Temporary Auto Insurance Coverage in 2026

Most companies no longer sell temporary auto insurance coverage, but several short-term alternatives are available. Rates start at just $35 per month, though they often cost more than a standard policy. Common short-term solutions include adjusting or canceling an existing policy or purchasing non-owner insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Copywriter

Malory Will has an M.A. in English from Arizona State University. She has over four years of experience in writing for the insurance industry. With a background in health, auto, life, and homeowners insurance, Malory is passionate about making complex insurance topics clear and approachable. Her goal is to help readers make informed decisions with confidence.

Malory Will

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated January 2026

The best way to get temporary auto insurance coverage is to purchase a regular policy and cancel it when you no longer need coverage.

- Most providers don’t sell true temporary auto insurance policies

- The most common temporary solution is to cancel a standard policy

- Other options include non-owner or usage-based insurance (UBI)

The best temporary auto insurance companies can help you find a solution that works for your needs, whether that be a standard policy you cancel later, rental car coverage, or even pay-as-you-go car insurance.

Read on to explore your options for temporary auto insurance coverage and how much it might cost. Then, enter your ZIP code into our free comparison tool to find the cheapest temporary car insurance in your area.

Temporary Auto Insurance Explained

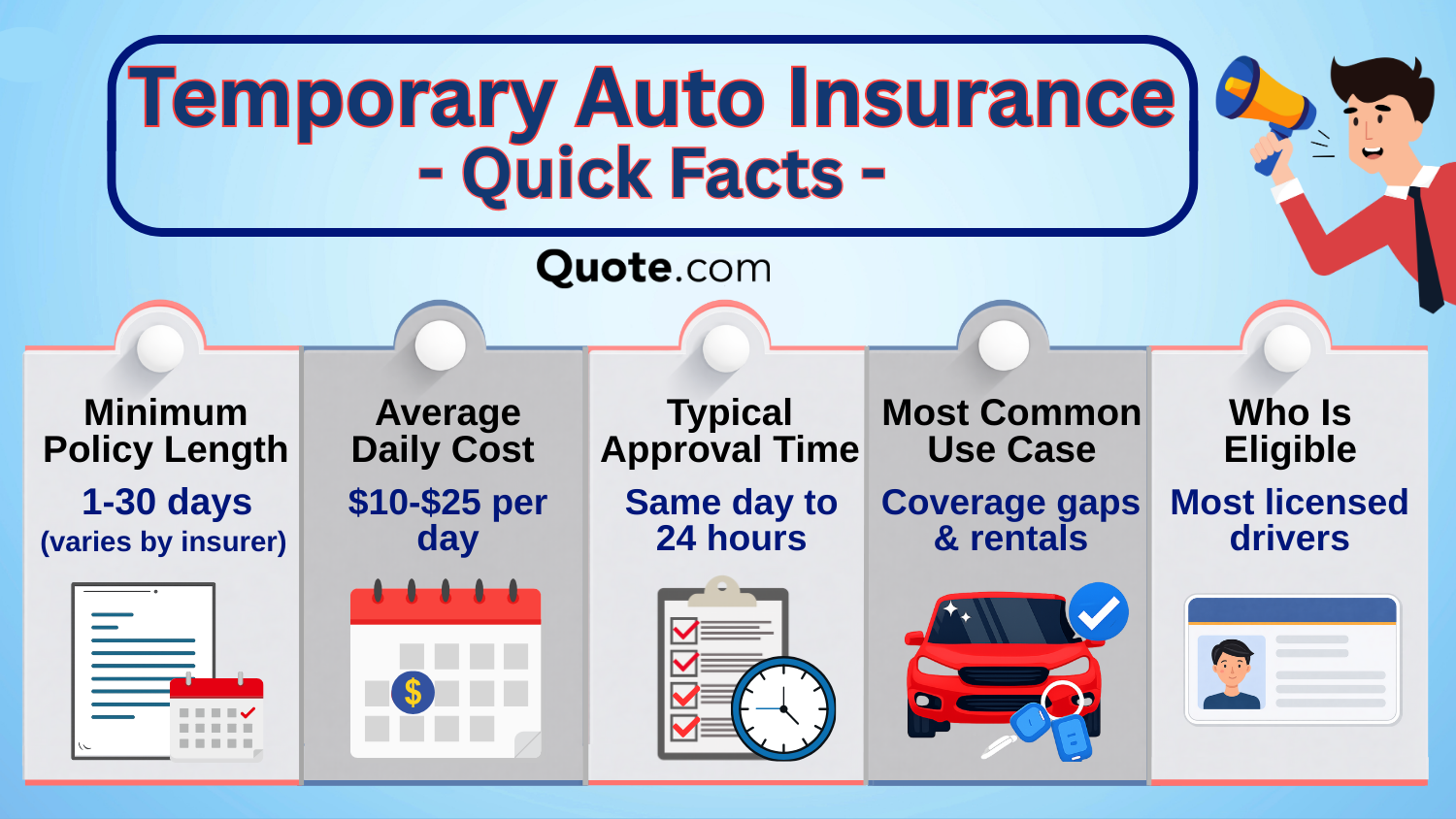

Temporary auto insurance usually refers to short-term coverage lasting from a single day to a few months. These alternatives must still meet your state’s minimum liability requirements, even if you only need coverage for a day or two.

