How Much Life Insurance You Need in 2026

How much life insurance you need depends on things like your total debt and your financial goals. Using a life insurance calculator or the DIME method can help determine your coverage needs. Term life insurance starts at $29 per month, but choosing the right amount of coverage is crucial to keep your premiums low.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Copywriter

Malory Will has an M.A. in English from Arizona State University. She has over four years of experience in writing for the insurance industry. With a background in health, auto, life, and homeowners insurance, Malory is passionate about making complex insurance topics clear and approachable. Her goal is to help readers make informed decisions with confidence.

Malory Will

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated January 2026

There are several factors to consider when deciding how much life insurance you need, including your annual income, unpaid debts, and the number of dependents you have.

- People with multiple dependents need more life insurance

- Term life insurance policies meet the needs of most people

- The cost of life insurance varies by your age, health, and gender

There are many reasons to buy life insurance, but the most important is that it can protect your loved ones from financial hardship after your passing.

- Life Insurance Basics

- Contingent Beneficiary (2026)

- Return of Premium (ROP) Life Insurance in 2026

- Cash Value Life Insurance in 2026

- Types of Life Insurance in 2026

- Term Life Insurance 2026 Guide

- Universal Life Insurance (2026 Guide)

- Single Premium Life Insurance in 2026

- Permanent Life Insurance (2026 Guide)

- Life Insurance Beneficiaries in 2026

- Modified Endowment Contract (MEC)

- Life Insurance Annuities (2026 Guide)

- One Quote That Convinced Me to Get Life Insurance

- The Life Insurance Guide: How to Get the Best Plan Possible for the Lowest Premium

Explore the options below to learn how much life insurance you need to protect your loved ones financially.

When you’re ready to get the perfect life insurance policy, enter your ZIP code into our free quote comparison tool.

Estimate How Much Life Insurance You Need

How much life insurance do you need? The amount you should get depends on the financial support your loved ones need if you were no longer around.

A great starting point is to compare your family’s financial obligations to the resources they already have. You can use a life insurance calculator, or follow these easy steps to calculate the right death benefit:

- Add Financial Obligations: Multiply annual living expenses by how many years your loved ones will need support. Then, add debts (including your mortgage) and future expenses like college tuition and childcare.

- Subtract Available Resources: Factor in anything your family will have access to, including savings, investments, other life insurance policies, and other incomes like retirement accounts or a spouse’s income.

- Adjust for Financial Goals: Decide whether your policy should cover essentials, pay off debts, replace your income entirely, or leave some of the death benefit as an inheritance.

The total amount you calculate will give you how much life insurance you need to support your family if you pass unexpectedly or fall terminally ill and are unable to work.

Consider a scenario where you aim to cover your family’s needs for 15 years and achieve several financial objectives. Your financial obligations might look like this:

- Living Expenses: $50,000/year × 15 years = $750,000

- Mortgage Balance: $200,000

- Future College Costs: $100,000

That would leave you with $1,050,000 in financial obligations for the next 15 years. You can find cheap million-dollar life insurance policies, but you may not want that much coverage.

Consider your savings and any existing life insurance policies, then add up all these available resources for your family:

- Savings and Investments: $150,000

- Existing Life Insurance: $100,000

That totals to $250,000 in liquid assets your family can rely on. In this case, a life insurance policy with a death benefit of $800,000 would cover your financial goals.

To calculate how much life insurance you would need in this situation, you’d subtract $250,000 from $1,050,000, leaving you with a sum of $800,000.

The quickest way to determine how much life insurance you need is to multiply your annual salary by 10, then add any big debts like a mortgage or car loan.

Michelle Robbins Licensed Insurance Agent

Picking the best life insurance policy with the right coverage might sound tricky, but it doesn’t need to be when you know where to shop.

Once you’ve determined your financial goals for your loved ones, you can get free quotes and start comparing different types of policies to determine how much life insurance you need.

DIME Method for Life Insurance

The DIME method is a simple way to estimate how much life insurance you need by looking at four key areas.

Your debt, income, mortgage obligation, and potential future education costs will determine how much life insurance you need.

- Debt: Add up what you owe, including credit cards, car loans, and medical debt.

- Income: Multiply your annual income by the number of years your family would need financial support.

- Mortgage: Factor in the remaining balance on your mortgage so your family can stay in their home.

- Education: Include the future education costs for your children, whether that be private school, after-school care, college, or a trade program.

By totaling these amounts, you get a rough estimate of the coverage needed to protect your loved ones. From there, you can add on other expenses or subtract existing savings or investments.

If you have pre-existing health conditions or children with special needs or medical conditions, you can also use life insurance to help finance what your health insurance won’t cover.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Things to Consider When Choosing a Policy

Life insurance provides a death benefit, which is a lump sum amount you can use to cover funeral costs, tuition and education costs, inheritance, debts, and more.

