Best Auto Insurance for Volkswagens in 2026

Get Volkswagen car insurance for $52 monthly. Erie, USAA, and Liberty Mutual offer the best auto insurance for Volkswagens. VW insurance rates are higher than average, especially for full coverage, due to expensive repairs and replacement parts, but drivers can save up to 30%-40% with safe driving habits.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Copywriter

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, AllWom...

Rachel Bodine

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated November 2025

The best auto insurance for Volkswagens is with Erie, USAA, and Liberty Mutual. All three have exceptional customer service ratings and affordable coverage.

- Erie won’t raise Volkswagen insurance rates after an accident

- Nationwide offers the biggest usage-based discount of 40%

- USAA is the best Volkswagen car insurance for military members

USAA has the most affordable liability auto insurance for Volkswagens at $52 a month, but coverage is only available to active and retired military members.

Erie’s rates may be a little higher, but it has the highest claims satisfaction out of our top ten Volkswagen auto insurance companies.

Top 10 Companies: Best Auto Insurance for Volkswagens| Company | Rank | Claim Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 743 / 1,000 | A+ | Customer Satisfaction |

| #2 | 741 / 1,000 | A++ | Military Benefits | |

| #3 | 730 / 1,000 | A | Comprehensive Coverage |

| #4 | 729 / 1,000 | A+ | Vanishing Deductible | |

| #5 | 720 / 1,000 | A | Roadside Assistance |

| #6 | 716 / 1,000 | A++ | Young Drivers | |

| #7 | 697 / 1,000 | A++ | Digital Tools | |

| #8 | 693 / 1,000 | A+ | Accident Forgiveness | |

| #9 | 690 / 1,000 | A | Personalized Policies | |

| #10 | 673 / 1,000 | A+ | Customizable Plans |

Always compare multiple companies to find the best Volkswagen car insurance for you. Use this guide to see what makes these providers stand out.

Enter your ZIP code into our free quote tool to find the best auto insurance companies for Volkswagens that match your needs and budget.

Compare Car Insurance Cost for Volkswagens

Finding the best Volkswagen insurance rates starts with comparing average rates across top providers. Among the standout options, USAA offers the cheapest car insurance for Volkswagens, but these rates are only available to military members.

Nationwide is an affordable option for minimum coverage, but its full coverage rates are higher than USAA and other companies on this list.

Volkswagen Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $59 | $145 |

| $72 | $175 | |

| $58 | $145 |

| $68 | $165 | |

| $60 | $155 | |

| $70 | $170 |

| $55 | $140 | |

| $62 | $150 | |

| $57 | $135 | |

| $52 | $130 |

If you’re considering comprehensive coverage as part of your protection plan, Allstate and Liberty Mutual show higher premiums that reflect broader policy features.

Liberty Mutual is a solid choice if you don’t mind paying extra for premium features like new car replacement, OEM coverage, or accident forgiveness. Keep reading to see how different factors impact your Volkswagen car insurance quotes.

