Best Military Auto Insurance Discounts in 2026

USAA, State Farm, and Nationwide offer the best military auto insurance discounts, with savings up to 30%. Drivers can also take advantage of deployment discounts and cheaper rates for stored vehicles while stacking multi-policy or low-mileage discounts from Allstate or Erie to lower military car insurance costs.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Content Creator

Lia Vergin develops both video and written content across all lines of insurance, with a primary focus on auto, home, and life coverage. She is dedicated to helping consumers better understand and navigate their insurance options. Driven by a passion for saving money and finding great deals, she is committed to creating clear, engaging, and practical content that empowers readers to make confident...

Lia Vergin

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding c...

Meggan McCain

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated February 2026

The top picks for the best military car insurance discounts are USAA, State Farm, and Nationwide. USAA stands out because of its low rates and exclusive military benefits.

- Deployment and storage discounts lower premiums for active-duty members

- Age, state, driving record, and military status affect discount eligibility

- USAA military car insurance rates start at $49 per month

Military drivers can secure discounts between 10%-30% from the best auto insurance companies for military and veterans, but only USAA offers the biggest military discount of 30% and up to 60% off for deployed service members who store their vehicles.

This guide lays out eligibility requirements, necessary proof of service, and the most efficient ways to stack military discounts for long-term savings.

Top 10 Companies: Best Military Auto Insurance Discounts| Company | Rank | Savings | A.M. Best | Eligible Groups |

|---|---|---|---|---|

| #1 | 30% | A++ | Military Households | |

| #2 | 25% | A++ | Active Duty Only | |

| #3 | 25% | A+ | Active Duty & Veterans | |

| #4 | 25% | A+ | Active Duty Only | |

| #5 | 20% | A | Active Duty & Veterans | |

| #6 | 15% | A++ | Active & Reserve | |

| #7 | 12% | A+ | Active Duty & Veterans |

| #8 | 12% | A | Active Duty Only |

| #9 | 10% | A++ | Active Duty & Veterans | |

| #10 | 10% | A | Military Affiliations |

We break down minimum and full coverage pricing for military members, compare pre-discount and post-discount rates, and explain how age, state, and driving history influence overall costs.

Avoid paying higher premiums by comparing military discounts with our free comparison tool to find the lowest available rates.

Comparing Military Car Insurance Rates

Several companies stand out not just because of their low prices, but because of how much the military discount actually reduces the premium.

USAA is one of the cheapest options but also offers the best military car insurance discount of 30%, which can drop rates as low as $34 per month for drivers who just need minimum coverage. See More: USAA Insurance Review

Auto Insurance Monthly Cost: Before & After Military Discount| Company | Before | After | Savings |

|---|---|---|---|

| $78 | $59 | $19 | |

| $69 | $61 | $8 |

| $56 | $49 | $7 |

| $74 | $59 | $15 | |

| $55 | $47 | $8 | |

| $82 | $74 | $8 |

| $64 | $48 | $16 | |

| $59 | $44 | $15 | |

| $70 | $63 | $7 | |

| $49 | $34 | $15 |

The State Farm military discount is also competitive at 25%, reducing rates from $59 to $44 a month. Nationwide also offers strong savings, dropping premiums from $64 to $48 per month.

Although many insurers offer military savings, monthly costs vary by provider and coverage level. Compare rates side by side to see which companies offer the most competitive pricing.

Military Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $78 | $175 | |

| $69 | $157 |

| $56 | $128 |

| $74 | $172 | |

| $55 | $126 | |

| $82 | $186 |

| $64 | $151 | |

| $59 | $133 | |

| $70 | $160 | |

| $49 | $112 |

USAA military car insurance is the cheapest because it was built specifically for military members and prices policies around deployments and frequent moves.

Geico and Erie keep full coverage auto insurance affordable at under $130 a month, compared to Farmers and Liberty Mutual. The Liberty Mutual military discount is also much smaller at 10%, saving drivers only $8 a month on coverage.

Military auto insurance costs more with full coverage. Match coverage to your vehicle’s value. For example, raising your deductible can lower monthly premiums while keeping liability protection.

Dani Best Licensed Insurance Agent

State Farm is also very affordable, at around $59 per month for minimum coverage and $133 per month for full coverage, and its widely available military discount can lower rates even further.

Allstate may offer the biggest monthly savings of $19 with its military discount, but its monthly rates are among the highest. That’s why it’s important to compare quotes from multiple providers before you buy.

