10 Best Auto Insurance Companies in Alabama for 2026

Erie, Nationwide, and State Farm are the best auto insurance companies in Alabama, with rates starting at just $32 per month. Geico offers a user-friendly app that makes managing your AL car insurance policy easy, and Progressive has flexible plans and discounts that reward safe driving.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Scott Young

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated November 2025

The best auto insurance companies in Alabama are Erie, Nationwide, and State Farm, offering rates as low as $32 per month.

- The best car insurance in Alabama includes accident forgiveness

- Erie has the cheapest Alabama auto insurance for $32 a month

- Alabama’s minimum liability limit is 25/50/25 for basic coverage

Erie makes coverage affordable for budget-minded drivers. Nationwide helps families and multi-policyholders save more with discounts of 20%.

State Farm offers dependable protection supported by strong financial ratings, giving Alabama drivers confidence in long-term coverage.

Top 10 Companies: Best Auto Insurance in Alabama| Company | Rank | Claims Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 718 / 1,000 | A+ | Claims Service |

| #2 | 691 / 1,000 | A+ | UBI Availability | |

| #3 | 677 / 1,000 | A++ | Local Agents | |

| #4 | 670 / 1,000 | A++ | Young Drivers | |

| #5 | 654 / 1,000 | A+ | Policy Add-Ons | |

| #6 | 645 / 1,000 | A+ | Tight Budgets | |

| #7 | 641 / 1,000 | A++ | Regional Strength | |

| #8 | 626 / 1,000 | A | 24/7 Support |

| #9 | 606 / 1,000 | A++ | Specialty Coverage | |

| #10 | 565 / 1,000 | A | Affordable Bundles |

Each provider also earns high marks for customer satisfaction, showing they deliver great claims service beyond just low prices.

Compare trusted options from the best auto insurance companies in Alabama using our auto insurance guide by entering your ZIP code into the free quote tool for savings.

Alabama Car Insurance Cost Comparison

If you’ve ever compared minimum and full coverage rates in Alabama, you’ve probably noticed a big price difference. That’s because minimum coverage only meets the state’s legal requirements.

It covers the injuries or damage you cause to someone else, but it won’t help with repairs if your own car gets wrecked, stolen, or vandalized. It keeps you legal on the road, but the protection is pretty limited when trouble hits.

Alabama Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $51 | $143 | |

| $47 | $124 | |

| $32 | $84 |

| $42 | $118 | |

| $77 | $215 |

| $46 | $128 | |

| $53 | $149 | |

| $38 | $101 | |

| $52 | $144 | |

| $37 | $104 |

Full coverage comes with collision and comprehensive insurance, which helps pay to fix or replace your car if it’s damaged in an accident, stolen, or hit by bad weather.

Since it offers more protection, it usually costs more each month, but it also gives drivers peace of mind knowing their own car is covered, too.

Minimum coverage rates seem cheap, but one bad wreck in Alabama can leave you paying thousands. In fact, limits run out fast.

Dani Best Licensed Insurance Agent

For Alabama drivers, choosing between the two comes down to budget and vehicle value. If you’re looking for the cheapest full coverage car insurance in Alabama, comparing multiple quotes before buying auto insurance can help you find the best mix of price and protection.

If your car’s getting up there in age and you’re trying to save a bit, minimum coverage can still give you solid protection. Knowing the difference helps Alabama drivers pick what fits best, whether they want to save money or go for more coverage.

How Age Impacts Alabama Auto Insurance Rates

In Alabama, the cost of auto insurance tends to shift as drivers get older, and the rates you see are based on minimum coverage. Teen drivers typically face the steepest prices, as insurers view them as a higher risk.

By the mid-20s, costs begin to ease as safe driving habits develop, and middle-aged drivers often see some of the cheapest car insurance in Alabama.

