Homeowners Insurance Coverage in 2026

Homeowners insurance covers your home, personal items, and other structures for as low as $79 a month, protecting against fire, theft, and storm damage. Most home insurance policies exclude damage from flooding and earthquakes, but you can add endorsements to cover those areas.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Copywriter

Malory Will has an M.A. in English from Arizona State University. She has over four years of experience in writing for the insurance industry. With a background in health, auto, life, and homeowners insurance, Malory is passionate about making complex insurance topics clear and approachable. Her goal is to help readers make informed decisions with confidence.

Malory Will

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated February 2026

What is home insurance and what does it cover? A basic home insurance policy covers your home’s structure and belongings after your deductible applies, starting at $79 per month.

- Home insurance offers dwelling coverage for your home’s structure

- Contents coverage protects personal belongings in your home

- Home insurance averages $114 a month for a $200K dwelling

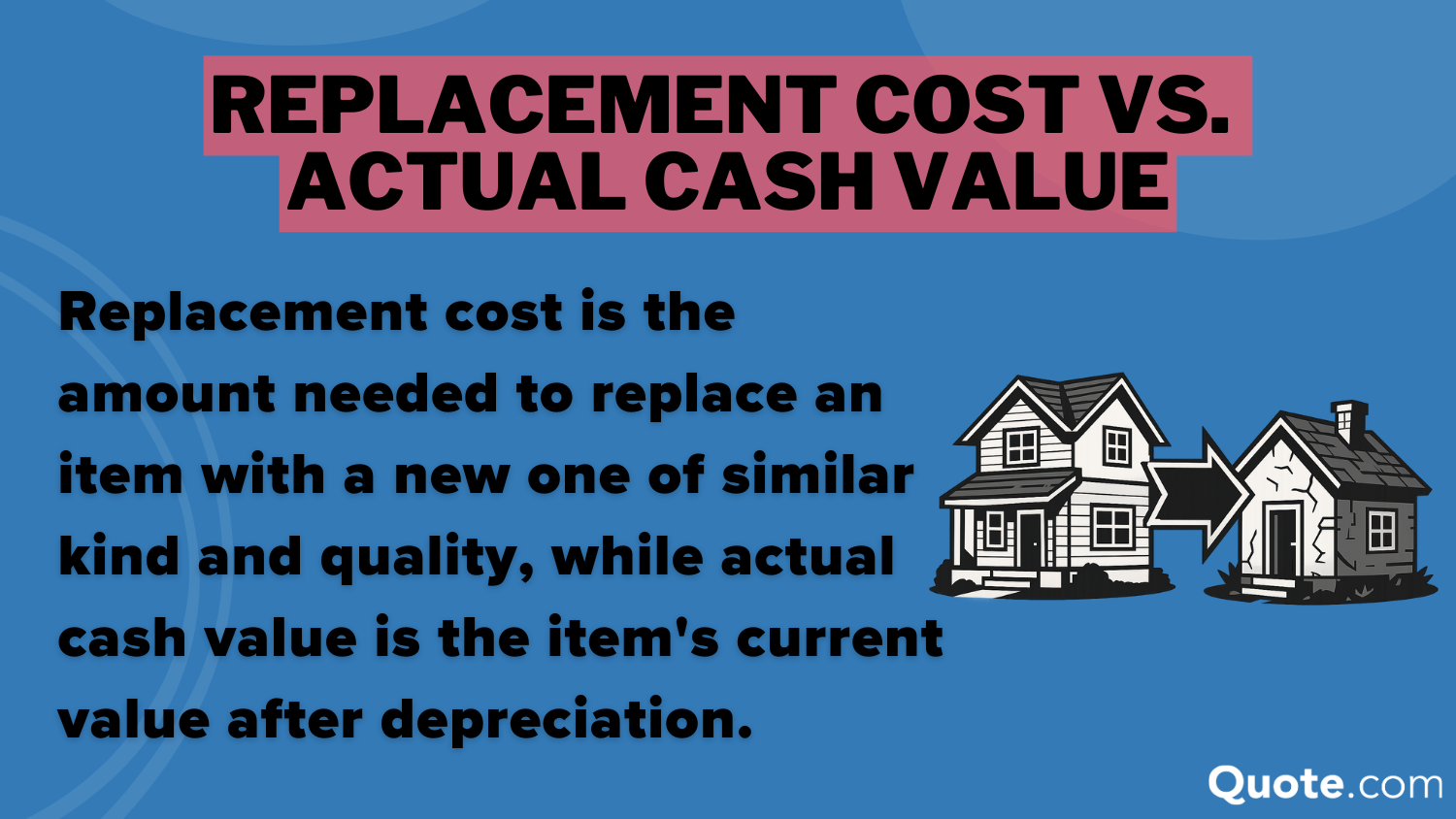

You can choose between replacement cost coverage, which pays its current value, or actual cash value coverage, which accounts for depreciation. Is home insurance required? Most mortage lenders require home insurance, but it’s not required by law.

- Home Insurance Basics

See how much homeowners insurance you need, and find out what home insurance covers. Then, enter your ZIP code to get free home insurance quotes from providers near you.

What Homeowners Insurance Covers

Homeowners insurance protects the structure of your home as well as your personal belongings.

It also protects guests who are injured on your property by covering medical costs and legal fees.

Home Insurance Coverage Options| Coverage Type | What it Covers |

|---|---|

| Dwelling | Your house and attached structures |

| Loss of Use | Extra costs if home is unlivable |

| Medical Payments | Medical bills for guest injuries |

| Other Structures | Property not attached to house |

| Personal Liability | Legal costs for injury lawsuits |