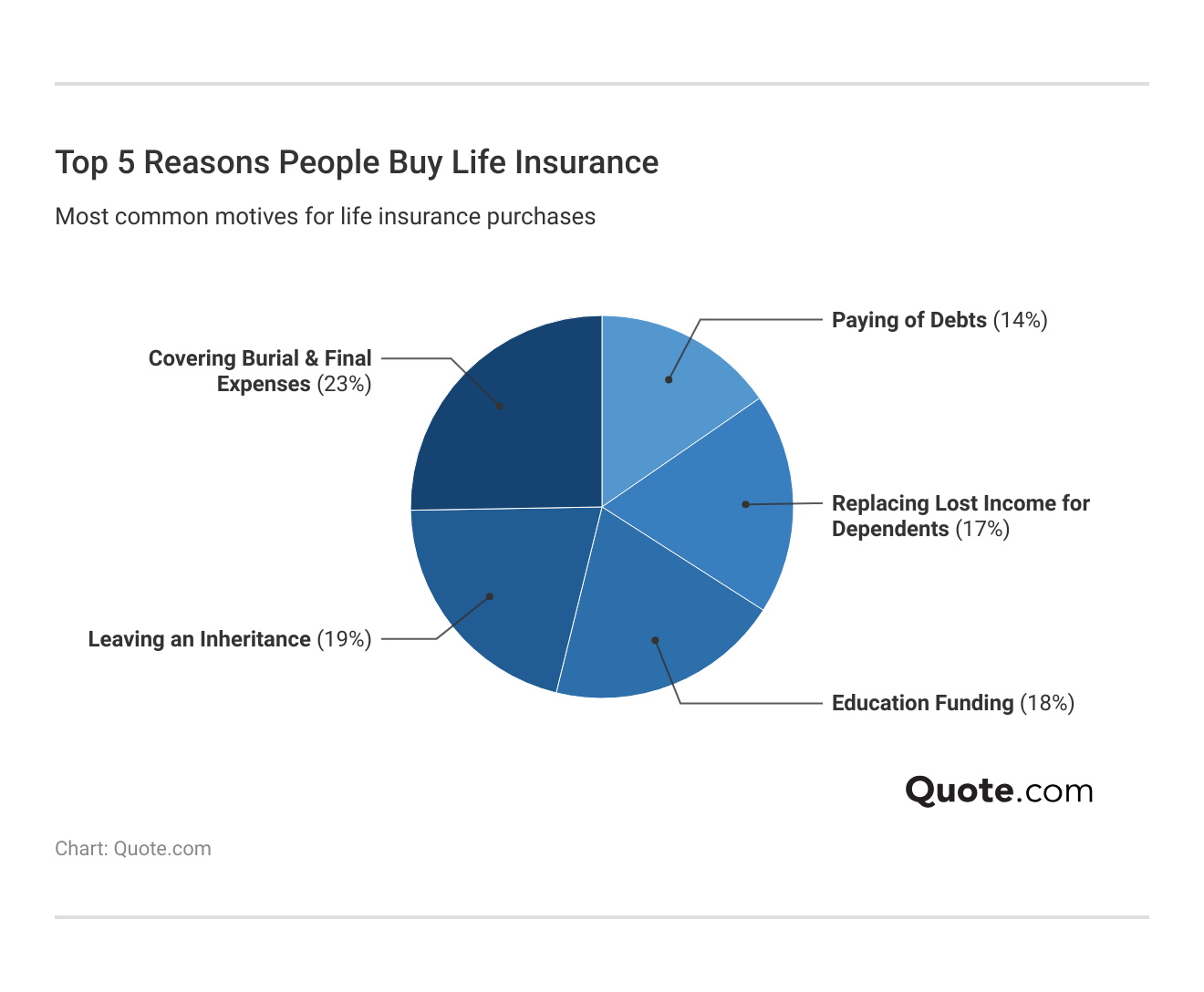

Keep in mind that the right coverage for you depends on your goals. Consider the top reasons people buy life insurance to get a few ideas of the most common ways a death benefit is put to use.

Suppose your only goal with life insurance is to ensure college tuition can be paid. In that case, you’ll need significantly less coverage than our example in the previous section.

Purchasing a higher level of coverage will increase the cost of your insurance, so compare quotes online before you buy to see which provider offers you the best rates.

The best life insurance companies can help you find the perfect policy, regardless of your financial goals. Shopping around at multiple companies can connect you with the most affordable rates, too.

If you’re still not sure how much life insurance you need, take a closer look at why people buy life insurance and how it can help you.

Covering Final Expenses

The most popular reason to buy life insurance is to cover burials and other final expenses, including funeral and cremation services.

Most funerals cost $10,000 on average, and it can still cost between $2,500 and $5,000 to bury a loved one without a viewing or funeral service.

You can buy final expense life insurance just to cover burials, and it often comes with cheaper rates due to lower benefit amounts.

Having life insurance will help your family celebrate life without financial stress, but you may want to choose higher coverage levels if you want to leave behind an inheritance or cover debts and tuition costs.

