Best Auto and Renters Insurance Bundles in 2026

Erie, USAA, and Liberty Mutual offer the best auto and renters insurance bundles, with rates starting at $53 per month. You can lower your premiums with bundling discounts and claims-free savings of up to 25%. Liberty Mutual alone can cut bundled costs by up to $27 a month compared to buying policies separately.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Content Creator

Lia Vergin develops both video and written content across all lines of insurance, with a primary focus on auto, home, and life coverage. She is dedicated to helping consumers better understand and navigate their insurance options. Driven by a passion for saving money and finding great deals, she is committed to creating clear, engaging, and practical content that empowers readers to make confident...

Lia Vergin

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated February 2026

The best auto and renters insurance bundles are with Erie, USAA, and Liberty Mutual. Erie offers bundled rates starting at $53 per month and ranks highest for claims satisfaction.

- Erie leads with $636 annual bundles and top claims satisfaction

- Liberty Mutual saves drivers up to $27 per month when they bundle

- Bundling with Allstate or AmFam can save you up to 25%

USAA offers competitive rates, strong customer satisfaction, and exclusive military discounts for eligible members.

Liberty Mutual features user-friendly digital tools and bundling discounts up to 25% for added savings. Get The Details: Car Insurance Discounts You Can’t Miss

Top 10 Companies: Best Auto & Renters Insurance Bundles| Company | Rank | Claim Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 743 / 1,000 | A+ | Claims Service |

| #2 | 741 / 1,000 | A++ | Military Savings | |

| #3 | 730 / 1,000 | A | Digital Tools |

| #4 | 729 / 1,000 | A+ | Coverage Flexibility | |

| #5 | 716 / 1,000 | A+ | Agent Network | |

| #6 | 702 / 1,000 | A | Loyalty Rewards |

| #7 | 693 / 1,000 | A+ | Custom Add-Ons | |

| #8 | 691 / 1,000 | A++ | Coverage Options | |

| #9 | 690 / 1,000 | A | Local Agents | |

| #10 | 673 / 1,000 | A+ | Online Quotes |

Rates vary by coverage level, renters property limits, and driving record, which can significantly impact total costs.

Enter your ZIP code into our free quote tool to find the best auto and renters insurance bundles for your needs and budget.

Comparing Renters and Car Insurance Prices

Bundling auto and renters insurance lowers monthly costs across nearly every major provider. Rates below are based on a 45-year-old male driver.

Liberty Mutual shows the largest savings, dropping from $110 to $83 per month for a $27 difference, while Allstate saves drivers $26 per month.

Auto & Renters Insurance Monthly Cost: Before vs. After Bundling| Company | Separate | Bundled | Savings |

|---|---|---|---|

| $104 | $78 | $26 | |

| $90 | $68 | $22 |

| $70 | $53 | $17 |

| $99 | $79 | $20 | |

| $110 | $83 | $27 |

| $83 | $66 | $17 | |

| $94 | $85 | $9 | |

| $75 | $62 | $13 | |

| $92 | $80 | $12 | |

| $61 | $55 | $6 |

Erie delivers the cheapest auto and renters insurance bundle for $53 per month, compared to $70 when purchased separately.

State Farm reduces costs from $75 to $62, and American Family cuts rates by $22 per month.

Minimum coverage remains the most budget-friendly option for most drivers who bundle car and renters insurance.

Read More: Best Auto and Home Insurance Bundles

Bundle discounts work by lowering your total premium when you purchase auto and renters insurance from the same company, often reducing costs by 10% to 25%.

Liberty Mutual and Allstate offer some of the highest bundling discounts, reaching up to 25%. Auto and renters insurance bundle comparison, both discount percentages and service quality helps ensure you get real savings—not just a lower introductory rate.

How Coverage Affects Bundled Insurance Premiums

Coverage levels play a major role in how much you pay for bundled insurance. Minimum coverage keeps monthly costs lower, while full coverage and higher renters limits increase premiums.

USAA offers the lowest rate at $49 per month, followed by Erie at $56 and State Farm at $59, keeping base protection affordable.

Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $78 | $175 | |

| $69 | $157 |

| $56 | $128 |

| $74 | $172 | |

| $82 | $186 |

| $64 | $151 | |

| $71 | $166 | |

| $59 | $133 | |

| $70 | $160 | |

| $49 | $112 |

Full coverage auto insurance raises premiums but varies widely by provider. USAA averages $112 per month and Erie $128, while Liberty Mutual reaches $186.

Renters insurance premiums for this same profile remain affordable across coverage tiers. Erie starts at $18 per month for $20,000 in personal property coverage, with USAA close behind at $19.

Renters Insurance Monthly Rates by Personal Property Limit| Company | $20K | $30K | $40K | $50K |

|---|---|---|---|---|

| $22 | $24 | $25 | $26 | |

| $35 | $38 | $40 | $42 |

| $18 | $19 | $20 | $21 |

| $38 | $41 | $43 | $45 | |

| $29 | $31 | $33 | $35 |

| $27 | $29 | $31 | $32 | |

| $32 | $35 | $37 | $39 | |

| $25 | $27 | $29 | $30 | |

| $24 | $25 | $27 | $28 | |

| $19 | $20 | $21 | $22 |

As limits increase to $50,000, premiums rise steadily rather than sharply. Travelers averages $28, State Farm $30, and Liberty Mutual $35 per month.