Alabama Auto Insurance Monthly Rates by Age| Company | Age: 16 | Age: 25 | Age: 45 | Age: 65 |

|---|---|---|---|---|

| $243 | $64 | $51 | $50 | |

| $260 | $60 | $47 | $46 | |

| $136 | $338 | $32 | $31 |

| $126 | $46 | $42 | $41 | |

| $336 | $85 | $77 | $76 |

| $206 | $60 | $46 | $45 | |

| $507 | $80 | $53 | $53 | |

| $208 | $47 | $38 | $42 | |

| $232 | $69 | $52 | $50 | |

| $470 | $41 | $37 | $38 |

Middle-aged drivers often get the most affordable coverage in Alabama, while seniors might notice small increases as insurers factor in health and slower reflexes. The best auto insurance companies in Alabama for seniors will offer discounts to reduce those increases.

That’s why checking the best car insurance in Alabama reviews can help you see how different companies perform for drivers at various life stages. Comparing options in this way is one of the smartest ways to keep your premiums low.

Alabama Car Insurance Rates After Claims & Citations

Car insurance costs in Alabama change a lot depending on your driving record. For a 45-year-old male with minimum coverage, the best prices usually go to drivers who avoid accidents and tickets.

Once a violation appears, whether it is a speeding ticket, an at-fault crash, or a DUI, insurers raise premiums to reflect the added risk. Companies view drivers with violations as more likely to file claims and raise rates accordingly.

Alabama Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $51 | $66 | $69 | $57 | |

| $47 | $70 | $72 | $59 | |

| $32 | $46 | $60 | $38 |

| $42 | $69 | $84 | $58 | |

| $77 | $108 | $105 | $104 |

| $46 | $45 | $80 | $54 | |

| $53 | $90 | $65 | $69 | |

| $38 | $59 | $67 | $48 | |

| $52 | $62 | $57 | $56 | |

| $37 | $41 | $68 | $52 |

Safe driving keeps insurance more affordable and makes it easier to qualify for the lowest rates, which is why many look for cheap auto insurance for high-risk drivers when traditional policies become too expensive.

Even a single mistake on the road can push costs higher for years, which is why avoiding risky behavior is one of the smartest ways to protect both your coverage and your budget.

