Medicare Enrollment Late Fees in 2026

Medicare enrollment late fees can increase your monthly premiums by 10% or more. Depending on the Medicare plan, some late enrollment penalties are permanent, while others eventually drop off. However, avoiding Medicare late fees is easy. Just enroll when you become eligible after turning 65.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Karen Condor is an insurance and finance writer who has degrees in both journalism and communications. She began her career as a reporter covering local and state affairs. Her extensive experience includes management positions in newspapers, magazines, newsletters, and online marketing content. She has utilized her research, writing, and communications talents in the areas of human resources, f...

Karen Condor

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Medicare Broker

Adam Lubenow is a partner in his family business, Senior Advisor, which specializes in bringing clarity to the Medicare enrollment process and coverage options to ensure that clients are making informed decisions. Senior Advisors is licensed to help clients in over 40 states and has offices in Arizona and New Jersey. Prior to joining the family business, Adam spent his career with Verizon Busin...

Adam Lubenow

Updated January 2026

Medicare late enrollment fees can increase your long-term health care costs by 10% or more if you miss key deadlines.

- Medicare late fee penalties are designed to encourage on-time sign-up

- Some Medicare late penalties are temporary, while some are permanent

- You may be exempt from a late fee if you continue working past 65

Medicare late enrollment fees apply to Parts A, B, and D, and can last for years or even the rest of your coverage. Understanding when and how to sign up for Medicare and how the rules work is essential for avoiding unnecessary late Medicare enrollment fees.

Read on to learn more about Medicare late enrollment fees. We have licensed insurance agents ready to answer your Medicare enrollment fee questions. Call (855) 634-0435 now for help, or enter your ZIP code.

Medicare Late Enrollment Penalty Explained

Medicare late enrollment penalties increase your monthly premiums if you miss your first chance to enroll in certain parts of Medicare.

These penalties are designed to encourage timely enrollment and prevent gaps in health coverage. However, understanding who is eligible for Medicare can help you avoid potential premium increases.

Depending on the part of Medicare you have, the penalty for not signing up for Medicare at age 65 can last for a limited time or for as long as you have Medicare. This can potentially add up to high long-term costs, so it’s important to sign up as soon as you can.

