10 Best Car Insurance Companies in 2026

USAA, Liberty Mutual, and Nationwide are the best car insurance companies, with rates starting at $22 a month. Liberty Mutual and State Farm both reward safe drivers with a 20% discount. For military members and their families, USAA offers some of the cheapest car insurance rates available.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson, a published insurance expert, is the fourth generation in her family to work in the insurance industry. Over the past two decades, she has gained in-depth knowledge of state-specific insurance laws and how insurance fits into every person’s life, from budgets to coverage levels. She specializes in autonomous technology, real estate, home security, consumer analyses, investing, di...

Melanie Musson

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated February 2026

USAA, Liberty Mutual, and Nationwide are the best car insurance companies. USAA is the top pick for its excellent customer service.

- USAA is the top pick for high customer satisfaction ratings

- USAA and Geico are the cheapest car insurance companies

- Nationwide’s usage-based discount can save you up to 40%

USAA has the best car insurance for military members, starting at $22 per month, but coverage is only available to military members and their families.

Everyone else can get the best auto insurance with Liberty Mutual, which is available in all 50 states, and Nationwide, which is available in 48 states.

Our Top 10 Picks: Best Car Insurance Companies| Company | Rank | Claims Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 741 / 1,000 | A++ | Military Drivers | |

| #2 | 730 / 1,000 | A | New Cars |

| #3 | 729 / 1,000 | A+ | Coverage Variety | |

| #4 | 718 / 1,000 | A+ | Customer Service | |

| #5 | 716 / 1,000 | A++ | Young Drivers | |

| #6 | 697 / 1,000 | A++ | Discounts | |

| #7 | 693 / 1,000 | A+ | Accident Forgiveness | |

| #8 | 691 / 1,000 | A++ | Hybrid Vehicles | |

| #9 | 690 / 1,000 | A | Rideshare & Delivery | |

| #10 | 673 / 1,000 | A+ | Online Tools |

Finding the best auto insurance for you depends on your driving history and whether you need liability vs. full coverage insurance.

Compare the top 10 auto insurance companies now to find the right provider.

- Auto Insurance Reviews

- MAPFRE Insurance Review for 2026

- Hugo Insurance Review for 2026

- State Farm vs. Farmers, Geico, Progressive, & Allstate

- Liberty Mutual vs. Nationwide Auto Insurance in 2026

- CSAA vs. Mercury Insurance (2026)

- Progressive vs. State Farm Auto Insurance (2026)

- Allstate vs. Geico Auto Insurance in 2026

- Auto Club Enterprises vs. The Hartford (2026)

- Farmers vs. USAA Auto Insurance in 2026

- Erie vs. Metlife Insurance (2026)

