Driving Without Auto Insurance in 2026

Driving without auto insurance is illegal in most states. Penalties for driving without car insurance include fines of $100–$5,000, reinstatement fees, license or registration suspension, and higher insurance rates. You must maintain your state’s required minimum coverage to avoid a coverage lapse.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Social Media Manager & Professor

Ashley Dannelly has a Master of Arts in English and serves as the Social Media Manager for Quote.com's portfolio of websites. Ashley also teaches English at Columbia International University and other higher education institutions. Ashley’s background in English and media has allowed her the unique opportunity to edit and create content for many publications, including Livestrong and DiveIn....

Ashley Dannelly

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Scott Young

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated January 2026

Driving without auto insurance can lead to serious consequences, including fines up to $5,000, license or registration suspension, and long-term increases in insurance rates.

- Driving without auto insurance can lead to fines, suspension, and higher rates

- Uninsured accidents may leave you paying medical, property, and legal costs

- Getting insured fast can limit penalties and speed up reinstatement

If an uninsured driver causes an accident, they may be personally responsible for tens or even hundreds of thousands of dollars in damages. Most states actively enforce coverage laws using electronic verification, making even short lapses risky.

This auto insurance guide breaks down the penalties, state laws, accident costs, and steps to take if you’re caught driving uninsured. Get fast and cheap auto insurance coverage today with our quote comparison tool.

