Costco Insurance Review for 2026

Costco auto insurance through CONNECT starts at $54 per month with member-only benefits and safe driver savings up to 30%. Costco home insurance rates begin at $58 a month with Executive Member discounts. CONNECT by American Family underwrites Costco policies with an excellent financial rating from A.M. Best.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Copywriter

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, AllWom...

Rachel Bodine

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated January 2026

This Costco insurance review breaks down its partnership with CONNECT by American Family to provide auto and home insurance policies, with exclusive discounts and coverage options only available to Costco members.

- Costco insurance saves members around $600 on auto coverage first year

- CONNECT by AmFam underwrites Costco auto and home insurance

- Costco home insurance offers lock replacement and fire damage assistance

Drivers can earn safe driver discounts of up to 30% while accident forgiveness helps protect against higher premiums after a first at-fault claim.

Costco Executive Members gain roadside assistance worth up to $100 per call, offering reliable help when vehicles break down (Read More: American Family Insurance Review).

Costco Insurance Rating| Rating Criteria |  |

|---|---|

| Overall Score | 4.5 |

| Business Reviews | 5.0 |

| Claim Processing | 4.7 |

| Company Reputation | 4.0 |

| Coverage Availability | 4.9 |

| Coverage Value | 4.8 |

| Customer Satisfaction | 1.9 |

| Digital Experience | 4.0 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.5 |

| Plan Personalization | 4.0 |

| Policy Options | 5.0 |

| Savings Potential | 4.7 |

Eligible policyholders receive a glass repair deductible waiver, allowing windshield repairs to be completed without extra expense.

If you aren’t a Costco member, check for other car insurance savings near you by entering your ZIP code into our free quote comparison tool.

Costco Auto Insurance Review

This Costco car insurance review looks at how auto rates change by age, gender, and driving history while comparing it to other major insurers. It also highlights the coverage options and exclusive discounts members get through CONNECT by AmFam.

Costco Auto Insurance Costs

Minimum coverage through Costco averages $67 per month, more expensive than Geico and USAA but cheaper than Farmers or Allstate.

Full coverage with Costco runs $223 per month, higher than Progressive and State Farm, though not far from Farmers at $198.

Costco vs. Competitors: Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $67 | $223 |

