10 Worst States for Filing Auto Insurance Claims in 2026

California, Massachusetts, and New Hampshire are the worst states for filing auto insurance claims. CA auto insurance rates jump 72% after a collision claim. Weather risks also make CA one of the most expensive states for car insurance at $219 a month. Rates start as low as $32 monthly for drivers with no claims.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson, a published insurance expert, is the fourth generation in her family to work in the insurance industry. Over the past two decades, she has gained in-depth knowledge of state-specific insurance laws and how insurance fits into every person’s life, from budgets to coverage levels. She specializes in autonomous technology, real estate, home security, consumer analyses, investing, di...

Melanie Musson

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Updated November 2025

California and Massachusetts are the worst states to file auto insurance claims, with longer settlement times and high rate increases. Michigan and New York have the worst car insurance after claims due to a higher rate of accidents (Learn More: How to File a Claim and Win it Each Time).

California is the worst state overall for auto insurance claims, due to a combination of high repair costs, increased accidents, and weather-related claims that increase comprehensive insurance rates by 271%.

- The worst states for filing car insurance claims see 42% longer delays

- Texas is the worst state for liability and comprehensive claims

- Erie has the cheapest car insurance after a claim

Erie, USAA, and State Farm are the cheapest auto insurance companies after claims, starting at $48 monthly. Read on to learn how claims affect auto insurance premiums. Enter your ZIP code to compare free quotes if your rates increased after a claim.

Top 10 Worst States for Auto Insurance Claims

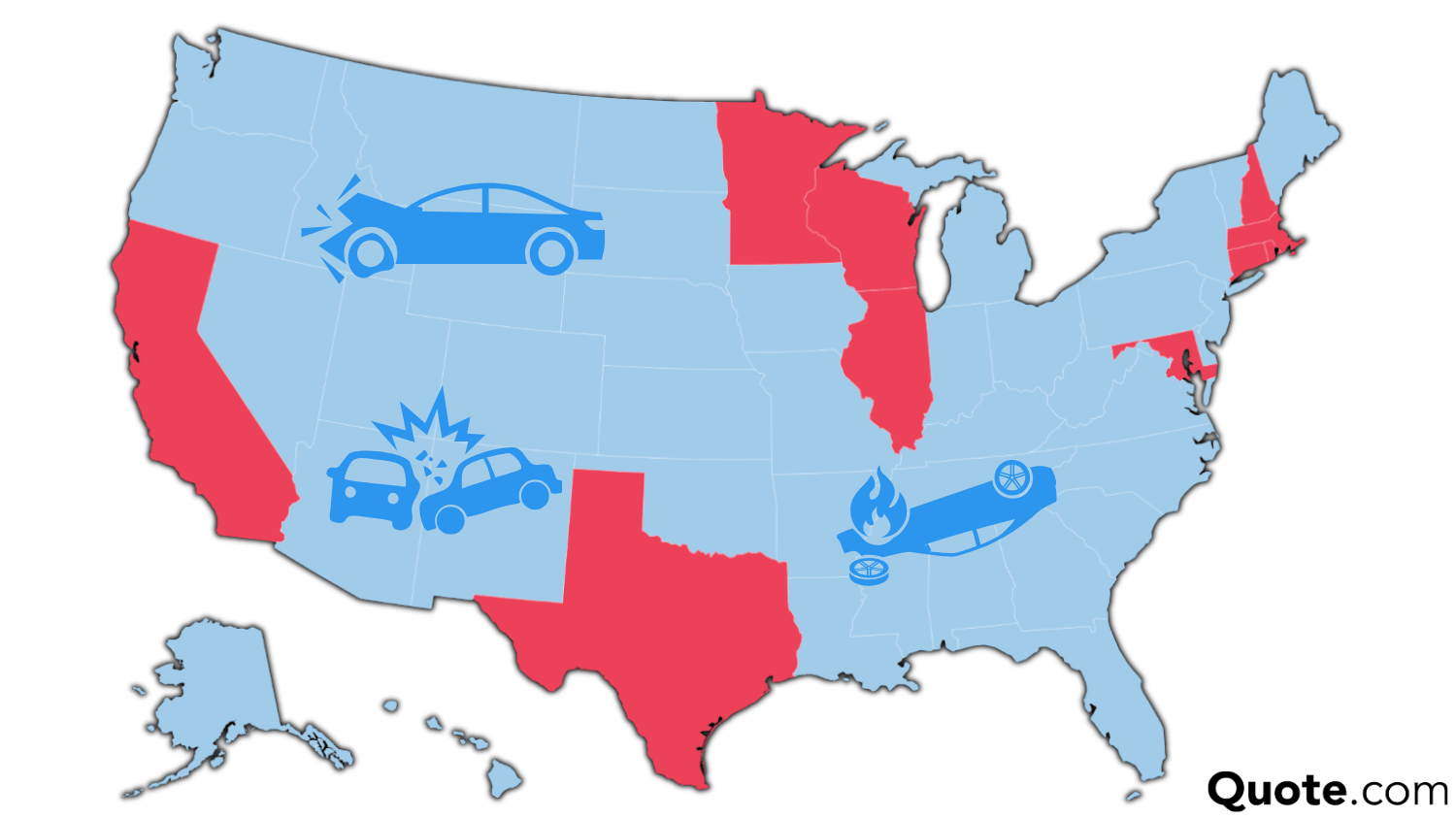

What is the worst state for car insurance? California, Massachusetts, New Hampshire, Rhode Island, and Texas are the top five states with the highest rates of car accidents. Claims are more expensive in these states, despite there being fewer claims filed each year compared to other states.

