Best Auto Insurance for Trucks in 2026

Erie, Liberty Mutual, and Nationwide have the best auto insurance for trucks. Truck coverage starts at $80 per month for minimum protection, while usage-based discounts can reduce costs by 40%. Look for insurers with strong claims scores, financial stability, and truck-focused perks to get the best coverage.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Karen Condor is an insurance and finance writer who has degrees in both journalism and communications. She began her career as a reporter covering local and state affairs. Her extensive experience includes management positions in newspapers, magazines, newsletters, and online marketing content. She has utilized her research, writing, and communications talents in the areas of human resources, f...

Karen Condor

Managing Editor

Aleksandra J. Churlinov holds a Bachelor of Arts in English Language and Literature and a Master of Science in Marketing Management. Over the past six years, Aleks has focused on the insurance sector, working on a range of content, including business, auto, and life insurance. In April 2025, she stepped into the role of Managing Editor, where she now leads a team of talented insurance writers. ...

Aleksandra J. Churlinov

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated January 2026

The best auto insurance for trucks is with Erie, Liberty Mutual, and Nationwide, which are known for high claims satisfaction and financial strength.

- Clean driving records can lower truck insurance costs by 25% to 30%

- Nationwide SmartRide can reduce truck insurance costs by up to 40%

- Erie locks in cheap rates for truck drivers even after an accident

Erie is a strong choice for cost-conscious truck owners, maintaining competitive pricing at $110 a month.

Liberty Mutual appeals to truck owners seeking accident forgiveness protection and strong safety feature discounts.

Top 10 Companies: Best Auto Insurance for Trucks| Company | Rank | Claim Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 743 / 1,000 | A | Cost Savings |

| #2 | 730 / 1,000 | A | Accident Forgiveness |

| #3 | 729 / 1,000 | A+ | Fleet Coverage | |

| #4 | 718 / 1,000 | A+ | Road Trips | |

| #5 | 716 / 1,000 | A++ | Customer Service | |

| #6 | 711 / 1,000 | A | Local Agents | |

| #7 | 701 / 1,000 | A | Affordable Rates | |

| #8 | 693 / 1,000 | A+ | Roadside Assistance | |

| #9 | 691 / 1,000 | A++ | Claim Support | |

| #10 | 690 / 1,000 | A | Policy Flexibility |

Nationwide works well for drivers managing multiple trucks, offering flexible multi-vehicle and fleet-style policy structures with SmartRide savings up to 40%.

Find the best auto insurance company near you by entering your ZIP code into our free quote tool.

Car Insurance Rates from Top Truck Insurers

Finding the best auto insurance for trucks requires looking past the monthly premium to see how companies like State Farm and Erie handle the high repair costs associated with larger frames.

State Farm currently leads in competitive rates, often because its massive agent network allows for highly localized risk pooling.

Meanwhile, Erie stands out by maintaining low base prices without sacrificing the high claims satisfaction truck owners need when specialized parts are on backorder.

Auto Insurance Monthly Rates for Trucks by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $118 | $205 | |

| $132 | $230 | |

| $113 | $195 | |

| $110 | $190 |

| $115 | $200 | |

| $125 | $218 |

| $114 | $197 | |

| $113 | $195 | |

| $108 | $185 | |

| $118 | $205 |

How much is insurance for a truck? The cheapest types of auto insurance are liability-only plans, which satisfy state requirements for roughly $75–$80 monthly, but won’t pay to repair your truck after a collision or accident.

The coverage you choose will impact the overall protection and total car insurance costs for trucks.

State minimums are a risky baseline for modern trucks. I always advise clients to look at the 'Recommended' column for actual protection.

Travis Thompson Licensed Insurance Agent

For a new truck or vehicle that doubles as a workspace or primary hauler, full coverage is the industry standard.

It combines liability with collision and comprehensive protections to ensure that, whether it’s a highway wreck or a falling branch in your driveway, you aren’t stuck with a five-figure repair bill.

Truck Insurance Costs by Coverage Type| Coverage Type | What it Covers | Monthly Cost |

|---|---|---|

| Collision | Accident damage to your truck | $35–$45 |

| Comprehensive | Theft and non-collision damage | $10–$20 |

| Full Coverage | Liability plus full vehicle protection | $180–$190 |

| Liability-Only | Damage or injuries you cause | $75–$80 |

| Rental Reimbursement | Rental car costs after a claim | $4–$8 |

| Roadside Assistance | Towing and emergency services | $3–$6 |

| Uninsured Motorist | Injuries caused by uninsured drivers | $10–$15 |

State-mandated minimums rarely provide adequate protection for truck owners, particularly those with financed vehicles or high-value assets.

The gap between minimum and recommended coverage is where many truck owners find themselves underinsured. If you drive over 10,000 miles a year or have a financed vehicle, you’ll want full coverage.

Learn More: Liability vs. Full Coverage Auto Insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Average Truck Insurance Costs