| $76 | $198 | |

| $43 | $114 | |

| $63 | $164 | |

| $50 | $150 | |

| $47 | $123 | |

| $53 | $141 | |

| $32 | $84 |

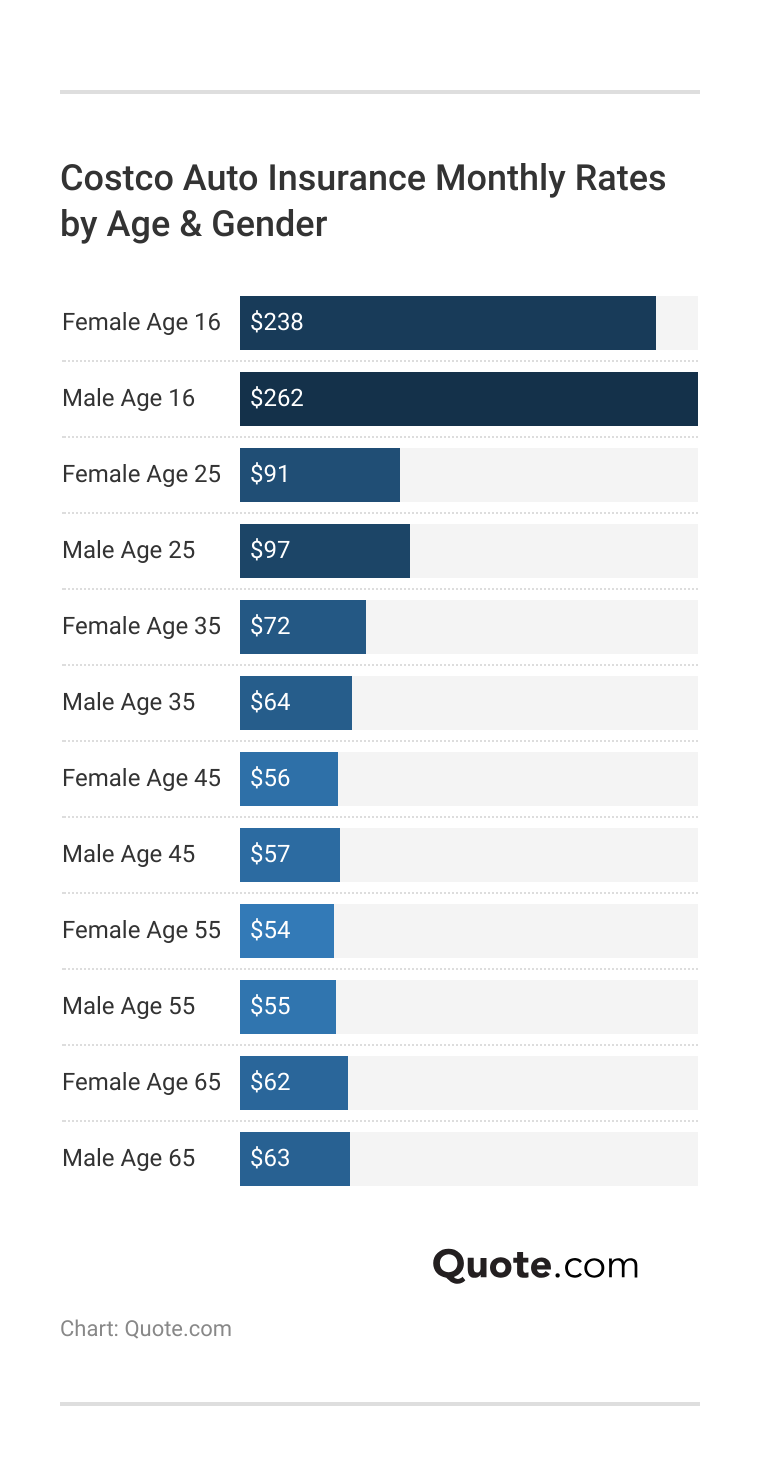

Costco car insurance for teens is more affordable than average. Sixteen-year-old males average $262 per month, while females pay $238 monthly.

The most affordable range comes at ages 45 to 55, holding steady near $55 before climbing modestly to $62 for women and $63 for men at age 65.

Along with age, your driving record is the other factor that can cause Costco auto insurance rates to skyrocket (Read More: At-Fault Accident: What it Means & How it Affects Insurance Rates).

Drivers with clean records get the best rates, but if you have an accident or at-fault liability claim on your Costco insurance, your monthly premiums could double or triple in price.

A clean driving record with Costco averages $67 per month, but after just one at-fault accident, monthly costs can climb to around $90, reflecting how risk directly impacts premiums.

A DUI brings premiums to $99 per month. However, even with a high-risk record, Costco car insurance is still cheaper than Allstate and Nationwide.

Costco vs. Competitors: Auto Insurance Monthly Rates by Driving Record| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $87 | $124 | $152 | $103 | |

| $62 | $94 | $104 | $73 |

| $67 | $90 | $99 | $69 |

| $76 | $109 | $105 | $95 | |

| $43 | $71 | $117 | $56 | |

| $63 | $75 | $129 | $75 | |

| $50 | $98 | $75 | $74 | |

| $47 | $57 | $65 | $53 | |

| $53 | $76 | $112 | $72 | |

| $32 | $42 | $58 | $36 |

Your Costco membership may unlock different rates based on the tier and length of your membership, so shop around before you buy.

Comparing quotes online is the easiest way to determine if Costco insurance is truly the best policy for your needs, helping you see how its member perks and rates stack up against other providers.

Learn More: Ways You’re Wasting Money on Your Car

Costco Auto Insurance Coverage

Costco auto coverage through CONNECT by AmFam covers the basics that drivers rely on, such as liability insurance, which pays for injuries and property damage you cause.

You may want to carry liability vs. full coverage car insurance based on the age of your vehicle and if you can afford to pay for repairs out-of-pocket.

- Roadside Assistance for Executive Members: Includes towing, battery jump-starts, flat tire help, and fuel delivery, with coverage up to $100 per call.

- Glass Repair Deductible Waiver: Waives your deductible for windshield chip or crack repairs, helping you avoid extra out-of-pocket costs.

- Accident Forgiveness: Prevents a premium increase after your first at-fault accident when you meet eligibility requirements.

- New Car Replacement: Provides a brand-new vehicle if your car is totaled within the first year of ownership, avoiding depreciation losses.

