Best Auto Insurance for Young Adults in 2026

Erie, Liberty Mutual, and Nationwide have the best auto insurance for young adults. The cheapest auto insurance for young adults starts at $119 per month. Other leading insurers offer savings for young drivers, such as Allstate’s 35% good student discount or American Family’s 25% multi-policy discount.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Content Creator

Lia Vergin develops both video and written content across all lines of insurance, with a primary focus on auto, home, and life coverage. She is dedicated to helping consumers better understand and navigate their insurance options. Driven by a passion for saving money and finding great deals, she is committed to creating clear, engaging, and practical content that empowers readers to make confident...

Lia Vergin

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated January 2026

The best auto insurance for young adults comes from Erie, Nationwide, and Liberty Mutual, with minimum coverage rates starting as low as $119 per month.

- Erie stands out with strong claims satisfaction for young adult drivers

- Liberty Mutual reduces premiums with anti-theft savings of up to 35%

- Allstate helps students save up to 35% with good student discounts

Erie has the best car insurance for young drivers, earning the top spot for its strong claims satisfaction score.

Nationwide keeps costs competitive for low-mileage drivers, while Liberty Mutual offers flexible policies with discounts of up to 35% (Read More: Liberty Mutual vs. Nationwide Auto Insurance).

Top 10 Companies: Best Auto Insurance for Young Adults| Company | Rank | Claims Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 743 / 1,000 | A+ | Budget Savers |

| #2 | 730 / 1,000 | A | Custom Options |

| #3 | 729 / 1,000 | A+ | Low Mileage | |

| #4 | 716 / 1,000 | A++ | Safe Drivers | |

| #5 | 716 / 1,000 | A+ | Reliable Protection |

| #6 | 702 / 1,000 | A | Family Inclusion |

| #7 | 697 / 1,000 | A++ | Lowest Rates | |

| #8 | 693 / 1,000 | A+ | Discount Opportunities | |

| #9 | 691 / 1,000 | A++ | Comprehensive Choices | |

| #10 | 690 / 1,000 | A | Personalized Service |

Rates drop significantly by age 24 and for drivers with a clean record. Comparing quotes helps young adults lock in the lowest rates.

See which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool.

Auto Insurance Rates for Young Adults

Car insurance rates for young adults vary significantly by insurer and coverage level. Auto insurance for young adults under 26 is the most expensive, specifically for male drivers aged 18.

Geico offers the cheapest car insurance at $119 per month, making it the most affordable option for young drivers on a tight budget.

Young Adult Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $172 | $405 | |

| $148 | $362 |

| $123 | $296 |

| $165 | $398 | |

| $119 | $314 | |

| $183 | $432 |

| $139 | $349 | |

| $128 | $331 | |

| $140 | $335 |

| $153 | $374 |

Erie follows at $123 per month, combining low rates with strong claims satisfaction, while State Farm averages $128 per month for drivers focused on safe driving habits.

For full coverage, Erie again stands out with an average rate of $296 per month, well below higher-priced options like Liberty Mutual and Allstate, showing why comparing quotes matters for young drivers.

