Best Auto Insurance for Hondas in 2026

Erie, Liberty Mutual, and Nationwide offer the best auto insurance for Hondas for $52 a month. Honda car insurance rates vary widely by model and driving record, but safe drivers without claims or accidents can get cheap coverage for a Honda through Allstate and Progressive's usage-based programs.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Copywriter

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, AllWom...

Rachel Bodine

Managing Editor

Aleksandra J. Churlinov holds a Bachelor of Arts in English Language and Literature and a Master of Science in Marketing Management. Over the past six years, Aleks has focused on the insurance sector, working on a range of content, including business, auto, and life insurance. In April 2025, she stepped into the role of Managing Editor, where she now leads a team of talented insurance writers. ...

Aleksandra J. Churlinov

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated January 2026

Erie, Liberty Mutual, and Nationwide offer the best auto insurance for Hondas. Erie has cheap Honda car insurance starting at $52 a month.

- Erie has the highest claim satisfaction for Honda owners

- Nationwide saves Honda drivers 40% with SmartDrive UBI

- Allstate gives safe drivers $100 off their deductible at sign-up

Car insurance for Honda drivers is cheaper than average, and Erie locks in rates to prevent premiums from going up after an accident or claim.

Nationwide is the best fit for drivers who qualify for its usage-based SmartDrive program or its mileage-based SmartMiles, which can cut your premiums by up to 40%.

Our Top 10 Company Picks: Best Auto Insurance for Hondas| Company | Rank | Claim Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 743 / 1,000 | A+ | Customer Support |

| #2 | 730 / 1,000 | A | Bundling Discount |

| #3 | 729 / 1,000 | A+ | UBI Discounts | |

| #4 | 716 / 1,000 | A++ | Reliable Coverage | |

| #5 | 702 / 1,000 | A | Families |

| #6 | 697 / 1,000 | A++ | Newer Hondas | |

| #7 | 693 / 1,000 | A+ | Deductible Rewards | |

| #8 | 691 / 1,000 | A++ | Accident Forgiveness | |

| #9 | 690 / 1,000 | A | Custom Plans | |

| #10 | 673 / 1,000 | A+ | Digital Tools |

Liberty Mutual offers the biggest bundling discount of 25% to Honda owners who bundle their home or rental insurance (Read More: Best Auto and Home Insurance Bundles).

Discover hidden savings and compare multi-policy discounts from the best Honda insurance companies when you use our free comparison tool to explore your options.

Honda Insurance Rates From Top Companies

If you see a higher price from brands like Erie vs. Liberty Mutual, it might reflect broader agent support or broader policy options.

Erie typically offers cheaper Honda car insurance quotes, but Liberty Mutual provides better coverage for new Hondas and often offsets its high pricing with great discount programs.

Honda Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $84 | $178 | |

| $68 | $154 | |

| $52 | $120 |

| $79 | $165 | |

| $60 | $138 | |

| $91 | $187 |

| $64 | $142 |

| $72 | $158 | |

| $58 | $132 | |

| $66 | $145 |

Geico, State Farm, and Nationwide also provide affordable coverage for under $70 a month, but many different factors impact Honda insurance costs.

Always get multiple auto insurance quotes to find the best company based on your model and driving record.

Driving History Can Raise Honda Car Insurance Rates

Honda insurance costs also rise quickly with violations. Keeping a clean driving record now can save you thousands on Honda car insurance over time.

For instance, a single ticket jumps your monthly rate by 20% or more, while older drivers see smaller price bumps for violations.

Honda Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $84 | $122 | $160 | $105 | |

| $68 | $99 | $129 | $85 | |

| $52 | $75 | $99 | $65 |

| $79 | $115 | $150 | $99 | |

| $60 | $87 | $114 | $75 | |

| $91 | $132 | $173 | $114 |

| $64 | $93 | $122 | $80 |

| $72 | $104 | $137 | $90 | |

| $58 | $84 | $110 | $73 | |

| $66 | $96 | $125 | $83 |

Erie has the best rates for high-risk Honda drivers, with the smallest rate increase after an accident and the cheapest auto insurance after a DUI.

