10 Best Auto Insurance Companies in Mississippi (2026)

Erie, Farmers, and State Farm are the best auto insurance companies in Mississippi. Erie has the cheapest car insurance in MS, with Rate Lock locking in monthly rates at $32. Farmers stands out with accident forgiveness and its Signal UBI app, and State Farm wins with discounts and agents across Mississippi.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Claims Support & Senior Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she had similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated November 2025

1,883 reviews

1,883 reviewsCompany Facts

Full Coverage in Mississippi

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage in Mississippi

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 18,157 reviews

18,157 reviewsCompany Facts

Full Coverage in Mississippi

A.M. Best Rating

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviewsErie, Farmers, and State Farm are the best auto insurance companies in Mississippi. Erie leads with its Rate Lock and shrinking deductible, helping drivers save more the longer they go without a claim.

Our Top 10 Picks: Best Auto Insurance Companies in Mississippi| Company | Rank | Claims Satisfaction | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 676 / 1,000 | A+ | Customer Service | Erie |

| #2 | 676 / 1,000 | A | Policy Options | Farmers | |

| #3 | 673 / 1,000 | A++ | Agency Network | State Farm | |

| #4 | 669 / 1,000 | A+ | Add-on Coverages | Nationwide | |

| #5 | 651 / 1,000 | A++ | Good Drivers | Geico | |

| #6 | 650 / 1,000 | A++ | Client Centric | Auto-Owners | |

| #7 | 642 / 1,000 | A++ | Unique Coverage | Travelers | |

| #8 | 637 / 1,000 | A+ | Qualifying Coverage | Progressive | |

| #9 | 637 / 1,000 | A | Customizable Policies | Liberty Mutual |

| #10 | 634 / 1,000 | A+ | UBI Discount | Allstate |

Farmers builds on that with the Signal app, offering up to 45% off for safe driving, plus extras like accident forgiveness and loss-of-use coverage.

State Farm rounds things out with big multi-policy discounts, rideshare protection, and a huge network of local agents, making it a reliable choice for drivers who want savings and support.

- Mississippi requires 25/50/25 liability; uninsured coverage is not required

- Gap coverage isn’t always included—some top insurers in MS exclude it

- Drivewise and Snapshot programs in MS can both lower and raise your rate

Together, they bring steady rates, smart savings, and local support for Mississippi drivers. Enter your ZIP code to explore local options, whether you need minimum coverage or want the added protection of comprehensive auto insurance.

Average Auto Insurance Rates in Mississippi

Choosing the right Mississippi auto insurance company depends on how much protection you want without stretching your budget. Erie’s low rates make it one of the best choices for the cheapest car insurance in Mississippi without sacrificing solid protection.

Mississippi Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $74 | $200 | |

| $47 | $124 | |

| $32 | $83 |

| $74 | $197 | |

| $36 | $97 | |

| $60 | $162 |

| $49 | $130 | |

| $61 | $163 | |

| $42 | $111 | |

| $45 | $120 |

Farmers charges over $190 a month for full coverage, which might make sense if you’re adding extras like accident forgiveness or gap coverage.

If your vehicle’s paid off, switching from full to liability coverage is one of the fastest ways to reduce your monthly insurance cost.