This gradual pricing structure makes it easier to expand renters coverage without dramatically increasing bundled totals.

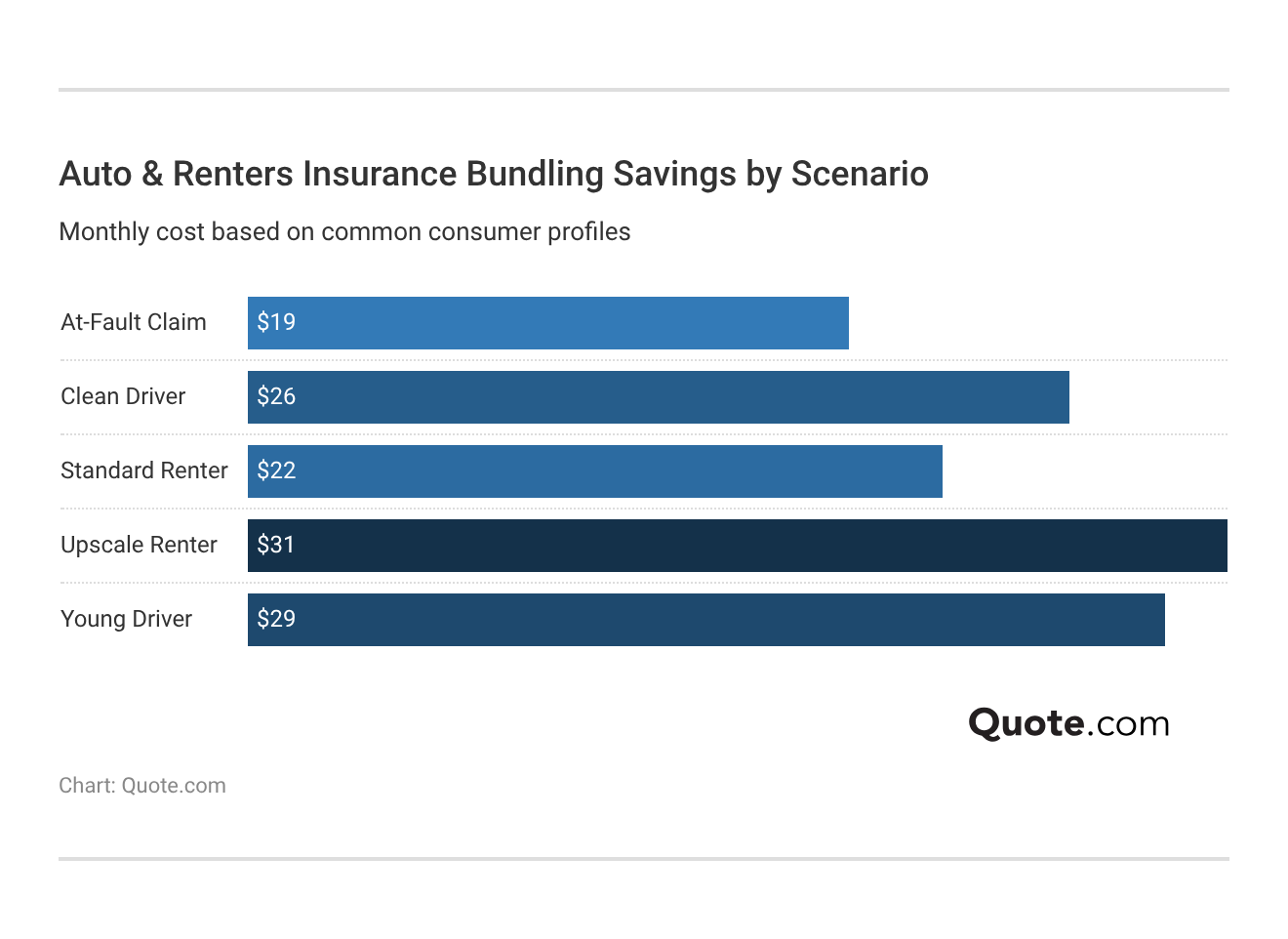

How Driving & Claim History Affect Bundled Car Insurance

The average cost of auto insurance changes significantly based on driving history. Drivers with a clean record pay the lowest premiums.

USAA offers the cheapest coverage at $49 per month, but it’s available only to military members. Erie is the next-cheapest at $56 per monthly.

Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $78 | $105 | $133 | $94 | |

| $69 | $93 | $118 | $84 |

| $56 | $76 | $96 | $68 |

| $74 | $100 | $127 | $90 | |

| $82 | $112 | $141 | $100 |

| $64 | $87 | $110 | $78 | |

| $71 | $96 | $122 | $86 | |

| $59 | $80 | $100 | $71 | |

| $70 | $94 | $119 | $83 | |

| $49 | $66 | $84 | $59 |

A single accident raises rates noticeably, increasing Erie to $76 a month and Allstate to $105 per month. More serious violations lead to steeper increases.