Read More: How to Get Life Insurance Quotes

Leaving an Inheritance

Before you buy life insurance, consider the needs of your life insurance beneficiary. For example, if you have several children who are still minors, you’ll need a larger death benefit to leave behind than if you had no children.

You can also name a trust as the beneficiary, which can hold onto death benefits and distribute funds according to the terms you set when buying the policy, such as releasing money when children turn 18.

Funding Family Education

If you have several children you want to put through college, life insurance benefits can cover tuition costs and private school funding.

Life insurance benefits can be used flexibly, which means a surviving spouse could also apply part of the payout toward education or retraining if they want to return to school.

Read More: Best Good Student Auto Insurance Discounts

Replacing Lost Income

Beyond education, life insurance is equally critical when the policyholder is the primary breadwinner. Death benefits can replace lost income.

Replacing lost income with instant life insurance guarantees that your family can maintain their lifestyle, pay bills, and stay financially secure.

Choose life insurance equal to at least 7–10 times your annual salary, but also consider future expenses like a mortgage, childcare, and college tuition.

Melanie Musson Published Insurance Expert

Paying off high-interest debts like credit cards also frees up household income for day-to-day expenses and creates long-term financial stability after a loss.

If you underestimate the cost of living, you risk leaving family members scrambling to find funds. Always account for inflation and annual tax increases when deciding how much life insurance you need.

Paying off Debts

When you pass away, mortgages, car loans, credit card balances, and other financial obligations don’t disappear.

Your family will be responsible for these payments, but life insurance benefits can pay down or eliminate debt.

For instance, using life insurance to pay off a mortgage protects your family and allows them to continue living in the family home without fear of foreclosure.

Read More: Firestone Credit Card Review

Most Common Types of Life Insurance

Although there are a variety of options to choose from, most life insurance quotes are for either term or whole life policies.

Choosing the best type of life insurance for your needs depends on your unique situation. You may require life insurance for investments and loans, as well as death benefit coverage.

Life Insurance Policy Types: Pros and Cons| Plan | Details | Pros | Cons |

|---|---|---|---|

| Term Life | Fixed term: 10-30 years | Low cost | Expires, no cash value |

| Universal Life | Flexible rates, permanent | Adjustable coverage | Complex, expensive |

| Variable Life | Stock-based market growth | High return potential | Investment risk, costly |

| Whole Life | Lifetime policy, cash value | Stable growth | High premiums |

Term life is best for parents with young children, homeowners with a mortgage, and anyone with substantial debts.

While it’s more expensive, whole life is a great option for people who want to lock in a monthly premium for the rest of their lives.

Final expense insurance can be affordable, but death benefits are usually capped at around $25,000, and are meant to cover funeral expenses.

Jeff Root Licensed Insurance Agent

There are other types of permanent life insurance policies, too. These types of whole life insurance are less commonly purchased.

If one sounds appealing to you, make sure to research your options before signing up for coverage.

- Universal Life Insurance: Universal life insurance offers permanent coverage with flexible premiums and adjustable death benefits.

- Variable Life Insurance: Get variable life insurance for permanent coverage with investment options for the cash value.

- Final Expense Insurance: Final expense insurance is a smaller policy meant to cover funeral and end-of-life costs.

While these types of whole life are available with most providers, many people choose term life over permanent policies for their streamlined structure and affordable premiums.