Today, most insurance providers don’t offer true temporary car insurance policies. Instead, you’ll need to find alternative solutions that work for your needs.

Common short-term auto insurance alternatives include non-owner car insurance, rental car insurance, pay-per-mile insurance, and standard auto insurance policies you can cancel at any time.

Temporary Auto Insurance: Coverage Overview| Feature | Description |

|---|---|

| Cost Structure | Higher per day, but cheaper for brief use |

| Coverage Duration | Usually 1 to 30 days, but up to 6 months |

| Coverage Options | Includes basic and optional coverages |

| Eligibility Requirements | Age and driving record may affect eligibility |

| Flexibility | Ideal for trips or borrowing a car |

While true day-by-day auto insurance policies are rare in the U.S., many insurers offer flexible alternatives that will cover your need for car insurance for a short period.

These options are often used when someone needs cheap same-day car insurance for a brief period without committing to a traditional long-term policy.

Drivers should be aware that there are downsides to buying car insurance for a short period. For one, purchasing day-by-day car insurance coverage will be more expensive than a regular policy.

Additionally, one factor that affects insurance rates is your coverage history. Having coverage gaps is a red flag to insurance companies, and you’ll likely see higher rates when you need car insurance again.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Types of Temporary Car Insurance

Although the most common solution drivers find is to purchase a standard insurance policy and cancel it when they no longer need coverage, you have other options.

Non-owner policies and usage-based insurance are popular short-term auto insurance options. Depending on your needs, it may be better to purchase rental car coverage, or ask your provider if they have reduced rates for storing a vehicle.

