Temporary Auto Insurance Coverage in 2026

Most companies stopped selling temporary auto insurance, but there are plenty of short-term solutions. These can cost as little as $35 per month, but temporary car insurance typically costs more overall. The most common short-term insurance solutions include cancelling a standard policy or non-owner insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Copywriter

Malory Will has an M.A. in English from Arizona State University. She has over four years of experience in writing for the insurance industry. With a background in health, auto, life, and homeowners insurance, Malory is passionate about making complex insurance topics clear and approachable. Her goal is to help readers make informed decisions with confidence.

Malory Will

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated January 2026

The best way to get temporary auto insurance is to purchase a regular policy and cancel it when you no longer need coverage.

- Most providers don’t sell true temporary auto insurance policies

- The most common temporary solution is to cancel a standard policy

- Other options include non-owner or usage-based insurance (UBI)

The best temporary auto insurance companies can help you find a solution that works for your needs, whether that be a standard policy you cancel later, rental car coverage, or even pay-as-you-go car insurance.

Read on to explore your options for temporary auto insurance and how much it might cost. Then, enter your ZIP code into our free comparison tool to find the cheapest temporary car insurance in your area.

Temporary Auto Insurance Explained

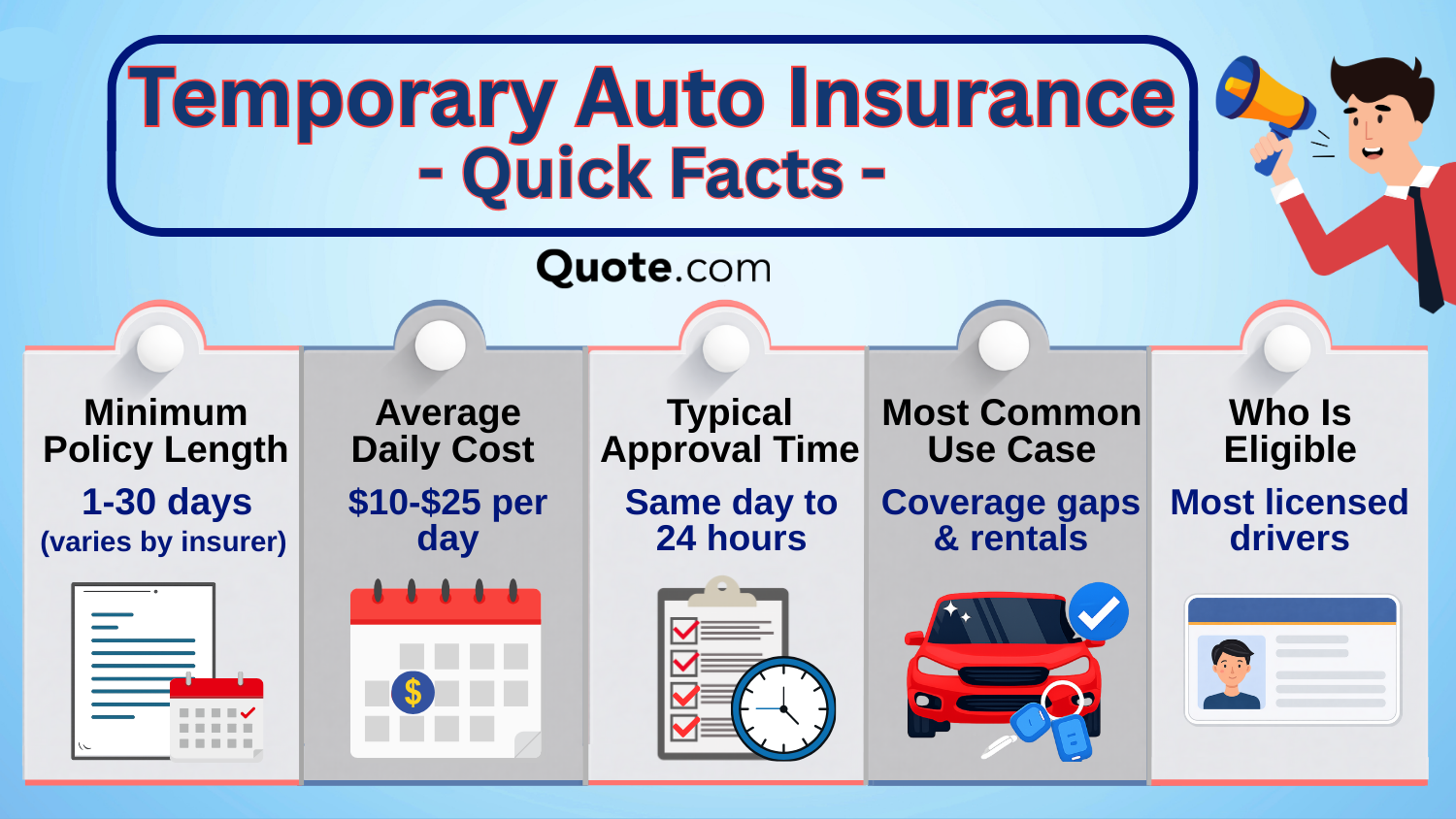

Temporary car insurance usually refers to short-term coverage lasting from a single day to a few months.

Today, most insurance providers don’t offer daily or temporary auto insurance coverage.

Temporary Auto Insurance: Coverage Overview| Feature | Description |

|---|---|

| Coverage Duration | Usually 1 to 30 days, but up to 6 months |

| Flexibility | Ideal for trips or borrowing a car |

| Cost Structure | Higher per day, but cheaper for brief use |

| Eligibility Requirements | Age and driving record may affect eligibility |

| Coverage Options | Includes basic and optional coverages |

While true day-by-day auto insurance policies are rare in the U.S., many insurers offer flexible alternatives that can function as temporary coverage.

These options are often used when someone needs cheap same-day car insurance for a brief period without committing to a traditional long-term policy.

Drivers should be aware that there are downsides to temporary car insurance. For one, purchasing day-by-day car insurance coverage will be more expensive than a regular policy.

Additionally, one factor that affects insurance rates is your coverage history. Having coverage gaps is a red flag to insurance companies, and you’ll likely see higher rates when you need car insurance again.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Types of Temporary Car Insurance