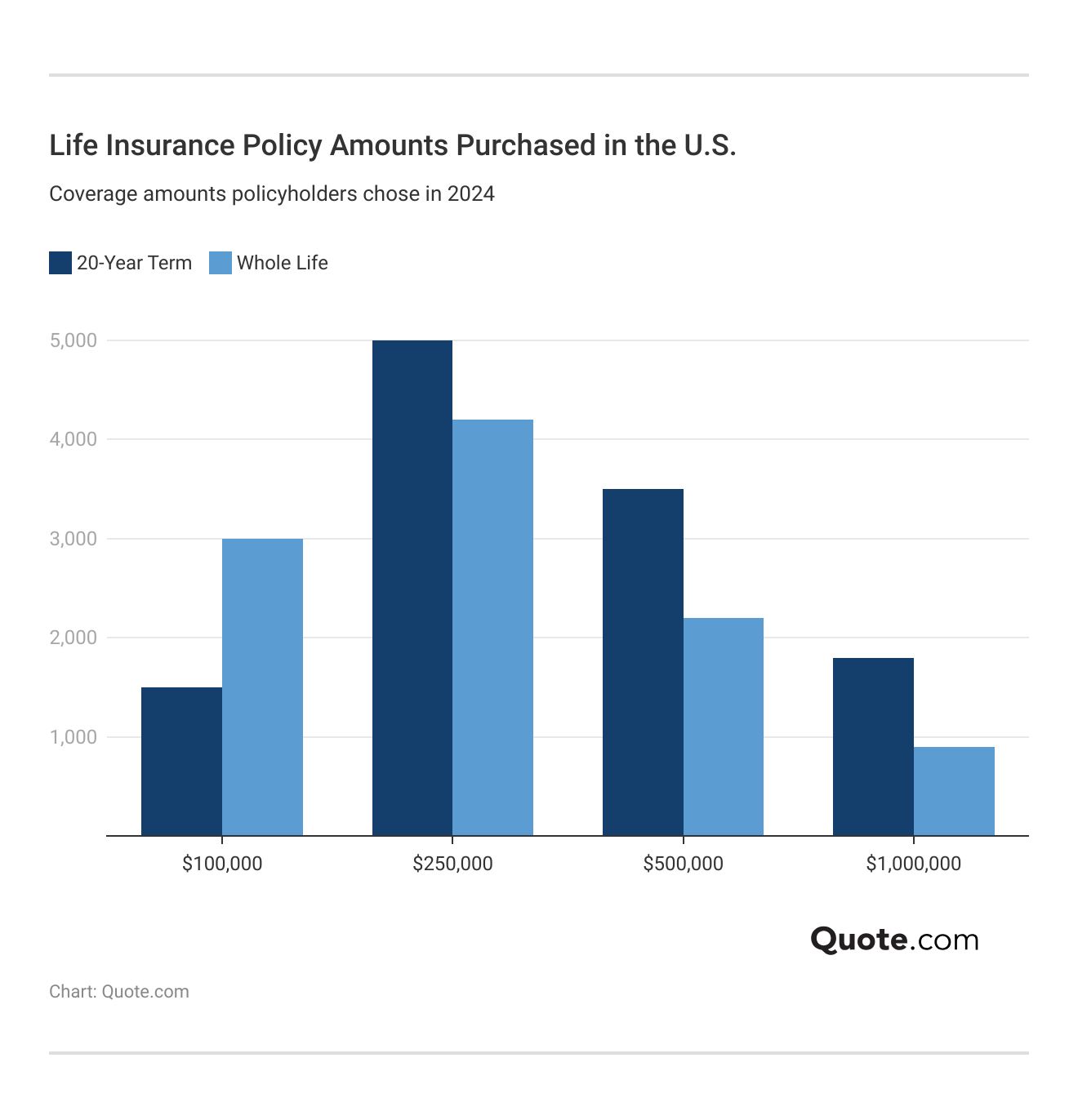

Term Life vs. Whole Life Insurance

The best term life insurance policies offer substantial death benefits for an affordable price. Because they’re affordable, offer a great value, and are easy to understand, term life insurance is the most popular type of coverage.

However, if you outlive the policy term, you lose your death benefits and any premiums paid unless you purchase add-ons to return your premiums at the end of the policy.

Alternatively, whole or permanent life insurance lasts for the policyholder’s lifetime and builds cash value based on investments, which can later be borrowed against or applied to premiums.

It’s recommended for parents with special needs children, high-income earners who have maxed out their retirement accounts, and anyone seeking guaranteed coverage.

Term and whole life insurance are the most commonly purchased policies because they are easy to understand and meet most people’s needs.

To ensure your financial obligations are met, you can choose from a variety of death benefit amounts, with $250,000 and $500,000 being the most popular.

A life insurance benefit is the lump-sum payment made to your beneficiaries after you pass away, helping them cover expenses like funeral costs, debts, or ongoing living needs.

Some choose a lower benefit to keep premiums affordable or cover only final expenses, while a higher benefit is often chosen to provide long-term financial security for loved ones at a more expensive rate.

