10 Best Auto Insurance Companies in Idaho for 2026

State Farm, The Hartford, and Geico are the best auto insurance companies in Idaho, known for reliable claims support. At just $35 a month, Geico offers the cheapest car insurance in Idaho. Drivers can save up to 30% with safe driver discounts and 20% by bundling multiple policies with these top providers.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Managing Editor

Aleksandra J. Churlinov holds a Bachelor of Arts in English Language and Literature and a Master of Science in Marketing Management. Over the past six years, Aleks has focused on the insurance sector, working on a range of content, including business, auto, and life insurance. In April 2025, she stepped into the role of Managing Editor, where she now leads a team of talented insurance writers. ...

Aleksandra J. Churlinov

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Scott Young

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated November 2025

The best auto insurance companies in Idaho are State Farm, The Hartford, and Geico. Auto insurance in Idaho starts at $35 per month with Geico.

- State Farm is the largest car insurance company in Idaho

- The Hartford offers excellent claims satisfaction for senior drivers

- Geico provides the lowest Idaho car insurance rates statewide

Idaho’s top insurers stand out for their pricing stability, strong local service, and driver rewards programs that help policyholders save more over time.

Geico car insurance in Idaho is the most affordable option for both minimum and full coverage policies. Compare liability vs. full coverage insurance for more quotes.

Top 10 Companies: Best Auto Insurance in Idaho| Company | Rank | Claims Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 648 / 1,000 | A++ | Local Agents | |

| #2 | 645 / 1,000 | A+ | Exclusive Benefits |

| #3 | 631 / 1,000 | A++ | Budget Rates | |

| #4 | 626 / 1,000 | A | Loyalty Rewards |

| #5 | 625 / 1,000 | A+ | Deductible Savings | |

| #6 | 621 / 1,000 | A+ | Drivewise Program | |

| #7 | 620 / 1,000 | A | Safe Drivers | |

| #8 | 607 / 1,000 | A+ | High-Risk Drivers | |

| #9 | 581 / 1,000 | A++ | Policy Choices | |

| #10 | 578 / 1,000 | A | Add-Ons |

Drivers can find the cheapest auto insurance in Idaho by comparing multiple car insurance quotes in Idaho and choosing the insurer that delivers the best combination of affordability, coverage, and customer support.

If you’re looking to lower your premiums, enter your ZIP code into our free quote comparison tool to compare your rates against the best car insurance companies in Idaho.

Comparing Auto Insurance Rates in Idaho

If you’re looking for the cheapest car insurance in Idaho for minimum coverage, focus on basic liability protection. State Farm, Geico, and Progressive all have minimum rates under $40 a month.

Those who want full coverage tend to choose plans that include collision and comprehensive benefits. Many of the best car insurance companies in Idaho offer a range of policy options that fit different coverage needs and budgets.

Idaho Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $47 | $105 | |

| $44 | $98 |

| $45 | $99 | |

| $35 | $77 | |

| $46 | $101 |

| $41 | $90 | |

| $38 | $84 | |

| $39 | $85 | |

| $43 | $96 |

| $42 | $92 |

State Farm and Geico have the cheapest full coverage insurance in Idaho for less than $90 a month. Compare State Farm vs. Farmers, Geico, Progressive, and Allstate auto insurance for more auto insurance quotes in Idaho.

Along with coverage, your Idaho insurance rates will also vary by location, age, driving record, and credit score.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Idaho Car Insurance Requirements

Idaho’s auto insurance laws require every driver to carry liability coverage to help pay for injuries and property damage.

These minimums do not cover your own vehicle, so you may consider increasing these limits and adding additional coverage. The minimum required limits are:

- $25,000 of bodily injury liability per person

- $50,000 of bodily injury liability per accident

- $15,000 of property damage liability

If you want coverage for your vehicle, add collision insurance to pay for repairs after an at-fault accident, and comprehensive coverage for non-collision losses, such as theft, weather damage, or vandalism.

When combined with minimum liability insurance, these are commonly referred to as full coverage auto insurance, offering broader financial protection for both you and your vehicle.

There are also additional car insurance coverage options to consider in Idaho, such as roadside assistance or uninsured motorist coverage, which can offer valuable protection depending on your driving habits.