One DUI pushes Liberty Mutual to $141 per month and Allstate to $133, while USAA remains comparatively lower at $84.

Bundling auto and renters insurance can cut costs, but always check your limits and deductibles to avoid gaps.

Dani Best Licensed Insurance Producer

Even a single ticket raises costs, with rates climbing to $100 a month at Liberty Mutual and $94 monthly at Allstate.

Comparing insurers becomes especially important after a violation, as your rates could increase more with one company over the next.

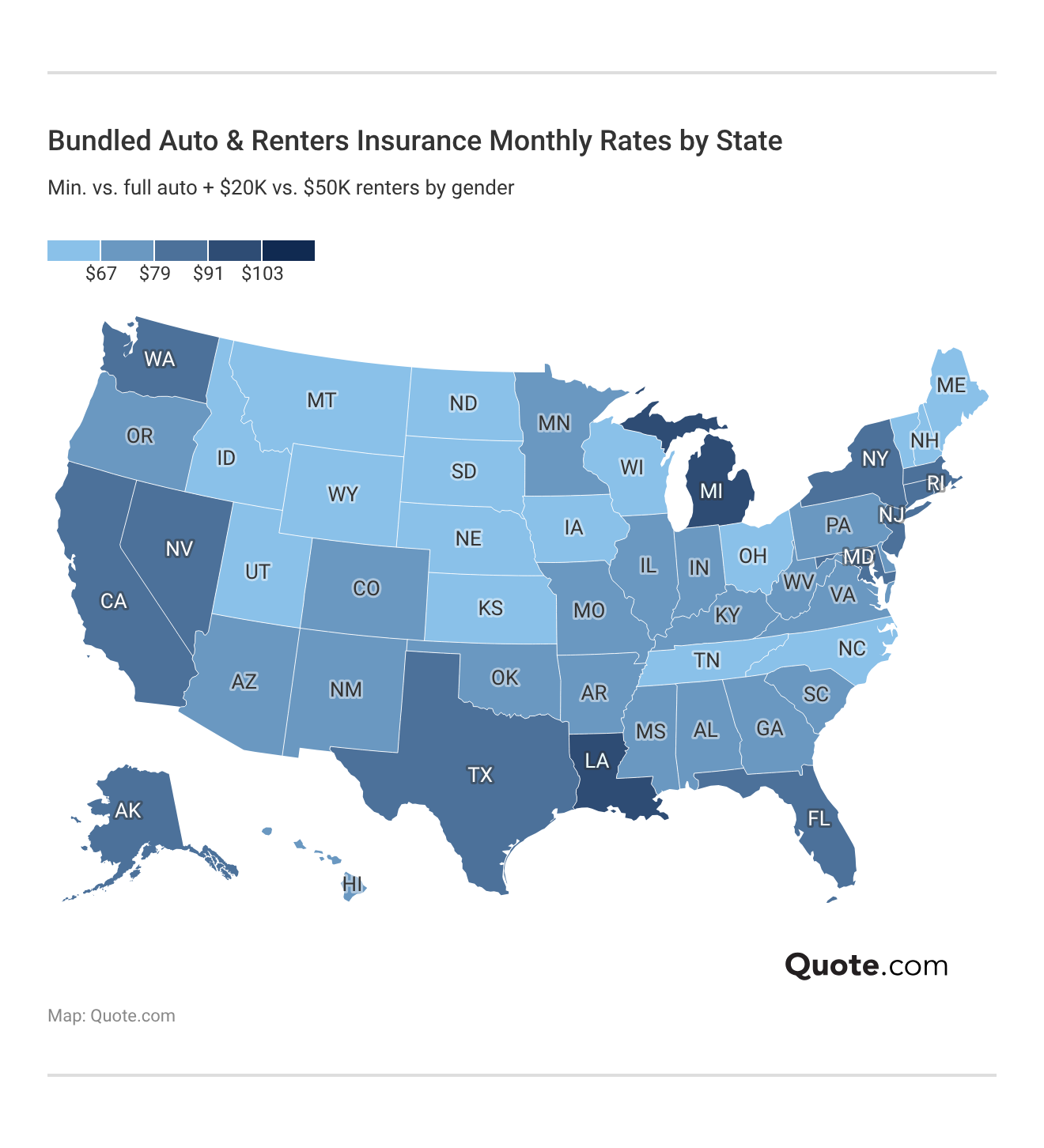

Bundled Insurance Premiums Based on Location

Bundle costs vary significantly by state, with monthly premiums ranging from roughly $56 monthly to over $103 a month, depending on coverage levels and gender.

States like Michigan, Louisiana, Florida, and Texas fall on the higher end of the spectrum, driven by higher claim frequency, severe weather risks, and litigation trends. See More: Auto Insurance Rates by State

In contrast, states across the Midwest and parts of the Mountain West tend to show lower bundled premiums, making them more affordable for both minimum auto with $20,000 renters coverage and full auto with $50,000 coverage renters combinations.