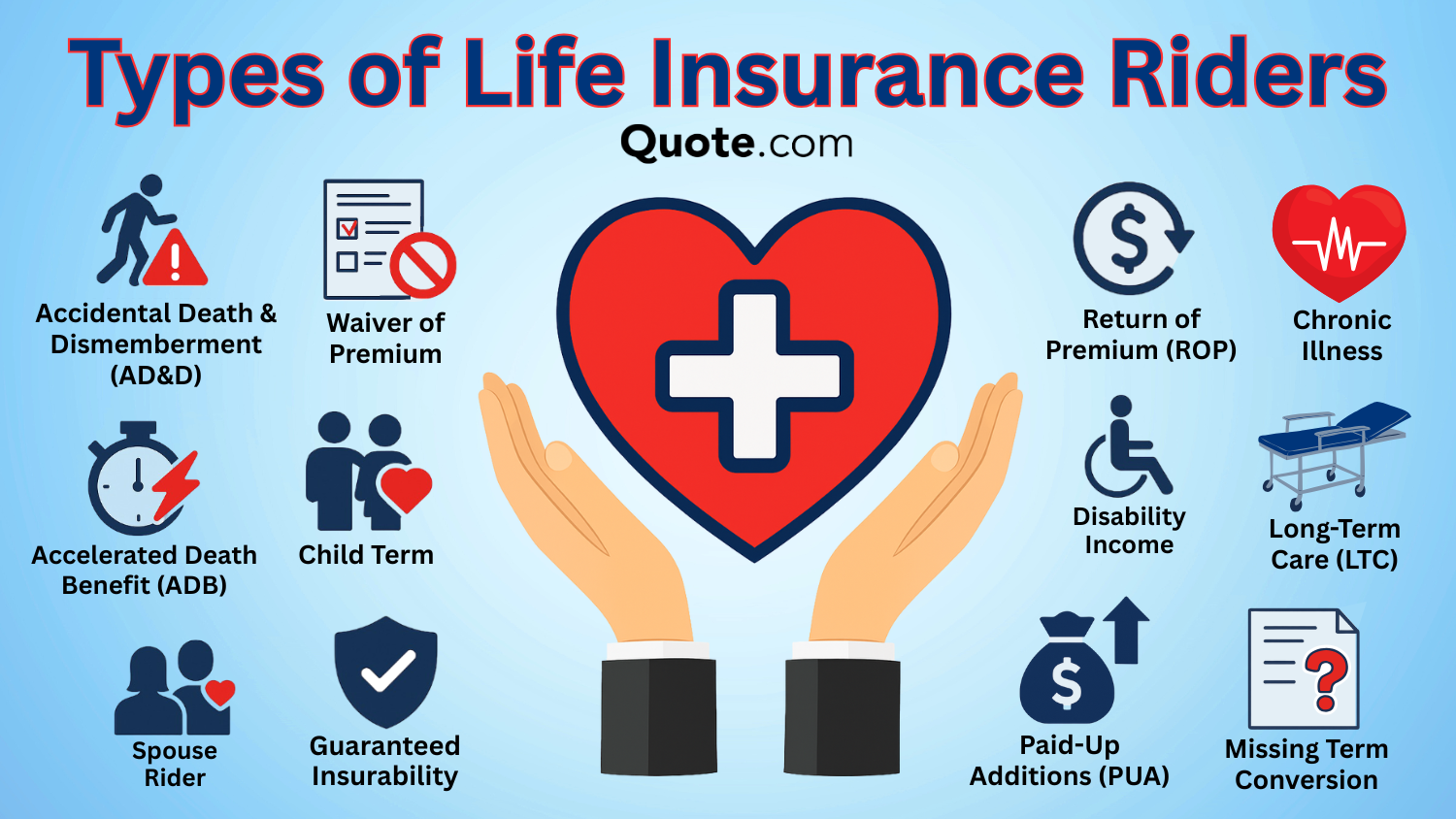

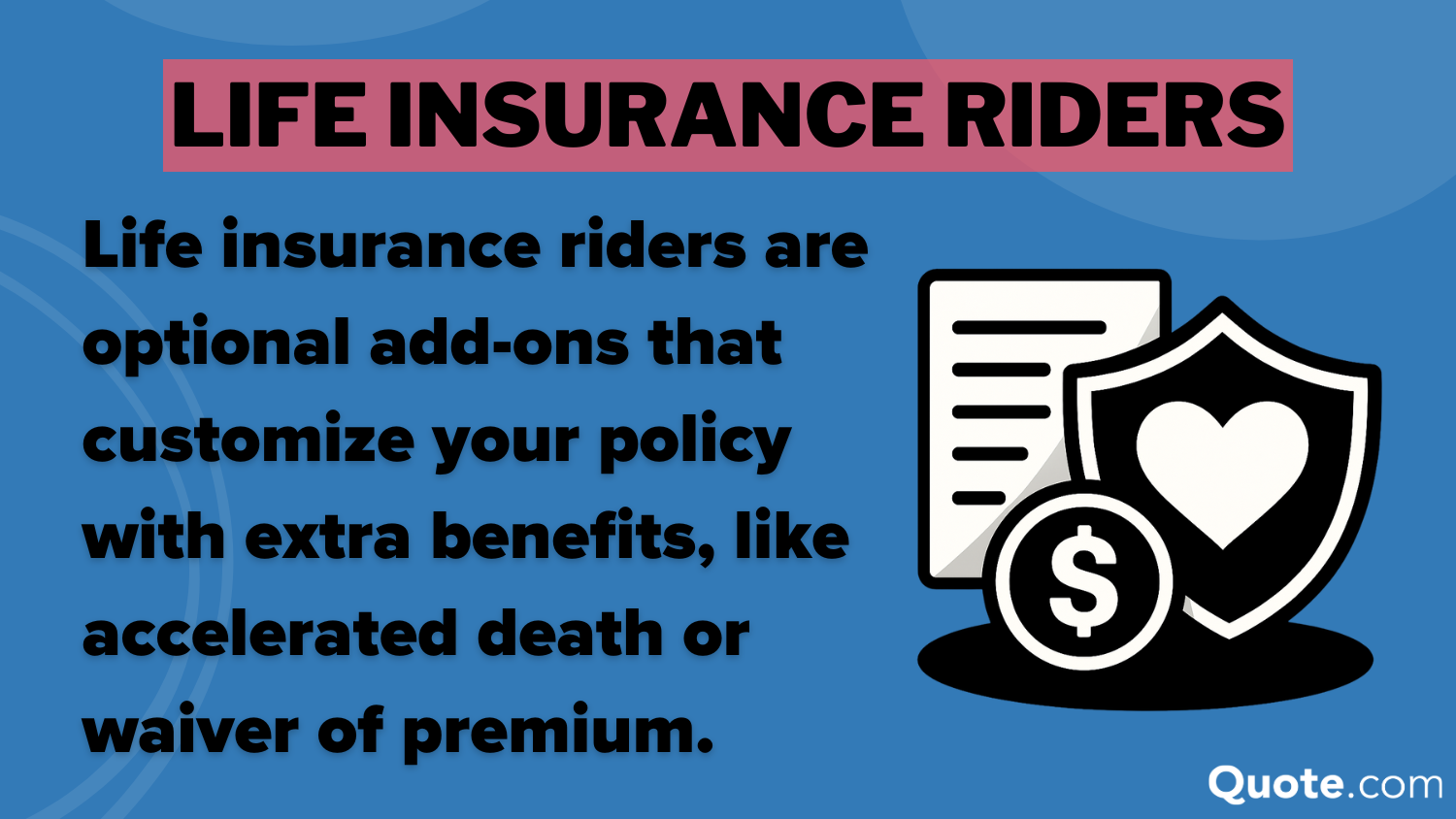

Life insurers also offer riders to customize your policy with features that fit your needs. For instance, an accelerated death benefit rider lets you access a part of your payout early if you’re diagnosed with a terminal illness.

A return of premium rider refunds any premiums you’ve paid if you outlive your term policy, allowing you to recover costs while keeping coverage in place.

How Much Life Insurance Costs

The amount you pay for life insurance depends on a variety of factors, like your age, gender, and overall health. One of the most important factors is which policy you buy.

There are many policies to choose from, but term life tends to be the most popular and the most affordable.

Term vs. Whole Life Insurance Monthly Rates by Provider| Insurance Company | 20-Year Term | Whole Life |

|---|---|---|

| $32 | $210 |

| $30 | $200 |

| $35 | $215 | |

| $33 | $205 |

| $38 | $230 | |

| $36 | $215 | |

| $30 | $205 | |

| $29 | $195 | |

| $31 | $200 | |

| $29 | $195 |

As you can see, term life is usually significantly cheaper than whole life. But, like most types of insurance, there are many factors that affect how much you’ll pay for life insurance.

Whether you want the best online life insurance or plan on buying through an agent, the following factors will affect your monthly premiums.

Top Factors Affecting Life Insurance Premiums| Factor | Impact on Rate |

|---|---|

| Age | Older applicants pay more due to higher mortality risk |

| Benefit Amount | Higher coverage raises the insurer's payout potential |

| Family History | Family medical history can signal long-term health risk |

| Gender | Women typically pay lower rates since they live longer |

| Health | Poor health raises rates, while good health lowers them |

| Lifestyle | Risky activities like skydiving increase death or injury risk |

| Occupation | Dangerous jobs like roofing increase injury or death risk |

| Plan Type | Term life is cheaper than whole, universal, or variable life |

| Policy Length | Whole life costs more for lifetime coverage and cash value |

| Smoking/Drugs | Tobacco/drug use raises heart disease and cancer risk |

Wondering which are the best ways to shop for term life insurance and whole life insurance quotes? Comparing term life insurance and whole life insurance quotes side by side helps you weigh lower upfront costs against long-term benefits like cash value accumulation.

Many people also prefer to purchase their life insurance in person. Meeting with an insurance professional in person can help clarify complex policy details, such as conversion options, dividends, and guaranteed renewability.

Learn More: One Quote That Convinced Me to Get Life Insurance

Unlike home and auto coverage, life insurance can be a long-term investment, and some people feel more comfortable committing in person.