- Amica vs. Auto-Owners 2026

- American Family vs. Travelers in 2026

- GoAuto Insurance Review for 2026

- Fred Loya Insurance Review for 2026

- 10 Best Auto Insurance Companies for Claims Handling in 2026

- Wawanesa Insurance Review

- USAA Insurance Review for 2026

- Travelers Auto Insurance Review for 2026

- The General Auto Insurance Review for 2026

- State Farm Auto Insurance Review for 2026

- Nationwide Auto Insurance Review for 2026

- Metromile Auto Insurance Review for 2026

- American Access Casualty Company Review for 2026

- State Auto Insurance Review for 2026

- Progressive Auto Insurance Review for 2026

- United Auto Insurance Review for 2026

- Good2Go Auto Insurance Review for 2026

- GAINSCO Auto Insurance Review for 2026

- Mercury Insurance Review for 2026

- Liberty Mutual Insurance Review for 2026

- Esurance Auto Insurance Review for 2026

- Elephant Insurance Review for 2026

- CURE Insurance Review for 2026

- Amica Insurance Review for 2026

- Allstate Insurance Review for 2026

- AAA Auto Insurance Review for 2026

- 21st Century Auto Insurance Review for 2026

- SafeAuto Insurance Review for 2026

- Geico Insurance Review for 2026

- Allied Insurance Review for 2026

- Infinity Insurance Review for 2026

- Auto-Owners Insurance Review in 2026

- National General Insurance Review for 2026

- Farmers Insurance Review for 2026

- The Hanover Insurance Review for 2026

- Clearcover Auto Insurance Review for 2026

- Safeco Auto Insurance Review for 2026

- Ag Workers Auto Insurance Review for 2026

- Direct Auto Insurance Review for 2026

- Root Insurance Review for 2026

- Mile Auto Insurance Review for 2026

- Erie Insurance Review for 2026

- Farm Bureau Insurance Review for 2026

- American Family Insurance Review for 2026

Get the right car insurance at the best price by entering your ZIP code and shopping for coverage from the top insurance companies in your state.

Car Insurance Rates With Top Providers

USAA has the lowest monthly car insurance rates of the providers in our ranking, starting at $22 per month for liability insurance coverage.

However, USAA only sells coverage to military members, making Geico and State Farm the best auto insurance companies with low rates for most drivers.

Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $61 | $228 | |

| $65 | $215 | |

| $53 | $198 | |

| $30 | $114 | |

| $68 | $248 |

| $44 | $164 | |

| $39 | $150 | |

| $33 | $123 | |

| $37 | $141 | |

| $22 | $84 |

Full coverage usually costs more since it offers more protection. It bundles liability, collision, and comprehensive insurance, protecting you for damages you cause to others and repairs to your own car.

USAA is the cheapest option, starting at just $84 a month, but it is only available to military families. Geico and State Farm are usually affordable for most drivers, but compare quotes from multiple companies to see which is the most competitive in your area.

So, it’s important to consider your coverage needs before buying a policy. Check out our review of State Farm vs. Farmers, Geico, Progressive, and Allstate auto insurance for a closer comparison.

