9 Best Home Insurance Companies in 2026

The best home insurance companies are Chubb, AIG, and Amica. Rates start at $79 per month. These top-rated providers stand out for strong customer satisfaction and valuable add-ons like extended replacement cost and water backup coverage to help protect your home.

Read more Secured with SHA-256 Encryption

Save Money by Comparing Insurance Quotes

Compare Free Home Insurance Quotes Instantly

Table of Contents

Table of Contents

Insurance Content Creator

Lia Vergin develops both video and written content across all lines of insurance, with a primary focus on auto, home, and life coverage. She is dedicated to helping consumers better understand and navigate their insurance options. Driven by a passion for saving money and finding great deals, she is committed to creating clear, engaging, and practical content that empowers readers to make confident...

Lia Vergin

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Mortgage Loan Originator

Steve Crowell is a New Hampshire based mortgage loan originator with Luminate Home Loans, Inc. After graduating from the University of New Hampshire in 2003 with a BS in Business and Economics and a BA in History, he went on to get his broker license in 2005. In 2021, he was recognized as a Luminate Home Loans “Circle of Excellence” top agent. Steve works as a trusted resource for clients w...

Steve Crowell

Updated February 2026

The best home insurance companies are Chubb, AIG, and Amica, starting at $79 monthly for $200K in dwelling coverage.

- Chubb has strong customer satisfaction according to J.D. Power

- State Farm offers a 6% home security discount and free ADT install

- Amica, known for great service, often pays policyholder dividends

Chubb ranks highest in customer satisfaction and offers a Masterpiece Policy for high-net-worth individuals, which provides homeowners insurance coverage for luxury homes, jewelry, fine art, and more.

Our Top 9 Picks: Best Homeowners Insurance Companies| Company | Rank | Claims Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 688 / 1,000 | A++ | High Net-Worth | |

| #2 | 680 / 1,000 | A | Global Coverage | |

| #3 | 679 / 1,000 | A+ | Customer Service | |

| #4 | 674 / 1,000 | A+ | Personalized Policies |

| #5 | 671 / 1,000 | A | Member Benefits |

| #6 | 643 / 1,000 | A++ | Discount Options | |

| #7 | 641 / 1,000 | A+ | Lowest Rates | |

| #8 | 638 / 1,000 | A | Family Plans |

| #9 | 635 / 1,000 | A+ | Rural Homes |

AIG stands out for offering global coverage to over 70 countries and providing customizable add-ons, such as cyber protection and equipment breakdown coverage. Keep reading to compare the best and worst homeowners insurance companies.

Avoid overpaying for your home insurance coverage by comparing top providers in one place. Enter your ZIP code into our free tool to instantly see the most affordable rates near you.

Compare Home Insurance Premiums

Where you live has the biggest impact on your home insurance rates. Comparing quotes is an important step in finding good homeowners insurance coverage at a fair price for your area.

Only a handful of providers operate in all 50 states, so use the map below to estimate homeowners insurance costs where you live.

Inflation, weather, crime rates, location, and the number of claims all impact home insurance prices in your area. For example, areas that experience frequent wind and hailstorms see higher premiums because of increased risk.

In states like Florida and Texas, hurricanes lead to higher home insurance costs to account for the greater likelihood of catastrophic storm damage.

Smaller, regional providers unique to where you live often have better customer service and cheaper rates despite fewer policy options.

See how regional providers in our list of the top homeowners insurance companies compare to national insurers:

Home Insurance Monthly Rates by Provider & Dwelling Coverage| Company | $200K | $300K | $400K | $500K |

|---|---|---|---|---|

| $125 | $158 | $190 | $225 |

| $150 | $185 | $220 | $260 | |

| $81 | $115 | $175 | $310 | |

| $140 | $165 | $195 | $225 | |

| $175 | $210 | $245 | $285 | |

| $110 | $140 | $175 | $205 |

| $86 | $120 | $150 | $179 |

| $79 | $115 | $140 | $168 | |

| $80 | $129 | $156 | $184 |

Since home insurance rates vary widely, it’s important to shop with multiple companies to find the best deal for your specific circumstances and needs.

In addition, home insurance rates are higher for people with lower credit because insurers view them as more likely to file claims.