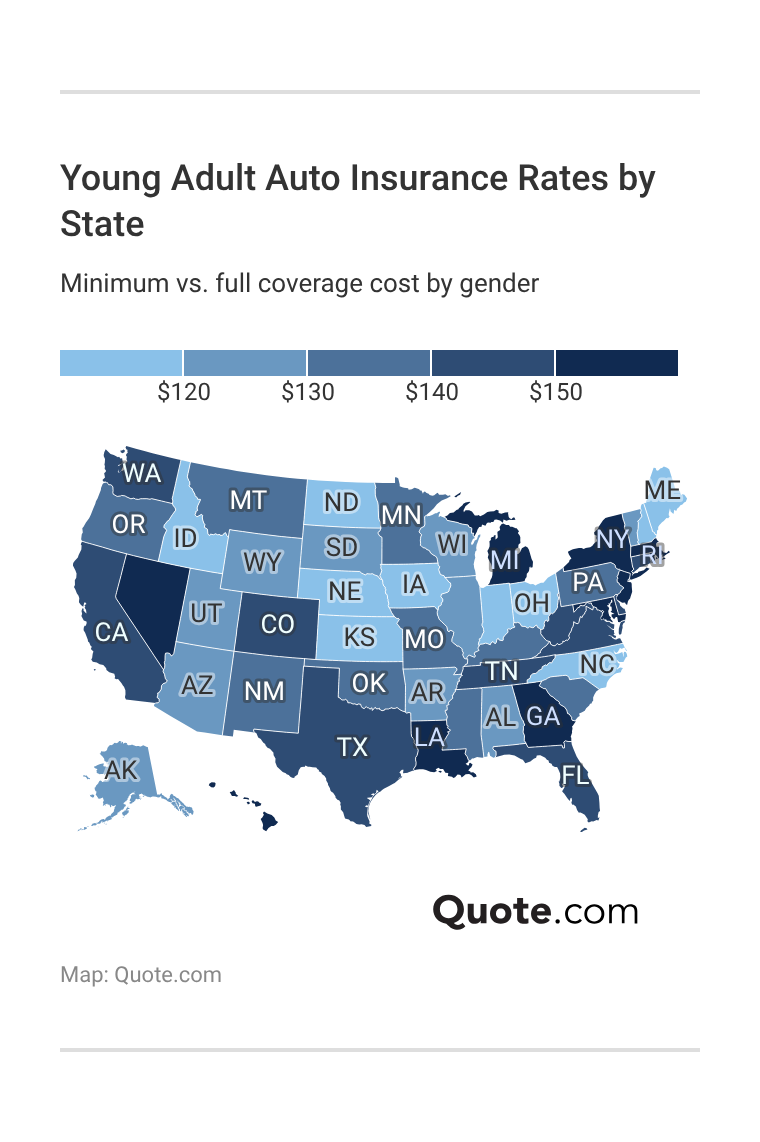

How to Find the Young Adult Insurance Rates Nationwide

Young adults see big differences in car insurance costs based on where they live. Local risks, such as weather, theft, and traffic, affect premiums, which is why even the best car insurance for young adults in California often costs more than in many other states.

States in the Midwest and parts of the inland West typically have the lowest rates, while coastal and densely populated states cost more. Compare auto insurance rates by state to see where young drivers pay the most.

Even in coastal states, premiums can vary. For instance, drivers shopping for the best car insurance for young adults in Georgia may see lower average premiums than those in Florida or Louisiana.

Since insurance laws and risk levels vary by state, comparing companies within the same state is important. Young drivers can still find affordable coverage by shopping around, using discounts, and choosing insurers that offer lower rates for new and low-risk drivers.

Read More: Auto Insurance Requirements by State

How Age Affects Young Adult Insurance Rates

Age plays a major role in car insurance costs for young adults. It can be hard to find cheap auto insurance for teens at first, but rates drop steadily as young drivers gain experience.

Geico offers cheap car insurance for 18-year-olds at $119 per month, making it the most affordable option for young drivers. Erie follows at $123 per month but has better claims service.

Young Adult Auto Insurance Monthly Rates by Age| Company | Age: 18 | Age: 20 | Age: 22 | Age: 24 |

|---|---|---|---|---|

| $172 | $150 | $132 | $114 | |

| $148 | $130 | $114 | $98 |

| $123 | $108 | $95 | $82 |

| $165 | $144 | $126 | $109 | |

| $119 | $104 | $91 | $79 | |

| $183 | $160 | $140 | $121 |

| $139 | $122 | $107 | $92 | |

| $128 | $112 | $98 | $85 | |

| $140 | $124 | $108 | $94 |

| $153 | $134 | $120 | $103 |

While State Farm averages $128 per month for safe drivers starting out, premiums decline quickly, with rates falling by age 20 and dropping even further by age 24.

For example, Geico’s average rate decreases from $119 at age 18 to $79 by age 24, highlighting how maintaining a clean record over time leads to significant long-term savings.

How Driving Habits Raise Insurance Costs for Young Adults

A clean record keeps auto insurance costs for young adults, specifically male drivers aged 18 with minimum coverage, as low as possible.

Among drivers with no violations, Geico offers the lowest average rate at $119 per month, followed closely by Erie at $123 and State Farm at $128, making these insurers the most affordable choices for responsible young drivers.