| Personal Property | Clothes, electronics, and furniture |

Most homeowners insurance policies also include loss of use coverage, which helps pay for temporary housing, meals, and extra living expenses if your home becomes uninhabitable after a covered loss.

However, policies list specific damages that aren’t covered without an optional rider or endorsement.

The most basic homeowners insurance policies come in two parts. Homeowners insurance dwelling coverage means the structure of your home, such as walls, the roof, and any built-in appliances. Meanwhile, liability coverage pays for any legal or medical bills if someone gets injured on your property.

Personal property coverage often has sub-limits for high-value items like jewelry, artwork, or collectibles, making scheduled endorsements essential for full reimbursement.

You can pick and choose more homeowners insurance coverage options based on the type of policy you buy.

The most common types of homeowners insurance are HO-3 and HO-5 policies. Both protect your home and belongings from common risks, but HO-5 offers broader coverage with fewer exclusions.

Types of Home Insurance Policies| Type | Policy | What it Covers |

|---|---|---|

| HO-1 | Basic | Perils like fire, theft, & falling objects |

| HO-2 | Broad | HO-1 perils + water damage, surges |

| HO-3 | Special | All perils except noted exclusions |

| HO-4 | Contents | Renters: Covers items and liability |

| HO-5 | Comprehensive | HO-3 perils at replacement value |

| HO-6 | Unit-Owners | Condos: Covers items and liability |

| HO-7 | Mobile Home | Mobile home coverage like HO-3 |

| HO-8 | Modified | Homes 40+ years old or historic |

HO-5 policies usually provide open-peril coverage for personal belongings, meaning items are covered unless specifically excluded in the policy.

Basic policies like HO-1 and HO-2 only cover risks that are listed in the policy. HO-3 and HO-5 protect against most risks unless they’re excluded. There are also special options like HO-4, HO-6, HO-7, and HO-8 that are designed for different property types and ages.

HO-4 policies are built for renters who need protection for their belongings and personal liability. Meanwhile, HO-6, HO-7, and HO-8 forms cover condo owners, mobile homes, and older or historic properties.

