How to Buy Insurance for a New Vehicle in 2026

New car insurance rates start at $55 a month. To buy insurance for your new vehicle, start by collecting driver and vehicle information. Check your state’s requirements and compare coverage options to understand when you might need comprehensive or collision insurance over basic liability protection.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Copywriter

Malory Will has an M.A. in English from Arizona State University. She has over four years of experience in writing for the insurance industry. With a background in health, auto, life, and homeowners insurance, Malory is passionate about making complex insurance topics clear and approachable. Her goal is to help readers make informed decisions with confidence.

Malory Will

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Insurance Claims Support & Senior Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she had similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Updated February 2026

Find out how to buy insurance for your new car online by comparing providers, coverage options, and discounts. Basic policies start at just $55 per month.

- Buy insurance for your new vehicle using the VIN before driving home

- Activate coverage the same day to meet lender rules and state minimums

- Add comprehensive or collision if your new car is financed or leased

Before you finalize anything, double-check your state minimums, lender rules, and the exact day your coverage should start.

Be sure your coverage is active before you drive your car home. This helps you avoid any gaps or penalties.

How to Buy Insurance for a New Vehicle| Step | What to Do | Why it Matters |

|---|---|---|

| #1 | Gather vehicle and driver info | Required for accurate quotes |

| #2 | Check state minimum coverage | Insurance laws vary by state |

| #3 | Confirm lender or lease rules | Most require full coverage |

| #4 | Compare coverage and quotes | Prices and protection differ |

| #5 | Choose policy and start date | Must be insured before driving |

| #6 | Pay and save proof of insurance | Proof is legally required |

This article covers new car insurance coverage options and when to consider comprehensive or collision insurance.

You’ll also learn how to compare quotes quickly by entering your ZIP code to review local pricing, coverage limits, and lender requirements before selecting a policy.

How to Buy Insurance for a New Vehicle

Getting insurance for your new car is more than just filling out forms. It helps you avoid problems before you even hit the road.

If you have your information ready, insurers can give you accurate prices instead of estimates that might change later, which is especially helpful if you’re also considering auto insurance for multiple vehicles.

When you compare quotes to buy auto insurance, you’ll notice each insurer prices risk differently, which is why monthly rates might start around $55 but can go up quickly.

State laws and lender rules decide how much coverage you need, and this can make your insurance cost more than just the basic amount.

Step #1: Gather Vehicle and Driver Info

It’s much easier to buy insurance for a new car if you have your driver and vehicle details ready before you start. Missing information can slow things down or change your price later when insurers check your details.

Having your VIN, mileage, address, license, and driving history on hand helps you get accurate quotes right away.

When insurers have all the details upfront, they can assess your risk without extra follow-up or changes. This way, you can compare options easily and avoid surprises after you choose a policy.

Being organized early also helps you get coverage faster, so you’re insured before you pick up your car and meet any state or lender requirements.

Check it Out: Auto Insurance Rates by Vehicle

Step #2: Check State Minimum Coverage

Before you choose a policy, make sure you know your state’s minimum coverage rules for insuring a new car.

Each state has its own coverage limits, so what’s enough in one state may not meet the requirements in another. Learn More: Auto Insurance Requirements by State

New car buyers should confirm state liability limits before pickup. In particular, low property damage limits can delay registration.

Michelle Robbins Licensed Insurance Agent

Minimum coverage rules affect not only what’s legal but also your costs and how secure you feel.

Using insurance comparison sites makes it easier to see how different insurers handle state requirements and pricing.

If you only have minimum coverage, you might pay more out of pocket if you get into an accident.

Looking up these rules early helps ensure your new car insurance coverage meets legal requirements and avoids fines, registration delays, or last-minute changes.

Step #3: Confirm Lender or Lease Rules

If you’re buying a new car, make sure to check the lender or lease rules early so you don’t run into delays. How you pay for the car is important.

If you’re financing, you’ll probably need full coverage auto insurance to protect the lender’s investment.

Insurance Requirements by How You Pay for a New Car| Purchase Type | Required Coverage | Why It’s Required |

|---|---|---|

| All Purchases | Proof of car insurance | Legal requirement to drive |

| Financed Vehicle | Standard full coverage | Protects the lender’s loan |

| Leased Vehicle | Expanded full coverage | Leasing company owns vehicle |

| Paid in Full | State minimum liability only | No lender financial risk |

If you pay for your car in full, you may only need your state’s minimum liability coverage because there’s no lender involved. Leased cars usually have stricter coverage rules since the leasing company still owns the car.

