Medicare Advantage Maximum Out-of-Pocket (MOOP) in 2026

The Medicare Advantage maximum out-of-pocket (MOOP) limit is $9,400 for in-network care and $14,000 when both in- and out-of-network services are included. These limits cover all deductibles, copays, and coinsurance. Once you reach the MOOP, your Medicare Advantage plan covers 100% of costs for the rest of the year.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Creator

Lia Vergin develops both video and written content across all lines of insurance, with a primary focus on auto, home, and life coverage. She is dedicated to helping consumers better understand and navigate their insurance options. Driven by a passion for saving money and finding great deals, she is committed to creating clear, engaging, and practical content that empowers readers to make confident...

Lia Vergin

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Travis Thompson

Updated January 2026

The Medicare Advantage maximum out-of-pocket (MOOP) is $9,400 for in-network care and $14,000 for in- and out-of-network care.

- Your Medicare Advantage MOOP resets on January 1 every year

- Medicare Advantage plans average about $17 per month

- Medicare Advantage plans are sold by private insurance companies

The purpose of Medicare out-of-pocket costs is to limit the amount customers have to spend on healthcare each year, as insurance covers 100% of approved health insurance costs after the maximum is met. Read on to learn more about the Medicare Advantage MOOP, the cost of Medicare Advantage, and more.

Speak with a licensed insurance agent today about your Medicare needs by calling (855) 634-0435. Or, you can enter your ZIP in our free tool for quotes.

How Your Medicare Advantage MOOP Works

Do Medicare Advantage plans have a cap? Yes, when you buy a Medicare Advantage Part C plan, your plan will have an annual maximum out-of-pocket amount that caps what you have to spend.

Once you have spent this amount on deductibles, copayments, and similar healthcare costs, your Medicare Advantage plan will cover the rest of your healthcare costs.

Medicare Advantage MOOP Overview| Category | Details |

|---|---|

| Definition | Max you pay before full coverage |

| Purpose | Limits yearly medical spending |

| Applies to | Deductibles, copays, coinsurance |

| Excludes | Premiums and non-covered care |

| Annual Limit | $9.4K in-network; $14K total |

| Set by | CMS, federal Medicare agency |

| Original Medicare | No MOOP without Medigap |

| Importance | Limits costs, ensures stability |

The standard Part C maximum out-of-pocket is $9,400 for in-network costs and $14,000 total. Once you hit those amounts for the Part C MOOP, your plan will cover the rest of your costs.

This can provide some peace of mind to customers in the event of a major medical event, as they won’t have to pay all of the unexpected medical expenses if they meet their maximum out-of-pocket.

With an Original Medicare plan, you won’t have a maximum out-of-pocket amount like you do with Medicare Advantage unless you get Medicare Supplemental Insurance (Medigap).

Because of this, a Medicare Advantage plan may be more attractive to some customers over a Medicare Original plan, as the maximum cap limits costs.

Medicare Advantage Exclusions to MOOP

It is important to note that the Medicare Advantage MOOP does not apply to premiums and non-covered care.

For example, your MOOP wouldn’t apply to a cosmetic procedure that is deemed not medically necessary by insurance.

Medicare Advantage MOOP Key Details| Category | Details |

|---|---|

| Federal Rule | Required for Parts A & B |

| Annual Limit | $9.4K in-network; $14K total |

| What's Included | Deductibles, copays, fees |

| What's Excluded | Premiums, Part D, extras |

| Yearly Reset | Resets Jan 1 each year |

| Network Rules | HMOs one; PPOs split |

| After Cap Met | Plan covers 100% after cap |

| Covered Services | Covered care for Parts A & B |

| Lower Limits | Some plans offer lower caps |

| CMS Oversight | CMS ensures compliance |

The Medicare Part C MOOP will also exclude the cost of Part D coverage, which is a prescription drug coverage add-on.

Because your Medicare Advantage MOOP resets every year, you may not always reach the MOOP and get 100% of costs covered if you don’t have many medical visits.

Every year, your Medicare Advantage maximum out-of-pocket will reset on January 1.

Adam Lubenow Medicare Broker

However, if you reach the MOOP, your costs will be covered for the rest of the year, even if it’s just for a short period.

For example, if you reach your out-of-pocket maximum in October, you will have about two months of complete coverage before you have to start paying deductibles, copays, and coinsurance again.