You can pick a policy that covers either the replacement cost or actual cash value (ACV) of your property. Replacement cost coverage is ideal because it covers the full cost to repair or rebuild your home at its current value, without factoring in depreciation.

ACV policies are often cheaper, but you won’t get back what you paid for your house or personal items.

Contents coverage protects the valuables inside your home, including furniture, jewelry, and electronics, against theft or damage.Travis Thompson Licensed Insurance Agent

All home insurance policies provide some version of these coverages unless you choose a renters policy.

Learn how to read your homeowners insurance policy:

- Premiums: The monthly or annual rate you agree to pay for home insurance coverage.

- Deductibles: The amount you pay for repairs out of pocket before the insurer pays.

- Covered Losses: In return, the insurer protects your property from the named perils in the policy.

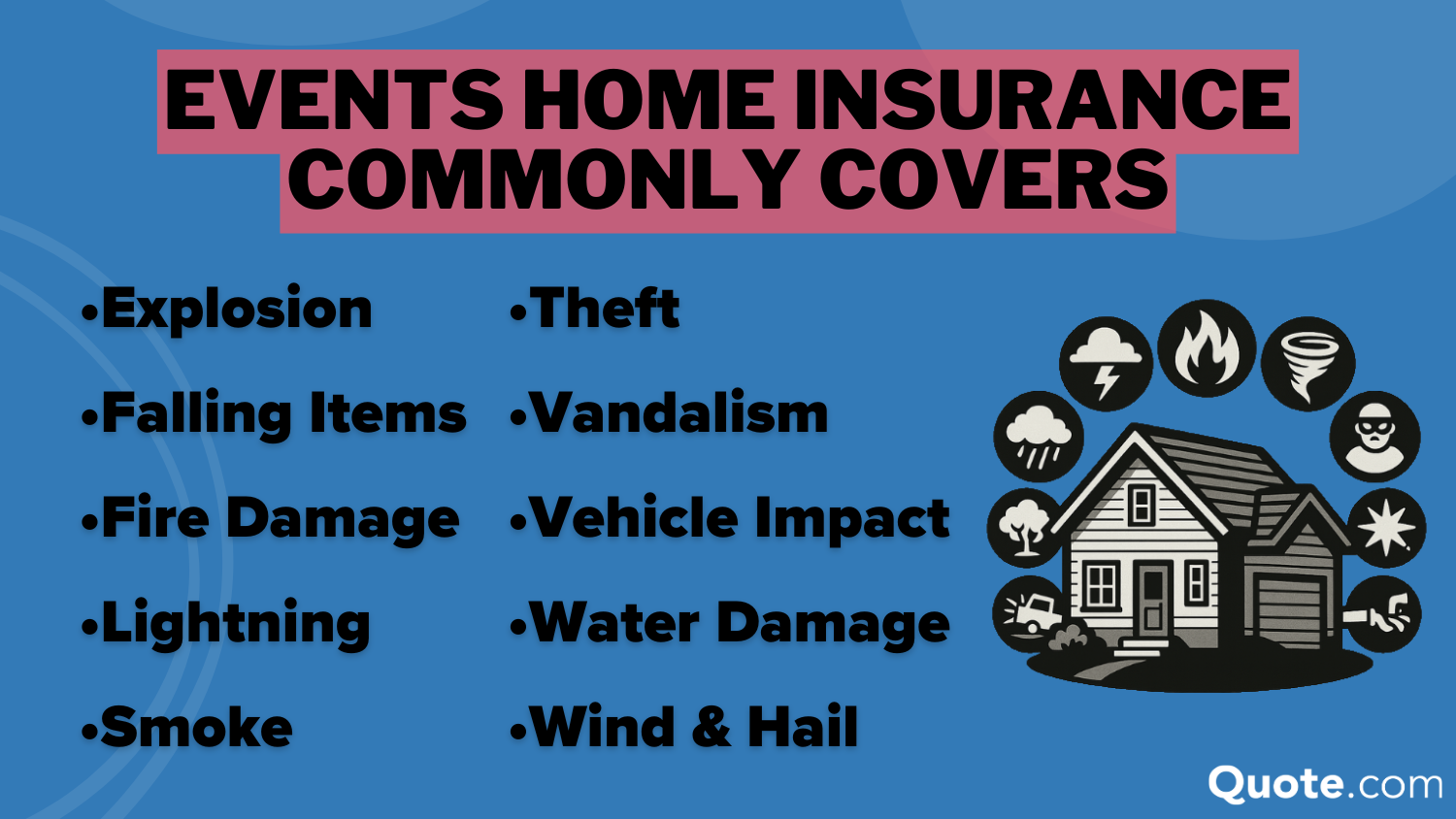

What does homeowners insurance cover and not cover? The 10 common perils covered by most insurance policies include fire, wind or hail, theft, vandalism, and lightning.

Other policies will cover damage caused by freezing and the weight of snow and ice, volcanic eruptions, and accidental damage to air conditioners and heating units.