One accident can increase rates by $30-$40 per month, but any high-risk behavior that adds points to your license will increase Honda auto insurance rates.

DUIs come with the highest rate increase, but multiple infractions can make you too risky to insure. A single Honda insurance claim can raise your rates, even if you aren’t at fault.

If you’re a high-risk driver, find out what to do if you can’t afford your auto insurance before you cancel.

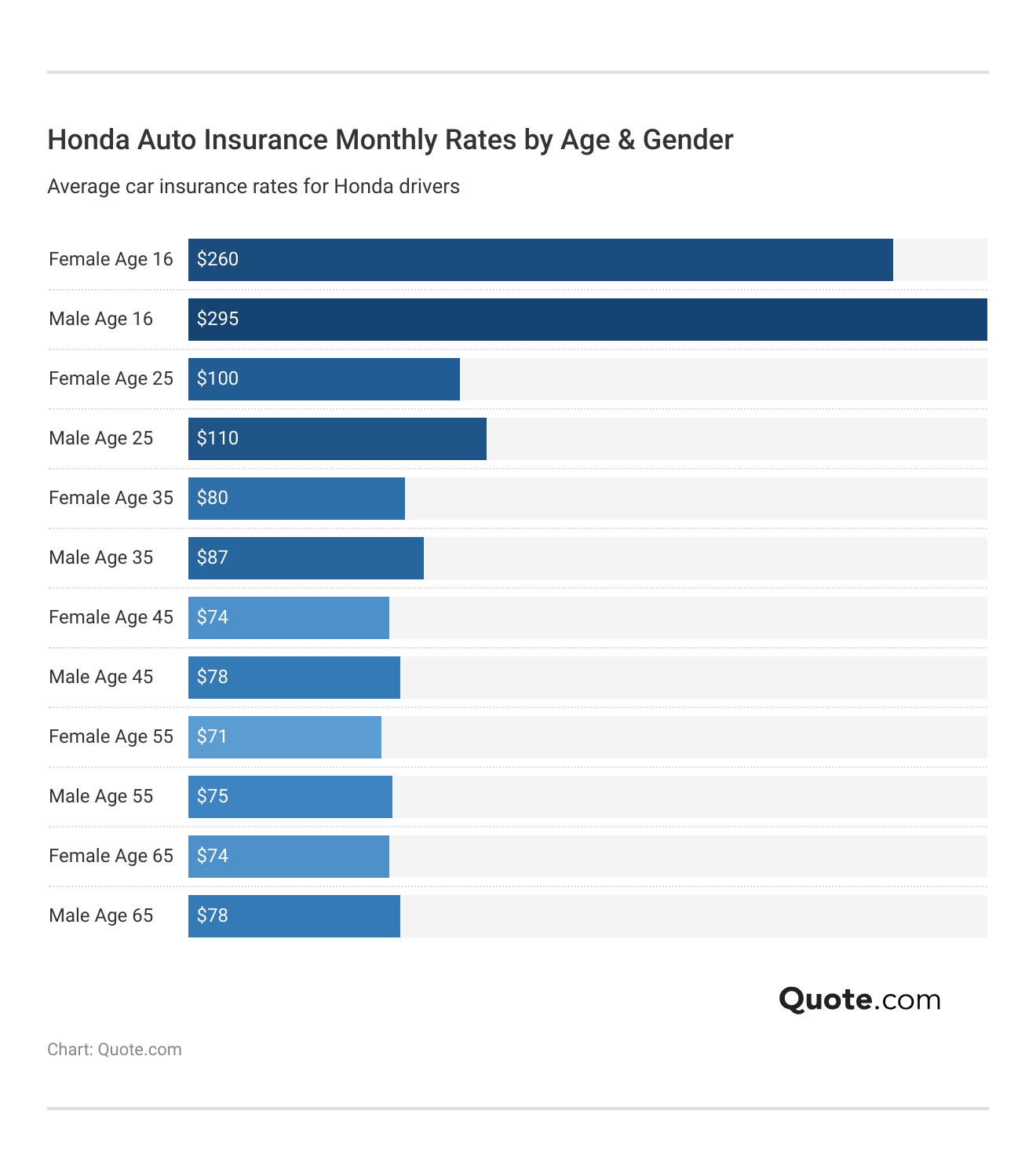

How Age Impacts Honda Auto Insurance

Teen drivers are considered high-risk, paying hundreds more for Honda insurance than older drivers with more experience on the road.

