Diminished Value Claims (2026)

Diminished value claims compensate you when an accident permanently reduces your vehicle's value. The average diminished value settlement is between $500 and $5,000. Determining if you're eligible for a DV claim can help you recoup any lost resale value and prevent thousands in unrecoverable losses.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Karen Condor is an insurance and finance writer who has degrees in both journalism and communications. She began her career as a reporter covering local and state affairs. Her extensive experience includes management positions in newspapers, magazines, newsletters, and online marketing content. She has utilized her research, writing, and communications talents in the areas of human resources, f...

Karen Condor

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Scott Young

Principal Broker

William Lemmon has been a licensed insurance agent for over 12 years. He is the principal broker and owner of Broadway Insurance Services in Los Angeles, CA. He works one-on-one with clients to create personalized plans that minimize risk and maximize savings. Being one of the foremost authorities on Airbnb and home-sharing property insurance, Lemmon offers his clients first-hand guidance on how t...

William Lemmon

Updated January 2026

Diminished value (DV) claims recover the loss of your vehicle’s market value after it has been repaired following an accident.

- Diminished value applies only if the car is repairable, not totaled

- At-fault drivers generally cannot recover diminished value

- Mileage and damage severity can reduce DV to under $1,000

Diminished value claims often range from $500 to $5,000, depending on vehicle value, mileage, and damage severity. Insurers commonly use a 10% base formula, while state insurance law determines whether a car value loss claim is allowed.

These claims are typically filed against the at-fault driver’s liability auto insurance, making eligibility and documentation key to whether compensation is possible.

If you need affordable auto insurance to cover DV claims, enter your ZIP code into our free quote comparison tool.

Diminished Value Claims Explained

When an accident permanently reduces a car’s resale value after full repairs, insurers refer to that loss as diminished value.

Even when repairs restore the car’s function and appearance, its accident history, often listed on vehicle reports, is the biggest factor reducing resale value.

Understanding diminished value claims is essential for drivers who want to recover the hidden resale loss that remains even after a vehicle has been fully repaired following an accident.

Diminished Value Claims: Key Details| Feature | Details |

|---|---|

| Biggest factor | Accident history on vehicle reports |

| Definition | Compensation for lost value after repairs |

| Example | $20k before → $17k after → $3k DV |

| Other name | Post-repair value loss |

| Purpose | Recover lost resale value |

| Typical payout | $500–$5,000 |

| When denied | If you’re at fault or DV restricted |

| When it applies | When another driver is at fault |

| What’s not covered | Your own collision or comprehensive |

| Who pays | At-fault driver’s liability insurance |

For example, if a vehicle was worth $20,000 before an accident and is only worth $17,000 afterward, the $3,000 difference represents diminished value.

Diminished value claims generally apply if the accident was clearly caused by another driver, since the at-fault party’s liability insurance is responsible for paying the claim.

Insurers typically require stronger evidence for a vehicle value loss claim, such as professional appraisals, market comparisons, and repair documentation, to substantiate the loss.

This documentation serves as proof of diminished value and helps establish a clear link between the accident, the completed repairs, and the vehicle’s reduced resale price.

There are two main types of diminished value in insurance you can file claims for: immediate and inherent DV.

- Immediate Diminished Value Claim: Occurs right after the accident, before repairs are completed

- Inherent Diminished Value Claim: Reflects the long-term loss caused by a permanent accident record

Inherent diminished value often applies even when repairs fully restore the vehicle’s appearance and performance.

Insurers frequently dispute inherent diminished value because it is tied to market perception rather than physical damage (Read More: Best Auto Insurance Companies for Claims Handling).

Diminished value claims are usually third-party claims filed against the other driver’s insurance.

Michelle Robbins Licensed Insurance Agent

Although less common, repair-related diminished value is another type of claim. It results from incomplete or improper repairs that leave lasting defects or reduce vehicle reliability.

However, you may not be eligible for a repair-related claim if the cost of repairs exceeds the value of your car.

Auto Insurance Diminished Value vs. Total Loss

Insurance outcomes vary significantly depending on whether a damaged vehicle is repairable or a write-off.

