Medicare Coverage & Eligibility in 2026

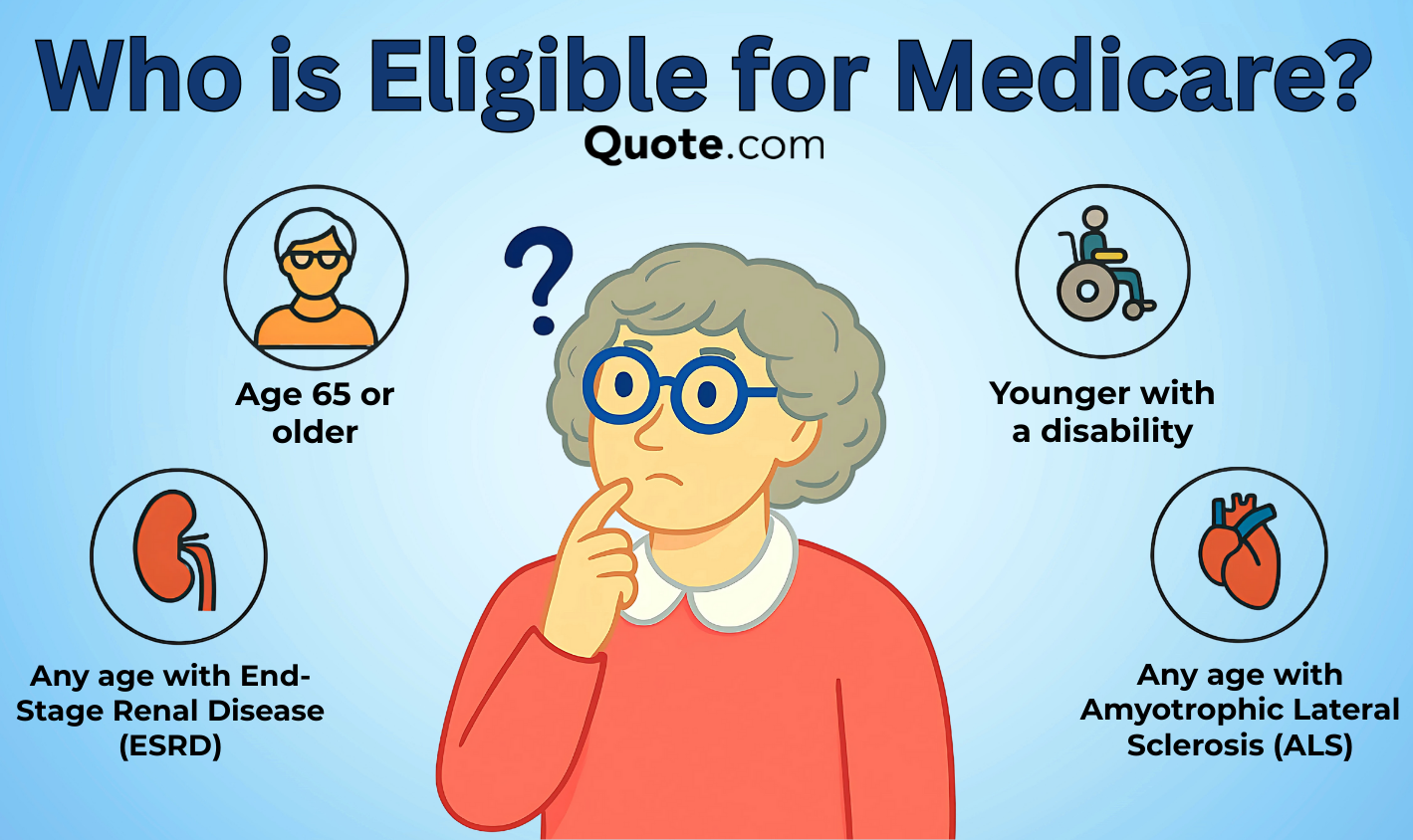

Understand your Medicare coverage and eligibility to avoid a 1% monthly late fee on Medicare Part D premiums. Most people 65 and older qualify for Medicare coverage. If you were diagnosed with ESRD, ALS, or a qualifying disability, you’re automatically eligible for Medicare insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding c...