Sixteen-year-old Honda drivers pay twice as much as 25-year-olds, but you’ll find that Honda Civic insurance for 17-year-olds is cheaper due to the high safety ratings for that model.

Insurance companies see younger drivers as long-term risks, so infractions like speeding tickets or accidents early on hit harder.

Compare rates based on the Honda you drive to find the best policy at the right price for your budget.

Honda Insurance Costs for Different Models

Not all Hondas cost the same to insure. Insurers look at how expensive your model is to fix, how it’s usually driven, and how likely it is to be involved in a claim. Honda Accord insurance is pretty affordable at $78 a month.

Honda Ridgeline and Honda Pilot car insurance often come with higher premiums because they are larger vehicles that cause more damage and cost more to repair, compared to Honda Accord car insurance, which has cheaper repair costs.

Honda Auto Insurance Monthly Rates by Model| Vehicle Model | Minimum Coverage | Full Coverage |

|---|---|---|

| Honda Accord | $78 | $155 |

| Honda Civic | $75 | $149 |

| Honda CR-V | $79 | $158 |

| Honda Fit | $72 | $144 |

| Honda HR-V | $77 | $153 |

| Honda Insight | $74 | $148 |

| Honda Odyssey | $81 | $162 |

| Honda Passport | $82 | $166 |

| Honda Pilot | $83 | $167 |

| Honda Ridgeline | $85 | $170 |

If you drive something like the Odyssey, insurers also consider that it’s likely carrying more passengers, which means a higher chance of medical claims. That’s why Honda Odyssey insurance rates climb to $162 a month for full coverage.

Read More: Auto Insurance Rates by Vehicle

On the other hand, insurance for a Honda Civic, Fit, or other smaller models tends to be cheaper because they’re easier to repair and are involved in fewer severe accidents.

Cheap car insurance for Honda Civics starts at $149 a month for full coverage, only slightly higher than Honda Insight car insurance, but $10-$20 less per month than other Hondas.

Honda Auto Insurance Rates by Model Year| Year | Minimum Coverage | Full Coverage |

|---|---|---|

| 2026 | $88 | $187 |

| 2025 | $85 | $180 |

| 2024 | $82 | $172 |

| 2023 | $80 | $165 |

| 2022 | $78 | $158 |

| 2021 | $75 | $150 |

| 2020 | $72 | $145 |

| 2019 | $70 | $140 |

| 2018 | $68 | $135 |

| 2017 | $65 | $130 |

Car insurance for Honda Civic drivers is the cheapest at $75 monthly, but insurance on Hondas drops by around $5 each model year. For instance, Honda Civic 2017 insurance rates are $40 less per month than a brand-new model.

A new Honda costs more to insure because its advanced driver-assistance systems and high-value parts cost more to repair.

Honda vehicles, in particular, are known for performing well in crash-safety tests across multiple models. Because of this consistent safety record, Hondas are more affordable to insure than other cars.

Dani Best Licensed Insurance Producer

Decreases in car value, repair expenses, and claims also contribute to the overall reduction in premiums (Learn More: How to Buy Auto Insurance).

If you need a full coverage quote under $120 a month for a 2018 Civic in Portland, you should start with insurance comparison websites like this one. Enter your ZIP code now to get quotes from Honda insurance companies in your city.

Comparing Honda Insurance Rates to Other Vehicles

Hondas are among the most affordable models on the road to insure. In particular, Honda Civic auto insurance comes with the cheapest rates.

The cost of insurance for Honda Civics is so low because of its high safety ratings and crash performance. Even full coverage costs less than many other models.