It’s a good idea to check these requirements before you start shopping. This way, you won’t get a policy that’s rejected. Taking care of this early helps keep your coverage active, your paperwork simple, and your pickup day easy.

Step #4: Compare Coverage and Quotes

Comparing coverage and premiums helps you make sense of buying insurance for your new car.

Since insurers assess risk differently, the same driver can get very different prices and coverage options. Use our guide on how to compare auto insurance companies to get free quotes.

Auto Insurance Monthly Rates for New Vehicles by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $65 | $147 |

| $78 | $175 | |

| $69 | $157 |

| $56 | $128 |

| $74 | $172 | |

| $55 | $126 | |

| $82 | $186 |

| $64 | $151 | |

| $59 | $133 | |

| $70 | $160 |

State Farm is one of the cheapest car insurance companies for new cars, along with Erie and Geico.

However, the best choice often combines a reasonable monthly price with the types of car insurance that match your driving habits.

Auto Insurance Options for New Vehicles| Coverage | What it Covers |

|---|---|

| Accident Forgiveness | Prevents rate hikes after claims |

| Collision Coverage | Pays for vehicle repairs after an accident |

| Comprehensive Coverage | Damage from theft, weather, or animals |

| Custom Equipment | Aftermarket parts and accessories |

| Gap Insurance | Loan balance beyond vehicle value |

| Glass Repair | Windshield and window repairs |

| Liability (BI / PD) | Injuries or damage you cause |

| Loan or Lease Payoff | Remaining loan or lease balance |

| Medical Payments (MedPay) | Medical bills for you and passengers |

| New Car Replacement | Replaces totaled car with new model |

| OEM Parts Replacement | Repairs using manufacturer parts |

| Personal Injury Protection (PIP) | Medical costs and lost wages |

| Rental Reimbursement | Rental car during repairs |

| Roadside Assistance | Towing, jump-starts, lockouts |

| Uninsured Motorist | Injuries caused by uninsured drivers |

| Underinsured Motorist | Costs when coverage limits fall short |

Lower prices can seem appealing, but they often mean less protection and higher costs if something happens. Other options help you control out-of-pocket costs, while others are more important for repairs, medical bills, or loan payments.

