Best Life Insurance for Seniors in 2026

Aflac, Fidelity Life, and Liberty Mutual offer some of the best life insurance for seniors, with term policies starting at around $80 a month. MassMutual rewards seniors with a 6% dividend return that helps policies grow, while Nationwide lets them access up to 75% of their benefits early if they are diagnosed with an illness.

Read more Secured with SHA-256 Encryption

Compare Quotes From Top Companies and Save

Life insurance policies starting at less than $1/day

Table of Contents

Table of Contents

Insurance Copywriter

Malory Will has an M.A. in English from Arizona State University. She has over four years of experience in writing for the insurance industry. With a background in health, auto, life, and homeowners insurance, Malory is passionate about making complex insurance topics clear and approachable. Her goal is to help readers make informed decisions with confidence.

Malory Will

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding c...

Meggan McCain

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Updated January 2026

The leading providers for the best life insurance for seniors are Aflac, Fidelity Life, and Liberty Mutual, with term plans starting around $80 a month for $15,000 in coverage.

- Aflac tops the list with fast payouts and flexible terms for seniors

- Flexible options meet seniors’ evolving financial and health needs

- Guaranteed fixed rates keep the best life insurance affordable

Aflac helps seniors manage medical costs with critical illness coverage that allows early access to up to 50% of benefits.

Fidelity Life offers fast, no-exam approvals for seniors who need quick protection, while Liberty Mutual offers lifetime coverage and stable premiums.

Top 10 Companies: Best Life Insurance for Seniors| Company | Rank | Claims Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 845 / 1,000 | A+ | Guaranteed Acceptance | |

| #2 | 768 / 1,000 | A- | Senior Oriented | |

| #3 | 717 / 1,000 | A | AD&D Coverage |

| #4 | 673 / 1,000 | A++ | Age Flexibility | |

| #5 | 670 / 1,000 | A++ | Customer Satisfaction | |

| #6 | 666 / 1,000 | A+ | Living Riders | |

| #7 | 659 / 1,000 | A+ | Expenses Policy | |

| #8 | 639 / 1,000 | A++ | Financial Strength | |

| #9 | 631 / 1,000 | A | Living Benefits | |

| #10 | 615 / 1,000 | A+ | Affordable Coverage |

Together, these are the best life insurance companies for seniors over 60 who want to cover end-of-life care or

Compare the best life insurance for seniors by using our free quote tool to find trusted coverage at a great rate.

The Best Life Insurance Rates for Seniors

The best life insurance for seniors over 60 depends on your goals, coverage needs, and how long you plan to keep the policy. Term life insurance for a 60-year-old is usually less expensive each month.

Fidelity Life has the lowest rates for seniors looking for term coverage, with premiums starting at $84 a month.

Senior Life Insurance Monthly Rates by Policy Type| Insurance Company | 20-Year Term | Whole Life |

|---|---|---|

| $89 | $265 | |

| $84 | $255 | |

| $109 | $340 | |

| $92 | $275 |

| $86 | $295 | |

| $90 | $279 | |

| $88 | $285 | |

| $99 | $325 | |

| $94 | $315 | |

| $85 | $270 |

Term life is a good option for seniors who want affordable coverage during retirement.

Whole life insurance costs more but builds cash value over time and guarantees lifelong protection for both you and your family.

Whole life insurance also comes with guaranteed premiums, meaning your rates won’t increase as you get older.

Choosing between the two comes down to what matters most to you, whether it’s keeping premiums low or securing coverage that complements your existing investments or retirement.