Many discussions about the best auto and renters insurance bundle Reddit users recommend also highlight how heavily pricing depends on location.

Location affects both auto and renters portions of a bundle, as repair costs, theft rates, storm exposure, and population density all influence premiums.

Coastal and hurricane-prone states typically show higher bundled totals, while inland states often see moderate rates.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Bundled Auto & Renters Insurance Coverage

Bundled auto and renters insurance lets you combine two policies under one provider while customizing each coverage type. You keep separate protections for your vehicle and personal property, but qualify for multi-policy discounts.

Most insurers allow you to mix minimum or full auto coverage with varying renters property limits to match your needs.

- Auto Liability Coverage: Pays for injuries and property damage you cause in an accident.

- Collision & Comprehensive: Collision and comprehensive auto insurance covers vehicle damage from accidents, theft, weather, or vandalism.

- Uninsured/Underinsured Motorist Coverage: Protects you if another driver lacks sufficient insurance.

- Personal Property Coverage (Renters): Covers belongings like furniture, electronics, and clothing.

- Loss of Use & Renters Liability: Pays for temporary housing and liability claims if someone is injured in your rental.

By selecting the right mix of auto coverage and renters property limits, you can strengthen your financial protection and qualify for multi-policy discounts at the same time.

Comparing insurance coverage options ensures your bundle fits both your vehicle and your home needs.

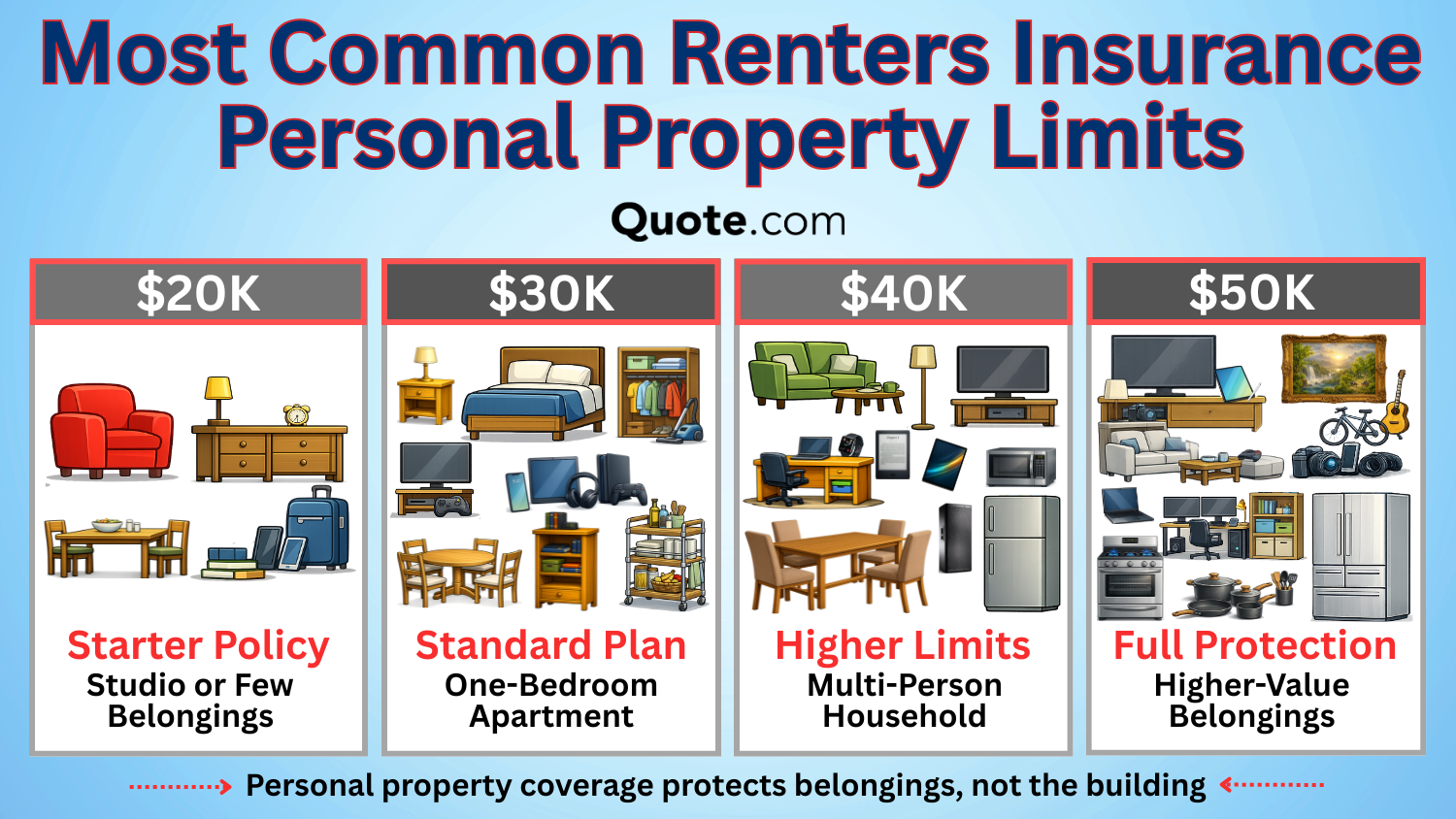

Personal Property Limits in Renters Insurance Explained

Choosing the right renters personal property limit is key to balancing protection and affordability in your bundled policy.

