Cheap No-Down-Payment Auto Insurance in 2026

Geico, Erie, and State Farm offer the cheapest no-down-payment auto insurance, with low upfront costs starting at $37/mo. No-money-down car insurance can be hard to find, but Nationwide can lower costs with UBI discounts. Amica’s dividend credits can ease first-month charges for long-term customers.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Expert

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life i...

Maria Hanson

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Scott Young

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated January 2026

Geico, Erie, and State Farm offer the cheapest no-down-payment auto insurance options, with upfront costs of around $37 per month.

- Payment is required to start, so you won’t get car insurance for $0 down

- No-down-payment insurance removes steps that usually slow coverage

- Geico offers fast online quotes and mobile tools for paying bills

Car insurance without a down payment doesn’t exist, but Geico stands out for its consistently low premiums across all 50 states, helping drivers get coverage with less money down.

Erie offers great value with low base rates and hardly any upfront fees, while State Farm’s strong financial footing helps keep no-down-payment coverage steady and reliable.

10 Best Companies: Cheapest No-Down-Payment Auto Insurance| Company | Rank | Monthly Rates | Claims Satisfaction | Best for |

|---|---|---|---|---|

| #1 | $55 | 697 / 1,000 | Good Drivers | |

| #2 | $56 | 743 / 1,000 | Filing Claims |

| #3 | $59 | 716 / 1,000 | Local Agents | |

| #4 | $61 | 718 / 1,000 | Customer Service | |

| #5 | $64 | 729 / 1,000 | Bundling Discounts | |

| #6 | $69 | 702 / 1,000 | Family Coverage |

| #7 | $72 | 672 / 1,000 | Online Tools | |

| #8 | $74 | 690 / 1,000 | Accident Forgiveness | |

| #9 | $78 | 693 / 1,000 | Multiple Discounts | |

| #10 | $82 | 730/ 1,000 | Flexible Policies |

Dividend perks with Amica make it easier for drivers to apply money toward their premiums and lower their payments, or get covered right away without paying anything up front.

Unlock the cheapest no-down-payment auto insurance rates by comparing auto insurance companies with our free comparison tool.

Comparing No-Down-Payment Insurance Rates

No legally operating provider sells auto insurance with no down payment. You will have to pay upfront for car insurance to reduce the insurer’s risk, just as you do with your lease or mortgage.

To save money, it really helps to see how your costs change once you choose a coverage level. Minimum coverage usually keeps things simple and affordable because it only handles the basics your state requires.

No-Down-Payment Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $78 | $175 | |

| $69 | $157 |

| $61 | $140 | |

| $56 | $128 |

| $74 | $172 | |

| $55 | $136 | |

| $82 | $186 |

| $64 | $151 | |

| $72 | $160 | |

| $59 | $143 |

Minimum coverage is great if you want to get insured fast and keep your monthly bill low without paying upfront.

Your monthly payment increases with full coverage insurance because it includes protection for your vehicle and your or your passengers’ injuries.

Monthly rates stay lower when you set up EFT autopay from day one. For instance, some insurers price closer to $37 only with a bank draft.

Jeff Root Licensed Insurance Agent

Since you won’t find a no-down-payment policy, you can sign up for automatic payments through your bank or digital account to reduce your upfront payments by 5% or more.

Full coverage provides more protection, but it comes at a higher cost. Knowing how each option affects your budget makes it a lot easier to choose the plan that fits your situation.