10 Worst States for Filing Auto Insurance Claims| Rank | State | Before Claim | After Claim | % Increase | Annual Claims |

|---|---|---|---|---|---|

| #1 | California | $72 | $124 | 72% | 3.8M |

| #2 | Massachusetts | $56 | $94 | 67% | 600K |

| #3 | New Hampshire | $50 | $78 | 55% | 150K |

| #4 | Rhode Island | $61 | $95 | 55% | 120K |

| #5 | Texas | $77 | $119 | 54% | 1.6M |

| #6 | Maryland | $126 | $192 | 52% | 732K |

| #7 | Connecticut | $87 | $132 | 51% | 350K |

| #8 | Wisconsin | $47 | $71 | 50% | 500K |

| #9 | Illinois | $57 | $85 | 49% | 1.1M |

| #10 | Minnesota | $90 | $127 | 41% | 600K |

Using car accident statistics presented by the Insurance Information Institute (III) and the National Association of Insurance Commissioners (NAIC), a U.S. organization that sets and regulates the insurance industry’s standards, we found that the average vehicle insurance claim costs $5,215, an increase of $600 over last year (Read More: What does the Insurance Institute for Highway Safety do?).

Different types of claims — liability, collision, and comprehensive — impact insurance premiums differently. California is the worst state for an auto insurance claim, experiencing the highest coverage price fluctuation when filing a claim which raises rates by at least 70%.

Worst States for Collision Auto Insurance Claims

New York and Michigan are the worst states for accident claims. Florida is one of the worst states for driving and claims, largely due to its denser population and higher minimum no-fault insurance requirements. Once you report an incident in these states, your rate goes up drastically.

5 Worst States to File Collision Auto Insurance Claims| Rank | State | Before Claim | After Claim | % Increase | Reason |

|---|---|---|---|---|---|

| #1 | Michigan | $66 | $275 | 317% | High accident severity |

| #2 | New York | $81 | $282 | 248% | Congested urban driving |

| #3 | Florida | $64 | $214 | 234% | High traffic density and theft |

| #4 | California | $88 | $238 | 171% | High repair and labor costs |

| #5 | Louisiana | $70 | $184 | 163% | Frequent severe weather |

Collision claims are some of the most expensive, raising rates by over 300% in some states. According to the NAIC, collision incurred losses increased by 13%, with each claim costing drivers an average of $5,200 and raising rates by 163% or more.

It tends to be the most costly because collision auto insurance covers vehicle repairs, which include luxury models and EVs, which have specialized parts and longer repair times. Traffic congestion and theft rates also impact collision insurance rates, which is why you see places like Texas and California among the worst states for filing car insurance claims.

Worst States for Comprehensive Insurance Claims

Of the three types of car insurance claims, comprehensive claims tend to be the least costly and have the lowest impact on insurance rates. However, you will see your rates go up if you live in a state with increased weather or theft risks. California and Florida are the worst states to report a comprehensive auto insurance claim (Learn More: Best Auto Insurance Companies in Florida).

5 Worst States to File Comprehensive Auto Insurance Claims| Rank | State | Before Claim | After Claim | % Increase | Reason |

|---|---|---|---|---|---|

| #1 | California | $58 | $215 | 271% | Expensive labor and parts |

| #2 | Florida | $32 | $109 | 241% | High theft rates |

| #3 | Texas | $31 | $102 | 229% | High accident frequency |

| #4 | Louisiana | $44 | $135 | 207% | Frequent severe weather |

| #5 | Michigan | $45 | $134 | 198% | High repair costs |

Comprehensive auto insurance only covers incidents outside of a driver’s control, such as hitting an animal or a falling tree. Since these collisions aren’t caused by driver error, there is no increase in high-risk behavior that would lead to higher premiums. Most states only show a rate increase of less than 2% at renewal, but coastal states and those at-risk for wildfires see rates increase by 200% or more after a claim.

Read More: How to File a Home Insurance Claim After a Wildfire

The Best States for Auto Insurance Claims

When comparing the best and worst states for driving, Nebraska, Colorado, and Idaho are the top three best states for filing auto insurance claims since they have smaller population sizes and fewer traffic-related collisions. Insurers in the best states for claims often have the cheapest state minimum car insurance, even though millions of claims are filed per year.

