get shared discounts and start with lower rates.

- Balanced Discount: New drivers can combine discounts for bundling, safe driving, and telematics to save up to 25%.

- Predictable Pricing Rate: If new drivers avoid violations, their rates are less likely to increase suddenly. Find out more in our American Family insurance review.

Cons

- Smaller Footprint: New drivers who live outside American Family’s main states might have fewer local service choices.

- Moderate Claims Scores: American Family’s claims score is 702, which is around average but lower than the top insurers for drivers who prioritize fast claims processing.

#6 – Geico: Best for Low Rates

Pros

- Lowest Entry Pricing: New drivers can often secure minimum coverage for about $119 per month, which is lower than most competitors’ offerings.

- Strong Financial Backing: Geico has an A++ rating from A.M. Best, which helps new drivers feel confident about the company’s long-term stability.

- Telematics Flexibility: New drivers can save up to 25% by sharing their driving data, and there’s no need to commit for a long time. Find out more in our Geico insurance review.

Cons

- Limited Forgiveness Options: If new drivers have their first accident, their rates may go up more than with companies that offer accident forgiveness.

- Fewer Human Touchpoints: The claims process can feel less personal, which may be tough for new drivers who want more help.

#7 – Allstate: Best for First-Time Drivers

Pros

- Structured Onboarding: Allstate is the best auto insurance for first-time drivers, with an online dashboard that helps new drivers understand their coverage and costs.

- Strong Telematics Savings: With Drivewise, new drivers can save up to 40% by showing safe driving habits. See more ways to save in our Allstate insurance review.

- Broad Discount Availability: New drivers can get up to 25% off by bundling policies and maintaining a good driving record.

Cons

- Higher Base Rates: Before discounts, new drivers usually pay about $172 per month to start.

- Credit Sensitivity: If a new driver has low or no credit, their rates may increase more quickly.

#8 – Travelers: Best for Extra Support

Pros

- Stable Claims Handling: Travelers has a clear claims process that helps new drivers avoid confusion after their first accidents. Get more details in our Travelers insurance review.

- Telematics Savings Access: New drivers can save approximately 30% by enrolling in Travelers’ usage-based driving programs.

- High Financial Strength: Travelers’ A++ financial strength rating makes it a strong choice for new drivers seeking a stable insurer.

Cons

- Higher Base Pricing: New drivers usually pay more than $153 per month for minimum coverage with Travelers.

- Fewer Youth-Specific Programs: Travelers does not offer many programs or discounts made just for new drivers.

#9 – Farmers: Best for Student Drivers

Pros

- Clean Record Rewards: Farmers offers new drivers with a clean driving record up to 30% off. Get a detailed discount list in our Farmers insurance review.

- Balanced Telematics Program: Safe new drivers can reduce costs by about 30% through tracking tools.

- Student Friendly Pricing: New drivers who leave family plans can avoid sudden price increases with Farmers’ student-friendly pricing.

Cons

- Heavy DUI Impact: A serious violation, such as a DUI, can increase new drivers’ rates to $327 per month.

- Average Claims Scores: Farmers’ 706 claims rating is lower than the top performers for new drivers.

#10 – Progressive: Best for Tech Savvy Drivers

Pros

- Snapshot Pricing Control: With Progressive’s Snapshot program, new drivers can help set their rates based on how they drive, including braking, mileage, and driving times.

- Competitive Midrange Costs: Snapshot can help new drivers lower their premiums by 20% to 30% in just a few months. Check out our Progressive insurance review for quotes.

- Strong Digital Tools: Progressive’s app makes it easy for new drivers to manage their policy from their phone.

Cons

- Steep Increases at Renewal: Many new drivers report big rate increases after six months, even with a clean record.

- Lower Rate Predictability: Rates can change from month to month, which may be hard for new drivers who need to stick to a budget.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Get the Best Auto Insurance for New Drivers

The best auto insurance for new drivers comes from companies that handle early risks well and help you save money as you get more experience. Find tips to pay less for car insurance that show new drivers how smart choices cut costs early.

Leading insurance companies have strong claims scores above 700, high financial ratings (A or A++), and offer programs that reward safe driving, clean records, and steady improvement.

New drivers should watch how insurers reprice risk after early renewals. For example, companies that reset rates after six clean months save more.

Jeff Root Licensed Insurance Agent

New drivers benefit from insurers who reduce the impact of early mistakes, keep credit penalties low, and clearly lower rates as you gain more experience.

Taking time to compare these details early can help you pay lower rates and make it easier to manage your insurance later. Unlock the best car insurance for young adults who are new drivers by using our free ZIP code rate comparison tool.

Frequently Asked Questions

What’s the best car insurance for first-time drivers?

The best auto insurance for new drivers usually comes from Liberty Mutual, Nationwide, and State Farm, which offer strong safe-driving programs, accident forgiveness, and student discounts, with minimum monthly rates typically starting at $115 to $140, depending on location.

What is the best car insurance for drivers under 25?

The best car insurance for drivers under 25 often includes Erie insurance, which stands out for strong student discounts, rate stability, and minimum monthly costs typically between $120 and $170, depending on location. Our Erie insurance review explains its benefits to young drivers.

Who has the cheapest insurance for teenage drivers?

The cheapest auto insurance for teenage drivers is often found with insurers that offer good student discounts and usage-based programs, helping reduce monthly costs from roughly $160 to $220 for minimum coverage. Find out how at-fault accidents & insurance rates increase early premiums.

How much does insurance cost for a first-time driver?

Insurance for a first-time driver typically costs $120 to $180 per month for minimum coverage, while full coverage can range from $300 to $430 per month, depending on age and driving history.

What is the least expensive car to insure for a new driver?

The least expensive car to insure for a new driver is often a compact sedan or small hatchback with high safety ratings. The cheapest car insurance for new drivers is tied to the Honda Civic, Toyota Corolla, or Mazda3, which have lower repair costs and strong safety records. See how auto insurance rates by vehicle change by car model.

How can I lower insurance costs for new drivers?

Insurance costs for new drivers can be lowered by enrolling in usage-based programs, maintaining a clean driving record, qualifying for student discounts, and bundling auto coverage with renters or homeowners insurance to reduce monthly premiums.

Does a credit score affect car insurance rates for new drivers?

Credit score impacts insurance rates for new drivers in most states; strong credit often lowers monthly premiums by 20% to 30% compared to poor credit, even when driving records are clean.

What is a good monthly payment for new driver auto insurance?

A good monthly payment for a new driver’s auto insurance is usually between $120 and $160 for minimum coverage, while full coverage commonly ranges from $300 to $400, depending on age and location.

What state has the cheapest car insurance for new drivers?

The cheapest car insurance for new drivers is often found in states like North Carolina, Idaho, and Ohio, where minimum monthly rates tend to range from $110 to $140 due to lower claim costs.

What is the most expensive month to insure a car for new drivers?

The most expensive month to insure a car for new drivers is typically February or March, when insurers adjust rates based on updated claim data and risk trends, sometimes causing noticeable monthly increases.

How does car insurance for new drivers over 21 cost?

What is the best auto insurance for new drivers in California?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.