Jeff Root Licensed Insurance Agent

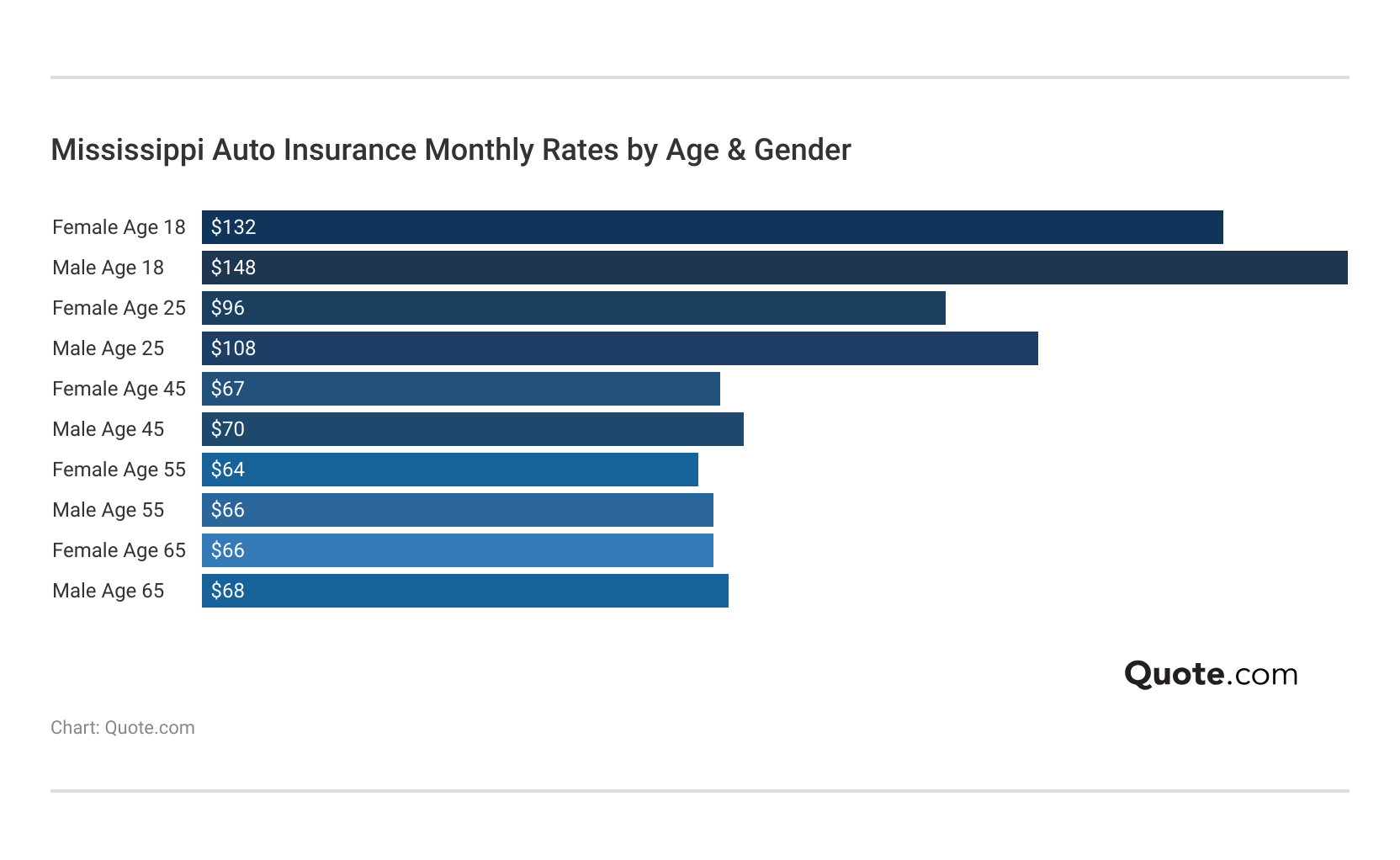

Auto insurance in Mississippi is sharply higher for teens, with 18-year-old males averaging $148 per month—more than double the rate for a 45-year-old woman. That $80 gap can seriously strain a young driver’s budget, especially without discounts.

By 25, rates improve but still vary—females pay $96 while males pay $108. The most stable pricing shows up after 55, where both genders hover in the $64–$68 range, offering predictability for older drivers on fixed incomes.

Your driving record can seriously change what you pay for car insurance in Mississippi, no matter the coverage. Some companies go easy after a mistake, while others raise rates fast.

Mississippi Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $74 | $99 | $104 | $84 | |

| $47 | $182 | $185 | $150 | |

| $32 | $118 | $153 | $100 |

| $74 | $104 | $102 | $92 | |

| $36 | $61 | $117 | $89 | |

| $60 | $94 | $96 | $84 |

| $49 | $68 | $89 | $56 | |

| $61 | $100 | $76 | $79 | |

| $42 | $50 | $45 | $45 | |

| $45 | $49 | $69 | $50 |

Erie is great if you’ve got a clean record, but a DUI sends your monthly rate jumping from $32 to $153 — a tough hit. But State Farm stays surprisingly steady, only increasing a few bucks even after a DUI, which makes it a safer long-term pick.

In Mississippi, your credit score can shape your insurance rate just as much as your driving history. Some companies stay consistent no matter what, while others raise rates fast when your record isn’t perfect.

