How to Get an Anonymous Auto Insurance Quote in 2026

To get an anonymous auto insurance quote, enter your ZIP code along with your car’s year, make, and model. You can compare rates starting at $43 per month without sharing personal details. Learn how to get a quote, review coverage limits, and weigh privacy trade-offs online.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Creator

Lia Vergin develops both video and written content across all lines of insurance, with a primary focus on auto, home, and life coverage. She is dedicated to helping consumers better understand and navigate their insurance options. Driven by a passion for saving money and finding great deals, she is committed to creating clear, engaging, and practical content that empowers readers to make confident...

Lia Vergin

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding c...

Meggan McCain

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated January 2026

If you’re wondering how to get an anonymous auto insurance quote without personal information, start using online insurance comparison sites with only your ZIP code.

- Get anonymous auto insurance quotes using only your ZIP code

- Anonymous quotes start at $43 a month without personal details

- Discounts up to 25% appear only after you share your full driver info

These platforms use ZIP code pricing and vehicle class data to group drivers into risk categories. This way, you can get a car insurance quote without personal information or verifying your identity.

You can look at both minimum and full coverage options and see how staying anonymous might affect your discounts and underwriting. You only need to verify your driver details if you decide to make a purchase.

Get anonymous car insurance quotes without phone calls by entering your ZIP code to view coverage estimates without sharing personal contact details.