The most effective way to narrow your choices is to get multiple auto insurance quotes and compare auto insurance rates from several providers. This makes it easier to understand how to find the best car insurance in Idaho based on both value and coverage quality.

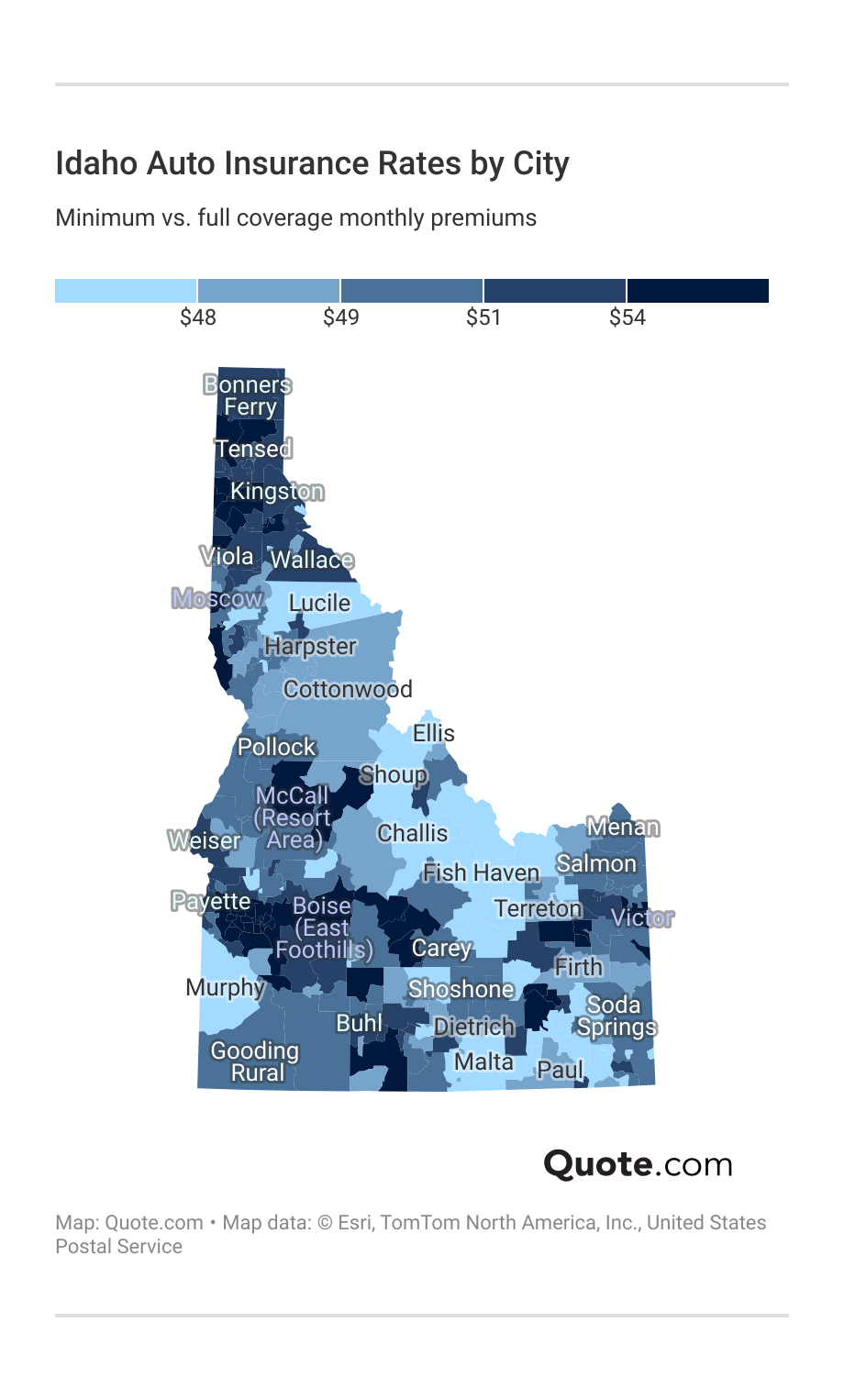

Auto Insurance Rates Across Cities in Idaho

Is car insurance cheaper in Idaho? Idaho consistently ranks among the states with some of the most affordable average auto insurance rates by state.