Young Adult Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $172 | $214 | $289 | $196 | |

| $148 | $185 | $251 | $169 |

| $123 | $155 | $209 | $141 |

| $165 | $205 | $277 | $188 | |

| $119 | $149 | $202 | $136 | |

| $183 | $228 | $308 | $209 |

| $139 | $174 | $235 | $159 | |

| $128 | $160 | $216 | $147 | |

| $140 | $176 | $237 | $160 |

| $153 | $191 | $258 | $175 |

Even minor incidents quickly raise insurance costs. One ticket can increase monthly premiums by $15 to $25, while a single at-fault accident often adds $30 or more per month to a young driver’s rate.

These increases apply even with minimum coverage, which shows how sensitive young adult pricing is to driving history.

A DUI has the biggest impact on rates and can nearly double monthly costs. Geico’s average premium jumps from $119 with a clean record to $202 after a DUI, while other insurers exceed $200 per month as well (Read More: Cheap Auto Insurance After a DUI).

Maintaining a clean record remains the most effective way for young adults to secure lower long-term insurance rates.

How Credit Score Impacts Young Adult Car Insurance

For an 18-year-old young adult male with minimum coverage, credit score plays a significant role in monthly auto insurance costs. Drivers with excellent credit see the lowest rates, with Geico offering the cheapest average at $119 per month.

Followed by Erie at $123 and State Farm at $128, making them the most affordable options for credit-strong young adults.

Young Adult Auto Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670-799) | Fair (580-669) | Poor (< 580) |

|---|---|---|---|---|

| $172 | $188 | $207 | $229 | |

| $148 | $161 | $178 | $199 |

| $123 | $134 | $149 | $167 |

| $165 | $181 | $200 | $222 | |

| $119 | $129 | $143 | $160 | |

| $183 | $201 | $223 | $248 |

| $139 | $152 | $168 | $187 | |

| $128 | $140 | $155 | $173 | |

| $140 | $154 | $171 | $191 |

| $153 | $168 | $186 | $207 |

Young drivers with poor credit face the highest auto insurance costs across all insurers. Monthly rates can climb to $160 with Geico and exceed $200 with several providers.

These higher premiums apply even with minimum coverage for an 18-year-old male. Building and maintaining good credit remains one of the most effective ways for young adults to lower long-term insurance expenses.

Learn More: Cheap Auto Insurance for High-Risk Drivers

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ways to Pay for Young Adult Auto Insurance

Staying on a parent’s policy is often the cheapest option for drivers under 25. Family plans range from $83 to $126 per month, which is far lower than individual rates of $119 to $183 per month.

This gap explains why the teenage car insurance average cost per month drops when young drivers stay on a family plan, making it one of the best ways to find the best car insurance for drivers under 25.

Parent Policy vs. Own Policy: Auto Insurance Monthly Rates| Company | Family Plan | Individual |

|---|---|---|

| $118 | $172 | |

| $104 | $148 |

| $86 | $123 |

| $112 | $165 | |

| $83 | $119 | |

| $126 | $183 |

| $98 | $139 | |

| $91 | $128 | |

| $101 | $140 |

| $109 | $153 |

Moving to an individual policy costs more but gives young adults full control over coverage and billing.

Even then, companies like Geico and Erie keep rates competitive for drivers under 25, which matters as young adults begin managing other costs, such as rent or the best health insurance for young adults.

Payment flexibility is also important when choosing the best car insurance for drivers under 25, especially those managing school, rent, and other monthly expenses.

Many insurers offer auto pay, bank transfers, and debit card options, helping young drivers avoid late fees and manage tight budgets.

Best Auto Insurance Payment Options for Young Adults| Company | Auto Pay | Bank Transfer | Debit Card | Flex Pay |

|---|---|---|---|---|

| ✅ | ✅ | ✅ | ✅ | |

| ✅ | ✅ | ✅ | ✅ |

| ❌ | ✅ | ❌ | ❌ |

| ✅ | ✅ | ✅ | ✅ | |

| ✅ | ❌ | ✅ | ❌ | |

| ✅ | ✅ | ✅ | ✅ |

| ✅ | ✅ | ✅ | ✅ | |

| ✅ | ✅ | ❌ | ❌ | |

| ❌ | ✅ | ❌ | ✅ |

| ✅ | ❌ | ✅ | ✅ |

Companies with more payment options make it easier for young drivers to maintain coverage and avoid lapses.

When insurers offer fewer payment methods, managing monthly bills can become more difficult, especially for younger drivers with tight budgets.