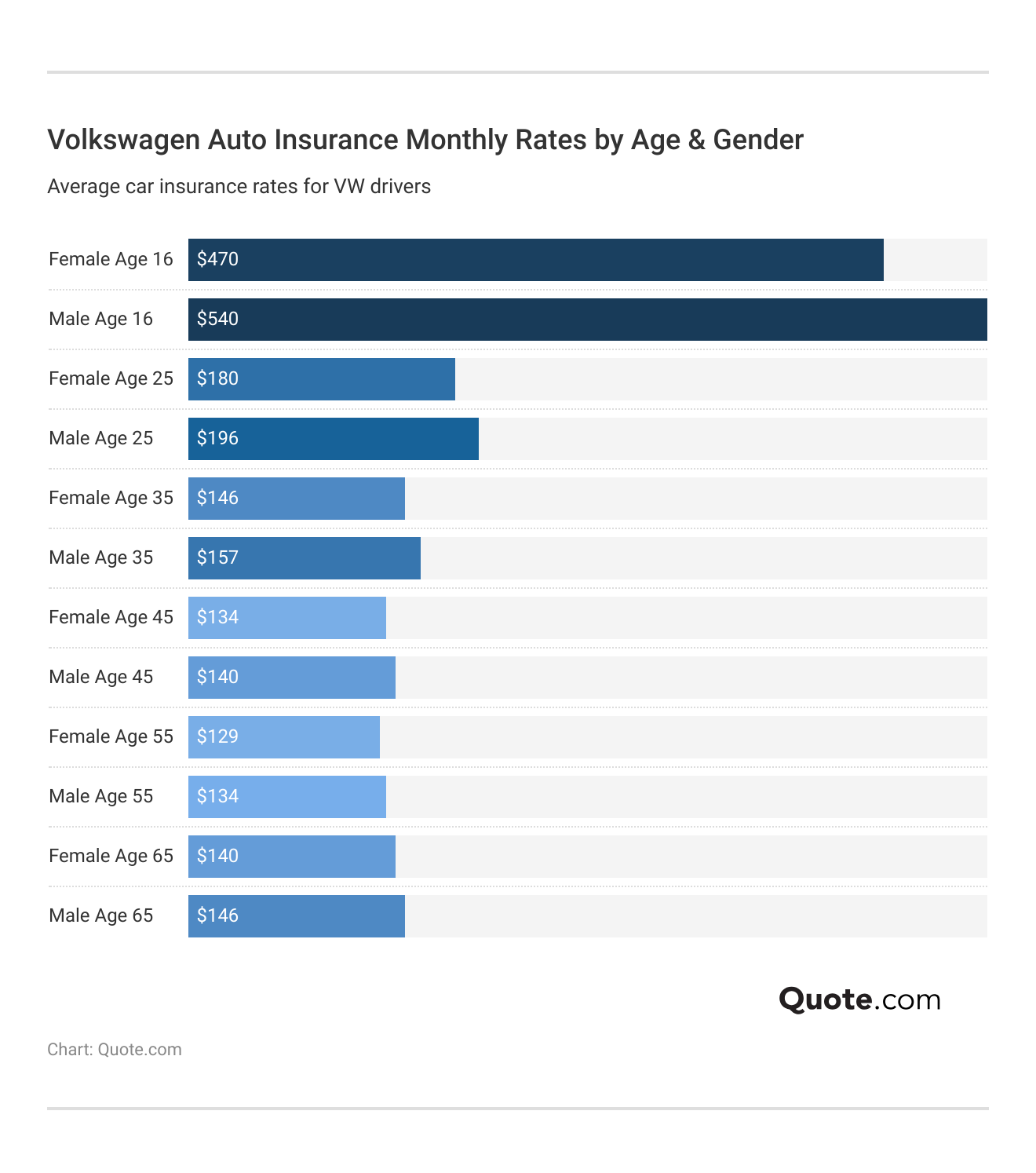

Why Age Matters for Volkswagen Insurance Prices

Are Volkswagens expensive to insure? That depends. Monthly auto insurance premiums for Volkswagen owners are largely determined by age.

Younger drivers, especially those in their teens and early twenties, typically face higher premiums due to perceived higher risk (Read More: Cheap Auto Insurance for Teens).

In contrast, drivers over 40 tend to benefit from lower Volkswagen insurance costs, particularly if they have a clean driving record.

Keep reading to see how a clean record can help secure affordable car insurance for VW drivers of all ages.

What High-Risk Drivers Pay for VW Insurance

To secure the best auto insurance rates, it’s important for Volkswagen owners to maintain a clean record when shopping for coverage options (Read More: The 17 Best Tips to Pay Less for Car Insurance).

Those with one or more traffic violations, such as speeding tickets or accidents, can expect higher Volkswagen insurance rates regardless of age.