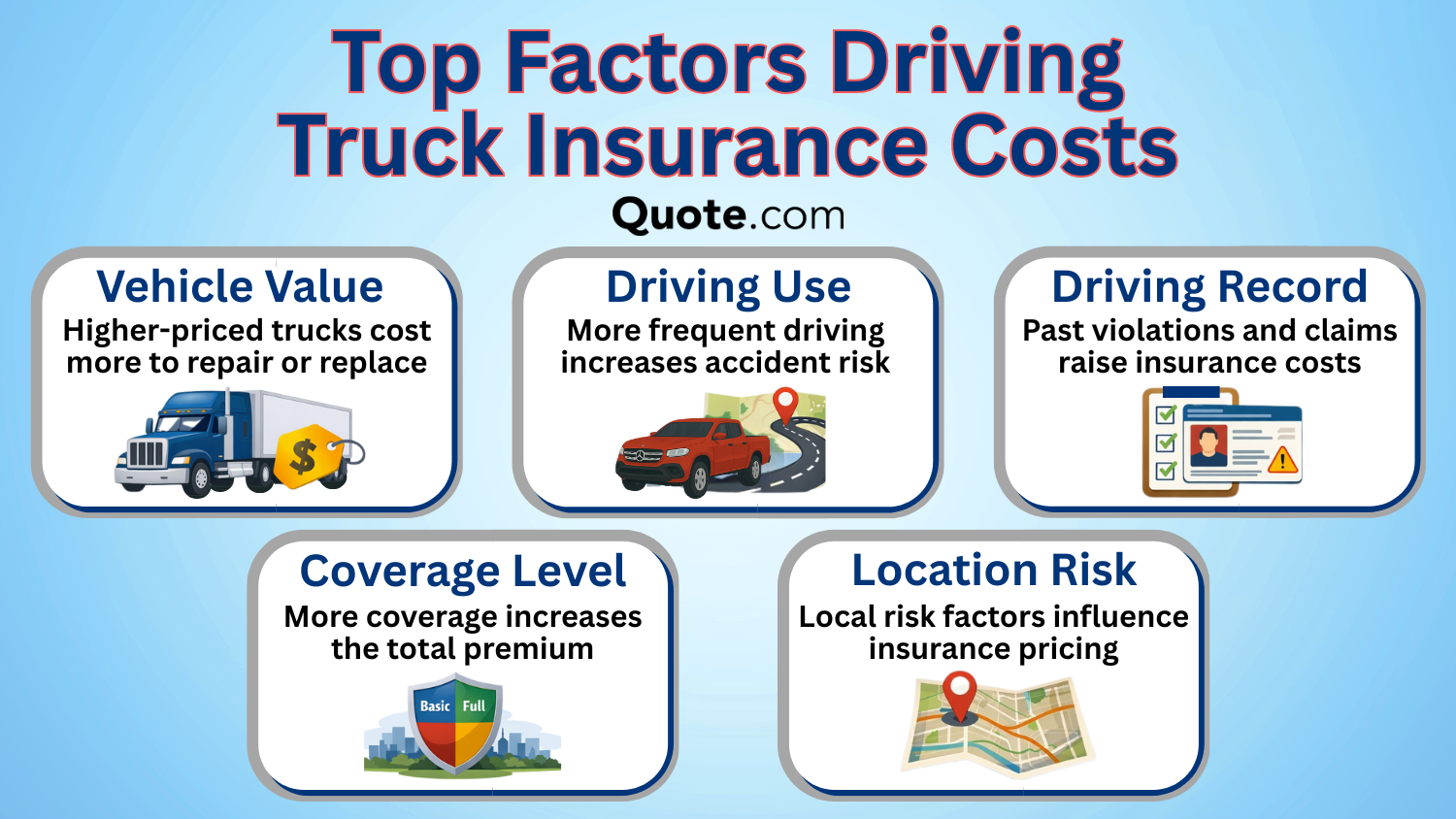

Several critical factors drive truck insurance premiums, ranging from the vehicle’s intrinsic value to the driver’s history.

High-priced trucks are naturally more expensive to repair or replace, directly increasing the collision and comprehensive portions of your premium.

State Farm is often a top choice for high-mileage drivers due to its extensive local agent support and competitive multi-policy discounts. For “high-risk” drivers with a less-than-perfect record, Liberty Mutual stands out with its accident forgiveness programs.

Meanwhile, families with teen drivers might find better value with Allstate, which offers flexible roadside assistance for new drivers and significant savings through its DriveWise and Milewise telematics programs.

Read More: State Farm vs. Farmers, Geico, Progressive, & Allstate Insurance Review

Truck Insurance Costs for Teens vs. Adult Drivers

Age is one of the strongest pricing factors in auto insurance for truck drivers because it directly reflects driving experience and long-term risk trends.

Younger drivers face higher premiums due to limited experience and statistically higher accident rates, making it hard to find cheap auto insurance for teens who drive trucks.

Auto Insurance Monthly Rates by Truck Driver's Age| Company | Age: 18 | Age: 25 | Age: 35 | Age: 45 |

|---|---|---|---|---|

| $265 | $185 | $135 | $118 | |

| $295 | $205 | $150 | $132 | |

| $255 | $175 | $130 | $113 | |

| $245 | $170 | $125 | $110 |

| $260 | $180 | $135 | $115 | |

| $280 | $195 | $145 | $125 |

| $258 | $178 | $132 | $114 | |

| $255 | $175 | $130 | $113 | |

| $240 | $165 | $120 | $108 | |

| $265 | $185 | $135 | $118 |

Insurers adjust premiums as drivers age, so middle-aged drivers benefit from the most competitive pricing.

Senior drivers may see gradual increases as insurers account for changing risk patterns associated with aging.

Impact of Driving Record on Truck Insurance

Driving history has a significant impact on truck insurance pricing due to the higher claim severity associated with accidents and serious violations.

Insurers respond differently to various driving records. State Farm and Erie have cheap auto insurance after a DUI, but premiums are still double what truck owners with clean records pay.

Auto Insurance Monthly Rates for Trucks by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $118 | $165 | $255 | $145 | |

| $132 | $185 | $285 | $162 | |

| $113 | $158 | $245 | $140 | |

| $110 | $154 | $235 | $136 |

| $115 | $162 | $250 | $142 | |

| $125 | $175 | $270 | $155 |

| $114 | $160 | $248 | $141 | |

| $113 | $158 | $245 | $140 | |

| $108 | $150 | $230 | $132 | |

| $118 | $165 | $255 | $145 |

A clean record signals predictable risk, while violations increase perceived exposure for insurers, especially for larger vehicles like trucks.

You can compare the best car insurance for pickup trucks by company based on individual driving history with free online tools. Enter your ZIP code to get free quotes.

Credit Score Can Raise Truck Insurance Premiums

It might feel disconnected from your driving ability, but your credit history is a major factor in determining your truck insurance premium.

Most insurers use a credit-based insurance score because data suggests a correlation between financial responsibility and claim frequency.