Cities with larger populations, such as Boise, Meridian, and Coeur d’Alene, might have slightly higher average premiums due to increased commute times, leading to a higher risk of collisions.

Local risk patterns also influence the claims process. More remote regions may also experience higher full coverage averages if repair shops and service providers are limited or there are increased comprehensive claims in the area.

When you need to file an auto insurance claim, insurers may review city-level loss data to assess risk and determine premium adjustments for drivers living in that area.

If you recently moved from a rural town to Boise or vice versa, re-shop your policy immediately since location alone can change your rate.

Michelle Robbins Licensed Insurance Agent

Idaho auto insurance companies weigh factors like accident frequency, repair availability, and how likely a vehicle is to incur damage based on where and how it’s driven.

However, affordability varies by age, gender, driving history, and vehicle type within the state.

Adult Driver vs. Teen Car Insurance in Idaho

Age plays a major role in determining Idaho insurance costs. Younger drivers typically pay more due to limited experience on the road, while older drivers with established driving histories generally benefit from lower pricing.

As drivers reach their mid-20s and maintain clean records, rates typically adjust downward to reflect decreased risk.

Idaho Auto Insurance Monthly Rates by Age| Company | Age: 18 | Age: 25 | Age: 35 | Age: 45 |

|---|---|---|---|---|

| $122 | $74 | $66 | $47 | |

| $89 | $53 | $54 | $44 |

| $109 | $68 | $55 | $45 | |

| $86 | $48 | $44 | $35 | |

| $111 | $69 | $53 | $46 |

| $96 | $70 | $50 | $41 | |

| $106 | $50 | $47 | $38 | |

| $91 | $54 | $48 | $39 | |

| $98 | $59 | $52 | $43 |

| $112 | $65 | $46 | $42 |

Nationwide generally offers the cheapest car insurance for teens in Idaho, while Geico provides the most affordable rates for adult drivers.

Families searching for the cheapest car insurance in Idaho for teen drivers often look for companies that offer good student auto insurance discounts, driver training incentives, or usage-based tracking programs that reward responsible habits behind the wheel.

Idaho Auto Insurance Rates by Driving History

Maintaining a clean record is one of the most reliable ways to get cheap car insurance in Idaho, especially when comparing multiple insurers side by side.

The best auto insurance companies in Idaho reward safe driving habits, while drivers with traffic violations or a history of claims may see higher premiums.

Idaho Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $47 | $66 | $116 | $59 | |

| $44 | $70 | $112 | $49 |

| $45 | $79 | $79 | $57 | |

| $35 | $48 | $76 | $38 | |

| $46 | $82 | $135 | $58 |

| $41 | $67 | $108 | $48 | |

| $38 | $65 | $107 | $40 | |

| $39 | $53 | $52 | $45 | |

| $43 | $68 | $110 | $47 |

| $42 | $83 | $104 | $46 |

Geico and State Farm have the cheapest high-risk auto insurance in Idaho, with State Farm offering the lowest rates to drivers with DUIs.

Defensive driving insurance discounts may also help lower premiums for drivers who complete approved safety courses, depending on the company.

Credit Score & Idaho Auto Insurance Costs

Your credit score is another rating factor frequently used by insurance companies in Idaho. Drivers with excellent credit often receive lower premiums.

Those with fair or poor credit may pay more, so improving credit over time can eventually reduce your average cost of auto insurance in Idaho overall.

Idaho Auto Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670–799) | Fair (580–669) | Poor (<580) |

|---|---|---|---|---|

| $47 | $52 | $64 | $89 | |

| $44 | $48 | $59 | $83 |

| $45 | $50 | $61 | $85 | |

| $35 | $39 | $47 | $67 | |

| $46 | $51 | $62 | $87 |

| $41 | $45 | $55 | $78 | |

| $38 | $42 | $51 | $72 | |

| $39 | $43 | $53 | $74 | |

| $43 | $47 | $58 | $82 |

| $42 | $46 | $57 | $80 |

Consider how different insurance companies adjust their pricing based on credit tiers. Some companies maintain more consistent pricing across credit levels, while others show wider gaps.

