10 Best Auto Insurance Companies in Rhode Island for 2026

The best auto insurance companies in Rhode Island are Amica, Allstate, and Geico, with minimum car insurance rates starting at just $54 per month. Rhode Island drivers can also find affordable full coverage options and save up to 40% statewide through usage-based and bundling discounts.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Karen Condor is an insurance and finance writer who has degrees in both journalism and communications. She began her career as a reporter covering local and state affairs. Her extensive experience includes management positions in newspapers, magazines, newsletters, and online marketing content. She has utilized her research, writing, and communications talents in the areas of human resources, f...

Karen Condor

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated November 2025

Amica, Allstate, and Geico are the best auto insurance companies in Rhode Island, offering minimum coverage rates as low as $54 per month.

- Find the best car insurance in Rhode Island for just $54 monthly

- Amica leads statewide for customer and claims satisfaction

- Rhode Island drivers must carry 25/50/25 liability to meet state laws

Amica ranks highest statewide with a 735/1,000 J.D. Power score for claims satisfaction and an A+ A.M. Best rating, making it the top choice among the best car insurance companies in Rhode Island.

Allstate appeals to tech-savvy drivers through its Drivewise app, which rewards safe driving habits with savings of up to 40%.

Top 10 Companies: Best Auto Insurance in Rhode Island| Company | Rank | Claims Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 735 / 1,000 | A+ | Customer Service | |

| #2 | 641 / 1,000 | A+ | Drivewise App | |

| #3 | 639 / 1,000 | A++ | Affordable Rates | |

| #4 | 634 / 1,000 | A++ | Claims Handling | |

| #5 | 626 / 1,000 | A | Policy Add-Ons |

| #6 | 622 / 1,000 | A++ | Bundling Policies | |

| #7 | 597 / 1,000 | A | Local Support |

| #8 | 594 / 1,000 | A+ | Senior Benefits | |

| #9 | 587 / 1,000 | A | Safe Drivers | |

| #10 | 582 / 1,000 | A+ | High-Risk Drivers |

Meanwhile, Geico offers the lowest rates for young and experienced drivers, with up to 25% savings for bundling and anti-theft features.

Keep reading to learn how to meet Rhode Island insurance requirements and which providers offer the best rates. Get fast and cheap RI auto insurance coverage today with our quote comparison tool.

Rhode Island Auto Insurance Rate Comparison

When comparing Rhode Island auto insurance rates, a few companies clearly offer the lowest prices for solid coverage. Geico is the cheapest option, with minimum coverage costing about $54 per month and full coverage costing around $121.

Progressive is another affordable choice, with rates starting at $58 for minimum coverage and $130 for full coverage, plus extra savings through its Snapshot program.

Rhode Island Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $74 | $165 | |

| $61 | $134 | |

| $66 | $148 | |

| $54 | $121 | |

| $68 | $152 |

| $62 | $137 |

| $58 | $130 | |

| $59 | $128 | |

| $65 | $143 | |

| $63 | $139 |

State Farm offers a good balance between cost and local support, averaging $59 per month for minimum coverage and $128 for full coverage. Amica, known for top-rated customer service, also keeps prices competitive at $61 a month.