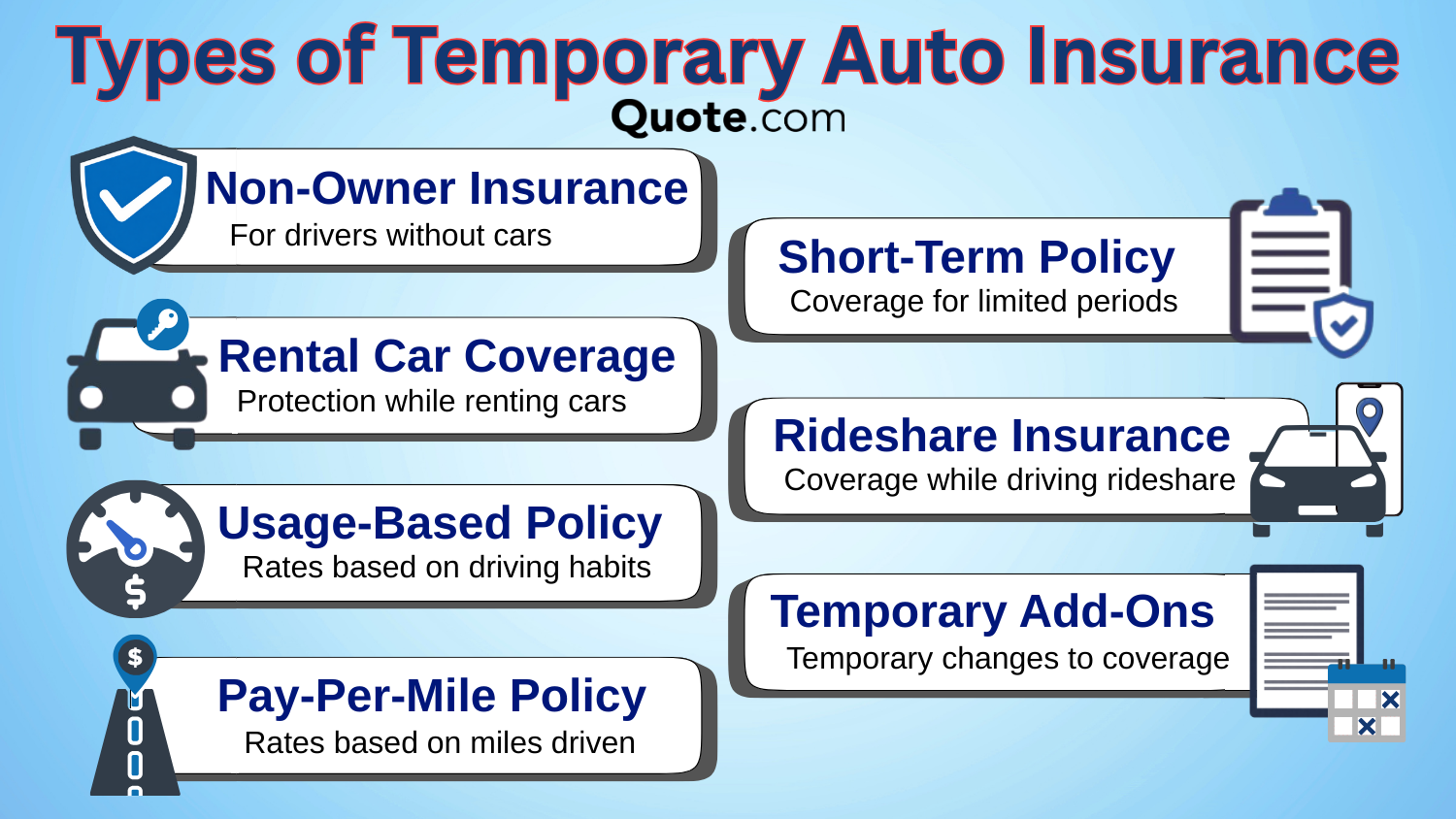

From rideshare insurance for Uber and Lyft drivers to finding temporary add-ons that increase the value of an existing standard policy, there are a ton of creative ways for you to get the coverage you need.

You have a variety of types of auto insurance to meet your short-term coverage needs, but the most common are the following:

- Non-Owner Insurance: Covers you when driving vehicles you don’t own, such as borrowed or rented cars. It’s ideal for people who need coverage but don’t own a car.

- Rental Car Coverage: If you need temporary car insurance because you’re renting a car, you can probably buy coverage from your rental company.

- Standard Policy: The most commonly used method of getting temporary coverage is to buy a standard policy, then cancel it when you no longer need it.

- Usage-Based Insurance: Usage-based car insurance includes pay-as-you-go car insurance and is a great option for drivers who own a car but rarely drive.

You should always check that your policy covers your needs before you start driving. For example, many standard auto insurance policies extend liability, comprehensive, and collision insurance to rental cars when you travel.

Be sure to verify your coverage before you drive a rental without other coverage, so you’re not financially responsible if something happens.

Another option is to be added to someone else’s policy if you’re going to be driving their car. This is a great option for people who frequently borrow someone else’s car for work, school, or running errands.

Typically, you can only add someone to your policy if they live with you, such as a spouse, parent, child, or roommate.

Michelle Robbins Licensed Insurance Agent

Teen drivers can save a significant amount of money on their insurance by having a parent or guardian add them to an existing policy. However, the policyholder will see their rates increase when adding a new driver, so this option might not work for everyone.

Regardless of why you want to buy month-to-month insurance for a car, researching your options before buying a policy will save you time and money. Even if it costs more over time than maintaining a standard policy, it’s best to purchase a temporary policy rather than risk driving without auto insurance.

Temporary vs. Standard Auto Insurance

The biggest difference between temporary and standard auto insurance is the duration of the policy.

Standard auto insurance policies typically last six or 12 months, while temporary options are designed to cover short-term needs.

