12 Ways You’re Wasting Money on Your Car in 2026

Discover 12 ways you’re wasting money on your car, like skipping discounts or paying for unused premium gas. These smart fixes help drivers 45+ pay as low as $58 per month with usage-based insurance, updated policies, and maintenance habits. Compare quotes now to start saving instantly.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson, a published insurance expert, is the fourth generation in her family to work in the insurance industry. Over the past two decades, she has gained in-depth knowledge of state-specific insurance laws and how insurance fits into every person’s life, from budgets to coverage levels. She specializes in autonomous technology, real estate, home security, consumer analyses, investing, di...

Melanie Musson

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as ...

Justin Wright

Updated November 2025

Our article on the 12 ways you’re wasting money on your car reveals common habits that quietly drain your wallet, like overpaying for insurance or skipping maintenance.

- Compare rates yearly to avoid overpaying; drivers 45+ pay $58 per month

- Stop using premium gas if not required; it adds over $100 in yearly fuel costs

- Ignoring maintenance, like a check engine light, can casue $1,000+ in repairs

Smart changes, such as usage-based insurance and quote comparisons, can lead to significant savings. Learn more in the definitive guide to usage-based auto insurance. Quote.com makes it easy to find the best rates fast.

Comparing quotes is key to finding the best rates. Use Quote.com’s free tool and enter your ZIP code to find personalized insurance offers today and save hundreds on your automotive insurance.

12 Ways You’re Wasting Money on Your Car

Getting your license and daily driving quickly becomes routine, but it’s easy to forget how many cars are on the road. In the U.S., 95% of households own a car, with over half owning two or more, totaling 252 million vehicles. It’s no wonder many people say cars are a waste of money.

Cars aren’t cheap, and after the 2006 recession, many drivers turned to used vehicles and the cheapest car insurance to cut costs. Today, most of the 260 million cars on U.S. roads are over 11 years old, indicating that drivers are holding onto vehicles longer and seeking the most affordable way to buy a car at present.

1. Overpaying for Your Car Insurance

Sticking with the same auto insurer year after year without checking quotes and wasting money on cars can quietly cost you more than you realize. Many providers reserve their best rates for new customers, while loyal policyholders often face gradual premium increases.

Since insurers don’t adjust your premium for things like reduced mileage, skipping annual quote checks could mean overpaying—or falling for wasting money quotes. Compare regularly to keep your coverage competitive and cost-effective.