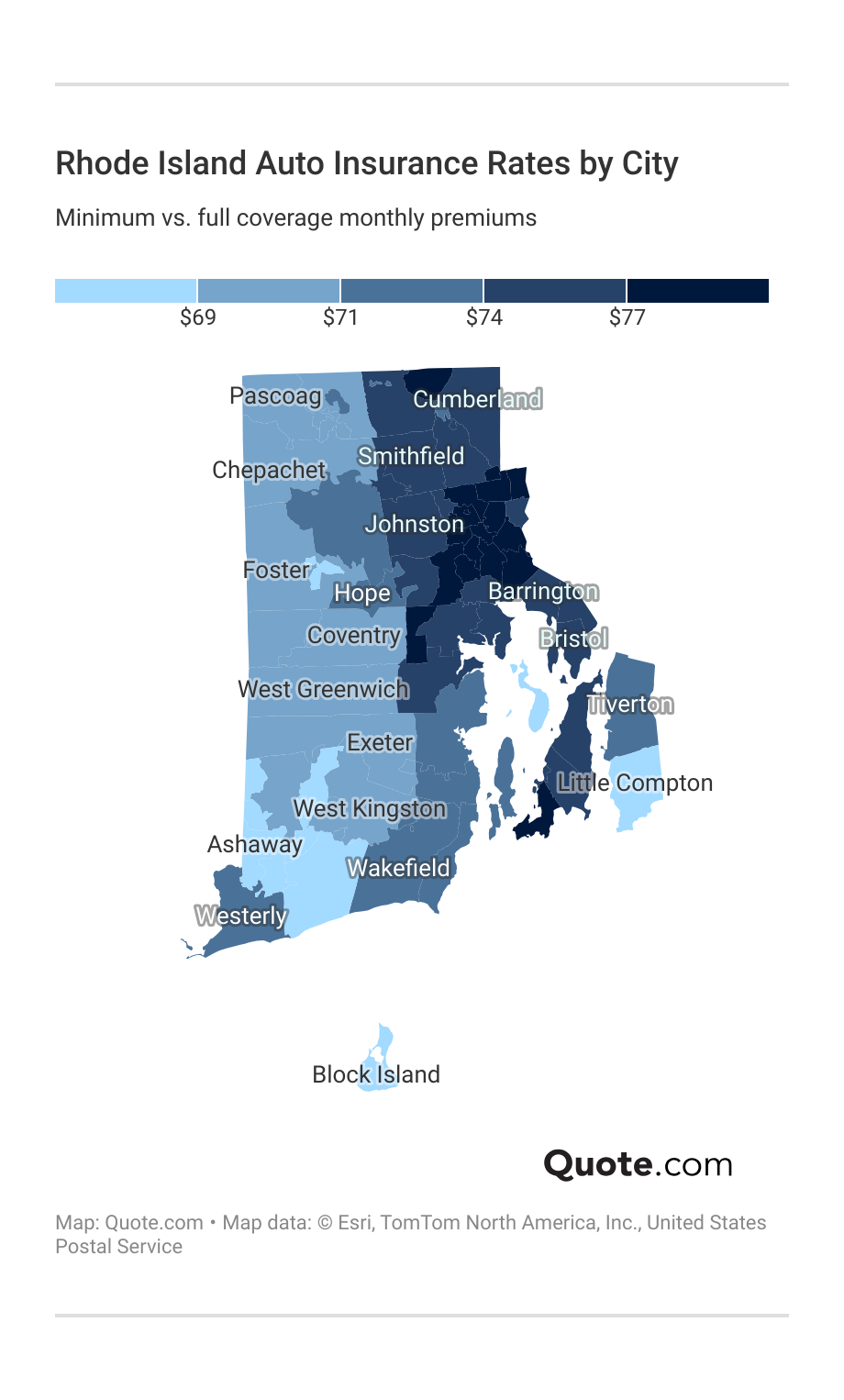

However, location has a big impact on car insurance costs in Rhode Island. Factors like traffic, population, and accident rates can all affect how much you pay (Read More: What to Do When You’re Denied Insurance Coverage).

Rhode Island drivers in cities with more traffic or higher claim rates often pay more than those in smaller towns with fewer accidents.

Melanie Musson Published Insurance Expert

Drivers in areas like Wakefield, Westerly, and Block Island enjoy the lowest average rates around $69 to $71 a month, thanks to lower population densities and fewer claims. In contrast, busier cities like Cumberland and Barrington have monthly premiums of $77.

Choosing one of the cheapest Rhode Island car insurance companies can help offset regional price differences, but check customer service reviews and claims satisfaction ratings before choosing a low-cost option based on price alone.

Remember to compare quotes before buying auto insurance in Rhode Island. Across the state, Geico continues to offer the cheapest overall rates, while Amica remains a top choice for its customer satisfaction and competitive pricing in coastal areas.

Progressive and State Farm also provide affordable options, especially for drivers in smaller communities like Exeter and West Greenwich, where average rates stay below the statewide average.

Rhode Island Car Insurance Costs Change With Age

Age plays a major role in determining car insurance costs in Rhode Island, with younger drivers paying the highest rates due to limited driving experience and higher accident risk.

For a minimum coverage policy in Rhode Island, Geico offers some of the cheapest car insurance, costing about $172 per month for 18-year-olds and only $54 for 45-year-olds, giving drivers steady savings as they gain experience on the road.