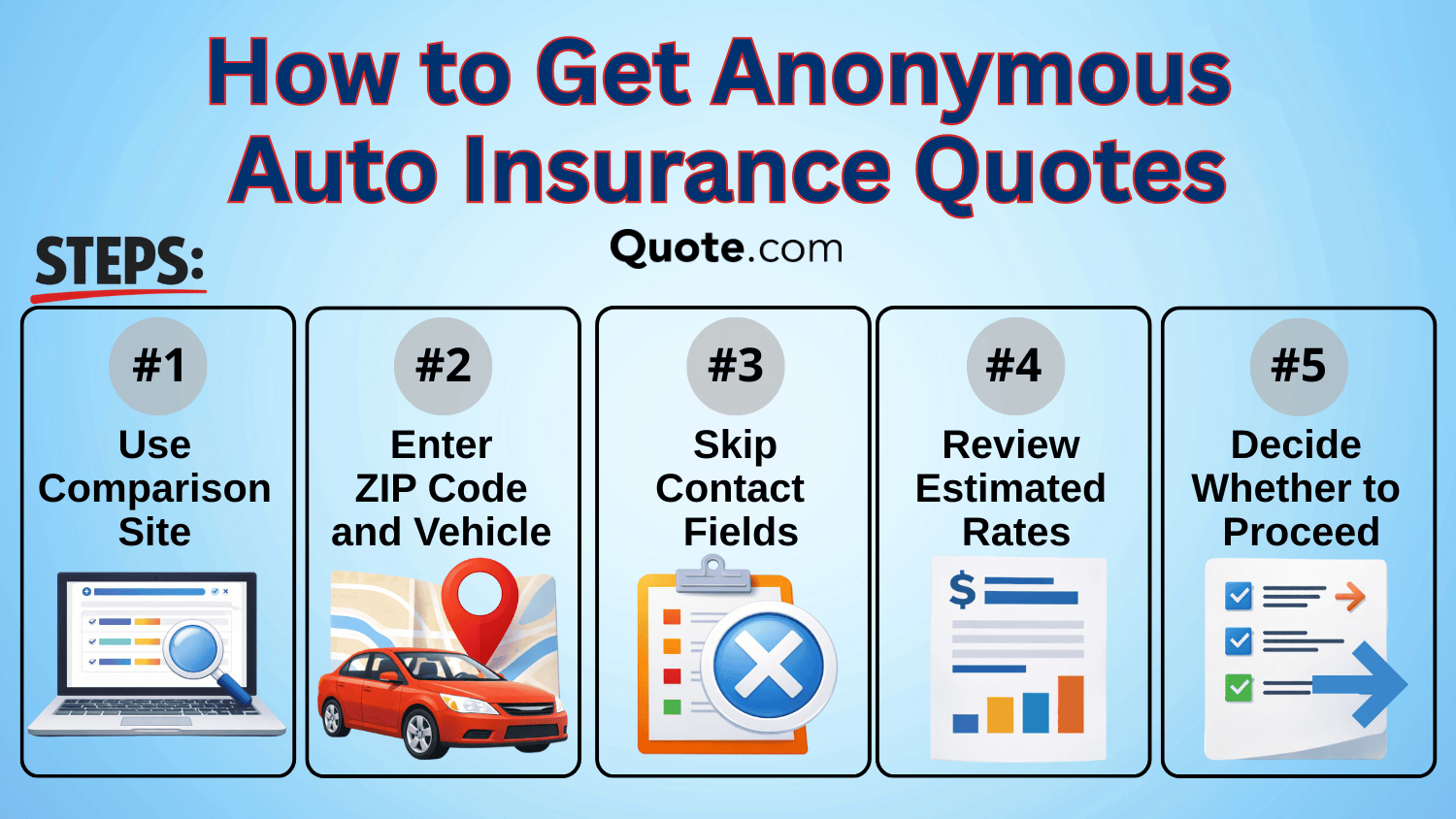

How to Get Anonymous Car Insurance Quotes

Curious about how to get an anonymous auto insurance quote online? Start shopping around with multiple companies at once.

The easiest way to get an anonymous auto insurance quote online is to use comparison sites that pull rates from three or more providers and list them side-by-side.

Steps to Get an Anonymous Auto Insurance Quote Online| Step | Action | Details |

|---|---|---|

| #1 | Visit comparison site | Minimal info needed |

| #2 | Enter your ZIP code | Local rates displayed |

| #3 | Add vehicle details | Year, make, model only |

| #4 | Answer driver details | Age and driving history |

| #5 | Review quote options | No contact required |

These sites give you quick price estimates without asking for your name or vehicle identification number (VIN). All you need is your ZIP code to get results based on local risk factors.

The year, make, and model of your vehicle affect repair costs, safety ratings, and how often claims are made. These details help set your price range without needing extra searches.

Your age group and driving history also change your estimate. These factors can shift prices by 15% to 30%, and you don’t have to enter your license number.

Looking at quotes side by side helps you narrow down your coverage options. You can do this before sharing your personal details securely later on.

This approach lets you compare coverage levels and price ranges first without triggering calls or emails.

Learn More: How to Compare Auto Insurance Companies

Step #1: Visit Comparison Sites

Begin by choosing a comparison site that lets you view auto insurance quotes without providing your name, phone number, or email address.

These platforms collect price estimates from multiple insurers, making it easier to compare no personal information car insurance quotes before sharing any personal details.

Auto Insurance Quote Methods: Privacy & Use Case| Quote Method | Privacy Level | Best Use Case |

|---|---|---|

| Comparison Sites | High: minimal personal info | Fast anonymous estimates |

| Insurer Websites | Medium: some contact info | Checking a specific insurer |

| Insurance Agents | Low: personal info needed | Personalized coverage help |

If you want an anonymous auto insurance quote, start by sharing only the basics. This helps you avoid spam emails, robocalls, and unwanted sales calls while you research.

Comparison tools that use your ZIP code work well for drivers aged 18 to 65 who want a general idea of prices without receiving follow-up calls. Monthly premiums for minimum coverage start at $43 a month if you have a good driving record.

Most insurance companies ask for your contact details, but if you are a high-risk driver, you can get anonymous quotes first. This lets you see how tickets or accidents might affect your rates before you share any personal information.

If you have anonymous quotes that show lower monthly prices, you can use them to negotiate with an agent. These quotes can help you prove what other companies are offering and help you get affordable coverage if standard insurers turn you down.

Step #2: Enter Your ZIP Code

Next, type in your ZIP code. This helps the system find local risk factors and state coverage rules for you.

This step connects your location to data such as traffic, theft rates, and claim trends. It does not show your address or street.