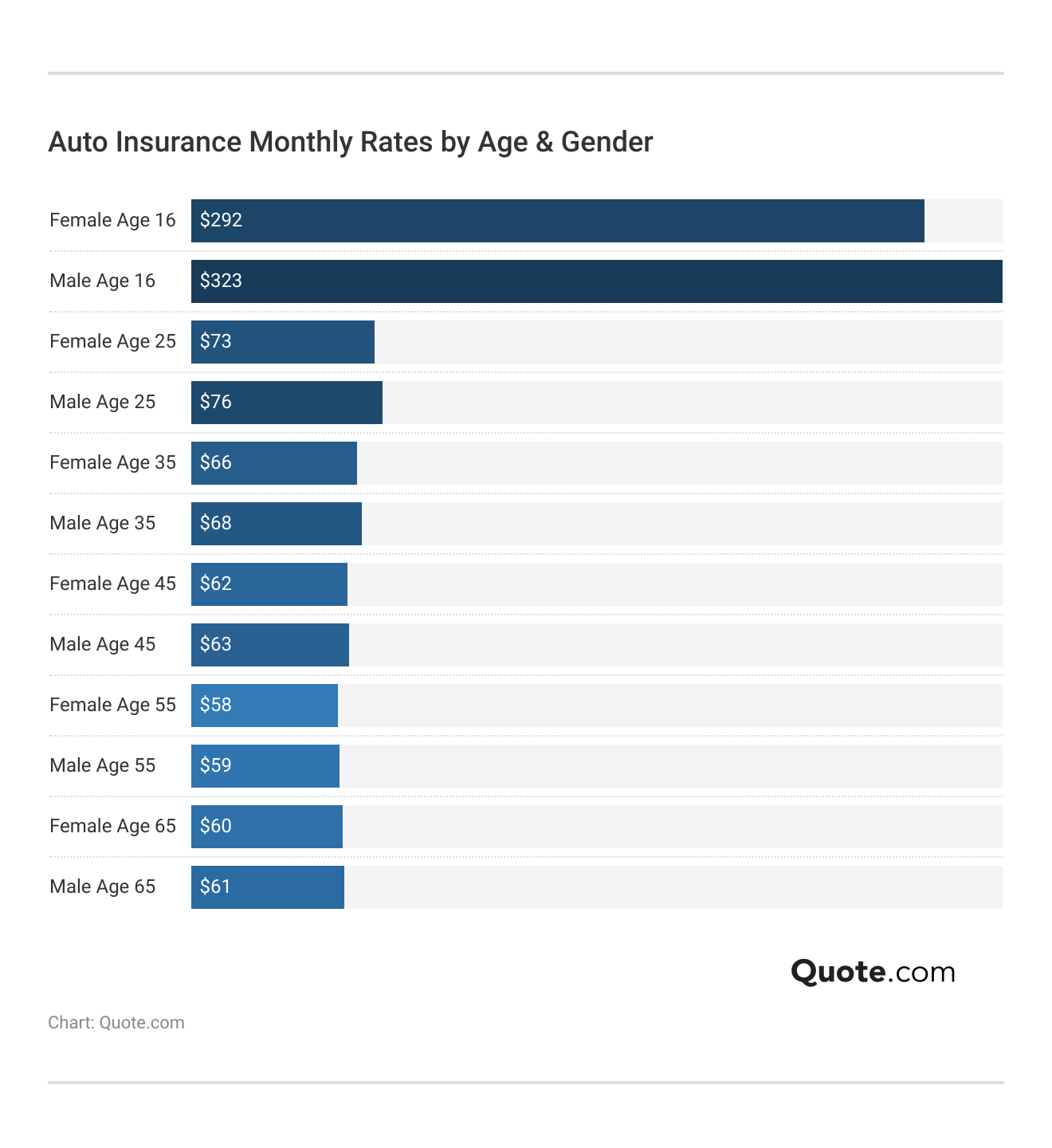

You’ll also find rates vary by factors like age and gender. Insurers often see younger drivers as higher risk, while men are statistically more likely to get in accidents.

Depending on your driving history, the best auto insurance for good drivers may not be the right fit for someone with accidents or DUIs on their record.

All insurance companies weigh risk differently, so the cheapest option for one driver may be more expensive for another.

Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $61 | $103 | $124 | $152 | |

| $65 | $81 | $99 | $123 | |

| $53 | $95 | $109 | $178 | |

| $30 | $56 | $71 | $129 | |

| $68 | $116 | $129 | $178 |

| $44 | $75 | $88 | $112 | |

| $39 | $74 | $98 | $75 | |

| $33 | $53 | $57 | $65 | |

| $37 | $72 | $76 | $123 | |

| $22 | $36 | $42 | $58 |

State Farm and USAA have the best car insurance after a speeding ticket, accident, or DUI, followed by Progressive.

Geico remains competitive, but drivers with a DUI conviction pay three times as much as drivers with a clean driving record.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Auto Insurance Companies by State