Rhode Island Auto Insurance Monthly Rates by Age| Company | Age: 18 | Age: 25 | Age: 35 | Age: 45 |

|---|---|---|---|---|

| $243 | $126 | $112 | $74 | |

| $194 | $95 | $82 | $61 | |

| $219 | $116 | $84 | $66 | |

| $172 | $81 | $74 | $54 | |

| $223 | $118 | $82 | $68 |

| $199 | $98 | $85 | $62 |

| $213 | $84 | $80 | $58 | |

| $182 | $92 | $81 | $59 | |

| $205 | $102 | $86 | $65 | |

| $224 | $110 | $71 | $63 |

Many companies on this list charge less than the average cost of auto insurance in Rhode Island, offering affordable and dependable options for drivers of all ages.

State Farm offers steady, affordable rates across all ages, charging $182 a month for 18-year-olds and $59 monthly for 45-year-olds.

Age affects rates in Rhode Island. Young drivers pay more, while older drivers can save with full coverage and safe-driving discounts.

Brandon Frady Licensed Insurance Agent

Amica, known for top-rated customer service, delivers some of the best rates for older drivers. Minimum coverage averages $61 per month at age 45.

Progressive is another low-cost choice, with monthly premiums starting at $213 for 18-year-olds and dropping to $58 by age 45. Young drivers can get additional savings through its Snapshot safe-driving program.

Comparing High-Risk Auto Insurance in Rhode Island

A single accident, DUI, or speeding ticket can raise your monthly premium, but some Rhode Island auto insurance companies still keep rates low for responsible drivers.

Geico offers cheap auto insurance for high-risk drivers at $54 per month with a clean record and stays affordable even after an incident, costing $79 a month after one accident and $126 monthly after a DUI.

Rhode Island Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $74 | $87 | $164 | $72 | |

| $61 | $84 | $139 | $67 | |

| $66 | $115 | $143 | $82 | |

| $54 | $79 | $126 | $62 | |

| $68 | $114 | $188 | $81 |

| $62 | $98 | $149 | $70 |

| $58 | $104 | $171 | $74 | |

| $59 | $82 | $131 | $73 | |

| $65 | $96 | $145 | $69 | |

| $63 | $129 | $161 | $75 |

Amica is close behind, offering excellent customer service and fair pricing at $61 per month for drivers with no violations and $84 monthly after an accident.

State Farm also provides reliable coverage with $59 per month for clean records and $82 after an accident, while Progressive remains a strong choice at $58 per month and $104 after one accident.

How Credit History Impacts Rhode Island Insurance Rates

Car insurance rates in Rhode Island often change based on your credit score, since insurers link better credit with lower risk.

Geico again offers the most affordable rates, starting at $49 per month for good credit and $54 for excellent credit. Drivers with poor credit still pay a reasonable $103 monthly.

Rhode Island Auto Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670-799) | Fair (580-669) | Poor (<580) |

|---|---|---|---|---|

| $74 | $67 | $100 | $141 | |

| $61 | $55 | $82 | $116 | |

| $66 | $59 | $89 | $125 | |

| $54 | $49 | $73 | $103 | |

| $68 | $61 | $92 | $129 |

| $62 | $56 | $84 | $118 |

| $58 | $52 | $78 | $110 | |

| $59 | $53 | $79 | $111 | |

| $65 | $57 | $85 | $120 | |

| $63 | $58 | $86 | $121 |

Amica is another strong option at $55 per month for good credit and $116 for poor credit. Drivers with bad credit who pay their premiums on time are also eligible for dividend payments with Amica.

Overall, Geico, Amica, Progressive, and State Farm provide the best balance of low rates and dependable coverage for Rhode Island drivers across all credit levels (Read More: State Farm vs Farmers, Geico, Progressive, and Allstate Review).

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Rhode Island Car Insurance Required Coverage

Rhode Island insurance law requires all drivers to carry a minimum of 25/50/25 liability auto insurance. These minimums ensure that drivers can cover basic costs if they cause an accident, but they may not be enough for serious crashes or high repair costs.

Driving without the required insurance in Rhode Island can result in fines, license suspension, and reinstatement fees. Continuous coverage can also lead to discounts from many auto insurance companies in Rhode Island.

