Full Coverage Auto Insurance 2026 Guide

Full coverage auto insurance provides liability, collision, and comprehensive protection for $84 a month. It covers repairs, theft, and weather damage. The average full coverage auto insurance cost varies by coverage limits, state insurance requirements, and the terms of your auto loan or lease.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Operations Specialist

Michael earned a degree in Business Management with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Automatio...

Michael Leotta

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Rachael Brennan has been working in the insurance industry since 2006 when she began working as a licensed insurance representative for 21st Century Insurance, during which time she earned her Property and Casualty license in all 50 states. After several years she expanded her insurance expertise, earning her license in Health and AD&D insurance as well. She has worked for small health insu...

Rachael Brennan

Updated January 2026

Full coverage auto insurance combines liability auto insurance, collision, and comprehensive protection to safeguard drivers from accident-related damage and repair costs.

- Safe drivers get cheap full coverage auto insurance for $84 monthly

- It covers your and others’ property in accidents, storms, or vandalism

- Full coverage is often required by auto loans and leases

This guide explains how full coverage auto insurance rates change based on location, age, and car model. You’ll learn what factors influence pricing, how to decide if full coverage fits your needs, and how to find affordable protection in your state.

Finding cheap full car insurance rates can be difficult, especially if you have accidents on your record. Enter your ZIP code to find the most affordable quotes in your area.

Get the Cheapest Full Coverage Auto Insurance

Full coverage auto insurance combines liability, collision, and comprehensive coverage to protect you from nearly all types of damage. Get more details in our guide to liability vs. full coverage car insurance.

Comparing full coverage insurance is key because rates tend to swing wildly from provider to provider. USAA is the cheapest at $84 per month, while some competitors, like Geico and Liberty Mutual, charge $50-$150 more per month.

Full Coverage vs. Liability-Only Auto Insurance Monthly Rates| Insurance Company | Full Coverage | Liability Only |

|---|---|---|

| $228 | $61 | |

| $166 | $43 |

| $124 | $33 | |

| $198 | $53 | |

| $114 | $30 | |

| $248 | $67 |

| $164 | $32 | |

| $150 | $39 | |

| $123 | $33 | |

| $141 | $38 | |

| $84 | $22 |

Should you get full coverage auto insurance? If your vehicle is new, leased, or has a high replacement value, full coverage is strongly recommended. Full coverage is often required for financed or newer vehicles due to high repair costs.

Drivers on a tight budget can still find protection for under $100 a month. Compare the full coverage auto insurance cost in your state against local providers based on your age and driving record to find the most affordable coverage.

Learn More: Does auto insurance cover theft?

Comparing Full Coverage Insurance Premiums Across the U.S.

Regional pricing differences are all about the varying repair costs, accident rates, and state insurance requirements.

Iowa and Washington have the cheapest full coverage auto insurance, while Texas and California are the most expensive states (Read More: Best Auto Insurance Companies in Texas).

Typically, full coverage auto insurance in Texas will set you back around $207 per month due to the increased highway speeds and weather-related claims in the state. In contrast, states like Iowa cost half that at $103 a month.

If you live in a state with higher liability limits, like Michigan or Minnesota, you can expect full coverage rates closer to $300 a month. Enter your ZIP code to see how much full coverage insurance costs in your state.

Full Coverage Insurance Rates for Popular Vehicles

The average cost of auto insurance depends on the car you drive. Larger trucks and SUVs have higher repair costs, which lead to higher rates.

Compare your full coverage auto insurance quote against the average price of coverage for popular vehicles.