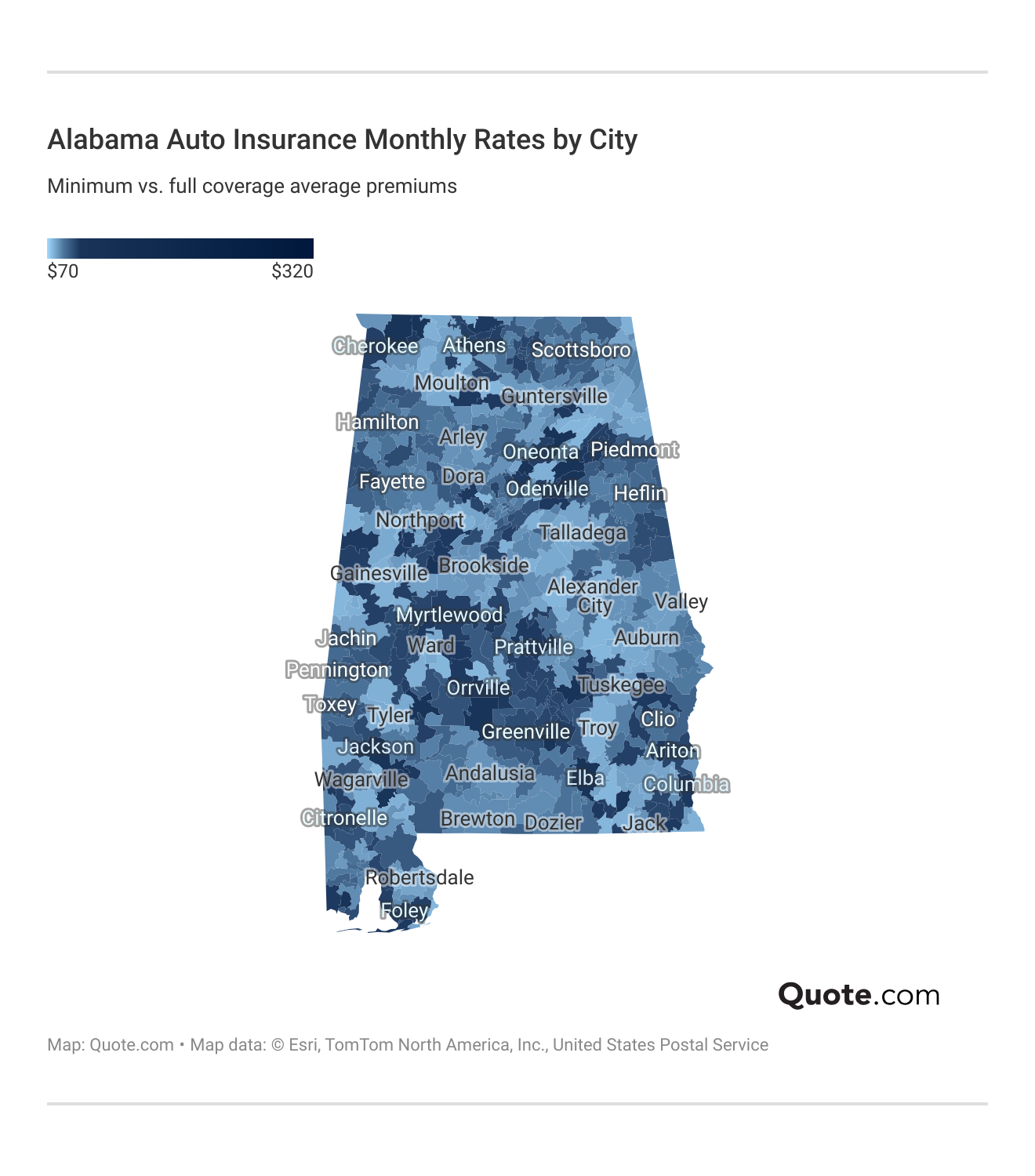

How Location Affects Auto Insurance Rates in Alabama

What you pay for auto insurance in Alabama often comes down to where you live. If you’re in a larger city, chances are your premiums will be higher because more traffic, frequent accidents, and higher theft rates make those areas appear riskier to insurers.

In contrast, people in smaller towns or rural areas often benefit from lower prices because there’s less congestion and fewer claims. These differences help explain why the average cost of auto insurance can vary so much from one part of Alabama to another.

For drivers across the state, this means your ZIP code can influence rates just as much as your age or driving record. Someone in a busy metro area may pay more, even with a clean driving history, while a driver in a quieter community could see lower monthly costs.

Compare auto insurance rates by state to understand how location affects insurance and get a competitive advantage when selecting providers that best fit your specific situation.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Alabama Insurance Coverage Requirements

If you’re driving in Alabama, the law says you need to carry at least the minimum required coverage. These limits are there to make sure you can handle basic costs if you’re at fault in a crash.

Here’s the minimum coverage you’ll need to drive legally in Alabama, but they don’t always stretch far enough to cover the real costs of a crash.

- $25,000 for bodily injury to one person

- $50,000 for bodily injury per accident

- $25,000 for property damage in an accident

Having these amounts keeps you legal on the road, but many drivers in Alabama look at raising their limits or adding extra coverage for better protection.

The best car insurance companies in Alabama offer drivers added ways to protect themselves. Collision coverage helps cover repairs if their car is damaged in a crash, and comprehensive coverage kicks in for things like theft, vandalism, or storm damage.

If your car is leased or financed, lenders typically require collision and comprehensive insurance coverage, making these two types of coverage important components of your Alabama auto insurance policy.

