10 Cheapest Home Insurance Companies in 2026

The cheapest home insurance companies are USAA, Geico, and Nationwide, with rates starting at $70 per month for $200,000 in dwelling coverage. A home security system could also save you 20%. Before buying a policy, shop around for quotes and discounts to ensure your coverage fully protects your home.

Read more Secured with SHA-256 Encryption

Save Money by Comparing Insurance Quotes

Compare Free Home Insurance Quotes Instantly

Table of Contents

Table of Contents

Insurance and Finance Writer

Karen Condor is an insurance and finance writer who has degrees in both journalism and communications. She began her career as a reporter covering local and state affairs. Her extensive experience includes management positions in newspapers, magazines, newsletters, and online marketing content. She has utilized her research, writing, and communications talents in the areas of human resources, f...

Karen Condor

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated January 2026

The cheapest home insurance companies are USAA, Geico, and Nationwide, starting as low as $70 per month.

- USAA has the cheapest home insurance at $70 monthly

- Nationwide specializes in coverage for high-value homes

- Home insurance rates vary by location and type of house

USAA has the lowest rates overall, though coverage is exclusive to military families. Meanwhile, Geico offers the cheapest home insurance for those who can’t get USAA.

U.S. homeowners insurance costs range from $70 to $425 a month, but the best homeowners insurance companies on this list cost less than that.

Our Top 10 Picks: Cheapest Home Insurance Companies| Company | Rank | Monthly Rates | Security Discount | Best for |

|---|---|---|---|---|

| #1 | $70 | 12% | Military Members |

|

| #2 | $75 | 8% | Bundling Policies |

|

| #3 | $79 | 10% | Luxury Homes |

|

| #4 | $80 | 15% | New Roof |

|

| #5 | $81 | 12% | Add-ons |

| #6 | $85 | 10% | Digital Tools |

|

| #7 | $86 | 20% | Claims Handling |

| #8 | $86 | 7% | Eco Homes |

|

| #9 | $88 | 11% | New Homes |

|

| #10 | $90 | 14% | First-Time Buyers |

You can lower your rates further by raising deductibles and maintaining a good credit score.

Keep reading for full homeowners insurance company reviews and ratings. Enter your ZIP code to find the best provider in your area.

Compare the Best Home Insurance Rates

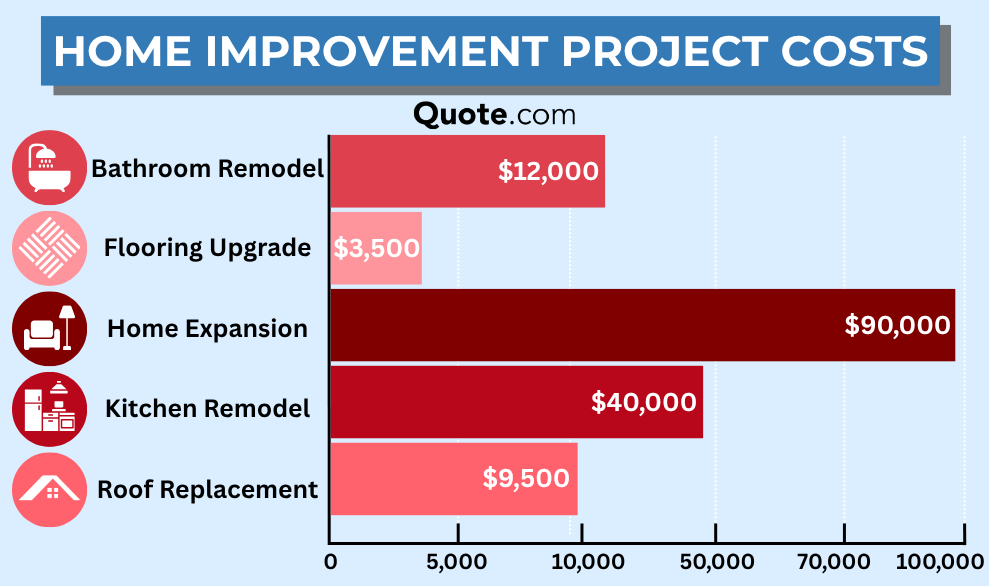

Buying a home in the U.S. is expensive. The average price is between $350,000 and $450,000, and your insurance premiums will be higher to reflect inflation.