Costco car insurance also adds member-only perks that make handling everyday driving needs a lot easier. After the core protections, members can access added benefits that focus on convenience and savings.

Costco insurance coverages through CONNECT by American Family combine essential protections with unique membership perks that aren’t available with other providers.

Costco Auto Insurance Discounts

Costco members can unlock a variety of auto insurance discounts through CONNECT Insurance. These savings reward safe habits, smart financial choices, and exclusive Costco membership benefits that make coverage more affordable.

- Safe Driver Discount: Offers savings up to 30% for members with clean driving records and no recent violations, and lowers premiums by an additional 5% when drivers finish an approved safety course.

- Multi-Vehicle Discount: Cuts costs by up to 23% when two or more cars are insured under the same Costco policy.

- Good Student Discount: A 25% discount applies to high school and college drivers who keep at least a B average.

- Low Mileage Discount: Reduces annual rates by 20% for members who drive less each year, reflecting fewer accident risks.

These Costco insurance discounts help members save in meaningful ways. Low-mileage discounts are the easiest way for Costco members to lower their rates if they don’t drive often.

Driving less than 10,000 miles per year can also qualify drivers for usage-based insurance discounts through CONNECT by AmFam.

By rewarding careful driving, low mileage, smart policy choices, and good grades for teens, these discounts on Costco car insurance can make premiums more affordable for even high-risk or young drivers.

Read our guide on how to buy auto insurance to find the right coverage for you, including tips for high-risk drivers who may face higher monthly premiums.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Costco Home Insurance Review

This Costco home insurance review breaks down how much homeowners insurance you need, with different coverage levels, from $200K to $1M policies. We also point out the coverages and discounts offered through CONNECT by AmFam, which protect your home, belongings, and provide extra living costs when needed.

Costco Home Insurance Costs

Costco is a competitive option for affordable homeowners insurance. A $200K policy with Costco averages $58 per month, lower than Farmers $64 monthly rate.

At $300K coverage, Costco home insurance averages $82 a month, coming in just under Nationwide’s $88 monthly rate.

Costco vs. Competitors: Home Insurance Monthly Rates by Dwelling Coverage| Insurance Company | $200K | $300K | $500K | $1M |

|---|---|---|---|---|

| $66 | $93 | $140 | $208 | |

| $61 | $86 | $129 | $195 |

| $58 | $82 | $124 | $188 |

| $64 | $90 | $136 | $202 | |

| $58 | $82 | $124 | $188 | |

| $62 | $88 | $133 | $199 | |

| $60 | $85 | $128 | $192 | |

| $59 | $83 | $125 | $186 | |

| $63 | $89 | $134 | $200 | |

| $56 | $79 | $120 | $182 |

A $500K home policy brings the monthly rate to $124, slightly below Progressive at $128 a month. Learn how to estimate home insurance costs based on where you live.

Even at $1M coverage, Costco averages $188 per month, beating Allstate at $208 a month and Travelers at $200 monthly for high-value properties.

Costco Home Insurance Coverage

Policy options go beyond just protecting the house itself, offering coverage that extends to belongings, liability, and living expenses when unexpected losses occur.

Costco homeowners insurance options through CONNECT by AmFam include dwelling coverage and coverage for other structures, such as fences, garages, and sheds.

Personal property coverage covers items you own inside your home, as well as loss of use coverage if a covered event makes your home unlivable.

Personal liability coverage provides protection if you are held responsible for injuries to others or property damage that occurs on or away from your property.

Read More: Understanding the 8 Types of Home Insurance Policies

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Costco Home Insurance Discounts

Costco members save on home coverage through CONNECT by AmFam with some exclusive savings, so it’s easy to bring home coverage costs down. For instance, adding a smart-home security system gets you the unique Safe, Secure, Smart Home discount.

- Multi-Policy Discount: Reduces premiums when home and auto coverage are bundled under the same policy.

- Executive Member Discount: Gives exclusive savings to Costco Executive Members with qualifying home coverage.

- Protective Device Discount: Applies when homes have monitored alarms, fire sprinklers, or smoke detectors installed.

- Claims-Free Discount: Rewards homeowners who maintain a clean claims history over several years.

- New Home Discount: Offers lower premiums for recently built homes that meet updated safety and building codes.

