Best Auto Insurance for Leased Vehicles in 2026

Erie, Liberty Mutual, and Nationwide offer the best auto insurance for leased vehicles, with gap-friendly coverage starting at $137 per month. If you lease a vehicle, AAA is known for roadside assistance. State Farm leased car insurance is a solid option if you want lower premiums and OEM repair coverage.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding c...

Meggan McCain

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated February 2026

Erie, Liberty Mutual, and Nationwide offer the best auto insurance for leased vehicles, providing lease-compliant coverage, including gap insurance, with a monthly rate of $137.

- Erie is known for its low premiums and strong service ratings

- Lease agreements restrict repairs, making OEM parts coverage important

- Leased vehicles lose value quickly, so gap coverage is important

Erie is recognized for offering lower premiums than most competitors and earning high customer satisfaction scores from J.D. Power.

Liberty Mutual lets you adjust coverage limits and add gap insurance to meet most lease requirements.

Top 10 Companies: Best Auto Insurance for Leased Vehicles| Company | Rank | Claim Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 743 / 1,000 | A+ | Lease Savings |

| #2 | 730 / 1,000 | A | Lease Flexibility |

| #3 | 729 / 1,000 | A+ | Lease Reliability | |

| #4 | 720 / 1,000 | A | Member Leasing |

| #5 | 716 / 1,000 | A+ | Lease Support | |

| #6 | 716 / 1,000 | A+ | Senior Leasing |

| #7 | 697 / 1,000 | A++ | Lease Bundling | |

| #8 | 693 / 1,000 | A+ | Lease Protection | |

| #9 | 691 / 1,000 | A++ | Premium Leasing | |

| #10 | 690 / 1,000 | A | Lease Benefits |

Nationwide is a solid choice for leased vehicles due to its accident forgiveness and a reliable claims record.

To see which of these insurers offers the best rate for your leased car, enter your ZIP code to compare options available in your area.

Compare Leased Vehicles Insurance Rates

Insurance for a leased vehicle usually costs more because the insurer assumes greater risk. Most lenders require full coverage, and adding gap protection helps if your car is totaled before the lease ends.

When shopping for auto insurance for leased cars, it’s important to match these higher limits with your lease agreement requirements. Selecting higher liability limits increases your premium since the insurer assumes greater risk.

Auto Insurance Monthly Rates for Leased Vehicles by Coverage Level| Company | Full Coverage | Full + Gap | High Limits |

|---|---|---|---|

| $155 | $162 | $176 |

| $218 | $226 | $239 | |

| $137 | $144 | $155 |

| $211 | $220 | $233 | |

| $156 | $164 | $178 | |

| $209 | $217 | $230 |

| $182 | $189 | $201 | |

| $162 | $176 | $188 | |

| $243 | $250 | $263 |

| $199 | $208 | $221 |

Even a small difference in your monthly payment can total hundreds of dollars over a three-year lease. Choosing a lower-priced insurer may free up funds for additional mileage or maintenance.

Understanding these costs clearly makes it easier to balance solid protection with what you can comfortably afford, as outlined in this auto insurance guide.