When repairs are possible, insurers assess whether the car’s accident history has permanently reduced its resale value. This can result in a loss-in-market-value claim tied to the gap between the vehicle’s pre- and post-repair values.

Diminished Value vs. Total Loss: Key Differences| Feature | Diminished Value | Total Loss |

|---|---|---|

| Definition | Loss in value after repairs | Repair costs exceed value |

| Key Factor | Accident history lowers resale | Repair cost over value |

| Payout Basis | Pre- and post-repair value gap | Paid actual cash value (ACV) |

| Typical Amount | $500–$5,000 | Full ACV minus deductible |

| When it Applies | Car is repairable | Damage is too severe or costly |

| Who Pays | At-fault driver’s liability | At-fault driver’s insurer |

How insurers handle your post-repair value claim also depends on the company and the evidence provided. If the accident is your fault, diminished value is generally not recoverable.

If damage is too extensive and repair costs exceed the vehicle’s value, the claim is classified as a total loss, and payment is based on actual cash value rather than resale value.

Many carriers listed review these claims only when liability is clearly established, and the claim is filed against their insured.

To assess payouts, adjusters typically apply a mileage multiplier to account for age and use, then apply a damage multiplier to reflect repair severity and structural impact.

Read More: At-Fault Accidents & Insurance Rates

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Calculate Diminished Value

Diminished value is commonly calculated using a standardized method that estimates how much a car’s market value drops after an accident.

This process is often used to support a lower-resale-value claim and begins with the vehicle’s pre-accident value. By reviewing these valuation steps, drivers can find out what their claim is worth before negotiating a diminished value settlement with the at-fault driver’s insurance company.

This is an example of a diminished value calculation with a car valued at $20,000 is assigned a base loss of 10%, or $2,000.

How Diminished Value Is Calculated| Step | Formula | Result |

|---|---|---|

| Pre-accident vehicle value | → | $20,000 |

| Base loss (10%) | $20,000 x 0.10 | $2,000 |

| Damage severity multiplier | $2,000 x 0.5 | $1,000 |

| Mileage multiplier | $1,000 x 0.8 | $800 |

| Final diminished value amount | → | $800 |

Insurers often reference widely used pricing guides, such as the Kelley Blue Book diminished value calculator, when determining a vehicle’s pre-accident value.

To understand how claim handling and valuation methods vary, it’s often helpful to compare auto insurance companies before filing or negotiating a DV claim.

Insurance Companies That Accept Diminished Value Claims| Insurance Company | Details |

|---|---|

| Reviews DV claims depending on state rules |

| Considers DV claims on a case-by-case basis | |

| Reviews DV claims when liability is clear | |

| Considers DV claims filed against their insured |

| Reviews DV claims with evidence | |

| Considers DV claims on eligible policies | |

| Accepts DV claims when liability is established |

| May request supporting valuation for DV | |

| Considers third-party DV with documentation | |

| Reviews DV claims from not-at-fault drivers |

| Reviews DV claims subject to state rules | |

| Considers DV claims case-by-case | |

| Considers DV claims with supporting proof | |

| Considers DV from not-at-fault claimants | |

| Third-party DV consideration varies by state |

Because diminished value claims are negotiated rather than automatic, each company has its own process based on carrier guidelines, state laws, and documentation standards.

Almost all providers request supporting evidence, so obtaining an independent appraisal, market comparisons, and detailed repair receipts can significantly influence whether an insurer accepts the claim and how much is ultimately paid.