Temporary vs. Standard Auto Insurance: Key Differences| Feature | Temporary | Standard |

|---|---|---|

| Best Uses | Gaps, rentals, borrowed car | Daily driving & ownership |

| Discounts | Limited discounts | Broad discounts |

| Duration | Days–weeks | 6–12 months |

| Flexibility | Cancel anytime | Cancellation fees |

| Premiums | Higher cost | Lower cost |

Temporary coverage often comes with fewer customization options and may cost more. Standard policies, on the other hand, usually offer better rates, more discounts, and broader coverage choices for drivers who need ongoing protection

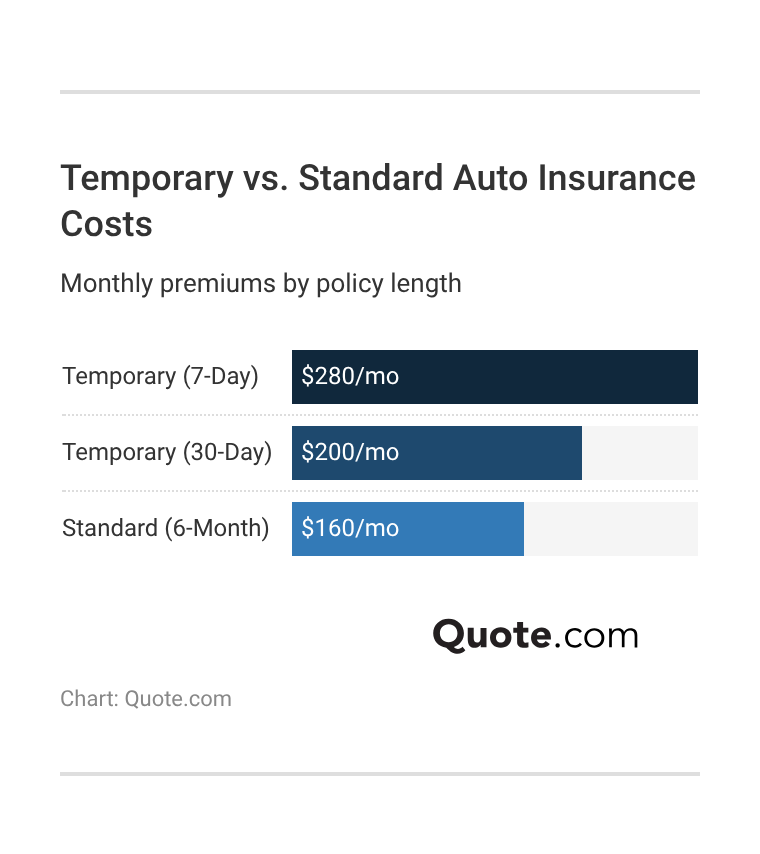

One major thing to keep in mind is that temporary auto insurance costs more than a standard policy, especially if you have gaps in your coverage history. Here’s an example of the price difference between temporary and standard insurance.

Temporary auto insurance can be significantly more expensive in the long run than maintaining standard coverage. How much you’ll pay depends on whether your need liability or full coverage auto insurance, but temporary policies are always more expensive in the long run.

The cheapest six-month car insurance policy can be very affordable, especially if you only need minimum coverage, and it can save you from the headache of increased rates later.