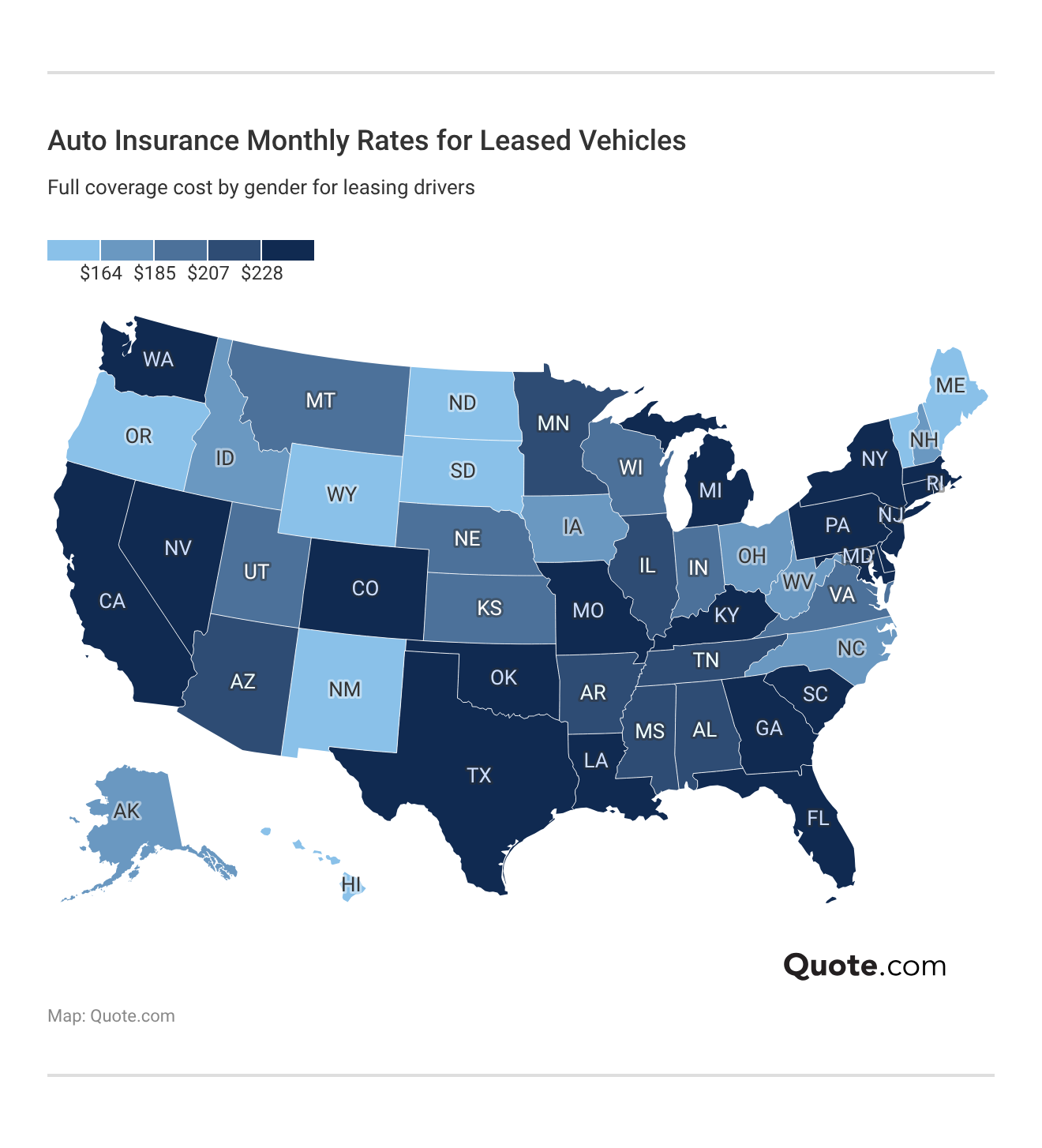

How Local State Risks Impact Rates for Leased Cars

Insurance rates for leased vehicles vary based on local risks, such as how often accidents occur, how much repairs cost, and the area’s weather.

Higher monthly premiums usually mean insurers expect more claims in that area, either because of heavy traffic or frequent severe storms.

For example, drivers reviewing leased car insurance requirements in California may notice stricter minimum liability limits compared to some other states.

In states with lower costs, drivers often see fewer claims and pay less for labor, helping keep insurance premiums affordable.

For people leasing a car, your ZIP code can affect your insurance price as much as your driving history does.

Big cities usually mean higher lease premiums because repairs cost more. For instance, suburban areas often offer cheaper options.

Michelle Robbins Licensed Insurance Agent

Even small monthly premium differences can add up to a lot over a typical 36-month lease term overall.

Knowing these regional trends, including broader auto insurance rates by state, can help drivers plan their budgets before signing a lease.

How Age Affects Leased Vehicle Premiums

How much you pay each month to insure a leased car depends a lot on your age and the average cost of auto insurance in your area.

Insurance companies see younger drivers as higher risk, which is why car insurance for leased vehicles often costs more during the first few years of driving.

Auto Insurance Monthly Rates for Leased Vehicles by Driver Age| Company | Age: 18 | Age: 25 | Age: 35 | Age: 45 |

|---|---|---|---|---|

| $364 | $240 | $183 | $155 |

| $534 | $353 | $262 | $218 | |

| $301 | $203 | $156 | $137 |

| $528 | $350 | $257 | $211 | |

| $371 | $245 | $186 | $156 | |

| $533 | $355 | $259 | $209 |

| $440 | $291 | $220 | $182 | |

| $377 | $249 | $190 | $162 | |

| $632 | $423 | $306 | $243 |

| $494 | $326 | $245 | $199 |

As drivers gain experience and maintain a clean driving record, their insurance rates usually decrease because they are less likely to file claims.

Erie is often rated as the best choice for keeping insurance costs lower for drivers of different ages. Knowing how your age affects insurance costs can help you plan ahead and avoid unexpected costs when leasing a car.

Driving History & Leased Car Insurance Costs

Your driving history has a big impact on your monthly insurance costs for a leased car. If you have accidents, DUIs, or tickets, insurers see you as a higher risk, which usually means your premiums will go up.

For people who lease cars, these higher premiums can last for the entire 36-month contract, adding hundreds or even thousands of dollars to what you pay overall.