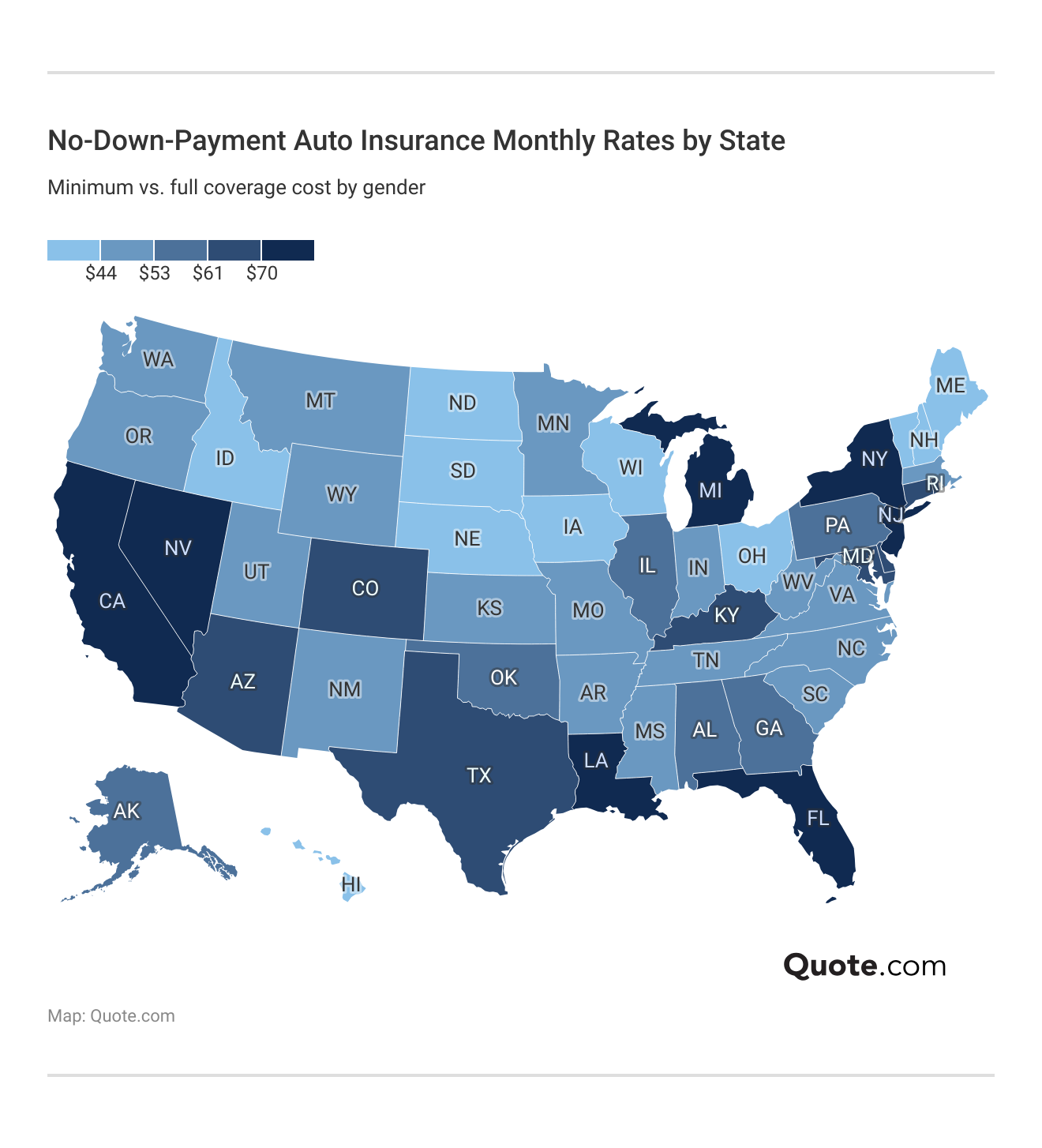

No-Down-Payment Auto Insurance Rates in Your State

No-down-payment auto insurance can look pretty cheap in one state and much more expensive in another. If you need no-down-payment auto insurance in Texas, rates start at $66 per month, $10 to $15 more than in neighboring states.

Where you live shapes what is considered cheap, and it also affects the overall average cost of auto insurance.

Even if two drivers are basically the same, where they live can affect the monthly cost because each state has its own rules, claim types, traffic, and repair costs.

In states where things cost more, getting coverage with a $0 down payment can help you get insured fast, but your monthly payments might be higher.

How Age Shapes No-Money-Down Car Insurance

Your age has a huge influence on cheap no-down-payment auto insurance costs. Teen drivers usually end up with the highest rates since insurers think they’re riskier,

Younger drivers often look at no-down-payment options to take the edge off that first bill (Read More: Best Auto Insurance for Young Adults).