Volkswagen Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One Ticket | One DUI |

|---|---|---|---|---|

| $59 | $88 | $79 | $148 |

| $72 | $108 | $97 | $174 | |

| $58 | $87 | $78 | $140 |

| $68 | $102 | $91 | $162 | |

| $60 | $90 | $80 | $144 | |

| $70 | $105 | $95 | $170 |

| $55 | $83 | $75 | $149 | |

| $62 | $94 | $85 | $153 | |

| $57 | $86 | $77 | $141 | |

| $52 | $79 | $71 | $130 |

Each Volkswagen insurance company treats violations differently. If you were recently ticketed, compare quotes to see how much your rates could go up and consider switching providers if you find lower rates.

Erie and USAA are the cheapest VW auto insurance companies for high-risk drivers who have DUIs or have recently been in an accident.

High-risk drivers who maintain continuous coverage and avoid future claims will see lower rates over time.

Michael Leotta Insurance Operations Specialist

Most Volkswagen insurance companies keep high-risk rates under $150 a month for minimum coverage. Full coverage will be more expensive since Volkswagens are higher-risk vehicles due to their expensive repair costs.

Driving a more affordable model can help lower rates for high-risk drivers. Keep reading to compare VW insurance rates by model.

How Auto Insurance Costs Vary by VW Model

Finding the best auto insurance for Volkswagens depends on the model you have. Premiums vary based on each vehicle’s repair complexity, safety ratings, and risk profile.

As a luxury vehicle manufactured in Europe, car insurance for Volkswagens is more expensive than average. Repairs and replacement parts cost more (Learn More: Everything You Need to Know About Luxury and Exotic Car Insurance).

VW Car Insurance Monthly Rates by Model & Coverage Level| Vehicle | Minimum Coverage | Full Coverage |

|---|---|---|

| Volkswagen Arteon | $66 | $198 |

| Volkswagen Atlas | $73 | $183 |

| VW Atlas Cross Sport | $74 | $184 |

| Volkswagen Golf | $58 | $159 |

| Volkswagen ID.4 | $70 | $193 |

| Volkswagen Jetta | $65 | $193 |

| Volkswagen Passat | $67 | $158 |

| Volkswagen Taos | $56 | $172 |

| Volkswagen Tiguan | $52 | $162 |

| Volkswagen Touareg | $80 | $225 |

Minimum coverage Volkswagen Jetta insurance is competitive at $65 monthly, but costs jump to $193 a month for full coverage. Volkswagen Atlas insurance also increases by $100 or more per month due to the high cost of repairs.

Volkswagen Touareg car insurance is the most expensive at $225 monthly for full coverage, compared to Volkswagen Tiguan insurance at $162 a month, one of the brand’s more affordable options.

VW Tiguan vs. Similar SUVs: Car Insurance Monthly Rates| Vehicle | Minimum Coverage | Full Coverage |

|---|---|---|

| Volkswagen Tiguan | $52 | $162 |

| Acura RDX | $58 | $180 |

| Audi Q3 | $64 | $200 |

| BMW X1 | $70 | $220 |

| Honda CR-V | $49 | $161 |

| Hyundai Tucson | $53 | $175 |

| Kia Sportage | $55 | $185 |

| Mazda CX-5 | $50 | $159 |

| Subaru Forester | $48 | $174 |

| Toyota RAV4 | $51 | $178 |

When you compare Volkswagen Tiguan car insurance against similar vehicles, it’s one of the more affordable luxury models. It’s even cheaper to insure than a Toyota RAV4.

However, these VW car insurance quotes are just an average. Your individual coverage needs and driving record will determine your final premiums (Read More: How to Get Multiple Auto Insurance Quotes).

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Insurance Policy Choices for Your Volkswagen

Whether you own a brand-new model or a reliable older vehicle, choosing the right coverage is key to protecting your Volkswagen from accidents, theft, and costly repairs.

Liability insurance is required by law, but these are the essential types of car insurance VW drivers should consider:

- Liability Insurance: Covers damage or injuries you cause while driving your Volkswagen.