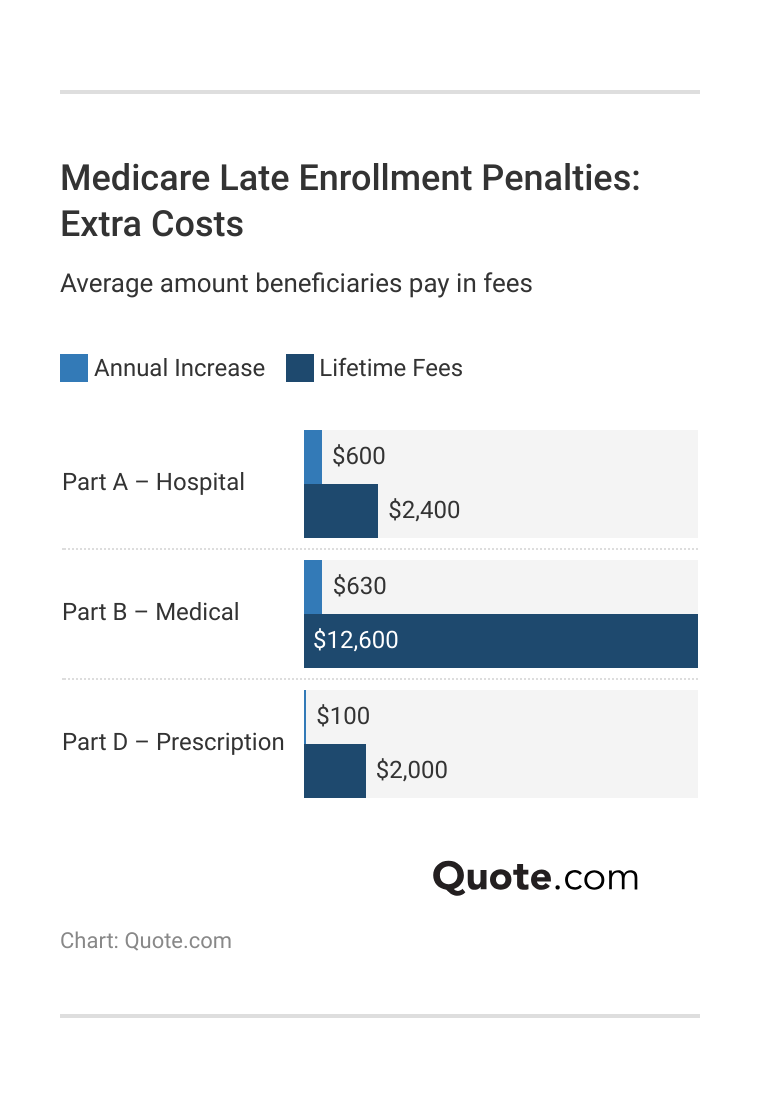

In fact, some late fees can cost you hundreds or even thousands of dollars each year, which is why avoiding them is so crucial.