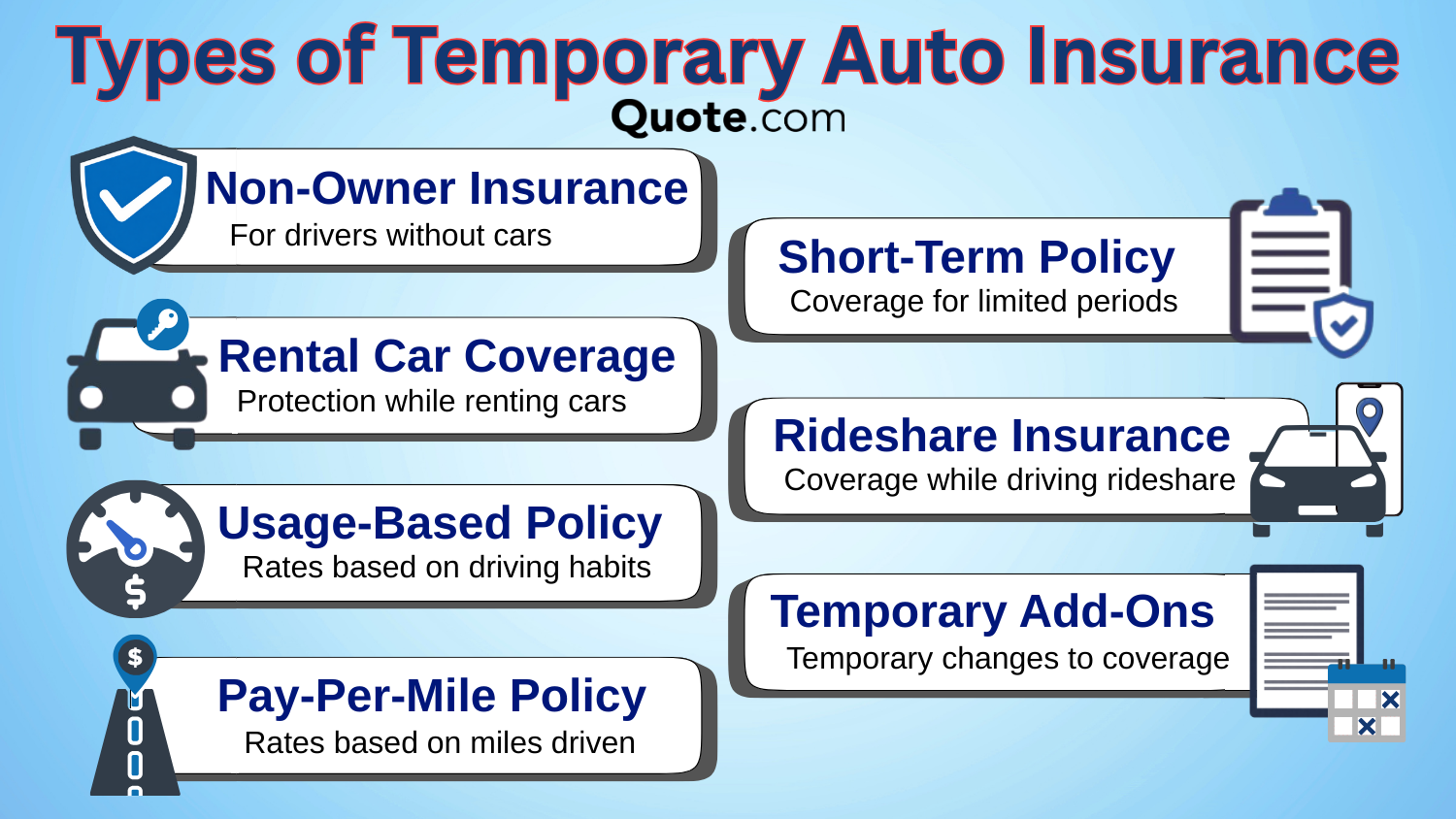

Although the most common solution drivers find is to purchase a standard insurance policy and cancel it when they no longer need coverage, you have other options.

Non-owner policies and usage-based insurance are popular short-term auto insurance options.

From rideshare insurance for Uber and Lyft drivers to finding temporary add-ons that increase the value of an existing standard policy, there are a ton of creative ways for you to get the coverage you need.

You have a variety of types of auto insurance to meet your short-term coverage needs, but the most common are the following:

- Non-Owner Insurance: Covers you when driving vehicles you don’t own, such as borrowed or rented cars. It’s ideal for people who need coverage but don’t own a car.

- Rental Car Coverage: If you need temporary car insurance because you’re renting a car, you can probably buy coverage from your rental company.

- Standard Policy: The most commonly used method of getting temporary coverage is to buy a standard policy, then cancel it when you no longer need it.

- Usage-Based Insurance: Usage-based insurance includes pay-as-you-go car insurance and is a great option for drivers who own a car but rarely drive.

You should always check that your policy covers your needs before you start driving. For example, many standard auto insurance policies extend liability, comprehensive, and collision insurance to rental cars when you travel.

Be sure to verify your coverage before you drive a rental without other coverage, so you’re not financially responsible if something happens.

Another option is to be added to someone else’s policy if you’re going to be driving their car. This is a great option for people who frequently borrow someone else’s car for work, school, or running errands.

Typically, you can only add someone to your policy if they live with you, such as a spouse, parent, child, or roommate.

Michelle Robbins Licensed Insurance Agent

Teen drivers can save a significant amount of money on their insurance by having a parent or guardian add them to an existing policy.

However, the policyholder will see their rates increase when adding a new driver, so this option might not work for everyone.

Temporary vs. Standard Auto Insurance

The biggest difference between temporary and standard auto insurance is the duration of the policy.

Standard auto insurance policies typically last six or 12 months, while temporary options are designed to cover short-term needs.

Temporary vs. Standard Auto Insurance: Key Differences| Feature | Temporary | Standard |

|---|---|---|

| Best Uses | Gaps, rentals, borrowed car | Daily driving & ownership |

| Discounts | Limited discounts | Broad discounts |

| Duration | Days–weeks | 6–12 months |

| Flexibility | Cancel anytime | Cancellation fees |

| Premiums | Higher cost | Lower cost |

Temporary coverage often comes with fewer customization options and may cost more. Standard policies, on the other hand, usually offer better rates, more discounts, and broader coverage choices for drivers who need ongoing protection