Compare Now: State Farm vs. Farmers, Geico, Progressive, & Allstate Insurance Review

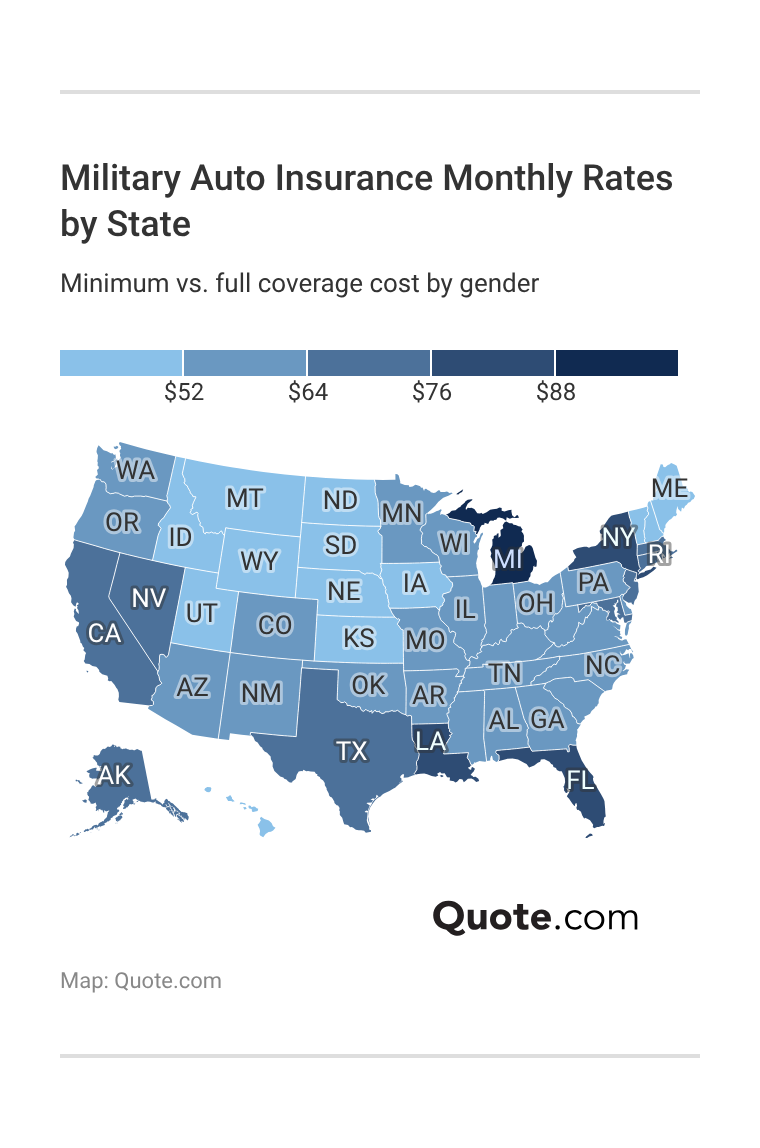

How Age and Location Impact Military Insurance Costs

Military auto insurance rates in Washington, Georgia, and Kentucky highlight how auto insurance rates by state vary based on location, gender, and age, even after military discounts are applied.

Minimum coverage comes to $60 to $65 a month, and full coverage is between $158-$169 per month, with female drivers typically paying a little less than males.

These differences reflect your local risk factors, including traffic and commute, accident rates, regional repair costs, and medical expenses.

Your state insurance requirements also impact how insurers set premiums, and your base rates will be higher if you’re required to carry higher liability limits or additional coverages.

Military auto insurance discounts also vary by state, with local regulations affecting how big of a discount providers can offer.

Even with military discounts, age and state risk factors will strongly affect your final rates.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Qualifying for a Military Insurance Discount

Getting a military auto insurance discount requires informing the insurer of your military status and providing proof of service when requesting a quote.

You can compare rates at first without entering your military status, but you won’t get as accurate quotes. Find out more details in our guide: How to Compare Auto Insurance Companies

Having your proof of service ready can help you see all the eligible discounts you qualify for and verify your overall savings before you buy.

Be sure to ask about deployment or storage discounts if the car won’t be driven, and how to bundle a military discount with other savings for safe drivers or multiple policies for an even higher total discount.

What You Need to Get a Military Car Insurance Discount

Insurers require proof of your military status to prevent fraud and ensure military car insurance discounts are applied correctly to eligible service members and veterans.

If you’re a member of the Army Reserve, submit a letter of affiliation to your insurer to get the discount. Proof of income or a military ID confirms active-duty status, and proof of discharge is supplied by veterans who have left the service.