For instance, Geico only charges $12 more per month for someone with fair credit, while The Hartford increases monthly rates by $15.

Optional Idaho Auto Insurance Coverages

Drivers can choose several optional Idaho car insurance coverage to enhance protection beyond the state’s liability requirements.

These add-ons help cover damage to your own vehicle, medical payment coverage, and unexpected costs that basic insurance doesn’t address.

- Collision Coverage: Helps pay for repairs or replacement if your vehicle is damaged in a crash, rollover, or single-vehicle accident.

- Comprehensive Coverage: Covers non-crash events such as theft, vandalism, falling objects, severe weather, and animal-related damage, common on Idaho’s rural roads.

- Medical Payments (MedPay): Provides extra medical coverage for you and your passengers, regardless of who caused the accident.

- Roadside Assistance: Offers towing, tire changes, jump starts, and lockout services, useful for drivers frequently traveling Idaho’s remote areas.

- Rental Car Reimbursement: Helps cover the cost of a temporary rental vehicle while your car is in the shop after a covered claim.

Because Idaho has long rural highways, wildlife collisions, and winter driving hazards, optional coverages can offer valuable peace of mind.

While they increase your premium, they can significantly reduce out-of-pocket expenses after a crash or weather-related incident.

Easy Ways to Save on Car Insurance in Idaho

The best car insurance in Idaho will come with a range of savings opportunities for motorists.

These car insurance discounts you can’t miss often reward safe driving habits, automatic payments, and customer loyalty.

- Bundling Discounts: Idaho policyholders often save by combining their auto insurance with homeowners, renters, or life insurance.

- Safe Driver Discounts: Drivers with clean records for several years may earn significant savings. Idaho insurers often reward accident-free and violation-free driving.

- Usage-Based Programs: Some companies offer performance-based programs that track driving behavior or mileage. Safe, low-mileage Idaho drivers may see major savings through telematics-powered discounts.

- Vehicle Safety Feature Discounts: Cars equipped with airbags, anti-lock brakes, anti-theft devices, and other safety systems often qualify for additional rate reductions with Idaho insurance companies.

- Automatic Payment & Loyalty Discounts: Many Idaho insurers lower premiums for customers who enroll in autopay, paperless billing, or maintain long-term relationships with the same company.

These discounts vary by insurer, so reviewing your options helps you match coverage with the Idaho auto insurance companies offering the strongest savings for your driver profile.

For example, Idaho policyholders who combine their auto policy with homeowners or renters insurance may qualify for a bundling discount, which simplifies coverage and can lower total insurance costs.

Safe drivers who maintain a clean record over time may also benefit from performance-based savings programs that track driving behavior and reward consistent caution behind the wheel.

Different Idaho auto insurance companies prioritize certain savings, with some offering stronger incentives for safe driving programs, while others emphasize savings through policy bundling or vehicle safety features.

Top Auto Insurance Discounts in Idaho| Company | Anti-Theft | Bundling | Good Driver | Usage-Based |

|---|---|---|---|---|

| 10% | 25% | 25% | 40% | |

| 25% | 25% | 25% | 20% |

| 10% | 20% | 30% | 30% | |

| 25% | 25% | 26% | 25% | |

| 35% | 25% | 20% | 30% |

| 5% | 20% | 40% | 40% | |

| 25% | 10% | 30% | $231/yr | |

| 15% | 17% | 25% | 30% | |

| 10% | 5% | 15% | 20% |

| 15% | 13% | 10% | 30% |

These differences matter based on your specific situation. Households with multiple policies benefit more from bundling, while consistent safe drivers gain more from usage-based programs.