Learn More: 8 Types of Homeowners Insurance Policies

What Home Insurance Doesn’t Cover

The most common home insurance exclusions are:

- Earthquakes

- Flooding

- Identity theft

- Termites

- Wear and tear

Some states require flood or earthquake riders on all home insurance policies. Since most providers don’t offer this kind of coverage, you can find a policy through the National Flood Insurance Program.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Homeowners Insurance Rates

Insurance companies use certain variables to set homeowner rates. The value of your home has the biggest impact on premiums, and your home insurance rates will be higher if you choose replacement coverage over actual cost value.

Home Insurance Monthly Rates by Provider & Dwelling Coverage| Company | $200K | $300K | $400K | $500K |

|---|---|---|---|---|

| $125 | $158 | $190 | $225 |

| $150 | $185 | $220 | $260 | |

| $81 | $115 | $175 | $310 | |

| $140 | $165 | $195 | $225 | |

| $175 | $210 | $245 | $285 | |

| $110 | $140 | $175 | $205 |

| $86 | $120 | $150 | $179 |

| $79 | $115 | $140 | $168 | |

| $80 | $129 | $156 | $184 |

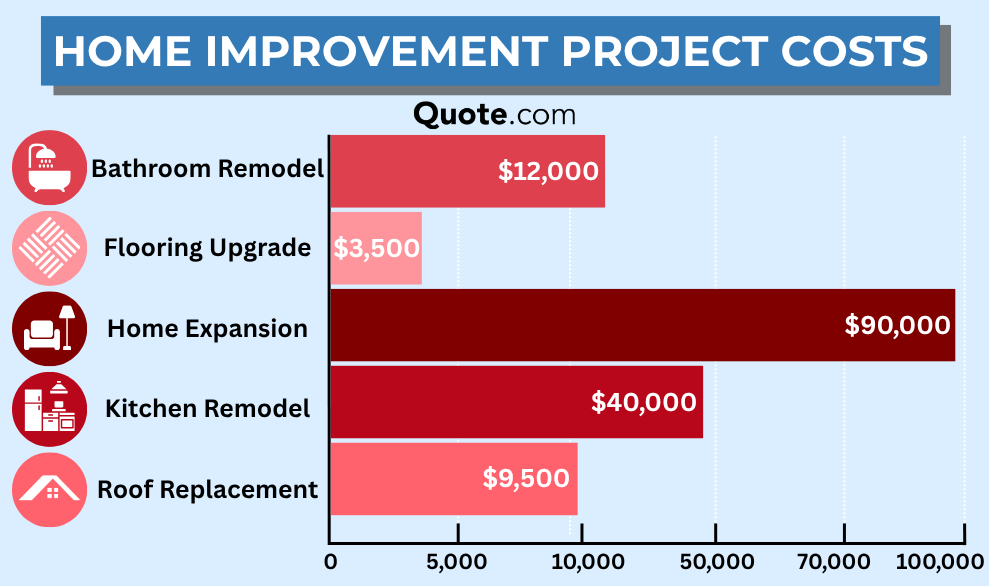

The average price of a home in America is $400K, and many homeowners pay around $200 per month for $400K to $500K in coverage.