While only liability coverage is required, many drivers in Rhode Island choose to add collision and comprehensive coverage for broader protection.

For the best protection, experts say to raise your coverage limits and shop around often to find a plan that’s both affordable and reliable.

More Auto Insurance Policy Options in RI

Rhode Island drivers can choose from several coverage options beyond the state’s minimum requirements.

Building the right mix of coverage helps protect against costly repairs, injuries, and unexpected losses.

- Liability Coverage: Covers injuries and property damage you cause to others. Rhode Island requires at least 25/50/25 coverage.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re hit by a driver with little or no insurance, an important safeguard in Rhode Island where uninsured accidents still occur.

- Personal Injury Protection (PIP) or Medical Payments: Pays for medical expenses for you and your passengers regardless of fault, helping reduce out-of-pocket medical costs.

- Collision Coverage: Covers repairs to your vehicle after an at-fault accident or collision with another object.

- Comprehensive Coverage: Covers non-collision damage, such as theft, vandalism, or storm damage, which is especially valuable in coastal RI areas prone to severe weather.

Choosing a combination of these coverages helps Rhode Island drivers stay financially protected and avoid paying large repair or medical bills after an accident.

Comparing quotes from multiple insurers can also help find the best value for the protection you need (Learn More: Comprehensive Auto Insurance).

Ways to Save on Rhode Island Auto Insurance

Rhode Island drivers can save a lot by using discounts for safe driving, car safety features, and bundling their policies.

Among all providers, Liberty Mutual offers the largest overall savings in Rhode Island, with discounts reaching 35% for anti-theft devices and up to 30% for usage-based programs that monitor safe driving habits.

Top Auto Insurance Discounts in Rhode Island| Company | Anti-Theft | Bundling | Multi-Vehicle | Usage-Based |

|---|---|---|---|---|

| 10% | 25% | 10% | 40% | |

| 18% | 30% | 25% | 20% | |

| 10% | 20% | 12% | 30% | |

| 25% | 25% | 25% | 25% | |

| 35% | 25% | 25% | 30% |

| 15% | 25% | 20% | 20% |

| 25% | 10% | 12% | $231/yr | |

| 15% | 17% | 20% | 30% | |

| 10% | 20% | 15% | 15% | |

| 15% | 13% | 8% | 30% |

Allstate provides some of the most generous usage-based car insurance savings, allowing drivers to earn up to 40% off through its Drivewise app. Amica helps residents save up to 30% by bundling auto and home insurance, and 25% for insuring multiple vehicles.

These savings can grow quickly when combined across multiple discounts, but there are other ways for Rhode Island drivers to reduce insurance costs:

- Keep a Clean Record: Avoid accidents and violations to qualify for the best rates from Rhode Island insurers.

- Raise Your Deductible: Picking a higher deductible can lower your monthly bill if you can pay for repairs out of pocket.

- Drive a Safer Vehicle: Cars with strong safety ratings and lower repair costs often qualify for reduced premiums in Rhode Island.

- Maintain Continuous Coverage: Having an uninterrupted insurance history shows reliability and can prevent rate increases.

- Reduce Annual Mileage: Driving fewer miles lowers your risk and may qualify you for low-mileage or pay-per-mile savings programs available in Rhode Island.

By combining these habits with the top Rhode Island insurance discounts, drivers can secure affordable, high-quality coverage without cutting back on protection.

Regularly comparing quotes ensures you always get the best rate and stay protected on the road.