Uninsured and underinsured motorist coverage helps out if the other driver doesn’t have enough insurance to pay for the damage.

Uninsured motorist coverage is a must in Alabama. For instance, plenty of crashes involve drivers without enough insurance.

Brandon Frady Licensed Insurance Agent

Medical payments coverage is optional in Alabama. It helps pay hospital bills for you and your passengers, no matter who caused the accident.

Best Ways to Save on Alabama Auto Insurance

There are practical steps drivers can take that go beyond advertised deals and still bring premiums down, many of which are also recommended by the best home and auto insurance companies in Alabama.

Many of these savings strategies play a big role in helping drivers secure the best car insurance in Alabama.

- Keep Your Record Clean: Keeping your driving record free of tickets and accidents shows insurers you’re less risky, and that usually means you’ll qualify for better rates.

- Choose the Right Car: Vehicles with strong safety scores, lower repair costs, and built-in anti-theft features are typically less expensive to insure.

- Bundle Smartly: Combining auto coverage with renters or homeowners insurance often leads to lower overall costs.

- Pay All at Once: Paying your premium in full instead of in monthly installments helps avoid extra fees that can increase costs.

- Update Coverage After Changes: Paying off a loan, driving fewer miles, or moving can all be chances to adjust your policy and save.

Usage-based auto insurance is also beneficial, especially for low-mileage drivers. Less time on the road typically means a lower risk.

Matching discounts to your lifestyle is one of the most effective ways to bring down your premium. Each company offers savings in different ways, by rewarding safe drivers, bundling multiple policies, and installing anti-theft devices.

Top Auto Insurance Discounts in Alabama| Company | Bundling | Good Driver | Multi-Vehicle | Usage-Based |

|---|---|---|---|---|

| 25% | 25% | 25% | 30% | |

| 25% | 25% | 10% | 30% | |

| 16% | 25% | 10% | 30% |

| 25% | 26% | 25% | 25% | |

| 25% | 20% | 25% | 30% |

| 20% | 40% | 12% | 40% | |

| 10% | 30% | 12% | $231/yr | |

| 15% | 10% | 20% | 30% | |

| 17% | 25% | 20% | 30% | |

| 13% | 10% | 25% | 30% |

Auto insurance discounts in Alabama can go a long way in cutting what you pay each month. A clean driving record can open the door to safe driver savings, while households with more than one vehicle that combine home and auto coverage often see the biggest relief.

But discounts aren’t the only way to lower your auto insurance costs in Alabama, and drivers have many options that can make just as much of an impact on their premiums.