Auto Insurance Monthly Rates by Truck Driver's Credit Score| Company | Excellent (800+) | Good (670–799) | Fair (580–669) | Poor (<580) |

|---|---|---|---|---|

| $118 | $135 | $170 | $230 | |

| $132 | $150 | $190 | $260 | |

| $113 | $130 | $165 | $220 | |

| $110 | $125 | $160 | $215 |

| $115 | $132 | $168 | $225 | |

| $125 | $145 | $185 | $250 |

| $114 | $131 | $167 | $223 | |

| $113 | $130 | $165 | $220 | |

| $108 | $124 | $158 | $210 | |

| $118 | $136 | $172 | $232 |

While a low score can certainly drive up costs, some providers are more lenient or offer better paths to savings than others.

For example, Nationwide and State Farm are frequently cited for having more balanced pricing for those with “fair” or “poor” credit.

Read More: 26 Hacks to Save Money on Auto Insurance

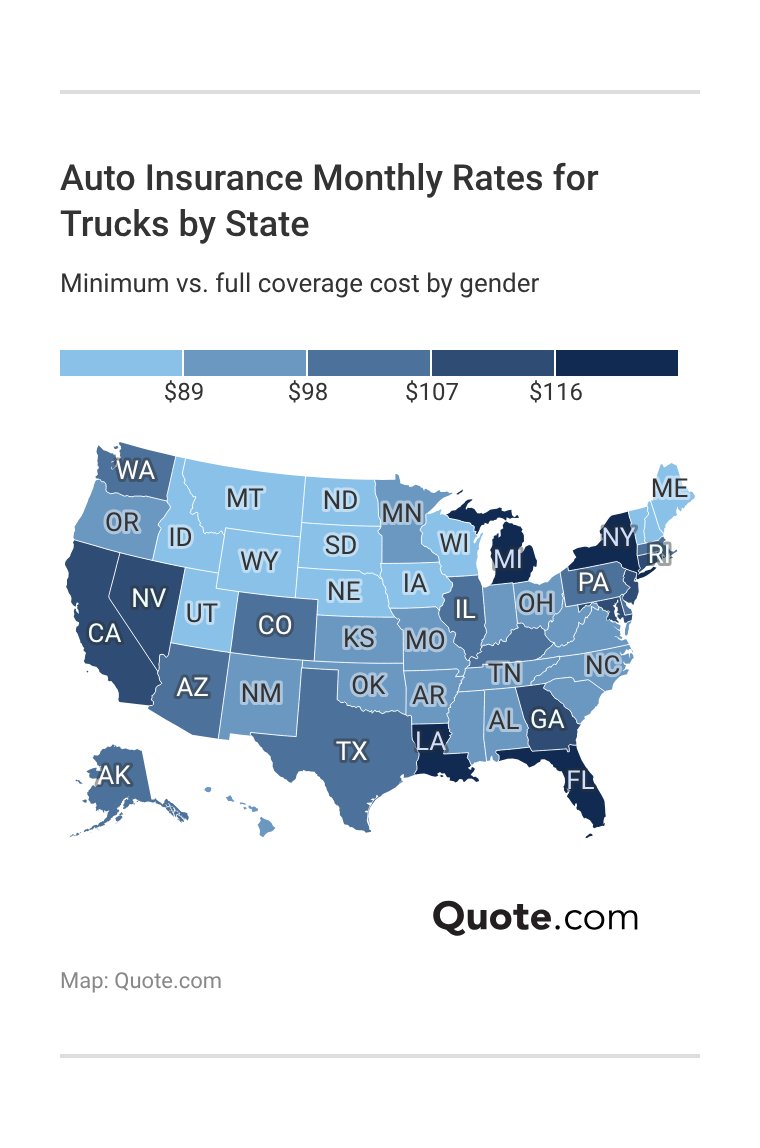

Truck Insurance Pricing Varies by State

Premiums fluctuate based on local accident rates and repair costs. Regional laws and litigation trends also drive costs. Truck owners in states with strict regulations often pay more to satisfy local legal requirements.

Urban areas typically see higher prices due to density and frequent claims, while the cheapest truck insurance rates start at $80 a month in less-populated states like North Dakota and South Dakota.

State-specific regulations and claims patterns create significant regional pricing differences that affect both personal and commercial truck policies.

While a state might only require a small amount of liability, these minimums are rarely enough to cover a total loss or a multi-vehicle accident.

Minimum vs. Recommended Truck Insurance Coverage Levels| Coverage Type | State Minimum | Recommended |

|---|---|---|

| Bodily Injury Liability | $25,000 / $50,000 | $100,000 / $300,000 |

| Property Damage Liability | $10,000–$25,000 | $50,000–$100,000 |

| Collision Coverage | Not required | Financed & newer trucks |

| Comprehensive Coverage | Not required | Theft & weather protection |

| Uninsured / Underinsured | Varies by state | $100,000 / $300,000 |

| Medical Payments / PIP | Varies by state | $5,000–$10,000 |

Comparing insurers within your state can reveal meaningful savings opportunities. Read More: Auto Insurance Requirements by State

Even with higher coverage levels, many providers offer discounts for advanced safety technology like telematics or collision-mitigation sensors.

How Truck Usage Affects Monthly Rates

Truck insurance pricing is heavily influenced by how a vehicle is classified, especially when comparing personal and business use.

Choosing the correct policy type is critical when looking for the cheapest pickup truck insurance. Each company underwrites personal and commercial risk very differently.

Personal vs. Commercial Truck Insurance Costs| Use Type | Required Policy | Cost Impact |

|---|---|---|

| Personal Use Only | Personal auto insurance | Cheapest coverage option |

| Business Use Only | Commercial auto insurance | 50–70% more than personal |

| Delivery or Hauling | Commercial auto insurance | 40–60% more than personal |

| Personal & Work Use | Personal + business rider | 15–30% more than personal |

| Rideshare / App Use | Personal + rideshare rider | 20–40% more than personal |

Using a truck strictly for personal driving generally qualifies for standard auto coverage.

Business-related use, such as delivery or ridesharing, exposes you to higher risk and stricter underwriting rules, which can raise rates.

Truck owners can achieve savings of up to 40% by taking advantage of Nationwide's SmartRide.