Determining Vehicle Market Value Losses

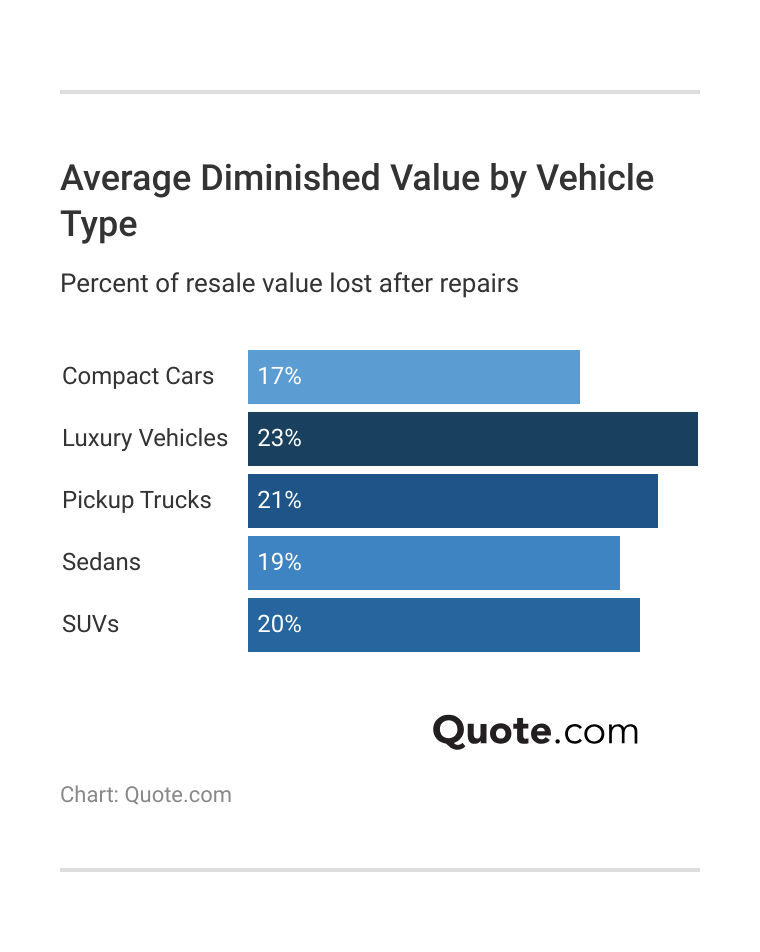

Like a diminished value calculator, this table compares vehicle market value before a crash and after repairs, showing how diminished value affects different vehicle types.

Even when repairs are completed, vehicles typically sell for less due to accident history, which often results in a loss-of-value claim.

Vehicle Market Value vs. Diminished Value Comparison| Vehicle Type | Pre-Crash Value | Post Repair | Diminished Value |

|---|---|---|---|

| Compact Car | $16,000 | $14,000 | $2,000 |

| Luxury Car | $58,000 | $52,000 | $6,000 |

| Pickup Truck | $42,000 | $37,500 | $4,500 |

| Sedan | $22,000 | $18,500 | $3,500 |

| SUV | $35,000 | $31,000 | $4,000 |

For example, a compact car drops from $16,000 to $14,000, resulting in a $2,000 diminished value, while a luxury car loses $6,000 after repairs.

Pickup trucks, sedans, and SUVs also show that diminished value increases with higher vehicle prices and resale expectations.

Luxury vehicles experience the highest average loss at 23%, followed by pickup trucks at 21% and SUVs at 20%.

Sedans and compact cars have lower percentage losses, reflecting steadier resale demand (Learn More: Auto Insurance Rates by Vehicle).

Filing a Diminished Value Claim

Unlike other auto insurance claims, a DV claim only covers a vehicle’s lost value after an accident. It focuses on reduced resale value rather than repair costs.

The only type of insurance you can file an auto value reduction claim on is liability or uninsured motorist. This principle applies when filing a USAA diminished value claim, a State Farm diminished value claim, or with any company, though insurer handling may vary.

Diminished Value Claim Eligibility by Coverage Type| Coverage | Eligibility | Who Pays? |

|---|---|---|

| Collision | ❌ | N/A |

| Comprehensive | ❌ | N/A |

| Liability-Only | ✅ If not at fault | At-fault driver |

| PIP or MedPay | ❌ | N/A |

| Uninsured Motorist | ⚠️ Varies by state | UM Coverage |

Collision, comprehensive, PIP, and MedPay do not compensate for diminished market value because they are designed to cover repairs or medical costs only.