5 Best States to File Auto Insurance Claims| Rank | State | Before Claim | After Claim | % Increase | Annual Claims |

|---|---|---|---|---|---|

| #1 | Nebraska | $117 | $178 | 52% | 5K |

| #2 | Colorado | $109 | $171 | 57% | 1.2K |

| #3 | Idaho | $119 | $188 | 58% | 4.3K |

| #4 | Florida | $108 | $180 | 67% | 2.8K |

| #5 | Alabama | $111 | $188 | 69% | 1.6K |

Repairs also cost less than on the East Coast, and some of these states are more likely to have insurance claims related to weather and animal collisions rather than high-priced liability claims. For instance, Florida is the only state to make both lists. It has expensive collisions and comprehensive claims, but liability claims are rare since it’s a no-fault state where each driver is responsible for their own repairs and medical bills.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Claims Impact Auto Insurance Rates

In the worst states for an auto claim, filing a single claim can result in an average annual premium increase of 44%. Filing a second claim within the same year could hike up the fee by 99%. But as you can see, each major insurer treats claims differently.

Auto Insurance Monthly Rates Before and After Filing a Claim| Company | No Claim | Liability | Collision | Comprehensive |

|---|---|---|---|---|

| $87 | $122 | $127 | $103 | |

| $32 | $67 | $72 | $48 |

| $76 | $111 | $116 | $92 | |

| $43 | $78 | $83 | $59 | |

| $96 | $131 | $136 | $112 |

| $63 | $98 | $103 | $79 | |

| $56 | $91 | $96 | $72 | |

| $47 | $82 | $87 | $63 | |

| $53 | $88 | $93 | $69 | |

| $32 | $67 | $72 | $48 |

Erie and USAA remain the most affordable auto insurance companies after a claim, but availability is limited, and insurance increases by state will vary based on minimum requirements and fault laws.

State Farm, Geico, Travelers, and Progressive are the cheapest providers after a claim. However, the cheapest quotes often come from the worst-rated car insurance companies.

Progressive and Geico might have low rates, but they rank among the worst car insurance companies for claims handling (Learn More: State Farm vs. Farmers, Geico, Progressive, & Allstate Insurance). So, always compare multiple quotes and review customer feedback after a claim.

If you live in the worst state for car insurance, you want to work with an insurer that can handle claims quickly and compassionately. If you’re having issues with payouts from your provider, call your state auto insurance claims phone number to speak with someone from your local Department of Insurance.

Auto Insurance Claims & Driving Record

Drivers with bad records have the worst auto insurance rates. Filing a claim after a speeding ticket or DUI will only make coverage more expensive, but Erie, State Farm, and USAA have the cheapest auto insurance for high-risk drivers.

Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $87 | $124 | $152 | $103 | |

| $32 | $45 | $60 | $38 |

| $76 | $109 | $105 | $95 | |

| $43 | $71 | $117 | $56 | |

| $96 | $129 | $178 | $116 |

| $63 | $88 | $129 | $75 | |

| $56 | $98 | $75 | $74 | |

| $47 | $57 | $65 | $53 | |

| $53 | $76 | $112 | $72 | |

| $32 | $42 | $58 | $36 |

Although the price surge typically kicks in only when you are at fault in a pile-up, that’s not always the case. Your policy price depends heavily on your driving record, whether you were at fault for the crash, the extent of damage to your vehicle, and the number of people injured. Reporting multiple claims in one year will increase rates even more.

View this post on Instagram

As an example, if your current plan is $99 per month (or $1,189 annually), and you submit an accident claim of $5,000 or more, you can expect your rate to go up to $1,709 next year (a $43 monthly increase on your rates). If you report another incident in the same year, your plan may cost $2,366 (a $197 increase per month).

The most important thing is not to lie about your driving record and collision history. All this information is recorded, and they will eventually find out. If your insurer discovers that you’ve lied while processing a new claim, they have the right to deny your request and terminate your policy without providing any compensation or refund.

Read More: At-Fault Accident: What it Means & How it Affects Insurance Rates

Why Auto Insurance Claims Affect Each State Differently

What your insurance company doesn’t tell you about claims is that each provider has its own set of regulations and guidelines to determine price increases for policyholders. Some may not change your rates if this is your first accident or if you have an otherwise great driving history. Others waive rate increases if you’re not at-fault, but this doesn’t apply in no-fault states like Michigan, where minimum coverage is the highest at $163 a month.

Why are car insurance prices so different from state to state? Most U.S. states are at-fault states for auto insurance, including Texas, California, and Illinois, where the driver who caused the accident pays for damages. This is why car insurance rates in California vs. Florida vary so much — Florida is a no-fault insurance state (Learn More: Best California Auto Insurance Companies).

No-fault auto insurance states require that each driver’s own policy pays for their medical expenses, regardless of who caused the accident, thereby limiting the need for lawsuits. No-fault states have higher minimum liability limits and extra coverage requirements, including PIP or MedPay minimums.