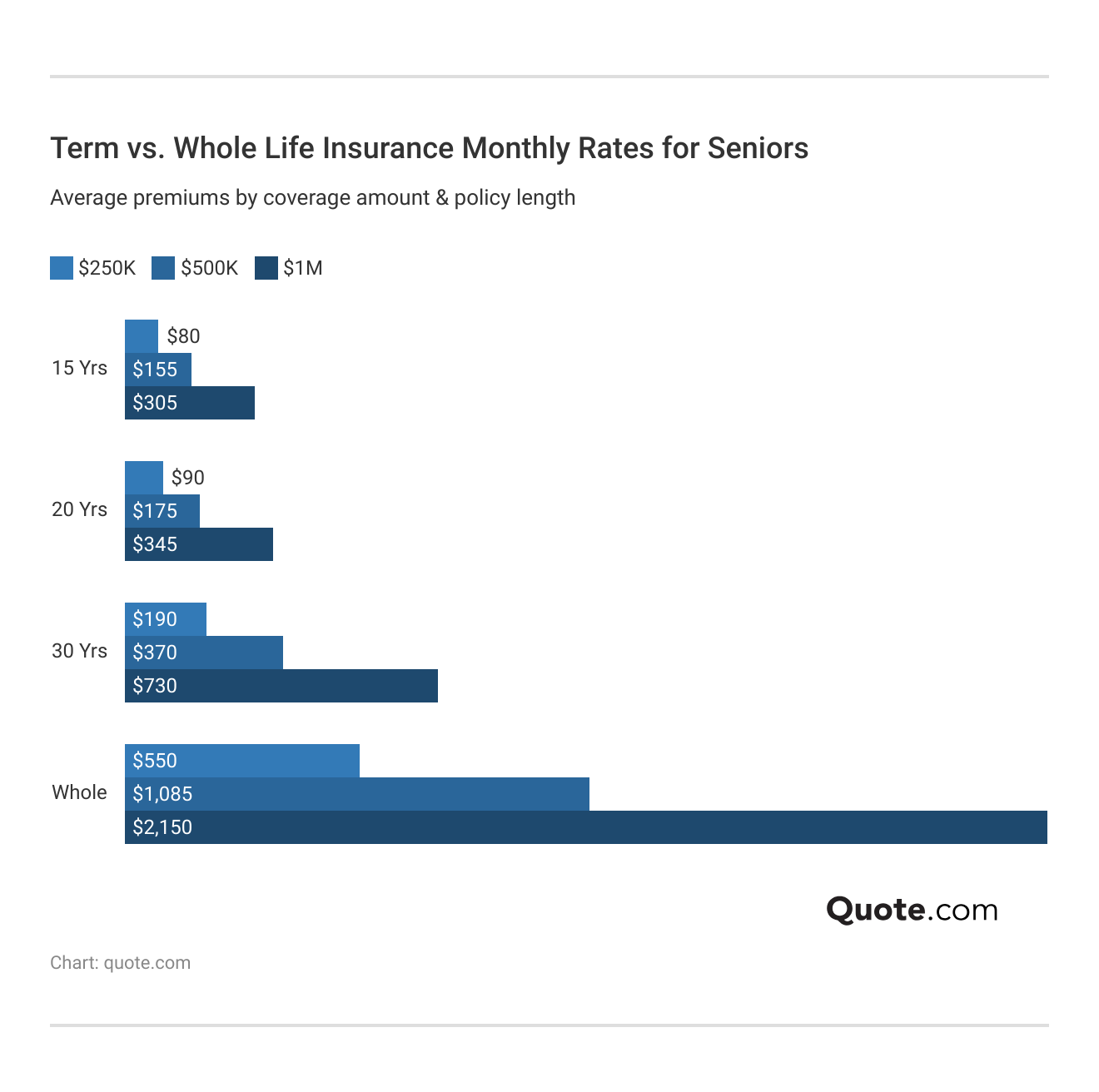

Comparing Term vs. Whole Life Insurance for Seniors

Knowing how term and whole life differ helps seniors make smarter choices that match their lifestyle, budget, and long-term goals.

Term life insurance is usually easier on the budget since it only covers you for a specific period of time.