What Happens When You Drive Uninsured

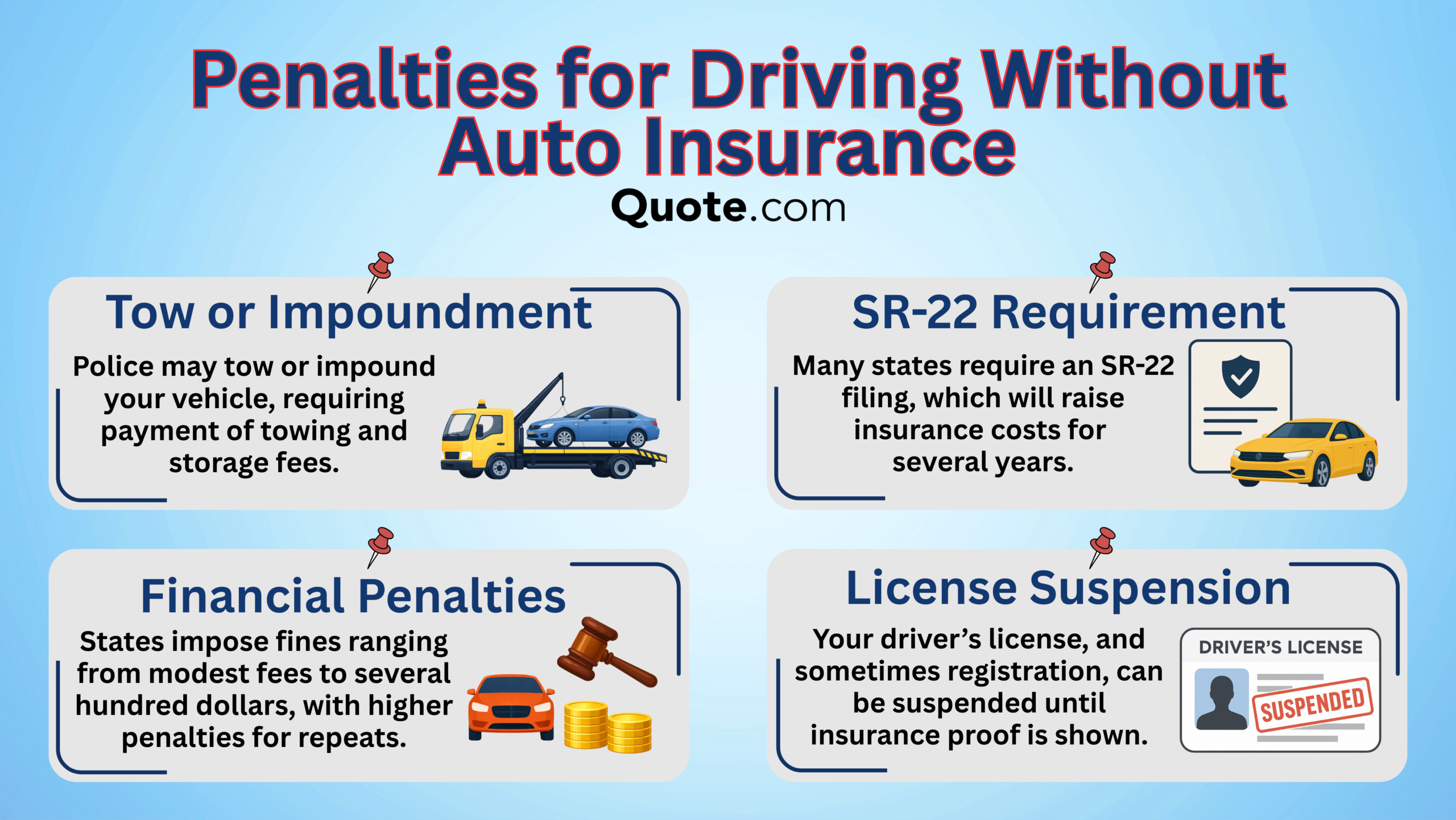

Driving without car insurance can lead to serious problems, even if you don’t get into an accident.

Many states issue tickets, suspend your license or registration, and charge reinstatement fees ranging from $50 to $500.

Consequences for Driving Without Auto Insurance| Consequence | Description | Financial Impact |

|---|---|---|

| At-Fault Crash Liability | You pay for all damages | Can be very high |

| Civil Lawsuits | Can be sued for damages | Can be very high |

| Higher Insurance Rates | Lapse can raise rates | High ongoing cost |

| License Suspension | Loss of driving privileges | Fees: $50-$500 |

| Registration Suspension | Can't be legally driven | Fees: $50-$500 |

| Reinstatement fees | Fees required to reinstate | High: up to $500 |

| SR-22 Requirement | Mandated for insurance | Fee + higher rates |

| Towing or Impoundment | Tow or impound possible | Fees: $150-$1,000+ |

| Traffic Fines | Fines & court penalties | Fees vary by state |

In some cases, your car may be towed or impounded, adding $150 to $1,000 or more in extra costs.

When you add up fines, fees, and higher insurance costs, driving without coverage usually costs far more than staying insured.

For instance, if you cause an accident while uninsured, you’re personally responsible for paying all medical bills, vehicle repairs, and property damage out of pocket, which is exactly what medical payments coverage is designed to help with.

Other drivers can also sue you, which may lead to large court judgments and long-term financial stress. The consequences don’t end once the fine for driving without insurance is paid.

A lapse in insurance often leads to higher rates when you try to get covered again, and many drivers are required to file an SR-22, which adds fees and raises premiums for several years.

Fines & Penalties After Multiple Offenses

Penalties for driving without insurance get worse each time you’re caught. A first offense usually means fines of $100 to $500, possible car impoundment, and a license suspension lasting 30 to 90 days.

For driving without insurance second offense, fines can rise to $1,000, suspensions last longer, and your car is more likely to be impounded.

Penalties for Driving Without Auto Insurance by Offense| Violation | Typical Fine | Jail Time | Vehicle Impound | License Suspension |

|---|---|---|---|---|

| 1st Offense | $100-$500 | Up to 5 days | Possible | 30-90 days |

| 2nd Offense | $300-$1K | Up to 15 days | Likely | 90-180 days |

| 3rd+ Offense | $500-$5K | Up to 1 year | Very Likely | 1 year-Permanent |

| Uninsured Crash | $5K + Damages | Possible | Yes | Until Fines Paid |

For third or repeat offenses, the penalty for driving without auto insurance is much more serious. Fines can reach $5,000, license suspension may last a year or longer, and jail time is possible.

The risk of driving without insurance depends on the situation, but it increases quickly if a crash is involved.

Uninsured Driving Consequences by Scenario| Driver Situation | Risk Level |

|---|---|

| 1st Offense; No Crash | Moderate |

| Long Lapse in Coverage | Moderate+ |

| Repeat Offense | High |

| Uninsured Crash | Very High |

A first offense with no accident is usually considered a moderate risk, while a long lapse in coverage or repeat offense raises the risk level.