Top Rhode Island Car Insurance Companies

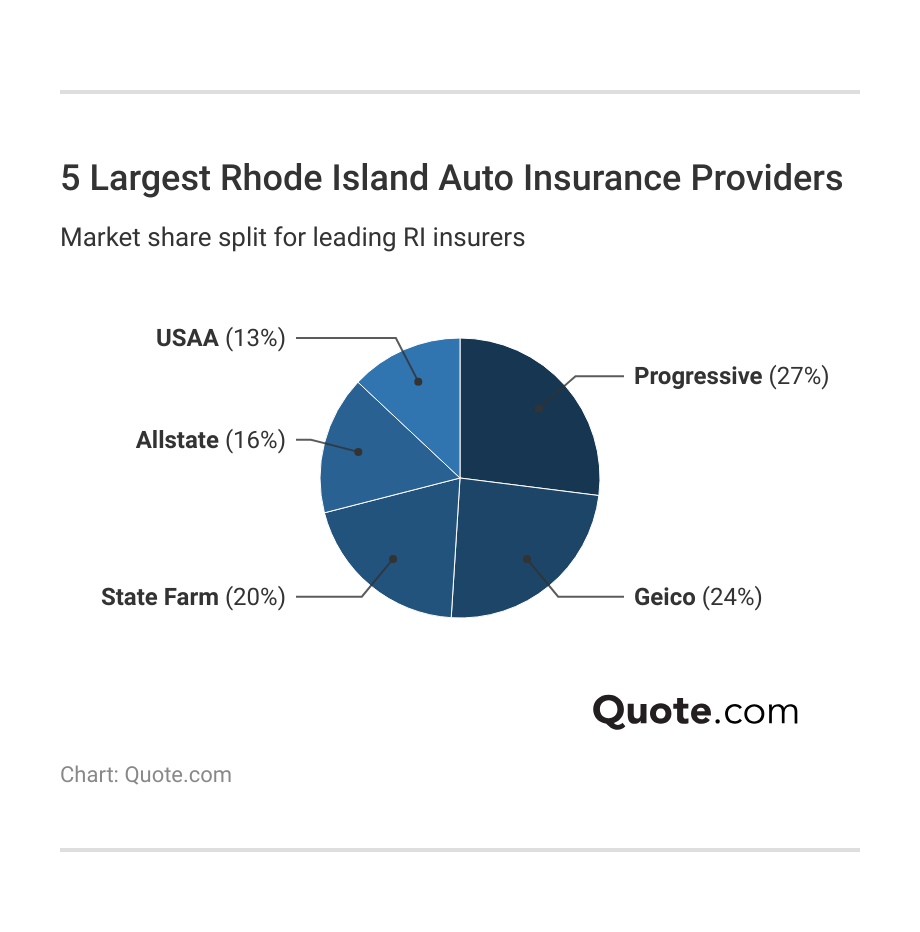

The top car insurance companies in Rhode Island are Progressive, Geico, State Farm, Allstate, and USAA. These five providers make up most of Rhode Island’s car insurance market and give drivers plenty of choices for price, coverage, and service.

Progressive is the biggest, holding 27% of the market, known for its flexible coverage, easy online tools, and safe-driving rewards through the Snapshot program.

These major companies shape how drivers in Rhode Island choose and manage their auto insurance. Each has unique advantages, such as affordability, service quality, or digital convenience, as well as a few drawbacks that depend on your needs and driving habits.

That’s why it’s smart for Rhode Island drivers to compare multiple insurance companies, look at each company’s pros and cons, and choose one that offers the best mix of price, coverage, and dependable service.

#1 – Amica: Top Overall Pick

Pros

- Exceptional Customer Service: Our Amica insurance review highlights that it leads RI insurers in claims satisfaction with a 735/1,000 score.

- Affordable Rates: With minimum coverage averaging $61 per month in RI, Amica combines low rates with premium service.

- Strong Financial Stability: A+ rating for financial strength, giving RI drivers peace of mind that the company is reliable for the long run.

Cons

- Limited Availability: Amica’s coverage network outside Rhode Island may be more limited compared to national competitors.

- Fewer Online Tools: Amica car insurance in Rhode Island has fewer digital tools, and its mobile app is lacking compared to Allstate or Geico.

#2 – Allstate: Best for Drivewise App

Pros

- Drivewise Savings: Allstate’s Drivewise app rewards safe Rhode Island drivers with up to 40% off premiums, encouraging safer habits.

- Comprehensive Coverage Options: Minimum coverage in RI starts at $74 per month, offering strong protection and add-ons like accident forgiveness.

- High Financial Strength: Rated A+ by A.M. Best, Allstate provides stable coverage for long-term RI policyholders.

Cons

- Higher Base Rates: Allstate’s minimum coverage cost of $74 monthly is higher than Geico and Amica car insurance in Rhode Island.

- Usage-Based Tracking: Some RI drivers may find Drivewise monitoring intrusive despite potential discounts. Check the Allstate insurance review to see more savings.