Whole life policies cost more each month, but your coverage lasts a lifetime and builds cash value you can later use for medical bills or family support.

Studying these pricing trends can help you find the best life insurance for seniors over 70 and older, where costs naturally rise but benefits like cash value growth and guaranteed payouts become more valuable.

How Age Impacts Life Insurance Rates for Seniors

Buying life insurance later in life will be much more expensive than if you bought a policy in your 20s or 30s.

As you age, insurers raise rates to account for health risks and shorter coverage periods, so waiting too long can mean paying much more for the same policy.

Senior Life Insurance Monthly Rates by Age| Company | Age: 60 | Age: 65 | Age: 70 | Age: 75 |

|---|---|---|---|---|

| $89 | $129 | $205 | $315 | |

| $84 | $124 | $198 | $305 | |

| $109 | $149 | $235 | $355 | |

| $92 | $132 | $212 | $325 |

| $86 | $128 | $205 | $318 | |

| $90 | $132 | $215 | $328 | |

| $88 | $130 | $210 | $322 | |

| $99 | $140 | $225 | $340 | |

| $94 | $135 | $218 | $330 | |

| $85 | $126 | $200 | $310 |

The younger you are when you buy life insurance, the easier it is to secure affordable coverage with more flexible benefits.

For example, a policy at 60 costs around $80-$100 a month, but rates increase by $40 a month for the same policy at 65. Seniors exploring life insurance for seniors over 60 with no medical exam can skip health checks and still lock in reasonable rates.

Age really makes a difference when it comes to life insurance for seniors. Premiums can go up around 8% each year after 60.

Dani Best Licensed Insurance Agent

There are many reasons to buy life insurance early. Waiting too long can make it tougher to find reasonable rates or the right level of protection.

The key is to compare plans early and find a senior life insurance company that keeps premiums affordable while still giving you and your beneficiaries financial peace of mind.

How Smoking Impacts Senior Life Insurance Rates

Getting the best senior life insurance at the right price largely depends on whether you use tobacco or live a smoke-free lifestyle, as well as the type of policy you choose (Learn More: Whole vs. Term Life Insurance).

Smokers usually see higher premiums because insurers consider them a greater health risk, while non-smokers get lower rates and easier approval.

Senior Whole Life Insurance Monthly Rates by Tobacco Use| Insurance Company | Non-Smoker | Smoker |

|---|---|---|

| $265 | $405 | |

| $255 | $390 | |

| $340 | $520 | |

| $275 | $425 |

| $295 | $455 | |

| $279 | $430 | |

| $285 | $440 | |

| $325 | $495 | |

| $315 | $485 | |

| $270 | $415 |

Insurers value healthy habits, and non-smokers often have an easier time locking in affordable rates with more flexible policy options because they have reduced health risks.

Smokers can still find good coverage, but it might take more comparison shopping or accepting shorter policy terms. This will be much more noticeable if you need the best life insurance for seniors over 80, where health and longevity play a bigger role in pricing.

How Medical History Shapes Senior Insurance Rates

Conditions like diabetes, heart disease, or obesity can raise costs since they carry higher risks, especially for seniors.

Seniors who stay proactive about their health often get more flexibility and lower rates, while those with more serious conditions might need to shop around a bit more.

Senior Life Insurance Monthly Rates by Health Condition| Company | Cancer History | Diabetes | Heart Disease | Obesity |

|---|---|---|---|---|

| $210 | $185 | $220 | $170 | |

| $215 | $190 | $225 | $175 | |

| $225 | $200 | $230 | $180 | |

| $230 | $205 | $235 | $185 |

| $235 | $210 | $240 | $190 | |

| $240 | $215 | $245 | $195 | |

| $245 | $220 | $250 | $200 | |

| $250 | $225 | $255 | $205 | |

| $255 | $230 | $260 | $210 | |

| $260 | $235 | $265 | $215 |

Even top companies like Aflac and Fidelity Life charge hundreds more for seniors with pre-existing conditions. Still, the best life insurance for seniors without a medical exam offers a way to skip the traditional health check.