- Collision Coverage: Pays to repair your Volkswagen if you crash into another vehicle or object.

- Comprehensive Insurance: Covers your Volkswagen against theft, vandalism, weather damage, and more.

- Accident Forgiveness: Prevents your Volkswagen insurance costs from increasing after your first accident.

- OEM Parts Coverage: Ensures your Volkswagen is repaired with original manufacturer parts, not aftermarket parts.

You may not want to carry more than liability coverage if you drive an older Volkswagen, but these options are still recommended if you live in a high-traffic area or have a long commute.

OEM parts coverage is important for VW drivers since aftermarket parts are notoriously unreliable in European makes and models.

This type of coverage doesn’t typically come standard, but the best providers will offer OEM coverage to protect the integrity of your vehicle.

The best car insurance companies for Volkswagens offer many of the policy options drivers want. Allstate and AAA are the only two providers without OEM coverage.

Volkswagen Auto Insurance Coverage Options by Provider| Company | Claim Forgiveness | Gap Plans | OEM Parts | Rideshare Coverage |

|---|---|---|---|---|

| ✅ | ❌ | ❌ | ❌ |

| ✅ | ✅ | ❌ | ✅ | |

| ✅ | ✅ | ✅ | ✅ |

| ✅ | ❌ | ✅ | ❌ | |

| ❌ | ❌ | ✅ | ✅ | |

| ✅ | ❌ | ✅ | ❌ |

| ❌ | ❌ | ✅ | ❌ | |

| ✅ | ✅ | ✅ | ✅ | |

| ✅ | ❌ | ✅ | ✅ | |

| ✅ | ✅ | ✅ | ✅ |

Erie, USAA, and Progressive offer all policy options, while other providers only offer a few. Review these options carefully to make sure your Volkswagen is fully protected while keeping your insurance costs affordable.

Get more insights by reading our guide about what to do when you’re denied insurance coverage.

Easy Ways to Save on VW Auto Insurance

If you want cheap auto insurance for a Volkswagen, keep your driving record clean and avoid filing claims.

You can also reduce coverage to the minimum liability, but you’ll be responsible for your own repairs if your VW is ever involved in an accident.

Liability-only insurance can save you 55%-60% compared to full coverage, but it puts you at financial risk if an accident exceeds your policy limits or your own vehicle needs repairs.

Dani Best Licensed Insurance Producer

Reducing coverage is only recommended for older VW models or if you’ve paid off your vehicle loan. You’ll still need to carry full coverage if you lease a Volkswagen or are still making car payments.

Luckily, there are practical tips that reduce auto insurance premiums without sacrificing essential VW coverage. Here are some of the effective ways to save on auto insurance:

- Maintain a Clean Driving Record: Safe driving practices lower your risk factor, which means lower rates on your Volkswagen, avoiding tickets and accidents, particularly for younger drivers.

- Improve Your Credit Score: A strong credit score can lead to better rates for Volkswagen insurance. Monitor your credit score by paying your bills on time, since insurance providers often base premiums on credit history.

- Increase Your Deductible: Opting for a higher deductible on your Volkswagen can lower your monthly premium. Just make sure the higher deductible is something you can afford if you need to file a claim.

- Limit Your Mileage: If you drive your Volkswagen less, you may qualify for lower premiums. Many insurers offer discounts for low-mileage drivers, making this a great way to cut costs.

Use these strategies to keep Volkswagen auto insurance affordable. All these factors will help ensure the lowest prices for your Volkswagen insurance.

Even if you’re a high-risk driver, raising deductibles and reducing your mileage will still give you lower Volkswagen car insurance rates.

How to Save With Volkswagen Insurance Discounts

If you’re looking for the best car insurance for Volkswagens, taking full advantage of available discounts can substantially lower your premium.

Most leading insurance companies offer a variety of savings tailored to Volkswagen drivers, rewarding safe habits, academic achievement, anti-theft technology, and more.