A $20,000 limit works well for studio apartments or renters with fewer belongings, while $30,000 fits a typical one-bedroom setup.

Households with more furnishings or shared living spaces may need $40,000, and $50,000 provides stronger protection for higher-value electronics, appliances, and furniture.

Since personal property coverage protects belongings, not the building, selecting the correct limit ensures you stay protected without overpaying.

Learn More: Best Renters Insurance Companies

Ways to Save on Car & Renters Bundles

Saving on auto and renters insurance bundles goes beyond standard discount programs. Adjusting risk factors, coverage levels, and payment habits can meaningfully reduce costs without relying on promotional discounts.

Many drivers overinsure vehicles or overestimate renters property values, which increases monthly payments. A strategic review helps align your coverage with your actual financial exposure.

- Adjust Coverage to Fit Your Needs: Drop unnecessary add-ons or reconsider full coverage on older vehicles to reduce total costs.

- Drive Fewer Miles: Reporting lower annual mileage can reduce your auto rate if your driving habits change.

- Improve Your Credit Profile: A stronger credit-based insurance score can lower both auto and renters premiums.

- Raise Your Deductible Carefully: Increasing your auto insurance deductible lowers your monthly premium if you can cover the out-of-pocket cost after a claim.

- Re-Evaluate Property Limits: Make sure your renters coverage reflects the actual value of your belongings, not inflated estimates.

Proactive updates keep your bundle efficient and cost-effective. Small, informed adjustments often produce steady long-term savings.

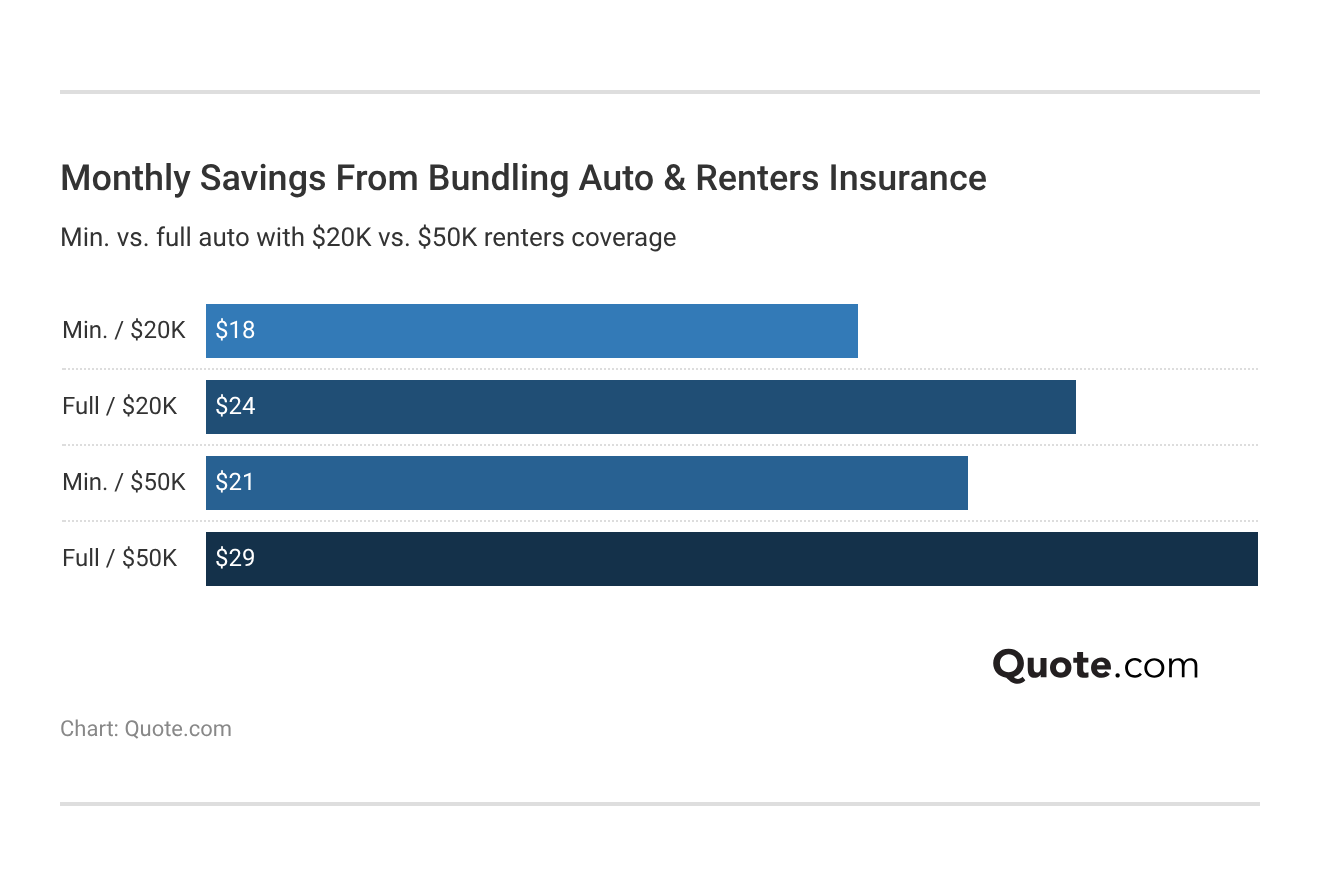

Bundling auto and renters insurance can lead to bigger savings when you choose higher coverage levels.