Meggan McCain

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated December 2025

When researching Medicare coverage and eligibility, remember that enrolling late can lead to late fees. Sign up if you meet the Medicare eligibility age requirement of 65.

- Medicare coverage eligibility starts when you turn 65

- People under 65 with disabilities may qualify for Medicare

- People can choose among Medicare Parts A, B, C, and D

Read on for an expert guide to Medicare that breaks down your choices and what the to determine your eligibility for Medicare.

Speaking to an insurance representative can help you determine your eligibility status and what Medicare plan is best. Call (855) 634-0435 to speak to a licensed insurance agent or enter your ZIP to learn more about your Medicare options.

Determining if You’re Eligible for Medicare

Wondering how to determine eligibility for Medicare? Almost anyone over 65 years of age can sign up for Medicare insurance.

While most Medicare-eligible customers must be over age 65, there are certain exceptions for those younger than 65 who have qualifying disabilities or medical conditions.

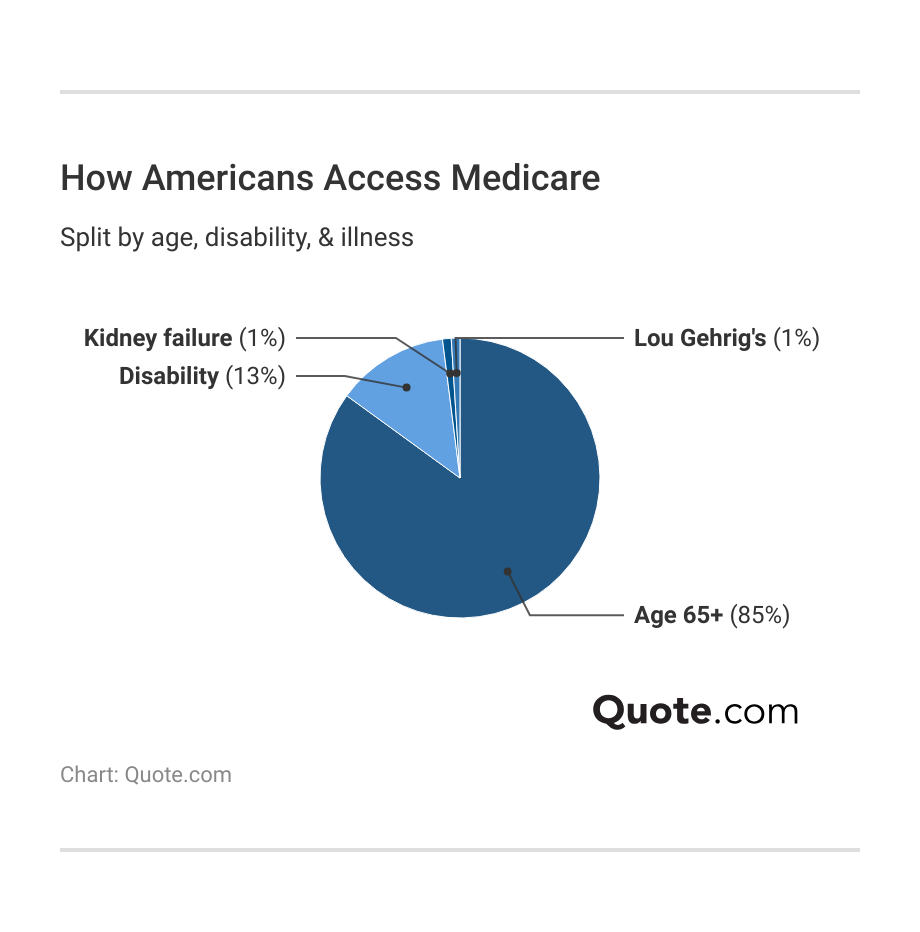

While 85% of Medicare enrollees are over age 65, 13% are under age 65 because they have a disability that qualifies them for Medicare.

For example, customers with end-stage renal disease (ERSD) can qualify for Medicare coverage, regardless of their age.

Besides age, disability, and medical conditions, customers must meet other requirements to qualify for Medicare insurance.

For example, customers must be either a U.S. citizen or a legal permanent resident for at least five years (Learn More: Who is eligible for Medicare?).