Knowing what auto insurance discounts are available and how to qualify for them is just as important as comparing base premiums.

These common auto insurance discounts are available from leading providers. We highlight the different percentage savings on key programs for Volkswagen owners.

Volkswagen Auto Insurance Discounts From Top Providers| Company | Anti-Theft | Bundling | Good Driver | Usage-Based |

|---|---|---|---|---|

| 8% | 15% | 30% | 30% |

| 10% | 25% | 25% | 40% | |

| 15% | 25% | 23% | 30% |

| 10% | 20% | 30% | 30% | |

| 25% | 25% | 26% | 25% | |

| 35% | 25% | 20% | 30% |

| 5% | 20% | 40% | 40% | |

| 25% | 10% | 30% | $231/yr | |

| 15% | 17% | 25% | 30% | |

| 15% | 10% | 30% | 30% |

Safe drivers get the best Volkswagen car insurance discounts, saving up to 30% with top companies Erie, USAA, and Liberty Mutual. Nationwide offers the biggest savings of up to 40$% for good drivers who track their habits with usage-based insurance.

By layering the discounts you’re eligible for, you can double or even triple the percentage and significantly reduce your total VW insurance costs.

The Best Car Insurance Providers for VWs

Erie, USAA, and Liberty Mutual stand out with the best auto insurance for Volkswagens, but you should always compare auto insurance companies before you buy in order to secure the right balance of price, coverage, and service.

State Farm and Progressive may be the largest and most popular VW car insurance companies, but each company offers drivers different perks and policy options.

Consider how factors like age, driving history, and vehicle model impact insurance rates with different companies, and who offers the best price based on your profile and habits.

Scroll down to compare our top ten list of providers, or enter your ZIP code to start comparing the best insurance for Volkswagen drivers in your city.

#1 – Erie: Top Pick Overall

Pros

- Rate Lock Feature: Erie allows you to lock in your Volkswagen insurance rate, avoiding premium increases unless you make major policy changes.

- Strong Satisfaction Scores: Erie is the #1 auto insurance company for claims service in J.D. Power’s customer satisfaction surveys.

- Free Full Coverage Add-Ons: Services such as locksmith assistance and full windshield repair are included at no extra cost, enhancing the value for Volkswagen drivers.

Cons

- Limited Availability: Erie is only available in 12 states and Washington, D.C. Use our Erie insurance review to find coverage near you.

- No Online Quote: Erie requires working with an agent to get a quote, which may slow down Volkswagen insurance comparisons.

#2 – USAA: Best for Military Benefits

Pros

- Exclusive Military Perks: USAA offers specialized perks, such as military storage discounts, ideal for service members with Volkswagens.

- Top Customer Satisfaction: USAA consistently ranks at the top in J.D. Power surveys for claims satisfaction, making it a trusted choice for Volkswagen drivers.

- A++ Financial Rating: The company has a top-rated financial rating, providing solid support for every Volkswagen claim. Get full ratings in our USAA insurance review.

Cons

- Eligibility Restrictions: USAA coverage is restricted to military members, veterans, and their families, which eliminates coverage for many Volkswagen drivers.

- Limited Physical Locations: USAA relies heavily on online support, which may be a drawback for those preferring in-person service.

#3 – Liberty Mutual: Best for OEM Coverage

Pros

- OEM Parts Coverage: Provides original manufacturer parts to help maintain the integrity and performance of your Volkswagen.

- Comprehensive Add-Ons: Explore VW insurance add-on options like new car replacement and better car replacement in our Liberty Mutual insurance review.

- Generous Bundling Discount: A 25% bundling discount can significantly lower premiums, making Liberty Mutual a competitive choice for the best auto insurance for Volkswagens.

Cons

- Above-Average City Rates: Premiums tend to be higher in big cities and for VW drivers with long commutes.

- Limited Agent Availability: In some regions, Volkswagen owners may find it challenging to access in-person support due to a smaller agent network.