Filing a depreciation claim requires more than showing repair invoices or photos of the damage. Drivers often ask, “How to file a diminished value claim?”, since the process requires specific documentation, proof of fault, and valuation support beyond standard repair claims.

Follow these steps to establish a clear link between the accident and your reduced value claim:

- Confirm the other driver was clearly at fault for the accident.

- Gather repair records, photos, and pre-accident market value data.

- Schedule a diminished value appraisal or market comparison.

- Submit the claim to the at-fault driver’s liability insurer.

Once you file a DV claim, you’ll likely need to negotiate the payout when the insurer disputes the valuation.

Strong documentation, including appraisals and market comparisons, can significantly help when providers question the claim’s validity or amount.

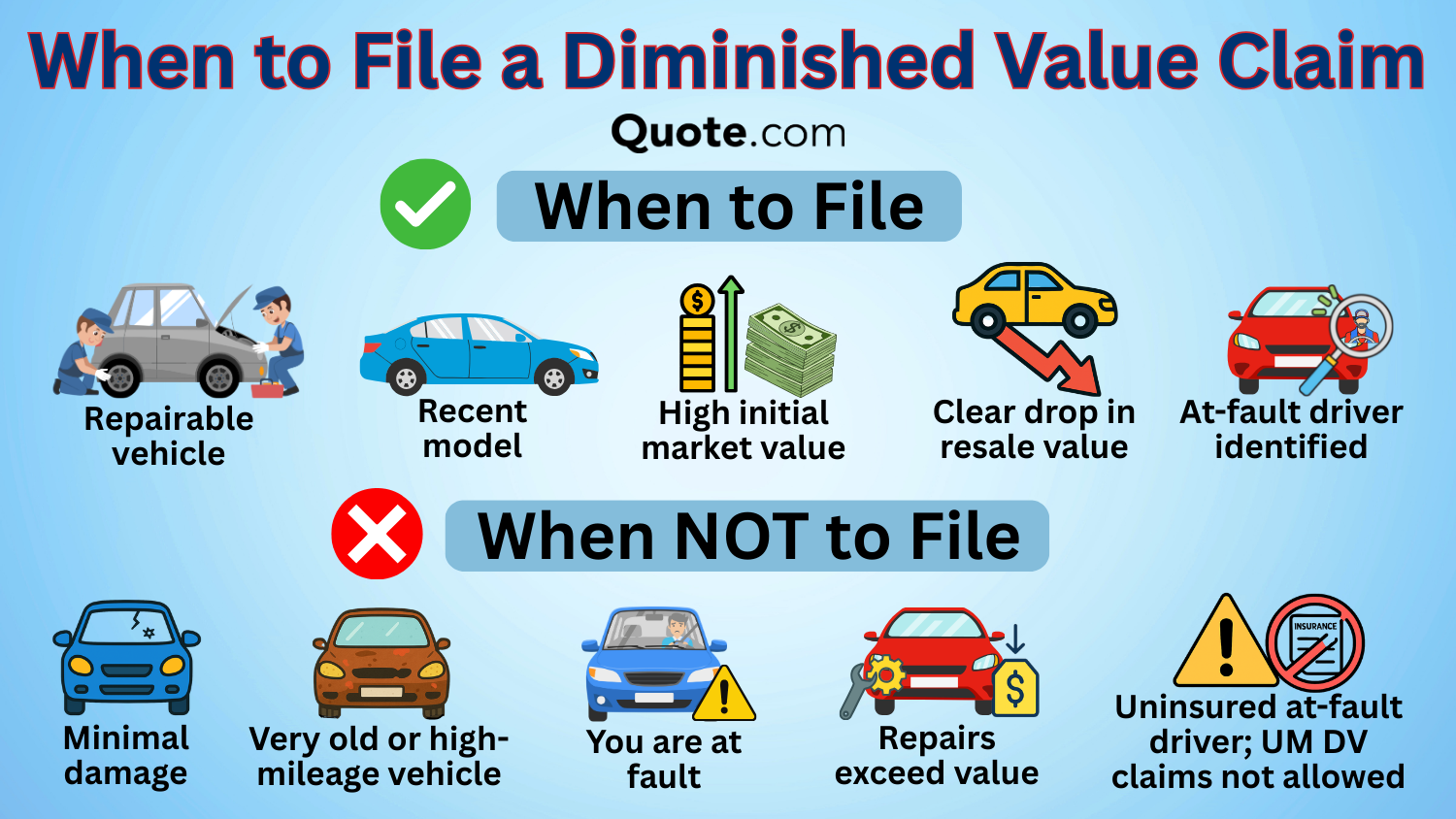

Knowing when to file is also important. State-level allowances vary, and eligibility depends on more than repair quality alone.

For instance, you won’t be eligible if you’re at fault for the collision or drive an older vehicle. Insurers will also reject DV claims where the repairs exceed the value of the car,