Mississippi Auto Insurance Full Coverage Monthly Rates by Credit Score| Insurance Company | Good Credit | Average Credit | Bad Credit |

|---|---|---|---|

| $200 | $224 | $265 | |

| $124 | $139 | $139 | |

| $83 | $139 | $139 |

| $197 | $246 | $281 | |

| $97 | $241 | $163 | |

| $162 | $224 | $249 |

| $130 | $148 | $265 | |

| $163 | $211 | $267 | |

| $111 | $121 | $135 | |

| $120 | $135 | $130 |

Erie starts reasonable, but that rate jumps if your record slips even a little. If you want something more stable, State Farm and Auto-Owners barely budge even with a ticket or accident on file.

Big city drivers in Mississippi see a “B” for traffic since packed roads lead to more fender benders — and, yes, pricier premiums. And with average claim sizes getting bigger, insurance companies are paying out more, which means your monthly bill probably feels that, too.

Mississippi Report Card: Auto Insurance Premiums| Category | Grade | Explanation |

|---|---|---|

| Weather-Related Risks | A | Frequent storms increase risk factors. |

| Traffic Density | B | High traffic congestion in cities. |

| Vehicle Theft Rate | B | Moderate theft rate in urban areas. |

| Average Claim Size | C | Average claim sizes are increasing. |

Regarding car insurance in Mississippi, most claims fall into just a handful of categories. But how much they cost—and how often they happen—can shift what you pay over time.

5 Most Common Car Insurance Claims in Mississippi| Claim Type | Portion of Claims | Cost per Claim |

|---|---|---|

| Collision | 30% | $3,500 |

| Property Damage | 25% | $2,500 |

| Theft | 20% | $4,000 |

| Vandalism | 15% | $2,000 |

| Weather-related | 10% | $1,500 |

Collision is the most common, and with an average $3,500 price tag, it’s enough to total an older car. Property damage, at $2,500 a hit, usually means you’re footing the bill for someone else’s vehicle. Theft losses climb to $4,000 on average, and most stolen cars aren’t returning.

You may also want to carry full coverage if you live in cities like Jackson or Gulfport, which see more car insurance claims than other parts of the state.

Mississippi Auto Accidents and Insurance Claims by City| City | Accidents per Year | Claims per Year |

|---|---|---|

| Biloxi | 3,000 | 2,100 |

| Gulfport | 4,500 | 3,200 |

| Hattiesburg | 2,200 | 1,500 |

| Jackson | 15,000 | 10,500 |

| Madison | 1,100 | 770 |

| Meridian | 1,300 | 900 |

| Oxford | 1,500 | 1,050 |

| Pascagoula | 1,000 | 700 |

| Southaven | 3,500 | 2,450 |

| Tupelo | 2,000 | 1,400 |

If you’re in Jackson, where there are around 15,000 accidents a year, insurers will charge more because the risk is higher. Gulfport and Southaven aren’t far behind, which could mean pricier premiums. But folks in Madison or Pascagoula? With fewer than 1,200 accidents a year, your rates might stay lower since there’s less overall risk.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Auto Insurance Discounts in Mississippi

When searching for the best auto insurance in Mississippi, saving money takes more than just comparing quotes. Stacking the right discounts can make a real impact.

Top Auto Insurance Discounts in Mississippi| Company | Accident-Free | Bundling | Defensive Driving | Good Driver |

|---|---|---|---|---|

| 25% | 25% | 10% | 25% | |

| 16% | 16% | 5% | 25% | |

| 25% | 25% | 5% | 23% |

| 20% | 20% | 10% | 26% | |

| 22% | 25% | 15% | 26% | |

| 20% | 25% | 10% | 20% |

| 20% | 20% | 10% | 40% | |

| 10% | 10% | 30% | 30% | |

| 17% | 17% | 15% | 25% | |

| 13% | 13% | 20% | 10% |

Defensive driving courses are another underrated hack. Both Geico and Progressive offer 10–15% off if you complete one. For younger drivers paying higher premiums, that’s a smart, easy win. Then there’s bundling. With companies like Allstate or Erie, combining your auto and home insurance could save $25–$30 each month. That’s especially useful in high-cost cities like Jackson.

The key? Focus on hacks to save money on auto insurance that actually lowers your rate—not just sound nice on paper. Those small savings stack up over time, especially in a state like Mississippi, where premiums can vary wildly.

Auto Insurance Coverage Requirements in Mississippi

When you’re choosing auto insurance in Mississippi, it helps to understand what each coverage actually does. Liability auto insurance is what Mississippi requires drivers to have to cover injuries and property damage they cause to others in an accident.