Drivers with minimum auto and $20,000 in renters coverage save about $18 per month, while full auto with $20,000 renters coverage saves around $24.

Increasing renters coverage to $50,000 raises savings to $21 with minimum auto and up to $29 per month with full coverage.

Your driving history affects how much you save. Drivers with clean records usually see better bundled rates because their base premiums are lower.

If you have an accident or ticket, you can still save by bundling, but the total savings may be smaller. Rental size matters—higher property limits often mean bigger bundle savings.

Bundled Car and Renters Insurance Discounts

Bundling remains one of the most effective ways to reduce total insurance costs, with several top providers offering discounts of up to 25%.

Allstate, American Family, Erie, and Liberty Mutual all provide 25% bundling discounts, while Farmers and Nationwide offer up to 20%.

Top Discounts for Auto & Renters Insurance| Company | Auto-Pay | Bundling | Claims-Free | Safety Devices |

|---|---|---|---|---|

| 9% | 25% | 20% | 20% | |

| 4% | 25% | 22% | 18% |

| 5% | 25% | 15% | 10% |

| 5% | 20% | 25% | 15% | |

| 15% | 25% | 20% | 12% |

| 10% | 20% | 18% | 18% | |

| 12% | 10% | 21% | 10% | |

| 13% | 17% | 24% | 20% | |

| 6% | 13% | 16% | 17% | |

| 6% | 10% | 23% | 15% |

Auto-pay savings can further lower premiums, reaching 15% with Liberty Mutual and 13% with State Farm.

Claims-free and safety device discounts also play a major role in reducing costs. Farmers offers up to 25% for claims-free drivers, while State Farm provides 24% and USAA 23%.

Ask about bundling and claims-free discounts. Combining them can reduce your auto and renters premiums more than raising your deductible.

Brad Larson Licensed Insurance Agent

Installing safety devices in your rental can save up to 20%. Alarm systems, smoke detectors, and security cameras often qualify for lower rates.

Combining multiple discounts—bundling, auto-pay, claims-free, and safety features—can significantly shrink your monthly premium.

Check Out This Page: Best Low-Mileage Auto Insurance Discounts

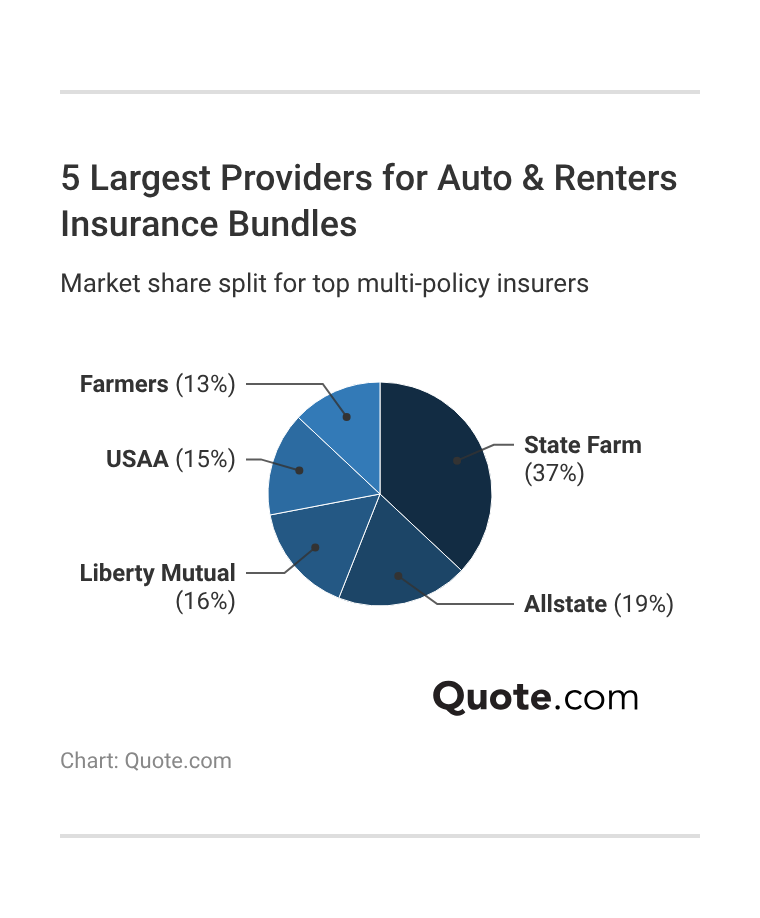

The Best Insurance Companies for Bundling

Erie, USAA, and Liberty Mutual stand out for their top auto and renters insurance bundles, thanks to strong claims service, financial stability, and broad coverage options.