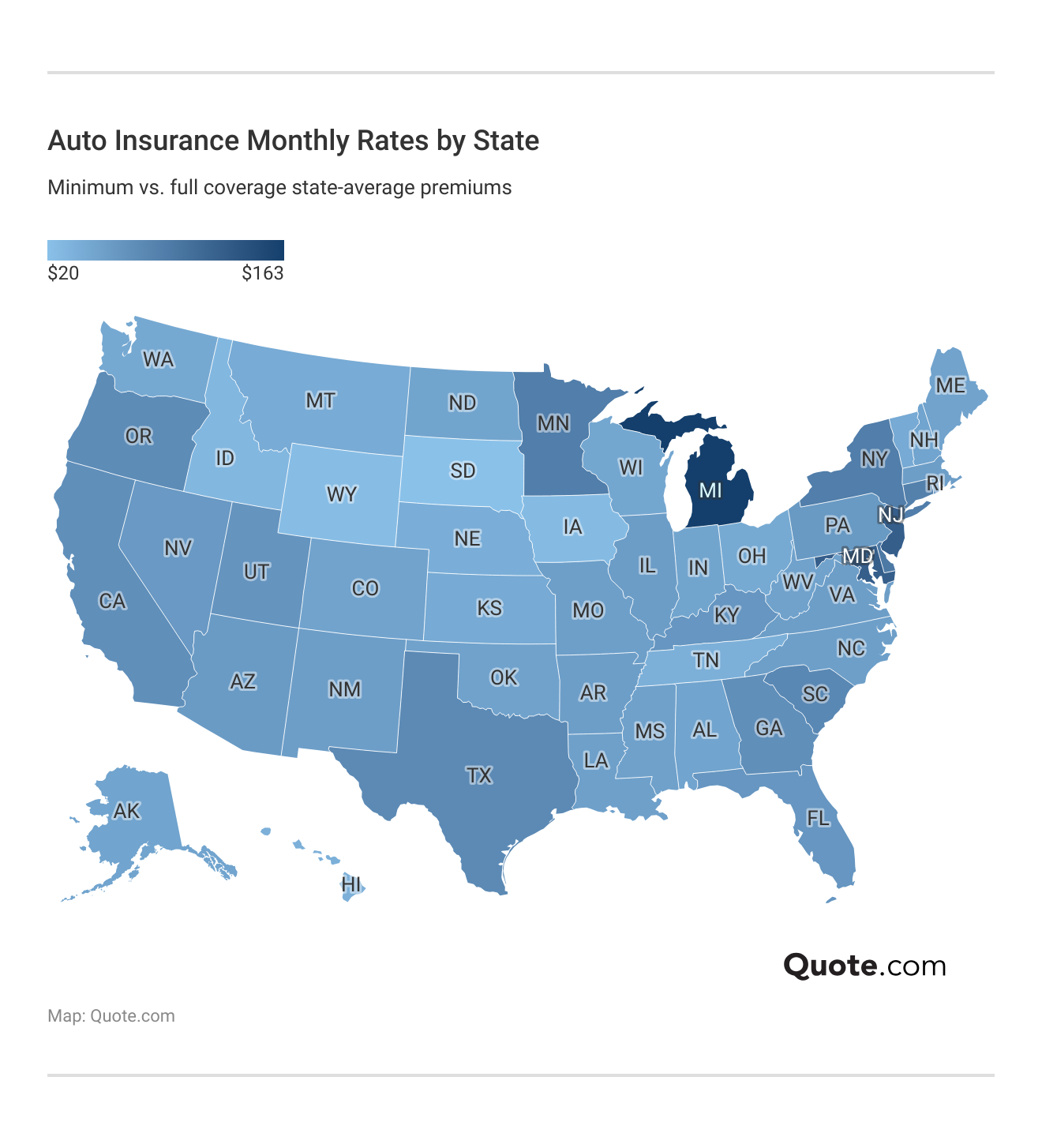

Rates and coverage options vary by location, so the top car insurance companies in the U.S. may be different from the best in your state.

In some areas, smaller regional companies may provide lower rates or deliver better service than well-known national providers.

For example, The Hanover offers coverage in various states across the Northeast and Midwest. They’re best known in Massachusetts, where the company was founded. Learn More: The Hartford vs. Auto Club Enterprises Review

At Quote.com, we ranked the best car insurance providers in each state. See which ones stand out for coverage and value in your state:

Find the Best Car Insurance by State (+Monthly Rates!)Premiums will be higher in some states based on coverage requirements, traffic density, claim rates, and weather-related risks.

Always compare auto insurance rates by state if you’re planning to move to find the best local provider.

Types of Car Insurance Coverage Explained

Every state requires some level of liability auto insurance, while car loans and lease agreements will require full coverage.