Top Alabama Car Insurance Companies

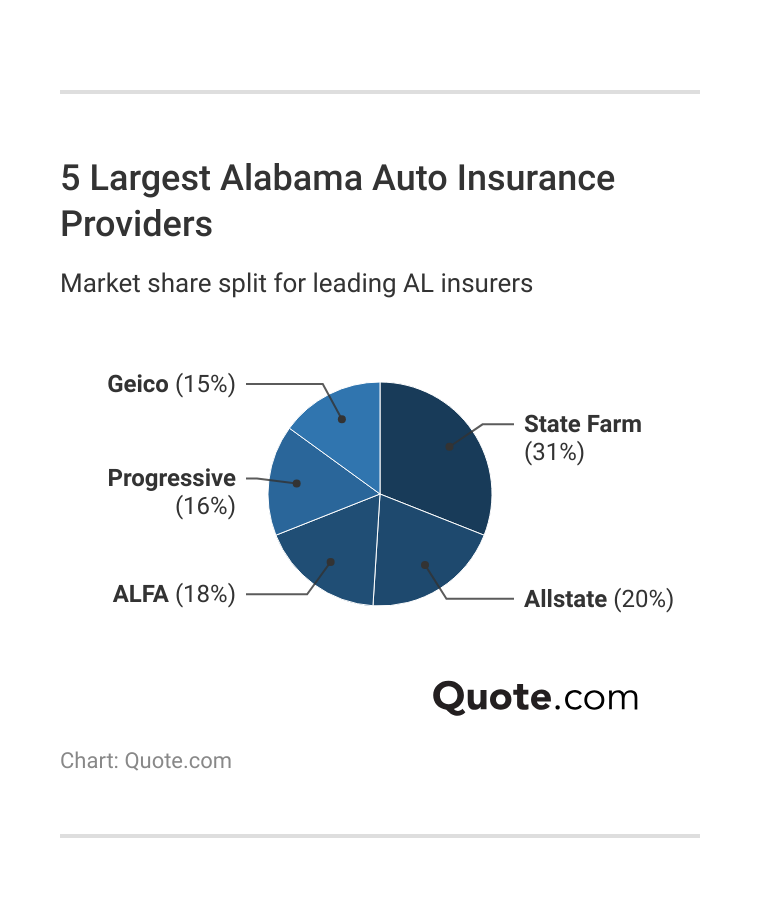

State Farm, Allstate, ALFA, Progressive, and Geico are the five largest auto insurers in Alabama, and they provide most of the coverage options drivers rely on.

Many of these providers also operate as renters insurance companies, allowing Alabama drivers to bundle auto with home or renters insurance for added discounts, making them central to how drivers manage costs and find value.

State Farm car insurance in Alabama remains one of the most trusted choices, dominating over a third of the market with strong local agent support and competitive pricing. Allstate, while slightly more expensive, ranks as the second-largest provider in the state.

Erie and Nationwide may not be the biggest, but Alabama drivers still prefer them for cheaper rates, exceptional service, and discount programs.

#1 – Erie: Top Pick Overall

Pros

- Superior Claims Service: Erie leads Alabama insurers with a 718/1,000 claims satisfaction score, the strongest among top competitors.

- Lowest Rates: Alabama drivers pay entry premiums ranging from $32 per month, making Erie the most affordable option statewide.

- Diminishing Deductible: Alabama policies include a $100 deductible reduction per claim-free year. See the Erie insurance review to find affordable coverage in Alabama.

Cons

- Limited Agent Access: Erie has fewer physical offices in rural Alabama, making in-person service harder for some drivers.

- Weaker Digital Tools: Alabama policyholders report limited online claim tracking and fewer mobile features within Erie’s system.

#2 – Nationwide: Best for UBI Availability

Pros

- Leading UBI Program: Alabama drivers save up to 40% with Nationwide’s SmartRide telematics tracking safe driving habits.

- Discount Variety: Multi-policy, accident-free, and defensive driving discounts are widely available in Alabama. See a full list in our Nationwide auto insurance review.

- Financial Stability: Nationwide’s A.M. Best A+ rating reassures Alabama drivers of long-term claim reliability.

Cons

- Limited Local Agents: Nationwide has fewer in-person service locations in Alabama, making face-to-face support less accessible.

- Teen Driver Costs: Alabama parents often face higher premiums for youthful operators despite SmartRide incentives.

#3 – State Farm: Best for Local Agents

Pros

- Largest Local Agent Network: Alabama policyholders benefit from dozens of State Farm offices statewide for in-person help.

- Financial Rating: A++ Superior A.M. Best score guarantees strong claims-paying ability in Alabama. See full ratings in our State Farm auto insurance review.

- Rich Discount Options: Safe driver, good student, and multi-policy discounts reduce Alabama monthly premiums.

Cons

- Claim Processing Delays: Alabama policyholders report slower resolution times on complex claims with State Farm.

- Limited Telematics Features: The Drive Safe & Save program in Alabama provides minimal feedback and fewer app-based insights for drivers.

#4 – Geico: Best for Young Drivers

Pros

- Affordable for Young Drivers: Geico offers competitive premiums for Alabama drivers under 25. See quotes in our Geico insurance review.

- Digital Convenience: Alabama policyholders benefit from the DriveEasy app, which provides claims filing and roadside assistance services.