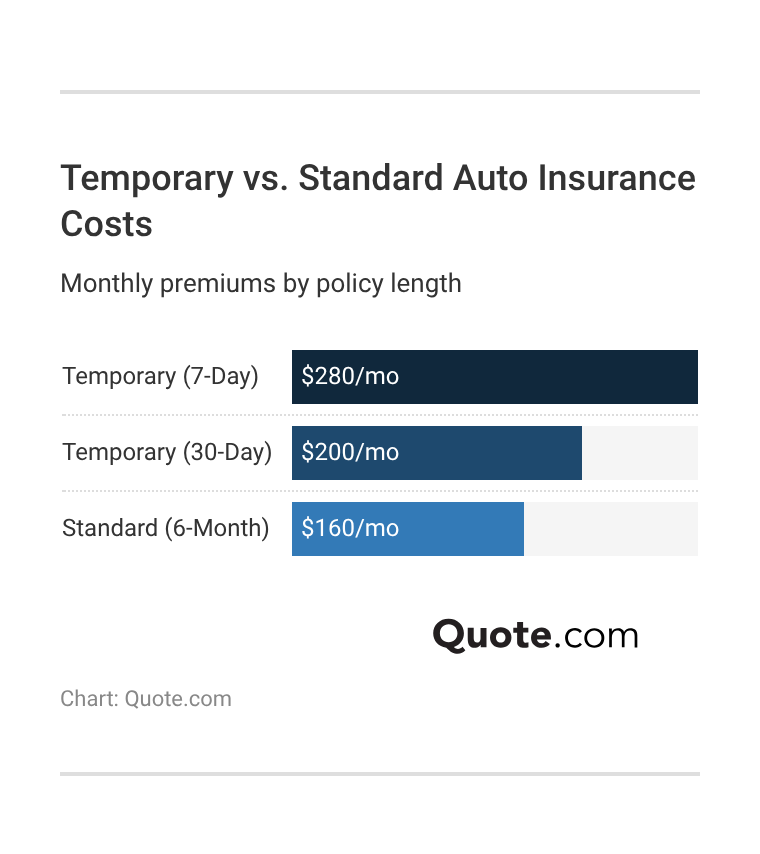

One major thing to keep in mind is that temporary auto insurance costs more than a standard policy, especially if you have gaps in your coverage history. Here’s an example of the price difference between temporary and standard insurance.

Temporary auto insurance can be significantly more expensive in the long run than maintaining standard coverage.

The cheapest six-month car insurance policy can be very affordable, especially if you only need minimum coverage, and it can save you from the headache of increased rates later.