No-Down-Payment Auto Insurance Monthly Rates by Age| Company | Age: 18 | Age: 25 | Age: 35 | Age: 45 |

|---|---|---|---|---|

| $172 | $102 | $89 | $78 | |

| $148 | $90 | $79 | $69 |

| $135 | $81 | $70 | $61 | |

| $123 | $74 | $64 | $56 |

| $165 | $97 | $84 | $74 | |

| $119 | $72 | $63 | $55 | |

| $183 | $108 | $94 | $82 |

| $139 | $84 | $73 | $64 | |

| $154 | $92 | $80 | $72 | |

| $128 | $77 | $67 | $59 |

Avoiding a down payment can feel like a win if you’re adding a teen driver, even if the monthly cost is still pretty steep.

Once you hit your mid-20s, your prices usually start to level out, especially when comparing different types of auto insurance.

How Your Record Affects No-Down-Payment Insurance

One thing that can change the cost of cheap no-down-payment auto insurance faster than you’d expect is your driving record.

Insurers pay close attention to your past habits since they use that to guess how risky you might be, so even one speeding ticket can bump your rate up.

No-Down-Payment Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $78 | $105 | $133 | $94 | |

| $69 | $93 | $118 | $84 |

| $61 | $83 | $105 | $74 | |

| $56 | $76 | $96 | $68 |

| $74 | $100 | $127 | $90 | |

| $55 | $74 | $94 | $66 | |

| $82 | $112 | $141 | $100 |

| $64 | $87 | $110 | $78 | |

| $72 | $95 | $120 | $85 | |

| $59 | $80 | $100 | $71 |

If you have a clean record, your bill is usually lower because insurers think you are a safer driver, especially when you’re trying to get coverage with no money down.

On the other hand, auto insurance after a DUI shows the largest increase. Knowing how all this impacts your price makes it easier to figure out whether a no-down-payment plan actually saves you money or just spreads out a higher cost.

How Credit Score Impacts Car Insurance With No Down Payment

Your credit score can really affect what you pay for cheap no-down-payment auto insurance, and the gap tends to grow as your score drops. If your credit falls into the fair or poor range, insurers usually charge more because they see it as a higher risk.

Erie and Geico are the best car insurance companies for drivers with poor credit, but the cheapest no-down-payment car insurance still costs twice as much as what drivers with excellent credit pay.

No-Down-Payment Auto Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670–799) | Fair (580–669) | Poor (<580) |

|---|---|---|---|---|

| $78 | $92 | $118 | $146 | |

| $69 | $82 | $105 | $131 |

| $61 | $72 | $93 | $118 | |

| $56 | $66 | $85 | $108 |

| $74 | $88 | $113 | $142 | |

| $55 | $65 | $84 | $106 | |

| $82 | $98 | $126 | $158 |

| $64 | $76 | $98 | $123 | |

| $72 | $86 | $111 | $139 | |

| $59 | $70 | $90 | $113 |

With better credit, it is easier to keep your monthly payments low while avoiding a large upfront payment with no deposit.

With lower credit, you likely won’t qualify for a reduced or $0 down payment on car insurance since providers see you as less likely to make payments on time, especially when shopping for no-deposit car insurance online.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Hidden Costs of No-Money-Down Insurance

A no-down-payment policy sounds like you can start coverage for free, but what it really means is that you are not paying an extra deposit just to activate the policy, which is why many people also call it no-money-down car insurance.

You will still usually owe something at signup, often your first month’s premium. Some companies might also throw in a small setup fee, and it’s easy to miss when you’re trying to get insured quickly.

Costs to Expect With a No-Down-Payment Policy| Cost Type | Amount | When Due |

|---|---|---|

| Down Payment | $0 | Not Required |

| 1st Month | $50–$95 | At Signup |

| Policy Setup | $0–$25 | At Signup |

| Premium | $50–$95 | Monthly |

| Policy Fees | $0–$10 | Monthly |

The main thing to know is that no-down-payment insurance just moves the cost into your first bill and monthly payments, rather than requiring a significant lump-sum upfront payment.

That can be a big help if you need coverage right away but do not want to pay a hefty upfront fee, and it is one of the reasons people get auto insurance right away by comparing what is due at signup before choosing a provider.

The cheapest option is usually the one with fewer extra charges. Ask about billing fees before you buy.

Michelle Robbins Licensed Insurance Agent

Just watch out for those small monthly policy fees, because they can sneak up on you over time.