Reviewing discount options and savings strategies allows you to match coverage with the Idaho car insurance companies that offer the best savings for your profile.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Car Insurance Companies in Idaho

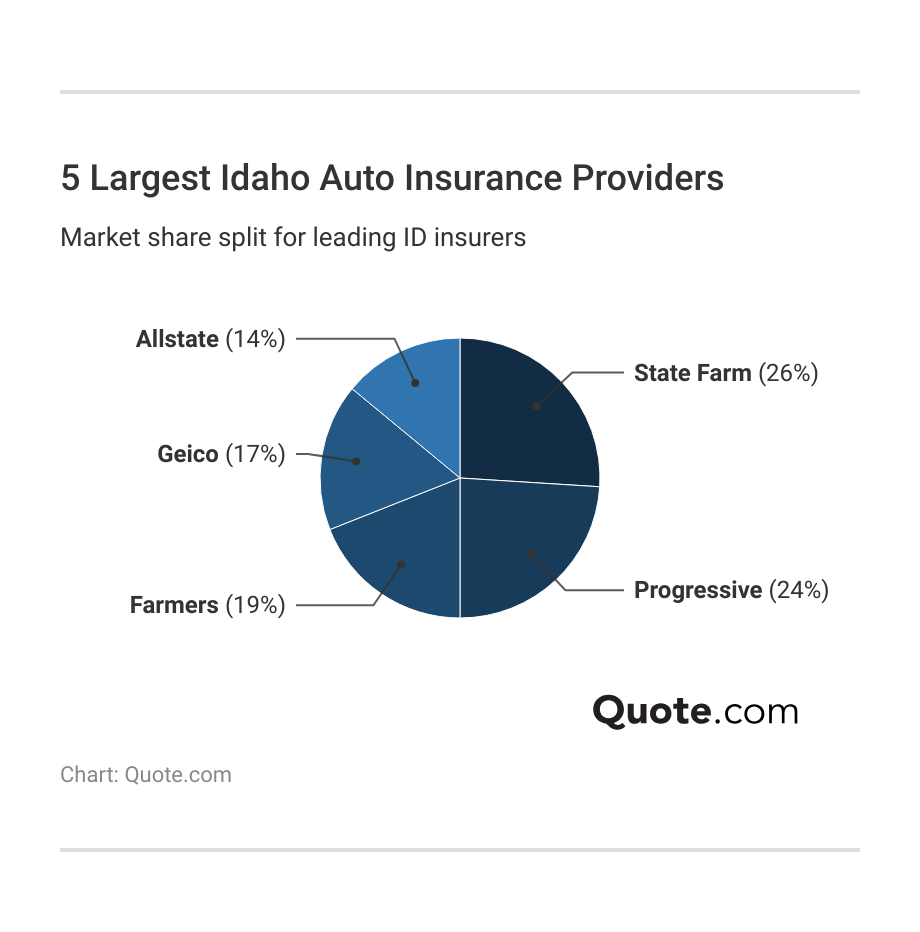

State Farm leads the Idaho market, followed by Progressive and Farmers, which are the largest Idaho auto insurance providers. Geico remains a popular choice among Idaho car insurance companies due to its affordable rates.

The Hartford’s smaller share likely reflects its smaller policyholder pool, since it only insures those with AARP memberships. However, it is one of the best auto insurance companies in Idaho for seniors.

Reviewing customer satisfaction data from the best car insurance in Idaho reviews can help identify how these companies perform beyond just cost. Check out the best insurance comparison sites for useful tools to evaluate coverage value and support.

You can start comparing now with our free comparison tool. Enter your ZIP code to get the cheapest Idaho car insurance.

#1 – State Farm: Top Overall Pick

Pros

- Widespread Agent Availability: State Farm offers more in-person agent support across Idaho than most insurers, making it easier for drivers to get customized advice.

- Consistent Customer Support: Our State Farm insurance review shows its claims and service interactions tend to be more personalized in Idaho.

- Strong Safe Driver Discounts: Idaho drivers with a clean record can earn meaningful long-term savings under its accident-free discount structure.

Cons

- Rates May Be Higher for Some: Idaho drivers with newer vehicles or limited credit sometimes pay more than with direct-to-consumer insurers.

- Less Tech-First Experience: Drivers in Idaho seeking app-only support may find the agent-driven model less convenient.

#2 – The Hartford: Best for Exclusive Benefits

Pros

- Member-Only Benefits: Offers Idaho policyholders access to exclusive perks and support services not widely available from standard insurers.

- High Claims Satisfaction: Idaho customers often report smoother claims handling and faster support response times. Learn more in our The Hartford insurance review.