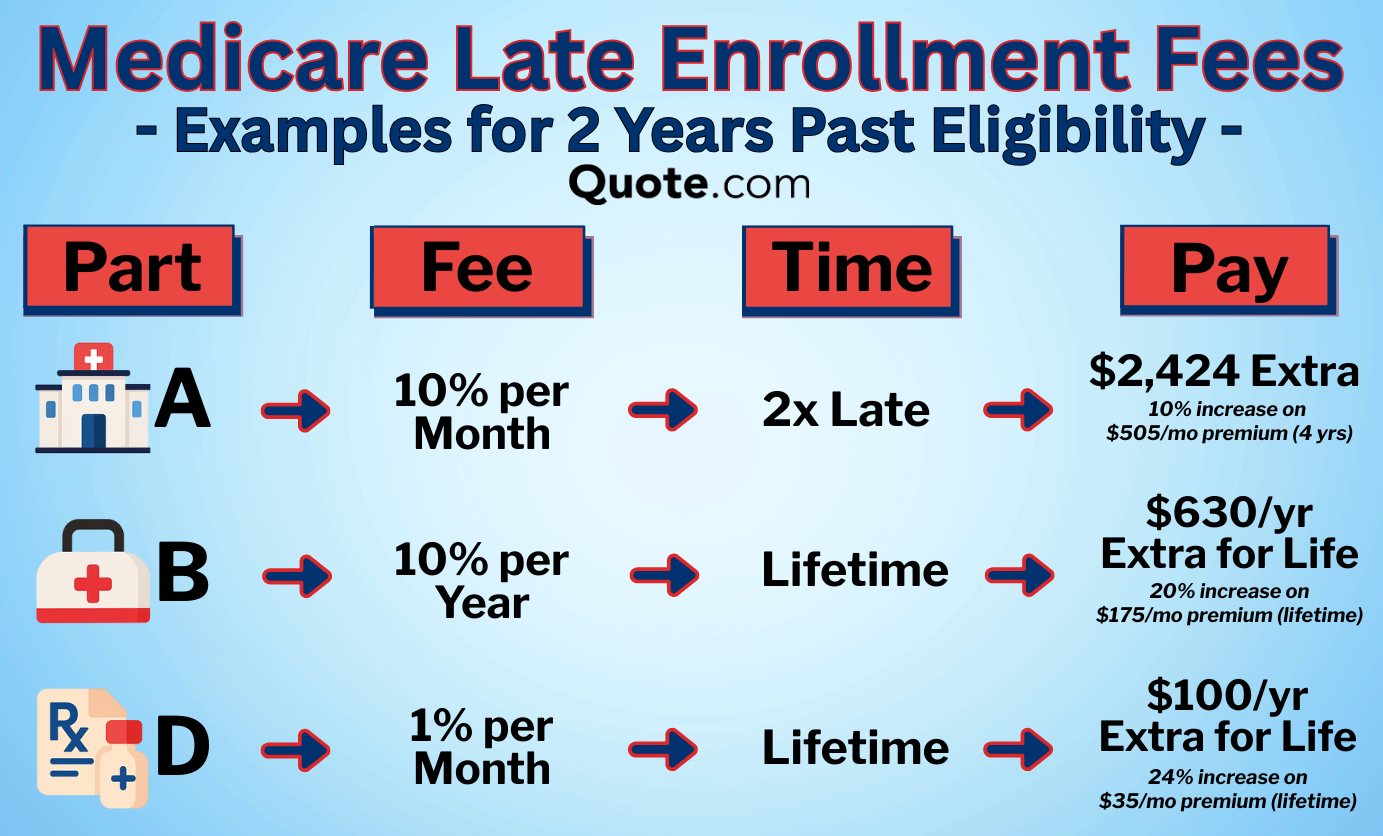

Medicare Late Enrollment: Fees & Penalties| Plan | Trigger | Penalty | Applies |

|---|---|---|---|

| Part A - Hospital | Late signup | 10% rate increase | Delay period x 2 |

| Part B - Medical | After eligible | 10% per year late | While in Part B |

| Part C - Advantage | Missed signup | No fee, only delay | Delay period only |

| Part D - Prescription | 63+ day lapse | 1% per month late | While in Part D |

The aim of these fees is to prevent people from waiting until they become sick or need costly care before enrolling.

Because each part of Medicare — Part A, Part B, and Part D — has its own enrollment rules, the penalties vary in amount, how they’re calculated, and how long they last.

Some penalties apply for a limited number of years, while others continue for as long as you have Medicare, potentially adding thousands of dollars in extra costs over time.

Understanding how these penalties work is an essential part of planning your transition into Medicare and avoiding unnecessary long-term expenses.

Understanding Short-Term Medicare Part A Late Fees

Medicare Part A covers inpatient hospital care, including semi-private rooms, meals, nursing services, and necessary hospital treatments.

Part A is designed to help pay for major medical needs that require overnight stays or ongoing care after a hospital stay. Plans also include skilled nursing facility care, hospice care, and certain types of home health services under specific conditions.

Most people qualify for premium-free Medicare Part A because they or their spouse paid Medicare taxes for at least 40 quarters.

Tracey L. Wells Licensed Insurance Agent

However, if you must pay a premium for Part A and don’t enroll when you’re first eligible, you may face a Part A late enrollment penalty. If you don’t qualify for premium-free Part A, your monthly payments could increase by 10%.

This fee for late Medicare enrollment in Part A lasts for twice the number of years you delayed enrollment. For example, if you waited two years to sign up, you would pay the higher premium for four years.

Medicare Part B Late Fees are Permanent

Medicare Part B covers outpatient medical services such as doctor visits, specialist appointments, and preventive care like screenings and vaccines.

It also includes durable medical equipment, lab tests, mental health services, and certain home health care.

Part B helps pay for medically necessary services that don’t require an overnight hospital stay.

If you don’t sign up for Part B when you’re first eligible, and you don’t qualify for a Special Enrollment Period, you’ll be facing an increase in your premiums of 10% for every full 12-month period you delay.

For example, if you delay enrollment for 24 months, your premiums will be 20% higher.

If you need help determining how much your late fee might be, you can always use a Medicare late fees calculator. And, unlike Part A, the Part B late enrollment penalty is permanent.

Breaking Down Medicare Part D Late Fee Costs

Medicare Part D provides prescription drug coverage to help lower the cost of both generic and brand-name medications.

These plans are offered through private insurers approved by Medicare, and each plan has its own list of covered drugs and cost-sharing amounts. Part D is designed to give beneficiaries affordable access to the medications they need to manage their health.

Late fees for Medicare Part D start after you’ve gone 63 or more days after your initial enrollment period without prescription drug coverage.

Dani Best Licensed Insurance Agent

If you sign up for Part D late, you’ll have a late penalty added for the rest of the time you’re enrolled. A 1% fee will be added to your premium for every month you’re late signing up for Part D.

That means that if you’re 17 months late signing up for Part D, you’ll have a permanent 17% late fee added to your premium.

Get a Free Medicare Plan Review

Speak With a Licensed Insurance Agent Today

Secured with SHA-256 Encryption

Medicare Enrollment Deadlines to Know

Understanding Medicare enrollment deadlines is not only ensures that your coverage will begin when you need it, but it also helps you avoid paying Medicare late enrollment penalties.

No matter if you want to sign up for Medicare Parts A, B, C, or D, being aware of enrollment deadlines is crucial as you near Medicare eligibity. If you don’t, you may miss the window to enroll in Medicare.