Many factors impact the cost of home insurance, including home value, location, coverage limits, and deductible amount, so shop around for quotes to find the cheapest provider.

Home Insurance Monthly Rates by Dwelling Coverage| Company | $200K | $300K | $500K | $1M |

|---|---|---|---|---|

| $85 | $175 | $258 | $400 | |

| $81 | $115 | $175 | $310 |

| $86 | $120 | $150 | $179 |

| $90 | $266 | $366 | $570 | |

| $75 | $110 | $170 | $300 | |

| $79 | $115 | $140 | $168 | |

| $88 | $151 | $189 | $300 | |

| $80 | $129 | $156 | $184 | |

| $86 | $175 | $280 | $425 | |

| $70 | $126 | $209 | $335 |

USAA is the cheapest for home insurance at just $70 per month for a $200,000 dwelling policy. Meanwhile, Geico charges $75 a month for the same coverage.

On the other hand, coverage for a $1M dwelling costs as low as $168 per month with Nationwide, making it the cheapest provider for a million-dollar home insurance policy.

However, the 80% rule in home insurance requires you to cover at least 80% of your home’s value, so be sure you have enough protection for your home.

Rates may be higher if you own an older home or live in a high-risk state, but they often drop with higher deductibles and good credit.

Home Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670–799) | Fair (580–669) | Poor (<580) |

|---|---|---|---|---|

| $95 | $99 | $104 | $110 |

| $101 | $106 | $112 | $119 | |

| $91 | $94 | $98 | $105 |

| $100 | $103 | $108 | $115 | |

| $104 | $108 | $113 | $121 | |

| $94 | $98 | $103 | $109 |

| $96 | $99 | $104 | $110 |

| $99 | $102 | $107 | $114 | |

| $98 | $101 | $106 | $113 |

For example, insurers often view policyholders with low credit as higher risk and charge them higher premiums.

Also, if your area is prone to wildfires, it’s critical to understand how to file a home insurance claim after a wildfire to get paid for property damage if your home is affected.

Home Insurance Monthly Rate Increases by Risk Factors| Factor | Risk | Premium | Increase |

|---|---|---|---|

| Property | Standard Home | $120 | NA |

| Property | Older Home | $126 | $6 |

| Property | High-Value Home | $135 | $15 |

| Weather | Low Risk Area | $122 | $2 |

| Weather | Moderate Risk Area | $129 | $9 |

| Weather | High Risk Area | $140 | $20 |

That way, you’re not left covering costly repairs on your own if a wildfire or other disaster damages your home.

Find out how much homeowners insurance you need before choosing a policy.

More expensive homes need higher levels of coverage, and many homeowners increase their limits with endorsements. For example, you can add extra coverage for high-value jewelry or fine art collections.

Angie Watts Licensed Real Estate Agent

Other common factors that affect homeowners insurance near you are:

- Fire Rating: The risk of wildfires and how close you live to a fire hydrant or fire station impact rates.

- Claims History: Filing a claim will increase rates while homeowners who remain claim-free earn a discount.

- Construction and Roof Materials: The kinds of materials used to build your home, its foundation, and roof all affect monthly premiums.

Policy coverage and home location have the biggest effect on homeowners insurance quotes. Policy limits and whether you want replacement cost or actual cash value coverage could raise or lower rates.