State Minimum Car Insurance Requirements| State | Liability | UM/UIM | PIP/MedPay | Fault System |

|---|---|---|---|---|

| Alabama | 25/50/25 | Not required | Not required | At-Fault |

| Alaska | 50/100/25 | Not required | Not required | At-Fault |

| Arizona | 25/50/15 | Not required | Not required | At-Fault |

| Arkansas | 25/50/25 | Not required | $5,000 (PIP) | At-Fault |

| California | 30/60/15 | Not required | Not required | At-Fault |

| Colorado | 25/50/15 | Not required | Not required | At-Fault |

| Connecticut | 25/50/25 | 25/50 | Not required | At-Fault |

| Delaware | 25/50/10 | Not required | $15,000/$30,000 (PIP) | At-Fault |

| Florida | 10/20/10 | Not required | $10,000 (PIP) | No-Fault |

| Georgia | 25/50/25 | Not required | Not required | At-Fault |

| Hawaii | 20/40/10 | Not required | $10,000 (PIP) | No-Fault |

| Idaho | 25/50/15 | Not required | Not required | At-Fault |

| Illinois | 25/50/20 | 25/50 | Not required | At-Fault |

| Indiana | 25/50/25 | Not required | Not required | At-Fault |

| Iowa | 20/40/15 | Not required | Not required | At-Fault |

| Kansas | 25/50/25 | 25/50 | $4,500 (PIP) | No-Fault |

| Kentucky | 25/50/25 | 25/50 | $10,000 (PIP) | No-Fault |

| Louisiana | 15/30/25 | Not required | Not required | At-Fault |

| Maine | 50/100/25 | 50/100 | $2,000 (MedPay) | At-Fault |

| Maryland | 30/60/15 | 30/60/15 | $2,500 (PIP) | At-Fault |

| Massachusetts | 20/40/5 | 20/40 | $8,000 (PIP) | No-Fault |

| Michigan | 50/100/10 | Not required | Tiered options (PIP) | No-Fault |

| Minnesota | 30/60/10 | 25/50 | $40,000 (PIP) | No-Fault |

| Mississippi | 25/50/25 | Not required | Not required | At-Fault |

| Missouri | 25/50/25 | 25/50 | Not required | At-Fault |

| Montana | 25/50/20 | Not required | Not required | At-Fault |

| Nebraska | 25/50/25 | 25/50 | Not required | At-Fault |

| Nevada | 25/50/20 | Not required | Not required | At-Fault |

| New Hampshire | 25/50/25 | 25/50 | Not required | At-Fault |

| New Jersey | 25/50/25 | 25/50 | $15,000 (PIP) | No-Fault |

| New Mexico | 25/50/10 | Not required | Not required | At-Fault |

| New York | 25/50/10 | 25/50 | $50,000 (PIP) | No-Fault |

| North Carolina | 30/60/25 | 30/60 | Not required | At-Fault |

| North Dakota | 25/50/25 | 25/50 | $30,000 (PIP) | No-Fault |

| Ohio | 25/50/25 | Not required | Not required | At-Fault |

| Oklahoma | 25/50/25 | Not required | Not required | At-Fault |

| Oregon | 25/50/20 | 25/50 | $15,000 (PIP) | At-Fault |

| Pennsylvania | 15/30/5 | Not required | $5,000 (PIP) | No-Fault |

| Rhode Island | 25/50/25 | Not required | Not required | At-Fault |

| South Carolina | 25/50/25 | 25/50 | Not required | At-Fault |

| South Dakota | 25/50/25 | 25/50 | Not required | At-Fault |

| Tennessee | 25/50/15 | Not required | Not required | At-Fault |

| Texas | 30/60/25 | Not required | $2,500, unless waived (PIP) | At-Fault |

| Utah | 25/65/15 | Not required | $3,000 (PIP) | No-Fault |

| Vermont | 25/50/10 | 25/50 | Not required | At-Fault |

| Virginia | 25/50/20 | 25/50/20 | Not required | At-Fault |

| Washington | 25/50/10 | Not required | Not required | At-Fault |

| West Virginia | 25/50/25 | 25/50 | Not required | At-Fault |

| Wisconsin | 25/50/10 | 25/50 | Not required | At-Fault |

| Wyoming | 25/50/20 | Not required | Not required | At-Fault |

Weather, traffic, high minimum requirements, and a high number of uninsured drivers make Michigan the worst state to drive in and file a claim. Who pays for car damage in a no-fault state in Michigan? Each driver’s own insurance covers medical bills, but vehicle damage is typically paid by the at-fault driver’s liability coverage under Michigan’s mini-tort law.

Each state’s regulations concerning auto insurance will also dictate your monthly cost. In states that are allowed to use any information to determine high-risk factors, such as marital status and credit score, claim trends tend to have a much lesser impact. However, certain states have regulations banning insurers from using certain factors to determine a driver’s high-risk status.

Factors like credit score, marital status, and education level are unrelated to driving skill and can be considered prejudiced against a driver when setting rates.

Aaron Englard Insurance Premium Auditor

In these places, insurance companies can only use five factors to calculate risk: age, ZIP code, driving history, annual mileage, and vehicle make and model, which means local claim trends drive up rates more in these states. Explore car insurance discounts you can’t miss if you’re having a hard time finding affordable insurance after a claim.