- Financial Rating: A++ ensures Geico provides Alabama drivers with reliable claims support and long-term stability.

Cons

- Sparse Local Offices: Limited Geico offices in Alabama result in reduced face-to-face customer support options.

- Restricted Telematics: DriveEasy availability in Alabama is not statewide, limiting access for some drivers.

#5 – Allstate: Best for Policy Add-Ons

Pros

- Coverage Enhancements: Policies in Alabama come with perks like accident forgiveness and new car replacement. Check the Allstate insurance review to see Alabama coverage benefits explained.

- Solid Financial Rating: Backed by an A.M. Best A+ rating, Alabama customers know Allstate can handle claims when needed.

- Strong UBI Discounts: With Drivewise, Alabama drivers can save up to 40% on their insurance for safe driving.

Cons

- Higher Average Rates: Alabama drivers face above-average premiums before applying UBI or other discounts.

- Customer Service Issues: J.D. Power data shows Allstate’s 654/1,000 claims satisfaction score in Alabama signals slower response times.

#6 – Progressive: Best for Tight Budgets

Pros

- Budget-Friendly Tool: Progressive’s Name Your Price makes it easy for Alabama drivers to shape coverage around their budget.

- Snapshot Rewards: Safe drivers in Alabama can cut costs by up to 30% with Progressive’s Snapshot program.

- Wide Coverage Access: Progressive offers coverage across nearly every Alabama ZIP code, giving drivers plenty of options.

Cons

- Mid-Tier Claims: With a 645/1,000 satisfaction score in Alabama, it falls behind leaders like Erie. Get details in our Progressive auto insurance review.

- Comprehensive Coverage Costs: Full coverage premiums in Alabama with Progressive trend higher than its liability-only options.

#7 – Auto-Owners: Best for Regional Strength

Pros

- Regional Expertise: Auto-Owners focuses on local markets, giving Alabama drivers dependable support within their communities. Learn more in our Auto-Owners auto insurance review.

- Financial Reliability: With an A++ A.M. Best rating, Alabama policyholders can count on strong claims security.

- Extra Coverage: Alabama customers have access to accident forgiveness, gap insurance, and diminishing deductible benefits.

Cons

- Limited Reach: Auto-Owners is not available in every Alabama ZIP code, which reduces accessibility for some drivers.

- Weak Digital Features: Alabama drivers have fewer online claim tools with Auto-Owners, making digital service less convenient.

#8 – Liberty Mutual: Best for 24/7 Support

Pros

- Constant Service: Liberty Mutual gives Alabama drivers 24/7 access to claims filing and roadside help whenever it’s needed.

- Multiple Discounts: Alabama customers save through good student, homeowner bundling, and new vehicle discounts. Our Liberty Mutual insurance review provides a full list.

- Policy Options: Liberty Mutual in Alabama provides accident forgiveness and better car replacement coverage.

Cons

- Higher Premiums: Liberty Mutual policies in Alabama often cost more before discounts are applied.

- Customer Satisfaction Lag: With a low of 626/1,000, Liberty Mutual underperforms in claims handling compared to other Alabama car insurance companies.

#9 – Travelers: Best for Specialty Coverage

Pros

- Specialty Options: Alabama policies offer rideshare protection and gap insurance, which aren’t available at all Alabama auto insurance companies.

- Strong Bundling Savings: Alabama drivers can save up to 15% by combining auto and home coverage in a single policy.

- Strong Financial Backing: Travelers carries an A++ A.M. Best rating, providing Alabama drivers with peace of mind that their claims will be handled reliably.

Cons

- Lower Claims Score: 606/1,000 shows weaker claims satisfaction among Alabama policyholders.

- Higher Premiums: Alabama drivers often face monthly costs that run above average. Discover Alabama savings options in our detailed Travelers insurance review.