Medicare Eligibility Requirements| Factors | Details |

|---|---|

| Age | Eligible at age 65 and older |

| Disability | Disability benefits for 24 months |

| Conditions | Kidney failure or Lou Gehrig's disease |

| Residency | U.S. citizen or legal resident 5+ yrs |

| Work History | 40 quarters (10 yrs) covered work |

| Special Cases | May qualify earlier through spouse’s work |

Who is not eligible for Medicare? Anyone under 65 without a qualifying medical condition, but another important factor is work history.

You won’t be eligible for Medicare insurance if you didn’t pay enough into Social Security taxes while employed. However, some people may still qualify if their spouse meets certain work requirements.

Get a Free Medicare Plan Review

Speak With a Licensed Insurance Agent Today

Secured with SHA-256 Encryption

When to Sign Up for Medicare

You can sign up for Medicare insurance coverage during the 7-month Initial Enrollment Period (IEP), which starts three months before you turn 65 and continues for three months after. Medicare coverage can start earlier for people who qualify due to certain disabilities, which helps reduce gaps in essential health care.

It’s important to note that delaying Medicare coverage can drive up the cost of monthly charges, so the longer you wait, the more you’ll pay.

Medicare Enrollment Periods: Dates & Options| Enrollment Period | When it Occurs | What You Can Do |

|---|---|---|

| Annual Enrollment (AEP) | October 15 – December 7 | Switch or change plans |

| Automatic Enrollment | At 65 with retirement benefits | Auto-enrolled in Part A |

| General Enrollment (GEP) | January 1 – March 31 | Enroll, possibly with penalty |

| Initial Enrollment (IEP) | 3mo before/after 65th bday | Enroll in Part A or B |

| Open Enrollment (OEP) | January 1 – March 31 | Pick Advantage or Original |

| Special Enrollment (SEP) | Employed or 8mo later | Enroll without penalty |

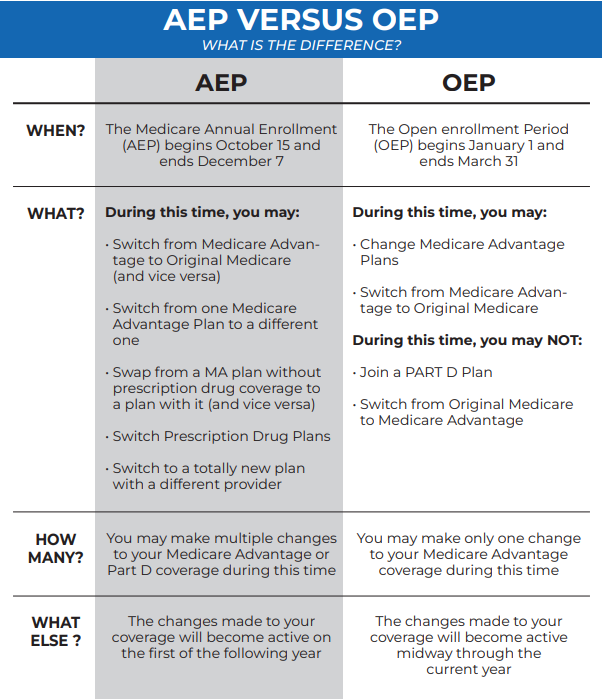

During the Annual Enrollment Period (AEP), reviewing changes to premiums and drug formularies can help you avoid unexpected costs in the upcoming year.

Meanwhile, the Open Enrollment Period (OEP) lets you adjust Medicare Advantage coverage early in the year so you’re not locked into a plan you don’t need.

Medicare enrollment is once a year, unless you meet special exceptions for applications outside of the regular enrollment period. For example, if you turn 65 outside of the enrollment period, you can still apply for coverage.

Some states offer extra Medicare Savings Programs that help lower premiums and deductibles for people who meet income limits.

Key Medicare Terms to Know| Term | Description |

|---|---|

| Initial Enrollment | Sign up during the 3mo before / after 65th bday |

| Late Penalties | Delaying Part B / D without coverage adds fees |

| Special Enrollment | Enroll after losing work coverage without penalty |

| Open Enrollment | Oct 15-Dec 7 to switch Advantage or drug plans |

| Medigap Window | 6mo after 65th bday & joining Part B (best rates) |

| Costs Not Covered | Deductibles, coinsurance, & excluded services |

You can also apply for coverage outside of general enrollment if you meet one of the special circumstances outlined by Medicare. Examples would be if you lost your employee health insurance or were diagnosed with ALS or ESRD.