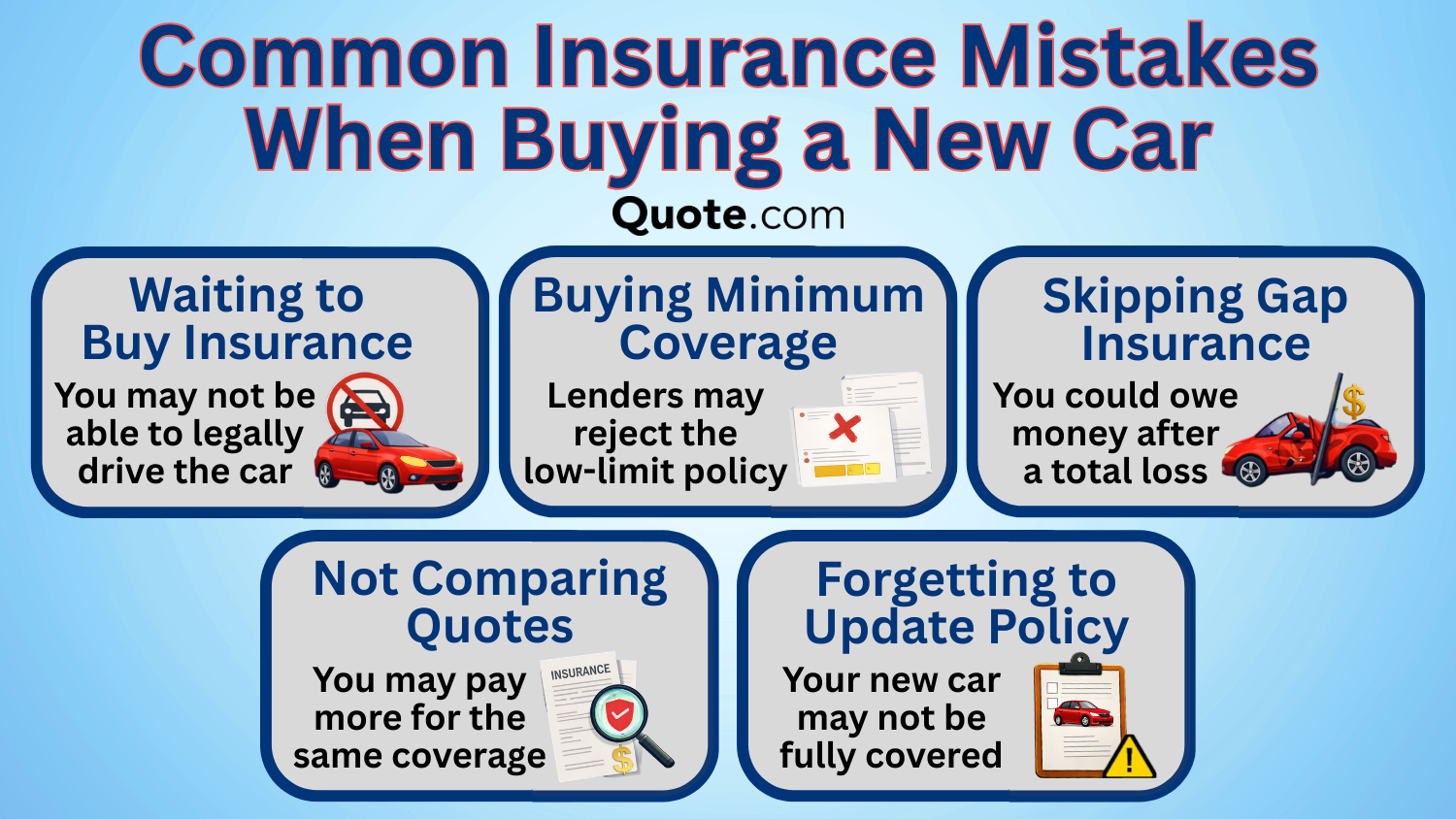

Comparing quotes makes it easier to find coverage that offers both a fair price and good protection, but many drivers don’t shop around for insurance quotes when they buy a new car. It’s one of the most common mistakes drivers with new vehicles make.

Once you look at monthly costs, it’s easy to see why comparing coverage and quotes matters so much when buying insurance for a new car. Read More: Average Cost of Auto Insurance

Comparing multiple providers also helps you see key details beyond price, like how the State Farm car insurance grace period compares to other companies.

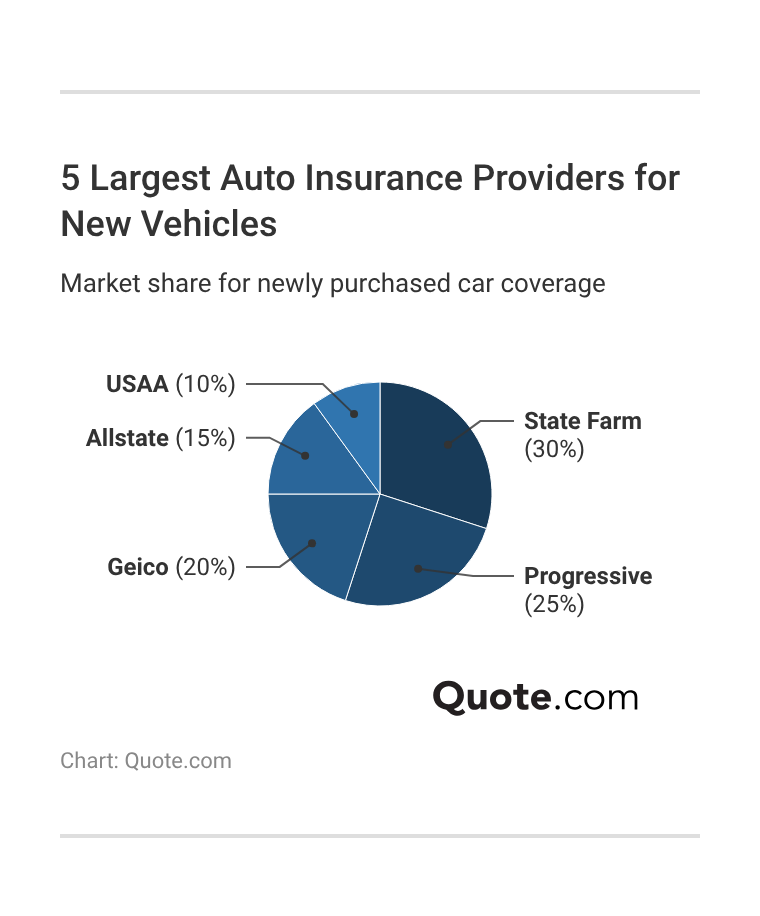

Insurers with a larger market share often make it easier to set up new-car policies, which can influence your claims experience and long-term costs.