Home Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670–799) | Fair (580–669) | Poor (<580) |

|---|---|---|---|---|

| $95 | $99 | $104 | $110 |

| $101 | $106 | $112 | $119 | |

| $91 | $94 | $98 | $105 |

| $100 | $103 | $108 | $115 | |

| $104 | $108 | $113 | $121 | |

| $94 | $98 | $103 | $109 |

| $96 | $99 | $104 | $110 |

| $99 | $102 | $107 | $114 | |

| $98 | $101 | $106 | $113 |

Compare quotes from at least three different companies to get an accurate idea of what your neighbors are paying for coverage.

Get started now by entering your ZIP code into our free quote comparison tool.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Save Money on Home Insurance

Discounts are the easiest way to save money on homeowners insurance. Most providers reduce rates for homeowners who pay online or renew their policy every year, but the biggest savings happen when you qualify for home security and bundling discounts.

Top Home Insurance Discounts| Company | Bundling | Early Quote | First-Time Buyer | Home Security |

|---|---|---|---|---|

| 10% | 7% | 5% | 8% |

| 12% | 8% | 5% | 10% | |

| 10% | 10% | 8% | 12% |

| 20% | 10% | 7% | 10% | |

| 10% | 5% | 5% | 12% | |

| 15% | 10% | 8% | 10% |

| 12% | 12% | 10% | 20% |

| 11% | 8% | 7% | 10% | |

| 20% | 12% | 10% | 15% |

State Farm and Amica offer the largest discounts of up to 20% for bundling home and auto insurance. It also stacks different home security discounts that add up to 20% in annual savings.

Policyholders who get an online home insurance quote can save up to 12% on their premiums, and another 10% if they’re a first-time home buyer.

However, even if you don’t qualify for half the home insurance discounts you see, you can still lower your premiums. Follow these tips to get cheaper rates on your policy:

- Upgrade Your Home Security: Enhance your home security with alarm systems and smoke detectors to potentially reduce your insurance costs.

- Increase Your Deductible: Choosing to pay more out-of-pocket when you file a claim will lower your monthly costs, just be sure to pick a deductible you can afford.

- Maintain Good Credit: Insurance companies consider credit history as an indicator of risk. A good credit score demonstrates financial responsibility and better rates.

- Avoid Filing Claims: Insurers reward homeowners who don’t file claims with cheaper rates and claims-free discounts.

Maintaining a good credit and insurance history will do wonders for your premiums. Insurance companies will consider you low-risk, and you’ll see fewer increases at your next policy renewal.

How to Buy a Home Insurance Policy

Buying cheap home coverage is easy — enter your ZIP code to find the best companies near you or visit the website of any of the top providers on our list.

Still, it helps to know how much homeowners insurance you need. Keep reading tips on finding affordable home insurance.

Step #1 – Choose Coverage Limits

Home insurance policies come with multiple layers of coverage to protect the home, your personal belongings, and provide liability protection.