Auto Insurance Monthly Rates for Leased Vehicles by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $155 | $206 | $225 | $191 |

| $218 | $291 | $317 | $269 | |

| $137 | $181 | $200 | $168 |

| $211 | $282 | $310 | $262 | |

| $156 | $209 | $230 | $194 | |

| $209 | $283 | $309 | $261 |

| $182 | $245 | $266 | $225 | |

| $162 | $216 | $236 | $200 | |

| $243 | $330 | $361 | $304 |

| $199 | $269 | $294 | $248 |

Erie is a top choice because its rate increases are usually smaller than those of many other companies, making it one of the cheapest car insurance options for leased vehicles after a violation.

Keeping a clean driving record helps you pay less for insurance and makes it easier to meet lender requirements. If you lease a car, protecting your record is one of the easiest ways to manage long-term costs.

Learn More: Cheap Auto Insurance for High-Risk Drivers

How Credit Shapes Leased Vehicle Insurance Prices

Your credit score has a bigger impact on the cost of insurance for a leased car than most people realize. Insurers look at your credit-based insurance score to predict how likely you are to file a claim, and this affects your monthly payments.

Drivers comparing options like State Farm lease car insurance may notice that pricing shifts significantly between excellent and poor credit tiers.

Auto Insurance Monthly Rates for Leased Vehicles by Credit Score| Company | Excellent (800+) | Good (670-799) | Fair (580-669) | Poor (< 580) |

|---|---|---|---|---|

| $155 | $167 | $197 | $271 |

| $218 | $236 | $279 | $385 | |

| $137 | $150 | $178 | $246 |

| $211 | $231 | $274 | $378 | |

| $156 | $172 | $206 | $285 | |

| $209 | $232 | $275 | $381 |

| $182 | $203 | $243 | $336 | |

| $162 | $182 | $220 | $305 | |

| $243 | $270 | $325 | $449 |

| $199 | $225 | $271 | $375 |

If your credit score is lower, you may see higher insurance costs because companies link lower credit with a greater chance of claims and missed payments.

During a typical 36-month lease, even small increases tied to your credit can add up to thousands of dollars in extra insurance costs. Keeping your credit in good shape before you lease can help you lock in the cheapest car insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Insurance Rules for Lease Agreements

Insurance rules can be very different depending on whether you lease, finance, or own your car. When you lease, the requirements are usually stricter because the car still belongs to the leasing company until your contract is over.

This gives you less freedom to change your deductible or remove some coverage to lower your monthly payment. Cars that are financed have similar rules, but after you finish paying off the loan, you usually get more choices for your insurance.

How Insurance Rules Change by Vehicle Type| Detail | Financed | Leased | Owned |

|---|---|---|---|

| Best Use Case | Build ownership | New car focus | Lowest cost |

| Collision Coverage | Required | Required | Optional |

| Comprehensive Plan | Required | Required | Optional |

| Policy Lapse Allowed | Not allowed | Not allowed | Allowed |

| Deductible Limits | Moderate limits | Strict limits | No limits |

| Coverage Flexibility | Limited | Very limited | Full flexibility |

| Gap Insurance Plan | Optional | Often required | Not needed |

| Loss Payee Required | Lender listed | Lessor listed | Not required |

| Monthly Premiums | Moderate cost | Highest cost | Lowest cost |

| New Car Replacement | Optional | Optional | Optional |

| Safety Discounts | Often included | Often included | Varies by car |

| State Minimums | Must meet | Must meet | Must meet |

If you own your car, you have the most control. You can increase or decrease your coverage based on your budget and how much risk you are comfortable with.