Still, just because an insurer is popular doesn’t mean it’s right for everyone. The best choice is one that’s reliable and offers coverage and prices that fit your budget and driving needs.

Important Details: How to Get an Anonymous Auto Insurance Quote

Step #5: Choose Policy and Start Date

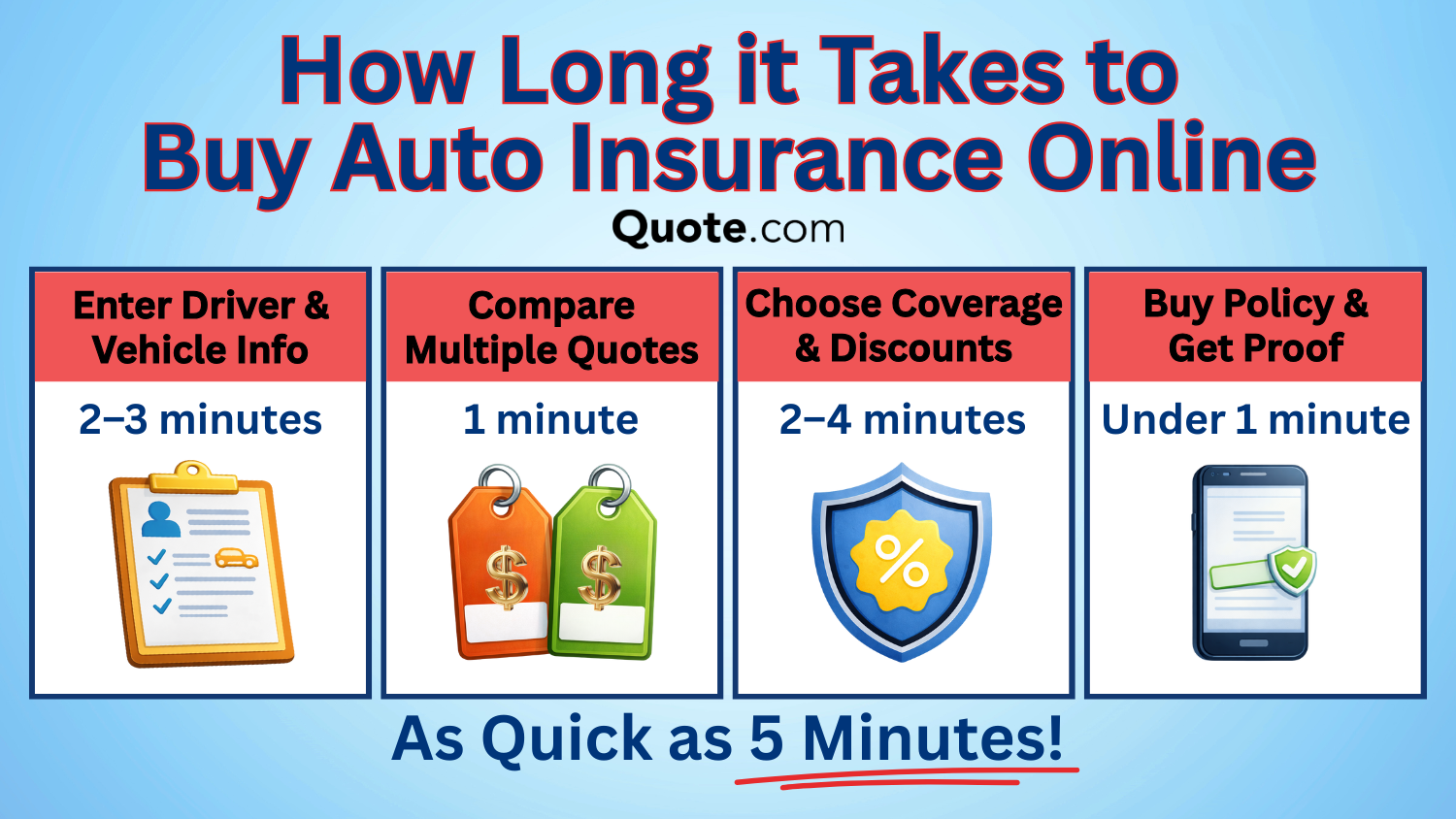

Picking your policy and start date is the next step in getting insurance for your new car. Your insurance should be active before you drive, even if it’s just the short drive home from the dealership.