If you budget for what you pay at signup and what you’ll keep paying each month, a no-down-payment policy can be an easy way to get covered fast without stressing your wallet.

Car Insurance With No Down Payment vs. Standard Auto Insurance

No-down-payment auto insurance might seem like the easiest choice since you can start your policy without paying anything right away.

However, insurers usually add that risk to your monthly bill, so your payments are often higher once the policy begins. With a traditional policy, you pay an upfront fee when you sign up, but this usually means your monthly rate is lower.

No-Down-Payment vs. Standard Auto Insurance Cost| Policy Type | Upfront Cost | Monthly Bill | 6mo Total |

|---|---|---|---|

| $0 Upfront | $0 | $78 | $468 |

| Traditional | $100–$200 | $65 | $390 |

Over a few months, that gap can add up, so the “cheaper” option really depends on your budget and when you can pay.

If you need coverage today and don’t have money for a deposit, no-down-payment is usually the best way to get insured fast. If you can pay upfront, traditional coverage is usually the best option for keeping costs down over time, especially when you follow smart tips to pay less for car insurance.

Who Qualifies for No-Down-Payment Auto Insurance

Qualifying for no-down-payment auto insurance really comes down to how risky you look to the insurer before you even apply.

If your credit and driving history show that you pay on time and have a clean record, insurers are more likely to let you start without a down payment.

Who Qualifies for No-Down-Payment Auto Insurance| Driver Profile | Approval | Explanation |

|---|---|---|

| Good Credit & Record | Likely | Most insurers approve |

| Average Credit | Possible | Limited carrier options |

| Recent Lapse | Unlikely | Upfront payment likely |

| DUI on Record | Very Unlikely | Usually not eligible |

If your credit is average, you might still get approved, but you could have fewer options and less flexibility to compare plans. If you recently had a coverage gap, insurers often want some money up front to feel more secure.

In general, drivers with good credit and a clean record have the best chance of getting no-down-payment coverage.

Learn More: How to Buy Auto Insurance

Auto Insurance Policy Options With $0 Down

Cheap no-down-payment auto insurance gives you the same coverage options you’d get with a regular policy, so the “no down payment” part mainly changes how you start the plan, not what protection you can choose.

Most people start with liability auto insurance coverage, which pays for the other driver’s injuries and damage if you cause an accident, and it’s usually what your state requires.

If you want your own car covered too, you can add collision auto insurance coverage to help pay for repairs after a crash and comprehensive coverage for things like theft, vandalism, storms, fire, or hitting an animal.

Many drivers also add uninsured or underinsured motorist coverage for extra protection. The key is choosing what you need so your no-down-payment plan stays affordable.

No-Down-Payment Car Insurance Payment Features

If you’re looking for affordable no-down-payment auto insurance, it’s helpful to find out which companies make the $0 down process simple. Providers with autopay are a good choice since they keep your payments regular and help you avoid missing a bill.

Be aware of billing fees. Even if you don’t have to pay a deposit, these extra charges can increase your monthly bill.

No-Down-Payment Auto Insurance Options by Provider| Company | Autopay | Billing Fees | No Deposit |

|---|---|---|---|

| ✅ | ✅ | ✅ | |

| ✅ | ❌ | ❌ |

| ❌ | ❌ | ❌ | |

| ❌ | ❌ | ❌ |

| ✅ | ✅ | ✅ | |

| ✅ | ✅ | ✅ | |

| ✅ | ✅ | ✅ |

| ✅ | ❌ | ✅ | |

| ✅ | ✅ | ✅ | |

| ✅ | ❌ | ✅ |

Companies with autopay and no-deposit options are often the easiest choice if you want quick coverage without extra hassle. If a company doesn’t offer a no-deposit plan, you’ll likely need to pay up front.

Taking a quick look at these features before you choose can help you avoid surprises and keep your no-down-payment plan truly affordable when you get multiple auto insurance quotes.

Ways to Save on No-Down-Payment Insurance

Discounts are what really help no-down-payment auto insurance stay affordable once the monthly bills start rolling in.

Bundling discounts reward you for stacking policies with the same company, so drivers who also need renters or homeowners insurance often get the biggest payoff.