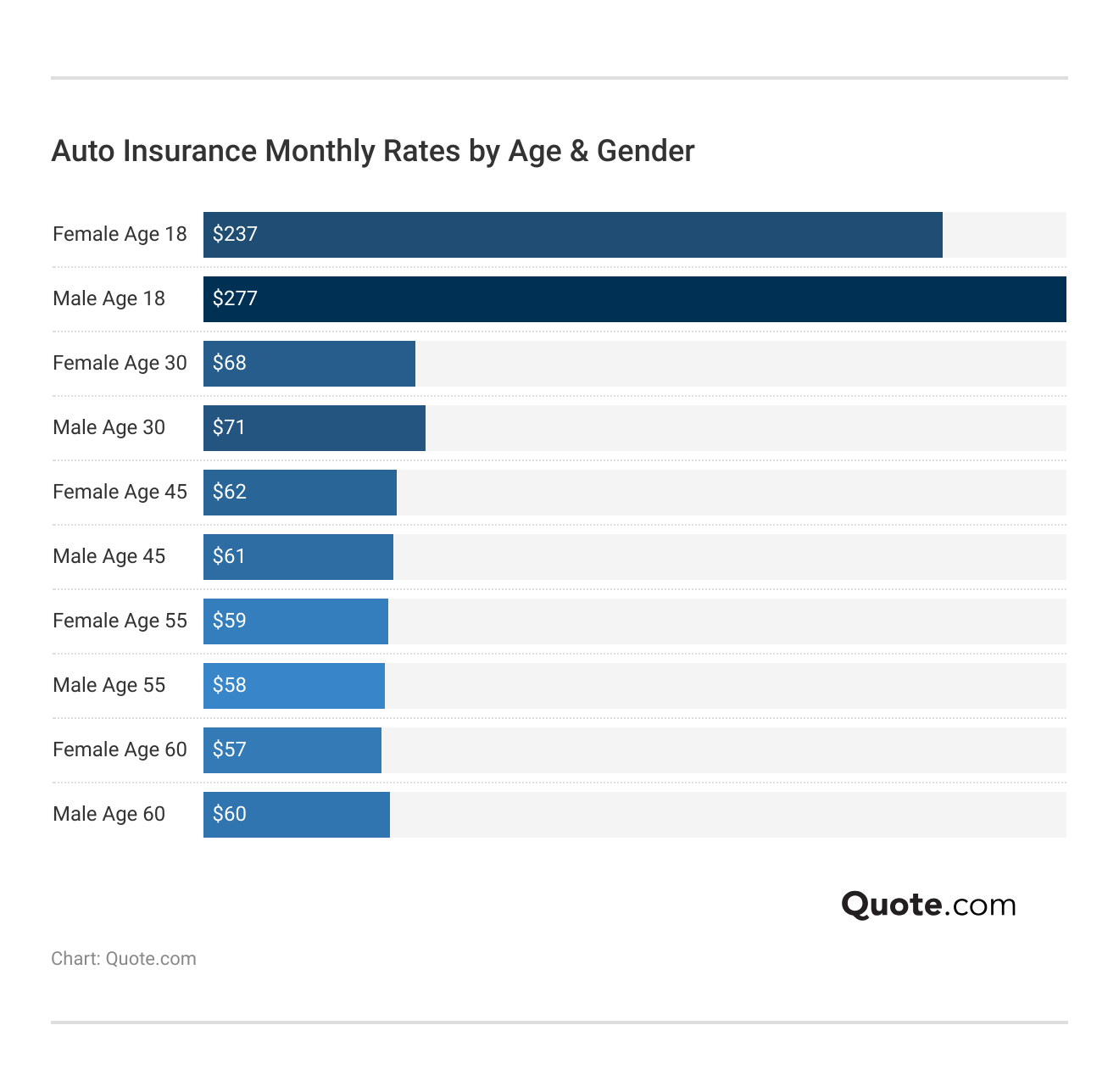

Auto insurance rates are highest at age 16—$292 for females and $323 for males, due to higher risk. As drivers gain experience, premiums drop significantly, reaching around $73–$76 by age 25.

By age 45 and older, rates average $58–$62 monthly, with minimal difference between genders, reflecting lower risk and more stable driving history—many of which are addressed in our 26 hacks to save money on auto insurance.

Compare Car Insurance Quotes Every 6 Months

Not comparing car insurance quotes every six months is one way you’re wasting your money. Premiums can change due to your driving record, credit score, vehicle use, or market shifts, so shopping around regularly helps ensure you’re not paying more than necessary for the same coverage.

Re-evaluating your options twice a year helps you find better deals and discounts, especially if you’ve faced issues like what to do when you’re denied insurance coverage. It’s a simple habit that can save you hundreds without compromising coverage.

Ready to see how much you could save? Use our Quote.com tool and enter your ZIP code to compare personalized auto insurance quotes and find the best rate in minutes.

Switch Insurance Providers When Rates Increase

Anticipating a rate increase and changing insurers is a proactive money-saving strategy that can help you avoid overpaying. A lot of insurers will slowly increase your rates over time, particularly if you’re a longtime customer who doesn’t shop around for quotes on a regular basis.