How to Get Temporary Auto Insurance

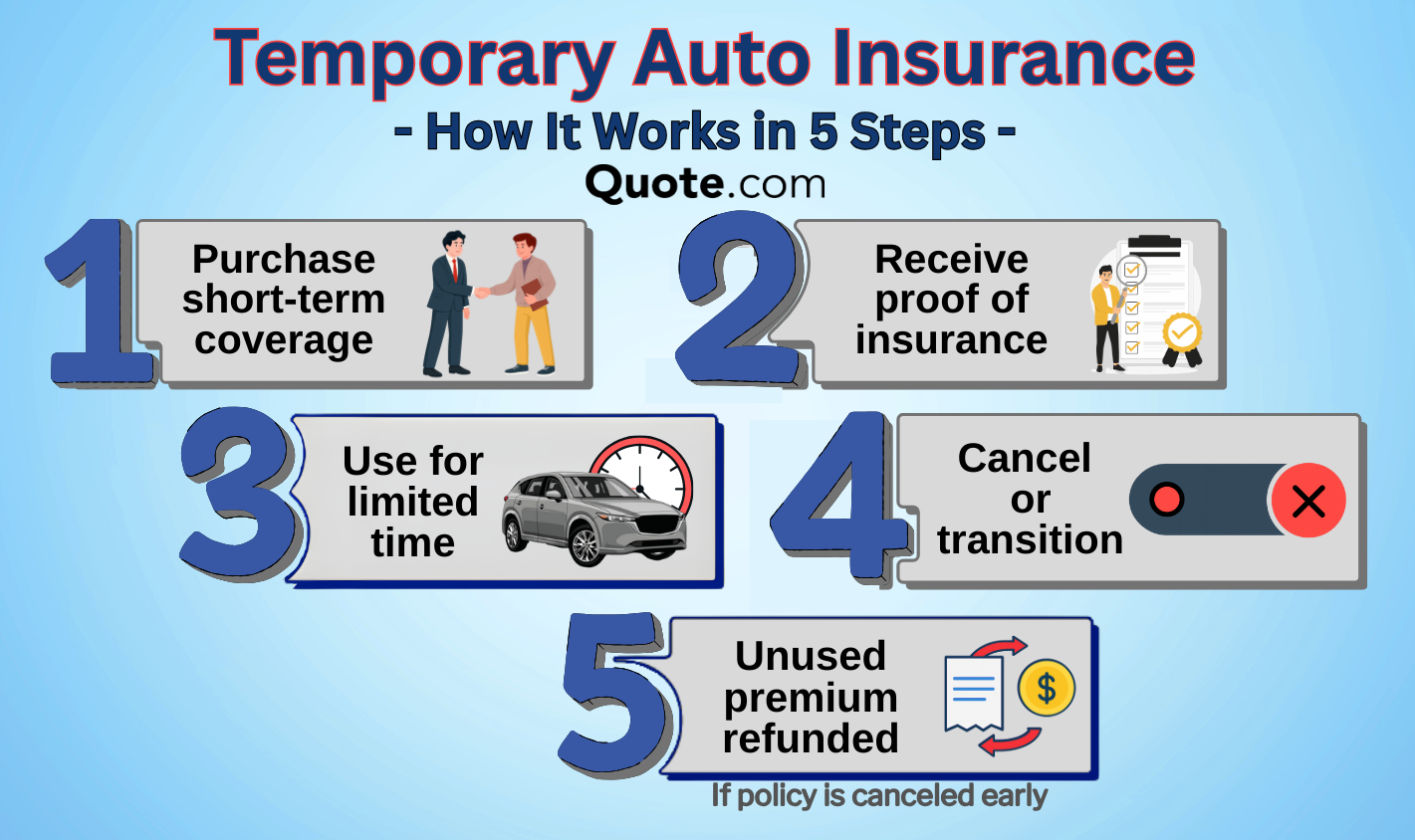

Since most insurance companies don’t offer true short-term car insurance, buying a temporary policy takes a few more steps than it does to purchase a standard policy. Instead, temporary coverage usually comes from flexible alternatives that can be started quickly and canceled when no longer needed.

Picking the right type of insurance can be tricky, especially when you only want temporary coverage. However, these helpful steps keep the process straightforward:

- Determine Your Coverage Needs: The best short-term workaround for car insurance depends on how long you need coverage.

- Choose the Right Option: Depending on your needs, a standard policy, non-owner coverage, pay-per-mile insurance, or rental car coverage will be your best option.

- Gather Your Documents: There are a few documents, like your driver’s license, that you need for auto insurance, even if the coverage will be temporary.

- Compare Multiple Quotes Online: Comparing quotes from multiple companies on insurance comparison websites is the best way to make sure you don’t overpay for coverage.

- Buy Your Short-Term Policy: You’ll need to make a payment before coverage can start. Most providers offer instant coverage in case you need auto insurance today.

The key is choosing the option that best matches your situation and coverage requirements. Our guide to how to buy auto insurance breaks down the process.

You’ll more than likely need to cancel your policy once you no longer need coverage, since insurance companies don’t offer true temporary policies.

However, you may be able to start the process online. To check, simply log in to your account either on your provider’s website or through their app.

Most companies allow you to cancel at any time during your policy, often with a prorated refund, making this a practical workaround for short-term needs.

Daniel S. Young Managing Editor

Before purchasing, confirm whether the insurer charges cancellation fees and how refunds are handled.

Some companies won’t send out a refund if you use less than a month’s worth of coverage, so check before you buy if you only need daily or weekly car insurance.

Average Auto Insurance Cancellation Fees| Company | Fee Amount | Refund Policy |

|---|---|---|

| $0–$30 | Prorated unused premium | |

| $0–$50 | Prorated after fee |

| $0–$50 | Prorated minus fees |

| $0–$50 | Prorated minus fees | |

| $0 | Prorated unused days | |

| $0 | Prorated remaining term |

| $0 | Prorated unused days | |

| $0–$50 | Prorated after fee | |

| $0 | Prorated unused days | |

| $0–$25 | Prorated unused premium |

Some companies charge an early cancellation fee if you end your policy before the first six months.