Home Insurance Coverage Options| Coverage Type | What it Covers |

|---|---|

| Dwelling | Your house and attached structures |

| Loss of Use | Extra costs if home is unlivable |

| Medical Payments | Medical bills for guest injuries |

| Other Structures | Property not attached to house |

| Personal Liability | Legal costs for injury lawsuits |

| Personal Property | Clothes, electronics, and furniture |

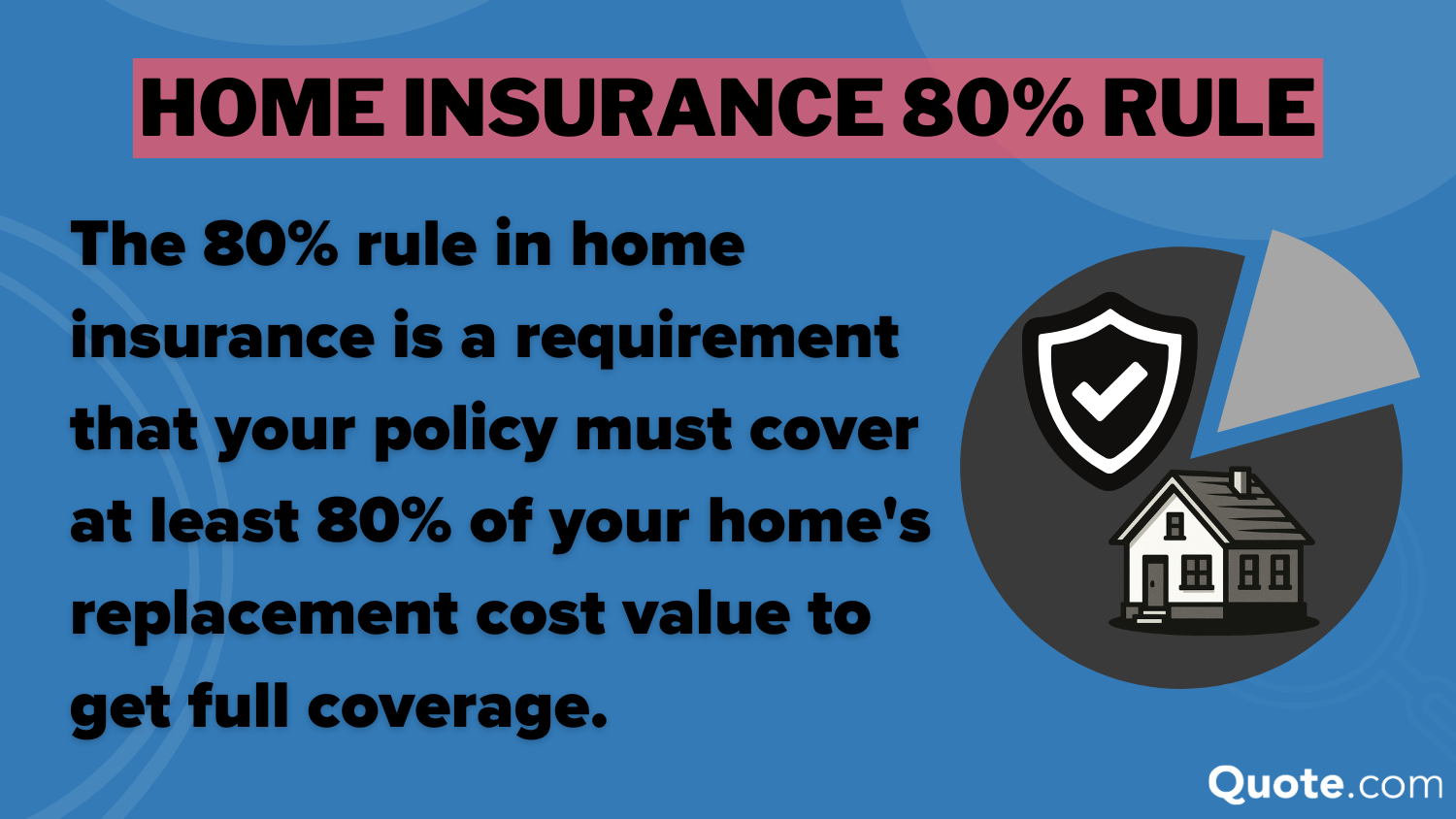

Decide on the limits you want for each type of coverage as you shop around. A rule of thumb for home insurance is to buy enough to cover at least 80% of your home’s value. Most mortgage lenders and homeowners associations require it.

The average home in the U.S. costs $450K, so you’ll need a $320K policy to avoid an underinsured homeowners penalty. However, this is only the bare minimum.

Most homeowners increase policy limits to factor in local risks like weather and crime rates.

Angie Watts Licensed Real Estate Agent

You also need to decide if you want replacement coverage or actual cash value. Choosing replacement cost will increase your rates at most companies, but State Farm and Erie offer it standard.

Erie home insurance goes above and beyond most companies by providing replacement cost for hard-to-replace items like passports and marriage certificates.