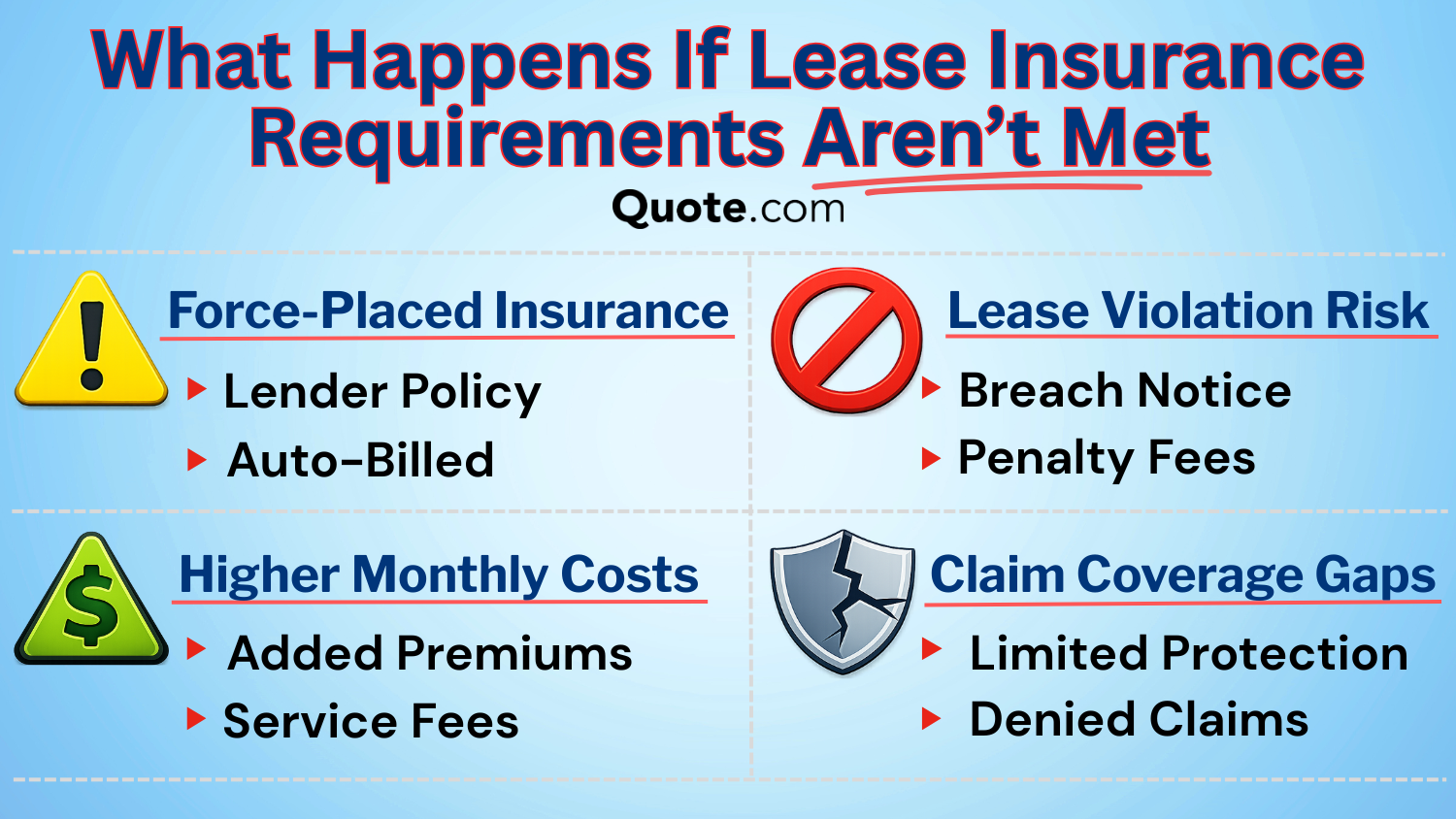

If you do not keep up with lease insurance requirements, like dropping collision coverage or lowering liability below the required limits, the leasing company can add force-placed coverage.

This type of insurance usually costs much more than a standard policy. If you keep breaking the rules, you could face penalty fees, default on your contract, or even have your car repossessed under the lease agreement.

Understanding these differences, including how insurance on leased cars vs. financed vehicles compares, not only helps you avoid surprise costs but can also guide your decision on the best time to buy a new car.