If you plan on getting daily or even weekly car insurance, you should check that there won’t be an early cancellation fee before you sign up.

Reasons to Buy Temporary Auto Insurance

The most common reasons drivers look to buy auto insurance month-to-month are when they want to borrow a vehicle, are infrequent drivers with their own car, or are students returning home for the summer.

It’s also useful for vacationers looking to cover a rental car, people relocating to a new city or state, and drivers waiting for a permanent policy to begin.

Temporary coverage can help ensure you stay legally insured without paying for months of coverage you don’t need. For many, it’s a practical workaround to an immediate problem rather than a long-term solution.

The type of insurance you purchase should match your needs, so shop around to get a better idea of which insurance might best suit you.

Best Temporary Insurance Options by Situation| Situation | Best Option | Why it Works |

|---|---|---|

| Borrowing a car | Non-owner policy | Liability-only coverage |

| Car in storage | Storage coverage | Weather, fire, & theft damage |

| Occasional driving | Usage-based policy | Pay-per-mile savings |

| Renting a car | Rental car insurance | Short-term rental protection |

| Short coverage gaps | Short-term policy | Prorated refund possible |

You should make sure to buy the coverage that best suits your needs. For example, if you frequently borrow other people’s vehicles but don’t own one yourself, a non-owner policy may be your best bet. Or, if you plan on storing a vehicle, the best discounts for garaging or storing cars could cut your rates significantly.

If you have a car but don’t drive very often, a pay-per-mile auto insurance policy is a great way to cut your premiums. You should only buy a pay-per-mile insurance policy if you put fewer than 10,000 miles on your car each year.

For other situations, your insurance company might offer solutions that don’t involve canceling your coverage. For example, military members should check out our USAA Insurance review for storage rates for drivers on active deployment.

Other common situations include college students leaving their cars behind at home when they attend a university in another city. A student-away-from-home discount significantly lowers insurance costs as long as they leave their vehicles at home.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Temporary Auto Insurance Costs

Like all types of auto insurance coverage, temporary auto insurance rates are affected by factors like the type of coverage you need, your driving history, where you live, and what you drive.

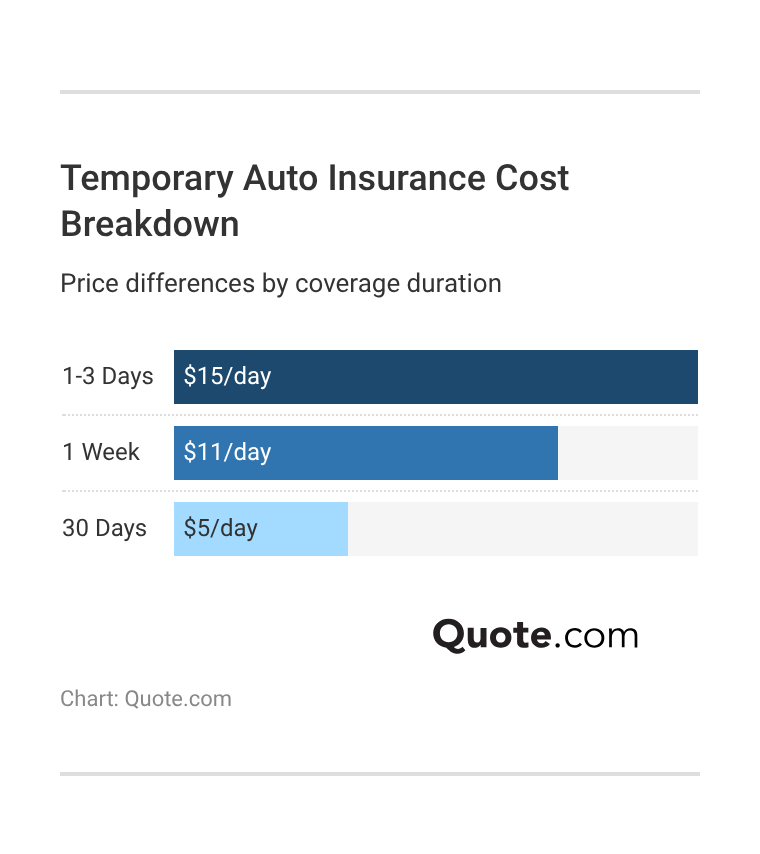

The amount you pay per day will also change depending on how long you actually need the insurance. Since you’ll likely have to pay for at least a month of coverage, you’ll pay less per day the longer you use it.