Top Discounts for Auto Insurance With No-Down-Payment| Company | Bundling | Good Driver | Multi-Vehicle | Usage-Based |

|---|---|---|---|---|

| 25% | 25% | 10% | 40% | |

| 25% | 25% | 23% | 20% |

| 30% | 25% | 25% | 20% | |

| 25% | 23% | 10% | 30% |

| 20% | 30% | 12% | 30% | |

| 25% | 26% | 25% | 25% | |

| 25% | 20% | 25% | 30% |

| 20% | 40% | 15% | 40% | |

| 15% | 20% | 20% | 30% | |

| 17% | 25% | 20% | 30% |

Good driver discounts also help because insurers reward lower-risk drivers, which keeps no-down-payment costs down. The easiest way to save more is to stack the discounts you qualify for, since even two can significantly lower your monthly payment.

But discounts aren’t the only way to cut costs. If you want cheap no-down-payment auto insurance to stay affordable long-term, it also helps to reduce fees, trim add-ons, and set up your policy in a way that keeps your monthly bill as low as possible.

- Avoid a Lapse in Coverage: Even a short gap can raise your rate or trigger upfront payment requirements.

- Go Paperless: Some companies add small billing or document fees, and going paperless can help you skip them.

- Match Coverage to Your Car’s Value: If your car is older or already paid off, you might no longer need collision or comprehensive coverage.

- Remove Add-Ons You Don’t Need: Extras like roadside assistance or rental reimbursement can raise your monthly cost.

- Use Autopay: This can reduce payment-related fees and lower the chance of missing a due date.

When you stack the right discounts with a few simple tweaks, it’s a lot easier to keep no-down-payment insurance affordable month to month.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

No-Down-Payment Insurance: Pros and Cons

Cheap no-down-payment car insurance can be a solid option if you need coverage quickly and don’t want to deal with a big upfront bill.

The biggest win is cash flow, since you can get insured right away and just pay month to month. It can also come in handy after a lapse if you need to get back on the road but don’t have extra money sitting around.

Pros & Cons of No-Down-Payment Auto Insurance| Advantages | Drawbacks |

|---|---|

| Easier cash flow | Possible payment fees |

| Faster policy start | Fewer insurer options |

| Helpful after a lapse | Limited eligibility |

| No large upfront cost | Higher monthly payments |

| Same coverage types | Less pricing flexibility |

The downside is that your monthly payments may be higher, and some companies could add payment fees, making it more expensive. You may also have fewer insurers to choose from and less pricing flexibility, even if you’re shopping for comprehensive auto insurance.

This type of insurance is usually best for drivers who need quick coverage and flexibility at the start, rather than the lowest cost over time.