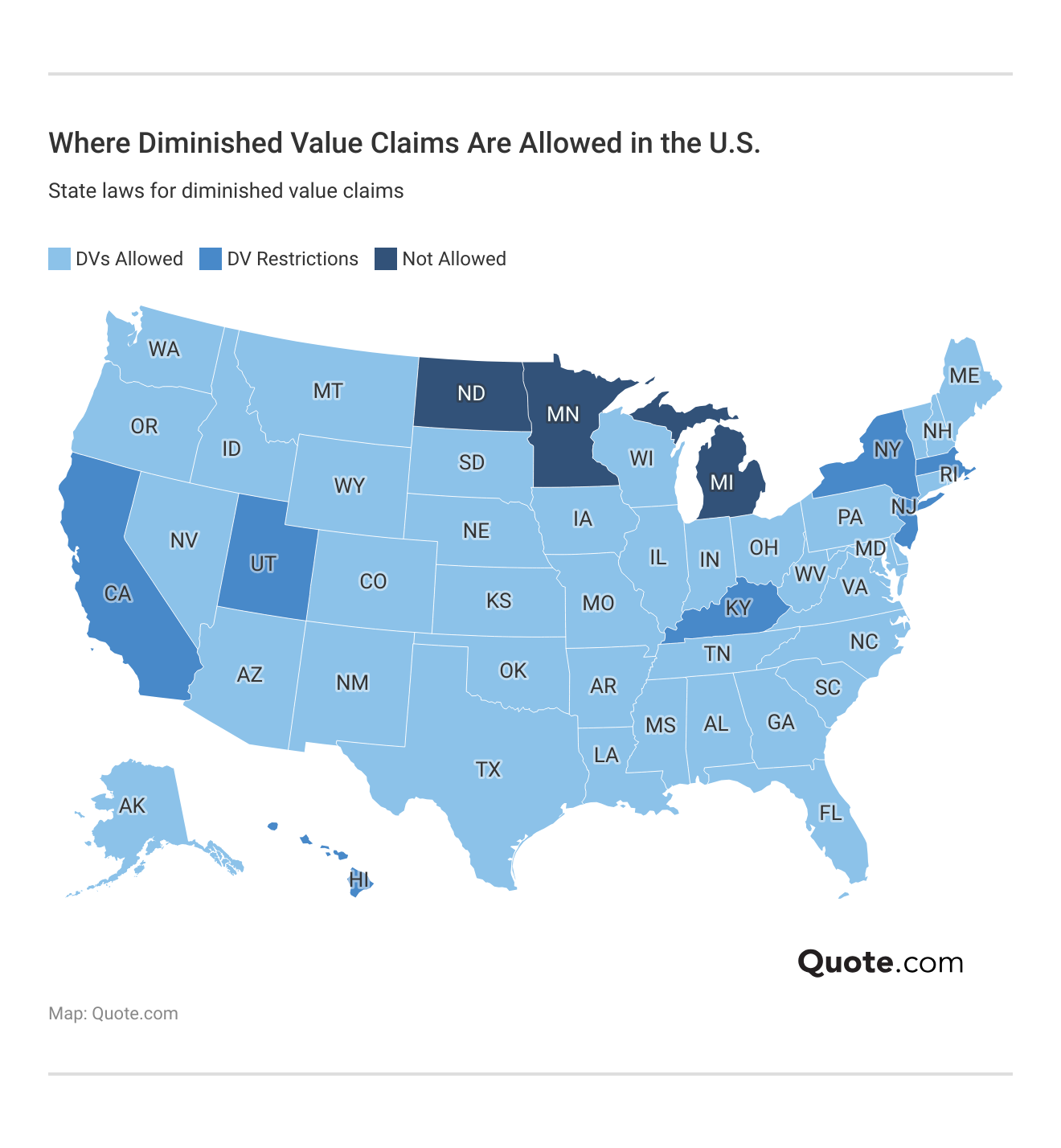

How Diminished Value Claims Work by State

Diminished value claims are not treated the same way nationwide. Whether an insurer must recognize a vehicle’s post-accident loss in value depends largely on state law, court precedent, and how insurers interpret liability obligations.

Some states clearly allow diminished value claims; others restrict their application; and a few do not recognize them at all.

In states with restrictions, insurers may deny claims unless specific legal or evidentiary standards are met.

Knowing where diminished value claims are permitted helps drivers set expectations and determine whether to gather documentation and negotiate with insurers.

Get the Most Out of a Diminished Value Claim

Diminished value claims help drivers recover the hidden financial loss that remains after an accident, even when repairs are completed correctly.