The good news is that Medicare offers a variety of enrollment periods, each designed for different life situations. Missing these windows can lead to higher costs or gaps in care.

These enrollment periods include:

- Initial Enrollment Period (IEP): A 7-month window starting three months before your 65th birthday month and ending three months after.

- General Enrollment Period (GEP): This enrollment is open from January 1 to March 31 of every year. Coverage begins July 1, but late fees may apply if you missed your IEP.

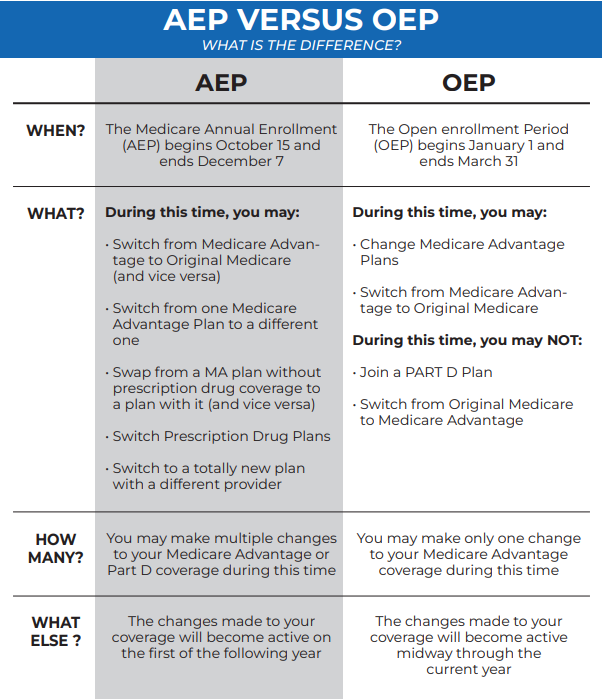

- Annual Enrollment Period (AEP): Open from October 15 to December 7, this period allows you to switch or join Part D or Medicare Advantage. However, it does not waive penalties.

- Special Enrollment Period (SEP): The SEP is available if you delay Medicare because you have qualifying employer coverage or other special circumstances. SEPs help you avoid penalties.

Keeping track of these enrollment windows and understanding which one applies to your situation will help you get the perfect Medicare coverage. You should also keep in mind that each plan is affected differently by late enrollment.

Successfully keeping these enrollment periods in mind can help you avoid late fees, maintain continuous coverage, and make confident decisions about your Medicare options.

While it’s always best to enroll as soon as you become eligible, you can minimize the harm a late enrollment will cause by keeping the penalties in mind.

For example, you should avoid being late to enroll in Medicare Parts B and D because the penalties are permanent. Medicare Part A late fees eventually drop off, but they can be expensive. It’s best to avoid late fees altogether and sign up for Medicare when you should.

How to Avoid Late Medicare Enrollment Fees

Avoiding Medicare late enrollment fees starts with understanding when you’re eligible for coverage and which types of insurance count as creditable coverage.

The most important step is enrolling during your Initial Enrollment Period, a seven-month window surrounding your 65th birthday.

Signing up on time prevents automatic penalties on Medicare Parts A, B, and D, which can otherwise follow you for years or even for life.

It’s also essential to stay informed about your prescription drug coverage. If you don’t enroll in a Part D plan, you must have another form of creditable drug coverage through an employer, VA benefits, TRICARE, or another approved source.

How to Prevent Medicare Late Penalties| Part | Action | Advice |

|---|---|---|

| Part A - Hospital | Enroll when first eligible | Sign up if not automatic |

| Part B - Medical | Keep employer coverage | Don’t drop coverage early |

| Part C - Advantage | Join during enrollment | Watch enrollment dates |

| Part D - Prescription | Maintain drug coverage | Keep lapse under 63 days |

Without the right coverage, even short gaps of 63 days or more can lead to permanent Medicare Part D late enrollment penalties.

Part D late fees are the lowest compared to Medicare Parts A and B, but a 1% increase can still add up to thousands of dollars after a few years.

If you plan to delay Medicare because you’re still working, make sure your employer or union plan is considered creditable. Even if you think your employer offers creditable coverage, it’s always best to check to avoid paying more than necessary.

Large employer group health plans typically qualify, but small employers or certain retiree plans may not. Always request written proof of creditable coverage each year so you can document your eligibility for a Special Enrollment Period later.