Michelle Robbins Licensed Insurance Agent

Truck owners who haul goods, make deliveries, or operate for work often need specialized commercial auto insurance rather than relying on personal plans.

Truck owners who occasionally use their vehicles for side work or freelance projects may fall into a gray area that requires specialized hybrid policies often referred to as rideshare insurance.

How and when you drive your truck affect insurance pricing because they increase your risk of accidents and claim severity.

Routine commuting and personal errands are viewed as lower risk due to predictable driving conditions.

How Truck Usage Affects Insurance Rates| Truck Use | Risk Level | Cost Impact |

|---|---|---|

| Commuting | Low | Baseline |

| Delivery Use | Medium–High | 25–40% higher |

| Personal Errands | Low | 5–10% higher |

| Recreational Use | Low–Medium | 8–15% higher |

| Rideshare / App | Medium | 20–35% higher |

| Towing / Hauling | Medium | 15–25% higher |

| Worksite Use | High | 30–50% higher |

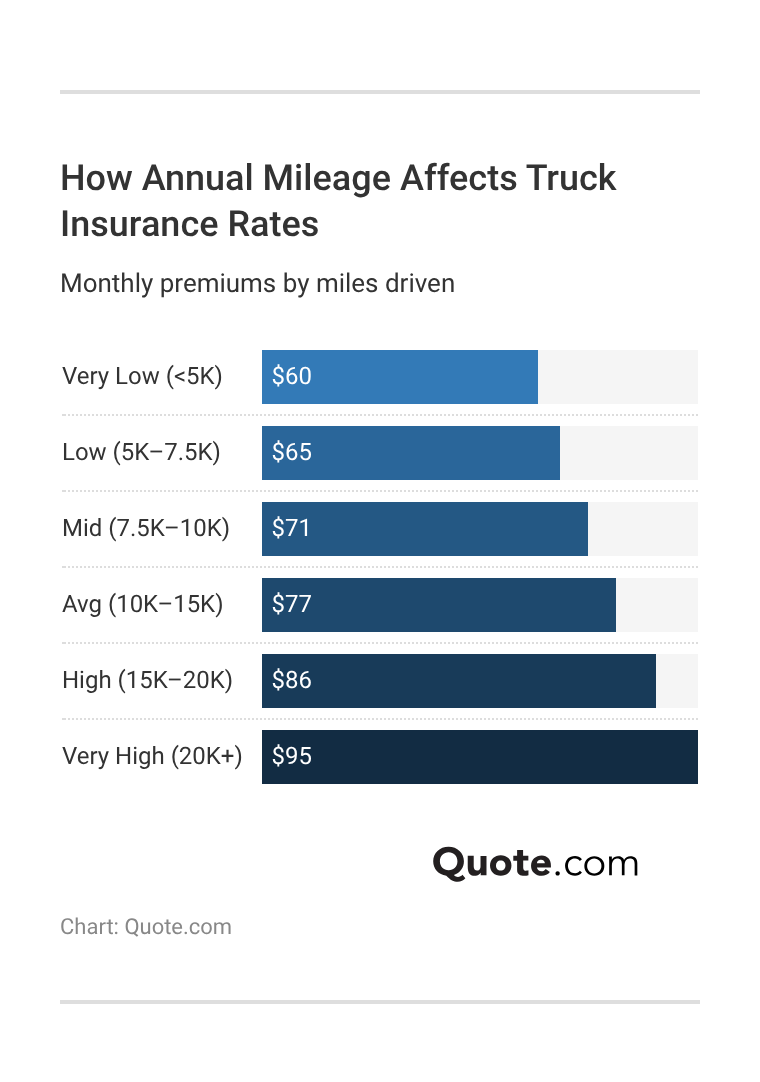

Annual mileage is a core pricing factor because it reflects how often a truck is exposed to traffic and potential losses.

Lower-mileage truck drivers typically face fewer claims due to reduced exposure on the road.

Trucks used primarily for short commutes face different risk profiles than those driven extensively for recreational towing, off-road activities, or long-distance travel.

Truck insurance companies use annual mileage estimates during quoting and may verify actual usage through odometer readings or telematics programs to ensure premium accuracy.

Truck Characteristics That Affect Premiums

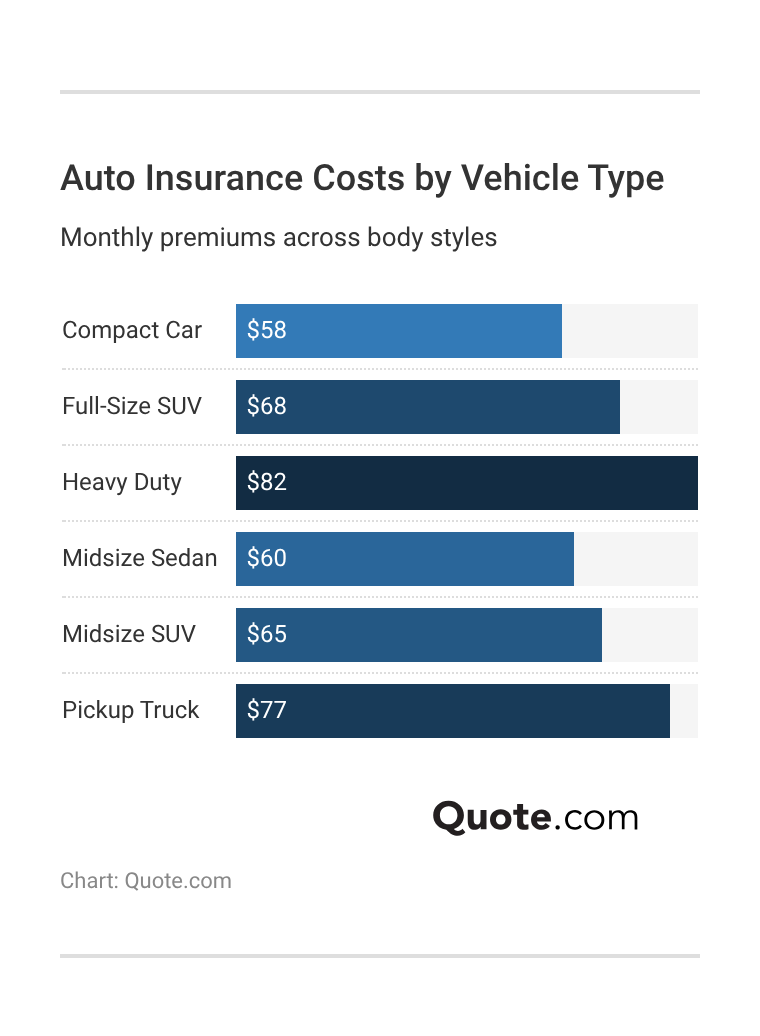

Auto insurance prices vary by body style because vehicle size, weight, and repair parts directly affect claim severity.