While short-term coverage may seem cheaper upfront, it often costs more per day than a standard policy. Cheap month-to-month car insurance isn’t difficult to find, especially if you only need liability-only insurance.

If you think you’ll need temporary insurance again in the near future, it may be best to simply purchase a standard policy.

Top Factors Impacting Temporary Car Insurance Rates

Your monthly premiums depend on the amount of coverage you choose. There are a ton of options out there, but most drivers pick between a minimum insurance policy or a full coverage policy.

The cheapest option is a minimum insurance policy that ensures you’re legally covered. Full coverage offers better protection, but costs more.

Temporary Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $95 | $252 | |

| $73 | $195 |

| $35 | $94 |

| $91 | $239 | |

| $46 | $124 | |

| $110 | $285 |

| $76 | $194 | |

| $42 | $113 | |

| $56 | $147 | |

| $58 | $154 |

Many insurance companies consider gaps in your insurance history to be a red flag. If you have gaps in your insurance history, you’ll likely be charged higher rates. If this is the case for you, temporary full coverage might be particularly expensive.

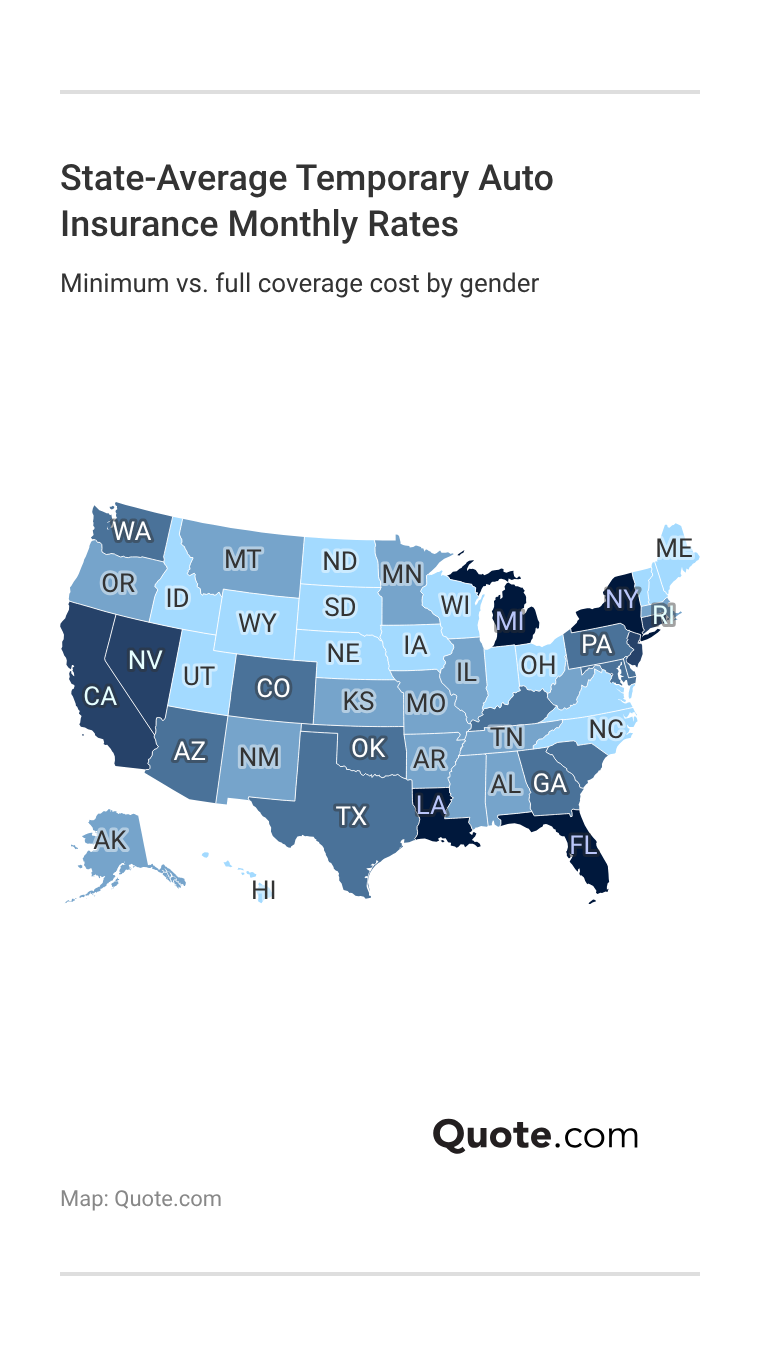

Although many other factors affect your rates, one of the most important is where you live. Take a look below to see average temporary auto insurance rates by state.