Those who prefer upfront payments, rather than watching their rates increase over time, might also consider single-premium life insurance, which lets you pay once for lifelong coverage.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Life Insurance Coverage Options for Seniors

When you’re looking at the best life insurance for seniors, the kind of coverage you choose can really shape how much you pay and what kind of peace of mind you get.

The most common life insurance policies people choose are typically between term life and whole life.

Term life insurance is cheaper since it covers you for 10–20 years, while whole life lasts forever, builds cash value, and keeps premiums steady but costs more monthly.

Whole, or permanent life, coverage works well if you want to leave money behind or cover long-term expenses, and there are multiple types to choose from:

- Universal Life: Universal life insurance lets you adjust premium payments and coverage limits as your needs change.

- Variable & Indexed Universal Life: Variable life and indexed universal life invest the policy cash value in different S&P markets to grow death benefits.

- Guaranteed Universal Life: For seniors with higher assets, guaranteed universal life can protect estate value and reduce the tax burden for beneficiaries.

Seniors who want simpler coverage can choose final expense, also known as burial insurance, which typically pays $10,000–$40,000 to help cover funeral or end-of-life costs.

Tips to Lower Life Insurance Rates for Seniors

When it comes to saving on the best life insurance for seniors, there are more innovative ways to cut costs just by making a few wise choices.

From how you pay to when you buy, a little planning can go a long way toward keeping your coverage affordable.

- Apply in Your Early 60s: Rates are usually lower when you’re younger since insurers see you as a lower health risk.

- Bundle Your Coverage: If you already have home or auto insurance with the same company, adding life insurance can often get you a better rate.

- Pay Once a Year: Paying annually instead of monthly can help you skip extra fees and save a little more overall.

- Pick the Right Policy Length: If you only need coverage for 15 to 20 years, term life is usually much cheaper than a lifetime policy.

- Take Care of Your Health: Keeping your weight, blood sugar, and blood pressure in a good range can help you get lower life insurance rates.

When seniors manage health conditions, choose the right policy length, and compare a few strong providers, premiums usually land in a better spot.

Compare quotes from multiple providers, including the best term life insurance companies, to lock in the right price and coverage fit.

Plenty of insurers reward healthy habits with senior discounts. In particular, staying active and managing blood pressure can lower rates fast.

Tracey L. Wells Licensed Insurance Agent

Insurers often reward steady habits and smart choices, so things like keeping up with checkups, sticking to medications, and paying on a predictable schedule can all help.

If you already have home or auto with the same company, bundling can simplify everything and trim your bill, too. Aflac and MassMutual offer 10% multi-policy discounts.

Top Life Insurance Discount for Seniors| Company | Bundling | Family History | Good Health | Healthy Lifestyle |

|---|---|---|---|---|

| 10% | 12% | 20% | 7% | |

| 4% | 8% | 10% | 6% | |

| 4% | 12% | 15% | 7% | |

| 5% | 8% | 12% | 6% |

| 10% | 6% | 8% | 7% | |

| 5% | 7% | 10% | 10% | |

| 8% | 5% | 14% | 7% | |

| 3% | 10% | 15% | 7% | |

| 4% | 20% | 25% | 7% | |

| 8% | 6% | 10% | 11% |

Being strategic with discounts will also help lower senior life insurance rates, especially if you’re over 65.

Policyholders can stack multiple savings programs to double their discounts and get lower rates. With smart planning, seniors can keep premiums low and enjoy lasting protection.

Top Senior Life Insurance Companies

Some of the best life insurance for seniors comes from long-established companies that have earned trust for their reliability and financial stability.

These insurers not only help you choose the right policy but also guide you in figuring out how much life insurance you need for your family’s future.