20 Top-Selling Vehicles: Full Coverage Auto Insurance Monthly Rates| Make & Model | Rank | Premium | Cost Factors |

|---|---|---|---|

| Ford F-Series | #1 | $139 | Large pickup; big driver pool lowers costs |

| Chevrolet Silverado | #2 | $147 | Full-size truck; slightly less than Ford |

| Toyota RAV4 | #3 | $122 | Compact SUV; strong safety, low claims |

| Honda CR-V | #4 | $131 | Compact SUV; reliable, affordable repairs |

| Ram 1500 Series | #5 | $162 | Full-size pickup; higher liability exposure |

| Tesla Model Y | #6 | $339 | EV; costly parts and repairs |

| GMC Sierra | #7 | $148 | Full-size truck; expensive parts |

| Toyota Camry | #8 | $144 | Midsize sedan; safe, moderate costs |

| Nissan Rogue | #9 | $142 | Compact SUV; affordable, family-friendly |

| Honda Civic | #10 | $133 | Compact car; cheap repairs, safe profile |

| Toyota Corolla | #11 | $135 | Compact sedan; dependable, modest costs |

| Chevrolet Equinox | #12 | $147 | Compact SUV; low repairs, safe profile |

| Jeep Grand Cherokee | #13 | $176 | Midsize SUV; higher theft/repair costs |

| Hyundai Tucson | #14 | $142 | Compact SUV; affordable, safe choice |

| Chevrolet Trax | #15 | $133 | Subcompact SUV; cheap repairs, safe |

| Ford Explorer | #16 | $179 | Midsize SUV; higher liability/repair costs |

| Toyota Tacoma | #17 | $160 | Midsize pickup; moderate premiums |

| Subaru Crosstrek | #18 | $122 | Subcompact SUV; strong safety, low claims |

| Subaru Forester | #19 | $133 | Compact SUV; safe, reliable, affordable |

| Subaru Outback | #20 | $133 | Wagon/SUV; safe, family-friendly |

Safety ratings, repair costs, and vehicle value affect premiums for America’s most popular models. On average, full coverage auto insurance for top-selling vehicles ranges from $122 per month to $339 monthly.

Among top-selling vehicles, SUVs and sedans offer the best balance of safety and affordability. In contrast, electric vehicles and full-size pickups have higher premiums due to the high cost of their parts and repair expenses.

Full Coverage Auto Insurance Monthly Rates by Provider & Vehicle Type| Company | Trucks | Sedans | SUVs |

|---|---|---|---|

| $190 | $147 | $174 | |

| $179 | $143 | $166 |

| $201 | $150 | $169 | |

| $156 | $114 | $144 | |

| $237 | $150 | $197 |

| $164 | $143 | $169 | |

| $200 | $150 | $176 | |

| $143 | $123 | $160 | |

| $183 | $141 | $174 | |

| $147 | $123 | $133 |

Insurance companies also price coverage differently based on the vehicle category. Pickups and trucks tend to have higher premiums because of their repair costs and liability exposure, while sedans and hatchbacks remain the most affordable to insure.

Sedans and compact SUVs remain the most cost-efficient to insure, while full-size pickups and EVs carry higher rates. Among major insurers, Geico and USAA consistently offer the lowest rates across most vehicle types.

Read More: Geico vs. Allstate Auto Insurance

How Driving History Affects Full Coverage Prices

Your driving record is a significant factor in determining your coverage costs, and maintaining a clean record will result in the lowest full coverage auto insurance rates.

If you’ve had any accidents or run-ins with the cops, you can expect your premiums to go up.

Full Coverage Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $228 | $321 | $385 | $268 | |

| $166 | $251 | $276 | $194 |

| $124 | $182 | $185 | $150 | |

| $198 | $282 | $275 | $247 | |

| $114 | $189 | $309 | $151 | |

| $248 | $335 | $447 | $302 |

| $164 | $230 | $338 | $196 | |

| $150 | $265 | $200 | $199 | |

| $123 | $146 | $160 | $137 | |

| $141 | $199 | $294 | $192 |

But at the other end of the spectrum, if you’ve been driving for decades and have a clean record, you could qualify for good driver auto insurance discounts.