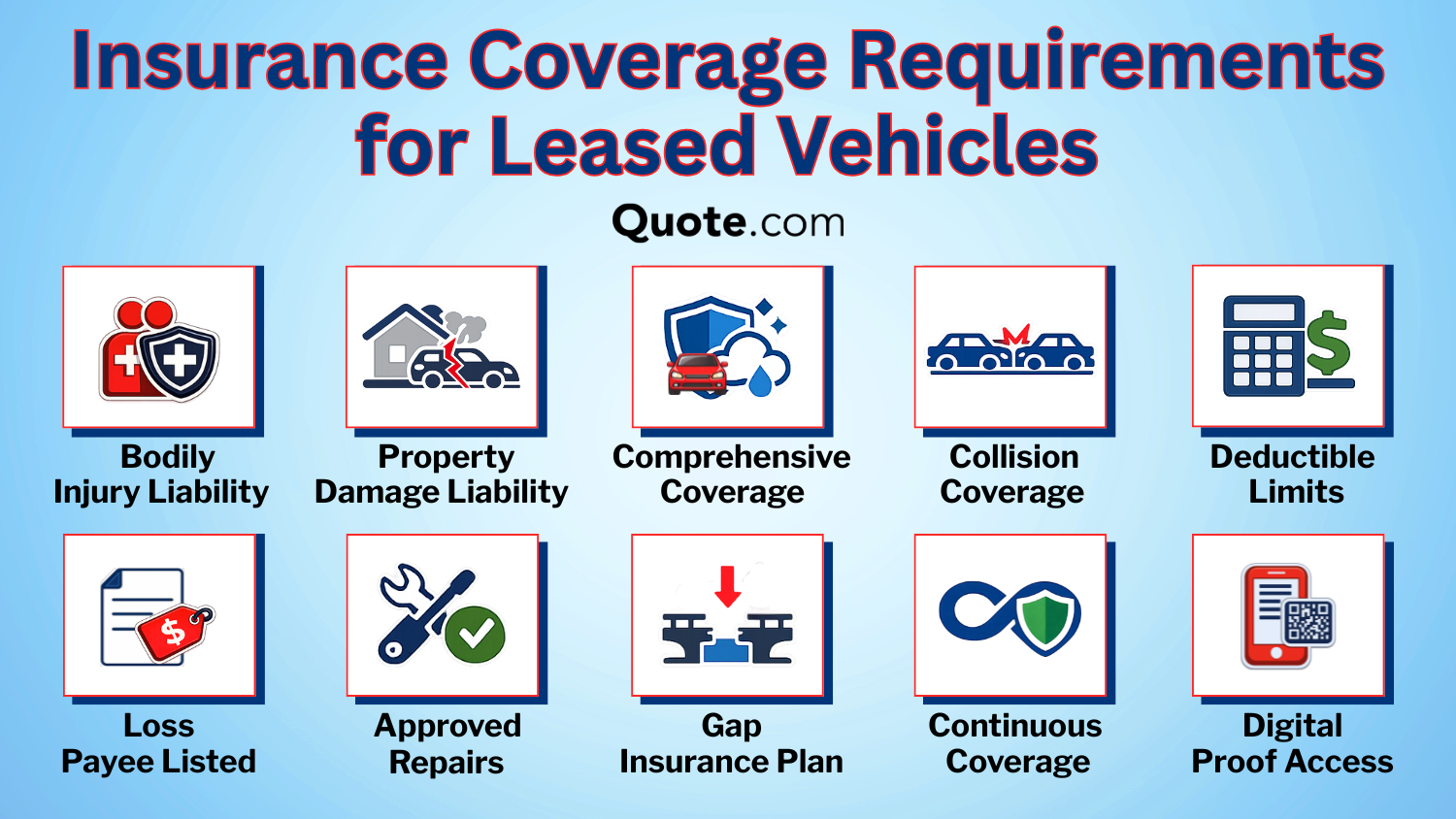

Essential Leased Vehicles Insurance Coverage

The best auto insurance for a leased vehicle should have certain coverage types that meet your lender’s requirements and help protect your finances.

Liability auto insurance coverage pays for injuries or property damage you cause to others. Most lease agreements require higher coverage limits than the state minimums.

Collision coverage pays for repairs to your leased car after an accident. Comprehensive coverage protects you if your car is stolen, vandalized, damaged by hail, or suffers other non-collision damage.

Gap insurance is important for leased vehicles. It covers the difference between your car’s value and what you still owe if the car is totaled.

Many insurance policies also offer rental reimbursement. This helps pay for a rental car while your leased vehicle is being repaired.

Choosing the right mix of these coverages helps you meet leased car insurance requirements and avoid surprise expenses.

Best Place to Get Gap Insurance for Leased Cars

Where you get gap insurance for your leased car can make a real difference in what you end up paying over the length of your lease.

If you add gap insurance when you sign your lease, the cost is usually included in your lease payments, so you end up paying interest on it as well.

Where to Buy Gap Insurance for a Leased Vehicle| Purchase Source | How it’s Added | What to Know |

|---|---|---|

| Auto Dealership | At signing for lease | Higher overall cost |

| Insurance Company | Added to auto policy | Usually lower cost |

| Leasing Company | Purchased separately | Availability varies |

Getting gap coverage from your auto insurer is usually the best choice because it’s often just a small monthly fee instead of a high upfront cost.

Insurer gap coverage can be as low as $5 to $15 per month, while dealership plans might add $500 or more to your lease.

Dealership gap plans are often non-refundable, while insurer options can usually be removed if the lease ends early. Insurer gap coverage also works with your collision and comprehensive policy, making total loss claims easier.

Over a three-year lease, even a small price difference can add up to hundreds of dollars. Spending a little time to compare your options can help you save money while still getting the coverage you need.

See More: Cheap Gap Insurance

Ways to Save on Leased Vehicle Insurance

Insurance discounts can help lower your monthly payments for leased vehicle coverage. Anti-theft savings are given to drivers who reduce the risk of theft, which is important because leased cars are usually newer and more appealing to thieves.

You can also save by bundling your auto insurance with renters or homeowners insurance, which helps lower your total household expenses.

Top Auto Insurance Discounts for Leased Vehicles| Company | Anti-Theft | Bundling | Good Driver | Usage-Based |

|---|---|---|---|---|

| 8% | 15% | 30% | 30% |

| 10% | 25% | 25% | 40% | |

| 15% | 25% | 23% | 30% |

| 10% | 20% | 30% | 30% | |

| 25% | 25% | 26% | 25% | |

| 35% | 25% | 20% | 30% |

| 5% | 20% | 40% | 40% | |

| 15% | 17% | 25% | 30% | |

| 10% | 5% | 15% | 20% |

| 15% | 13% | 10% | 30% |

Usage-based auto insurance tracks your driving and mileage, letting careful drivers lower premiums based on habits.