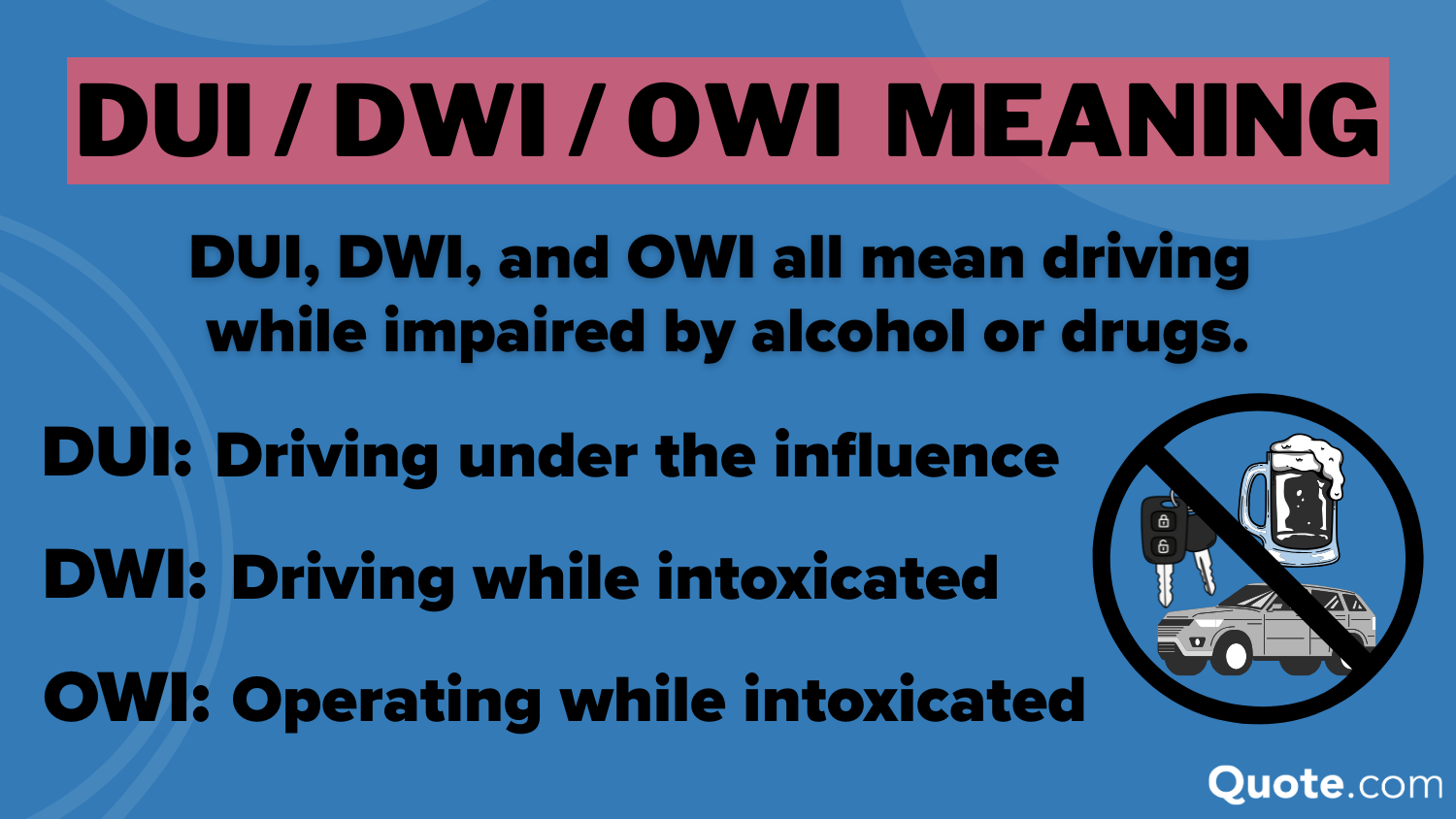

Auto Insurance Monthly Rates by Driving Record

| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $87 | $124 | $152 | $103 | |

| $62 | $94 | $104 | $73 |

| $76 | $109 | $178 | $95 | |

| $43 | $71 | $129 | $56 | |

| $96 | $129 | $65 | $116 |

| $63 | $88 | $112 | $75 | |

| $56 | $98 | $58 | $74 | |

| $47 | $57 | $38 | $53 | |

| $53 | $76 | $123 | $72 | |

| $32 | $42 | $93 | $36 |

Auto insurance rates rise with violations, while drivers with a clean record receive the lowest premiums. USAA and Geico offer some of the best rates, but a DUI can double your cost. Safe driving keeps insurance affordable. Learn more in our Geico insurance review.

Premium hikes often result from insurer pricing changes, not your driving. If your rate increases, it’s a great time to compare quotes. Other companies may offer better coverage for less, especially if your driving record or mileage has improved. Staying loyal can cost you more.

2. Forgetting Regular Vehicle Maintenance

Although it might save some time or money upfront, avoiding regular vehicle maintenance tends to create a host of expensive issues. Missing oil changes, tire rotations, or brake checks can cause engine damage, uneven wear, and safety issues. Just like understanding how fire engines work highlights the need for reliability, routine care keeps your car ready and safe.

Skipping maintenance can lead to claims that raise your rates. Keeping records shows you're low-risk. For example, it may help you qualify for discounts with some insurers.

Michelle Robbins Licensed Insurance Agent

Staying on top of routine maintenance keeps your car running efficiently, extends its lifespan, and helps avoid unexpected breakdowns—because it’s not how you stand by your car quote, it’s how you maintain it.

Don’t Ignore the Check Engine Light

It may seem harmless to ignore the “check engine” light or use a quick fix for foggy headlights, but just like using a quick fix for foggy headlights, it only masks a potential problem.

The light can indicate anything from a loose gas cap to serious problems such as a malfunctioning oxygen sensor or catalytic converter, which results in costly maintenance if it goes ignored.

Delaying a check engine diagnosis can backfire—ignoring your car’s specifics, like a faulty oxygen sensor or worn spark plugs, may turn a simple $100 fix into a $1,000+ repair. Resources like the ultimate insurance cheat sheet can help you understand how maintenance issues may also impact your insurance costs.

The smart move is to check the light within 1–2 days. Problems can be detected early, your car and wallet saved by simply reading a code or making a brief trip to the mechanic.

Addressing the check engine light promptly can turn a small fix into major savings. A quick scan or mechanic visit now can help you avoid costly repairs later.