Insurance comparison sites help choose a company with flexible payment options, which can help young adults balance car insurance costs alongside everyday expenses and other coverage needs.

This helps drivers choose a company that fits their cash flow and reduces the risk of policy cancellation during unexpected financial changes.

Auto Insurance Coverage for Young Adults

Auto insurance coverage matters more for young adults because new drivers face a higher risk and higher prices.

Understanding what types of auto insurance do makes it easier to choose a policy that fits both driving habits and budget.

- Collision Coverage: Helps young adults pay for car repairs after an accident, even if they are at fault.

- Comprehensive Coverage: Covers damage from theft, fire, vandalism, or bad weather, which helps protect a young driver’s car.

- Personal Injury Protection or Medical Payments: Helps cover medical bills after an accident, which is useful for young adults on a tight budget.

- Liability Coverage: Pays for injuries and damage you cause to others and is required in most states for young adult drivers.

- Uninsured and Underinsured Motorist Coverage: Helps pay costs if a young adult is hit by a driver with little or no insurance.

The right coverage helps protect against costly accidents, car damage, and medical bills while keeping monthly payments manageable.

Choosing the right mix of coverage can lower out-of-pocket costs after a crash and prevent large financial setbacks.

Young adults should carry required liability coverage, choose full coverage only for newer cars, and compare quotes to lock in the lowest rate.

Jeff Root Licensed Insurance Agent

Young adults can save money by comparing coverage levels, adjusting deductibles, and avoiding extras they don’t need.

Taking time to understand coverage options leads to better protection and smarter spending.

Tips to Save on Car Insurance for Young Adults

Auto insurance discounts play a big role in helping young adults lower their monthly costs. The best auto insurance for good drivers offers up to 35% savings from Allstate, and up to 25% with American Family and State Farm.

Multi-policy discounts also add meaningful savings, with several insurers, including Erie, Geico, and Liberty Mutual, offering up to 25% off when bundling auto insurance with renters or homeowners coverage.

Top Auto Insurance Discounts for Young Adults| Company | Anti-Theft | Good Student | Multi-Policy | Safe Driver |

|---|---|---|---|---|

| 10% | 35% | 25% | 18% | |

| 25% | 25% | 25% | 18% |

| 15% | 20% | 25% | 15% |

| 10% | 20% | 20% | 20% | |

| 25% | 15% | 25% | 15% | |

| 35% | 12% | 25% | 20% |

| 5% | 15% | 20% | 12% | |

| 15% | 25% | 17% | 20% | |

| 10% | 12% | 5% | 8% |

| 15% | 8% | 13% | 15% |

Safe driving and vehicle safety features also reduce premiums for young adult drivers. Liberty Mutual and Farmers provide safe driver discounts up to 20%, while anti-theft savings reach 35% with Liberty Mutual and 25% with Geico.

Young adults can lower car insurance costs by making smart choices beyond standard discounts. Simple changes in coverage, driving habits, and policy structure can lead to steady long-term savings.

- Choose a Higher Deductible: Raising deductibles lowers monthly premiums if you can afford higher out-of-pocket costs.

- Compare Quotes Regularly: Shopping around helps young adults find the lowest available rates.

- Limit Mileage: Driving fewer miles each year can reduce rates with low-mileage programs.

- Maintain a Clean Record: Avoiding tickets and accidents keeps premiums from rising.

- Stay on a Parent’s Policy: Family plans usually cost much less than individual policies for young drivers.

Taking advantage of discounts and adjusting coverage choices helps young adults keep insurance affordable.

Comparing rates and reviewing policies each year ensures drivers don’t overpay as their risk level improves.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top 10 Insurance Companies for Young Adults

Young adults often choose auto insurance companies that combine affordable rates, strong discounts, and easy-to-manage policies.