Combining discounts can save hundreds of dollars on a 36-month lease, but it’s not the only way to save on auto insurance for leased vehicles. Changing how your policy is set up can also lower your costs.

- Buy Gap Coverage from Your Insurer: Adding gap coverage to your insurance policy is often less expensive than including it in your 36-month lease agreement.

- Check for New Quotes During Your Lease: Insurance rates change often, so it’s a good idea to compare prices every 6 to 12 months. You might find a better deal.

- Cut Unnecessary Extras: Optional coverages like roadside assistance or rental reimbursement can add $10 to $25 to your monthly bill over time.

- Increase Your Deductible: If your lease allows a $1,000 deductible instead of $500, you could save 5% to 12% on your premiums.

- Pay Your Premium Upfront: Some insurers offer up to 8% off if you pay your premium in full rather than in installments.

Combining discounts with smart policy choices helps lease drivers take control of their total insurance costs.

Even small monthly savings can add up to hundreds of dollars over a 36-month lease. Taking action early helps keep your insurance costs in line with your budget.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top Insurance Companies for Leased Vehicles

Some car insurance companies work especially well for people who lease their vehicles. Erie is a top choice for lease drivers because it offers lower average premiums and strong customer satisfaction, although it is available in fewer states.

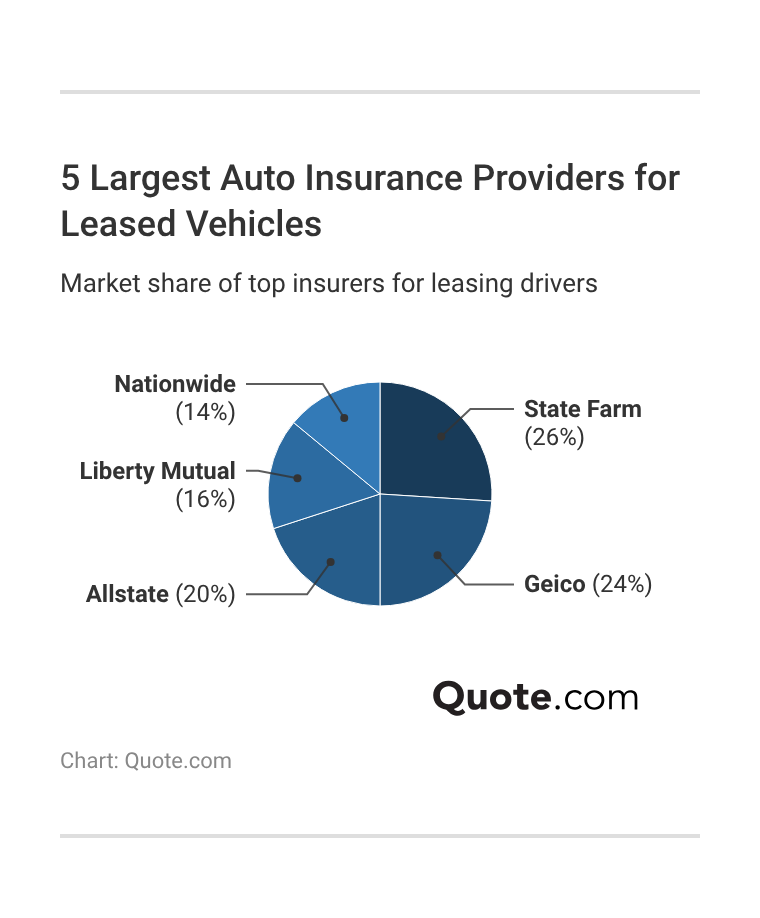

State Farm has the largest market share, and Geico is close behind. Both are among the best car insurance companies because their size lets them offer competitive monthly rates and a wide range of coverage options.

State Farm’s many local agents are a good fit for drivers who want personal help. Geico lease car insurance is especially popular with drivers who prefer to manage their policies online with easy-to-use digital tools.

Allstate and Liberty Mutual are good choices because they are in many places, which makes it easier to move or transfer a lease. Nationwide is smaller, but drivers like that it is financially strong and handles claims well.

#1 – Erie: Top Overall Pick

Pros

- Lease-Oriented Pricing: Erie keeps costs low for leased cars while meeting the usual lender rules, such as minimum coverage requirements.

- Claims Performance: Erie got a claims satisfaction score of 743 out of 1,000, showing it handles repairs well and helps keep extra costs low for leased cars.

- Reliable Financial Backing: Erie has an A+ rating from A.M. Best, indicating it has sufficient funds to pay claims while you are leasing.

Cons

- Limited Availability: Coverage for leased vehicles is available in only 12 states, so availability depends on your location. See More Details: Erie Insurance Review.

- Fewer Add-On Options: Erie offers fewer add-on coverage options for leased cars than larger national insurance companies.