State Farm leads the multi-policy market with a 37% share, reflecting its extensive agent network and nationwide availability, while Erie is available in only 12 states.

USAA car and renters insurance consistently earns high satisfaction ratings and competitive pricing for military families, while Farmers provides flexible coverage options and personalized agent support.

Important Details: Types of Auto Insurance

Compare the top auto and renters insurance companies to find the right provider for you.

#1 – Erie: Best for Claims Service

Pros

- Claims Satisfaction: Erie ranks highest for auto and renters claims satisfaction and offers competitive minimum coverage starting at $56 per month.

- Affordable Bundles: Erie’s auto and renters insurance drops from $70 per month when purchased separately to $53 per month when bundled.

- Financial Strength: Erie holds an A+ A.M. Best rating, reinforcing long-term reliability for auto and renters policyholders.

Cons

- Limited Availability: Erie auto and renters coverage is not offered nationwide. Use our detailed Erie insurance review to find a policy near you.

- Fewer Digital Tools: Erie’s online experience for managing auto and renters policies is less robust than that of Liberty Mutual or Progressive.

#2 – USAA: Best for Military Savings

Pros

- Military Pricing: USAA provides exclusive military auto and renters savings, with minimum coverage starting at $49 per month.

- High Satisfaction: As mentioned in our USAA insurance review, it scores high in claims satisfaction for auto and renters insurance.

- Superior Stability: An A++ A.M. Best rating supports long-term financial security for auto and renters customers.

Cons

- Eligibility Limits: USAA auto and renters policies are restricted to military members, veterans, and eligible families.

- Lower Bundle Discount: USAA’s 10% bundling discount is lower than competitors’ offers.

#3 – Liberty Mutual: Best for Digital Tools

Pros

- Digital Management: Liberty Mutual offers advanced mobile tools for auto and renters policy tracking and claims.

- Strong Bundle Savings: Auto and renters bundling earns a 25% discount, even though the minimum coverage starts higher.

- Custom Options: According to our Liberty Mutual insurance review, it allows flexible deductibles and renters property limits within auto and renters bundles.

Cons

- Higher Base Rates: Minimum coverage for auto and renters begins at $82, higher than Erie and USAA.

- Full Coverage Costs: Full coverage auto and renters pricing can exceed $180 per month, depending on limits.

#4 – Nationwide: Best for Coverage Flexibility

Pros

- Flexible Coverage: Nationwide allows customized deductibles and renters limits in auto and renters bundles.

- Balanced Pricing: Minimum coverage auto and renters starts at $64 per month with moderate bundled reductions.

- Strong Ratings: Nationwide carries an A+ A.M. Best rating and an above-average claims score. Learn more in our guide: Nationwide Auto Insurance Review

Cons

- Moderate Discounts: Bundling discounts for auto and renters typically cap around 20%, below other leading companies that offer 25%.

- Mid-Level Rates: Nationwide auto and renters bundles have a minimum coverage cost of $64 a month, which is above Erie and USAA.

#5 – State Farm: Best for Agent Network

Pros

- Agent Access: State Farm’s nationwide agent network supports bundled auto and renters customers locally.

- Competitive Minimums: State Farm’s auto and renters insurance have minimum coverage that begins at $59 per month.

- Financial Stability: According to our review of State Farm, it holds an A+ rating and a high claims satisfaction score for bundling auto and renters insurance.

Cons

- Lower Bundle Rate: Bundling savings for auto and renters average 17%, below 25% competitors.

- Violation Increases: State Farm auto and renters insurance rates rise quickly after tickets or accidents.

#6 – American Family: Best for Loyalty Rewards

Pros

- Loyalty Benefits: American Family rewards long-term auto and renters customers with retention perks and renewal incentives.

- Claims-Free Savings: Claims-free discounts reach 22% for bundled auto and renters policyholders with clean records, according to our review of American Family.

- Mid-Tier Pricing: Minimum coverage auto and renters begins at $69 per month for standard drivers.

Cons

- Higher Entry Cost: The $69 minimum coverage rate exceeds top-ranked Erie and USAA competitors.

- Regional Availability: American Family’s auto and renters bundles are not available nationwide in all states.

#7 – Allstate: Best for Custom Add-Ons

Pros

- Extensive Add-Ons: Allstate allows expanded endorsements in auto and renters bundles for broader protection.

- Strong Bundle Discount: Allstate auto and renters insurance bundles can reduce premiums by up to 25%.

- Moderate Minimums: Minimum coverage auto and renters starts at $78 per month for drivers.

Cons

- Higher Full Rates: Full coverage auto and renters can exceed $175 monthly in many areas. Compare quotes for free in our Allstate insurance review.

- Lower Satisfaction: Allstate’s auto and renters insurance has a below-average claims score, ranking below top providers.

#8 – Travelers: Best for Coverage Options

Pros

- Policy Variety: Travelers offers broad auto and renters coverage options with flexible limits.