- Bundled Policy Value: Idaho families who insure multiple vehicles or home policies may see notable multi-line savings.

Cons

- Membership Eligibility Required: Some Idaho drivers may not qualify for policy access depending on affiliation requirements.

- Limited Walk-In Offices: Fewer physical service locations in Idaho compared to large retail-based carriers.

#3 – Geico: Best for Budget Rates

Pros

- Lowest Average Pricing: Geico offers the most competitive minimum and full coverage rates statewide. Discover everything you need to know about Geico.

- Fast Online Policy Management: Idaho drivers who prefer digital self-service can quote, update, and file claims online efficiently.

- Usage-Based Savings Potential: Idaho drivers with shorter commutes or careful driving habits may benefit from DriveEasy telematics monitoring.

Cons

- Limited In-Person Support: Some Idaho regions have fewer local Geico agent offices, reducing face-to-face assistance options.

- Optional Coverage Range Can Be Narrow: Slightly fewer customizable endorsements than some Idaho competitors, especially for specialty vehicles.

#4 – American Family: Best for Loyalty Rewards

Pros

- Long-Term Customer Savings: Idaho policyholders who maintain continuous coverage may receive progressive loyalty-based cost benefits.

- Strong Bundling Opportunities: Idaho households can save by pairing auto with renters or home insurance under the same provider.

- Supportive for Teen Drivers: The company offers Idaho families beneficial student and driver training discounts to offset higher young driver rates.

Cons

- Limited Agent Availability in Rural Areas: Some smaller Idaho towns may have fewer American Family offices.

- Rate Increases After Accidents: Idaho drivers may see noticeable premium changes after at-fault claims. Learn more from our American Family auto insurance review.

#5 – Nationwide: Best for Deductible Savings

Pros

- Vanishing Deductible Program: Idaho policyholders can earn deductible reductions over time for staying claim-free.

- Flexible Telematics Plans: Usage-based SmartRide and SmartMiles programs fit well for Idaho drivers with irregular or low annual mileage.

- Reliable Multi-Policy Value: Idaho homeowners benefit from bundling car and home insurance under one provider (Read More: Nationwide Auto Insurance Review).

Cons

- Rates May Vary by Location: The average car insurance costs in Idaho rural regions are higher than urban areas.

- Telematics Participation May Be Required: Best savings often depend on opting into app or device monitoring programs.

#6 – Allstate: Best for Drivewise Program

Pros

- Drivewise Rewards Good Habits: Idaho drivers with safe driving behavior may earn ongoing policy savings through telematics tracking.

- Strong Claim Support Tools: Allstate’s Easy Claim features help Idaho drivers speed up repair scheduling and claim communication.

- Optional Accident Forgiveness: Can help Idaho drivers avoid sharp premium increases after their first at-fault crash. Learn more in our Allstate auto insurance review.

Cons

- Higher Base Premiums: Allstate’s average cost of car insurance in Idaho are higher than several Idaho competitors.

- Telematics Savings Can Vary: Idaho drivers may see inconsistent discount results depending on driving conditions.

#7 – Farmers: Best for Safe Drivers

Pros

- Signal App for Safe Driving: Idaho drivers who avoid hard braking and rapid acceleration may earn performance-based discounts.

- Personalized Agent Guidance: Local agents in Idaho often help tailor coverage for mountain, farm, and rural commuting conditions.

- Good OEM and Glass Repair Options: Offers repair parts options that can benefit Idaho drivers with newer or leased vehicles.

Cons

- Higher Costs for Drivers with Violations: Rates for Idaho drivers with recent tickets or at-fault accidents may run above competitors.

- Discounts May Not Stack: Some motorists may not qualify for cheap auto insurance in Idaho. Learn everything you need to know about Farmers Insurance here.

#8 – Progressive: Best for High-Risk Drivers

Pros

- More Flexible Approval for Risk Histories: Idaho drivers with DUIs, accidents, or violations often receive more affordable quotes from Progressive.

- Snapshot Rewards Data-Driven Driving: Telematics can provide Idaho drivers with personalized pricing based on real behavior.

- Strong Support for Modified Vehicles: Progressive is often a go-to in Idaho for custom equipment and aftermarket parts coverage.