#2 – Liberty Mutual: Best for Lease Flexibility

Pros

- Customizable Coverage Limits: Liberty Mutual gives you a lot of control, making it easier to set coverage that fits lease requirements without paying for extras you don’t need.

- Optional Gap Insurance: Adding gap coverage can really help protect leased vehicles if the car is totaled and depreciation becomes an issue.

- Dependable Claims Handling: With a 730 out of 1,000 claims satisfaction score, Liberty Mutual usually processes leased vehicle claims without much hassle.

Cons

- Higher Starting Premiums: Base rates for leased vehicles are often higher upfront than those of some competitors. Get full ratings in our Liberty Mutual insurance review.

- Add-Ons Cost More: Important options like gap insurance and OEM repairs aren’t included and will raise the total cost.

#3 – Nationwide: Best for Lease Reliability

Pros

- Accident Forgiveness Coverage: With Nationwide, your first at-fault claim on a leased vehicle will not cause your rates to go up.

- Consistent Claims Handling: Nationwide earned a 729 out of 1,000 satisfaction score, showing reliable service for leased-vehicle repairs.

- Strong Financial Rating: Our Nationwide insurance review often highlights the A+ A.M. Best rating as a key reason the company is trusted for leased vehicles.

Cons

- Limited Gap Availability: In some states, you may need to get gap insurance for your leased vehicle from another provider.

- Fewer Discount Programs: Nationwide offers fewer usage-based discounts for leased vehicles compared to other companies.

#4 – AAA: Best for Member Leasing

Pros

- Roadside Assistance Included: AAA membership includes towing and help if you get locked out, which is helpful for leased cars with mileage restrictions.

- Member Rate Discounts: Getting car insurance through AAA often lowers leasing costs by 5% to 15%. See more ways to save in our AAA insurance review.

- Consistent Claims Experience: AAA usually handles leased-car repairs fairly and easily, with a 720 out of 1,000 satisfaction score.

Cons

- Membership Fee Required: Leased vehicles require an active AAA membership, which typically costs $50-$120 per year.

- Regional Coverage Differences: Leased-vehicle coverage isn’t consistent across regions when drivers relocate.

#5 – State Farm: Best for Lease Support

Pros

- OEM Repair Option: State Farm covers manufacturer-approved parts, which is helpful since many leases require OEM repairs to avoid penalties.

- Strong Financial Strength: With an A+ rating from A.M. Best, State Farm has the financial muscle to handle costly repairs tied to leased vehicles.

- Huge Agent Network: More than 19,000 local agents make it easier to manage paperwork and endorsements for leased vehicles.

Cons

- No Dedicated Gap Product: Leased vehicles often require third-party gap insurance. Check out our State Farm insurance review for quotes.

- Middle-of-the-Pack Claims Score: A 716 out of 1,000 puts State Farm behind top competitors, which could mean slower handling of leased-vehicle claims.

#6 – The Hartford: Best for Senior Leasing

Pros

- AARP Member Benefits: If you’re eligible, you can save about 10%–12% on premiums, which helps keep insurance costs down for leased vehicles.

- Steady Long-Term Coverage: The Hartford is known for renewing policies as long as you keep paying, giving seniors one less thing to worry about during a lease.

- Strong Financial Backing: An A+ rating from A.M. Best shows The Hartford has the financial strength to handle claims throughout your lease.

Cons

- Age-Focused Savings: Savings opportunities tend to center on drivers 50+ rather than younger drivers with leased cars. Learn more in our guide: The Hartford Insurance Review

- Fewer Add-On Options: Coverage extras are more limited, making it harder to customize protection for a leased car.

#7 – Geico: Best for Lease Bundling

Pros

- Bundling Savings: If you bundle renters or homeowners insurance, you can save up to 25% on your leased vehicle, which helps lower your total costs.

- Strong Financial Backing: Geico’s A++ rating from A.M. Best means it has the financial strength to pay claims reliably for leased vehicles.

- Easy-to-Use Mobile Tools: The Geico app lets you easily access ID cards or file a claim, which is convenient if you’re often on the go.

Cons

- Lower Claims Satisfaction: With a 697 out of 1,000 score, claims for leased vehicles may take longer or feel less smooth than with some competitors.

- No Built-In Gap Coverage: As mentioned in our Geico insurance review, gap coverage isn’t standard, so most lessees must look elsewhere.

#8 – Allstate: Best for Lease Protection

Pros

- Accident Forgiveness: If you drive safely for 5 years, Allstate may keep your premium from increasing after certain accidents involving your leased vehicle.

- Telematics Discount Program: Allstate’s Drivewise program can lower your leased vehicle premium by up to 30% if you drive safely and keep your mileage low.

- Trusted Financial Strength: Allstate holds an A++ financial strength rating for leased vehicles. See how it stands out in our Allstate insurance review.