Info Required at Each Stage of Auto Insurance Shopping| Stage | Info Needed | Purpose |

|---|---|---|

| Anonymous Quote | ZIP code and vehicle basics | View price ranges privately |

| Detailed Quote | Driver details and coverage level | Refine pricing and eligibility |

| Policy Purchase | Identity and license verification | Activate and bind coverage |

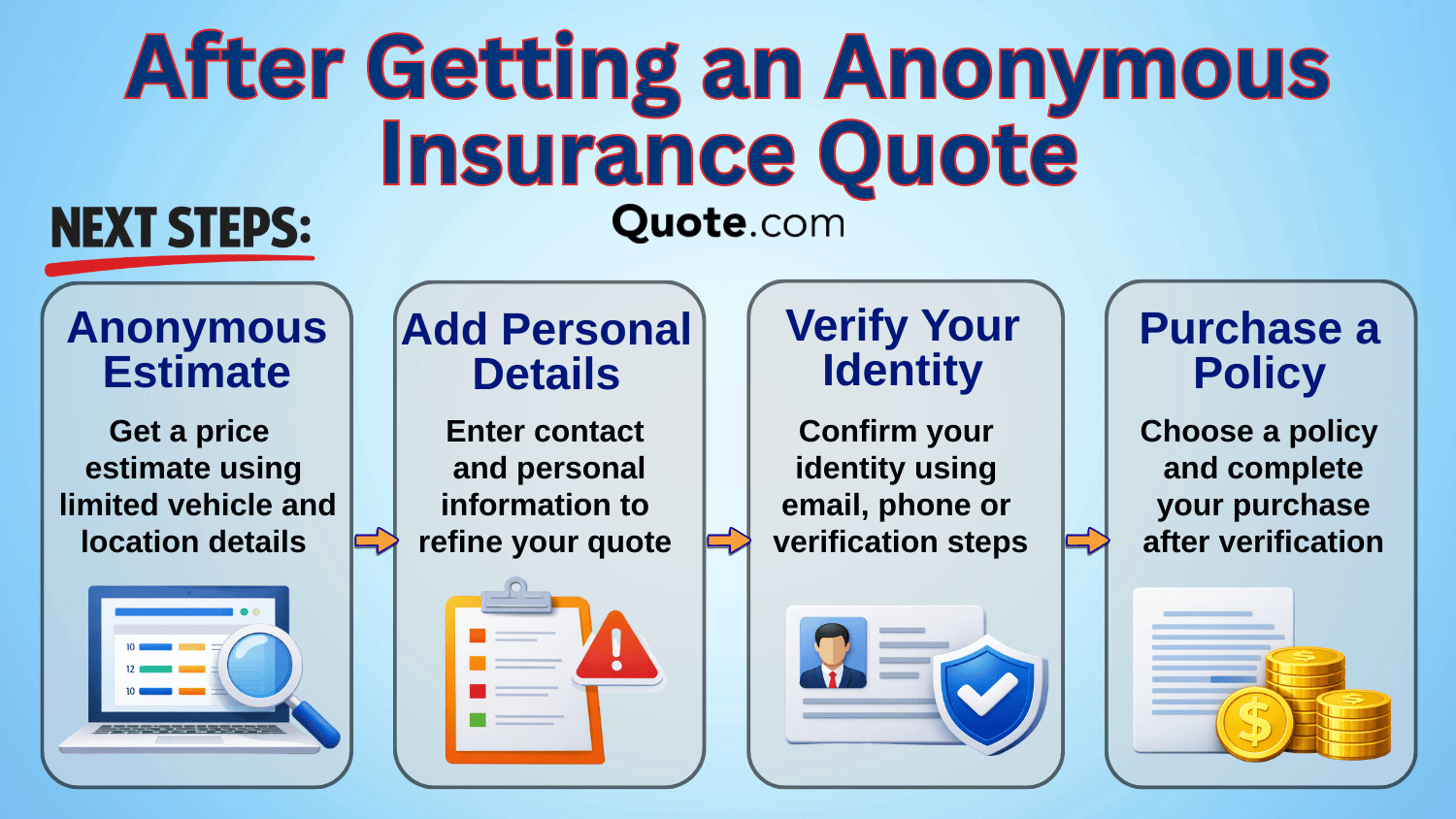

When you start shopping for coverage online, you begin anonymously and only need to share more details as you get closer to buying a policy.