How to Get Temporary Auto Insurance

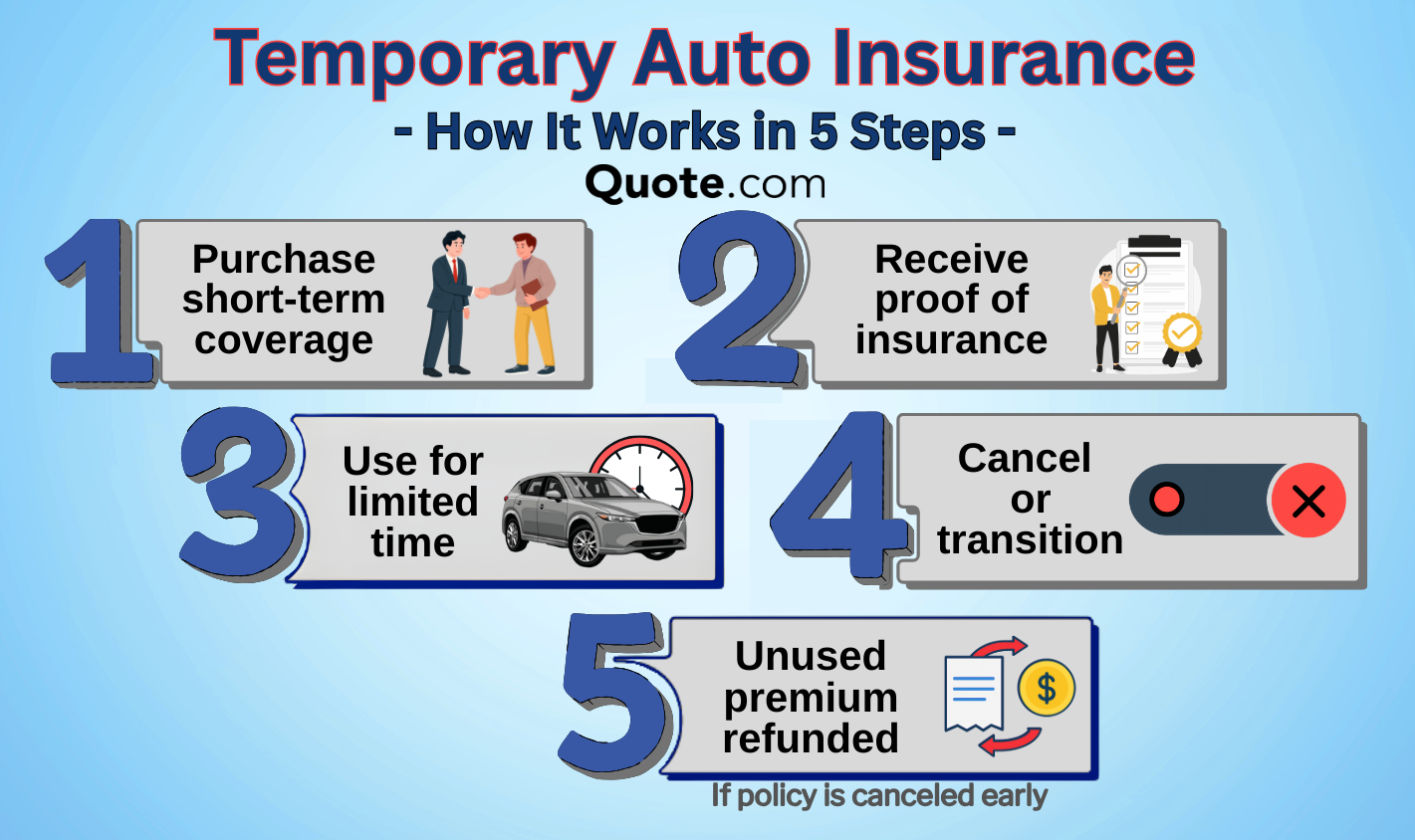

Since most insurance companies don’t offer true short-term car insurance, buying a temporary policy takes a few more steps than it does to purchase a standard policy.

Instead, temporary coverage usually comes from flexible alternatives that can be started quickly and canceled when no longer needed.

The key is choosing the option that best matches your situation and coverage requirements. Our guide to how to buy auto insurance breaks down the process.

Picking the right type of insurance can be tricky, especially when you only want temporary coverage, but these helpful steps keep the process straightforward:

- Identify how long you need coverage. The best short-term workaround for car insurance depends on how long you need coverage.

- Choose the right option. Depending on your needs, a standard policy, non-owner coverage, pay-per-mile insurance, or rental car coverage will be your best option.

- Gather your documents. There are a few documents, like your driver’s license, that you need for auto insurance, even if the coverage will be temporary.

- Compare quotes online. Comparing quotes from multiple companies on insurance comparison websites is the best way to make sure you don’t overpay for coverage.

- Buy your policy: You’ll need to make a payment before coverage can start. Most providers offer instant coverage in case you need auto insurance today.

You’ll more than likely need to cancel your policy once you no longer need coverage, since insurance companies don’t offer true temporary policies.

You’ll more than likely need to call and speak with a representative to cancel your coverage, but you may be able to start the process online.

Most companies allow you to cancel at any time during your policy, often with a prorated refund, making this a practical workaround for short-term needs.

Daniel Young Published Insurance Expert

Before purchasing, confirm whether the insurer charges cancellation fees and how refunds are handled.

Some companies won’t send out a refund if you use less than a month’s worth of coverage, so check before you buy if you only need daily or weekly car insurance.

Average Auto Insurance Cancellation Fees| Company | Fee Amount | Refund Policy |

|---|---|---|

| $0–$30 | Prorated unused premium | |

| $0–$50 | Prorated after fee |

| $0–$50 | Prorated minus fees |

| $0–$50 | Prorated minus fees | |

| $0 | Prorated unused days | |

| $0 | Prorated remaining term |

| $0 | Prorated unused days | |

| $0–$50 | Prorated after fee | |

| $0 | Prorated unused days | |

| $0–$25 | Prorated unused premium |

Some companies charge an early cancellation fee if you end your policy before the first six months.

If you plan on getting daily or even weekly car insurance, you should check that there won’t be an early cancellation fee before you sign up.