Maintain Proper Tire Pressure

Fuel up on the recommended tire pressure and avoid leaving your tires under-inflated, as this can be a silent thief from your pocket. Tires that are under-inflated increase rolling resistance, use more gasoline, and wear the tread unevenly.

This not only reduces the life of your tires, but it also increases your replacement frequency. As shown in our visual guide to auto insurance, keeping your tires properly inflated improves fuel efficiency, extends tire life, and helps you avoid unnecessary expenses.

Don’t Ride on Old or Worn Tires

Driving on old or used tires is a significant safety and financial risk. Worn tires lose their grip, and when the road is wet or slick, accidents can happen, which can lead to expensive repairs and higher insurance rates.

They also reduce fuel efficiency by increasing rolling resistance. Insurers may see worn tires as a higher risk, which can affect your rates or complicate the process of how to file an auto insurance claim if they contribute to an accident.

To stay safe and keep your costs down, monitor tread depth, maintain the correct air pressure, and replace your tires when they reach an out-of-wear level.

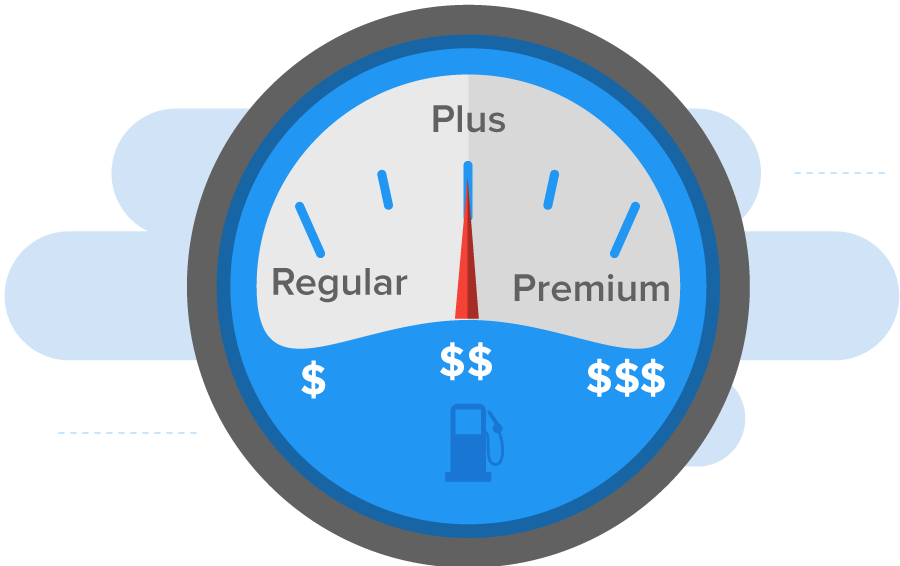

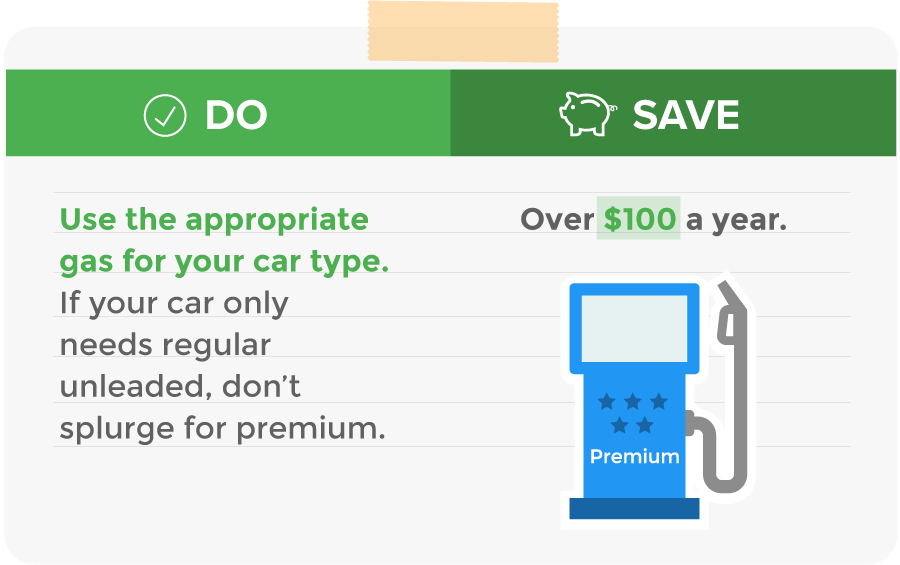

3. Paying More for Premium Gas When Unnecessary

Paying extra for premium gas when your car doesn’t need it can quietly drain your budget. Most vehicles run just as well on regular unleaded gasoline, and habits like pumping gas while the car is running can also be unsafe and wasteful, without offering any performance benefit.