If you buy full coverage insurance, your policy will be eligible for add-ons that enhance your protection on the road and reduce your out-of-pocket costs.

Auto Insurance Coverage Options: Complete Breakdown| Coverage Type | What it Covers |

|---|---|

| Liability | Pays for damage/injuries you cause |

| Collision | Repairs/replaces your car after crash |

| Comprehensive | Covers theft, weather, or animal loss |

| Uninsured/Underinsured Motorist | Pays for injuries from uninsured drivers |

| Medical Payments (MedPay) | Covers med bills for you & passengers |

| Personal Injury Protection (PIP) | Covers medical bills and lost wages |

| Accident Forgiveness | Prevents rate hike after first accident |

| Custom Equipment | Covers custom or added car parts |

| Gap Insurance | Pays loan balance if car is totaled |

| New Car Replacement | Covers new car after total loss |

| Rental Car Reimbursement | Pays for rental while car’s repaired |

| Rideshare Coverage | Protects during rideshare driving |

| Roadside Assistance | Covers towing, jumps, or lockouts |

Roadside assistance coverage is the most popular add-on, available at every company. This kicks in to pay for towing, tire replacement, gas delivery, and more if your car breaks down and leaves you stranded.

Another common add-on is new car replacement, which provides a brand-new version of the same make and model if your car gets totaled within the first few years.

Coverage Availability by Leading Auto Insurers| Company | Gap Insurance | New Car Replacement | Rideshare Coverage | Vanishing Deductible |

|---|---|---|---|---|

| ✅ | ✅ | ✅ | ❌ | |

| ❌ | ✅ | ❌ | ✅ | |

| ✅ | ❌ | ✅ | ✅ | |

| ❌ | ❌ | ✅ | ❌ | |

| ✅ | ✅ | ❌ | ❌ |

| ✅ | ✅ | ❌ | ✅ | |

| ✅ | ❌ | ✅ | ✅ | |

| ❌ | ❌ | ✅ | ❌ | |

| ❌ | ✅ | ❌ | ✅ | |

| ✅ | ✅ | ❌ | ❌ |

However, availability varies from company to company. Speak with an insurance representative to discuss coverage options before buying coverage.

The best auto insurance for you will depend on your coverage needs, so always compare before you buy. Learn More: How to Get Multiple Auto Insurance Quotes

How to Choose the Best Car Insurance for You

When selecting from the best auto insurance companies, a myriad of factors influence the final decision beyond just the price.

Before deciding on a car insurance company, consider these four key factors to find the best auto insurance company for you.

- Claims Process: A streamlined and transparent claims process reduces hassle and ensures timely support during stressful times.

- Coverage Options: From basic liability to comprehensive coverage, the breadth and flexibility of policy options play a pivotal role in whether you can save more money on car insurance.

- Customer Service: The responsiveness and support provided by the insurance company can greatly impact the overall satisfaction, especially when claims arise.

- Financial Stability: The insurer’s ability to fulfill its financial obligations reflects its long-term reliability and trustworthiness.

The goal is not just to find affordable car insurance but to select a policy that provides adequate protection tailored to your specific needs.

For example, while one company may have the cheapest rates, another may have stronger customer service and discount options that provide greater value.

Choosing the right company involves evaluating premiums, coverage options, and support from top-rated providers.

Enter your ZIP code now to compare car insurance quotes in just 2 minutes and find the most affordable coverage for your needs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Proven Tips to Lower Your Insurance Rates

The best car insurance companies in the U.S., such as Allstate, Amica, and Farmers, provide a wide variety of ways to save, including usage-based, multi-policy, safe driver, and loyalty discounts.

Safe drivers can also significantly benefit from usage-based auto insurance (UBI), which tracks driving habits for additional discounts.