10 Cheapest No-Down-Payment Companies

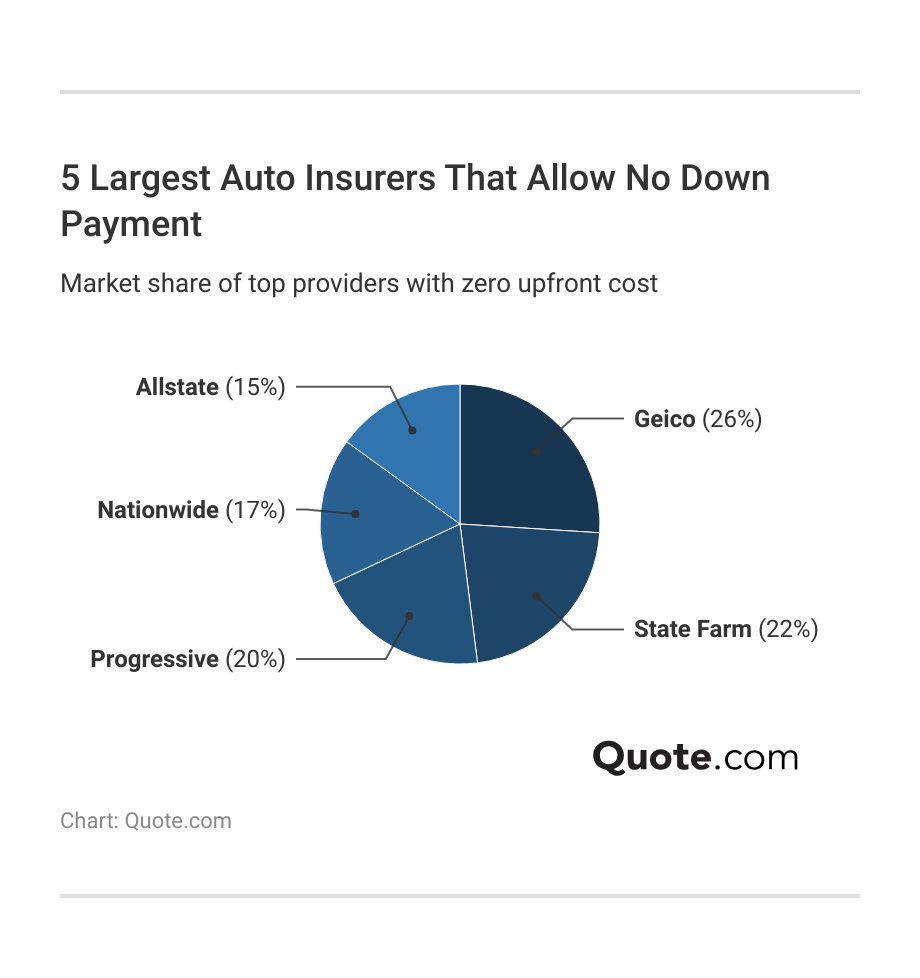

When people look for cheap no-deposit car insurance, they usually start with the biggest companies. This makes sense because these companies are the most popular and easiest to find across multiple states.

Geico, State Farm, Progressive, Nationwide, and Allstate dominate the market because they are easy to find, well-known, and simple to sign up with. This is especially true if you want $0 down and a quick online process.

Large insurance companies usually offer smoother billing and faster quotes. This makes it easier to get coverage without paying anything up front.

However, looking at different driver profiles shows that the biggest company is not always the best choice for everyone.

Cheapest No-Down-Payment Choice by Driver Profile| Driver Type | Best Option | Monthly Rate |

|---|---|---|

| Budget-Focused | $55 | |

| Frequent Claims |  | $56 |

| Clean Record | $59 | |

| Service-Focused | $61 | |

| Multiple Policies | $64 | |

| Family Coverage |  | $69 |

| Digital Shopper | $72 | |

| Recent Accident | $74 | |

| Agent Support | $78 | |

| Flexible Needs |  | $82 |

Some companies are better for people who want to save money, while others are a good choice if you need to make claims often, mostly buy online, or want help from a real agent.

Even smaller regional companies can be the best $0-down fit depending on your needs, so match your driver type to the right insurer to get the cheapest car insurance for your situation.

#1 – Geico: Top Pick Overall

Pros

- Safe-Driver Pricing Advantage: Geico usually offers good rates for drivers with clean records, so a $0 down payment is easier to manage each month.

- Lowest Monthly Rate: At $55 per month, this is an affordable option with no down payment and no large first bill.

- DriveEasy Telematics: Using DriveEasy can save you up to 25%, which helps lower your monthly cost with no down payment.

Cons

- Moderate Satisfaction: Geico has a J.D. Power score of 697 out of 1,000, indicating an average claims experience rather than an excellent one.

- Budget-Focused Tradeoff: According to our Geico insurance review, the no-down-payment appeal relies more on low cost than top-tier satisfaction.

#2 – Erie: Best for Filing Claims

Pros

- Claim-Filing Strength: Erie scores 743/1,000 for satisfaction, so no-down-payment drivers can feel more confident if they need to file a claim after an accident.

- Low Monthly Cost: At $56 per month, Erie stays close to the cheapest no-down-payment options on the list.

- Rate Lock Stability: Erie’s Rate Lock helps limit premium increases, which can protect your no-down-payment savings over time.

Cons

- Limited Availability: Erie only sells auto insurance in 12 states and Washington, D.C., so many no-down-payment shoppers cannot access its coverage.

- Claims-First Focus: As this Erie insurance review points out, if you rarely file claims, you might end up paying a little more than you really need with a no-down-payment plan.