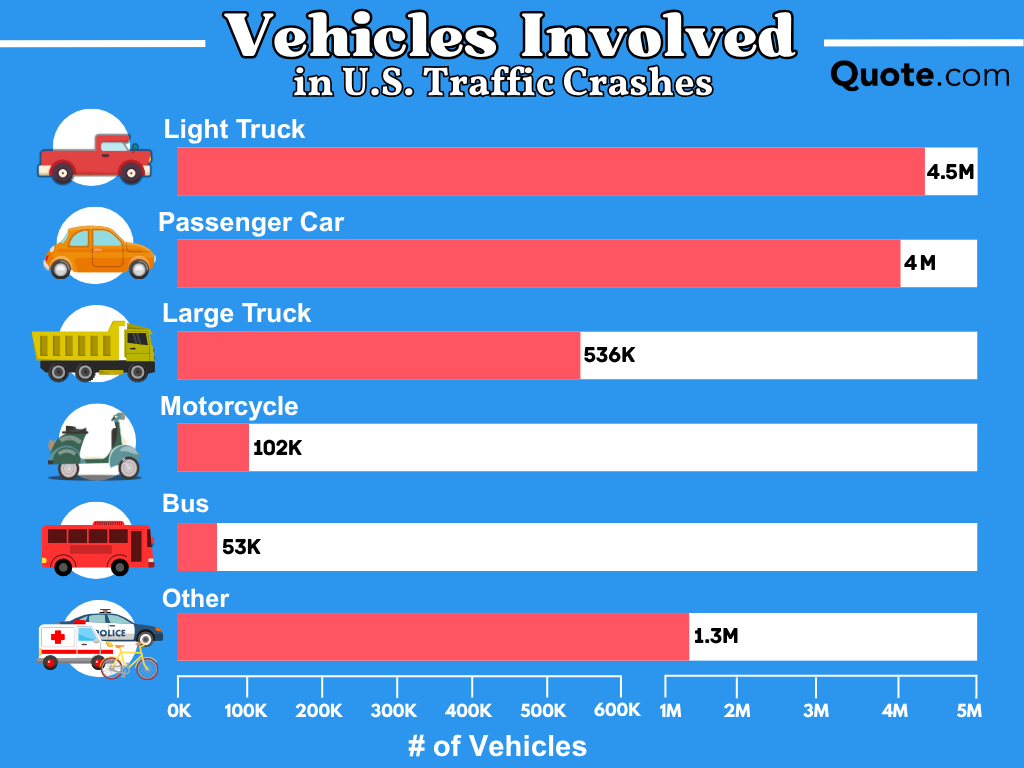

Vehicles Involved in Auto Insurance Claims

No matter where you live, what you drive has a big impact on what you pay for car insurance. Certain vehicles are more likely to get into collisions, and insurance companies pay close attention to local motor vehicle accident trends when setting car insurance rates by state.

For instance, driving a light truck like a Ford F-150 in Texas could result in higher rates compared to other states, as Texas is more likely to see liability and comprehensive claims. Compare the best auto insurance for Fords to find the right coverage for your model.

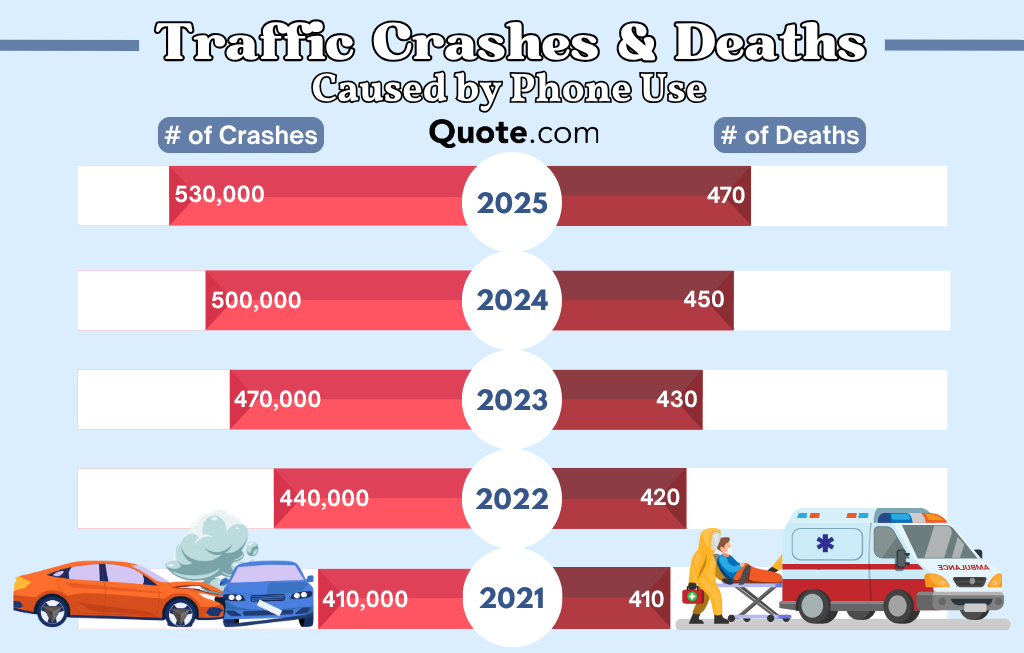

Accident Causes and Insurance Claims

Claims for incidents involving other vehicles and drivers, especially if caused by distracted driving or speeding, will have very expensive consequences. Distracted driving is a leading cause of auto accidents in most states, with phone usage causing several thousand crashes and claims per year.