#3 – Geico: Best for Budget Rates

Pros

- Lowest Average Rate: Geico offers the cheapest car insurance in Rhode Island at just $54 per month. Compare quotes in our Geico insurance review.

- Strong Digital Experience: RI policyholders enjoy a top-rated mobile app for managing policies and claims efficiently.

- Broad Discounts: Geico provides up to 25% savings in RI through bundling, multi-vehicle, and anti-theft discounts.

Cons

- Limited Local Agents: Rhode Island drivers preferring in-person support may find fewer Geico offices statewide.

- Customer Service Variability: While rates are low, some RI customers report slower claims processing during high-demand periods.

#4 – State Farm: Best for Local Agents

Pros

- Excellent Claims Handling: High customer satisfaction ratings make State Farm a trusted choice for RI drivers. See full ratings in our State Farm auto insurance review.

- Personalized Support: Local agents in RI give hands-on help and know the area well to get support when they need it.

- Competitive Pricing: Minimum coverage in RI averages $59 per month, balancing affordability and coverage value.

Cons

- Limited Online Quotes: Rhode Island users may need to contact agents directly for personalized rate estimates.

- Discount Caps: State Farm’s bundling and multi-vehicle discounts in RI are smaller than those from Geico or Liberty Mutual.

#5 – Liberty Mutual: Best for Policy Add-Ons

Pros

- Extensive Add-On Options: Offers extra coverage in Rhode Island, including new car replacement and accident forgiveness. Our Liberty Mutual review provides a full list.

- Strong Savings Potential: Minimum coverage costs $68 per month in RI, with up to 35% savings via anti-theft discounts.

- Reliable Claims Support: Known for prompt service and local adjusters across Rhode Island.

Cons

- Above-Average Rates: RI drivers may pay slightly higher premiums compared to Amica or Geico for similar coverage.

- Usage-Based Variability: Liberty’s telematics discounts depend heavily on driving behavior, which may reduce savings for some Rhode Island drivers.

#6 – Travelers: Best for Bundling Policies

Pros

- Bundling Opportunities: RI drivers can save up to 30% by combining home or renters insurance with their auto policies.

- Well-Rounded Affordable Coverage: Travelers car insurance in Rhode Island averages $63 monthly for minimum coverage plans.

- Financial Strength: Backed by an A++ A.M. Best rating, Travelers ensures long-term stability for Rhode Island customers. Learn more in our Travelers auto insurance review.

Cons

- Limited Availability of Local Agents: Travelers insurance in Rhode Island has fewer physical offices compared to State Farm or Amica.

- Higher Premiums for Young Drivers: Rates for drivers under 25 in RI tend to be higher than competitors like Geico.

#7 – MAPFRE: Best for Local Service

Pros

- Strong Regional Presence: Its regional service is ideal for Rhode Island residents seeking localized policy management and knowledgeable agents.

- Flexible Policy Options: This provider offers tailored coverage in Rhode Island, including pay-as-you-go and high-risk driver plans.

- Affordable Minimum Coverage: Average RI minimum coverage rates are $62 per month. Discover the cheapest car insurance in Rhode Island.

Cons

- Less Name Recognition: This insurer may not have the same trust level in RI as established brands like Amica or Allstate.

- Limited Digital Support: Online tools for managing claims or payments may be less advanced than national competitors.

#8 – The Hanover: Best for Senior Benefits

Pros

- Customizable Senior Insurance: The Hanover provides unique policy enhancements for Rhode Island drivers over 65, including roadside assistance and glass coverage.

- Reasonable Pricing: Minimum coverage costs $65 per month in RI, offering a solid balance of price and protection.

- Strong Financial Reputation: Rated A+, ensuring reliability for long-term RI customers.

Cons

- Smaller Market Share: Fewer offices and agents in Rhode Island limit accessibility.

- Limited Discount Variety: RI drivers may find fewer savings programs compared to Liberty Mutual or Geico. Browse the full list in our The Hanover insurance review.

#9 – Farmers: Best for Safe Drivers

Pros

- Safe Driver Savings: Farmers rewards Rhode Island’s safe drivers with discounts up to 30%. Explore more discounts in our Farmers Insurance review.

- Affordable Coverage: Minimum coverage in RI costs $66 per month, providing strong value for high-quality protection.