Pickup trucks have higher auto insurance rates by vehicle compared to cars and SUVs due to greater damage potential and parts costs.

Pickup trucks generally carry more risk than smaller vehicles because of towing capability, higher repair labor, and greater impact force in collisions.

Heavier trucks like Ford’s F150 models often cause more damage during accidents, leading to higher liability costs. Read More: Best Auto Insurance for Fords

The specialized parts and labor required for modern truck repairs can significantly increase the total payout for an insurer compared to a standard sedan or a compact vehicle.

Insurance Costs by Truck Make and Model

Truck insurance costs also vary significantly by specific make and model due to differences in safety ratings, repair frequency, and parts availability.

Popular brands like Chevrolet, Ford, and GMC each have unique insurance considerations based on their truck lineups. Read More: Best Auto Insurance for GMCs

Auto Insurance Monthly Rates for Popular Truck Models| Make & Model | Minimum Coverage | Full Coverage |

|---|---|---|

| Chevy Colorado | $88 | $160 |

| Chevy Silverado | $82 | $158 |

| Ford F-150 | $80 | $155 |

| Ford Maverick | $77 | $177 |

| Ford Ranger | $80 | $180 |

| Ford Super Duty | $120 | $235 |

| GMC Canyon | $95 | $142 |

| GMC Sierra 1500 | $75 | $145 |

| GMC Sierra HD | $120 | $210 |

| Honda Ridgeline | $88 | $165 |

| Jeep Gladiator | $95 | $170 |

| Nissan Frontier | $85 | $184 |

| Nissan Titan | $100 | $185 |

| Ram 1500 | $86 | $167 |

| Toyota Tacoma | $96 | $187 |

| Toyota Tundra | $100 | $195 |

Midsize and light-duty trucks tend to be less expensive to insure because they are easier to repair and have lower claim severity.

Heavy-duty and specialty models typically cost more to insure due to stronger frames, higher replacement values, and commercial-style use.

Most and Least Expensive Trucks to Insure

Some trucks consistently rank among the most expensive to insure because they are associated with higher repair costs and more severe claims.

Models that insurers view as higher risk based on historical loss data command premium pricing.

Most Expensive Trucks to Insure| Make & Model | Rank | Monthly Rate | Reason |

|---|---|---|---|

| Ford Super Duty | 1 | $122 | High repair costs |

| GMC Sierra HD | 2 | $118 | Heavy-duty risk |

| Ram 2500 | 3 | $113 | Higher claim severity |

| Nissan Titan | 4 | $101 | Large engine size |

| Ford F-250 | 5 | $98 | Higher repair costs |

Heavy-duty trucks often fall into this category because their size increases the damage in accidents, and repairs require specialized parts.

These factors raise insurer exposure even when the truck is used for personal driving. Other trucks are cheaper to insure due to strong safety records and lower ownership costs.

Least Expensive Trucks to Insure| Make & Model | Rank | Monthly Rate | Reason |

|---|---|---|---|

| Ford Maverick | 1 | $76 | Low repair costs |

| Nissan Frontier | 2 | $79 | Reliable build |

| Toyota Tacoma | 3 | $82 | Strong safety |

| GMC Sierra 1500 | 4 | $85 | Common parts |

| Chevy Colorado | 5 | $88 | Lower risk |

These trucks benefit from common replacement parts, proven reliability, and lower claim severity.

As a result, they are often easier to insure for drivers seeking the best auto insurance for trucks without unnecessary cost.

Read More: Best Auto Insurance for Chevrolets

How Truck Age Affects Insurance Pricing

Vehicle age is another major factor in truck insurance pricing because it affects replacement value and repair expectations and plays a direct role in the average cost of auto insurance for truck owners.

Insurers assess risk differently for new versus older trucks based on depreciation and overall loss potential.

New vs. Used Truck Insurance Monthly Rates| Truck Age | Cost | Reason |

|---|---|---|

| New (0–2 Years) | $90 | Higher replacement value |

| 3–5 Years Old | $80 | Moderate repair costs |

| 6–9 Years Old | $75 | Lower vehicle value |

| 10+ Years Old | $70 | Lower replacement value |

Newer trucks are more costly to insure because repairs and replacements often involve advanced technology, specialized parts, and higher market values.

Older trucks generally carry lower insurance costs since insurers face reduced payout exposure and lower replacement obligations in the event of a total loss.

Safety Features and Claim Risk Reduction

Safety technology plays a meaningful role in lowering truck insurance costs by reducing both accident frequency and claim severity.

Common safety features insurers reward when evaluating truck risk include anti-lock brakes, electronic stability control, blind spot monitoring, and automatic emergency braking.

Trucks equipped with multiple safety systems are often viewed as less likely to be involved with a claim, making them easier and more affordable to insure over time.

Sara Routhier Senior Director of Content

Features that prevent theft or reduce collision likelihood help insurers limit losses, which can lead to anti-theft auto insurance discounts and other savings opportunities.