Top Auto Insurance Discounts| Company | Bundling | Low Mileage | Safe Driver | Usage- Based |

|---|---|---|---|---|

| 25% | 30% | 18% | 40% | |

| 30% | 25% | 15% | 20% | |

| 20% | 10% | 20% | 30% | |

| 25% | 30% | 15% | 25% | |

| 25% | 30% | 20% | 30% |

| 20% | 20% | 10% | 40% | |

| 10% | 30% | 10% | 20% | |

| 17% | 30% | 8% | 30% | |

| 13% | 20% | 17% | 30% | |

| 10% | 20% | 10% | 30% |

For instance, Progressive provides Snapshot usage-based discounts, and drivers with clean records can sign up for usage-based auto insurance with Drive Safe & Save from State Farm.

However, some insurers may increase your rates if you drive poorly while enrolled, so usage-based insurance is not right for everyone.

Companies like Travelers and USAA cater to specific needs, with discounts for hybrid and electric vehicles and military personnel.

However, you may be wondering what else you can do to lower your rates. Consider the tips below to help you get the cheapest car insurance rates possible.

- Evaluate Your Coverage Needs: To determine the level of coverage you need, consider factors such as your vehicle’s value, your driving habits, and your financial security in case of an accident.

- Reassess Annually: Your insurance needs may evolve due to changes in your personal life, driving patterns, or even adjustments in your state’s insurance regulations.

- Shop Around: Don’t settle for the first quote you get. Each company has its own method of assessing risk and calculating premiums, which means prices can vary significantly.

Don’t forget to ask about other discounts you may qualify for. State Farm offers 15% savings for drivers with a car less than two years old.

Knowing the best time to buy a new car can further enhance your overall experience when buying a car insurance policy.

Look for more opportunities to save through various discounts, such as multi-car policies, anti-theft device installations, and a claim-free history. Read our guide on the best anti-theft auto insurance discounts to learn more.

Top 10 Auto Insurance Companies in the U.S.

USAA, Liberty Mutual, and Nationwide rank as the best car insurance companies in the U.S., with rates starting at just $22 per month.

These top 10 auto insurance companies offer competitive rates, excellent service, and comprehensive coverage options. Amica stands out by providing low prices, great discounts, and personalized customer service.

Meanwhile, Nationwide offers various add-on coverages to increase your policy’s value, and USAA has the best car insurance policies for military families.

#1 – USAA: Top Pick Overall

Pros

- Tailored Services for Military: USAA is renowned among car insurance companies for its services designed for military personnel and their families.

- Exceptional Customer Support: USAA stands out among car insurance companies for its high customer satisfaction and support.

- Competitive Pricing: Compare quotes in our USAA insurance review, where monthly rates for minimum coverage start at $65.

Cons

- Limited Eligibility: USAA’s services are exclusive to military members and their families, which limits accessibility compared to other car insurance companies.

- Lacks In-Person Support: USAA does not have as many local agents to provide personalized service when compared to other auto insurance companies like State Farm or Allstate.

#2 – Liberty Mutual: Best for New Car Replacement

Pros

- New & Better Car Replacement: Liberty Mutual excels among car insurance companies with its better car replacement add-on for vehicles less than a year old.

- Broad Coverage Options: Read our Liberty Mutual insurance review for its wide range of coverage options and customizable add-ons.

- Customizable Discounts: Provides numerous discounts for teachers, young drivers, seniors, and drivers with multiple policies.

Cons

- Higher Monthly Rates: Out of the ten best car insurance companies, Liberty Mutual is often the most expensive,

- Inconsistent Customer Service: Customer service quality can vary, which may impact satisfaction levels compared to other car insurance companies.

#3 – Nationwide: Best for Comprehensive Coverage

Pros

- Extensive Coverage Options: Nationwide offers broad and comprehensive coverage options, making it a leader among car insurance companies.

- Customizable Policies: Explore our Nationwide insurance review to learn about its significant policy customization for tailored coverage.

- Inclusive Coverage Add-ons: Includes various riders and add-ons for comprehensive protection, setting it apart from other car insurance companies.