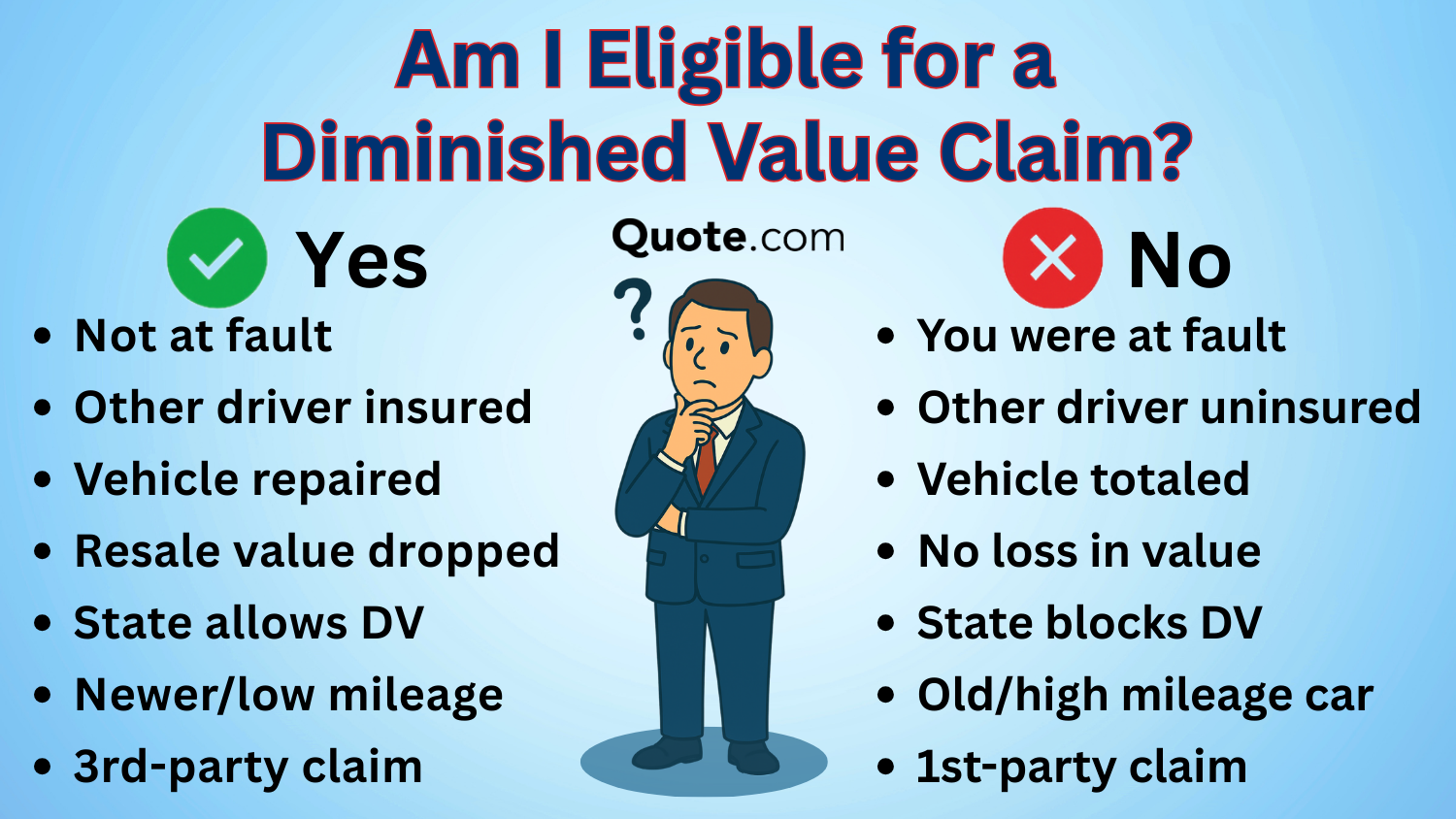

These claims are typically available only to not-at-fault drivers and are usually filed against the other party’s liability coverage, not their own collision or comprehensive policies.

The importance of filing a diminished value claim becomes clear when drivers realize that accident history alone can reduce a vehicle’s resale value by thousands of dollars, even when repairs are completed correctly.

Eligibility depends on fault, state law, vehicle condition, and supporting proof such as appraisals and local market trends. Totaled vehicles are generally excluded.

When properly documented and filed in an eligible state, a diminished value claim can help protect a vehicle’s true resale value and reduce long-term financial loss after an accident.

You can only file diminished value claims on certain types of auto insurance. Enter your ZIP code to compare policies near you.

Frequently Asked Questions

What is a diminished value claim?

A diminished value claim refers to the loss in a vehicle’s market price after an accident, even when repairs are completed correctly, and the car appears fully restored.

Will your insurance company pay for a diminished value claim?

Insurance companies may pay a diminished value claim when another driver is at fault, but the outcome often depends on documentation quality, valuation support, and how well the claim is presented.

Read More: How to File an Auto Insurance Claim & Win

Are insurance companies required to pay a diminished value claim?

Insurance companies are not universally required to pay diminished value claims, as obligations depend on state law, liability rules, and applicable coverage requirements.

Enter your ZIP code to explore which companies have the cheapest auto insurance rates for you.