Honda Civic vs. Similar Sedans: Auto Insurance Monthly Rates| Vehicle Model | Minimum Coverage | Full Coverage |

|---|---|---|

| Honda Civic | $75 | $149 |

| Acura Integra | $88 | $180 |

| Ford Focus | $78 | $155 |

| Hyundai Elantra | $82 | $165 |

| Kia Forte | $80 | $158 |

| Mazda3 | $83 | $162 |

| Nissan Sentra | $78 | $155 |

| Subaru Impreza | $85 | $170 |

| Toyota Corolla | $77 | $150 |

| Volkswagen Jetta | $75 | $148 |

Honda Civic car insurance is comparable to the Toyota Corolla, which is one of the cheapest cars to insure (Read More: Best Auto Insurance for Toyotas).

Similar luxury models, like the Acura Integra, cost $10-$15 more per month to insure due to the price of repairing or replacing high-end parts compared to a Civic. Compare the best auto insurance companies for Acuras to find affordable luxury car insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Save Money on Honda Car Insurance

The right discount can shave $30 to $60 off your monthly premiums with every Honda car insurance renewal.

Whether it’s how you drive, how you pay, or the model you choose, each provider weighs your habits differently. Don’t skip these car insurance discounts you can’t miss.

Honda Auto Insurance Discounts From Top Providers| Company | EV/Hybrid | Multi-Policy | Pay-in-Full | Usage-Based |

|---|---|---|---|---|

| 7% | 25% | 10% | 30% | |

| 5% | 25% | 20% | 30% | |

| 5% | 25% | 5% | 30% |

| 8% | 20% | 10% | 30% | |

| 5% | 25% | 10% | 25% | |

| 8% | 25% | 12% | 30% |

| 10% | 20% | 15% | 40% |

| 5% | 10% | 15% | 25% | |

| 5% | 17% | 15% | 30% | |

| 10% | 13% | 15% | 30% |

Nationwide’s 40% UBI discount is the highest available, but it only applies if you use its SmartRide program and show consistent low-risk driving.

The State Farm Drive Safe & Save usage-based discount isn’t as big at 30%, but State Farm won’t raise your rates if you drive poorly.

Stacking two or more of these discounts can help Honda drivers save $300 to $600 per year on average, especially when paired with a clean driving record.

There are a few more discounts and proven ways to lower your rates. These tips are especially for popular Honda models, like the CR-V, Accord, and lowering Honda Civic insurance costs:

- Bundling: Combine Honda car insurance with renters or homeowners coverage to unlock up to 25% in savings. Geico and Allstate offer the biggest discounts.

- Deductibles: Increase your deductible from $500 to $1,000 to save an average of $150–$250 annually, especially if your Honda is older and you rarely file claims.

- Paying In Full: Pay your full annual premium upfront and skip monthly installment fees. Companies like American Family and Travelers offer 15%–20% off for paying in full.

- Safety Features: Hondas are some of the safest vehicles on the road, and installing additional safety and anti-theft devices can further reduce your rates.

Safety features can lower your Honda insurance cost by reducing the likelihood of accidents and minimizing injury and damage if there is a collision.

Honda models already equipped with lane assist, back-up cameras, automatic emergency brakes, or advanced airbag systems will often already get lower rates, but adding cameras or GPS locators can earn you additional discounts.

Read More: Best Time to Buy a New Car

Insurance Coverage Honda Drivers Need

Honda car insurance rates can vary significantly depending on the type and level of coverage you choose. Liability coverage is the cheapest and is legally required in most states.

Carrying only state-minimum liability policies can lower your Honda insurance cost, but may leave you financially vulnerable after an accident.

Auto Insurance Coverage Options for Hondas| Coverage | What it Covers |

|---|---|

| Liability | Injuries and damages to others' property |

| Collision | Damage to your vehicle in a collision |

| Comprehensive | Non-collision damage (e.g., theft, fire) |

| Uninsured/Underinsured | Damage from uninsured drivers |

| Medical Payments (MedPay) | Medical expenses after an accident |

| Personal Injury Protection | Medical costs and lost wages |

| Roadside Assistance | Breakdowns or emergencies, including towing |

| Rental Reimbursement | Rental car during repairs |

| Gap Insurance | Difference between loan or lease and car value |

You must carry collision insurance to fix or replace your Honda, and comprehensive insurance kicks in when animals or natural disasters damage your vehicle.