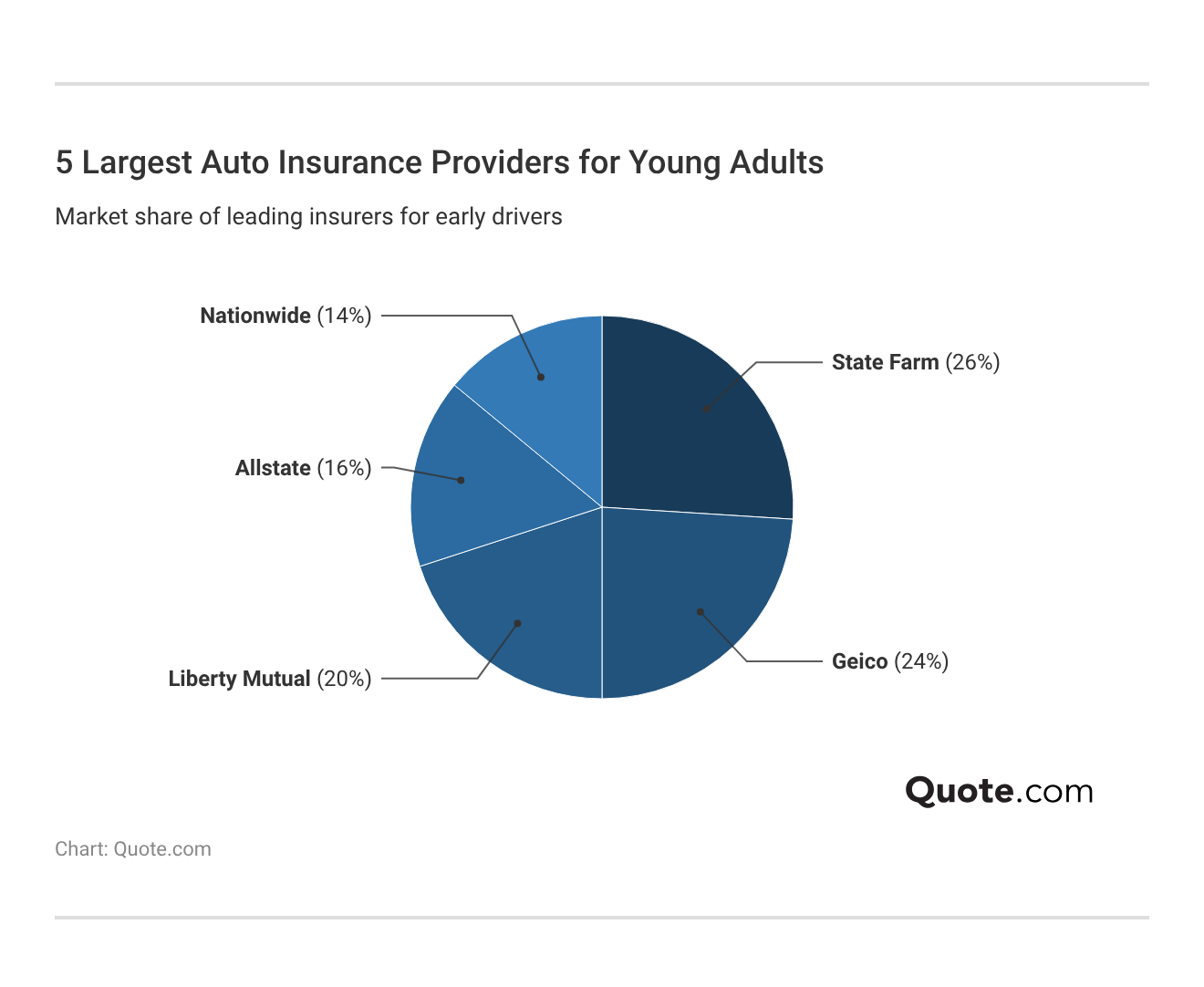

State Farm leads among young drivers with about 26% market share, offering broad availability, reliable customer support, and solid safe driver savings (Read More: State Farm vs. Farmers, Geico, Progressive, & Allstate).

Erie leads with low minimum rates and strong claims satisfaction, making it a top pick for young drivers focused on value and reliability.

Nationwide offers nationwide coverage for low-mileage young adults and family policies through usage-based savings, while Liberty Mutual offers flexible coverage with major discounts.

#1 – Erie: Top Overall Pick

Pros

- Low Pricing: Erie keeps minimum coverage around $123 per month, and it’s the cheapest option for young adult full coverage plans at $296 monthly.

- Claims Support: With a 733/1,000 claims satisfaction score, Erie helps young adults resolve claims faster while maintaining low minimum coverage costs.

- Bundle Savings: Our Erie Insurance review shows that young adults can reduce coverage costs by up to 25% by bundling auto and renters insurance.

Cons

- Limited Availability: Erie operates only in select states, limiting access to its pricing and coverage benefits for many young adults.