Learn More: Medicare Advantage vs. Original Medicare

Get a Free Medicare Plan Review

Speak With a Licensed Insurance Agent Today

Secured with SHA-256 Encryption

Cost of Medicare Advantage Plans

How much does Medicare cost? Medicare Advantage plans have varying deductibles and drug coverage, depending on the provider you choose.

On average, Medicare Advantage premiums are typically around $17 per month at most insurance companies.

Medicare Advantage (Part C) Plan Costs| Category | Details |

|---|---|

| Monthly Premium | ~$17 (Can be $0 with Part B) |

| Deductible | $0–$500, varies by plan |

| Copays/Coinsurance | Fixed amounts per visit/service |

| Drug Coverage | Often included (varies by plan) |

| Out-of-Pocket Max | $9.4K in-network; $14K total |

| Extra Benefits | Dental, vision, hearing, fitness, etc. |

| Network Rules | Varies by plan (HMO, PPO etc.) |

Medicare Advantage (Part C) plans may also come with some benefits, such as added dental or vision coverage, which will raise premiums and out-of-pocket costs.

It depends on the insurance provider you choose, as not all providers will offer added benefits like these.

Always compare multiple Part C plans based on premiums and maximum out-of-pocket costs to find coverage that fits your budget.

You should also consider your current group plan, individual health insurance, or dental coverage, as they might be more cost-effective based on your age and employment.

Find the Best Medicare Advantage Plan for You

Medicare Advantage plans may not be right for every customer. While your Medicare Advantage MOOP can help cap costs, Medicare Advantage can still be expensive.