Reasons to Buy Temporary Auto Insurance

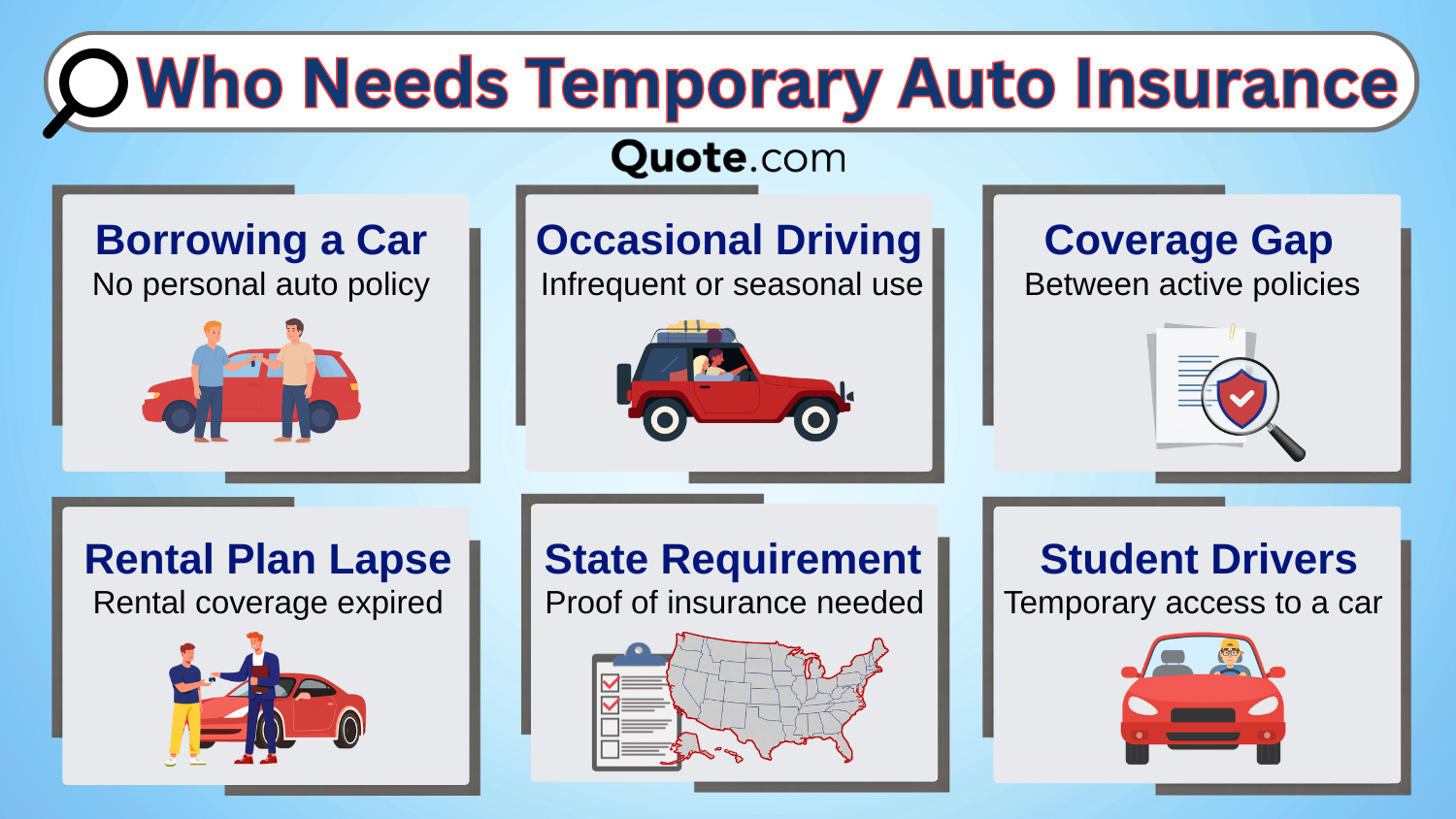

Drivers often seek temporary auto insurance when borrowing a car, test-driving a vehicle, or needing coverage between longer-term policies.

It’s also useful for students home for a short break, people relocating, or drivers waiting for a permanent policy to begin.

Temporary coverage can help ensure you stay legally insured without paying for months of coverage you don’t need. For many, it’s a practical workaround to an immediate problem rather than a long-term solution.

The type of insurance you purchase should match your needs, so shop around to get a better idea of which insurance might best suit you.

Best Temporary Insurance Options by Situation| Situation | Best Option | Why it Works |

|---|---|---|

| Borrowing a car | Non-owner policy | Liability-only coverage |

| Car in storage | Storage coverage | Weather, fire, & theft damage |

| Occasional driving | Usage-based policy | Pay-per-mile savings |

| Renting a car | Rental car insurance | Short-term rental protection |

| Short coverage gaps | Short-term policy | Prorated refund possible |

You should make sure to buy the coverage that best suits your needs and how often you actually drive (Read More: Best Auto Insurance for New Drivers).