At first, drivers just provide their ZIP code and basic vehicle information to see monthly price ranges privately, with no commitment needed.

For detailed quotes, you’ll need to share your age, driving record, and coverage limits. These details can change your estimate by 20% or more.

It’s best to review your anonymous results before buying a policy, since identity checks are needed to finalize your rate and activate coverage for drivers across the country.

Read More: How to Buy Auto Insurance

Step #3: Add Vehicle Details

Enter basic details about your vehicle, like the year, make, and model. This helps estimate repair and replacement costs.

If you leave out the VIN, your quote stays anonymous, but insurers can still see safety features and vehicle class information.

Details Requested in Anonymous Auto Insurance Quotes| Info Requested | How it's Used |

|---|---|

| Coverage Level | Used to estimate prices from selected limits |

| Driver's Age | Used to group drivers into pricing tiers |

| Driving History | Sometimes used to improve quote accuracy |

| Email Address | Sometimes requested to save or view results |

| Full Name | Not required to view anonymous quotes |

| Phone Number | Not required to access estimated quotes |

| Vehicle Class | Used to determine base risk & pricing factors |

| Vehicle Details | Year, make, and model used to assess repairs |

| ZIP Code | Required to determine local and state rates |

To get the best anonymous quotes, start by giving only the basics and focus on the price details instead of entering your personal information.

Where you live matters a lot for estimates because state laws, traffic, and claim rates all influence the average monthly cost. Learn auto insurance requirements by state for accurate anonymous quotes.

The kind of car you have and its safety record can really affect your estimate, but ownership records are only checked once you decide to buy.

It’s best to compare price ranges first. Add your personal details only after you’ve narrowed down your coverage options and are ready to make a purchase.

Step #4: Answer Driver Details

Answer a few questions about your age range and driving history. This helps estimate your price range. You can usually pick options like ‘clean record’ or ‘prior incident’ without giving your license number yet.

Getting insurance quotes anonymously is easier if you know which details change the price and which could delay online verification later.

Personal Info Requested for Anonymous Insurance Quotes| Not Required | Often Optional | May Be Needed |

|---|---|---|

| Full name | Phone number | Vehicle ID (VIN) |

| Driver’s license | Email address | Driving history |

| Address | Date of birth | Coverage history |

You can see early price estimates based on your age range and vehicle type without giving your identity when you browse anonymously.

Adding optional details can make your quote more reliable, but you’ll get the most accurate price after insurers review your history, eligibility, and coverage.

You only need to give your VIN when you’re ready to buy. This lets insurers lock in your rate, make fewer changes, and confirm your acceptance.

However, if you want to buy cheap no-down-payment car insurance, you’ll have to provide more personal details upfront, including VIN and credit score information.

Step #5: Review Quote Options

Finally, you can review quote options. Price ranges for minimum and full coverage auto insurance are shown side by side for each insurer.

This lets you compare coverage limits and privacy choices before you decide to share more details or buy a policy.

Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $65 | $122 |

| $87 | $228 | |

| $62 | $166 |

| $65 | $215 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $47 | $123 | |

| $53 | $141 |

American Family, Nationwide, and Travelers are mid-range options. Their monthly rates increase somewhat when drivers choose full coverage.

See More: American Family vs. Travelers

AAA and Amica usually charge more for full coverage. It’s a good idea for shoppers to compare prices before choosing a policy.

Even one speeding ticket can raise auto insurance costs by about 15–20%, since insurers see violations as higher risk.

Michelle Robbins Licensed Insurance Agent

Farmers is often priced between budget and premium options. This can help drivers who want to balance protection, monthly costs, and coverage choices.

Given these trends, Geico is still the best choice for most drivers looking for affordable minimum and full coverage. You can see pricing and coverage options in our Geico insurance review.