Lower rates also apply to homes with recent updates to roofing or plumbing, to payments set up on automatic transfer, and to properties with increased anti-theft security or that are located in secured gated communities that carry less risk.

Read More: 17 Car Insurance Discounts You Can’t Miss

Costco Renters Insurance Review

Costco renters insurance keeps pace with well-known competitors. Members also get access to protections for belongings, liability, and optional add-ons through CONNECT by AmFam, along with discounts for safety features and Costco membership. See how Costco compares to the best renters insurance companies.

Costco Renters Insurance Costs

Costco offers $30,000 in coverage for approximately $9 a month, which is just one dollar more than Geico at $8 and the same price as Nationwide.

If you increase the coverage to $50,000, Costco remains steady at $13 per month, offering consistent affordability, while State Farm’s price climbs to $16.

Costco vs Competitors: Renters Insurance Monthly Rates by Property Coverage| Insurance Company | $30K | $50K | $70K |

|---|---|---|---|

| $10 | $14 | $18 | |

| $12 | $16 | $21 |

| $9 | $13 | $18 |

| $11 | $15 | $19 | |

| $8 | $12 | $16 | |

| $9 | $13 | $17 | |

| $10 | $14 | $18 | |

| $11 | $16 | $22 | |

| $12 | $17 | $23 | |

| $7 | $11 | $15 |

A $70K policy costs $18 per month through Costco, aligning with Allstate and Progressive while offering a clear savings edge over Travelers, which reaches $23 a month for the same coverage level.

Although Costco may not always be one of the cheapest home insurance companies, its consistency and predictability can be very valuable for renters on a budget.

Costco Renters Insurance Coverage

Costco renters insurance through CONNECT protects belongings, living expenses, and liability exposures with straightforward coverages designed to address everyday risks.

Along with the personal property and loss of use coverage available with home insurance, Costco CONNECT also offers:

- Theft Coverage Away From Home: Extends protection to belongings stolen while you are traveling or away from your residence.

- Personal Liability Coverage: Covers legal costs and damages if you are responsible for injuries to others or property damage.

- Medical Payments to Others: Helps pay medical expenses if a guest is injured inside your rental, regardless of fault.

Beyond these essentials, Costco renters insurance also includes optional protections that give members extra peace of mind for unique or higher-value risks.

With both standard benefits and customizable add-ons, members can build policies that match their needs while maintaining reliable safeguards.

- Valuable Items Coverage: Increases coverage limits for jewelry, watches, or collectibles that exceed standard policy caps.

- Water Backup Coverage: Reimburses for damage caused by backed-up drains or sump pump failures that affect your property.

- Identity Theft Protection: Provides monitoring services and reimburses recovery expenses if your personal information is compromised.

- Earthquake Coverage: Offers protection for belongings damaged by earthquakes in eligible states (Learn More: Does homeowners insurance cover wildfires?).

- Replacement Cost Coverage: Ensures you receive the cost of new items rather than depreciated value when property is lost or destroyed.

These Costco renters insurance coverages provide practical protection with additional perks like earthquake coverage and identity theft protection that you don’t get from all providers.

Many of these policy features are available to homeowners, but Costco CONNECT Insurance through American Family is one of the few to include them on renters policies.

Water backup coverage is available through Costco renters insurance. In particular, it protects belongings if drains clog or a sump pump fails.

Michelle Robbins Licensed Insurance Agent

However, renters insurance policy options and rates will vary by state. Compare providers online to see if CONNECT Insurance is the best choice for you.

Enter your ZIP code to get started now with free quotes, compare top insurance providers side by side, and unlock exclusive savings available in your area.

Costco Renters Insurance Discounts

Costco members can take advantage of real savings on renters insurance through CONNECT by AmFam. Discounts apply to everyday situations like bundling policies, safe rentals, and even exclusive Costco membership perks. These Costco insurance discounts give renters straightforward ways to save.

- Multi-Policy Discount: Cuts costs when renters insurance is combined with an auto policy through CONNECT by AmFam.

- Executive Member Discount: Gives extra savings to Costco Executive Members with a qualifying renters plan.

- Protective Device Discount: Applies when a rental has smoke alarms, sprinkler systems, or a monitored security service.

- Claims-Free Discount: Rewards renters who have no recent insurance claims over several policy periods.