An uninsured accident carries the highest risk, often leading to large fines, license suspension, and full responsibility for all damages and injuries.

Learn More: What Happens If You Cancel Auto Insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

State Laws on Driving Without Car Insurance

Most states require drivers to carry mandatory liability insurance, which helps pay for injuries and property damage you cause to others and is often available through cheapest liability-only auto insurance options.

Driving without liability car insurance is considered illegal in nearly every state and can result in fines, license or registration suspension, and reinstatement fees.

Carrying your state’s required liability insurance is the simplest way to avoid fines, suspensions, and risks of driving without coverage.

Jeff Root Licensed Insurance Agent

States enforce these laws in different ways, but many follow a moderate enforcement approach, where penalties increase if you’re caught driving uninsured more than once.

No-pay-no-play states limit what uninsured drivers can collect after a crash, meaning you may not get paid for certain damages even if the accident wasn’t your fault.

How Driving Without Insurance Is Treated by State| State Law Type | What it Means | Driver Impact |

|---|---|---|

| Moderate Enforcement | Fines & reinstatement fees | Higher penalties for repeats |

| No-Pay-No-Play | Limits ability to recover damages | You may not be paid after crash |

| Strict Enforcement | Heavy fines & suspensions | High penalties even for 1st offense |

Strict enforcement states impose heavy fines for driving without a license or with a suspended registration, and strong penalties, even for a first offense.

Where you live plays a big role in how serious the consequences are. In strict states, one violation can quickly lead to losing your driving privileges and paying high fees.

Even in moderate states, repeat violations can still cause long-term problems, making it harder and more expensive to stay on the road legally.

Drivers in states with tougher insurance laws usually pay higher monthly premiums, while other states see smaller increases. In some areas, average rates can rise above $250 per month after a violation.

These consequences can stay with you long after the incident. Higher car insurance rates can last three to five years in some states, especially if you’re required to file an SR-22.

License suspensions can range from 30 days to over a year, depending on the state. States also vary in how long suspensions last if you have an existing record of violations.

How Long Uninsured Driving Penalties Stay on Your Record| Consequence | Typical Duration |

|---|---|

| Higher Premiums | 3-5 years |

| License Suspension | 30 days-1 year+ |

| Record of Violation | Varies by state |

| SR-22 Requirement | 1-3 years |

Many drivers are also required to file an SR-22 for one to three years, which makes insurance more expensive and harder to keep.

When you add these higher premiums to fines and fees, driving without insurance can cost far more over time than keeping a policy active.

Read More: Auto Insurance Rates by State

What to Do After a Wreck With No Insurance

If you cause an accident while uninsured, you may face fines over $5,000, lose your license until all costs are paid, and be responsible for all damages in at-fault accidents.

Even a minor accident without insurance can be costly, with total expenses ranging from $1,200 to $6,500 for medical bills, car repairs, and court costs.

Keep your auto insurance active at all times. Just one lapse can trigger fines, higher rates, and long-term driving restrictions.

Michelle Robbins Licensed Insurance Agent

A moderate crash can push costs much higher, often between $8,700 and $52,800, especially if injuries are involved.

Severe accidents are the most expensive because they often include large medical bills, major property damage, lost income, and a required SR-22, which makes future insurance much more expensive.

What an Accident Costs Without Auto Insurance| Category | Minor Crash | Moderate Crash | Severe Crash |

|---|---|---|---|

| Court Damages | Up to $10K | $15K-$75K | $100K-$500K |

| Lost Wages Risk | Low | Moderate | High (up to 25%) |

| Mandated SR-22 Risk | Low | High | Very High |

| Medical Bills (Others) | $350-$1.8K | $8K-$34K | $42K-$187K+ |

| Medical Bills (Yours) | $300-$2K | $3K-$10K | $6K-$27.5K |

| Property Damage | $1.2K-$4.7K | $6K-$18K | $20K-$75K+ |

| Your Vehicle Damage | $300-$2K | $3K-$10K | $6K-$27.5K |

| Total Cost | $1.2K-$6.5K | $8.7K-$52.8K | $58K-$785K+ |

Some situations are handled differently under state laws, but they don’t always mean you’ll avoid penalties.