Learn More: The 7 Most Dangerous Threats Facing American Homeowners

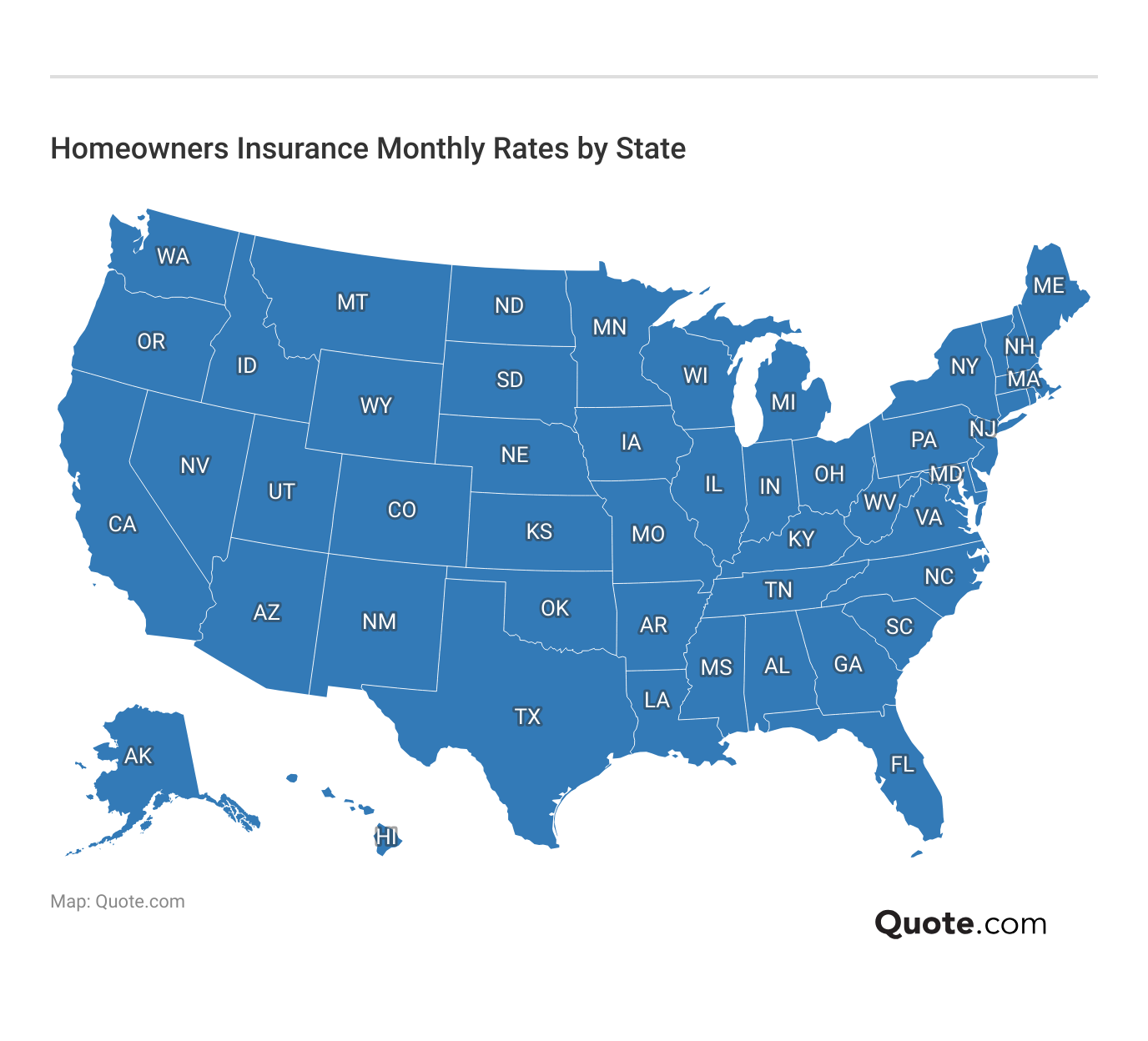

State-by-State Comparison of Home Insurance Rates

Where you live impacts home insurance rates, discount availability, and coverage. Other neighborhood variables like crime rates, weather risks, and increased claims also impact rates.

Find your state in the map below to compare home insurance quotes where you live. You can also enter your ZIP code to compare free quotes in just 2 minutes or less.

Why is home insurance getting so expensive in the U.S.? Inflation and the increased cost of repairs and materials are a big reason why home prices and insurance premiums keep climbing.

For example, high levels of property crime in your neighborhood or living in areas with wildfires, earthquakes, floods, hurricanes, or tornadoes will raise homeowners insurance costs.

Trends of home insurance companies dropping customers are more common in coastal states like Florida and California, which are at risk for weather-related claims. You’ll see more expensive rates in states like these, too.