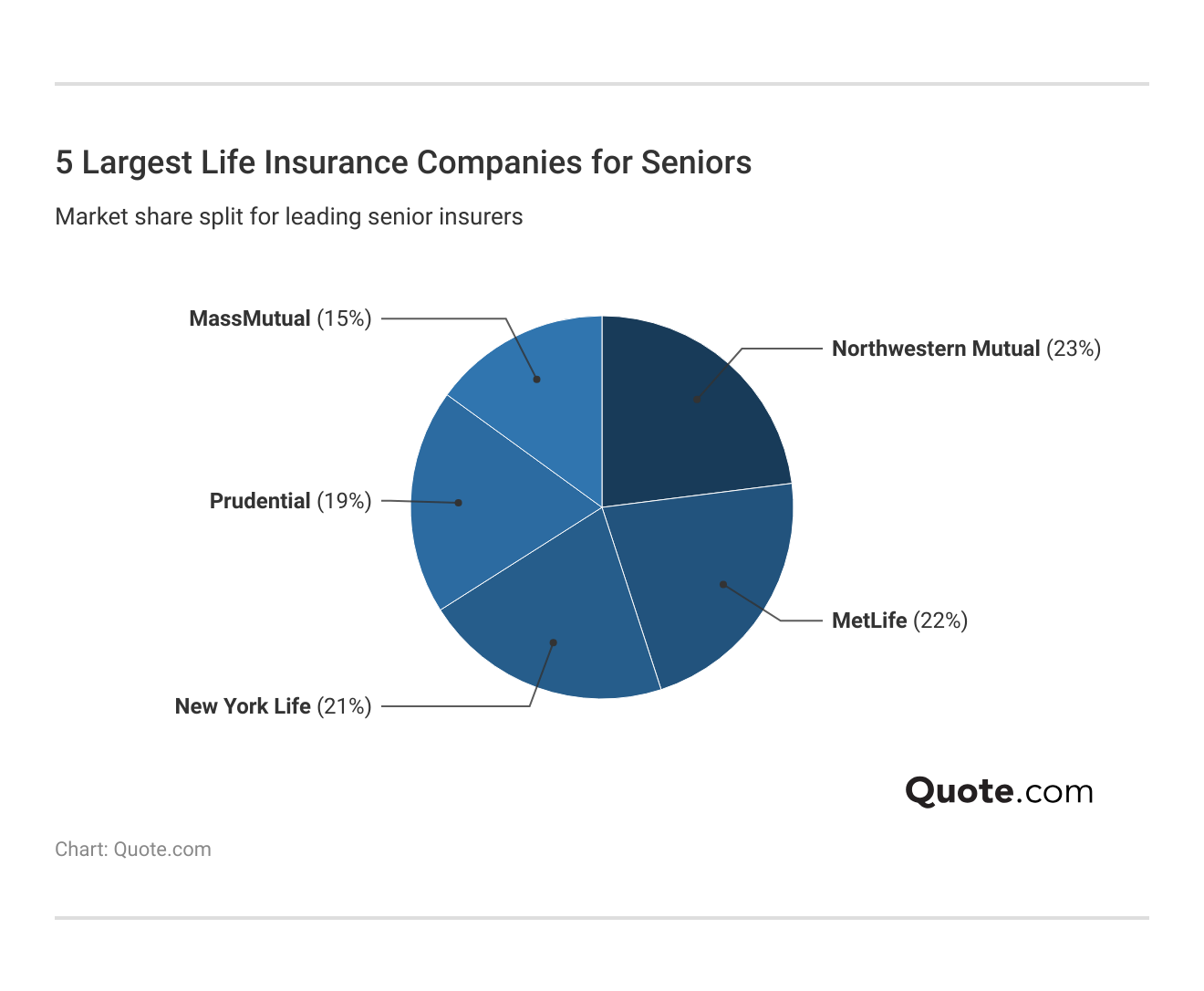

A lot of seniors choose Northwestern Mutual for its strong financial reputation, while MetLife and New York Life are popular for their flexible coverage and easy support.