Cons

- Higher Starting Premiums: Leased vehicles usually have higher base rates than the national average, especially if you don’t use the telematics program.

- Complex Policy Riders: Essential lease protections (OEM parts, roadside) often require separate endorsements, adding cost and complexity.

#9 – Travelers: Best for Premium Leasing

Pros

- High Liability Limits: Travelers offers liability limits of $500,000 or more, which is higher than what most standard leases require.

- OEM Parts Coverage Option: Travelers covers leased vehicles with original manufacturer parts, which can help you meet lease return standards.

- Loss Forgiveness Available: This feature can shield leased vehicles from premium spikes after specific claims. What To Know: Travelers Insurance Review

Cons

- Above-Average Pricing: Because Travelers offers higher coverage, their premiums are usually higher than those of most competitors.

- Fewer Lease-Specific Discounts: Lease holders have access to fewer manufacturer or partner discounts compared to other companies.

#10 – Farmers: Best for Lease Benefits

Pros

- Custom Endorsements: Farmers lets you add coverage options like rental reimbursement and sound system protection to help protect your leased vehicle.

- Personalized Policy Reviews: Local agents help you set up coverage that meets your lender’s requirements for leased vehicles.

- Rental Reimbursement Coverage: If your leased vehicle needs repairs, this coverage helps pay for a rental car so you can keep up with your plans.

Cons

- Lowest Claims Satisfaction: With a 690 out of 1,000 score, Farmers ranks below the others, which could mean slower claim experiences for leased vehicles.

- Higher Add-On Costs: As explained in our Farmers insurance review, many extra protections for leased vehicles cost more on top of the basic policy.

Choosing the Best Insurance for Leased Cars

To get the best insurance for leased vehicles, look for a policy that meets your lender’s requirements, such as 100/300 liability limits, collision, comprehensive, and often gap coverage.

Erie, Liberty Mutual, and Nationwide are top choices because they usually meet these standards and keep rate increases lower during a 36-month lease.

Erie’s rates often start around $137 per month for qualified drivers. Liberty Mutual lets you adjust coverage to fit your lease, and Nationwide offers accident forgiveness to help avoid premium increases if you have a claim.

If allowed, raising your deductible to $1,000 can lower premiums by 5% to 12%. Even $20 to $40 more per month adds up fast, and credit, driving history, and ZIP code impact your rate.

The most effective strategy is to get multiple auto insurance quotes, carefully compare coverage details, and enter your ZIP code to see accurate rates available in your area.

Frequently Asked Questions

What is the best auto insurance for leased vehicles?

Erie, Liberty Mutual, and Nationwide are the top companies for leased car insurance. They have the highest claims satisfaction ratings and strong customer service reviews, with a wide variety of policy options to meet the terms of your lease agreement.

Is full coverage mandatory for a leased car?

Yes. Leasing companies want you to have both collision and comprehensive coverage, plus higher liability limits (often 100/300), to make sure the car is fully protected during your lease.

Does a leased vehicle require gap insurance?

Gap insurance isn’t always required by law, but many leasing companies either require it or suggest it. Because new cars can lose 20% or more of their value in the first year, gap coverage helps if your car is totaled early in the lease.

Can I choose a higher deductible on a leased vehicle?

Usually, no. Most lease contracts cap the insurance deductible at $500 or $1,000. Exceeding those limits can violate your lease agreement and may trigger penalties.

What happens if my insurance policy is canceled during a lease?

If your insurer drops you or your policy lapses, the leasing company can add force-placed insurance. This coverage is typically far more expensive and only protects the lender’s interest, not you.

Am I allowed to switch insurance providers mid-lease?

Yes. You can change insurers at any time as long as the new policy meets lease requirements and correctly lists the leasing company as the loss payee.

Who pays insurance on a leased car?

The lessee (the person leasing the vehicle) is responsible for paying the insurance on a leased car. The leasing company may require specific types of auto insurance and higher coverage limits to protect the car’s value.

How much more is insurance on a leased car?

Insurance on a leased car is typically higher than insurance for an owned car. This is because leasing companies require full coverage, including collision and comprehensive coverage, which increases the monthly premium.

Do you need special insurance for a leased vehicle?

Yes, you need special insurance for a lease. Leasing companies often require higher coverage limits and may also mandate gap insurance to cover the difference between the car’s value and what you owe if it’s totaled.

How do you insure a leased car?

To insure a leased car, you need to choose a policy that meets the leasing company’s requirements, which often include collision, comprehensive auto insurance, and gap coverage. Most insurers can provide coverage that fits these needs.

What is the cheapest auto insurance for leased vehicles?

What happens if I don’t have insurance on a leased car?

What kind of insurance do you need for a leased vehicle?

Can I use minimum coverage on a leased car?

Why is leased car insurance more expensive than regular car insurance?

How does insurance work for leased vehicles?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.