Read More: Home Insurance Rates by State

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Home Insurance Coverage to Consider

Homeowners insurance typically covers your home, personal belongings, and other structures on your property. It provides liability protection and helps pay for additional living expenses if your home becomes uninhabitable.

You can also add optional coverages for further protection, like water backup coverage, flood insurance, and earthquake coverage.

Home Insurance Coverage Options| Coverage Type | What it Covers |

|---|---|

| Dwelling | Your house and attached structures |

| Loss of Use | Extra costs if home is unlivable |

| Medical Payments | Medical bills for guest injuries |

| Other Structures | Property not attached to house |

| Personal Liability | Legal costs for injury lawsuits |

| Personal Property | Clothes, electronics, and furniture |

Various types of homeowners insurance policies are available, depending on your property and the risks you need covered. The most common are HO-3 policies, which cover your home, belongings, and liability.

Personal liability coverage can help with legal costs and damages if someone gets hurt on your property or if you accidentally damage someone else’s property.

It may also pay for medical bills if a guest is injured in your home, even if you are not at fault. Picking higher liability limits can give you more financial protection, especially if you have savings or other assets you want to keep safe.

HO-5 policies offer broader coverage because they cover any loss or damage to your home unless the cause is specifically excluded.

Types of Home Insurance Policies| Type | Policy | What it Covers |

|---|---|---|

| HO-1 | Basic | Perils like fire, theft, & falling objects |

| HO-2 | Broad | HO-1 perils + water damage, surges |

| HO-3 | Special | All perils except noted exclusions |

| HO-4 | Contents | Renters: Covers items and liability |

| HO-5 | Comprehensive | HO-3 perils at replacement value |

| HO-6 | Unit-Owners | Condos: Covers items and liability |

| HO-7 | Mobile Home | Mobile home coverage like HO-3 |

| HO-8 | Modified | Homes 40+ years old or historic |

Most insurance companies no longer offer HO-1 or HO-2 policies. For mobile homeowners, HO-7 policies cover everything a standard dwelling policy does but are designed for mobile and manufactured homes.

If you’re looking for a simple policy with basic coverage, USAA has the cheapest homeowners insurance, and Geico comes in second for drivers who aren’t eligible to get USAA.

Auto-Owners offers great rates for those seeking more comprehensive coverage options like water backup coverage, extended replacement coverage, and umbrella insurance.

Check out our Auto-Owners insurance review to see if this top-rated provider is right for your needs as a homeowner.

Most Affordable Home Insurance Providers

USAA, Geico, and Nationwide have the cheapest homeowners insurance, starting at just $70 per month for a $200,000 dwelling policy.

USAA stands out for having specialized coverage for military members and veterans, while Geico is more affordable if you’re looking to bundle policies.

In addition, State Farm offers a free ADT benefit for homeowners to help secure their home and get lower premiums.

Check out the pros and cons below to see why we chose these top providers. Then, enter your ZIP code to instantly compare home insurance costs in your area.

#1 – USAA: Top Pick Overall

Pros

- Lowest Rates: Homeowners insurance premiums start at just $70 monthly for military members.

- Identity Theft Protection: Standard home insurance policies include $5,000 in identity theft coverage.

- Superior Financial Strength: Earned an “A++” rating from A.M. Best, making it one of the most reliable homeowners insurance companies. Explore more in our USAA insurance review.

Cons

- Exclusive Coverage: Only military members and their families can buy USAA homeowners insurance.

- Smaller Discounts: Other cheap homeowners insurance companies provide two or three times the discount amount for common things like bundling policies and getting quotes early.

#2 – Geico: Cheapest for Bundling Policies

Pros

- Save by Bundling: Geico lets you combine home, auto, renters, business, life, and other insurance products to get lower rates. Learn more in our Geico insurance review.

- Many Coverage Options: Offers optional add-ons to enhance protection, such as flood, umbrella, and earthquake insurance.

- Easy Online Experience: The mobile app and website make it easy to get quotes, manage your policy, and more.

Cons

- Doesn’t Underwrite Its Policies: Geico relies on third parties to issue its home insurance policies, meaning coverage details and costs vary.