Proof Required for Military Auto Insurance Discounts| Proof Type | Used by |

|---|---|

| Affiliation Letter | Reserve Members |

| Deployment Orders | Deployed Status |

| Earnings Statement | Active Service |

| Military Identification | Service Enrollees |

| Veteran Identification | Veteran Status |

If you also need insurance discounts for vehicle storage or a deployment discount, most companies require that deployment orders be used to prove your vehicle won’t be driven.

Proof of status is essential to receive and maintain the discount because savings are only available to active or retired members and certain eligible family members.

You’ll generally need to prove your military connection for these savings to apply to your policy.

Civilian drivers with no military connection are not eligible, and dependents who apply without the qualified service member listed on the policy may also be denied.

Who Does Not Qualify for Military Auto Insurance Discounts| Group | Reason |

|---|---|

| Civilian Drivers | No military affiliation |

| Dependents on Own | Eligible member not listed |

| Expired Status | Service no longer active |

| Retirees Without Proof | Verification not provided |

| Veterans Without Status | Does not meet criteria |

Veterans and former members are not eligible unless the insurer chooses to extend underwriting consideration. For instance, State Farm, Allstate, and AmFam military discounts are not available on veterans auto insurance.

Retirees and veterans may lose access to the discount when they leave service or are unable to provide the required documentation.

Read More: Average Cost of Auto Insurance

Stack Discounts to Maximize Military Savings

Military discounts are about more than saving money, however. They assist military families when finances are tight, including during moves and deployments.

These discounts matter because they align insurance pricing with the way military members and veterans actually use their vehicles, preventing service members from overpaying.

Low-mileage discounts are important, especially since many service members drive less due to base assignments, training schedules, or deployments.

Drivers can save even more by doubling or tripling their savings with additional discounts, such as a safe driving record or multiple policies.

Top Auto Insurance Discounts for Military Drivers| Company | Deployment | Low Mileage | Military | Vehicle Storage |

|---|---|---|---|---|

| 30% | 30% | 25% | 30% | |

| 15% | 20% | 12% | 15% |

| 15% | 30% | 12% | 15% |

| 10% | 10% | 20% | 15% | |

| 25% | 30% | 15% | 25% | |

| 30% | 30% | 10% | 30% |

| 40% | 40% | 25% | 40% | |

| 15% | 30% | 25% | 15% | |

| 15% | 20% | 10% | 15% | |

| 60% | 20% | 30% | 60% |

Military drivers can significantly reduce their premiums by stacking additional discounts on top of their military savings.

Safe, claim-free drivers receive discounts from many insurers, such as Travelers’ accident-free discount. Discounts for bundling auto with renters insurance or homeowners coverage are also widely available.

Auto Insurance Deals That Stack With a Military Discount| Provider | Accident- Free | Home Bundling | Usage- Based | Vehicle Storage |

|---|---|---|---|---|

| ✅ | ✅ | ⚠️Varies | ⚠️Varies | |

| ✅ | ✅ | ❌ | ❌ |

| ✅ | ⚠️Varies | ❌ | ❌ |

| ⚠️Varies | ✅ | ⚠️Varies | ⚠️Varies | |

| ✅ | ✅ | ⚠️Varies | ✅ | |

| ✅ | ✅ | ⚠️Varies | ✅ |

| ⚠️Varies | ⚠️Varies | ⚠️Varies | ⚠️Varies | |

| ⚠️Varies | ✅ | ❌ | ❌ | |

| ✅ | ✅ | ❌ | ❌ | |

| ❌ | ⚠️Varies | ❌ | ✅ |

Usage-based programs can be stacked with military discounts if you qualify with a safe driving record and drive less than 10,000 miles per year.

Being able to stack these savings on top of a military discount is significant, as each approved discount lowers the total premium and helps service members better afford coverage while deployed or re-stationed elsewhere, even if they’re driving less.

Other Ways to Save on Military Insurance

Outside the popular auto insurance discounts, there are more ways to save that can have a big impact on your budget.

Military and veteran car insurance is eligible for the same type of reward programs as other drivers, including accident forgiveness and defensive driving rewards:

- Accident Forgiveness: Some insurers offer accident forgiveness to long-term military policyholders, preventing rate increases after a first at-fault accident.

- Defensive Driving: If a driver has completed an approved defensive driving course, they should be eligible for a policy rate reduction.

- Early Purchase or Advance Quote: Securing a policy before a PCS move or renewal may qualify for a small discount.

- Multi-Vehicle: Car insurance for military personnel often includes multi-vehicle discounts that lower premiums when insuring multiple cars.

- Safe Driving: Enrolling in a usage-based program that tracks habits like speed and braking can earn additional savings for safe driving.

Maintaining a clean driving record is the easiest way to get cheaper military auto insurance, but you won’t know who has the best rates based on your driving history until you compare quotes online.