For example, pay-per-mile auto insurance is a great way to cut your premiums, but only drivers who drive fewer miles than the average person should buy it.

For other situations, your insurance company might offer solutions that don’t involve canceling your coverage. For example, military members should check out our USAA Insurance review for storage rates for drivers on active deployment.

Other common situations include college students leaving their cars behind at home when they attend a university in another city. A student away from home discount significantly lowers the cost of insurance as long as they leave their vehicles at home.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Temporary Auto Insurance Costs

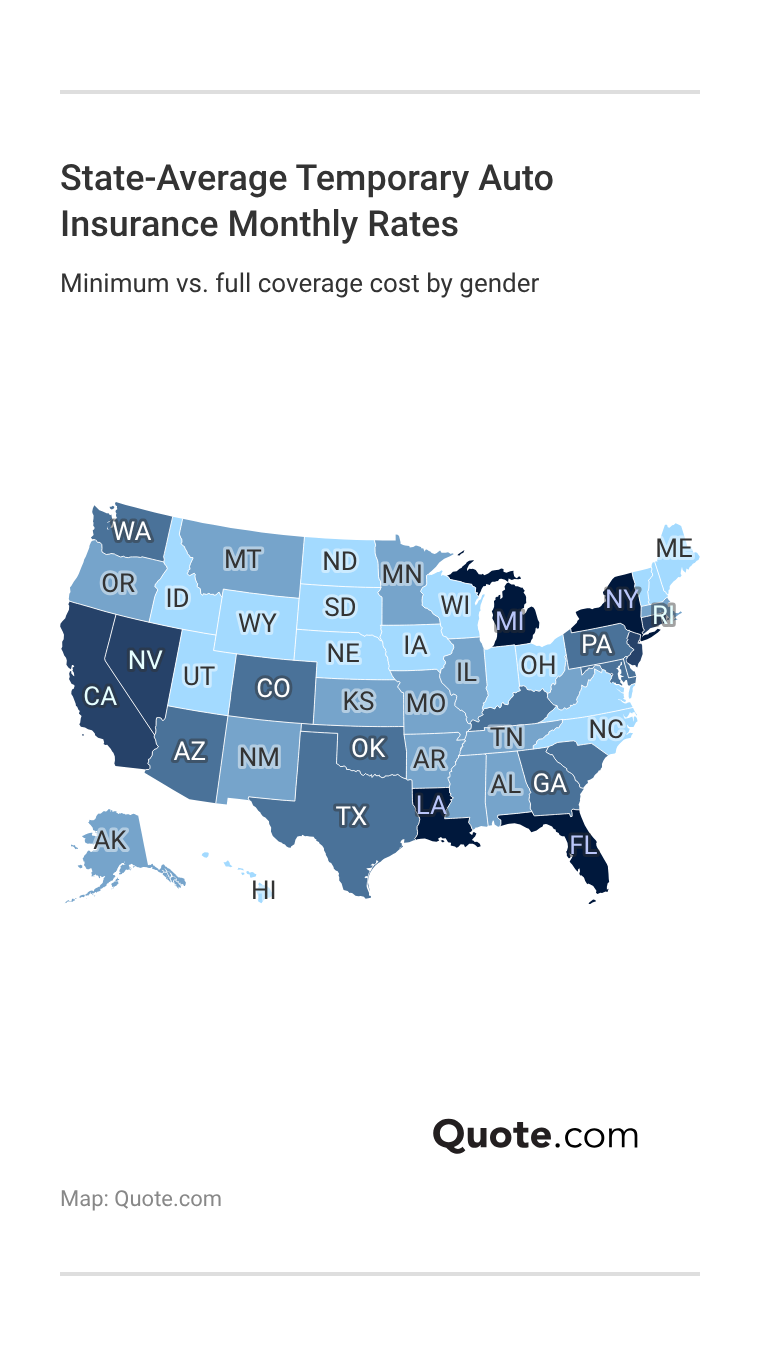

Like all types of auto insurance coverage, temporary auto insurance rates are affected by factors like the type of coverage you need, your driving history, where you live, and what you drive.