- Basic Digital Tools: Mobile and online features are limited, which may not meet the expectations of tech-focused young adults.

#2 – Liberty Mutual: Best for Custom Options

Pros

- Policy Flexibility: Liberty Mutual allows young adults to customize deductibles and add-ons, with a $183 minimum coverage.

- Anti-Theft Savings: Young adults can reduce coverage costs by up to 35% with approved vehicle security features.

- Multi-Policy Deals: Bundling renters insurance can reduce minimum coverage costs by up to 25% for young adults.

Cons

- Higher Base Costs: Customization often increases premiums, which may strain tight budgets (Learn More: Liberty Mutual Review).

- Complex Discount Rules: Some savings depend on vehicle type or enrollment steps that not all young adults can meet.

#3 – Nationwide: Best for Low Mileage

Pros

- Mileage Savings: Nationwide averages $139 per month for minimum coverage, rewarding young adults who drive fewer miles each year.

- Usage Discounts: SmartRide allows young adults to reduce coverage costs by proving safe driving habits (Read More: Nationwide Insurance Review).

- Financial Strength: An A+ rating supports reliable claim payouts for young adults with minimum coverage policies.

Cons

- Program Dependence: Many savings require enrolling in tracking programs, which may not suit all young adults.

- State Variations: Discounts and features differ by location, creating uneven benefits across states.

#4 – State Farm: Best for Safe Drivers

Pros

- Clean Record Rates: State Farm averages $128 per month for minimum coverage, rewarding young adults with safe driving histories.

- Agent Access: Local agents help young adults understand and manage minimum coverage policies. Our State Farm Insurance review breaks down all of your policy options.

- Driving Rewards: Drive Safe & Save helps safe drivers lower their young adult auto insurance rates at every renewal.

Cons

- Limited Customization: Coverage options are more standardized than some competitors.

- Fewer Payment Options: Billing flexibility is more limited than that of insurers offering multiple payment methods.

#5 – The Hartford: Best for Reliable Protection

Pros

- Steady Pricing: The Hartford averages $140 per month for minimum coverage, offering predictable costs for young adults.

- Payment Flexibility: Flex Pay helps young adults spread minimum coverage payments over time.

- Strong Backing: The Hartford has an A+ rating, ensuring reliable claims support for young adults.

Cons

- Limited Youth Discounts: The Hartford insurance review notes that fewer programs target students or first-time drivers.

- Less Custom Fit: Coverage options are geared toward experienced drivers rather than young adults.

#6 – American Family: Best for Family Inclusion

Pros

- Family Savings: Staying on shared policies keeps $148 minimum coverage affordable for young adults.

- Bundling Deals: Young adults can save up to 25% when combining auto and renters insurance.

- Student Discounts: In American Family, good grades help young adults lower minimum coverage costs.

Cons

- Limited Availability: Coverage is not offered nationwide. Use our American Family Insurance review to see if it’s available near you.

- Mid-Level Pricing: American Family’s costs are higher than those of the most budget-focused insurers.

#7 – Geico: Best for Lowest Rates

Pros

- Lowest Cost: Geico offers the cheapest auto insurance for young adults at $119 per month for minimum coverage.

- Digital Tools: Strong apps and online tools help young adults manage minimum coverage easily.

- Wide Access: Geico’s nationwide availability makes coverage accessible to most young adults.

Cons

- Limited Agent Support: Geico has fewer in-person options for drivers who prefer guidance.

- Rate Sensitivity: Premiums increase quickly after tickets or accidents. Compare high-risk quotes in our Geico insurance review.

#8 – Allstate: Best for Discount Opportunities

Pros

- Student Savings: Allstate offers up to 35% off, with a minimum coverage of $172, for qualifying young adults.

- Multiple Discounts: Allstate’s anti-theft and bundling help young adults reduce higher base rates.

- Agent Support: Allstate has strong local agent access, which helps young adults set up policies.

Cons

- Higher Base Premiums: As mentioned in our Allstate insurance review, prices remain higher for some young adults, even after discounts.

- Eligibility Requirements: Allstate requires young drivers to meet strict criteria to qualify for many of its savings.

#9 – Travelers: Best for Comprehensive Options

Pros

- Policy Variety: Travelers offers flexible options, with a $153 minimum coverage for young adults.