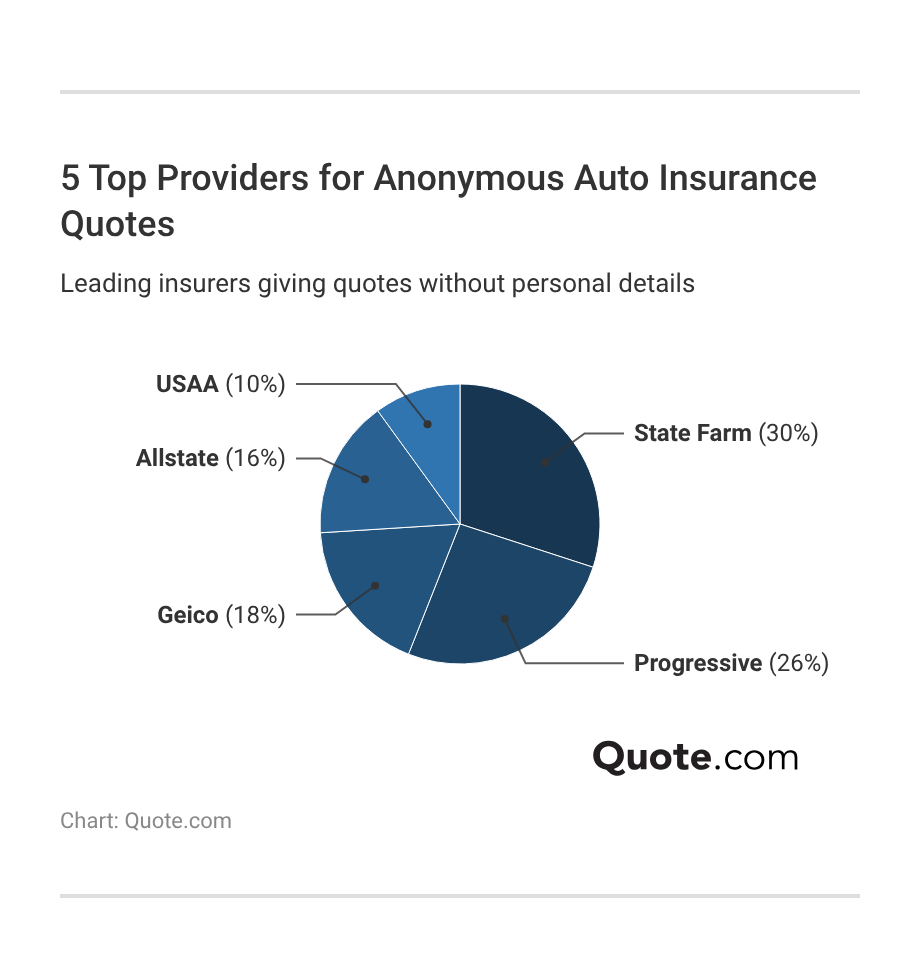

The biggest and most well-known insurance companies usually offer the most reliable anonymous quotes since their pricing covers more states and types of drivers.

Getting quotes straight from these major companies lets you compare real rates before you have to give any personal information.

After reviewing the anonymous quotes, review them first to see if the price range fits your needs before you share more information.

Only add your driver and coverage details when you are ready to check if you qualify and want to make a purchase.

Read More: State Farm vs. Farmers, Geico, Progressive & Allstate Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Anonymous Car Insurance Quotes by State