Step #2 – Add Endorsements

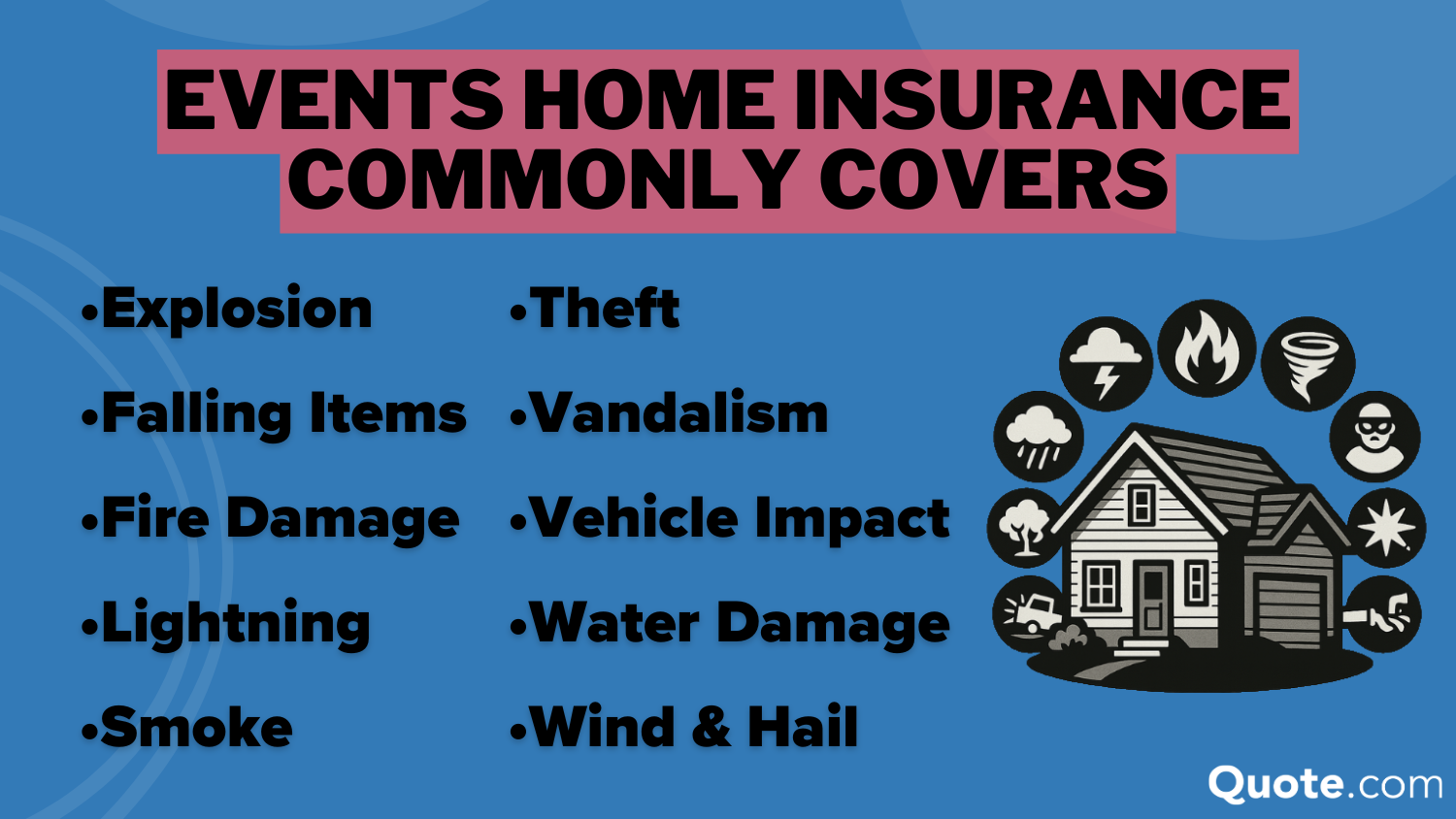

A home insurance endorsement is an add-on to your regular policy for extra protection. They help cover special situations, like earthquakes, floods, or power surges.

Here is a common list of homeowners insurance endorsements. Depending on state laws or your mortgage lender, some of these endorsements might be required:

- Extended Replacement Cost: Increases policy limits by 20% or more if repair costs rise after a disaster.

- Hail/Windstorm Protection: Additional protection for hail and wind damages not typically covered in standard policies.

- Inflation Protection: Automatically raises policy limits to reflect home and building cost increases over time.

- Sewer/Water Backup: Covers damage to your home or other structures but doesn’t always pay to repair or replace septic tanks, water heaters, etc.

These endorsements can enhance your homeowners insurance policy, ensuring you are better protected against various risks and potential damages.

Step #3 – Pick a Policy

Once you know how much coverage you need, choose the eight types of homeowners insurance that best fit your home. HO-3 broad policies are the most popular since they cover every peril unless it’s explicitly excluded from the policy.

Types of Home Insurance Policies| Type | Policy | What it Covers |

|---|---|---|

| HO-1 | Basic | Perils like fire, theft, & falling objects |

| HO-2 | Broad | HO-1 perils + water damage, surges |

| HO-3 | Special | All perils except noted exclusions |

| HO-4 | Contents | Renters: Covers items and liability |

| HO-5 | Comprehensive | HO-3 perils at replacement value |

| HO-6 | Unit-Owners | Condos: Covers items and liability |

| HO-7 | Mobile Home | Mobile home coverage like HO-3 |

| HO-8 | Modified | Homes 40+ years old or historic |

The most common home insurance exclusions are earthquakes and floods, which should be clearly listed in your policy. You can purchase separate riders or endorsements to cover those specific risks.