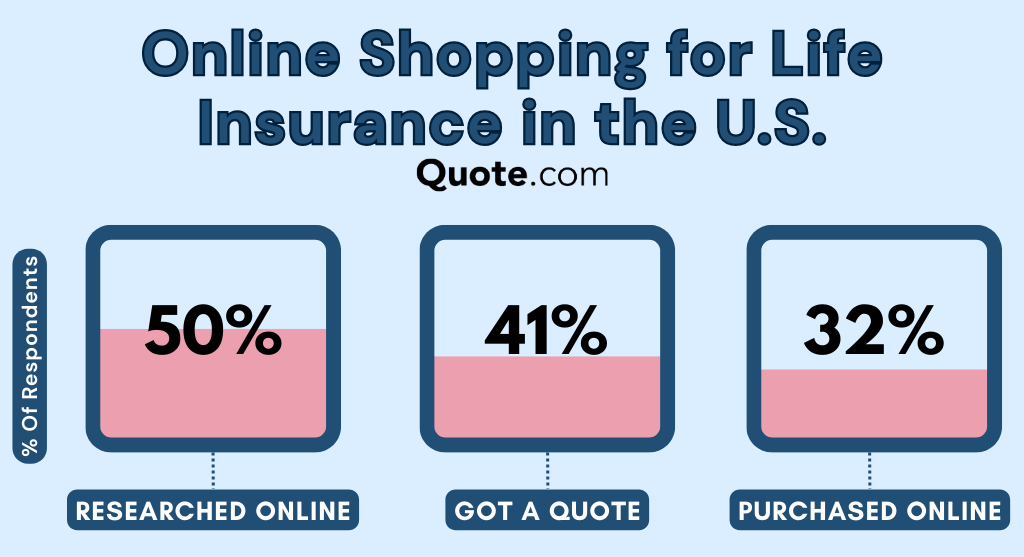

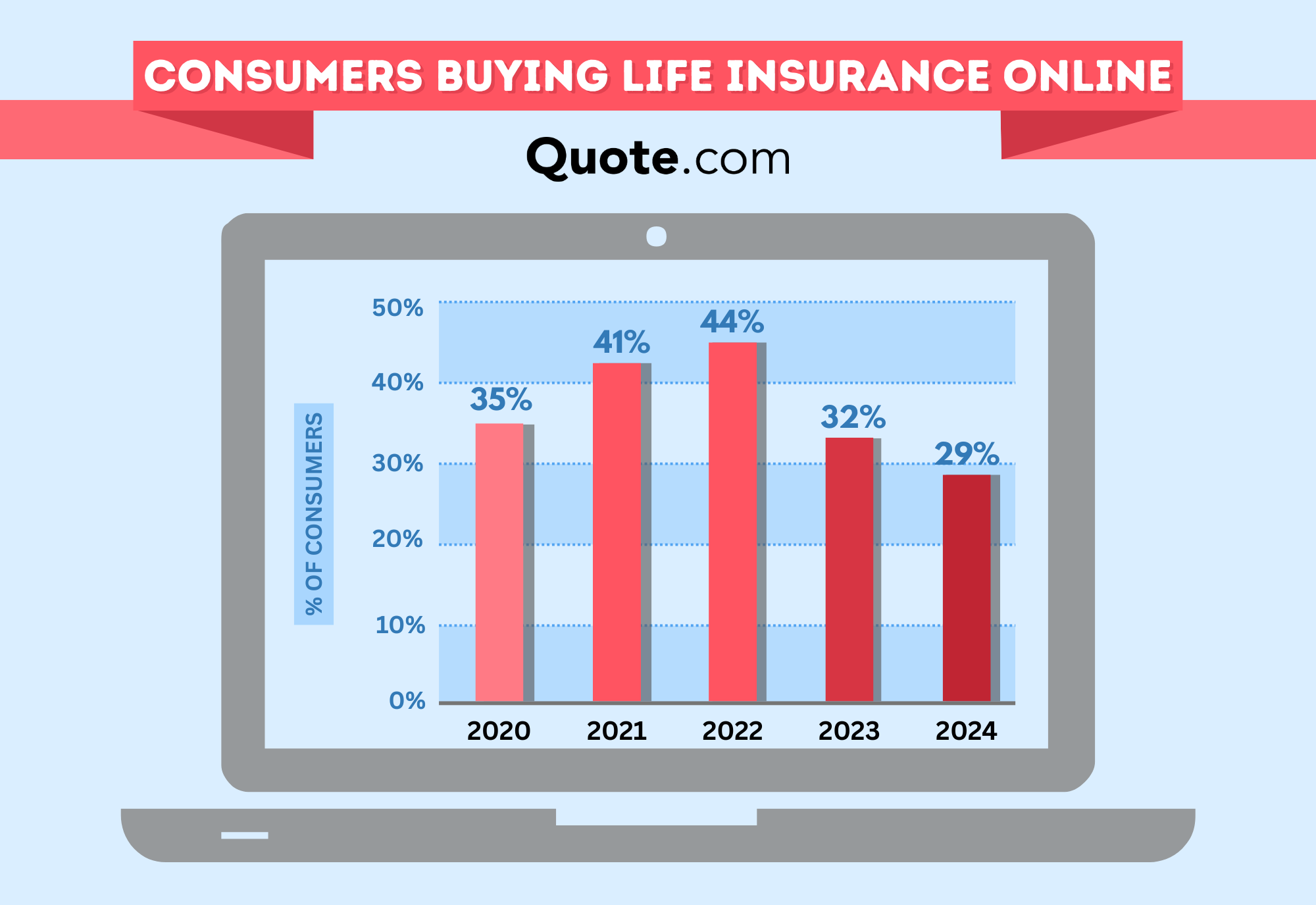

However, there’s no reason not to purchase life insurance online. One third of shoppers still buy life insurance online after comparison shopping or consulting with a financial advisor.

Online tools make it easier to compare life insurance quotes side by side, helping shoppers quickly identify differences in price, coverage length, and policy features.

If you know how much life insurance you need and want to compare policies online, enter your ZIP code here to get free online life insurance quotes today.

Term Life Insurance Rates

Term life insurance is the cheapest option for life insurance, making it a popular choice for those looking to keep costs down.

Compare the average price of term life from some of the top life insurance companies to find an affordable policy.