Unless your owner’s manual specifically recommends premium, there’s no added benefit in performance, fuel efficiency, or engine protection—instead, focus on routine care like getting your engine flushed to keep it running smoothly.

The higher cost per gallon may seem small, but it can add up to over $100 per year with no real return, making it one of the easiest ways to overspend on your car, just one of the many pitfalls covered in our 17 tips to pay less for car insurance.

4. Missing Out on Car Insurance Discounts

Many drivers assume their rate is set and there is nothing they can do about it, despite the fact that there can be dozens of other little-known discounts available to insurers. These savings are not always automatically applied; you often have to inquire.

Insurers may not proactively update your file when your circumstances change, like moving, driving less, or completing a defensive driving course.

Top auto insurance companies offer valuable discounts for features such as anti-theft devices, defensive driving, multiple vehicles, and safe driving. Savings range from 5% to 35%, depending on the provider.

Top Auto Insurance Discounts by Provider & Savings

| Company | Anti-Theft | Defensive Driving | Multi-Car | Safe Driver |

|---|---|---|---|---|

| 10% | 10% | 25% | 18% | |

| 25% | 5% | 20% | 18% |

| 10% | 10% | 20% | 20% | |

| 25% | 15% | 25% | 15% | |

| 35% | 10% | 25% | 20% |

| 5% | 10% | 20% | 12% | |

| 25% | 30% | 12% | 10% | |

| 15% | 15% | 20% | 20% | |

| 15% | 20% | 8% | 17% | |

| 15% | 5% | 10% | 10% |

For example, Liberty Mutual offers up to 35% off with some of the best anti-theft auto insurance discounts, while Progressive gives 30% off for defensive driving. When combined, these two discounts can have a huge impact on your premium, so be sure to compare your options.

How to Find the Best Auto Insurance Discounts

Auto insurance discounts can significantly lower your premium based on your vehicle, driving habits, and personal profile. You can also save with car features such as anti-theft technology, hybrid engines, or safety technology, and earn driver discounts for safe habits, training programs, or low mileage.

Most Common Auto Insurance Discounts

| Vehicle Discounts | Driver Discounts | Personal Discounts |

|---|---|---|

| Anti-Theft Device | GPA 3.0 or Higher | Parent Policy Inclusion |

| New Car Safety Features | Teen Smart Driver Course | College Student Away from Home |

| Daytime Running Lights | No At-Fault Accidents | Multi-Policy Family |

| VIN Etching | Driver Training Program | Full-Time Student Verification |

| Hybrid Vehicle | Clean Driving Record | Household Student Discount |

| Adaptive Headlights | Low Annual Mileage | Family Academic Achievement |

| Garaged Vehicle | Paperless Billing | Military Dependent Student |

| Vehicle Recovery System | No Prior Claims | Student Group Member |

| Newer Model Year | School Enrollment Proof | Alumni-Connected Household |

| Safety Tech Bundle | Safe Driving App Usage | Consistent Residency |

Personal discounts are available for students, military dependents, and multi-policy families. Stacking these discounts can lead to big savings on your insurance.

Staying passive about your policy could mean overpaying due to outdated or incomplete information. Reviewing resources such as 17 car insurance discounts you can’t miss can help you re-evaluate your eligibility and unlock meaningful, ongoing savings.

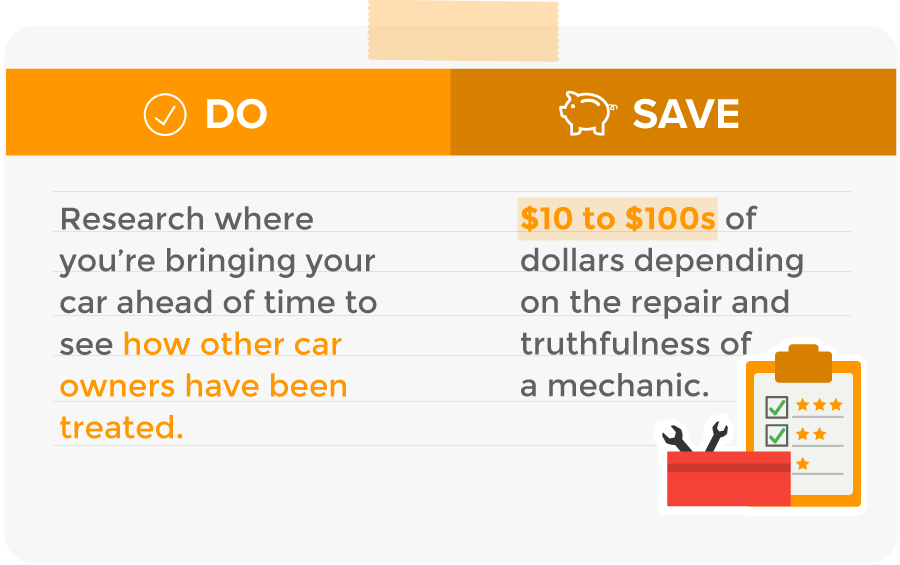

5. Overpaying for Dealership Services

Overpaying for dealership services is a common car waste of money, especially on routine maintenance like oil changes, where choosing synthetic oil wisely can reduce costs, as well as brake repairs or tire rotations.