Cons

- Rates Can Shift at Renewal: Idaho policyholders sometimes experience noticeable price changes after review periods.

- Less Face-to-Face Interaction: As mentioned in our Progressive insurance review, it has fewer agent offices in Idaho, which may affect drivers who prefer in-person service.

#9 – Travelers: Best for Policy Choices

Pros

- Wide Range of Endorsements: Idaho drivers seeking fine-tuned coverage options, including gap or new car coverage, may benefit.

- Rate Protection Benefits: Accident and violation forgiveness can help Idaho drivers avoid premium increases after minor incidents.

- Financially Reliable Carrier: Strong financial backing provides Idaho policyholders peace of mind for long-term claims stability.

Cons

- Telematics Savings May Be Modest: Drivers may not receive as large a usage-based discount compared to other Idaho auto insurance companies.

- Fewer Agent Locations: Some Idaho communities may have limited access to in-person support offices. Learn more in our Travelers auto insurance review.

#10 – Liberty Mutual: Best for Add-Ons

Pros

- Strong Add-On Coverage Options: Idaho drivers can choose protections such as new car replacement or better car replacement.

- High Safety Feature Discounts: Vehicles in Idaho equipped with anti-theft or advanced safety systems may qualify for additional savings.

- Accident Forgiveness Options: Multi-tier forgiveness programs can help Idaho drivers manage rate changes after claims.

Cons

- Premiums Can Be Higher: Liberty Mutual often prices above several other carriers in Idaho (Read More: Liberty Mutual Auto Insurance Review).

- Quotes May Vary Widely: Idaho drivers may see fluctuating pricing based on ZIP code and driving history.

Frequently Asked Questions

What is the best auto insurance company in Idaho?

State Farm is considered the best auto insurance company in Idaho for its strong local agent network, reliable claims service, and consistent safe driver discounts that reward clean driving records.

What Idaho insurance company has the highest customer satisfaction?

The Hartford and State Farm consistently earn high satisfaction ratings in Idaho for their responsive claims handling, personalized agent service, and strong reputation for reliability among policyholders.

Read More: Auto Club Enterprises (ACE) Insurance vs. The Hartford

How does State Farm rank among insurance companies in Idaho?

State Farm ranks as Idaho’s largest insurer with a leading market share and top ratings for claims satisfaction, agent availability, and safe driver discounts that promote long-term savings.

What is the average cost of auto insurance in Idaho?

The average cost of auto insurance in Idaho is around $35 per month for minimum coverage and $77 per month for full coverage, making it one of the most affordable states nationwide. Find your cheapest Idaho car insurance quotes by entering your ZIP code into our free comparison tool.

Is Geico or Progressive car insurance better in Idaho?

Geico is generally better for Idaho drivers seeking lower rates and strong digital tools, while Progressive suits those with past violations or high-risk histories who need flexible coverage approval.

Read More: Allstate vs. Geico Auto Insurance

Does credit score affect Idaho auto insurance rates?

Yes, Idaho car insurance companies use credit scores to determine risk. Drivers with excellent credit typically receive lower premiums, while those with poor credit may pay significantly higher insurance costs.

How can I lower my Idaho car insurance premium?

Idaho drivers can lower premiums by maintaining a clean driving record, improving credit, enrolling in telematics programs, bundling policies, and re-shopping for quotes regularly to find the best deal.

Read More: 17 Tips to Pay Less for Car Insurance

What is a good deductible for car insurance in Idaho?

A deductible between $500 and $1,000 is ideal for most Idaho drivers. Higher deductibles lower monthly premiums but increase out-of-pocket costs after a claim, so balance is key.

How much liability coverage do you really need in Idaho?

Idaho requires minimum limits of $25,000/$50,000/$15,000, but experts recommend at least $100,000/$300,000/$100,000 for better protection against injury and property damage claims after a serious accident.

Which Idaho insurance company denies the most claims?

Claim denial rates vary yearly, but larger national insurers like Allstate and Liberty Mutual have historically received more complaints compared to State Farm or The Hartford in Idaho.

What is the cheapest full coverage car insurance in Idaho?

What is considered full coverage auto insurance in Idaho?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.