If your start date is too late, you might drive without coverage, and driving without auto insurance is illegal in most states.

When to Get Insurance for a New Car| Scenario | When to Buy |

|---|---|

| Adding a second vehicle | Within the same day |

| Buying a car online | Before the delivery date |

| Buying a car out of state | Before driving the car home |

| Buying from a dealership | Before leaving the dealership |

| Buying from a private seller | Before picking up the car |

| Dealer grace period offered | Before the grace period ends |

| First-time car buyer | Before driving the car |

| Leasing a vehicle | Before signing the lease |

| Registering a vehicle | Before registering the vehicle |

| Replacing an insured vehicle | Before driving the new vehicle |

| Switching insurers | Before canceling current policy |

If it’s too early, you’ll pay for coverage you don’t need yet. It’s best to set your policy to start on the day you pick up your car, so you’re covered as soon as you get the keys.

Most providers sell car insurance online to help drivers get covered quickly, and companies like Geico and Progressive offer additional flexibility, like the Progressive new car grace period.

Taking a moment to check your timing can help you avoid gaps in coverage, fines, or problems with claims later.

This keeps lenders and state regulators satisfied and avoids additional hassle during the car-buying process.

Step #6: Pay and Save Proof of Insurance

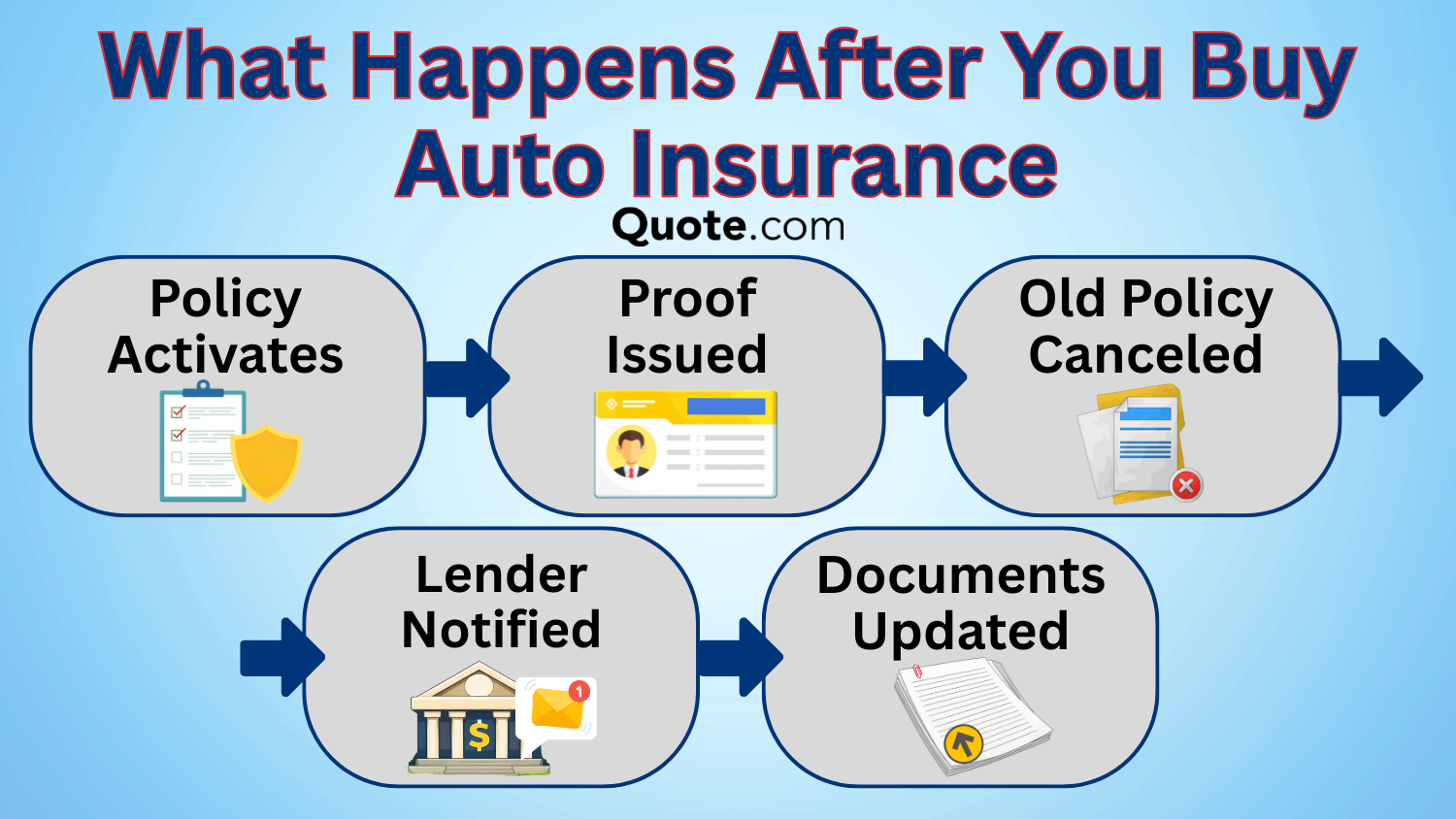

The final step in learning how to buy insurance for a new car is paying for your policy and saving your proof of insurance, as outlined in this auto insurance guide.

This step matters. After you pay, your coverage starts, and you can drive legally without worrying about fines.

Proof of insurance lets officers, lenders, or dealerships know you’re covered, so keep it easy to find. Most people use digital proof on their phones for daily needs.

It’s a good idea to keep a backup copy saved or printed in case your phone isn’t available. Storing your proof properly can help you avoid stress during traffic stops or registration.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

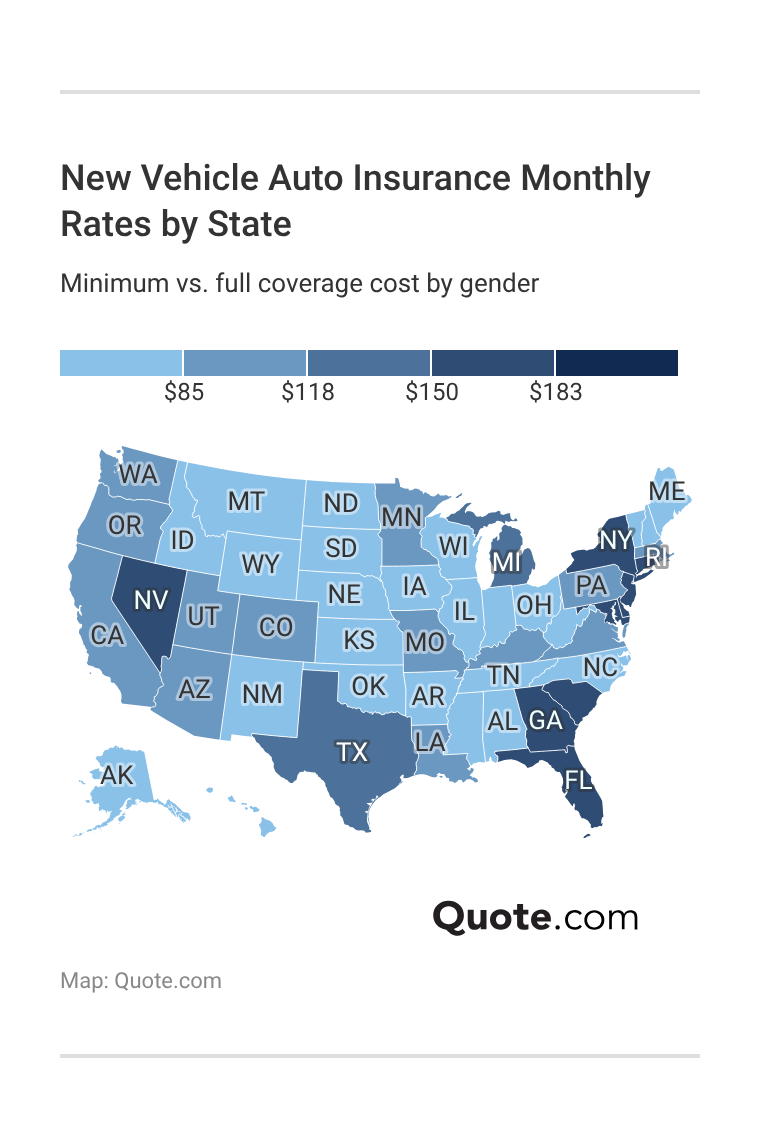

How Location Impacts Auto Insurance

When you look for auto insurance for a new car, the monthly rates tell you more than just the cost. They also show how your location affects what you pay, based on accident rates, repair costs, and local risks.