Prudential and MassMutual also stand out for offering affordable rates and quick, hassle-free claims, but we chose Aflac and Fidelity Life as the top senior life insurance companies for their guaranteed acceptance and fast approval times for older applicants.

#1 – Aflac: Best for Guaranteed Acceptance

Pros

- Easy Policy Approval: Seniors can get Aflac life insurance without any medical exams or long health forms.

- Early Access to Funds: Seniors can use up to 50% of their payout early through Aflac’s Living Benefits rider to help cover medical bills or long-term care.

- Quick and Dependable Claims: Aflac’s strong satisfaction score shows seniors can expect fast claim payouts and friendly support when they need it most.

Cons

- No Instant Quotes Online: Seniors need to talk with an Aflac agent to get prices and policy details.

- Limited-Term Options: Seniors wanting more extended coverage may find fewer term choices, but Aflac’s life insurance guide helps them pick the right plan easily.

#2 – Fidelity Life: Best for Senior-Oriented Policies

Pros

- Designed With Seniors in Mind: Fidelity Life’s RapidDecision Senior Life plan offers simplified coverage built specifically for seniors who want quick, no-hassle approval.

- Fast Approval Times: Seniors can get approved in 24 hours or less, making it one of the quickest options available.

- Strong Financial Base: Fidelity’s A- A.M. Best rating assures seniors of stable claim payments and long-term company reliability.

Cons

- Limited Policy Add-Ons: Seniors have fewer rider options, such as living benefits or accidental death coverage, compared to other insurers.

- Age Restrictions: Some plans end at age 80, but Fidelity Life’s types of life insurance give seniors other coverage options to choose from.

#3 – Liberty Mutual: Best for AD&D Coverage

Pros

- Accidental Death Coverage: Seniors get built-in Accidental Death and Dismemberment (AD&D) coverage for extra protection at no added cost.

- Super Easy to Manage: Seniors can check their policy or make changes anytime using Liberty Mutual’s online portal or mobile app.

- Add-on Flexibility: Seniors can choose optional Critical Illness or Chronic Condition Riders for more personalized coverage.

Cons

- Claims Could Be Faster: Liberty Mutual’s satisfaction rating suggests some seniors experience slower processing times.

- Higher Starting Premiums: Seniors might pay a bit more upfront, but as noted in our Liberty Mutual insurance review, bundling policies can help them save over time.

#4 – MassMutual: Best for Age Flexibility

Pros

- Age Flexibility: Seniors up to 85 can qualify for both term and whole life plans, a rare feature among top-rated life insurance companies.

- Unmatched Financial Strength: An A++ A.M. Best rating guarantees claim security for seniors with significant policies.

- High Policy Limits: Seniors can select coverage exceeding $500,000, ideal for estate and legacy planning. Compare policies in our MassMutual insurance review.

Cons

- Medical Exams Required: Seniors applying for higher-value policies must complete a full underwriting process.

- Higher Premiums: MassMutual is one of the more expensive life insurance companies for seniors, with term life starting at $90 a month.

#5 – Northwestern Mutual: Best for Customer Satisfaction

Pros

- Customer Experience Leader: A 670/1,000 satisfaction score shows seniors get responsive, helpful support.

- Permanent Policies Earn Dividends: Seniors can earn dividends on their life insurance payments each year and apply it to lower premiums or grow cash value.

- Excellent Financial Backbone: With an A++ rating, seniors get rock-solid stability and dependable long-term payouts they can count on.

Cons

- Higher Entry Premiums: Seniors often start at over $90 per monthly, compared to budget options.

- Extended Claims Timelines: Seniors wait longer for claims that require review, so checking insurance comparison sites can help them find faster-service alternatives.