Cons

- Higher Premiums: Comprehensive coverage from Nationwide may come with higher premiums compared to more basic plans from other car insurance companies.

- Complex Policy Choices: The wide array of options can be overwhelming for those looking for basic liability-only coverage from other car insurance companies.

#4 – Amica: Best for Customer Service

Pros

- Top-Tier Customer Service: Amica is frequently recognized among car insurance companies for its exceptional customer service and client satisfaction.

- High Claims Satisfaction: Based on our Amica insurance review, the company is known for high claims satisfaction rates, making it a reliable choice.

- Dividend Payments to Policyholders: Unlike other car insurance companies, Amica is a mutual company and returns annual dividends to drivers.

Cons

- Higher Cost: Amica’s premium rates can be higher than average among car insurance companies, reflecting its premium service quality.

- Limited Availability: Amica’s services are not available in every state, which might limit options for some customers compared to other nationwide car insurance companies.

#5 – State Farm: Best for Young Drivers

Pros

- Competitive Rates for Young Drivers: State Farm is recognized among car insurance companies for offering cost-effective policies tailored to younger drivers (Learn More: Cheap Auto Insurance for Teens).

- Extensive Agent Network: Explore our State Farm insurance review to see why it’s known for its broad agent network and personalized service.

- Resourceful Online Tools: State Farm offers educational resources that help young drivers understand their policies better.

Cons

- Increased Premiums After Claims: State Farm may increase rates more significantly than other auto insurance companies after claims.

- Limited Policy Customization: Compared to other car insurance companies, State Farm offers fewer customization options, which may not meet all needs.

#6 – Geico: Best for Low Rates

Pros

- Low Premiums: Geico stands out among car insurance companies for its consistently low rates, making it attractive for budget-conscious drivers.

- Efficient Online Services: Geico is recognized for its streamlined online quote and mobile claim processes.

- Usage-Based Discounts: Safe drivers earn additional discounts when tracking their habits with Geico DriveEasy. Read everything you need to know about Geico to learn how it works.

Cons

- Basic Customer Service: Geico’s customer service ranks below other companies, especially for claims satisfaction.

- Generic Policy Offerings: Geico’s policies can be quite generic and are missing key add-ons, like gap insurance.

#7 – Allstate: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Allstate is notable among car insurance companies for offering accident forgiveness policies, helping to prevent premium increases after an initial accident.

- Multiple Discount Options: Offers a variety of discounts that enhance affordability among car insurance companies. Find a list in our Allstate Insurance review.

- Robust Coverage Options: Allstate stands out among car insurance companies for its comprehensive policies and extensive coverage options.

Cons

- Higher Premiums: Generally, Allstate has higher premiums than some other car insurance companies.

- Complex Policy Management: Some customers find managing their policies through Allstate more complex compared to other car insurance companies.

#8 – Travelers: Best for Hybrid Vehicles

Pros

- Incentives for Eco-Friendly Vehicles: Travelers is noted among car insurance companies for offering discounts and incentives for hybrid and electric vehicles.

- Extensive Policy Options: View our Travelers auto insurance review for options and to see how its comprehensive coverage makes it a flexible choice.

- Competitive Pricing: Known for competitive pricing, especially beneficial for owners of hybrid vehicles within the car insurance companies market.

Cons

- Complex Claims Process: Some customers find the claims process complex and time-consuming compared to other car insurance companies.

- Less Accessible Customer Support: Customer support can be less accessible during peak times, which could detract from the overall experience with this car insurance company.

#9 – Farmers: Best for Rideshare & Delivery Drivers

Pros

- Innovative Coverage Solutions: Farmers provides flexible policies for rideshare and delivery drivers, or those who work from home. See everything you need to know about Farmers for policy options.

- Extensive Agent Network: Maintains a vast agent network that facilitates personalized service, a significant plus among car insurance companies.