While dealerships offer brand familiarity and factory-trained technicians, they often charge higher labor rates and mark up parts, one of the secrets car dealers won’t tell you. Many local mechanics deliver the same quality service with personalized attention at a much lower cost.

Before agreeing to any service, it’s wise to compare estimates and reviews from independent shops in your area. Applying the same approach you would in guides like how to buy auto insurance can help you avoid inflated prices without sacrificing reliability or warranty protection.

6. Letting Your Car Idle Too Long

It might seem convenient to leave your car idling for extended periods, particularly on cold mornings or while you’re waiting in parking lots, but there are hidden costs. They are engineered to warm up fast from driving, so extended idling for warm-up is both counterproductive and wasteful.

Excessive idling wears your engine and can lead to claims that raise premiums. For example, limiting idle time helps maintain your car and supports discount eligibility.

Daniel S. Young Managing Editor

When you idle, you’re burning fuel and getting zero miles to the gallon, which means the price and negative environmental effect of all the fuel consumed go up. It also helps to form carbon deposits in the engine, which can cause engine problems and expensive repairs.

Unnecessary idling increases pollution, wastes fuel, and strains your engine. To save money and reduce emissions, turn off your car if stopped for more than a minute, just like getting multiple auto insurance quotes helps you cut costs by comparing better options.

7. Never Trying UBI Insurance Programs

Traditional insurance may not reflect your driving habits. UBI rewards safe, low-mileage drivers with big savings by tracking behavior through an app or device.

Usage-Based Insurance (UBI) programs reward safe driving with discounts of up to 40%, utilizing mobile apps or in-vehicle devices to track driving habits such as speed, braking, and mileage.

Top Usage-Based Auto Insurance (UBI) Programs

| Company | Program Name | Savings | How It's Tracked |

|---|---|---|---|

| Drivewise® | 40% | Mobile App | |

| KnowYourDrive | 20% | Mobile App |

| Signal® | 30% | Mobile App | |

| DriveEasy | 25% | Mobile App | |

| RightTrack® | 30% | In-Vehicle Device |

| SmartRide® | 40% | Mobile App / In-Vehicle Device | |

| Snapshot | 30% | Mobile App | |

| Drive Safe & Save™ | 30% | Mobile App / In-Vehicle Device | |

| IntelliDrive® | 30% | Mobile App | |

| SafePilot | 30% | Mobile App |

Top insurers like Allstate (Drivewise), Progressive (Snapshot), and State Farm (Drive Safe & Save) offer savings ranging from 20% to 40% based on your driving behavior. For additional information, explore our Allstate insurance review.

If you’re a safe driver, you shouldn’t pay the same as risky ones. UBI programs can lower your premium by up to 40%, rewarding your real driving habits. Check car insurance rates today to see how much you could save.

8. Skipping Car Washes

It might not seem like a big deal to skip a few car washes, but you may find your vehicle’s value and condition on the line in the long run. Dirt, road salt, bird droppings, and grungy buildup accumulate on your car’s surface and underneath over time.

Skipping car washes won’t raise your rate, but poor upkeep can lower claim payouts. A clean car may be valued higher after damage.

Melanie Musson Published Insurance Expert

If not removed, these substances can erode paint, cause rust, and damage key components, reducing your car’s value and lifespan. Regular washing prevents corrosion and keeps your vehicle in top shape, just like the smart drivers in these 3,000 people got auto insurance right.

9. Making Financing Mistakes

Mistakes in financing can result in higher long-term costs. Opting for a longer loan term can reduce your monthly payments, but you will probably end up paying far more in interest.

Many buyers skip key steps like getting pre-approved, comparing lender rates, or checking their credit, which can result in higher interest rates or poor loan terms. Some also roll existing debt into a new loan or overlook fees and taxes, increasing the overall cost.

Being informed and using smart car buying strategies, including effective financing techniques, helps you avoid overpaying. If costs get too high, consider resources like what to do if you can’t afford your auto insurance to stay covered affordably.