#6 – Nationwide: Best for Living Riders

Pros

- Living Benefits Access: Seniors can use Nationwide’s Accelerated Death Benefit Rider to cover chronic or terminal illness expenses.

- Strong Finances: With an A+ A.M. Best rating, seniors can expect dependable payouts and long-term stability.

- Easy to Tailor: Seniors can combine term and permanent life coverage in one policy to match changing needs.

Cons

- Claims Responsiveness: A 666/1,000 satisfaction score shows seniors experience only average claim support. See full ratings in our Nationwide Insurance review.

- Limited Online Tools: Seniors often need an agent to make billing changes or to add or update life insurance riders.

#7 – Mutual of Omaha: Best for Final Expense Policy

Pros

- Final Expense Focus: Seniors can buy whole life plans for funeral and medical costs up to $50,000.

- Locked-in Premiums: Seniors’ rates never increase, remaining around $80-$90 per month.

- High Financial Strength: The A+ A.M. Best rating confirms strong claims-paying capacity and reliability for senior families.

Cons

- Benefit Limitations: According to the Mutual of Omaha insurance review, seniors who need coverage above $50,000 may need to combine multiple policies.

- Moderate Claims Rating: With 659/1,000, Mutual of Omaha’s claims processing speed ranks mid-tier among senior insurers.

#8 – New York Life: Best for Financial Strength

Pros

- Rock-Solid Stability: With an A++ A.M. Best rating, seniors get dependable claims and strong protection.

- Big Coverage Options: Seniors can get life insurance quotes for coverage up to $1 million, great for legacy or estate goals.

- Helpful Add-Ons: Seniors can add Chronic Care or Waiver of Premium riders for extra flexibility.

Cons

- Slower Underwriting: Seniors may wait longer for approval due to thorough financial and health reviews.

- Higher Premiums: Monthly costs for seniors often top $100, especially for coverage above $500,000.

#9 – Globe Life: Best for Living Benefits

Pros

- Living Benefit Access: Seniors can use their policy to help cover terminal illness expenses while they’re still living.

- No Medical Exam Required: It’s super easy to qualify since you don’t need a health check or have to wait around.

- Term and Whole Life Options: Seniors can choose term for a lower initial cost or whole life for lifetime coverage.

Cons

- Rising Premiums: Seniors see rate increases every five years, raising the cost of life insurance and straining budgets.

- Lower Service Score: A 631/1,000 rating signals below-average claims responsiveness for seniors.

#10 – Transamerica: Best for Affordable Coverage

Pros

- Affordable Coverage Focus: Seniors can start with budget-friendly term or permanent options made for cost-conscious buyers.

- Plan Variety: Seniors can choose from several term lengths or opt for lifetime coverage to fit their goals.

- High Financial Backing: Seniors get the confidence of an A+ A.M. Best rating for steady, reliable claims.

Cons

- Lower Satisfaction Score: A 615/1,000 satisfaction score suggests seniors may see average claims support.

- Fewer Add-Ons: Even at the cheapest life insurance companies, seniors may find fewer rider options, limiting customization.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Choosing the Best Life Insurance for Seniors

When shopping for the best life insurance for seniors, it’s really about what feels right for your lifestyle, health, and budget.

Stick with companies that have solid reputations, easy claim processes, and good benefits that actually work for you.

- Ask About Living Benefits: Providers like Nationwide allow seniors to use part of their payout early if they’re diagnosed with a serious illness.

- Check Financial Ratings: Choose insurers with solid finances and strong claim records so you know they’ll come through when you need them.

- Find Easy Approval Options: If you have health conditions like diabetes or heart issues, Mutual of Omaha offers no-exam or simplified policies.

- Match the Coverage to Your Needs: Decide if term, whole, or final expense life insurance fits your goals based on how long you need coverage and what you want it to protect.

- Watch for Stable Rates: Choose companies like Fidelity Life that keep pricing consistent so your premiums stay predictable.