If you drive a new Honda, you may also want to add gap coverage to pay off your loan in case your vehicle is totaled in a collision or claim.

If your Honda is financed or leased, gap insurance is one of the most overlooked coverages that can save you thousands after a total loss.

Jeff Root Licensed Insurance Agent

Honda gap insurance isn’t available with every company. Popular providers like Geico and Nationwide are missing this key coverage.

Geico also lacks a new car replacement add-on, which is available from every other Honda insurance company on this list.

Honda Auto Insurance Coverage Options by Provider| Company | Claim Forgiveness | Custom Parts | Gap Plans | Rideshare |

|---|---|---|---|---|

| ✅ | ✅ | ✅ | ✅ | |

| ✅ | ❌ | ✅ | ✅ | |

| ✅ | ✅ | ✅ | ✅ |

| ✅ | ✅ | ❌ | ❌ | |

| ❌ | ✅ | ❌ | ✅ | |

| ✅ | ✅ | ❌ | ❌ |

| ❌ | ✅ | ❌ | ❌ |

| ✅ | ✅ | ✅ | ✅ | |

| ✅ | ✅ | ❌ | ✅ | |

| ✅ | ✅ | ✅ | ✅ |

Erie offers all of these popular add-ons for Honda auto insurance, but adding them to your policy will increase your monthly rates.

Shop around for quotes that include all the coverages you need. Comparing providers like Geico vs. MetLife vs. Erie Insurance will help you pick out the company that provides the most well-rounded Honda insurance coverage.

Top Honda Auto Insurance Companies

How can I lower my Honda insurance rates? Shop with Erie, Liberty Mutual, and Nationwide, which offer the best auto insurance for Hondas.

These top three companies aren’t the largest Honda insurers, but they stand out with lower rates and more competitive discounts than other providers.

However, another company might have a better policy for you, especially if you’re a military veteran or need customized equipment protection.

Our guide on how to compare auto insurance companies will help you pick the best insurance for Hondas.

#1 – Erie: Top Pick Overall

Pros

- Customer Satisfaction: Erie is the highest-rated company when it comes to Honda car insurance claims support and customer service.

- Rate Lock Program: Keeps Honda premiums fixed unless policyholders move or add a new driver or vehicle to the policy (Learn More: Erie Insurance Review).

- New Vehicle Protection: Replaces total-loss Hondas with the same-year, same-make model if under two years old.

Cons

- Limited National Reach: Erie is only available in 12 states, restricting Honda coverage availability.

- Basic Digital Tools: Erie lacks some of the digital and online perks that larger Honda auto insurance companies offer.

#2 – Liberty Mutual: Best for Multi-Policy Discounts

Pros

- Bundling Discount: Liberty Mutual offers one of the highest bundling savings for Honda policies at 25%. Get a full list of discounts in our Liberty Mutual review.

- 12-Month Rate Guarantee: Honda owners lock in premiums for a full year instead of six months, protecting against sudden hikes.

- Better Car Replacement: Replaces a totaled Honda with a newer model one year ahead with fewer miles.

Cons

- No Mechanical Breakdown Coverage: Hondas beyond factory warranty don’t qualify for extended repair protection.

- Limited Off-Roading Support: This does not offer custom coverage for Honda trail or rock-crawling use.

#3 – Nationwide: Best for UBI Discounts

Pros

- SmartRide UBI Program: Honda drivers receive up to 40% savings for low mileage and safe habits tracked through its usage-based plan.

- SmartMiles Pay-As-You-Go: Nationwide rewards low-mileage Honda drivers with cheaper rates, tracking only their monthly driving distance to set premiums.

- Multi-Policy Discount: Bundling Honda auto with home insurance lowers premiums by 20%.

Cons

- Limited Quote Speed: Honda drivers may experience slower online quotes compared to digital-first carriers.

- Regional Restrictions: SmartRide and SmartMiles are not available for Hondas in all ZIP codes. To compare options, start with our Nationwide insurance review.