Auto Insurance Coverage Options in Mississippi| Coverage | Description |

|---|---|

| Liability Insurance | Covers damage to others |

| Collision | Pays for car damage from crashes |

| Comprehensive | Covers non-collision damages |

| Personal Injury Protection | Covers medical expenses for injuries |

| Uninsured Motorist | Covers injuries from uninsured drivers |

| Underinsured Motorist | Covers injuries from underinsured drivers |

| Medical Payments | Pays medical bills regardless of fault |

| Roadside Assistance | Provides help for breakdowns |

| Rental Reimbursement | Covers rental car expenses |

| Gap Insurance | Covers difference between car value and loan |

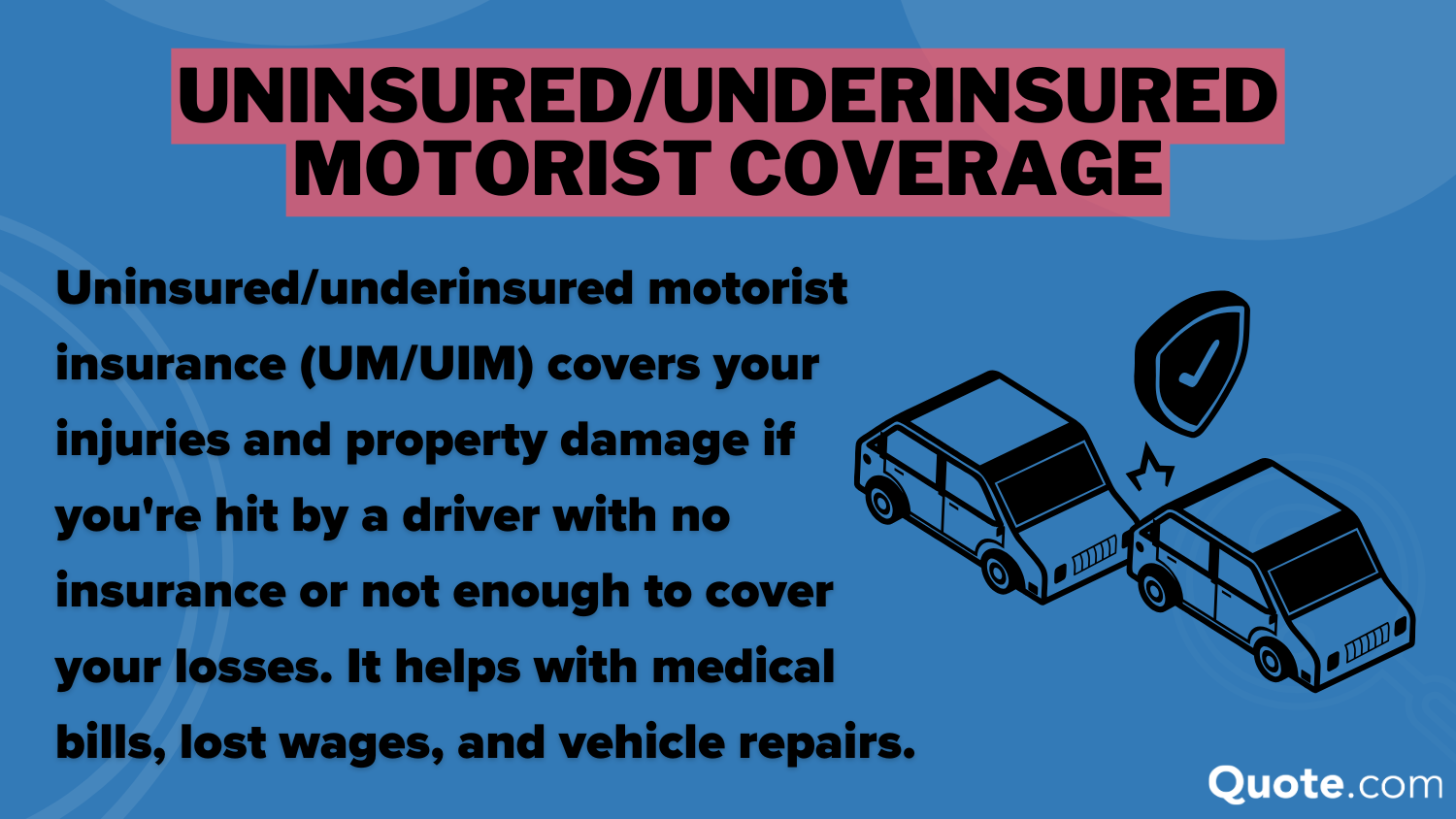

Mississippi car insurance companies are also required to provide uninsured/underinsured motorist protection (UM/UIM) due to the higher number of uninsured drivers in the state. If you don’t want to pay for this coverage, you have to opt out of it in writing by sending a letter to the DMV and your insurance company.