If you’re driving a borrowed car, coverage depends on the owner’s insurance policy, not yours, which is explained further in our guide to types of auto insurance.

Uninsured Driving Exceptions & Special Cases| Situation | What Happens |

|---|---|

| Driving a borrowed car | Depends on policy |

| Insurance just lapsed | May still face fines |

| Parked, not driving | Usually not penalized |

| Proof not in vehicle | Ticket may be dismissed |

A short insurance lapse may still lead to fines, even if coverage was restored quickly. Other cases may be less serious but still require proof.

Vehicles that are parked and not being driven are usually not penalized, and tickets for not carrying proof of insurance may be dismissed if valid coverage is shown later. Even in these exceptions, rules vary by state, so penalties can still apply.

Read More: Average Cost of Auto Insurance

Steps to Take After a No-Insurance Ticket

If you’re caught driving without insurance, the first step is to get coverage as soon as possible. Buying insurance right away may help lower fines or shorten a license or registration suspension.

Next, check your court notice and DMV rules carefully, since deadlines and auto insurance requirements vary by state. Missing them can make penalties worse.

What to Do if You’re Caught Driving Without Insurance| Step | What to Do | Why it Matters |

|---|---|---|

| #1 | Get insurance right away | May reduce fines or suspension |

| #2 | Check court and DMV rules | Deadlines vary by state |

| #3 | Pay required fines and fees | Unpaid fees extend penalties |

| #4 | File proof of insurance | Required to reinstate privileges |

| #5 | Reinstate license & registration | Legal driving restored |

After that, pay all required fines and fees on time, as unpaid balances can extend suspensions or add extra costs. You’ll also need to file proof of insurance with the court or DMV to move forward.

Once everything is submitted and approved, you can reinstate your license and registration so you can legally drive again.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Don’t Get Caught Driving Without Insurance