The key is to shop around and get a few different quotes from different insurers. That way, you can find the best deal on full coverage auto insurance without breaking the bank.

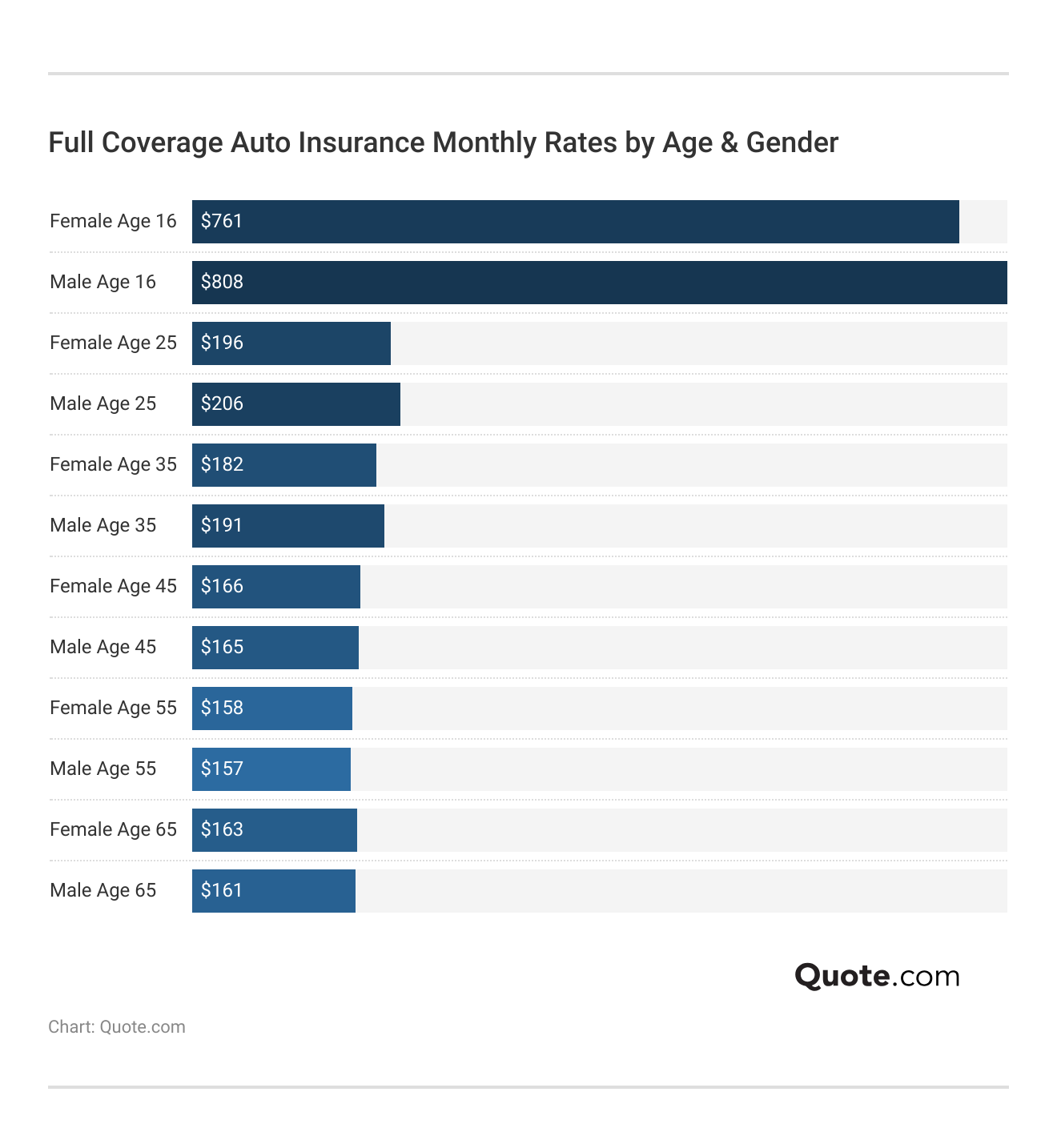

How Age and Gender Impact Full Coverage Rates

Teen drivers are the ones getting slammed with the highest rates. At 16, drivers pay around $761 and $808 a month.