- Long List of Discounts: Farmers offers more discounts than the best auto insurance companies on this list, including usage-based and loyalty savings.

Cons

- Potentially Higher Premiums: Customization and comprehensive coverage through Farmers can lead to higher premiums compared to other car insurance companies.

- Variable Customer Experience: Customer experience can vary greatly depending on the local agents where you live.

#10 – Progressive: Best for Online Tools

Pros

- Innovative Online Tools: Progressive is noted among car insurance companies for its advanced online tools, which help drivers stay on budget.

- Flexible Policies: Known as one of the more flexible auto insurance companies, with usage-based insurance, rideshare coverage, and SR-22 filings.

- Competitive Discounts: Get a full list of discounts in our guide to everything you need to know about Progressive Insurance.

Cons

- Variable Customer Service: The quality of customer service at Progressive can vary.

- Higher Rates for High-Risk Drivers: Progressive charges more than the best car insurance companies after an accident or DUI.

Find the Best Car Insurance Company Today

We found that USAA, Liberty Mutual, and Nationwide are the best car insurance companies for their strong customer satisfaction, trusted service, and coverage options.

J.D. Power’s recent auto insurance studies show these providers have consistently high claims satisfaction, including USAA and Amica. Read More: Amica vs. Auto-Owners Insurance Review

Each provider offers unique benefits, discounts, and coverage options, so compare car insurance companies before you switch. Top providers like State Farm often receive high marks for customer satisfaction, which can be a crucial factor if you ever need to file a claim.

See which car insurance company has the best rates and claims satisfaction in your state with our free quote comparison tool.

Frequently Asked Questions

Who are the best car insurance companies?

The top auto insurance companies are USAA, Liberty Mutual, and Nationwide. Top-rated auto insurance companies typically offer competitive rates, valuable features like roadside assistance and accident forgiveness, and exceptional customer service.

How much does car insurance cost?

Car insurance costs as low as $22 per month for liability coverage, while full coverage starts at $84 a month.

Who is the cheapest car insurance company?

USAA offers the best cheap auto insurance at $22 per month, but eligibility is limited to military members.

For all drivers, Geico is the most affordable, starting at $30 per month. Check out our Geico insurance review to see if it’s the right choice for you.

How much car insurance do you need?

All states except New Hampshire require car insurance coverage, but the exact amount depends on your state’s minimum requirements, the value of your car, and personal needs. While it’s essential to meet legal minimums, consider higher limits and optional coverages for better protection.

Learn More: How to Buy Auto Insurance

How do I find the best car insurance?

To find the best auto insurance quotes, use online comparison tools that allow you to compare policies from various auto insurance companies based on your specific driving profile and coverage needs. See if you’re getting the best deal on car insurance by entering your ZIP code.

How can I lower my car insurance rates?

To reduce your average cost per month for car insurance, look for discounts such as multi-car, good driver, and loyalty discounts.

Why should you compare auto insurance companies before buying?

Comparing auto insurance companies helps ensure that you receive the most comprehensive coverage at the most competitive rate. It also allows you to assess the service quality and customer satisfaction levels of different insurers.

What factors affect car insurance rates?

The average monthly car insurance rate is influenced by factors such as the driver’s age, driving history, the type of vehicle insured, geographical location, and the level of coverage. If your rates are high, compare quotes from the cheapest car insurance companies here.

Who is cheaper: Geico or Progressive?

Geico is usually cheaper, with rates starting at $30 per month compared to Progressive’s $39.

Read More: Progressive Auto Insurance Review

While Progressive may offer lower rates for high-risk drivers, most shoppers will find Geico has the best auto insurance for good drivers.

Is State Farm cheaper than Geico?

State Farm and Geico compete for the cheapest rates in most states, but Geico is typically cheaper on average at $30 per month compared to State Farm’s $22 monthly rate.

Who are the best car insurance companies for a DUI?

Who are the best car insurance companies according to Reddit?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.