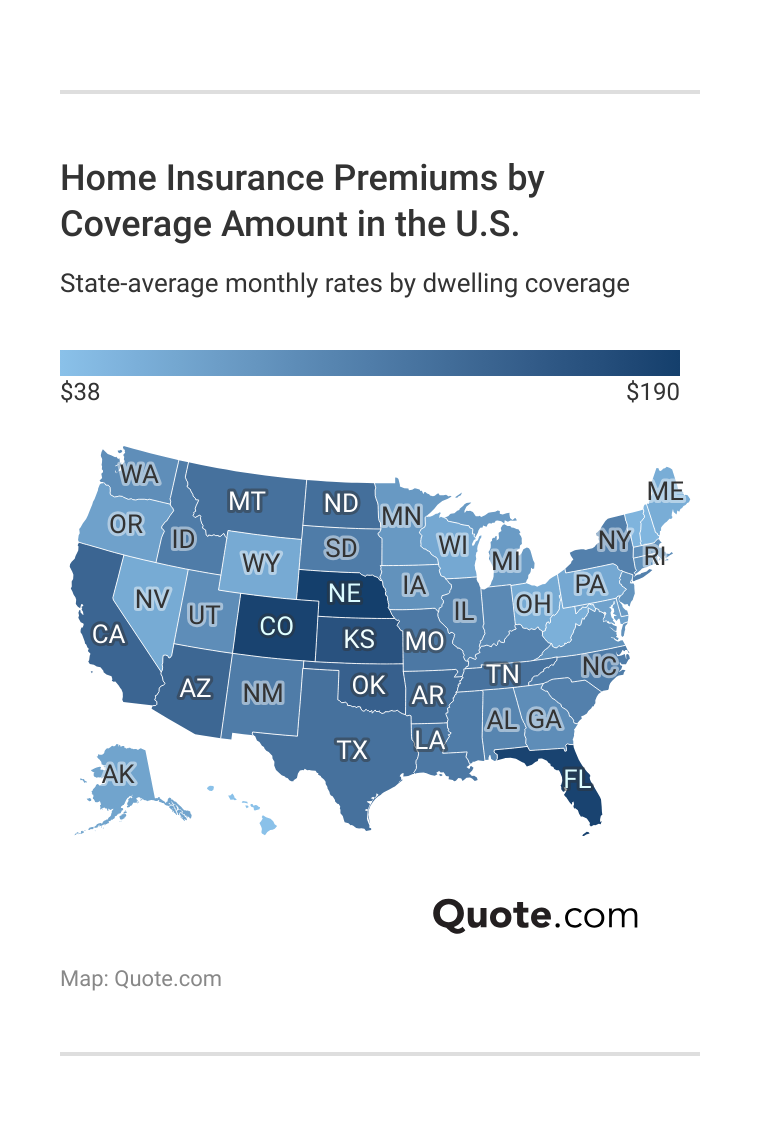

Premiums vary by state based on differences in laws, population density, weather risks, and local claim trends. Also, when homeowners remodel with upgraded materials or add square footage, the cost to rebuild the home goes up, and insurers consider that higher replacement cost when setting insurance premiums.

Always compare home insurance quotes from multiple providers to find the most competitive price based on:

- Location: Living in an area prone to natural disasters like hurricanes or wildfires will raise rates.

- Crime Rates: Premiums are higher in densely-populated neighborhoods with high crime and property damage rates.

- Credit Score: Homeowners with poor credit scores pay more for insurance.

- Deductibles: Agreeing to pay more out of pocket with a higher deductible gets you cheaper premiums but costs more when you file a claim.