Rates drop like a rock for drivers in their 20s and 30s as they gain more driving experience, and it stays that way all the way till they’re older, which is why full coverage auto insurance for seniors often ends up being so cheap.

For instance, drivers around age 65 are only paying $161-$163 a month, which is over $600 less monthly than a new driver.

Insurers tend to view seniors and middle-aged drivers with experience as lower risk, so they reward them with extremely affordable full coverage auto insurance rates.

Read More: Cheap Auto Insurance for Seniors

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Full Coverage Auto Insurance Meaning

Full coverage auto insurance isn’t a single policy but a combination of protections that safeguard you, your passengers, and your vehicle in nearly every situation.

It typically includes liability, comprehensive, and collision coverage, with optional add-ons that enhance protection and flexibility.

Common Auto Insurance Coverage Options| Coverage | What it Covers |

|---|---|

| Liability | Injuries, damages to others |

| Collision | Crash damage to your car |

| Comprehensive | Non-crash damage: theft, fire |

| Personal Injury Protection (PIP) | Medical bills, lost wages |

| Medical Payments (MedPay) | Your medical bills only |

| Uninsured/Underinsured Motorist | If other driver isn't covered |

| Gap Insurance | Loan vs. car value difference |

| Umbrella | Extra liability beyond limits |

| Rental Reimbursement | Rental car during repairs |

| Roadside Assistance | Towing, flat tire, lockout |

| Non-Owner Coverage | Liability in a borrowed car |

| Modified Car Insurance | Coverage for custom parts |

| Windshield Coverage | Glass repair or replacement |

| Mechanical Breakdown (MBI) | Repair or replacement of glass |

Understanding each type of auto insurance coverage helps you choose the right balance of protection and affordability. Liability covers others, comprehensive handles non-collision damage, and collision repairs your own car after an accident.

Together, they form a reliable full coverage auto insurance policy that minimizes financial risk and keeps you protected wherever you drive.

Liability Coverage Explained

Liability coverage is the core component of every auto insurance policy and is legally required in most states.

It pays for other drivers’ medical expenses, vehicle repairs, and property damage when you’re found at fault in an accident.

This coverage usually covers you for bodily injury, property damage, and sometimes legal fees, protecting you from the financial nightmare of being sued after an at-fault accident.

While liability insurance doesn’t cover your own vehicle, it’s still a good insurance policy as it ensures you meet the state minimums and gives other people involved in an accident you cause some much-needed financial protection.

Comprehensive Coverage Explained

Comprehensive coverage protects your vehicle from damage unrelated to a collision. It covers losses from theft, vandalism, fire, falling objects, animal strikes, and weather-related damage such as hail, floods, or hurricanes.

If you lease or finance your car, lenders often require comprehensive coverage until the vehicle is paid off or the lease ends (Learn More: Collision vs. Comprehensive Auto Insurance).

It’s good to have this sort of protection to make sure your car stays financially insured in case something goes wrong, like if a tree falls on your car or someone breaks into your vehicle, and you can’t afford to fix it out of pocket.

Comprehensive insurance is typically more affordable than collision coverage or a full coverage policy unless you live in a high-risk state for flooding and wildfires, like California.

It’s also recommended that you carry comprehensive coverage if you park your car on the street or in a parking lot, which increases the risk of theft and vandalism, incidents not covered by collision or liability-only policies.

Even for older cars, comprehensive coverage is worth considering if the vehicle’s value exceeds the cost of the deductible and coverage.

Learn More: Does auto insurance cover hitting a deer?