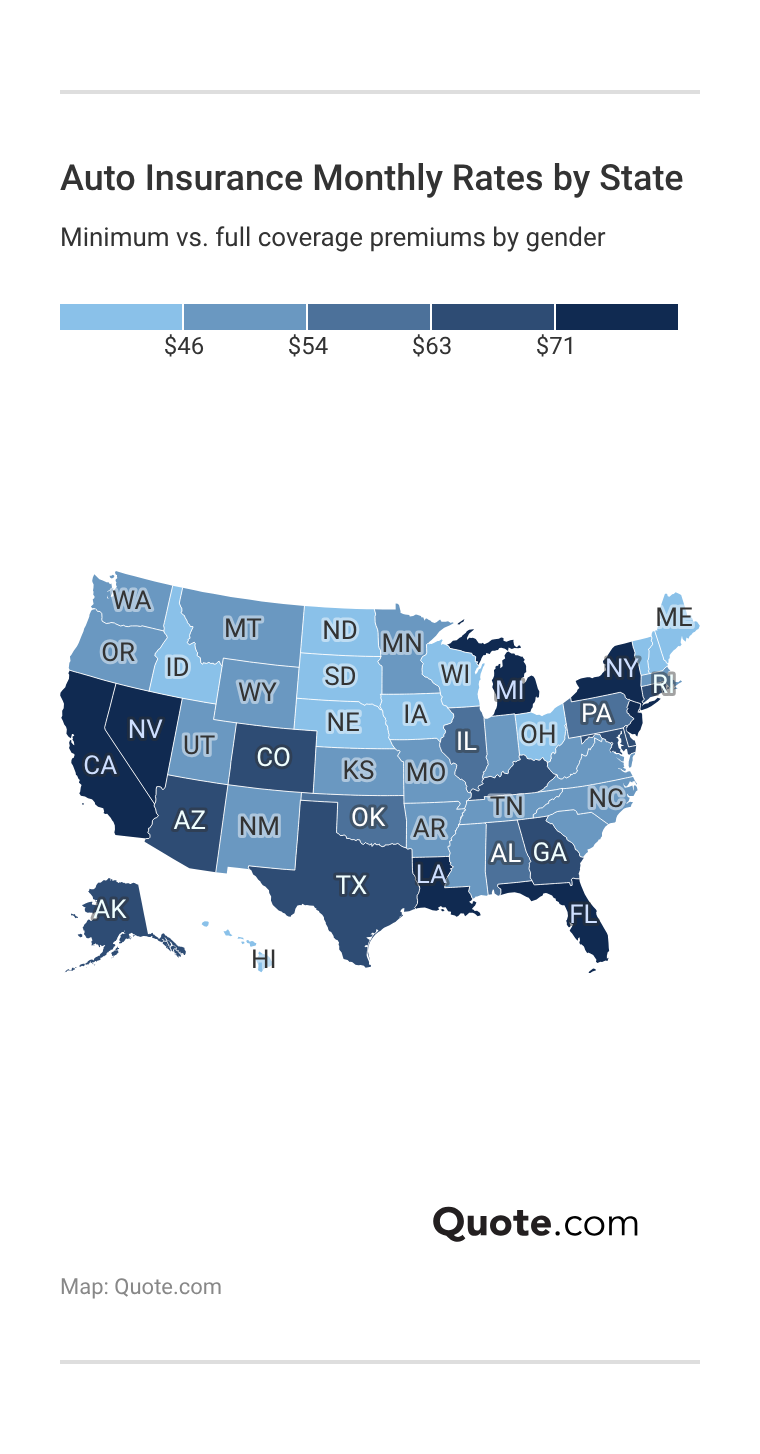

Anonymous insurance quotes let drivers see how state rules and gender-based pricing affect their monthly premiums before they give out any personal information.

In states that allow gender-based pricing, the difference between minimum and full coverage costs is bigger than in states that do not use gender as a factor.

In states with more frequent claims, upgrading your coverage usually raises your monthly costs more quickly, even if anonymous quotes seem similar at first.

The easiest states for comparing anonymous quotes are those with steady rate rules, where changes in coverage lead to predictable price changes.