Higher prices often indicate more traffic, bad weather, or higher medical costs in that area. Check Out: Auto Insurance Rates by State

Lower prices usually mean there are fewer claims and lower insurance costs overall. This means the same coverage might be cheap in one state but expensive in another.

Ways to Lower New Car Insurance Costs

You can save money on insurance for your new car by making a few smart choices early on. Depending on how you shop, when your coverage begins, and which discounts you get, your monthly rate could drop by $20 to $60.

The biggest savings often come from combining several small choices, rather than looking for one big discount. This is especially important for new cars, which usually cost more to insure. Here are some practical ways to lower your insurance costs:

- Ask for Discounts: Ask your insurer about discounts for safety features that are common in newer cars.

- Begin Coverage Right Away: Start your coverage on the day you pick up your car so you don’t risk driving uninsured.

- Bundle Policies: Bundle your auto insurance with your renters or homeowners policy to get a discount.

- Choose Higher Deductibles: Pick a higher deductible if you can afford to pay it in case of a claim.

- Compare Free Quotes: Compare quotes using your VIN to make sure the price matches your exact car.

Read our guide to the 10 best auto insurance companies to learn how to buy insurance for a new car online at the best price.

Another easy way to save is by taking a closer look at your coverage limits and skipping extras you don’t really need. Sticking to what meets state or lender rules can help keep your monthly costs down without leaving you unprotected.

Getting the Best Insurance for Your New Car

To get the right policy for your new car, take time to make informed choices instead of picking the first option you find, especially when considering the best time to buy a new car.

The best way to find the right policy is to compare quotes. This lets you see how prices, coverage limits, and exclusions can vary for the same car and driver.

Monthly rates are important, but a good policy should also protect you from costly repairs, claim issues, and coverage gaps. People who compare quotes often save money and feel more confident in their decision.

By carefully comparing options, you can make sure your new car is well protected from the start when you enter your ZIP code to get a new car insurance quote.

Frequently Asked Questions

How do you get insurance for a new car?

To add coverage, give the insurer your car’s VIN, pick the types of coverage you want, choose a start date, and pay your first premium.

Can you buy car insurance and use it immediately?

Yes, most insurers let you start your coverage the same day, often within minutes, once your payment goes through and you pick a start time.

What documents do you need to get insurance for a new car?

Insurers typically require the VIN, driver’s license, address, garaging location, and driving history.

How does car insurance work when you buy your first car?

Car insurance covers both you and your vehicle. Your rate depends on things like your driving record, the car’s value, where you live, and the coverage you choose. Shop with the best auto insurance companies for new drivers to find affordable coverage.

How quickly do you have to insure a new car?

Insurance must be active before the car is driven, including driving it off the lot or using public roads, as outlined in this ultimate insurance cheat sheet.

When you buy a car from a dealership, does it come with insurance?

No, dealerships do not provide insurance, and proof of active coverage is required before taking delivery.

Which insurance is best for a brand-new car?

Full coverage is usually best because it protects against collision damage, theft, weather losses, and lender requirements. Compare cheap full coverage auto insurance to find the best rates near you.

Do newer cars get cheaper insurance?

No, newer cars usually cost more to insure because repairs are more expensive, they have advanced technology, and they’re worth more.

When should you shop for new car insurance?

If you shop for insurance before you buy or pick up your car, you’ll get accurate quotes, avoid delays, and make sure your coverage starts when you need it.

What is the cheapest day to buy auto insurance?

There is no cheapest day, but shopping early helps you find the cheapest car insurance options and reduces the risk of higher last-minute premiums.

Do you need insurance to buy a car from a private seller?

Do you need insurance to buy a car from a dealership?

How long do you have to get insurance on a new car in Texas?

How much coverage do you need for a new car?

Do you need full coverage for a new car?

Do all insurance companies have grace periods for new cars?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.