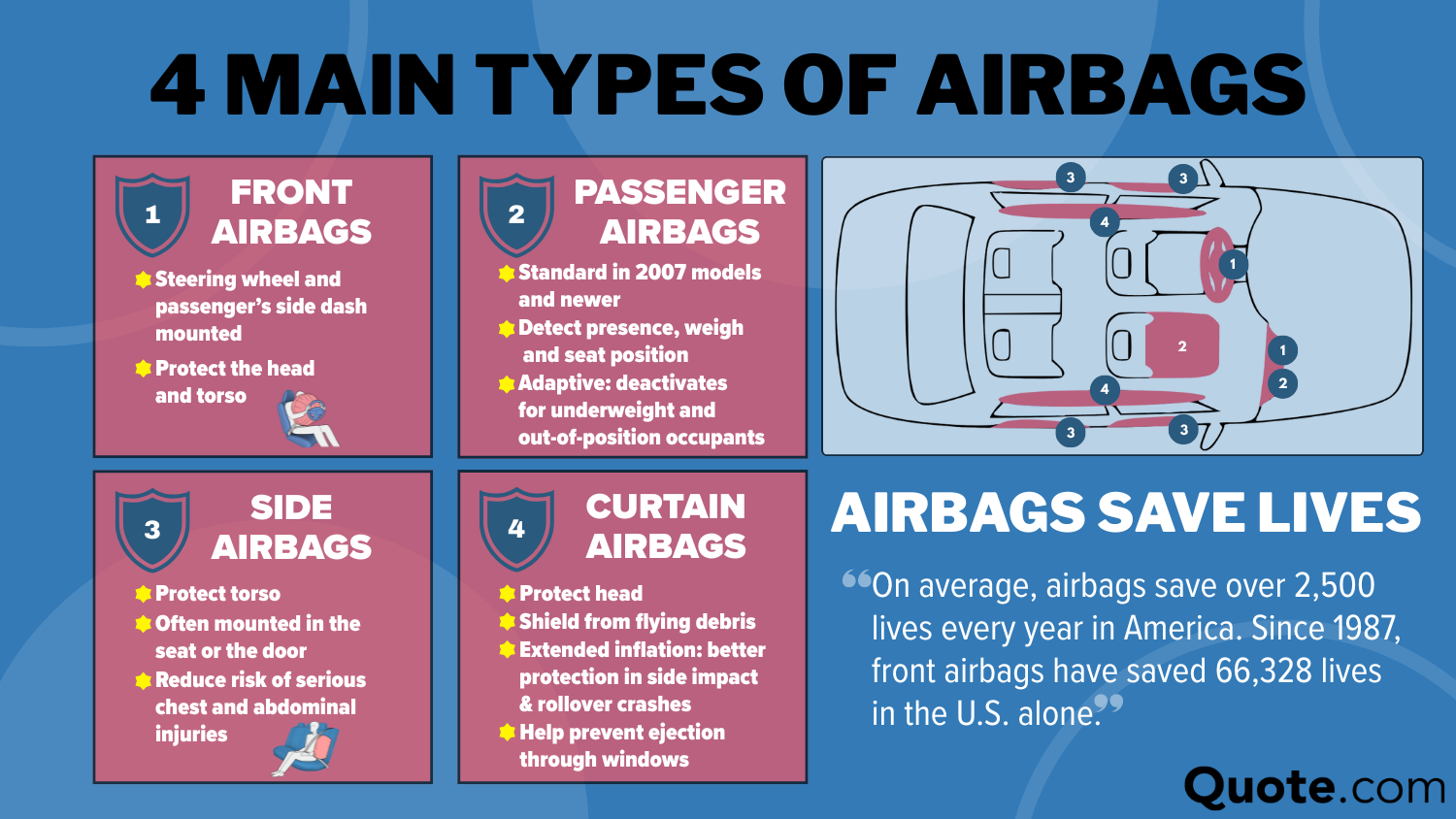

10. Ignoring Vehicle Recalls

Vehicle recalls should never be ignored. Failure to act on a recall can result in severe safety and financial consequences.

Recalls occur for issues such as brake trouble, airbag defects, engine problems, or safety risks from brake fluids that are left ignored, which affect the way your car runs and put you more at risk while driving.

Failure to watch recalls can be a risk signal to insurers; staying current is evidence of responsibility. Correcting them can also prevent an accident and a higher premium.

These repairs are typically offered at no cost, yet many drivers overlook or delay addressing them. Failing to act on a recall can lead to breakdowns, accidents, or further damage that may not be covered by warranty or insurance, resulting in expensive out-of-pocket repairs.

Regularly checking for recalls keeps your car safe and reliable, just like understanding how wankel rotary engines work shows why timely fixes matter.