Learn More: 10 Worst States for Filing Auto Insurance Claims

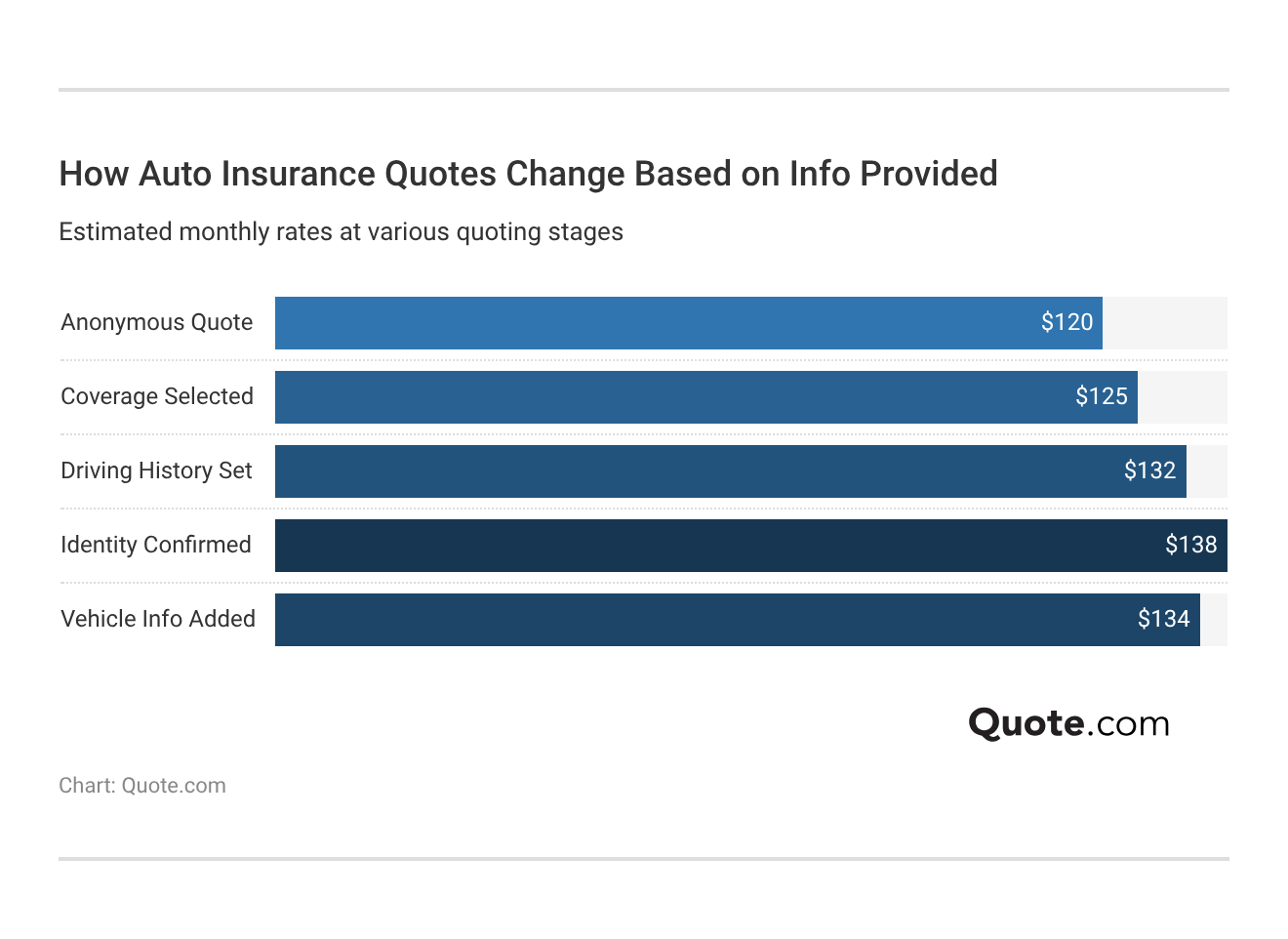

Explaining Shifts in Anonymous Quote Pricing

If you ask for an anonymous auto insurance quote, the estimate is usually broad and flexible since insurers only use a small amount of risk information at first, not your full records.

Early estimates are often lower because your driving record, ownership details, and identity checks are not included during the first, privacy-focused stage online.

Rates usually go up as you share more details, such as your coverage choices, vehicle information, and loss history.

This extra information lets insurers give a more accurate quote and begin their validation process. See the average cost of auto insurance before entering full driver information.

Why Drivers Want to Stay Anonymous

Can you get a car insurance quote without giving personal information? Many drivers search for a car insurance quote without personal information to review coverage options privately without sharing contact details or beginning a formal application.

Privacy is especially important for drivers who have had lapses, tickets, or claims and want to compare car insurance quotes without getting phone calls.