#3 – State Farm: Best for Safe Drivers

Pros

- Drive Safe & Save Savings: With Drive Safe & Save, you can score lower rates based on how you drive, helping keep no-down-payment insurance costs lower over time.

- Local Agent Support: State Farm’s large agent network makes it easier to get one-on-one help when setting up no-down-payment coverage.

- Affordable Monthly Rate: This State Farm review shows you can get started at around $59 a month, helping keep no-down-payment coverage budget-friendly.

Cons

- Tracking isn’t for Everyone: If you don’t want an app tracking you, Drive Safe & Save may not be worth it.

- Prices Can Change Later: Your no-down-payment rate may increase at renewal if your driving data or discounts change, so the lowest price isn’t guaranteed.

#4 – Amica: Best for Customer Service

Pros

- Service Leader Proof: Amica has the highest customer score at 718/1,000, which is excellent for no-down-payment drivers who just want things to go smoothly.

- Dividend Policy Perk: Amica offers dividend-paying policies in many states, which can return money and help lower the real cost of no-down-payment coverage.

- Easy Online Management: Online billing and claims tools help no-down-payment drivers avoid hassles.

Cons

- Dividends Aren’t Guaranteed: Dividend payouts can vary, so no-down-payment savings aren’t always predictable.

- Availability Can Be Limited: This Amica insurance review notes that options can vary by state for no-down-payment shoppers.

#5 – Nationwide: Best for Bundling Discounts

Pros

- Bundling Savings Standout: This Nationwide insurance review is a reminder to bundle auto with home or renters and compare which discounts lower your $0 down bill.

- SmartRide Savings: With SmartRide, you can earn discounts based on how you drive, helping keep costs down over time.

- Vanishing Deductible: Nationwide offers a vanishing deductible, so what you pay out of pocket can shrink over time, which helps when starting coverage with no money down.

Cons

- Telematics Takes Buy-In: SmartRide works best if you are okay sharing driving data, which some $0 down shoppers may want to skip.

- Discounts Can Change at Renewal: SmartRide results can change, so no-down-payment savings may not last in the long term.

#6 – American Family: Best for Family Coverage

Pros

- Family Coverage Positioning: American Family is a good fit for no-down-payment shoppers trying to cover more than one driver at home.

- Teen Driver Savings: It offers discounts like good student and student away at school, which can really help families keep no-down-payment costs down.

- Telematics Savings Option: With KnowYourDrive, safe drivers in your household can earn discounts over time, making no-down-payment coverage easier to stick with.

Cons

- Not Available Everywhere: As mentioned in this American Family insurance review, American Family isn’t available nationwide for no-down-payment shoppers.

- Tracking Might Be a Turnoff: KnowYourDrive uses driving data, and not everyone wants that just to save on no-down-payment coverage.

#7 – Safeco: Best for Online Tools

Pros

- Online Tools That Help: Safeco lets you quickly pull ID cards, pay bills, and track claims online, which is handy for $0 down shoppers.

- Mobile App Convenience: With Safeco’s app, you can access digital ID cards, pay your bill, and check the status of your claims without calling anyone.

- RightTrack Discount Option: Safeco’s RightTrack program can lower premiums based on driving behavior, helping no-down-payment coverage stay cheaper over time.

Cons

- RightTrack Requires Monitoring: No-down-payment drivers who don’t want an app tracking their driving may miss out on Safeco’s biggest savings option.

- Fewer Local Support Options: Safeco is pretty digital-first, so in-person help may be limited for no-down-payment policies, as this Safeco insurance review explains.

#8 – Farmers: Best for Accident Forgiveness

Pros

- Accident Forgiveness Focus: Farmers can help keep your rate from jumping after your first at-fault accident, which helps when you manage a $0 down monthly payment.

- Signal App Discount: By using the Signal app, you might get discounts based on your driving, which can lower the cost of your no-down-payment coverage.

- New Car Replacement Option: Farmers has new car replacement, which is a perk if you’re covering a newer car and kicking things off with a no-down-payment plan.

Cons

- Accident Forgiveness Has Fine Print: Farmers’ accident forgiveness depends on driving history and time with the company, so some $0 down drivers may wait.

- Signal App Isn’t for Everyone: As this Farmers review explains, if you don’t use the app, you could miss discounts that help keep no-down-payment coverage affordable.