What caused the collision will impact your auto insurance after a claim. Texas, Michigan, and Maryland have the worst bodily injury claims for accidents caused by:

- Speeding: Higher speeds increase the severity of the collision damage and the risk of serious injuries and fatalities

- Distracted Driving: This includes texting, eating, adjusting the radio, or anything that takes your attention off the road.

- Impaired Driving: Alcohol, drugs, and certain medications slow reaction times and are a major contributor to fatal crashes in all 50 states.

Comprehensive claims for collisions with animals or damage from fallen trees will cost much less for insurance companies, unless you live in places like Texas or Michigan, where weather risks like flooding and hail increase claim costs.

Learn More: How Self-Driving Cars Work

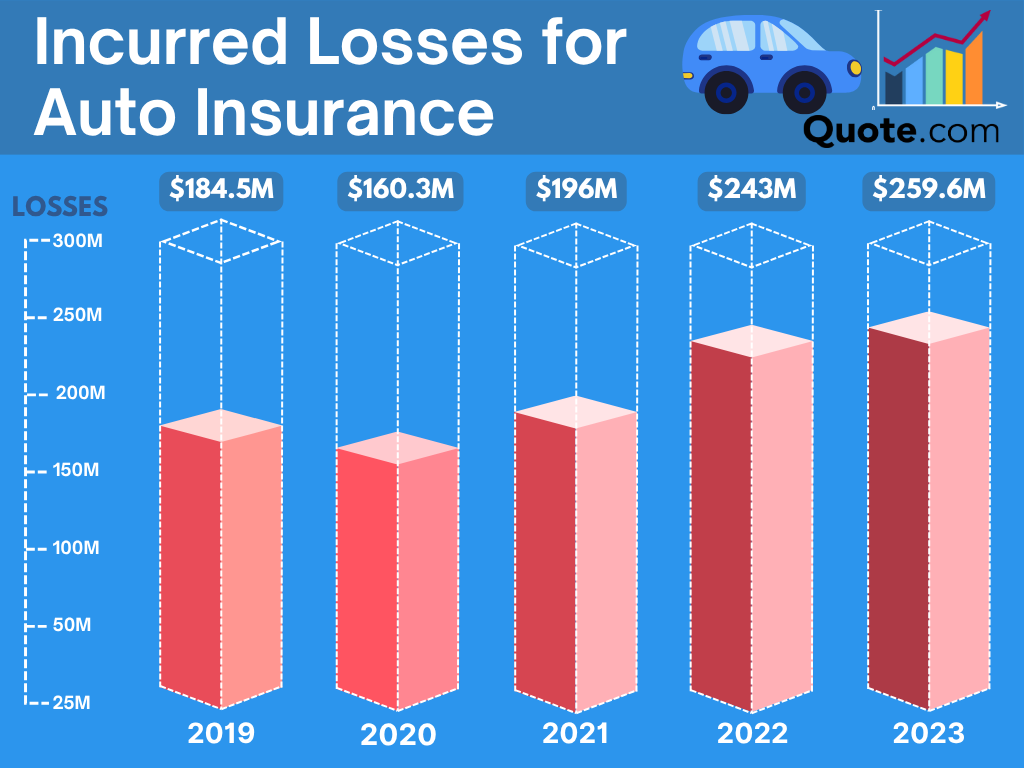

Incurred Losses for Auto Insurance Claims

Every year, your auto insurance policy rate will increase slightly simply due to inflation and the state of the economy. What does this have to do with your cost? In order to recover incurred losses, insurance providers raise rates to ensure there are sufficient funds and services to cover your vehicle repairs, legal fees, and medical-related expenses.

Consequently, the average insurance coverage rate across America has increased by almost 11% due to inflation. Consider how these things hinge on the economy:

- Labor Costs: The manual labor cost of repairing your car increases drastically every year, and repairs for electric or hybrid vehicles are even more expensive.

- Vehicle Costs: The newer your car, the more it costs to repair. This is why newer car policies tend to be more expensive than ones for older vehicles.

- Cost of Living: The cost of living gradually increases year over year, so if you are injured and require compensation for salary loss during the time you cannot work, the compensation must also scale up.

It is essential to note that premium surcharges vary depending on the type of claim submitted. Usually, if someone hits your vehicle, their insurance should cover both their own and your injury and loss. In reality, not all companies comply with this guideline, and the number of insured vehicles increased by only around 8%, resulting in a significant number of underinsured drivers on the road.

Insurers know that if you report a collision, whether you are at fault or not, you are statistically more likely to submit another incident in the future. As a result, you can even see your coverage rate go up after filing an incident for which you are not at fault. Compare auto insurance plans to secure the right coverage to avoid rate hikes.