- Financial Strength: Travelers has an A++ rating, ensuring reliable claim payments for young adults.

- Payment Options: Travelers offers flexible billing, helping young adults manage monthly costs.

Cons

- Lower Claims Satisfaction: Scores trail higher-ranked competitors (Learn More: Travelers Insurance Review).

- Smaller Discount Programs: Travelers offers fewer savings options specifically designed for young adults.

#10 – Farmers: Best for Personalized Service

Pros

- Agent Guidance: Farmers provides one-on-one support to young adults selecting the $165 minimum coverage.

- Safe Driver Savings: Discounts of up to 20% help young adults offset higher minimum coverage costs.

- Optional Add-Ons: Features like accident forgiveness add value to young adults’ policies (Read More: Farmers Auto Insurance Review).

Cons

- Higher Overall Costs: Personalized service and add-ons often come with higher premiums.

- Weaker Digital Experience: Farmers’ online tools are less advanced than those of digital-first insurers.

Buying Auto Insurance for Young Adults

Comparing the best auto insurance for young adults starts with Erie, Nationwide, and Liberty Mutual, which consistently stand out for their balance of affordability, coverage options, and overall value.

Rates vary widely based on age, location, driving record, and credit, making it important for young drivers to review multiple insurers before choosing a policy.

Staying on a parent’s policy, avoiding tickets, and driving a safe, low-cost vehicle can quickly lower insurance costs for young adults.

Michelle Robbins Licensed Insurance Agent

Taking advantage of discounts can significantly reduce costs over time, with good student and anti-theft savings reaching up to 35%. Find tips to pay less for car insurance by making smart choices early.

Staying on a family plan when possible and maintaining a clean driving record further boost savings. Start comparing auto insurance rates by entering your ZIP code here.

Frequently Asked Questions

What car insurance is best for young adults?

Companies like Erie, Nationwide, and Liberty Mutual stand out for offering the best car insurance for young adults, with competitive pricing, good student savings, and flexible coverage options.

What insurance company has the best rates for young drivers?

Geico often offers the lowest starting rates for young drivers, especially for minimum coverage. Erie and State Farm also offer strong value to drivers with clean records and limited driving histories.

Is Geico or Progressive cheaper for young drivers?

Geico is often cheaper for young drivers with clean records and basic coverage needs. According to our Progressive auto insurance review, Progressive may be more competitive for drivers who benefit from usage-based programs or need specialized coverage options.

What’s the cheapest car to insure for a young person?

Sedans and small SUVs with strong safety ratings, such as the Honda Civic, Toyota Corolla, and Subaru Impreza, are typically the cheapest cars to insure for young drivers. These vehicles cost less to repair and have lower theft rates.

At what age does car insurance go down for young adults?

Car insurance rates typically begin to decline around age 20 and decrease more noticeably by age 24 or 25, provided the driver maintains a clean record and avoids claims. Find the best auto insurance company near you by entering your ZIP code into our free quote tool.

How much is insurance for first-time drivers under 25?

Insurance for first-time drivers under 25 typically ranges from $120 to $180 per month for minimum coverage, depending on location, vehicle, and driving history. Comparing auto insurance quotes helps new drivers find the best insurance for first-time car owners at the lowest available rate.

At what age is car insurance the lowest?

Car insurance rates are typically lowest for drivers in their 50s and early 60s. For younger drivers, rates become much more affordable in the mid-to-late 20s after several years of driving experience.

Should young adults stay on a parent’s car insurance policy?

Staying on a parent’s policy is usually the cheapest option and works well for car insurance for young adults under 26, especially if the driver lives at home or attends school nearby.

Do young drivers need full coverage?

Full coverage is recommended for financed or newer vehicles and provides better protection in the event of an accident. When choosing the best car insurance for young drivers, full coverage helps cover repairs, theft, and weather damage that liability-only policies do not.

What is the cheapest way to add a teen driver?

The cheapest way to add a teen driver is to add them to a parent’s existing policy rather than buying a separate policy. This approach usually qualifies families for multi-driver discounts. Families get the best auto insurance with teen drivers from American Family and Geico.

Which insurance type is best for young drivers?

What discounts help young adults lower car insurance costs?

What is a good auto insurance deductible for teens and young adults?

Why is young adult car insurance so high?

Who has the best car insurance for young drivers with accidents?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.