#9 – Allstate: Best for Multiple Discounts

Pros

- Substantial Discount Variety: Allstate also has discounts like multi-policy, safe driver, and new car, so you can cut your monthly cost even if you skip the down payment.

- Local-Agent Advantage: Allstate is a good pick if you want an agent to walk you through no-down-payment coverage.

- Drivewise Discount Option: With Drivewise, you can earn discounts based on how you drive, helping keep no-down-payment insurance costs lower.

Cons

- High Monthly Rate: As this Allstate insurance review shows, at $78 a month, it’s tougher to call this a cheap no-down-payment option.

- Satisfaction Doesn’t Match the Cost: With a 693/1,000 score, the experience might feel a bit underwhelming for what you’re paying on a no-down-payment policy.

#10 – Liberty Mutual: Best for Flexible Policies

Pros

- Flexibility Focus: According to Liberty Mutual reviews, this insurer is a good pick for no-down-payment drivers who want more control over their policy.

- Wide Discount Variety: It’s also got discounts like multi-policy, multi-car, and safe driver, which can help keep no-down-payment costs lower.

- Useful Coverage Add-Ons: With add-ons like accident forgiveness and new car replacement, you’re less likely to see a big premium spike after an accident.

Cons

- Savings Aren’t Always Instant: With no-down-payment coverage, some discounts only kick in if you sign up or meet requirements, so you might not get the best rate right away.

- Add-Ons Can Get Pricey: Liberty Mutual offers a lot of extras, but piling them on can quickly raise your no-down-payment premium.

Find No-Down-Payment Car Insurance Online

No-down-payment car insurance is a solid choice if you need coverage fast and want to skip a big upfront bill. Geico no down payment is popular because it’s easy to sign up, and the pricing stays pretty steady.

Before you choose a policy, watch for billing or installment fees, since they can sneak in and raise your monthly cost.

Using autopay and choosing paperless billing can help you avoid extra admin charges. If your credit or driving record has issues, keeping your insurance active is important, since a gap could mean you have to pay more upfront later.

When you’re ready to shop, compare several quotes and enter your ZIP code to find the most affordable $0 down options in your area.

Frequently Asked Questions

Can you get car insurance without a down payment?

Yes, but “no down payment” usually just means no extra deposit. You’ll still pay the first month at signup, plus any setup fees.

Is there a car insurance that doesn’t require a deposit?

Yes, some insurers offer no-deposit plans, meaning they do not charge an extra upfront amount, but the first bill is still due immediately.

Is no-down-payment car insurance legit?

Yes, it’s legit when it comes from a licensed insurer, but you’ll usually trade that $0 down for higher monthly payments or extra fees, and some drivers prefer pay-as-you-go auto insurance since it matches the cost more closely to how much they actually drive.

How do I avoid putting a down payment on car insurance?

Choose a $0 down insurer, set up autopay, and avoid lapses since gaps can trigger upfront payments.

What credit score is needed for no-down-payment auto insurance?

You don’t need a specific credit score, but having a higher score can make it easier to qualify. In states that use credit-based pricing, a lower score may lead to higher monthly costs.

Can I get auto insurance and pay later?

Most insurers do not allow delayed payment because the first month is typically due at signup, even on $0 down plans, so coverage starts only after payment, which is why it helps to look into hacks to save money on auto insurance before you choose a provider.

Are you supposed to get car insurance before you get a car?

Yes, dealerships and lenders usually require proof of insurance before you drive off, and many states require insurance to register the vehicle.

How many days after buying a new car do you have to insure it?

If you already have insurance, many companies give a short grace period to add the new car, but it is safest to insure it immediately because rules vary.

What car insurance companies do not check credit?

In states like California, Hawaii, Massachusetts, and Michigan, insurers cannot use credit scores for pricing, so credit is not part of the rate calculation, including for many auto insurance companies in California.

What are my alternatives to no-deposit car insurance?

A good alternative is paying a small upfront amount to unlock a lower monthly bill, choosing minimum coverage, raising deductibles, or paying the policy in full to avoid installment fees.

Who has the lowest down payment for car insurance?

What kind of car insurance can I get for $200 a month?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.