It’s important to review exclusions carefully to ensure you don’t face unexpected costs from a gap in coverage, and adding endorsements can help cover what your standard policy doesn’t.

While coverage type and cost are important, always compare insurers by customer satisfaction, financial strength, and available discounts to find the best company for your needs. Enter your ZIP code to compare free quotes from the top homeowners insurance companies near you.

Best Home Insurance Companies in the U.S.

Chubb, AIG, and Amica are the best homeowners insurance companies, and rates for $200K in dwelling coverage start at just $79 monthly.

While Chubb stands out for its luxury asset coverage for jewelry and other valuables, AIG covers more places across the globe.

However, you should compare home insurance quotes to get the lowest rates based on your personal factors. While one provider may have the cheapest rates for a specific area, they may have higher rates elsewhere.

Learn more about why we chose these top providers below.

#1 – Chubb: Top Pick Overall

Pros

- High-Value Coverage: Chubb’s tailored home insurance coverage protects luxury homes, jewelry, and fine art for wealthy homeowners.

- Worldwide Protection: Coverage is available globally to protect possessions and luxury homes, despite your location.

- Fast Claims Service: Customers praise Chubb for its quick claims handling, as shown by its A++ rating from A.M. Best.

Cons

- Expensive Rates: Chubb’s home insurance costs the most of all the top providers in our ranking.

- Limited Availability: Not all types of insurance coverage are available in every state.

#2 – AIG: Best for Global Coverage

Pros

- Global Coverage: AIG offers coverage for homes worldwide for policyholders who own multiple homes or international properties.

- High-Value Protection: Offers policies to cover expensive assets, including luxury homes, collectibles, fine art, and jewelry.

- Customizable Policies: You can add various types of home insurance endorsements, such as cyber protection and equipment breakdown coverage, with AIG.

Cons

- Higher Premiums: AIG’s coverage is more expensive than most competitors in our ranking.

- Many Complaints: According to NAIC’s complaint index, AIG receives more complaints than average.

#3 – Amica: Best for Customer Service

Pros

- Smart House Discounts: Amica partners with different home security and sensor companies to offer free equipment, installs, and home insurance discounts.

- Dividend Plans: Amica returns a portion of any unused premiums to its policyholders every year.

- Excellent Customer Service: Top two for customer satisfaction in annual J.D. Power surveys. Get full rankings in our Amica home insurance review.

Cons

- Fewer Policy Options: Amica doesn’t offer as many homeowners insurance endorsements as its competitors.

- Rate Increases: Reddit users report rate increases in high-risk states like Texas, California, and Florida.

#4 – Erie: Best for Personalized Policies

Pros

- Replacement Coverage Included: Base policies cover hard-to-replace items like passports and deeds with fewer restrictions than other companies.

- Pet Coverage Included: Standard home insurance includes up to $500 for pet injuries (including birds and fish).

- Big Savings for New Homeowners: First-time buyers get 12% off the first few years of their policy.

- Cheap Rates: Erie home insurance is cheaper than most companies at $129/month. Read our Erie vs. MetLife insurance review to learn more.

Cons

- Regional Coverage: Erie Insurance is only available in 12 states and Washington, D.C.

- No Online Quotes: You must speak with an agent to get homeowners insurance quotes with Erie.

- Not Many Discounts: Erie doesn’t offer as many home insurance discounts as other top-rated companies.

#5 – AAA: Best for Member Benefits

Pros

- Membership Benefits: AAA members enjoy exclusive perks, including discounts, roadside assistance, and other savings.

- Bundling Savings: You can bundle your AAA home and auto insurance policy to save with multi-policy and loyalty discounts. Check out our AAA auto insurance review to learn more.

- Many Policy Endorsements: Offers service line, equipment breakdown, water backup, home systems, and identity theft protection.

Cons

- Limited Availability: AAA home insurance coverage isn’t available in all states.

- Must be a Member: To qualify for home insurance coverage, you must have a AAA membership.

#6 – State Farm: Best for Discount Options

Pros

- ADT Discount: Free ADT installation and equipment plus a 6% home insurance discount.