Collision Coverage Explained

Collision auto insurance pays for repairs or the replacement value of your car if it’s damaged in an accident, regardless of who’s at fault.

While it’s optional for fully paid-off cars, it’s crucial for newer or financed vehicles to avoid major out-of-pocket repair costs.

Beyond collisions with other vehicles, collision insurance also kicks in if you hit stationary objects like fences or poles, or are involved in a single-car accident, such as a rollover.

By combining collision with comprehensive and liability coverage, you achieve true full coverage auto insurance, protecting both your car’s value and your long-term financial stability after an accident.

Who Needs Full Coverage Auto Insurance

What is full coverage auto insurance, and who really needs it? A full coverage policy combines liability, collision, and comprehensive insurance. It also includes personal injury protection (PIP), MedPay coverage, or uninsured motorist protection in states that require it.

Full coverage car insurance covers your vehicle and injuries in a lot of scenarios, including theft, vandalism, weather damage, and collisions, regardless of who’s at fault.

Full coverage auto insurance is often worth the cost for newer vehicles since repair and replacement expenses can easily exceed the monthly premium savings of liability-only policies.

Brandon Frady Licensed Insurance Agent

A common myth is that “full coverage” means you’re covered for everything, but that’s not true. While it has extensive coverage, it doesn’t include add-ons like gap insurance, roadside assistance, or rental reimbursement unless you buy them separately.

Those who live in high-traffic areas or areas prone to severe weather may need full coverage. To find the best full coverage auto insurance, compare providers like Geico, State Farm, and USAA.

Enter your ZIP code to explore which companies have the cheapest auto insurance rates for you.

Frequently Asked Questions

What does full coverage mean for car insurance?

Full coverage means your policy includes liability, collision, and comprehensive insurance, protecting against damages you cause, accidents, theft, weather, and other unexpected incidents.

What are the disadvantages of full coverage auto insurance?

Full coverage costs more than liability-only insurance and may exceed your car’s value if it’s older, especially when monthly premiums outweigh potential repair payouts.

Read More: Ways You’re Wasting Money on Your Car

What is included in full coverage insurance?

Full coverage car insurance includes liability for others, collision for your car’s damage, and comprehensive coverage for theft, fire, vandalism, or weather-related incidents.

What is the best insurance company for full coverage?

The best insurer depends on your location, vehicle type, and driving record. Enter your ZIP code to compare multiple companies near you to find the lowest rates and coverage that fit your needs.

Which insurance is best for a car like an SUV?

The best insurance for an SUV is full coverage, which includes liability, collision, and comprehensive protection to safeguard your finances and vehicle from accidents, theft, and natural disasters.

Read More: Auto Insurance Rates by Vehicle

What happens if I don’t get full coverage auto insurance?

Without full coverage, you’ll pay out-of-pocket for vehicle damages caused by theft, weather, or at-fault accidents.

Is full coverage the same as comprehensive insurance?

No. Comprehensive coverage covers non-collision events like theft or fire, while full coverage combines comprehensive, collision, and liability insurance for broader protection.

Does Progressive offer full coverage auto insurance?

Yes. Progressive offers full coverage auto insurance that includes liability, collision, and comprehensive protection, with optional add-ons like roadside assistance, rental reimbursement, and gap coverage. Learn more in our Progressive auto insurance review.

What are the coverages that make up an auto insurance policy?

An auto insurance policy typically includes liability, collision, and comprehensive coverage, plus optional protections like medical payments (MedPay), uninsured motorist, gap, and rental reimbursement. Enter your ZIP code to find out if you can get a good deal on your policy.

Does Geico offer full coverage auto insurance?

Yes, as mentioned in our Geico auto insurance review, the company provides full coverage auto insurance combining liability, collision, and comprehensive coverage, plus optional features such as mechanical breakdown insurance and emergency roadside assistance.

How can I customize my car insurance policy to get the “full coverage” I need?

How can I fit full coverage car insurance into my budget?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.