Quick comparisons help drivers who are juggling work, family, and policy renewals, since fast estimates save time when researching online in private.

Another reason is to avoid sales calls, which lets drivers choose when to decide on coverage and next steps at their own pace. Always look online first to weigh your options and shop around for car insurance without sharing an email or phone number.

Read More: Types of Auto Insurance

Understanding Anonymous Quote Limitations

Anonymous auto insurance quotes are helpful for people who want to check prices early without giving out personal information while researching online.

These tools use limited risk information, so you may see fewer insurance companies than if you filled out a full quote.

Anonymous Auto Insurance Quotes: Tradeoffs| Pros | Cons |

|---|---|

| Fewer calls or emails | Limited insurer participation |

| Better data privacy | Some discounts may not appear |

| Compare without contact | Extra steps to finalize pricing |

| No details required upfront | Initial quotes are less precise |

| Fast price estimates | Full details needed to purchase |

Discounts for things like your driving record, mileage tracking, or having more than one policy usually appear only after you confirm who you are.

Anonymous quotes are designed to be quick, not exact, so the monthly price often changes after you provide more details.

Anonymous tools compare ranges but final tiers depend on records you cannot hide. For example two tickets raise rates 30%.

Jeff Root Licensed Insurance Agent

It’s smart to protect your privacy at first, but be prepared to share more information before you buy coverage from a licensed insurer. Check out the documents needed to buy auto insurance when you’re ready to get a policy.

Drivers get the most out of anonymous quotes by using them to compare price ranges, then taking their time to get more accurate details before making a decision.

View anonymous auto insurance quotes by entering your ZIP code to compare coverage estimates without sharing personal identifiers.

Frequently Asked Questions

Can I get an anonymous car insurance quote?

Yes, an anonymous car insurance quote is possible through comparison sites that only require a ZIP code and basic vehicle details. These quotes show estimated monthly price ranges without asking for a full name, phone number, or driver’s license until purchase. Find auto insurance rates by vehicle without submitting contact details.

Can I get an insurance quote without an email address?

Yes, many online quote tools allow shoppers to get insurance estimates with only a ZIP code and vehicle details, letting shoppers compare prices without providing an email or receiving follow-up messages.

Can I get an anonymous motorcycle insurance quote online?

Yes, an anonymous motorcycle insurance quote can be viewed using a ZIP code and basic bike details. Monthly estimates appear without a name or phone number.

Can you get an insurance quote without talking to someone?

Yes, many online tools allow drivers to get insurance quotes without talking to someone by using automated forms. Monthly estimates are generated instantly based on location, vehicle type, and age range without agent interaction. Enter your ZIP code to get an anonymous quote today.

Can I get an anonymous home insurance quote without sharing personal details?

Yes, an anonymous home insurance quote is available using property basics like ZIP code and dwelling type. Contact details are not required to view estimates.

Is it cheaper to go to an insurer directly or comparison shop?

Comparison shopping is usually cheaper because it shows multiple pricing models at once, revealing monthly differences that direct insurer quotes may not disclose without full verification.

What should I not say to an insurance agent?

Avoid guessing about accidents, mileage, or prior claims when speaking with an insurance agent. Inaccurate statements can affect eligibility, pricing, or coverage approval.

How do you get car insurance quotes without getting spammed?

To get car insurance quotes without getting spammed, use platforms that clearly state no phone number is required. Avoid entering an email address early, since follow-up messages usually start after contact details are submitted.

Is it possible to get health insurance quotes without phone calls?

Yes, you can get a health insurance quote without email or phone call spam. Quotes are available through online tools that use age and location, but results show estimated monthly premiums only.

What is the best way to get cheaper car insurance quotes?

The best way to get quotes for car insurance at lower monthly prices is to start by comparing premiums using your ZIP code and vehicle details, then refine coverage limits and deductibles to reduce overall costs.

What do you do if nobody will insure you?

Who typically has the cheapest car insurance?

At what age is car insurance most expensive?

Is $300 a month bad for auto insurance?

Is it better to have a $500 deductible or a $ 1,000 deductible?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.