Seniors dealing with health issues can also check out the best life insurance for seniors with pre-existing conditions, which offers options that don’t require long approval times or strict exams.

Aflac, Fidelity Life, and Liberty Mutual are the best life insurance companies for seniors because they offer flexible payment options, quick claim payouts for beneficiaries, and great customer service reviews.

If you want real experiences and honest advice, reading about the best life insurance for seniors on Reddit can help you see what others recommend based on their own experiences.

Taking the time to compare these details can help you find a life insurance company that fits your needs, protects your life insurance beneficiary, and gives you peace of mind without breaking the bank.

The easiest way to find affordable protection is to enter your ZIP code, compare life insurance quotes for seniors, and choose the provider that best fits your budget.

Frequently Asked Questions

What is the best life insurance for seniors?

Aflac, Fidelity Life, and Liberty Mutual have the best senior life insurance. Aflac and Fidelity Life approve seniors quickly and without a medical exam, and Liberty Mutual offers affordable AD&D and chronic illness riders.

Why should seniors get life insurance?

Seniors should get life insurance to cover real-life costs, such as funeral expenses (which can average $8,000–$10,000), medical bills, or mortgage balances. It can also replace lost retirement income for a spouse and help manage estate taxes, protecting loved ones from unexpected financial stress.

How much life insurance should seniors get?

Most seniors benefit from $100,000–$300,000 in coverage, enough to pay off debts and cover end-of-life costs. Those with dependents or a mortgage might need closer to $500,000. Using a life insurance calculator based on monthly expenses ensures you buy just enough coverage—no more, no less.

Should a 70-year-old buy life insurance?

Yes. A 70-year-old can still get affordable coverage through term, final expense, or instant life insurance plans. Monthly costs for a 10-year term usually range from $70 to $120, providing enough protection for medical bills and funeral expenses without burdening loved ones.

How much is a $500,000 life insurance policy for a 60-year-old man?

A healthy, non-smoking 60-year-old male pays roughly $150–$220 monthly for a 20-year term policy worth $500,000. Those with health conditions might pay more, but they can offset costs by choosing shorter terms or lowering coverage to $250,000.

Is life insurance worth it after 65?

Absolutely. Life insurance after 65 is valuable for covering debts and funeral costs, or for supplementing a spouse’s income. Many insurers also offer smaller, low-cost policies—ranging from $40 to $90 per month—that make sense for seniors on fixed incomes.

What happens after 20 years of paying for whole life insurance?

After 20 years, your cash value life insurance continues to grow, letting you build savings inside your policy. You can borrow from it or use it to cover premiums. Many seniors use these funds for medical expenses, debt payoff, or to boost their death benefit later.

What death is not covered by life insurance for seniors?

Life insurance typically won’t pay for deaths caused by suicide within the first two years, fraudulent claims, or illegal activities. Some insurers may also exclude high-risk hobbies like skydiving or scuba diving, so always review your exclusions carefully.

What is the downside of life insurance for seniors?

The biggest downsides are higher monthly premiums and limited term options. For instance, a 75-year-old might pay twice as much as a 65-year-old would. Seniors should compare multiple quotes and avoid policies with unnecessary riders to stay within budget.

What is the cheapest life insurance for seniors over 70?

Final expense insurance is one of the cheapest options, starting around $50 a month for $25,000 in coverage. Featured in many guides to health insurance resources, companies like Mutual of Omaha and Aflac offer no-exam plans with quick payouts to cover end-of-life costs.

How much a month is a $500,000 whole life insurance policy for seniors?

What should I not say as a senior applying for life insurance?

What does life insurance for seniors cover?

What happens if I outlive my term life insurance?

Can seniors have more than one life insurance policy?

At what age should you stop buying life insurance?

What happens after 20 years of paying for life insurance?

Do I get my money back after term life insurance expires?

Is there a life insurance policy that pays out while you are alive?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.