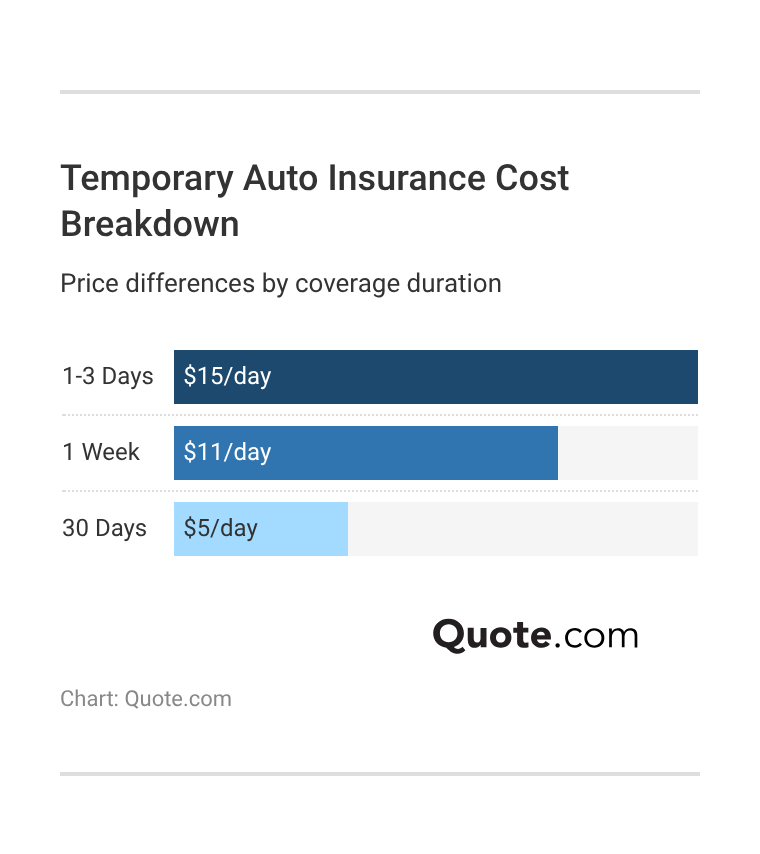

The amount you pay per day will also change depending on how long you actually need the insurance. Since you’ll likely have to pay for at least a month of coverage, you’ll pay less per day the longer you use it.

While short-term coverage may seem cheaper upfront, it often costs more per day than a standard policy. Cheap month-to-month car insurance isn’t difficult to find, especially if you only need liability-only insurance.

If you think you’ll need temporary insurance again in the near future, it may be best to simply purchase a standard policy.

Top Factors Impacting Temporary Car Insurance Rates

Your monthly premiums will also be affected by the amount of coverage you choose between liability and full coverage car insurance.

The cheapest option is a minimum insurance policy that ensures you’re legally covered. Full coverage offers better protection, but costs more.

Temporary Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $95 | $252 | |

| $73 | $195 |

| $35 | $94 |

| $91 | $239 | |

| $46 | $124 | |

| $110 | $285 |

| $76 | $194 | |

| $42 | $113 | |

| $56 | $147 | |

| $58 | $154 |

Many insurance companies consider gaps in your insurance history to be a red flag, so temporary full coverage can be particularly expensive.

Although many other factors affect your rates, one of the most important is where you live (Read More: Auto Insurance Rates by State).

If you’re interested in other types of temporary insurance listed above, the good news is that they’re typically affordable. For example, a non-owner policy can be significantly less expensive compared to a standard plan.

Whichever type of insurance you choose, one of the most important things to do to save money is to compare as many quotes as possible. Comparing quotes and understanding cancellation fees can help you avoid overpaying for short-term coverage.

Find Affordable Temporary Car Insurance

Temporary auto insurance can be a helpful solution for short-term driving needs, even though true day-by-day policies are rare in the U.S.

By understanding the available options, such as cancellable standard policies, non-owner insurance, rental car coverage, and pay-as-you-go auto insurance, drivers can find flexible coverage that keeps them legally protected without committing to a long-term policy.

The key is choosing coverage that matches how long you’ll be driving and what vehicle you’ll be using. Reviewing cancellation terms and learning how to compare multiple auto insurance quotes can help you avoid gaps in coverage or unnecessary costs.

If you’re ready to find temporary car insurance today, enter your ZIP code into our free comparison tool now.

Frequently Asked Questions

Can you temporarily insure a car?

True short-term auto insurance policies are rare in the U.S., but you can get temporary coverage through alternatives like cancelable standard policies, non-owner insurance, or rental car coverage. These options can provide legal protection for short periods.

Learn More: How to Cancel an Auto Insurance Policy

Does temporary car insurance work?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.