For instance, homeowners in Florida often face higher premiums due to the greater threat of hurricanes and severe storms.

While you can’t control these factors, you can lower rates by improving your credit score, increasing your deductible, and bundling policies. Compare home insurance rates by state to see how specific regional risks impact your premiums.

Learn More: Best Home Insurance for High-Value Properties

How to File a Home Insurance Claim

Most insurance companies have an online claim portal, or policyholders can start the process on the mobile app. Still, the quickest way to file an insurance claim is directly with an agent over the phone.

When you file a home insurance claim, you need your policy number and home inventory of your items ready. Document the damage and give the agent a detailed description. Include receipts, appraisals, photos of the damage, and repair estimates from local shops to support your claim.

Having this information ready makes the claims process smoother and helps you get your reimbursement faster.

It helps to take a photo inventory of your personal belongings when you buy a policy so you can verify any damaged or stolen property.

Leslie Kasperowicz Farmers CSR for 4 Years

Then, get repair estimates from local repair shops soon after you file so you’re prepared to negotiate with the insurance adjuster when they come to appraise the damage. If you live in a fire-prone area, learn how to file a home insurance claim after a wildfire.

Homeowners Insurance Policy Explained

Home insurance covers dwellings and personal items inside the home. Homeowners are responsible for deductibles and monthly premium payments, but policies protect against common perils like fire and theft.

Basic home insurance covers property damage and theft, personal liability, loss of use, and medical payments for guests injured on your property. Compare the different types of homeowners insurance to learn more.

However, multiple exclusions apply. For example, earthquake and flood damage is never covered by home insurance unless you buy an endorsement.

Insurance endorsements will raise your monthly rates. Living in high-risk areas prone to crime or natural disasters also raises rates. Enter your ZIP code to compare quotes from the best home insurance companies near you.

Frequently Asked Questions

What does homeowners insurance cover?

Home insurance protects the structure of your home and personal belongings inside from common damages like fire, wind or hail, theft, vandalism, and lightning. Other surprising things homeowners insurance covers include riots and explosions.

What does homeowners insurance not cover?

Homeowners policies do not cover flood or earthquake damage. Other exclusions will be listed in your policy.

What is the most common homeowners insurance policy?

HO-3 Special Form home insurance is the most popular policy. Compare all 8 types of homeowners insurance to pick the right coverage for you.

What is a high-risk item in home insurance?

Insurance companies define high-risk items differently, but typically it refers to very valuable pieces of art, jewelry, furniture, musical instruments, and other rare or collectible items. Electronics like smartphones, computers, and audio-visual production equipment are also high risk.

What are the two main types of homeowners insurance?

Basic homeowners insurance policies come in two parts: dwelling and contents coverage. Dwelling coverage protects the home itself, while contents coverage applies to personal belongings.

What are the cons of homeowners insurance?

Home insurance coverage is limited. Your home isn’t protected against every type of risk or damage, and add-ons and endorsements can get very expensive. Compare homeowners insurance quotes to find the cheapest homeowners insurance in your area.

What are the disadvantages of filing a homeowners insurance claim?

Your monthly home insurance rates will increase at your next renewal if you filed a claim in the past year.

What endorsements should you include on home insurance?

Flood and earthquake endorsements are important to add if you live in a high-risk area.

Should you have homeowners insurance if your house is paid off?

Unless you can afford to repair or replace your home after a fire, flood, or other risk, you should always have home insurance. Find out how much homeowners insurance you need.

How can you lower your home insurance premiums?

Create a thorough home inventory and only buy coverage for what you need. Reducing coverage and increasing your deductibles are two fast and easy ways to lower home insurance rates. Just be sure you’re able to afford to cover the difference if you ever need to make a claim.

What happens if you have a mortgage and no homeowners insurance?

Do you need homeowners insurance if your house is paid off?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.