11. Paying for Unnecessary Add-Ons

Paying for unnecessary add-ons when buying a car can inflate your costs without providing real value. The secrets of buying a car include skipping overpriced extras like rustproofing, VIN etching, or extended warranties, which are often already covered by the manufacturer or available at a lower cost elsewhere.

Many of these upsells are meant to boost dealer profits more than improve your car’s performance. What we learned analyzing 815 insurance companies shows that many add-ons offer little value and raise costs. Always research, check your coverage, and decide if the extra is truly necessary.

12. Driving Aggressively

Driving aggressively with rapid acceleration, hard braking, and speeding reduces fuel efficiency and wears down your brakes, tires, and engine faster. It can also raise insurance costs, so reviewing how to compare auto insurance companies can help you find providers that reward safer driving.

In addition to higher maintenance and fuel costs, aggressive driving can increase the risk of accidents, which in turn can lead to higher insurance premiums. Adopting a more gentle and deliberate driving style will help keep the car in one piece, save fuel, and lower costs over time.

Explore Costly Mistakes and Save More on Auto Expenses

12 ways you’re wasting money on your car explores how everyday decisions, like sticking with the same insurer, ignoring maintenance, or filling up with unnecessary premium gas, can quietly drain your wallet.

Being proactive with comprehensive auto insurance, using available discounts, and exploring usage-based programs can lead to big savings.

By age 45, drivers typically pay around $58 per month on average, indicating that smart coverage choices can help reduce costs and prevent overspending.

Jeff Root Licensed Insurance Agent

Want to save on car insurance? Quote.com helps you compare top providers so you can find the right coverage at the best price. Just enter your ZIP code to get started.

Frequently Asked Questions

How do you know if you are wasting money?

You may be wasting money if you’re paying for things you don’t use, missing out on discounts, or not comparing prices regularly. Reviewing your spending habits and insurance policies can help you quickly identify areas where you can cut unnecessary costs.

What is the biggest thing people waste money on?

Many believe car insurance is a waste of money, and overpaying for it only reinforces that idea. As countless quotes about wasting money suggest, small overlooked costs add up. Failing to compare quotes or update your policy can quietly drain hundreds of dollars each year.

Does another provider have lower rates? Find out by entering your ZIP code into our free quote comparison tool.

Does a usage-based insurance plan make sense if you drive a fancy car a lot of miles each month?

Probably not. Usage-based insurance favors low-mileage drivers, so if you drive a fancy car often, you may miss out on savings. A traditional plan, like those in the best auto insurance for good drivers, may offer better rates based on your driving record.

Could wasting money on my car be a sign that I’m bad with money overall?

Wasting money on your car doesn’t automatically mean you’re bad with money overall, but it can be a red flag. Overlooking things like insurance discounts, unnecessary repairs, or premium gasoline may indicate habits worth reviewing. Small changes in car-related spending can lead to smarter financial decisions elsewhere.

What to do with an end-of-life car?

When your car reaches the end of its life, consider selling it for parts, trading it in for scrap value, or donating it to a charity for a tax deduction. Always transfer the title properly and cancel your insurance to avoid ongoing costs.

What’s the fastest way to save for a car?

The fastest way to save for a car is to set a clear goal, stick to a strict budget, and automate deposits into a high-yield savings account. Cutting extras, boosting income, and finding cheap auto insurance for multiple vehicles can help you reach your savings target even faster.

How do you turn your car into cash?

You can turn your car into cash by selling it privately, trading it in at a dealership, or using online car-buying platforms like CarMax or Kelley Blue Book Instant Cash Offer. Make sure to clean the car, gather your title and records, and compare offers to get the best deal.

What are the best ways to prevent my car from running rich and wasting fuel?

To prevent your car from running rich and wasting fuel, regularly check and replace faulty oxygen sensors, mass airflow sensors, and spark plugs. Ensure your air filter is clean, fuel injectors aren’t clogged, and there are no vacuum leaks. Routine maintenance and diagnostics can help your engine burn fuel efficiently.

How to lose the least amount of money on cars?

To lose the least amount of money on cars, choose a reliable used vehicle, skip unnecessary extras like premium gas or excess insurance, and stay on top of maintenance. Review your policy annually, understand the difference between collision and comprehensive auto insurance, and explore usage-based plans to reduce costs.

How can I make money from my car?

You can earn money from your car by driving for rideshare or delivery services, renting it out through car-sharing platforms like Turo or Getaround, advertising with vehicle wrap companies, or offering local services such as pet transportation or moving assistance. Just ensure you’re properly insured.

Which cars depreciate the most?

What to do with an old, dead car?

What business can you do with a car?

Can I get money for a dead car?

What steps should you take if you realize you’ve been wasting money on your car?

What should I do with my older car?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.