Medicare Deadlines & Next Steps if Missed| Period | When Late | Next Chance |

|---|---|---|

| Initial Enrollment (IEP) | Part A, B, & D Penalties | Enroll in SEP or GEP |

| Special Enrollment (SEP) | Lose penalty-free signup | Wait for GEP or AEP |

| General Enrollment (GEP) | Coverage delay and fees | Jan 1–Mar 31 annually |

| Annual Enrollment (AEP) | Stuck in the current plan | Oct 15–Dec 7 annually |

Review your coverage as you approach retirement or major life changes. Talking with your employer’s HR department, checking your Medicare eligibility dates, and consulting a licensed Medicare specialist can help ensure you’re meeting all enrollment deadlines.

Getting a Medicare card and being proactive is the key to avoiding long-term penalties and keeping your health care costs as low as possible, so you shouldn’t delay.

Sign Up for Medicare Today With No Late Fees

Medicare enrollment late fees can add thousands of dollars to your health care costs over time, but the good news is they’re completely avoidable.

By understanding Medicare enrollment rules, maintaining creditable coverage, and reviewing your options early, you can protect your budget and ensure continuous, reliable health care coverage.

Now is the perfect time to explore your options in our expert Medicare guide so you can enroll confidently and avoid unnecessary penalties.

To speak with a licensed insurance agent about your Medicare needs, call (855) 634-0435 for answers, or enter your ZIP code to get started.

Frequently Asked Questions

How much is the Medicare late enrollment penalty?

Medicare penalties for late enrollment vary by part. Part A adds 10% to your premium, Part B adds 10% for each full year you delayed, and Part D adds 1% per uncovered month. These penalties can last for years or for as long as you have the coverage.

When should I enroll in Medicare for the first time?

Understanding Medicare coverage and eligibility is crucial to avoid late penalties. You should enroll during your Initial Enrollment Period, which begins three months before the month you turn 65 and ends three months after. Enrolling during this window helps you avoid late fees.

If you need help with Medicare enrollment, our agents are ready to speak with you. Call (855) 634-0435 to get the help you need, or enter your ZIP code to get started.

How do I avoid Medicare late enrollment fees?

Sign up during your Initial Enrollment Period or have creditable employer or union coverage that lets you delay without penalty. Keep documentation to prove you had qualifying coverage.

What is the Medicare Part A late enrollment penalty?

If you must pay a premium for Part A and delay enrollment, you face a 10% higher premium. This increased amount lasts for twice the number of years you waited to enroll.

How long does the Medicare Part B penalty last?

The Part B penalty applies for as long as you have Medicare Part B. It increases your premium by 10% for every full 12-month period you delay enrollment.

Is there a late fee for Medicare Part C?

Unlike the other parts, there are no Part C late fees. Medicare Part C (also known as Medicare Advantage) does not have its own late enrollment penalty. There may not be a Part C late enrollment penalty, but you must be enrolled in Parts A and B to join, so penalties for those parts may still apply.

Why is there a penalty for Medicare Part D?

The Part D penalty exists to encourage continuous prescription drug coverage and prevent people from waiting until they need expensive medications. It also helps keep premiums more affordable for everyone.

Why is there a penalty for late enrollment in Medicare?

Medicare uses penalties to encourage timely enrollment and help maintain stable insurance risk pools. Without penalties, people might wait until they need care to enroll, increasing overall program costs.

Are there Medicare late enrollment penalty exceptions?

Yes, you can avoid Medicare late enrollment penalties if you qualify for a Special Enrollment Period, such as having creditable employer coverage. Certain situations, like receiving Medicaid, may also help waive or reduce fees.

Low-income seniors may be able to get their premiums reduced through Medicare Savings Programs. These programs can help people with up to $10,000 in assets reduce their Medicare premiums. The Medicare penalty for high-income recipients, however, will remain the same.

What are the three requirements to enroll in Medicare?

You generally must be a U.S. citizen or permanent resident, be at least 65 (or qualify through disability), and be eligible for Social Security or Railroad Retirement benefits. Most people meet these automatically by age 65.

Can I delay Medicare Part A without a penalty?

What is the 63-day rule for Medicare?

What is the grace period for Medicare payments?

How much does Medicare cost?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.