#4 – State Farm: Best for Reliable Coverage

Pros

- Rental Reimbursement Coverage: Covers up to $500 for rental if your Honda is in the shop after a covered loss.

- Drive Safe & Save UBI: Honda drivers can save up to 30% based on real-time driving behavior (Read More: State Farm Auto Insurance Review).

- 17% Bundling Discount: Combining Honda auto insurance with home insurance reduces the total premium cost.

Cons

- No Loan/Lease Payoff Coverage: Honda owners with financing receive no gap protection on depreciation.

- Limited Accessory Coverage: State Farm lacks trail-use or off-road parts protection for modified Hondas.

#5 – American Family: Best for Families

Pros

- Generational Discounts: Honda policies passed to teen drivers receive legacy rewards and loyalty discounts.

- Multi-Policy Discount: Honda-driving households bundling auto and renters insurance can save up to 25%.

- KnowYourDrive Program: Telematics-based discount of up to 20% for low-risk Honda drivers.

Cons

- Availability Issues: Not all policy coverage features are available to Honda drivers in every state.

- Digital Tools Are Basic: American Family’s app lacks advanced policy management for Honda owners. See how it stacks up in our American Family Insurance review.

#6 – Geico: Best for Newer Hondas

Pros

- Mechanical Breakdown Insurance: Covers major Honda components for up to seven years or 100,000 miles.

- Multi-Policy Discount: Honda vehicle insurance bundled with renter, condo, or home insurance offers 25% off annual rates.

- Military Discount: Active-duty Honda drivers save up to 15%, especially on multiple vehicles. Explore everything you need to know about Geico in our quick guide.

Cons

- More Customer Complaints: Hondas insured with Geico may face more customer service issues than competitors.

- No Loan/Lease Payoff: Hondas with outstanding loans do not get gap coverage for the owed balance after a total loss.

#7 – Allstate: Best for Deductible Rewards

Pros

- Deductible Rewards: Honda drivers instantly earn $100 off the collision deductible upon sign-up.

- New Car Replacement: Allstate replaces a totaled Honda under 2 years old with a brand-new model. Take a look at our Allstate insurance review before picking a plan.

- Drivewise UBI Discount: Up to 40% off Honda premiums with good braking, mileage, and drive-time patterns.

Cons

- Bundling Required: Without bundling multiple lines of insurance, Honda owners won’t qualify for Allstate’s lowest rate tier.

- Repair Limitations: Allstate requires Hondas to be repaired only at in-network body shops.

#8 – Travelers: Best for Accident Forgiveness

Pros

- Premier Responsible Driver Plan: Waives surcharge for one at-fault Honda accident every 36 months.

- Bundling Discount: Combining Honda auto insurance with a homeowners policy reduces total premiums by 13%.

- New Car Replacement Coverage: Replace a totaled Honda with a brand-new model of the same make and trim if it is under five years old.

Cons

- No Mechanical Coverage: Travelers does not offer extended warranty-type plans for Honda drivers (Read More: Travelers Auto Insurance Review).

- App Lacks Functionality: Honda drivers may find digital tools limited compared to top tech-forward providers.

#9 – Farmers: Best for Custom Plans

Pros

- Customized Equipment Coverage: Farmers provides add-on protection for Honda lift systems, winches, and off-road upgrades.

- Bundling Discount: Combine Honda car insurance with homeowners or renters insurance for up to 20% off your rates.

- Accident Forgiveness: If you’re accident-free for three years after your first at-fault Honda accident, your rate won’t increase.

Cons

- No Vanishing Deductible Program: Honda drivers won’t get annual deductible reductions for safe driving.

- Limited Online Tools: Honda drivers must contact agents directly for most policy changes or claims. Let’s go over everything you need to know about Farmers Insurance.

#10 – Progressive: Best for Digital Tools

Pros

- Name Your Price Tool: Honda drivers can choose an auto insurance plan online based on their budget. Learn how it works in our Progressive Insurance review.

- Snapshot Discount Program: Up to 30% savings for Honda drivers who track their habits and avoid speeding, hard braking, and driving at night.

- Loan/Lease Payoff Coverage: Progressive’s gap policies cover a financed or leased Honda’s remaining loan balance.