#10 – Safeco: Best for Affordable Bundles

Pros

- Affordable Bundling: Alabama drivers can save more by combining auto and home insurance with Safeco packages.

- Discount Options: Alabama customers benefit from accident-free, defensive driving, and multi-car discounts that lower monthly costs.

- Flexible Coverage Add-Ons: Safeco policies in Alabama include handy extras, such as roadside assistance and rental car reimbursement.

Cons

- Weakest Claims Satisfaction: Safeco ranks lowest at 565/1,000 among Alabama insurers for claims service. See the Safeco auto insurance review for claims details in Alabama.

- Narrower Reach: Alabama drivers may face limited coverage availability compared to larger providers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Get the Best Car Insurance in Alabama Now

The best auto insurance companies in Alabama stand out because they pair dependable service with smart ways to keep costs down. Pay attention to customer service ratings and financial strength to ensure the company can handle claims when you need them.

Erie, Nationwide, and State Farm are the best car insurance companies for claims satisfaction and low rates, but you can get cheaper Alabama car insurance by comparing quotes and discounts, such as safe-driver or bundling options.

Consider usage-based auto insurance if you don’t drive frequently. Some drivers even turn to online communities to see real experiences, with many discussing the best car insurance in Alabama on Reddit for added insight.

The easiest way to compare options and save is to enter your ZIP code online and review multiple auto insurance quotes in Alabama. Take these steps makes to identify the best auto insurance in Alabama that matches both your budget and coverage needs.

Frequently Asked Questions

What is the average car insurance cost in Alabama?

Full coverage car insurance in Alabama usually costs around $144 a month, while minimum coverage is closer to $47. What you pay really depends on things like your age, driving record, and even where you live.

Learn More: Liability vs. Full Coverage Auto Insurance

What is the best car insurance in Alabama?

Erie, Nationwide, and State Farm are often regarded as the top car insurance providers in Alabama. Erie is praised for top claims satisfaction, Nationwide for usage-based savings, and State Farm for its strong agent network.

What is the minimum car insurance coverage in Alabama?

Alabama law requires a minimum of $25,000 for bodily injury per person, $50,000 per accident, and $25,000 for property damage. These amounts cover other drivers’ costs if you cause an accident, but won’t cover any of your medical bills or damages to your vehicle.

Read More: Auto Insurance Requirements by State

How many days do you have to get insurance on a car in Alabama?

Alabama requires insurance to be purchased at the time of purchase. A car cannot be registered or legally driven without proof of coverage, so policies must be active immediately.

What is a good deductible for Alabama car insurance?

A $500 deductible works well for drivers who want lower out-of-pocket costs, while a $1,000 deductible is better for those who want to lower their monthly premiums if savings are the goal.

Do you need full coverage in Alabama?

Full coverage isn’t required by Alabama law, but lenders and leasing companies usually make it a condition for financed vehicles to protect both you and their investment.

Is USAA cheaper than Geico car insurance in Alabama?

For military families, USAA typically offers lower monthly rates than Geico, averaging under $40 for minimum coverage. Geico, however, remains one of the cheapest options for non-military drivers.

Learn More: Farmers vs. USAA Auto Insurance

What is the cheapest car insurance company in Alabama?

Geico and State Farm are often the most affordable options in Alabama. Many drivers pay under $45 per month for the minimum coverage, especially those with a clean driving record.

Do you pay a deductible if you are at fault in Alabama?

Yes. With collision auto insurance coverage, an Alabama driver at fault must pay their deductible (usually $500 or $1,000) before insurance pays for the remaining repair costs.

How do I submit a car insurance claim in Alabama?

To file a claim, contact your insurer by phone, online, or through their mobile app. Provide accident details, a police report if available, and photos of any damage.

Does Alabama have AAA insurance?

What auto insurance coverage options are Alabama drivers required to purchase?

Why is my Alabama car insurance so expensive?

What’s the difference between full coverage and comprehensive in Alabama?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.