How to File a Claim After an Auto Accident

To make sure your car insurance claim gets approved and not denied, you need to know what insurers look at and how to safeguard your interests during the process. Here are important steps you should follow to strengthen your claim:

- File Within Required Deadline: States typically give 30-90 days to file a claim. Missing the deadline can result in your claim being denied, so act promptly and check your policy for specific timeframes.

- Fill Out All Forms: Provide accurate information, check signatures, and submit strong evidence on every required claim form to avoid delays or denials.

- Collect Strong Evidence: Gather photos, videos, police reports, medical records, or witness statements to support your claim and prove the extent of your loss.

- Document All Communication: Keep receipts of all interactions with your insurance company and the adjuster, including emails, phone calls, and letters, in case of disputes.

- Understand State Claim Laws: Determine the at-fault or no-fault laws in your state to ensure you have the right coverage and legal rights to a claim.

Understanding common mistakes and preparing your case thoroughly can significantly increase the chances of receiving the claim payment you deserve.

By following these steps carefully, you can strengthen your position during the claims process and ensure that you receive a fair payment for your loss. Follow these tips on how to buy auto insurance with proper coverage to minimize the risk of claim denial.

When to File an Auto Insurance Claim

If you live in one of the worst states for filing car insurance claims, the first thing you should know is that filing is not a necessity in certain situations. Understanding the difference between when to submit a claim and when you should pay out of pocket will help you avoid an unnecessary premium increase. You should always file when:

- You are part of a major accident involving multiple cars.

- Someone is injured or there is serious property damage.

- Your car is stolen or damaged by rare events, such as wildfire, animal collision, or natural disasters.

- You’re found at fault or fault is unclear, and you need your insurer’s help to resolve the dispute.

- The other driver is uninsured, and repair costs exceed your deductible amount.

If the damage has totaled your vehicle, caused mechanical problems, or affected how the vehicle runs, and you can’t afford to pay out of pocket immediately, then filing a claim is likely your best bet.

If the cost is less than your deductible, or you don’t have collision auto insurance, there is simply no point in submitting your case, as you have to pay out of your own pocket for the repair anyway. In situations where you’re unsure about whether to file, visit a repair shop and obtain a quick estimate for the repair.

If repairs cost more than your deductible, consider whether the damage is worth filing for, especially if your rates increase even though you might not be at fault.

Kristine Lee Licensed Insurance Agent

If the repair cost is less than the estimated price hike of your insurance plan, especially if you were not at fault for the collision or were the only party involved in a fender-bender (i.e., backing into a wall or a pole), you may not want to submit a claim for the sake of keeping your record clean.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ways to Lower Auto Insurance Rates After a Claim

What can you do if you’re living in one of the worst states to file? The good news is that the premium increase is not permanent. After the first year of the raise, your rate will gradually drop each year that passes without incident. Within 3-5 years, your insurance policy cost should return to the pre-accident rate. Follow these tips to pay less for car insurance in the meantime.

Avoid Further Traffic Violations

Getting another traffic violation on your record after a claim (i.e., texting while driving, running a red light, or speeding) can drastically change your annual policy. You can expect your premium cost to go up by $100 to $150 per year after the first violation. The second ticket will likely increase your rate by several hundred dollars. The third can increase your rate by $1,000 per year.

Depending on the company, they may decide to drop you as a customer altogether or demand a hefty deposit for high-risk car insurance before allowing you to keep your policy. Some accident forgiveness programs will also overlook your first ticket. Our definitive guide to usage-based auto insurance explains how driving habits can help prevent future rate hikes.

Increase Your Deductibles

Increasing your insurance deductible after filing a claim is one of the fastest ways to lower your auto insurance premiums. A higher deductible means you agree to pay more out of pocket if you file another claim, which lowers the insurer’s risk.

Raising your deductible post-claim can cut premiums fast. In particular, bumping it to $1,000 saves 15%–20% annually.

Kalyn Johnson Insurance Claims Support & Sr. Adjuster

Keep in mind that while it lowers monthly costs, the trade-off could be expensive if you need to file again soon. This strategy only makes sense if you can comfortably afford the higher deductible in case of another claim.

Read More: What to Do if You Can’t Afford Auto Insurance

Qualify for Accident Forgiveness

How does accident forgiveness work? Typically, if you have a driving record with no collision history, insurance companies will allow you to enroll in their forgiveness program. The best auto insurance for good drivers can help you avoid claim denials with better policy options and lower risks. But each company has slightly different regulations.

Some companies offer forgiveness as soon as your policy starts, but limit it to one accident per year or one driver per policy. Others require you to stay collision-free for a few years first. Only a few, like Progressive, offer free minor accident forgiveness to safe drivers right away. Most, including Liberty Mutual and Allstate, offer it as an add-on to a premium plan.

By paying slightly more for your policy (about 8% to 15% more than the same policy without the option), your provider will overlook your first mishap and allow your premiums to stay the same without any penalty. However, review all the details and fine print before subscribing to the program. Be sure that you understand what services are included and how to take the most advantage of your policy.