Getting an anonymous insurance quote can help you find the most affordable military car insurance with or without discounts.

How Usage-Based Auto Insurance Helps Military Drivers Save

Usage-based insurance (UBI) is becoming one of the most effective ways for military drivers to lower their auto insurance costs because they reward actual driving behavior rather than relying only on age, location, or past driving history.

These programs track habits such as speed, braking, mileage, and time of day through a mobile app or plug-in device, allowing safe drivers to earn significant discounts.

Top Usage-Based Insurance Programs for Military Drivers| Company | Program | Savings | System |

|---|---|---|---|

| Drivewise | 40% | Mobile App | |

| DriveMyWay | 20% | Mobile App |

| YourTurn | 30% | Mobile App |

| Signal | 30% | Mobile App | |

| DriveEasy | 25% | Mobile App | |

| RightTrack | 30% | Plug-in Device |

| SmartRide | 40% | Mobile App or Plug-in | |

| Drive Safe & Save | 30% | Mobile App or Plug-in | |

| IntelliDrive | 30% | Mobile App | |

| SafePilot | 30% | Mobile app |

Allstate Drivewise and Nationwide SmartRide offer up to 40%, and several others reach up to 30%.

Geico and American Family have the lowest UBI discounts, but drivers can still save 20%-25%.

For instance, stacking the 25% Geico military discount with UBI savings could cut your premiums in half.

These telematics programs are particularly crucial for military personnel who may log fewer miles due to deployments or base stationing, but signing up does require constant monitoring, which some drivers are not comfortable with.

Where to Find the Best Military Discounts

The best military auto insurance discounts help service members and veterans save a substantial amount of money. USAA offers the largest discount of up to 30%, and savings extend to family members.

Companies like State Farm and Nationwide also stand out for combining competitive base rates on comprehensive auto insurance with military savings.

By stacking available discounts with military insurance savings, active members and veterans can lower their monthly premiums by 60% or more.

Finding affordable car insurance with a military discount is simple. Enter your ZIP code into our free comparison tool to instantly compare personalized quotes from top providers near you.

Frequently Asked Questions

Who offers the best military auto insurance discount?

USAA typically offers the best car insurance for military discounts. It offers the biggest discount of 30% to active and retired military members and 60% to deployed service members who store their cars. State Farm and Nationwide also offer strong military discount options and decent pricing.

How much of a discount does the military get on car insurance?

Military car insurance discounts are generally between 10% and 30%, but compare providers near you to find the biggest discounts in your state.

See how much you’ll pay after military auto insurance discounts by entering your ZIP code into our free comparison tool.

Does Geico offer a military discount?

Yes, but the Geico military discount is only available for active-duty and reserve members. Eligible drivers can receive savings for military affiliation and may also qualify for additional reductions during deployment or when storing a vehicle.

Learn more in our guide: Geico Insurance Review

What car insurance benefits are available to military personnel?

Members of the military can take advantage of deployment, vehicle storage, and military-affiliation discounts, as well as flexible policy options for PCS moves. Many insurers also offer these savings in addition to other discounts, such as bundling or safe-driving discounts, to help lower your premiums further.

Are military discounts automatically applied, or do drivers need to request them?

Military discounts are not always applied automatically and typically must be requested when getting a quote or updating a policy. Drivers should inform the insurer of their military status and provide the required proof to ensure the discount is properly applied.

Does age affect rates even with a military discount?

Yes, age affects car insurance based on risk, but qualifying for a military discount can help many families looking for cheap auto insurance for teens.

Do I qualify for USAA if my brothers are active military members?

USAA membership is usually limited to service members, veterans, and their spouses or children. Having a brother in the military typically does not qualify you unless you meet eligibility through your own service or a parent.

Use our free comparison tool to see which insurance you qualify for from providers in your area.

How do deployment or vehicle storage discounts work?

Deployment or vehicle storage discounts lower premiums when a service member is deployed because risk is reduced when the car is not being driven. USAA offers the biggest deployment discount of 60%.

Can military discounts be combined with other auto insurance savings?

Yes, many insurers allow service members to stack bundling, safe driver rewards, vehicle storage, usage-based programs, and low-mileage auto insurance discounts to reduce military car insurance premiums.

Do military auto insurance discounts vary by state?

Yes. Although several insurance companies offer between 10% and 30% military car insurance discounts, the final rate is determined by local laws, coverage needs, and claim costs.

Can I avoid paying for car insurance while I am on active-duty military leave?

Do veterans qualify for the same discounts as active-duty members?

Who’s eligible for military car insurance coverage?

Does USAA membership extend to grandchildren?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.