Comprehensive coverage is for the unexpected, like hail damage, theft, or even a falling tree branch. Collision insurance pays for damages caused by accidents and crashes. Buying collision vs. comprehensive auto insurance together is known as full coverage, which is recommended since collision and property damage claims make up 55% of Mississippi auto insurance claims.

Drivers in low-claim areas should ask about low-mileage or claim-free discounts—they’re often overlooked but highly impactful.

Michelle Robbins Licensed Insurance Agent

A lot of top insurers now offer driving programs that put you in control of your rate. They track things like how often, how far, and how safely you drive. Allstate’s Drivewise and Liberty Mutual’s RightTrack give you perks for smooth driving, while Progressive’s Snapshot and State Farm’s Drive Safe & Save offer savings if you keep your mileage low. If you’re a safe driver, these can really help cut your costs.

If you’re driving in Mississippi, the state says you’ve got to carry a minimum amount of liability insurance. That means your policy needs to help cover the other person’s expenses if you’re at fault in a crash, but it doesn’t cover your own car or medical bills. Here’s what the state minimum liability looks like:

- $25,000 for injuries to one person

- $50,000 total for injuries per accident

- $25,000 for damage to someone else’s car or property

These numbers might sound like a lot, but they can run out fast. Say you hit a new $40,000 truck—your insurance would only cover $25,000 of the damage, and you’d be stuck with the rest. That’s why many drivers bump up their limits and add things like comprehensive auto insurance, just in case. It’s not just about being legal—it’s about being smart with your coverage.

Other Ways to Save on Auto Insurance in Mississippi

Have you already grabbed some discounts? Nice. But there are still a few other ways to keep your auto insurance bills in Mississippi from creeping up, especially if you’re driving less or your car’s not worth as much anymore.

- If your car’s paid off or is getting older, you might no longer need collision or comprehensive.

- Paying the full premium upfront can help you dodge extra installment fees.

- A higher deductible—say $1,000 instead of $500—can shrink your monthly bill. Drive less? A usage-based program could reward your habits with real savings.

- Removing rental coverage could knock off a few bucks each month if unnecessary.

All this ties back to knowing when your needs shift—like around the best time to buy a new car—and when reviewing your policy makes the most sense. Don’t settle for default settings. A few smart changes can quietly lower your bill all year long.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top 10 Best Auto Insurance Companies in Mississippi

Finding the best auto insurance in Mississippi isn’t just about who’s cheapest—it’s about who actually shows up when you need them. These companies prove people got auto insurance right by offering solid rates, reliable service, and coverage that works in real-life situations. With satisfaction scores and rates that vary widely, it pays to know what sets each one apart.

#1 – Erie: Best for Customer Service

Pros

- Rate Lock Program: Erie allows Mississippi drivers to lock in $32 monthly premiums, avoiding rate hikes after claims.

- Diminishing Deductible: Deductibles shrink by $100 annually for claim-free Mississippi drivers under Erie’s policy. See why drivers trust Erie insurance review for rate stability.

- New Auto Security: Erie offers new car protection for up to 24 months, which is ideal for Mississippi drivers with recent purchases.

Cons

- Limited Digital Access: Erie lacks a mobile app with digital ID cards or claims tracking for Mississippi users.

- Coverage Area Limits: Roadside and locksmith coverage may not apply in remote Mississippi ZIP codes.

#2 – Farmers: Best for Policy Options

Pros

- Signal Telematics Discount: Safe Mississippi drivers save up to 45% using the Farmers’ Signal program. Explore everything you need to know about Farmers Insurance now.

- Accident Forgiveness: Farmers waives the first at-fault accident surcharge for Mississippi drivers with clean records.

- Loss of Use Coverage: Farmers reimburses up to $50 per day in Mississippi while your vehicle is in the shop.

Cons

- Fewer Bundling Incentives: Farmers offers fewer auto and renters bundling discounts in Mississippi compared to State Farm.

- Policy Stacking Confusion: Mississippi drivers may find coverage tiers and options complex without agent help.