- Local Agent Support: Rhode Island policyholders benefit from personalized guidance and claims assistance.

Cons

- Higher Premiums for High-Risk Drivers: Those with violations in RI may face higher-than-average rate increases.

- Limited Digital Experience: Farmers’ app tools are less advanced than Allstate’s Drivewise in RI.

#10 – Progressive: Best for High-Risk Drivers

Pros

- Strong for Risky Drivers: Progressive offers affordable rates for Rhode Island drivers with past violations, with minimum coverage starting at $58 per month.

- Snapshot UBI Program: RI drivers can save up to $231 annually through usage-based driving discounts. Get details in our Progressive auto insurance review.

- Comprehensive Online Tools: Progressive’s digital platform helps Rhode Island drivers easily compare and customize policies.

Cons

- Rate Increases After Claims: Progressive insurance in Rhode Island often has higher renewal rates after an at-fault accident than other companies.

- Limited Personalized Service: Progressive car insurance in Rhode Island is a direct-to-consumer model with fewer local agents than other companies.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Find the Best RI Auto Insurance Companies

Amica, Allstate, and Geico stand out as the best auto insurance companies in Rhode Island. Amica for customer service, Allstate for safe-driving rewards, and Geico for cheap rates.

Drivers in Rhode Island can save the most with usage-based programs, which offer up to 40% off for safe driving through tools like Geico DriveEasy and Allstate’s Drivewise.

Drivers must have at least 25/50/25 liability insurance to drive legally in Rhode Island, but many choose to add collision and comprehensive coverage for extra protection against theft, weather, and collisions.

See which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool.

Frequently Asked Questions

What are the best auto insurance companies in Rhode Island?

The top five best auto insurance companies in Rhode Island are Amica, Allstate, Geico, State Farm, and Progressive. These companies stand out for their mix of affordable pricing, reliable claims handling, and strong customer satisfaction ratings.

Who has the cheapest car insurance in Rhode Island?

Geico offers the cheapest car insurance in Rhode Island, with minimum coverage starting around $54 per month. Delve into our guide to learn the different ways to pay less for car insurance.

What is the average cost of auto insurance in Rhode Island?

The average cost of auto insurance in Rhode Island is about $61 per month for minimum coverage and $138 per month for full coverage. Rates vary depending on factors like age, driving history, location, and credit score. Enter your ZIP code to compare free quotes now.

Who is the most trusted insurance company in Rhode Island?

Amica is widely considered the most trusted insurance company in Rhode Island. It is known for its exceptional customer service, smooth claims process, and strong financial ratings. The company consistently ranks high in J.D. Power’s customer satisfaction studies.

Which is the most reliable car insurance company in Rhode Island?

State Farm and Amica are the most reliable car insurance companies in Rhode Island. Both have excellent reputations for claims satisfaction, financial strength, and consistent customer support through local agents.

How can I save money on car insurance in Rhode Island?

Rhode Island drivers can save by bundling home and auto policies, maintaining a clean driving record, and enrolling in usage-based programs like Allstate’s Drivewise or Progressive’s Snapshot. Adding anti-theft devices and reducing mileage can also lead to extra savings (Read More: Best Anti-Theft Auto Insurance Discounts)

Who is cheaper in Rhode Island, Geico or Progressive?

In most cases, Geico is cheaper than Progressive car insurance in Rhode Island at $54 per month compared to $58 per month. However, Progressive may offer better savings for high-risk drivers or those who use its Snapshot UBI program. Start saving on your auto insurance by entering your ZIP code and comparing car insurance quotes in Rhode Island.

Which Rhode Island insurance company has the most complaints?

MAPFRE receives the most insurance complaints, five times more than other Rhode Island car insurance companies.

Which Rhode Island insurance company denies the most claims?

Progressive and Farmers have the lowest claims satisfaction ratings in Rhode Island, reflecting denied claims and slow response times.

What is the minimum auto insurance in Rhode Island?

Rhode Island law requires at least 25/50/25 liability coverage, which includes $25,000 for bodily injury per person, $50,000 per accident, and $25,000 for property damage. Drivers may also choose to add uninsured motorist, collision auto insurance, or comprehensive coverage for added protection.

Do I need full coverage car insurance in Rhode Island?

What’s the best car insurance right now in the U.S.?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.