How long does it take to get a diminished value claim payout?

Receiving payment for a diminished value claim can take weeks or months, depending on insurer response times, valuation disputes, and how efficiently the claim is reviewed.

Is a diminished value claim worth it?

A diminished value claim is often worth pursuing when resale loss exceeds several hundred dollars, though success rates tend to be lower in states with stricter claim limitations.

Can you negotiate a diminished value claim?

Yes, a diminished value claim is negotiable, especially when market data, appraisals, and comparable sales support the loss, with state-specific auto insurance rates often influencing how aggressively insurers evaluate and settle claims.

Read More: Auto Insurance Rates by State

How do you calculate a diminished value claim?

Diminished value claim is commonly calculated using a base percentage of the vehicle’s pre-accident value, adjusted for damage severity, mileage, and overall vehicle condition.

Who can file diminished value claims?

Only not-at-fault drivers with repairable vehicles are typically eligible to file a diminished value claim, while eligibility may be restricted in certain states.

How do you file a diminished value claim?

To file a diminished value claim, drivers must submit repair records, valuation evidence, proof of fault, and supporting market comparisons.

Does mileage affect a diminished value claim?

Mileage directly impacts diminished value claims because vehicles with higher mileage have lower resale appeal. Our auto insurance guide discusses depreciation.

Does state law affect diminished value claim eligibility?

Can an accident caused by animals or natural disasters result in a diminished value claim?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.