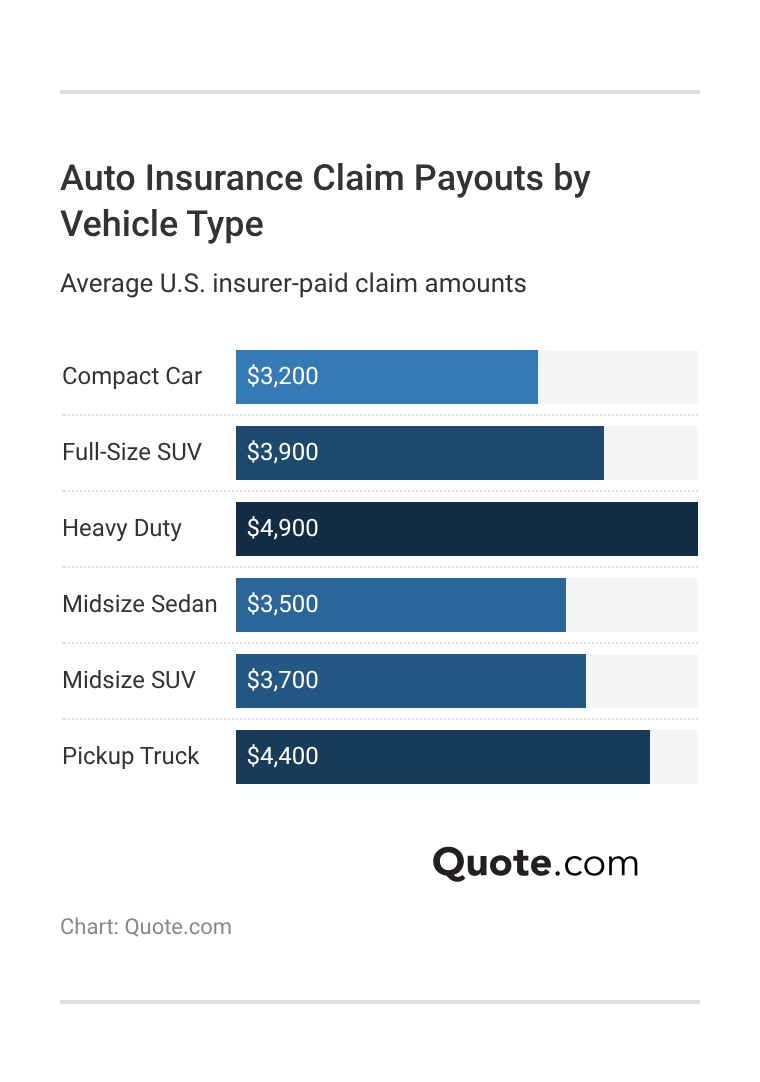

Insurance claim payouts vary by vehicle type because size, weight, and repair complexity directly affect the severity of losses.

Pickup trucks tend to generate larger claims due to stronger frames, higher impact force in collisions, and more expensive parts.

This claim behavior influences underwriting decisions and helps explain why car insurance for trucks is often priced differently than coverage for smaller passenger vehicles.

How to Save on Car Insurance for Trucks

Truck insurance discounts play a major role in offsetting higher premiums tied to vehicle size and repair severity.

Common savings like anti-theft, bundling, good driver, and usage-based programs can significantly reduce monthly truck insurance costs.

Top Auto Insurance Discounts for Trucks| Company | Anti-Theft | Bundling | Good Driver | Usage-Based |

|---|---|---|---|---|

| 10% | 25% | 25% | 40% | |

| 18% | 30% | 25% | 20% | |

| 12% | 16% | 25% | 30% | |

| 15% | 25% | 23% | 30% |

| 10% | 20% | 30% | 30% | |

| 35% | 25% | 20% | 30% |

| 12% | 20% | 25% | 50% | |

| 5% | 20% | 40% | 40% | |

| 15% | 17% | 25% | 30% | |

| 15% | 13% | 10% | 30% |

Advanced safety features do more than just protect you on the road, which is why you see significant premium reductions for features like crash-avoidance systems and electronic stability control.

These systems mitigate the high-impact force inherent to larger vehicles, turning potential total-loss accidents into minor incidents or “near misses.”

Truck Safety Features That Can Lower Insurance Costs| Safety Feature | Why it Helps | Typical Savings |

|---|---|---|

| Anti-Theft Systems | Reduces vehicle theft claims | 5–10% |

| Blind Spot Monitoring | Reduces lane-change collisions | 3–7% |

| Crash Avoidance Systems | Helps prevent at-fault accidents | 5–15% |

| Electronic Stability Control | Reduces rollover risk | 5–10% |

| Forward Collision Warning | Lowers rear-end collision risk | 3–8% |

| Lane Departure Warning | Reduces unintended lane drift | 2–5% |

| Rear Backup Camera | Reduces backing accidents | 2–4% |

Comparing discount structures across these providers helps truck owners find practical savings without sacrificing reliability.

To get the most out of these features, you shouldn’t just look for one discount but “stack” them.

For instance, pairing a truck’s built-in forward collision warning with a good driver discount and a bundling credit can often slash your base premium by nearly half.

You can also combine good driving with usage-based discounts for even bigger savings. Usage-based programs, such as Nationwide’s SmartRide or Progressive’s Snapshot, remain the heavy hitters in the industry.

In addition to traditional discounts, truck owners can reduce insurance costs through several practical strategies:

- Bundle Policies: Combining home, auto, and other insurance with one carrier typically yields 15-25% savings.

- Increase Deductibles: Higher deductibles reduce premium costs but require more out-of-pocket expense during claims.

- Install Anti-Theft Devices: Alarm systems, GPS tracking, and immobilizers can qualify for additional discounts.

- Maintain A Clean Driving Record: Avoiding accidents and violations can lower premiums by 25% to 30% over time.

- Take Defensive Driving Courses: Many insurers offer premium reductions for completing approved safety courses.

These programs are ideal for truck owners who may have higher base rates due to vehicle size but drive conservatively enough to prove they are a lower risk than the typical driver in their zip code.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top Truck Auto Insurance Providers

The best auto insurance for trucks balances competitive pricing with specialized protection designed for larger, heavier vehicles.

Erie currently leads the industry rankings with a top-tier claims satisfaction score of 743/1,000.