- No Direct Claims With Geico: Since partners handle Geico’s home insurance policies, you’ll need to file claims with the partner company.

#3 – Nationwide: Cheapest for High-Value Homes

Pros

- High-Value Coverage: Nationwide Valuables Plus® offers optional protection for jewelry, fine art, collectibles, and other high-value assets.

- Big Bundle Discount: Bundle home and auto insurance to save 20% on annual home insurance premiums. Learn more in our Nationwide review.

- Variety of Endorsements: This home insurance company offers earthquake and water backup riders, or choose to add identity theft or appliance breakdown coverage.

Cons

- Poor Customer Service: Nationwide ranks below average for customer and claims satisfaction by J.D. Power, when compared to other home insurance providers.

- Regional Coverage: Nationwide homeowners insurance isn’t available in Oklahoma, Louisiana, Hawaii, or Alaska.

#4 – State Farm: Cheapest Roof Coverage Options

Pros

- Roof Replacement Cost: State Farm replaces your roof if it’s declared a total loss without increasing your homeowners insurance deductible. Learn more in our State Farm insurance review.

- Free ADT Security: State Farm partners with ADT to offer free equipment and installation with an additional discount on homeowners insurance coverage.

- Low Rates: State Farm is a cheap home insurance company, starting at $80 per month for a $200,000 policy.

Cons

- Few Endorsements: Compared to other insurers, State Farm doesn’t offer as many optional home insurance add-ons.

- Not in All States: New State Farm home insurance policies aren’t available in California, Massachusetts, or Rhode Island.

#5 – American Family: Cheapest With Endorsements

Pros

- Wide Range of Endorsements: Offers customizable add-ons, including protection for identity theft, equipment breakdown, and sewer backup. Learn more in our American Family insurance review.

- Few Complaints: American Family has fewer customer complaints than other top insurers, according to the NAIC.

- Discount Variety: American Family offers many discounts for homeowners, including for home security, paperless billing, and loyalty.

Cons

- Limited Availability: American Family only offers home insurance in 19 states.

- Lower Claims Satisfaction: Claims satisfaction from J.D. Power is slightly lower than average for American Family compared to other insurers.

#6 – Allstate: Cheapest With Digital Tools

Pros

- Digital Tools: Allstate stands out for its tech-savvy mobile app and website, making it simple to file claims and pay premiums on the go.

- Biggest Multi-Policy Discount:Homeowners save 25% off annual rates when bundling home and auto insurance, more than at any other cheap home insurance company.

- Home Security Savings: Certain safety devices and security systems earn up to 20% off annual rates. Get more details about home insurance company discounts in our Allstate review.

Cons

- Poor Customer Service: Allstate homeowners insurance ranks below average and performs worse than its competitors in annual J.D. Power satisfaction surveys.

- No Coverage in High-Risk States: Allstate announced in 2023 that it’s no longer writing home insurance policies in California.

#7 – Erie: Best for Claims Handling

Pros

- Great Customer Service: Ranks #1 in home insurance company customer satisfaction according to J.D. Power

- Cheaper Than Average: Erie insurance costs $86 per month for a $200,000 policy, making it an affordable home insurance company in most states.

- Competitive Bundles: Save 20% with this home insurance company when you bundle home and auto coverage.

Cons

- Regional Coverage: You can only buy Erie homeowners insurance in 12 states and Washington, D.C.

- No Online Quotes: You have to speak with an agent to get home insurance company quotes and compare coverage.

#8 – Travelers: Cheapest for Eco-Friendly Homes

Pros

- Green Home Perks: Homes certified by Leadership Energy and Environmental Design (LEED) earn discounts and add-ons to cover eco-friendly items with this homeowners insurance company.

- Great Rates: Travelers is a competitively priced home insurance provider at $86 per month.

- Superior Financial Strength: It received the highest A++ rating from A.M. Best as one of the most reliable home insurance companies.

Cons

- Worst Customer Service: Home insurance customer service ranks in the bottom three overall for customer satisfaction. Get a full review of Travelers Insurance.

- No Coverage in High-Risk States: Travelers is no longer writing home insurance policies in Florida or California.