- Financial Strength: Travelers maintains an A++ rating for financial stability.

- Moderate Pricing: Our Travelers insurance review found that minimum coverage when bundling auto and renters begins at $70 per month.

Cons

- Smaller Discount: Bundling savings for auto and renters reach about 13%, below 25% leaders.

- Mid Claims Score: Travelers auto and renters bundles earn lower overall customer satisfaction ratings.

#9 – Farmers: Best for Local Agents

Pros

- Local Support: Farmers emphasizes agent-based service for bundled auto and renters customers nationwide.

- Claims-Free Discount: Farmers offers up to 25% claims-free savings on auto and renters bundles. More Details Here: Farmers Insurance Review

- Coverage Variety: Farmers offers many auto insurance add-ons to suit different driver profiles, including rideshare insurance and accident forgiveness.

Cons

- Higher Base Rate: The $74 minimum coverage cost exceeds several lower-priced competitors.

- Moderate Satisfaction: Farmers auto and renters insurance holds a lower claims satisfaction score overall, dropping below average in the most recent J.D. Power surveys.

#10 – Progressive: Best for Online Quotes

Pros

- Fast Quotes: Progressive car and renters insurance excels in instant online pricing for auto and renters bundles.

- Auto-Pay Savings: As explained in our Progressive auto insurance review, auto-pay discounts reach 12% for bundled auto and renters policies.

- Mid-Level Rates: Progressive auto and renters insurance coverage begins at $71 per month.

Cons

- Lower Satisfaction: Progressive renters and auto insurance bundles score below average in overall claims satisfaction rankings.

- Lower Bundle Cap: Bundling savings for Progressive auto and renters insurance trails competitors’ discounts by 25%.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Get Bundled Car & Renters Insurance Today

Your auto and renters insurance bundles make coverage easier to manage and can lower your monthly bill. Companies like Erie, USAA, and Liberty Mutual offer minimum coverage starting at $53 per month, with bundling savings that can reach 25%.

Strong financial ratings and good claims service also matter when choosing the right provider. A reliable company helps ensure your auto and renters insurance are there when you need them.

Comparing auto insurance companies and quotes is the best way to find the right bundle for your budget. Prices change based on where you live, your driving record, and how much coverage you choose.

You can also save by adjusting deductibles and selecting the right renters property limit. Start saving on your auto and renters insurance by entering your ZIP code and comparing best car and renters insurance bundle quotes.

Frequently Asked Questions

Who has the best auto and renters insurance bundles?

Erie, USAA, and Liberty Mutual offer some of the best car and renters insurance bundles. Erie ranks highest for claims satisfaction, while USAA offers the cheapest car insurance rates for eligible military members. Liberty Mutual offers strong digital tools and bundling discounts of up to 25%.

Is it better to bundle renters insurance with auto?

Yes, bundling renters insurance with auto usually lowers your total premium. Many insurers offer bundling discounts of up to 25%, and it also simplifies billing and policy management under a single provider.

Does Geico bundle renters and auto insurance?

Yes, Geico auto and renters insurance offers bundled coverage options through partner renters providers. Renters insurance is typically provided through partner companies, but bundling can still qualify you for a multi-policy discount on your auto coverage.

Don’t Miss It: Best Multi-Vehicle Auto Insurance Discounts

Does Progressive bundle renters and car insurance?

Yes, Progressive offers renters and car insurance bundles, allowing customers to combine both policies under one account. While bundling discounts may not reach 25% like some competitors, Progressive provides competitive rates and convenient online quote tools.

How much would $100,000 worth of renters insurance cost?

The cost of $100,000 in renters insurance coverage typically ranges from $30 to $50 per month, depending on location, deductible, and risk factors. Bundling with auto insurance can help reduce the total cost.

See our detailed Lemonade auto and renters insurance review before choosing your policy.

What is the number one auto and home insurance company?

State Farm is currently the largest auto and home insurance company by market share, holding approximately 37% of the multi-policy market due to its nationwide agent network and financial strength. Get fast and cheap auto insurance coverage today with our quote comparison tool.

How much can you save by bundling auto and renters insurance?

Savings vary by company, but drivers can save an average of $17 to $27 per month. Some insurers offer bundling discounts of up to 25% on combined policies.

See Our Article: Hacks to Save Money on Auto Insurance

Does bundling insurance affect coverage limits?

No, bundling does not reduce coverage quality. You can still choose minimum or full auto coverage and select renters personal property limits like $20,000, $30,000, or higher based on your needs.

What coverage is included in an auto and renters bundle?

An auto and renters bundle includes separate policies under one provider. Auto coverage may include liability, comprehensive, and collision auto insurance, while renters insurance covers personal property, liability, and additional living expenses.

What company has the best renters insurance policy?

Erie and USAA are consistently rated among the best for renters insurance, thanks to strong claims satisfaction, financial strength, and competitive pricing. State Farm also stands out for nationwide availability and reliable service.

Which insurance company denies the most claims?

Does your driving record affect bundled insurance rates?

What’s a reasonable price for renters insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.