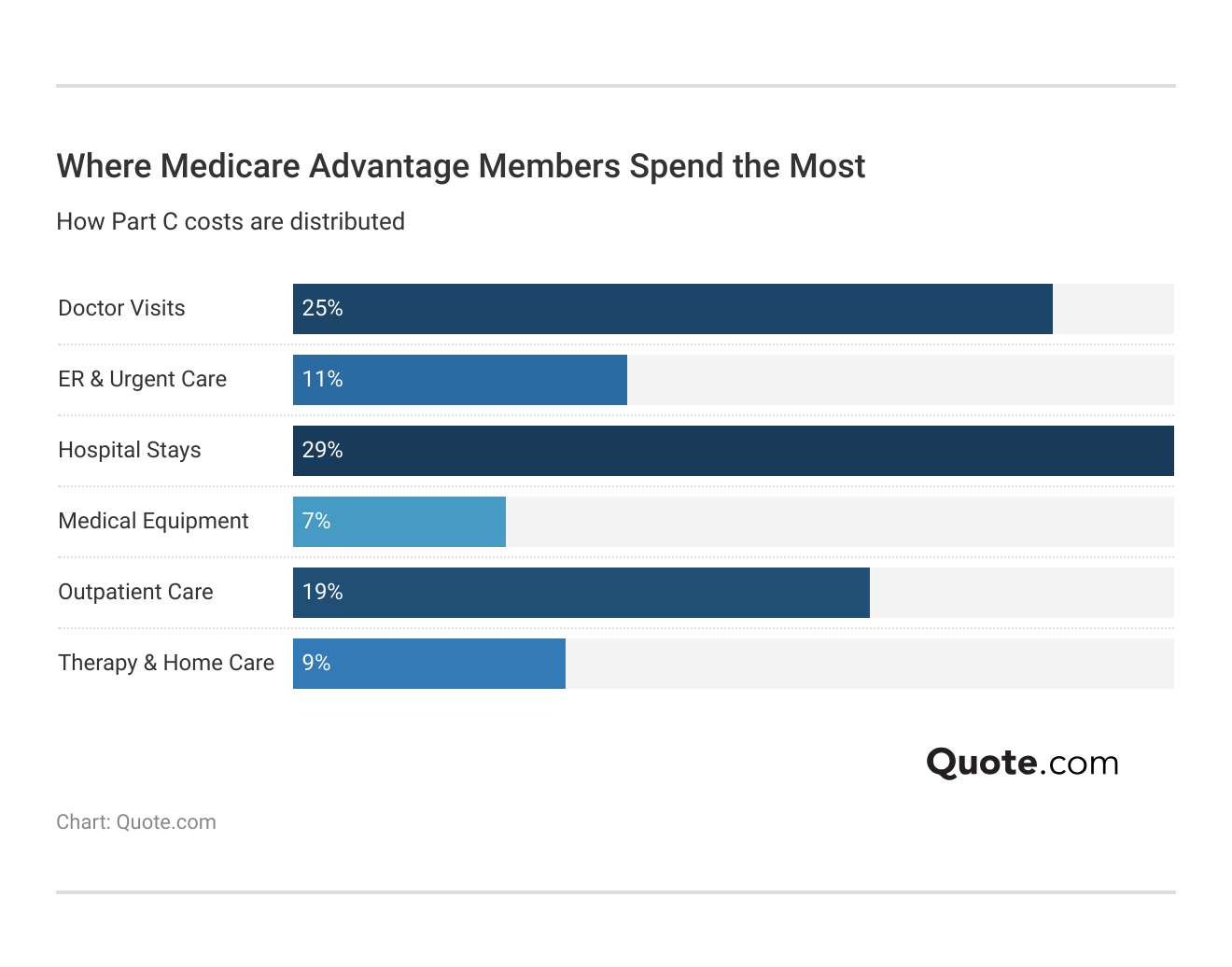

The biggest cost that Medicare Advantage customers will need insurance for is hospital stays, accounting for 29% of Medicare Part C costs.

Doctor visits, medical equipment, therapy, and home care are other reasons you might want to shop around for affordable Medicare Advantage plans.

Take the time to fully consider the pros and cons of the Medicare Advantage maximum out-of-pocket, as well as taking the time to choose what Medicare parts you want on your plan (Read More: Medicare Parts A, B, C, & D).

Medicare Advantage MOOP Pros & Cons| Pros | Cons |

|---|---|

| Financial Cap | Still Expensive |

| Predictable Costs | Excludes Drugs |

| Encourages Care | Varies by Plan |

| Adds Cost Limit | Out-of-Network Costs |

| Full Coverage After Cap | Non-Medicare Gaps |

| CMS Standardized | Hard to Track |

Some customers may also find it difficult to track the amount spent toward the maximum out-of-pocket for Medicare Advantage, leaving them unsure when they will meet their MOOP.

To speak with a licensed insurance agent about your Medicare needs, call (855) 634-0435 today. You may also enter your ZIP in our tool for free quotes.

Frequently Asked Questions

Do Medicare Advantage plans have a max out-of-pocket?

Yes, the out-of-pocket maximum for Medicare Advantage is $9,400 for in-network costs and $14,000 total.

What counts towards the out-of-pocket maximum for Medicare Advantage?

Deductibles, copays, and coinsurance all apply to the out-of-pocket maximum for Medicare Advantage.

Does Medicare Advantage cover 100% of hospital bills?

Medicare Advantage will only cover 100% of hospital bills under Medicare Part A once the cap is met. Talking with a licensed insurance agent about your Medicare options can help you make sense of costs. Call (855) 634-0435 to get the help you need or enter your ZIP code to compare free quotes.

What is the average out-of-pocket cost for a Medicare Advantage plan?

Premiums can vary based on which provider you purchase a Medicare Advantage plan from, but the average monthly out-of-pocket cost is $17 per month.

Is there an out-of-pocket maximum for Medicare Part B?

There is no out-of-pocket maximum for Medicare Part B.

Is there an out-of-pocket maximum for Medicare Part D?

Yes, there has been a Medicare maximum out-of-pocket for drugs on Medicare Part D since the start of 2025 (Learn More: What is Medicare Part D?).

What is the biggest disadvantage of the Medicare Advantage plan?

The biggest disadvantage of Medicare Advantage plan is its limited provider network, as it’s not accepted by as many hospitals and doctors as Original Medicare. There are also other disadvantages, such as needing prior authorization for certain tests or specialists, or a higher risk of denied claims.

Can I drop my Medicare Advantage plan and go back to original Medicare?

Yes, you can choose to go back to original Medicare during the next sign-up period. Check out our step-by-step guide: How to Sign up for Medicare

Why do people choose original Medicare over Medicare Advantage?

Some people may choose Medicare original plans if they want a bigger network of providers, as original Medicare is more widely accepted.

What is not covered under Medicare Advantage?

Medicare Advantage will not cover cosmetic procedures, and it may not cover dental and vision.

Why are people leaving Medicare Advantage plans?

What are the biggest mistakes people make with Medicare?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.