Cons

- Limited Off-Road Coverage: Progressive does not offer specialized protection for Hondas used in trail or rock-crawling activities.

- Telematics Penalty: Snapshot may raise rates for Honda drivers with harsh braking or high mileage.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Find the Best Honda Car Insurance Near You

Erie, Liberty Mutual, and Nationwide offer the best auto insurance for Hondas. Erie boasts a 0.22 complaint index, the lowest among major insurers, while Nationwide rewards safe Honda drivers with a 40% usage-based discount.

Honda insurance prices vary based on model, driver age, and driving record. Most Hondas, especially the Honda CR-V and Civic, are the cheapest cars to insure.

Hondas are reliable vehicles for teens and those with multiple accidents, as their low repair costs mean cheaper full coverage rates for high-risk drivers.

To get the best deal near you, compare multiple Honda insurance quotes online and match discount programs to your driving habits. Enter your ZIP code to compare costs now.

Frequently Asked Questions

Which company has the best auto insurance for Hondas?

Erie and Liberty Mutual are the best companies to insure your Honda due to their high claims satisfaction and variety of policy options. You’ll get a cheaper Honda car insurance quote with Erie, but Liberty Mutual offers higher levels of protection for new Hondas.

Who has the cheapest insurance for Hondas?

Erie has cheap Honda car insurance, starting at $52 per month, but it’s only available in 12 states. State Farm and Geico have the next cheapest rates in more states, starting at $58 a month. Enter your ZIP code to see who has the cheapest insurance near you.

Is Geico or Progressive auto insurance better for Hondas?

Geico is better if you want mechanical breakdown insurance for Hondas under seven years or 100,000 miles, while Progressive offers stronger savings for multi-vehicle households. Is Allstate cheaper than Geico for a Honda? Geico is usually cheaper, especially when you qualify for a 25% bundling discount.

Read More: State Farm vs. Farmers, Geico, Progressive, Allstate Insurance

How much does car insurance for a Honda Ridgeline cost?

When it comes to car insurance, Honda Ridgeline car insurance premiums are on the higher end, starting at $85 a month for minimum coverage.

How much is car insurance for Honda Accords?

The Accord is one of the cheapest Hondas to insure at $78 per month for minimum coverage and $155 for full coverage.

Does Honda have its own car insurance?

Yes, Honda Insurance Solutions launched in 2025 to offer customizable insurance policies for auto, RVs, motorcycles, and recreational vehicles like ATVs. Honda also offers homeowners, renters, and pet insurance. However, Honda doesn’t underwrite these policies, but works with licensed insurers to offer coverage to Honda owners through its insurance marketplace.

Is AAA auto insurance worth it for Honda?

AAA auto insurance is worth it for Honda owners who need built-in roadside assistance and travel benefits, but monthly premiums are often 10%–15% higher than other providers, as shown in our AAA auto insurance review.

What is the cheapest Honda car insurance for seniors over 60?

The cheapest Honda car insurance for seniors over 60 averages $97 per month, and insurers like Liberty Mutual offer discounts for driving under 7,500 miles annually. If you’re looking for the best car insurance for seniors, Honda CR-V rates are affordable at $79 a month, with high IIHS crash-test ratings.

How much does Honda Fit insurance cost?

Honda Fit insurance rates range between $72 a month for minimum coverage and up to $144 per month or more for full coverage. But compare rates by model year because the 2016 Honda Fit insurance cost would be cheaper than a Honda Fit from 2020 or later.

Is insurance high for Hondas?

Are Hondas more expensive to insure? No, insurance isn’t high for Hondas. Models like the Civic and CR-V average $149 to $158 per month, partly due to their strong safety ratings and lower theft rates, but using hacks to save more money on car insurance can bring those costs down even further.

How much does full coverage auto insurance cost for a Honda?

How do I lower my Honda auto insurance rates?

How much is insurance on a Honda Civic?

What factors influence Honda auto insurance rates?

Which Honda auto insurance company has the highest customer satisfaction rating?

How can Honda owners choose the best car insurance for claims?

What are the main coverage options available for Honda auto insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.