#9 – Progressive: Cheapest for New Homes

Pros

- New Home Savings: Progressive offers discounts to homeowners of newly-built houses. The newer your home is, the greater the discount you can get on your policy.

- Name Your Price Tool: Tell Progressive how much you can afford, and it will find the cheapest homeowners insurance policy possible.

- Superior Financial Strength: Earned an A+ rating from A.M. Best as one of the most reliable home insurance providers. Learn more in our Progressive review.

Cons

- Fewer Endorsements: Progressive only offers two homeowners insurance endorsements: personal injury and water backup/overflow.

- Smaller Bundle Discount: Drivers only save an average of 5% on homeowners insurance when bundling with auto policies.

#10 – Farmers: Cheapest for First-Time Homeowners

Pros

- First-Time Buyer Perk: Home buyers get a rent-to-own discount if they had renters insurance through Farmers before buying a homeowners policy.

- Smoke-Free Discount: Unique homeowners insurance discounts for those who don’t smoke for at least two consecutive years. Find more discounts in our Farmers insurance review.

- HOA and Retirement Community Discounts: Residents who live in HOA, gated, or retirement communities get additional discounts.

Cons

- Higher Premiums: Policy rates are $90 a month, which is more expensive than the cheapest home insurance companies on this list.

- Limited Discount Availability: Some Farmers homeowners insurance discounts are only available in select states.

How to Save Money on Home Insurance

Still wondering how to get cheap homeowners insurance? The cheapest homeowners insurance companies are USAA, Geico, and Nationwide for those without claims and who have good credit scores.

Home insurance costs vary based on where you live, so regularly compare quotes from different insurers in your city to find a cheap homeowners insurance company near you.

Your quotes will be higher if you recently filed a claim. If you have a less-than-perfect insurance history, follow these tips to get better rates no matter which company you choose:

- Bundle Policies: Combine home insurance with auto or other policies to get a multi-policy discount. Auto-Owners, Allstate, and Liberty Mutual have the biggest discount of 25%.

- Increase Your Deductible: Opt for a higher deductible to lower your premium, but ensure you can afford the out-of-pocket cost if you need to file a claim.

- Improve Home Security: Install security systems, smoke detectors, and deadbolts to qualify for discounts. Allstate and Erie have the biggest discounts from 15-20%.

Enter your ZIP code and we’ll help you compare multiple providers to find the cheapest home insurance policy rates.

Frequently Asked Questions

How much is homeowners insurance?

Homeowners pay anywhere from $70 to $175 per month for a $200,000 policy. Compare home insurance quotes online to find the cheapest home insurance rates near you.

Who has the cheapest rates on homeowners insurance?

We found that USAA has the cheapest rates for most homeowners at $70 per month for a $200,000 policy.

What company has the best homeowners insurance?

State Farm is the most popular home insurance company in the U.S. for its comprehensive roof coverage, discount variety, and affordable rates. Get home insurance quotes now to find the best homeowners insurance company near you.

Which homeowners insurance company has the highest customer satisfaction?

Erie Insurance is the #1 company for customer satisfaction in its region.

What is the most common homeowners insurance?

HO-3 Broad Form policies are the most common because they provide open coverage except for named exclusions. Explore the eight types of home insurance to learn more.

Who is cheaper for home insurance: Geico or Progressive?

Geico generally offers cheaper home insurance rates, with a $200,000 policy starting at $75 per month compared to $88 per month with Progressive.

Is Allstate homeowners insurance cheaper than Geico?

No, Geico is typically cheaper, starting at $75 monthly for a $200,000 policy, while the same coverage with Allstate costs $85 per month.

Who has the most expensive home insurance?

Chubb is one of the most expensive companies for homeowners insurance, starting at $175 per month.

How can I lower my home insurance premiums?

Picking higher deductibles is a quick way to lower rates, but be sure you can afford the out-of-pocket cost if you ever need to file a claim. Find out how much homeowners insurance you need here.

What factors affect home insurance costs?

Where you live, the building materials of your home and roof, and your deductible all impact home insurance rates.

Does credit score affect home insurance rates?

Will my home insurance go up if I file a claim?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.