#4 – Nationwide: Best for Vanishing Deductibles

Pros

- Vanishing Deductible: This feature lowers your VW insurance deductible by $100 each year without a claim, rewarding safe driving.

- SmartRide Telematics: SmartRide, a usage-based program, rewards good driving with 40% discounts. Learn how it works in our Nationwide insurance review.

- Solid Coverage Selection: Extras like total loss deductible waiver and identity theft coverage add valuable protection for Volkswagen owners.

Cons

- No OEM Parts Option: Without specific customization, Volkswagen repairs may not include original manufacturer parts.

- Digital Tools Lag: The Nationwide app and website may not be as user-friendly as competitors, making policy management less efficient.

#5 – AAA: Best for Roadside Assistance

Pros

- Roadside Assistance Package: Free roadside assistance is included with every VW auto insurance policy, covering up to 200 miles or more in some areas.

- Safe Driver Discounts: Drivers who avoid claims and traffic citations can save up to 30% on Volkswagen insurance premiums. See more discounts in our AAA Insurance review.

- Few Customer Complaints: AAA receives half the number of complaints from customers as other VW car insurance companies on our list.

Cons

- Regional Service: Customer service experiences with AAA auto insurance vary by city and state. Same with VW insurance discounts and membership services.

- Membership Required: To qualify for AAA car insurance and roadside assistance, you must be a AAA member and pay annual membership fees.

#6 – State Farm: Best for Young Drivers

Pros

- Steer Clear Program: Offers discounts for young drivers with Volkswagens who complete a safe driving course. Learn more in our State Farm insurance review.

- Reliable Financial Backing: With an A++ A.M. Best rating, State Farm offers dependable financial strength to support long-term Volkswagen coverage.

- Travel Coverage: Rental car and travel reimbursement features make life easier if your Volkswagen is in the shop for repairs after a covered claim.

Cons

- Limited Custom Add-Ons: Compared to some competitors, State Farm provides fewer optional coverages that might appeal to Volkswagen owners seeking more flexibility.

- Variable Discounts: Discount availability can differ by state, which may limit savings opportunities for some Volkswagen drivers.

#7 – Geico: Best for Digital Tools

Pros

- Efficient Digital Tools: Everything you need to know about Geico includes its user-friendly mobile app and website, which make it easy for tech-savvy Volkswagen drivers.

- Competitive Premiums: Geico consistently offers rates that are lower than average, making it a popular, budget-friendly choice for Volkswagen owners.

- Strong Financial Stability: Geico’s A++ rating from A.M. Best ensures long-term reliability for covering claims on your Volkswagen.

Cons

- Limited Coverage Customization: Geico’s policy options may lack some of the specialized coverage features Volkswagen owners seek.

- Average Customer Interaction: While service is efficient, Geico has received mixed Volkswagen car insurance reviews regarding the customer support experience.

#8 – Allstate: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Our Allstate insurance review highlights accident forgiveness as a strong feature for VW drivers to avoid rate hikes after their first at-fault accident.

- Deductible Rewards: Safe drivers can reduce their deductibles by $100 each year, which adds long-term savings for responsible Volkswagen owners.

- Drivewise Program: This usage-based telematics program offers potential discounts to VW drivers who practice safe driving.

Cons

- Higher Premiums for Young Drivers: Young Volkswagen drivers under 25 can expect higher rates than with other insurers.

- Mixed Claims Feedback: Some customers report delays or issues with claims, which may impact the experience for Volkswagen policyholders.

#9 – Farmers: Best for Personalized Policies

Pros

- Highly Customizable Coverage: Farmers allows VW owners to add unique options, like glass deductible buyback and accident forgiveness, to better protect their vehicle.

- Strong Local Agent Support: Everything you need to know about Farmers Insurance is its network of local agents, providing Volkswagen drivers with personalized guidance.

- Discount Opportunities: With up to 20% bundling discounts and usage-based programs, Farmers provides more discounts on VW insurance than any other company.