Meanwhile, providers like Nationwide and Liberty Mutual stand out by offering niche benefits. We break down these benefits in our Liberty Mutual vs. Nationwide auto insurance comparison.

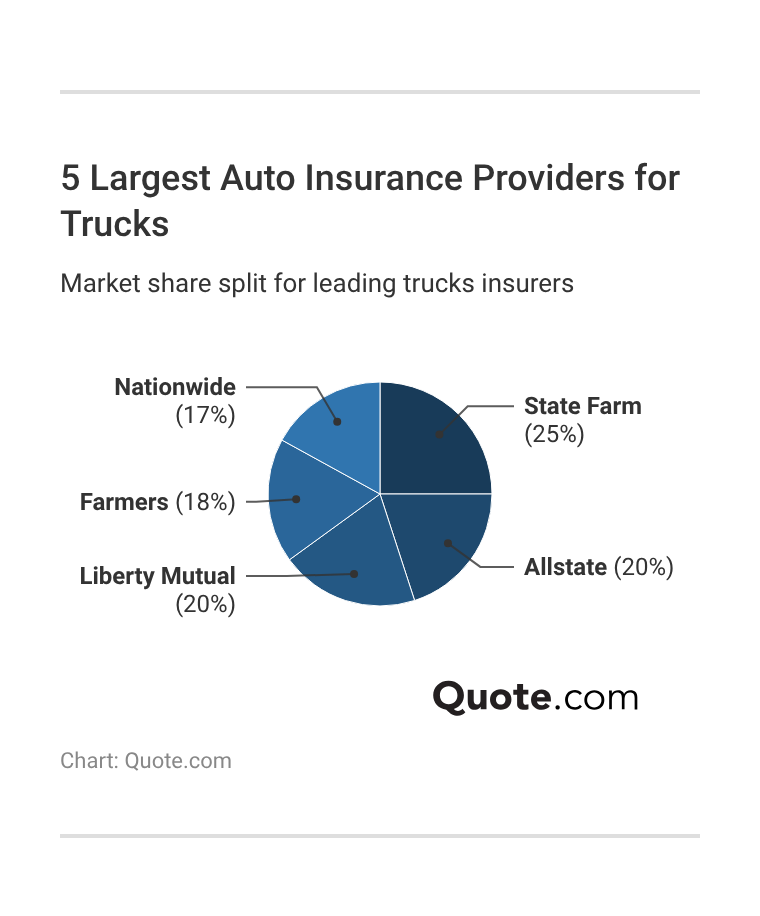

Market dominance is currently split among a few major carriers, with State Farm holding the largest share at 25%.

Allstate and Liberty Mutual follow closely, each maintaining 20% of the market, reflecting their massive capacity to handle the high claim severity inherent to trucks.

Use our free comparison tool to get personalized quotes from top-rated insurers and find the best coverage for your truck at the most competitive rate.

#1 – Erie: Top Overall Pick

Pros

- Competitive Regional Pricing: Erie maintains lower rates in its coverage areas, making it ideal for cost-conscious truck owners.

- Highest Claims Satisfaction: With a 743/1,000 score, Erie provides the most reliable claims handling for truck-related incidents.

- A Financial Strength: Erie’s A rating from A.M. Best ensures financial stability for long-term policyholders. See more details in our Erie insurance review.

Cons

- Limited Geographic Coverage: Erie only operates in 12 states and Washington, D.C., excluding most truck owners nationwide.

- Fewer Premium Features: Truck owners may find fewer specialized coverage options compared to larger national carriers.

#2 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Accident Forgiveness Protection: Liberty Mutual helps truck owners avoid large rate increases after their first at-fault accident.

- Strong Safety Feature Discounts: Truck owners can save significantly on premiums for vehicles equipped with advanced safety technology.

- A Financial Strength: Liberty Mutual’s A rating ensures reliable claims processing and financial stability. Get full ratings in our Liberty Mutual insurance review.

Cons

- Higher Base Premiums: Before discounts, truck owners often face elevated starting rates compared to budget insurers.

- Complex Policy Customization: Liberty Mutual’s extensive coverage options can overwhelm truck owners seeking straightforward policies.

#3 – Nationwide: Best for Fleet Coverage

Pros

- SmartRide Telematics Savings: Truck owners can save up to 40% on premiums by demonstrating safe driving habits through Nationwide’s SmartRide program.

- Multi-Vehicle Policy Flexibility: Nationwide excels at insuring multiple trucks with flexible fleet-style policy structures.

- A+ Financial Rating: Nationwide’s A+ rating provides truck owners with confidence in claims payment reliability. Learn how to qualify in our Nationwide insurance review.

Cons

- App Participation Required: To maximize SmartRide savings, truck owners must keep the app active and continuously track their driving.

- Smaller Anti-Theft Discounts: Truck owners receive limited savings for anti-theft features compared to other insurers.

#4 – Amica: Best for Road Trips

Pros

- Strong Claims Satisfaction: Amica’s 718/1,000 claims satisfaction score ensures truck owners receive reliable support after accidents.

- Strong Roadside Assistance: Truck owners who take frequent road trips benefit from Amica’s dependable roadside assistance program for long-distance driving.

- A+ Financial Strength: Amica’s A+ rating from A.M. Best gives truck owners confidence in the company’s ability to pay claims.

Cons

- Limited Regional Availability: Amica operates in fewer states than national competitors, which may limit access for some truck owners.

- Higher Premium Costs: Truck owners may pay more upfront compared to budget-focused insurers like Erie or Mercury. Compare quotes in our Amica insurance review.

#5 – State Farm: Best for Customer Service

Pros

- Drive Safe & Save Program: Truck owners can save up to 30% by using monitored driving data through State Farm’s telematics program.

- Extensive Agent Network: State Farm’s large network provides accessible local support and personalized service.

- A++ Financial Strength: State Farm’s highest financial rating gives exceptional confidence in claims payment ability. Learn more in our State Farm insurance review.

Cons

- Smaller Bundling Discounts: Truck owners receive up to 17% off with multi-policy discounts, which is lower than some competitors.