Take a Defensive Driving Class

If you see that your rate has jumped significantly, you’re able to soften the hit by offering to take a driving class to brush up on your driving skills. After completing the course, your insurer will offer you a 10-15% defensive driving discount for taking the initiative to be a safe driver. You can also see if you qualify for other discounts that will lower your premium.

Ask About Discounts

Along with defensive driving course discounts, many providers offer savings that are unrelated to your driving record and claims history, including anti-theft device and new car discounts if you drive a more recent model.

One of the easiest discounts to qualify for is a multi-policy discount for drivers who bundle auto policies with homeowners or renters insurance. Compare the cheapest home insurance companies to find the provider with the best multi-policy discounts.

Shop Around and Compare Companies

If all else fails and you still don’t like the price, you can always switch to another provider. Different providers treat prior cases differently. If they see that you have been a responsible driver for a long time before any incident, they may overlook it and still offer you a great price just to make you one of their customers.

Drivers in some states can avoid a rate hike if the claim is only for a small amount of destruction and requires very little repair. If you have been a long-term customer, you may want to contact customer service and attempt to negotiate a lower rate. As a last resort, threatening to take your business elsewhere may prompt them to offer a lower rate just to keep you as a customer.

Learn More: How to Get Multiple Auto Insurance Quotes

The Best And Worst States for Auto Insurance Claims

What state has the worst car insurance? California, Massachusetts, and New Hampshire are the worst states for auto insurance claims. These three states are also among the most expensive for car insurance. California has the highest rates at $219 per month for full coverage, primarily due to its high claims rate and weather-related risks.

Weather volatility raises comprehensive claims in Midwest states. And such risks make insurers charge higher base premiums there.

Jeff Root Licensed Insurance Agent

Michigan is the most expensive state for auto insurance, with minimum coverage starting at $163 monthly and full coverage at $339 per month. Colorado and Idaho are among the best states for filing claims due to their small populations and low traffic density.

Erie, USAA, and State Farm have the cheapest auto insurance after a claim in most states, with minimum coverage starting at $48 after one claim.

Unfortunately, not all companies are the same. If your insurer raises rates, even if you are not at fault for the collision, don’t worry just yet. These companies often offer accident forgiveness programs, where they will overlook the first incident as long as you have elected the option.

Knowing what happens if you cancel auto insurance protects you from claim disputes and higher premiums, but your state laws and claim trends ultimately determine how much you’ll pay for coverage. See how your state ranks among the worst states for filing auto insurance claims by entering your ZIP code into our free quote comparison tool.

Frequently Asked Questions

What are the worst states for filing auto insurance claims?

California, Massachusetts, and New Hampshire are the worst states for filing car insurance claims, with higher-than-average minimum rates starting at $163 a month.

What are the worst states for car accident claims?

The worst states for car accidents are South Carolina, Mississippi, and New Mexico, which report the highest accident and fatality rates per capita. The best auto insurance companies in South Carolina will offer better rates to drivers with no claim history.

What are the worst states for car insurance?

What is the worst state to have car insurance? The worst states for car insurance are Michigan, New Jersey, and Texas due to high monthly premiums, dense traffic, and costly liability claims.

Will my auto insurance go up if I file a claim?

Filing an at-fault claim typically raises monthly premiums by 30–50%, and even not-at-fault claims can cause small increases with some insurers. Check affordable coverage in the worst states to file auto insurance claims using our free quote tool.

Should I get a quote before filing an insurance claim?

Getting a repair quote before filing an insurance claim is recommended to determine if repair costs exceed the deductible and justify potential premium increases. See how to get multiple auto insurance quotes to minimize denied claim risks.

When should I not file an auto insurance claim?

Don’t file if the repair cost is lower than the insurance deductible or if filing would raise monthly premiums more than the payout. Is it better to file a claim or pay out of pocket? Paying out of pocket is better for minor damage below or close to the deductible, while filing a claim is advised for significant repairs or liability.

What are the worst auto insurance companies for paying claims?

According to J.D. Power surveys, the worst-rated car insurance companies are National General, Mercury, and Progressive. Which auto insurance company denies the most claims? Progressive is one of the worst insurance companies for denied claims due to stricter claim investigations and higher dispute rates over fault.

Which auto insurance company has the most complaints?

According to the National Association of Insurance Commissioners, Liberty Mutual has the highest number of complaints, primarily due to delays in claims handling and disputes. Read more in our Liberty Mutual Insurance review.

Which insurance company has the fewest complaints?

Amica Mutual has the fewest complaints nationally and is known for strong claims handling and customer satisfaction.

How many claims before State Farm drops you?

State Farm may drop a policyholder after two or more at-fault claims within three years, depending on state laws and policy terms. Check our State Farm auto insurance review to learn about denied claim rates.

What state has the strictest auto insurance laws?

Which states are matching states for insurance?

What is the most expensive state to insure a car?

What are the worst states to own a car?

What are the worst states to buy a car?

What are no-fault insurance states?

Who pays for car damage in a no-fault state in Pennsylvania?

Is car insurance cheaper in no-fault states?

Can you sue someone in a no-fault state?

What is the riskiest state to drive in?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.