- Early Quote Discount: Offers lower rates for members who lock in a new policy before their current one runs out.

By rewarding membership status, responsible living, and property safety, Costco helps make renters coverage more affordable without cutting back on important protections.

Learn More: 26 Hacks to Save Money on Insurance

Costco Insurance Ranked by Consumers

Costco insurance reviews by J.D. Power and BBB highlight its leading performance when it comes to claims satisfaction, business practices, and customer service.

J.D. Power scores it 850 out of 1,000, reflecting above-average satisfaction. Learn why Costco is a strong alternative to the best homeowners insurance companies and check your rates.

Costco Insurance Business Ratings & Consumer Reviews| Agency |  |

|---|---|

| Score: 850 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices |

|

| Score: 78/100 Positive Feedback |

|

| Score: 0.83 Fewer Complaints Than Avg. |

|

| Score: A Excellent Financial Strength |

The BBB awards an A+ for strong business practices, while Consumer Reports posts a 78 out of 100 with favorable feedback.

NAIC shows a 0.83 complaint index, meaning fewer issues than average, and A.M. Best gives an A rating, signaling excellent financial stability and dependable long-term strength.

In a Costco insurance review on Reddit, a member shared that switching from Mercury to Costco insurance saved them $1,200 over the year.

They pointed out that results depend on individual factors like driving history and coverage needs, but their experience shows Costco CONNECT insurance can offer meaningful savings for some members.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What You Need to Know About Costco CONNECT Insurance

Costco insurance, underwritten by CONNECT by American Family, gives members practical value with protections for autos, homes, and rentals.

Costco members receive roadside assistance and glass repair waivers on auto insurance and additional home insurance discounts for security systems.

Costco insurance reviews show perks that reach beyond savings and discounts. For instance, members get access to 24-7 claims help.

Jeff Root Licensed Insurance Agent

Executive Members see exclusive discounts that stack with safe driver and multi-policy savings. With these features, Costco insurance delivers a mix of coverage and benefits that make your membership worthwhile.

See how Costco insurance quotes compare to providers near you by entering your ZIP code into our free quote comparison tool.

Frequently Asked Questions

Is Costco auto insurance good?

Costco CONNECT auto insurance holds an A rating from A.M. Best, offers safe driver discounts up to 30%, and includes member perks like accident forgiveness and roadside assistance.

How much is Costco auto insurance?

Costco auto insurance quote through CONNECT averages about $67 per month for minimum coverage. Full coverage costs around $223 monthly. Unlock more free quotes by entering your ZIP code into our comparison tool.

Does Costco have home insurance?

Yes, Costco offers home insurance through CONNECT by American Family. Monthly rates start at about $58 for $200K in coverage, with discounts for security systems, roofing updates, and exclusive Executive Member savings that can further reduce premiums.

What insurance carrier does Costco use?

Costco uses CONNECT by American Family Insurance to provide auto, home, and renters coverage for its members. See how savings and discounts differ in the American Family vs. Travelers auto insurance review.

Does Costco really offer car insurance?

Yes, Costco offers car insurance through CONNECT by American Family, with minimum coverage averaging about $67 per month for members.

Is insurance cheaper through Costco?

Insurance through Costco can be cheaper for some members, especially with Executive membership perks and discounts, but rates vary, and competitors like Geico and USAA may be lower.

Who handles Costco insurance?

Costco insurance is handled by CONNECT by American Family Insurance, which underwrites policies for auto, home, and renters coverage.

Is Costco an Aetna PPO or an HMO?

Costco offers health plans through Aetna, which are available in both PPO and HMO options, depending on the state and plan selection. Use our complete guide to health insurance to compare plans near you.

Are Costco benefits worth it?

Costco insurance benefits can be worth it for members, offering roadside coverage up to $100 per call, accident forgiveness, and discounts tied to Costco membership.

Does Costco offer better insurance rates than Geico?

No, Geico often provides lower auto insurance rates, averaging $43 per month compared to Costco’s $67 monthly rate, though Costco adds member-exclusive benefits and discounts.

What carrier does Costco use for deliveries?

What company does Costco use for home insurance?

How does a credit score affect Costco car insurance?

Does car color affect Costco insurance rates?

How can the Costco auto insurance phone number be used for support?

What is the purpose of the Costco insurance login for members?

How does Costco auto insurance in California compare to other providers?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.