- Slower Telematics Savings: Usage-based discount increases develop more gradually compared to other insurers’ programs.

#6 – Auto-Owners: Best for Local Agents

Pros

- Strong Local Agent Network: Auto-Owners provides truck owners with accessible, personalized service through regional independent agents.

- Above-Average Claims Satisfaction: With a 711/1,000 score, Auto-Owners delivers reliable claims processing for truck-related incidents.

- A Financial Strength: Auto-Owners’ A rating ensures financial stability and dependable claims payment. See more details in our Auto-Owners insurance review.

Cons

- Regional Coverage Limitations: Auto-Owners operates primarily in the Midwest and South, limiting availability for many truck owners.

- Fewer Digital Tools: Truck owners may find less robust online and mobile app features compared to tech-focused insurers.

#7 – Mercury: Best for Affordable Rates

Pros

- Lowest Premium Pricing: Mercury offers truck owners some of the most competitive base rates in the market.

- Above-Average Claims Satisfaction: Mercury’s 701/1,000 score provides solid claims handling for truck owners.

- A Financial Rating: Mercury maintains solid financial strength for reliable claims processing. Check out our Mercury insurance review for quotes.

Cons

- Lower Claims Score Than Leaders: Mercury’s claims satisfaction trails behind top performers like Erie and Amica.

- Limited Geographic Availability: Mercury primarily serves Western states, excluding most truck owners across the country.

#8 – Allstate: Best for Roadside Assistance

Pros

- Comprehensive Roadside Coverage: Allstate provides truck owners with extensive roadside assistance programs ideal for breakdowns and emergencies.

- Strong Telematics Savings: Through Drivewise, truck owners can save significantly by demonstrating safe driving behaviors.

- A+ Financial Rating: Allstate’s A+ rating gives truck owners confidence in the company’s financial stability. See more ways to save in our Allstate insurance review.

Cons

- Higher Base Premiums: Before discounts, truck owners typically pay elevated rates compared to budget-focused competitors.

- Credit Score Sensitivity: Truck owners with lower credit scores may face steeper rate increases than with other insurers.

#9 – Travelers: Best for Financial Strength

Pros

- A++ Financial Rating: Travelers’ highest financial rating ensures exceptional reliability for truck insurance claims.

- Telematics Discount Programs: Truck owners can save approximately 30% through Travelers’ usage-based driving programs.

- Clear Claims Process: Travelers provides truck owners with straightforward, well-structured claims handling. Get more details in our Travelers insurance review.

Cons

- Below-Average Claims Satisfaction: Travelers’ 691/1,000 score falls below the industry average of 700.

- Fewer Truck-Specific Programs: Travelers does not offer many programs or discounts made just for truck owners.

#10 – Farmers: Best for Policy Flexibility

Pros

- Customizable Coverage Options: Farmers offers truck owners flexible policy structures that can be tailored to specific usage needs.

- Above-Average Claims Satisfaction: Farmers’ 690/1,000 claims score provides reliable support for truck-related incidents.

- A Financial Rating: Farmers maintains solid financial strength for reliable claims handling. Get a detailed discount list in our Farmers insurance review.

Cons

- Severe Violation Impact: A DUI or major violation can significantly increase truck insurance costs for affected drivers.

- Lower Claims Score Than Leaders: Farmers’ claims satisfaction trails behind top performers like Erie and Liberty Mutual.

Frequently Asked Questions

How can I lower my truck insurance costs?

Lower truck insurance costs by maintaining a clean driving record, bundling policies, installing anti-theft devices, completing defensive driving courses, and enrolling in telematics programs like Nationwide SmartRide to save up to 40%. See more ways to save in our guide to car insurance discounts you can’t miss.

What is the best auto insurance for trucks?

Erie is the best auto insurance for trucks, with an A+ financial strength and reliable roadside assistance. Nationwide also provides excellent coverage for truck owners. Start comparing total coverage auto insurance rates by entering your ZIP code here.

Is AAA auto insurance for trucks cheaper than State Farm?

AAA and State Farm pricing varies by location and driver profile. State Farm typically offers competitive rates around $110 monthly for clean records, while AAA provides strong member benefits and roadside assistance programs.

Why is my truck insurance so high?

Truck insurance costs more due to higher repair expenses, increased collision severity, greater liability exposure, and expensive replacement parts. Vehicle weight, towing capability, and claim frequency also contribute to elevated premium rates.

What is the most expensive truck to insure?

Heavy-duty trucks like the Ford F-250 and Ram 2500 are among the most expensive to insure due to higher replacement values, specialized parts requirements, stronger frames, and increased damage potential in collisions.

Read More: Best Auto Insurance for Dodges

What discounts are available for truck insurance?

Common truck insurance discounts include multi-vehicle bundling, anti-theft devices, telematics programs, clean driving records, defensive driving courses, automatic payments, and good student discounts. Stack multiple discounts to maximize savings opportunities. Explore all available options in our comprehensive car insurance discounts guide.

Does insurance go up if you get a truck?

Yes, insurance typically increases when switching to a truck because of higher repair costs, greater collision severity, increased liability exposure, and expensive replacement parts compared to standard passenger vehicles.

Does credit score affect truck insurance rates?

Yes, credit score significantly impacts truck insurance rates. Drivers with excellent credit pay less, while those with poor credit face higher premiums. Insurers use credit-based scoring to predict claim frequency and payment reliability.

How much is full coverage insurance for a truck?

Cheap full coverage truck insurance averages $150 to $250 monthly, depending on driver age, location, credit score, driving record, and truck model. Full coverage car insurance starts around $108 monthly for truck drivers with clean records and good credit.

What is the difference between personal and commercial truck insurance?

Personal truck insurance covers private use like commuting and errands, while commercial truck insurance protects business operations, including deliveries, hauling goods, and work-related driving, with higher liability limits and specialized coverage options. Compare personal vs. commercial truck insurance coverage today with our free quote comparison tool.

Do older trucks cost less to insure?

How does mileage affect truck insurance rates?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.