#3 – State Farm: Best for Agency Network

Pros

- 19,000 Local Agents: State Farm’s network ensures in-person help across all Mississippi regions. See how Mississippi drivers save with our updated State Farm insurance review.

- Multi-Line Discount: Bundling auto and renters or home insurance can save Mississippi drivers up to 17%.

- Rideshare Gap Coverage: Protects Mississippi drivers when using personal vehicles for Uber or Lyft.

Cons

- No Gap Insurance Option: Mississippi drivers financing vehicles must seek gap protection elsewhere.

- Less Flexibility: State Farm offers fewer add-ons compared to Nationwide or Farmers in Mississippi.

#4 – Nationwide: Best for Add-On Coverages

Pros

- Vanishing Deductible: Mississippi drivers get $100 off their deductible per year without a claim.

- OEM Endorsement: Repairs under Nationwide in Mississippi use original parts if the OEM coverage option is selected.

- SmartRide Discount: Mississippi participants in SmartRide earn up to 40% off based on driving habits. Explore savings and features in this Nationwide insurance review.

Cons

- 669/1,000 Satisfaction Score: Ranked below Erie and State Farm for Mississippi claims satisfaction.

- Limited In-Person Support: Fewer local agents may delay service in some Mississippi counties.

#5 – Geico: Best for Good Drivers

Pros

- Defensive Driver Discount: Certified Mississippi drivers completing safety courses get 5–10% off.

- Low Mileage Savings: Drivers under 7,500 miles per year in Mississippi qualify for low-mileage pricing. Explore everything you need to know about Geico in one place.

- Military & Federal Employee Discounts: Mississippi residents employed in federal service receive up to 15% off.

Cons

- 651/1,000 Satisfaction Rating: Below average compared to top providers like Erie and Nationwide in Mississippi.

- Fewer Local Agents: Mississippi customers needing in-person assistance may find limited support locations.

#6 – Auto-Owners: Best for Client-Centric Approach

Pros

- Personal Price Guarantee: Mississippi drivers see consistent renewals with no sudden rate jumps under this policy.

- Loan/Lease Gap Coverage: Available as an add-on for Mississippi drivers with financed vehicles. Find helpful insights in the latest Auto-Owners insurance review.

- High A.M. Best Score: An A++ rating confirms Auto-Owners’ financial reliability for Mississippi claims.

Cons

- 650/1,000 Satisfaction Score: Below Erie and Farmers in Mississippi customer experience metrics.

- No Mobile Claims App: Mississippi drivers must rely on agents or desktop access for claims support.

#7 – Travelers: Best for Unique Coverage

Pros

- Premier New Car Replacement: Covers full replacement cost for totaled new cars in Mississippi within the first five years.

- Accident Forgiveness Option: The available add-on prevents premium increases after the first accident in Mississippi.

- IntelliDrive Program: Offers up to 20% off after 90 days of safe driving tracked in Mississippi. Get all the facts in this helpful Travelers insurance review.

Cons

- 642/1,000 Satisfaction Score: Reflects lower claims satisfaction than competitors in Mississippi.

- Penalty Risks with IntelliDrive: Aggressive driving behavior in Mississippi can result in increased premiums.

#8 – Progressive: Best for Qualifying Coverage

Pros

- Name Your Price Tool: Mississippi drivers input budget goals and customize limits within that range.

- Snapshot Discount: Safe Mississippi drivers may earn up to 30% off through driving behavior tracking.

- Large Repair Network: Mississippi customers gain access to over 1,800 repair shops via Progressive’s network.

Cons

- 637/1,000 Satisfaction Score: Progressive ranks low for claims experience in Mississippi.

- Snapshot Can Raise Rates: Unsafe Snapshot data may cause premium spikes for Mississippi drivers. Find everything you need to know about Progressive Insurance in one place.

#9 – Liberty Mutual: Best for Customizable Policies

Pros

- Better Car Replacement: Mississippi drivers can get coverage that replaces a totaled car with a newer one, not just the same-year version.

- Teacher Discounts: Certified educators in Mississippi receive policy savings through Liberty’s exclusive program.

- Custom Equipment Coverage: Covers aftermarket parts like rims and electronics for Mississippi drivers.

Cons

- 637/1,000 Satisfaction Score: Same as Progressive, indicating potential claims delays in Mississippi.

- High Starting Rates: Premiums in Mississippi begin at $47, higher than most top-five providers. Explore top features in this Liberty Mutual insurance review today.