20-Year Term Life Insurance Monthly Rates by Policy Amount| Insurance Company | $250k | $500k | $1M |

|---|---|---|---|

| $32 | $55 | $90 |

| $30 | $50 | $85 |

| $35 | $60 | $95 | |

| $33 | $58 | $92 |

| $38 | $65 | $100 | |

| $36 | $60 | $95 | |

| $30 | $50 | $85 | |

| $29 | $47 | $80 | |

| $29 | $50 | $80 |

Depending on your circumstances and how large a benefit you want, you could term life insurance for as little as $29 per month.

Read More: What is a modified endowment contract (MEC)?

Whole Life Insurance Rates

The average cost of life insurance is significantly higher for whole life insurance compared to term life insurance.

It also gets more expensive on average for older people, with seniors in their 60s and 70s paying hundreds more per month than someone in their 30s.

Whole Life Insurance Monthly Rates by Age, Gender, & Policy Amount| Age & Gender | $250k | $500k | $1M |

|---|---|---|---|

| 20-Year-Old Female | $110 | $220 | $430 |

| 20-Year-Old Male | $120 | $240 | $470 |

| 30-Year-Old Female | $125 | $250 | $500 |

| 30-Year-Old Male | $135 | $270 | $540 |

| 40-Year-Old Female | $160 | $320 | $630 |

| 40-Year-Old Male | $175 | $350 | $690 |

| 50-Year-Old Female | $230 | $460 | $910 |

| 50-Year-Old Male | $250 | $500 | $1,000 |

| 60-Year-Old Female | $350 | $700 | $1,400 |

| 60-Year-Old Male | $380 | $760 | $1,520 |

| 70-Year-Old Female | $520 | $1,040 | $2,080 |

| 70-Year-Old Male | $600 | $1,200 | $2,400 |

If you’re interested in whole life insurance, you should purchase it as soon as possible. You can lock in very low rates if you buy coverage in your 20s or 30s.

For example, $120 per month as a 20-year-old is much easier to afford than $380 per month for the same level of coverage as a 60-year-old.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Get the Life Insurance Coverage You Need

The main factors for how much life insurance you need include how many dependents, outstanding debts, and mortgage payments you have.

Other factors, like retirement and inheritance planning, are also important to consider. Multiplying your annual income by 10 is a simple solution for determining the total amount of your death benefit.

If you need more information, our helpful life insurance guide has more answers. You can compare life insurance quotes and match policies with your financial goals.

When you’re ready to buy, enter your ZIP code into our free comparison tool to see personalized life insurance quotes.

Frequently Asked Questions

How much life insurance do I need?

The amount of life insurance you need depends on several factors, including how many dependents you have, how much debt you have, and what your financial goals are. Generally speaking, you can subtract your family’s liquid assets from your debts and yearly expenses to determine how much insurance you need.

How much life insurance do I need at 60?

If your mortgage is paid off and your children are independent, you may only need enough coverage for final expenses or to leave a legacy, rather than if you still have debts or dependents relying on your income, a larger policy may be necessary (Read More: Cheap Auto Insurance for Seniors).

What is the DIME method for life insurance?

The DIME method for life insurance makes determining your coverage needs a little simpler. DIME stands for debt, income, mortgage, and education. To determine how much insurance you need, simply add these values together.

How much life insurance do you need for a single person?

For a single person, life insurance needs are usually lower since there are no dependents relying on your income. Coverage is often used to pay off debts, cover final expenses, or leave money to loved ones or charities. If you have co-signed loans or aging parents who depend on you financially, you may want a larger policy.

To see how much life insurance you need, enter your ZIP code into our free comparison tool today.

What is the 10x rule for life insurance?

Most insurance experts and financial experts recommend you buy at least 10 times your income in life insurance, but it’s not a rule. How much life insurance you need depends on your current savings and any existing life insurance policies you may have.

Is term or whole life insurance better?

Comparing whole life vs. term life insurance is relatively easy. For most people, a 20-year term life insurance policy covers their needs. Term life insurance quotes are usually the most affordable. On the other hand, the best whole life insurance may cost more, but it means you won’t have to worry about your life insurance expiring.

Is $100,000 enough life insurance?

While it depends on your situation, $100,000 in life insurance isn’t usually enough to cover a mortgage and living expenses. However, it can be enough for older adults looking for a final expense policy to cover their end-of-life costs.

Is $500,000 enough life insurance?

$500,000 can be enough for your insurance needs, depending on your situation. You’ll need to carefully consider your family’s finances to determine if $500,000 covers everything you have in mind.

Is universal life insurance worth it?

Universal life may be worth investing in if you want more control over your premiums and death benefit. However, it is more complicated to understand and often requires the insight of a financial advisor. Most insurance experts recommend either term or whole life insurance for its simplicity.

Is single-premium life insurance worth it?

Although some companies offer single-premium life insurance, it’s not usually worth the expense. These policies require a massive upfront payment, which most people can’t afford.

How much does a $1,000,000 term life insurance policy cost?

At what age should you stop getting life insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.