Cons

- Higher Premiums Than Average: Farmers tend to charge higher premiums than other providers, which may make it harder for Volkswagen owners seeking the best rates.

- Basic Digital Tools: Farmers’ website and mobile app lag behind competitors, limiting convenience for Volkswagen drivers who prefer managing insurance online.

#10 – Progressive: Best for Customizable Plans

Pros

- Customizable Coverage Options: Progressive offers a wide range of add-ons like gap insurance and custom parts coverage, great for modified Volkswagens.

- Name Your Price Tool: Drivers can customize policies by budget, keeping essential VW insurance coverage intact.

- Snapshot Program: Safe Volkswagen drivers can earn discounts through this telematics program. Our guide to everything you need to know about Progressive explains how.

Cons

- Complex Policy Structures: The variety of choices can make Progressive policies difficult to navigate for Volkswagen owners new to auto insurance.

- Inconsistent Claims Experience: Some policyholders report slower resolution times, which may frustrate Volkswagen drivers needing fast support.

Frequently Asked Questions

Which providers offer the best auto insurance for Volkswagens?

Erie, USAA, and Liberty Mutual have the best car insurance for Volkswagen drivers, offering low rates and high claims satisfaction. Compare Liberty Mutual vs. Nationwide auto insurance to learn more.

Are Volkswagens more expensive to insure?

Volkswagens do have higher insurance costs than other makes and models because of their expensive repair costs. Find the best auto insurance, no matter how much coverage you need, by entering your ZIP code into our comparison tool.

What factors impact Volkswagen insurance rates?

Consider the coverage you need, monthly premiums, deductibles, customer service ratings, available discounts, and your driving history. Some providers may specialize in policy types that better suit your model based on repair costs or safety features.

How much does auto insurance for Volkswagens typically cost?

Volkswagen auto insurance costs vary depending on the model, your driving record, and the level of coverage. On average, Volkswagen owners can expect to pay $52 a month for minimum coverage and around $130-$150 a month for full coverage. Higher-end models or performance-focused vehicles, such as the Golf, may have higher premiums.

Does my age affect the cost of Volkswagen auto insurance?

Yes, your age is a significant factor in determining your premiums. Young drivers, especially those under 25, typically face higher premiums because they are considered higher-risk drivers. Older drivers with more experience and a clean driving record generally pay less (Read More: Cheap Auto Insurance for Seniors).

How does the Volkswagen model affect insurance rates?

The model of your Volkswagen can significantly impact your rates. Volkswagen Jetta insurance rates are often higher than the VW Tiguan or Taos, especially for full coverage. It can also be hard to find cheap car insurance for a VW Golf, since performance vehicles tend to have higher premiums due to their higher repair costs and increased risk of accidents.

What is the cheapest Volkswagen to insure?

Volkswagen Tiguan auto insurance rates are the cheapest, starting at $52 per month for minimum coverage.

How much is insurance for a Volkswagen Jetta?

Volkswagen Jetta car insurance costs $65 monthly for minimum coverage and around $193 monthly for full coverage. When comparing coverage costs by vehicle, Volkswagen auto insurance rates are among the highest, since its repair costs are often very expensive.

How much is Volkswagen Passat car insurance?

Volkswagen Passat insurance rates start at $67 a month for minimum coverage and $158 per month for full coverage. It’s one of the cheapest models for full coverage VW insurance.

How much does Volkswagen CC car insurance cost?

The Volkswagen CC (originally the VW Passat CC) is no longer in production, which means rates could be cheaper than the average $67 monthly Passat insurance rate. Enter your ZIP code to find Volkswagen CC car insurance quotes from companies near you.

How can I lower my Volkswagen insurance rates?

What discounts are available for Volkswagen drivers?

Can I find cheap auto insurance for Volkswagens with a poor driving record?

What is VW tire insurance, and is it worth it?

What type of Volkswagen insurance coverage should I get?

What Volkswagen auto insurance companies use OEM parts?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.