- Replacement Cost Included: Standard home insurance policies automatically come with replacement cost instead of actual cash value.

- Affordable Rates: State Farm is one of the cheapest national home insurance companies at $133/month. Compare quotes in our State Farm review.

Cons

- Financial Rating Downgrade: A.M. Best downgraded State Farm financial rating from “A” to “B” due to increased claims.

- Regional Discounts: Home insurance discounts vary by state. For instance, the ADT discount is only available in 14 states.

#7 – Nationwide: Best for Cheapest Rates

Pros

- Lowest Rates: The cost of home insurance with Nationwide starts at $79 per month, making it the most affordable option in our ranking (Learn More: Nationwide Auto Insurance Review).

- Smart Home Savings: Nationwide offers a monitoring device that detects leaks, smoke, or intrusions, while qualifying homeowners for a discount.

- Many Add-Ons: Offers coverages like extended replacement cost, better roof replacement, water backup, service line, and identity theft protection.

Cons

- No Mobile Home Coverage: Nationwide does not insure mobile or manufactured homes.

- Not Available in All States: You can’t get a Nationwide home insurance policy in Alaska, Florida, Hawaii, Louisiana, Massachusetts, New Jersey, or New Mexico.

#8 – American Family: Best for Families

Pros

- Unique Family Coverage: Standard home insurance policies protect against damages caused by kids or pets.

- No Banned Dog List: AmFam homeowners insurance doesn’t restrict dog breeds.

- Long List of Endorsements: Homeowners can add affordable riders to cover home-based businesses and short-term rentals, renovations, and more.

Cons

- Regional Availability: Homeowners insurance is only in 19 states.

- Poor Customer Service:American Family receives more customer complaints than other regional providers. Read American Family Insurance vs. Travelers for our full review.

#9 – Country Financial: Best for Rural Homes

Pros

- Specialized Rural Coverage: Country Financial is well-known for offering specialized coverage to rural policyholders and farms.

- Premier Plans: Premier homeowners insurance extends covered perils to ones not explicitly listed in the policy.

- Claim Forgiveness: Country Financial won’t raise home insurance rates if you haven’t filed a claim in five years.

Cons

- Regional Availability: Coverage is only available in 19 states.

- No Online Quotes: Excellent personalized service comes at the cost of online convenience. Contact an agent to compare home insurance quotes.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Find the Best Home Insurance Today

We ranked Chubb, AIG, and Amica as the best home insurance companies, with rates starting at $140 per month. These providers also offer a home security discount that can reduce your premiums by up to 20% when you install approved safety features like alarm systems or smart locks.

Compare home insurance quotes today to get personalized options that fit both your coverage needs and your budget.

Learn More: How much homeowners insurance do you need?

Frequently Asked Questions

Which insurance company is best for home insurance?

Chubb is the best homeowners insurance company for customer service, national availability, and comprehensive coverage.

Which homeowners insurance company has the highest customer satisfaction?

Chubb and AIG are the top two home insurance companies for customer service.

Which insurance company has the most complaints?

Allstate has more than twice as many complaints as other national homeowners insurance companies. Read our Allstate review to find out why.

Which insurance company has the fewest complaints?

Amica, American Family, and The Hartford all have fewer home insurance complaints on average.

What is the average deductible for home insurance?

Most homeowners choose an insurance deductible between $1K-$2K.

What is the 80% rule in homeowners insurance?

You must insure your home for at least 80% of its replacement cost to buy a policy. Your mortgage lender may require higher limits. Find out how much homeowners insurance you need.

How much is home insurance on a $400K house?

On average, home insurance costs around $183 per month, but your premium ultimately depends on regional factors, the value of your home, and your coverage limits.

Is it better to have a high or low deductible for home insurance?

A higher deductible lowers your monthly cost, but you’ll pay more out of pocket after a claim. Meanwhile, lowering your deductible increases your rates, meaning you’ll pay less after a loss, so choose the option that works best for your budget and needs.

What insurance is the most commonly purchased homeowners insurance?

Broad-form HO-3 policies are the most common type of homeowners insurance since they cover a long list of perils and only exclude damages clearly listed in the policy.

Are home insurance rates going up?

Homeowners insurance rates are increasing in many states due to inflation and the high costs of lumber and other building supplies.

Sick of rising home insurance premiums? Enter your ZIP code now to get a free quote in just 2 minutes.

Is replacement cost home insurance worth it?

How can I lower my home insurance cost?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.