#10 – Allstate: Best for UBI Discount

Pros

- Drivewise Savings: Safe Mississippi drivers can save up to 40% through the Drivewise app. Find key insights in our latest Allstate auto insurance review.

- Deductible Rewards: Earn $100 off the deductible per year without a claim, up to $500 for Mississippi customers.

- New Car Discount: Recently purchased vehicles in Mississippi qualify for Allstate’s new car discount program.

Cons

- 634/1,000 Satisfaction Score: Lowest among the top 10 Mississippi companies for claims experience.

- Higher Premiums Despite Discounts: Mississippi drivers may still pay more even with full Drivewise rewards applied.

Where to Find The Best Auto Insurance in Mississippi

Erie, Farmers, and State Farm are the best Mississippi auto insurance companies because they deliver savings where it counts and reward smart driving habits. Erie keeps rates low in Madison, where claims average just $770 a year, making it ideal for drivers in safer areas.

Farmers helps Jackson drivers save with accident forgiveness, which is especially useful in a city with around 15,000 crashes annually. State Farm’s Steer Clear program offers young Tupelo drivers a simple way to earn discounts while building safer driving habits.

If you’re looking for tips to pay less for auto insurance, start by enrolling in usage-based programs. Many top insurers offer driving programs that track how, when, and how far you drive. For example, Progressive’s Snapshot looks at real-time behavior, and State Farm’s Drive Safe & Save offers discounts to low-mileage drivers.

These features are common among providers offering the best auto insurance in MS, but the easiest way to cut your premium is to compare real offers. Just enter your ZIP code to see what top Mississippi auto insurance companies are offering in your area.

Frequently Asked Questions

What’s the typical cost of auto insurance in Mississippi?

Auto insurance in Mississippi usually runs about $135 per month, though your rate might be lower if you have a good driving history, combine policies, or keep your mileage low.

Is car insurance expensive in Mississippi?

Mississippi car insurance is relatively expensive due to high rates of uninsured drivers, accidents, and theft, but joining usage-based programs like Drive Safe & Save can significantly lower your premiums.

Who is the best company in Mississippi to get auto insurance?

The best car insurance company in Mississippi really depends on things like your age, driving record, where you live, and what kind of coverage you need. A lot of drivers save money by going with companies that offer bundling deals, usage-based programs like State Farm’s Drive Safe & Save. Always compare auto insurance companies side by side to find the right match.

Which auto insurance company is best at paying claims in Mississippi?

The insurance company best at paying claims in Mississippi usually has a strong claims satisfaction score. Look for providers with an A or A+ A.M. Best rating and 24/7 claims support.

What is a good amount of car insurance coverage in Mississippi?

A good amount of car insurance coverage in Mississippi includes at least $100K/$300K for bodily injury and $100K for property damage, plus uninsured motorist and comprehensive coverage.

Does it matter which insurance company you use in Mississippi?

Yes, it matters which insurance company you use in Mississippi. Some offer faster claims handling, more valuable discounts, or flexible coverages like gap insurance or roadside assistance. Choosing the wrong provider is one of the ways you’re wasting money on car insurance, especially if you’re overpaying for limited benefits or missing out on multi-policy savings.

Is State Farm better than Geico auto insurance in Mississippi?

State Farm may be better than Geico in Mississippi for drivers who want local agents and safe driving rewards, but Geico can offer better rates for high-risk or low-mileage drivers.

Which auto insurance company has the most complaints in Mississippi?

The insurance company with the most complaints in Mississippi varies by year, but complaint ratios can be found in the NAIC database or your state’s Department of Insurance site.

What insurance company has the highest customer satisfaction in Mississippi?

The insurance company with the happiest customers in Mississippi usually handles claims fast and offers dependable service, worth checking J.D. Power ratings before picking one. To find the right fit, get multiple auto insurance quotes and compare service reviews, not just prices.

Is $200 a month for auto insurance high in Mississippi?

Paying $200 a month for car insurance in Mississippi is high unless you’re a high-risk driver or have a new car. Most drivers can find monthly rates under $150 with discounts or usage-based policies.

How often should you change auto insurance in Mississippi?

Do I need both comprehensive and collision insurance in Mississippi?

Is State Farm good for auto insurance in Mississippi?

What car insurance do you need in Mississippi?

Is Mississippi a no-fault state?

What types of insurance are not recommended in Mississippi?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.