If you’re interested in other types of temporary insurance listed above, the good news is that they’re typically affordable. For example, a non-owner policy can be significantly less expensive compared to a standard plan.

Whichever type of insurance you choose, one of the most important things to do to save money is to compare as many quotes as possible. Comparing quotes and understanding cancellation fees can help you avoid overpaying for short-term coverage.

Find Affordable Temporary Car Insurance

Temporary auto insurance can be a helpful solution for short-term driving needs, even though true day-by-day policies are rare in the U.S.

By understanding the available options, such as cancellable standard policies, non-owner insurance, rental car coverage, and pay-as-you-go auto insurance, drivers can find flexible coverage without having to commit to a long-term policy.

The key is choosing coverage that matches how long you’ll be driving and what vehicle you’ll be using. Reviewing cancellation terms and learning how to compare multiple auto insurance quotes can help you avoid gaps in coverage or unnecessary costs.

If you’re ready to find temporary car insurance today, enter your ZIP code into our free comparison tool now.

Frequently Asked Questions

Can you temporarily insure a car?

True short-term auto insurance policies are rare in the U.S., but you can get temporary coverage through alternatives like cancelable standard policies, non-owner insurance, or rental car coverage.

Learn More: How to Cancel an Auto Insurance Policy

How does temporary car insurance work?

Depending on the type of coverage you purchase, temporary driver insurance works similarly to standard policies. For example, if you purchase a standard policy with plans to cancel it later, you’ll have access to all the coverage in that plan while it’s active. Then, when you’re done with the policy and no longer need it, you’ll lose your coverage once you cancel it.

How long can you use temporary car insurance?

Since there aren’t any true temporary car insurance options on the market, most short-term solutions can be used indefinitely. You’ll need to cancel your policy when you no longer need coverage, so you can buy car insurance for one week or one month of car insurance. Simply cancel the policy when you’re done with it.

How much does temporary auto insurance cost?

Insurance by the day tends to cost more than a standard policy over time, but you can find rates as low as $5 per day with the right companies. There are many factors that affect short-term driving insurance, though, including your age, driving record, and what type of car you drive.

Read More: Best Low-Mileage Auto Insurance Discounts

Is temporary insurance cheaper than full coverage?

Short-term insurance for a car is usually more expensive than a standard full coverage policy when you break it down by daily cost. Full coverage policies often offer better overall value if you need insurance for more than a short period. Enter your ZIP code to compare full coverage and temporary car insurance costs near you.

What is one-day car insurance?

One-day car insurance typically refers to very short-term coverage needs rather than an actual daily car insurance policy. If you need car insurance for a single day, a non-owner policy or rental car policy might be the right choice for you.

Who offers temporary car insurance coverage?

While insurance companies don’t offer true temporary car insurance for short-term use, you can find alternative solutions from most companies. The best temporary auto insurance companies include Erie Insurance, Nationwide, and Liberty Mutual because they offer affordable rates and solutions like non-owner insurance and easy-to-cancel standard policies.

Who is the cheapest for temporary car insurance?

The cheapest auto insurance for temporary typically comes from companies like Erie Insurance and Geico. However, the best way to get cheap temporary car insurance is to compare quotes with as many companies as possible. To get started, enter your ZIP code into our free comparison tool today.

Can you buy temporary auto insurance for a rental car?

Yes, you can purchase insurance directly from the rental company. If you already have a standard insurance policy, it probably already covers rental cars. Alternatively, you may get rental coverage through a credit card. Coverage details and limits vary, so make sure to check before you start driving.

Can someone add you to their insurance policy?

Yes, many insurers allow drivers to be added to an existing policy temporarily or permanently. This is often a simple and cost-effective solution for short-term driving situations. However, you probably need to live with the person before you can be added to their policy.

Read More: Best Auto Insurance for Young Adults

How does insurance work when driving someone else’s car?

Can you buy instant car insurance?

Can you buy insurance for a car that you don’t own?

Do car dealerships offer temporary insurance?

What is pay-as-you-go auto insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.