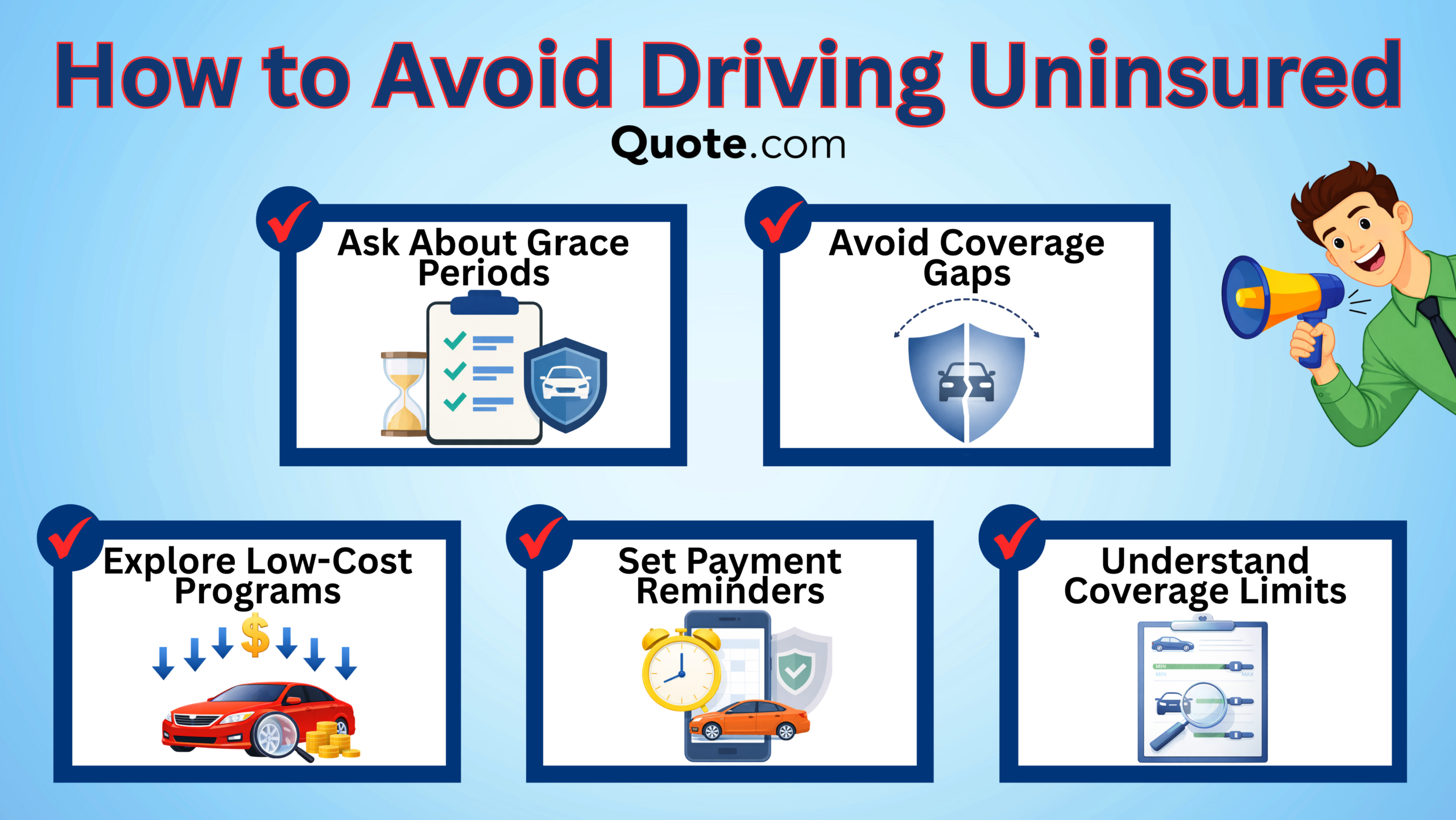

Staying insured means watching for coverage gaps, asking about grace periods, setting payment reminders, and choosing coverage you can afford, especially if you explore what you do if you can’t afford auto insurance.

Exploring low-cost options and understanding your policy limits can also help prevent lapses.

Keeping active insurance is one of the simplest ways to protect your money, your license, and your ability to drive legally, especially when you compare options using the best insurance comparison sites.

Avoid paying the penalty for driving without auto insurance and start saving money today. Enter your ZIP code and compare free insurance quotes.

Frequently Asked Questions

Do cops know if you drive without car insurance?

Yes, police officers can verify your insurance history electronically and can issue tickets, suspensions, and tow your vehicle if you’re driving uninsured.

What is the penalty for driving without insurance?

The driving without car insurance fine can go up with each violation and may be accompanied by license suspension, vehicle impoundment, and jail time in some states.

Read More: How to Buy Auto Insurance

Can you get arrested for driving without auto insurance?

Yes, some states allow jail time for repeat offenses or for causing an accident while uninsured, though fines and suspensions are more common.

What happens if you get into an accident without insurance?

You may face a driving without car insurance penalty, including paying medical bills, property damage, and court costs out of pocket, which can total tens or even hundreds of thousands of dollars.

How long does a driving-without-insurance violation stay on your record?

Higher insurance rates often last 3 to 5 years, while license suspensions and SR-22 requirements may last from months to several years, depending on the state.

What is an SR-22, and when is it required?

SR-22 auto insurance isn’t an actual policy but proof of insurance filed by your provider after high-risk offenses, like DUIs or driving without insurance. It’s often required after serious or repeated violations of uninsured driving.

Will my insurance be more expensive after driving without coverage?

Yes, most drivers see higher premiums after a lapse in coverage or a citation, especially if an SR-22 filing is required.

What is the maximum fine for driving without auto insurance?

The maximum penalty for driving without insurance depends on your state laws, but fines can range from $1,000 to $5,000 for multiple offenses.

What if my insurance just expired or lapsed?

Even short lapses can result in a no-insurance ticket or fines, though some insurers or states may offer limited grace periods, which is why it helps to understand how to buy auto insurance before coverage ends.

Can my car be towed or impounded for no insurance?

Yes, many states allow police to tow or impound your vehicle if you’re caught driving without valid insurance.

Read More: Auto Insurance Rates by Vehicle

Is driving without insurance a felony?

Am I covered if I’m driving someone else’s car?

What’s the fastest way to fix a no-insurance violation?

How much is a no-insurance ticket?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.