Comparing Medicare plans early can help you lock in lower rates because premiums often rise each year.

Know Your Medicare Coverage Options

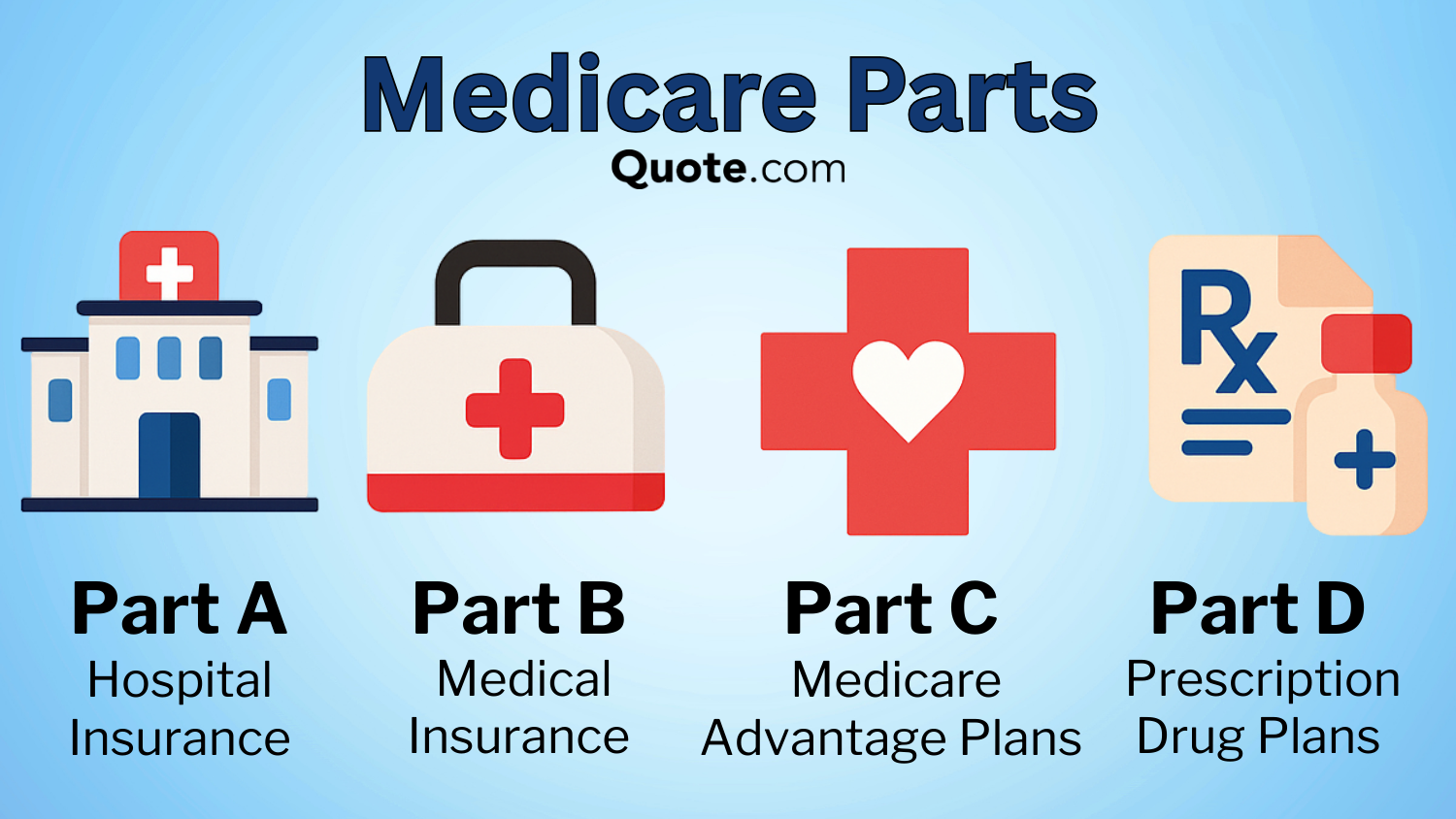

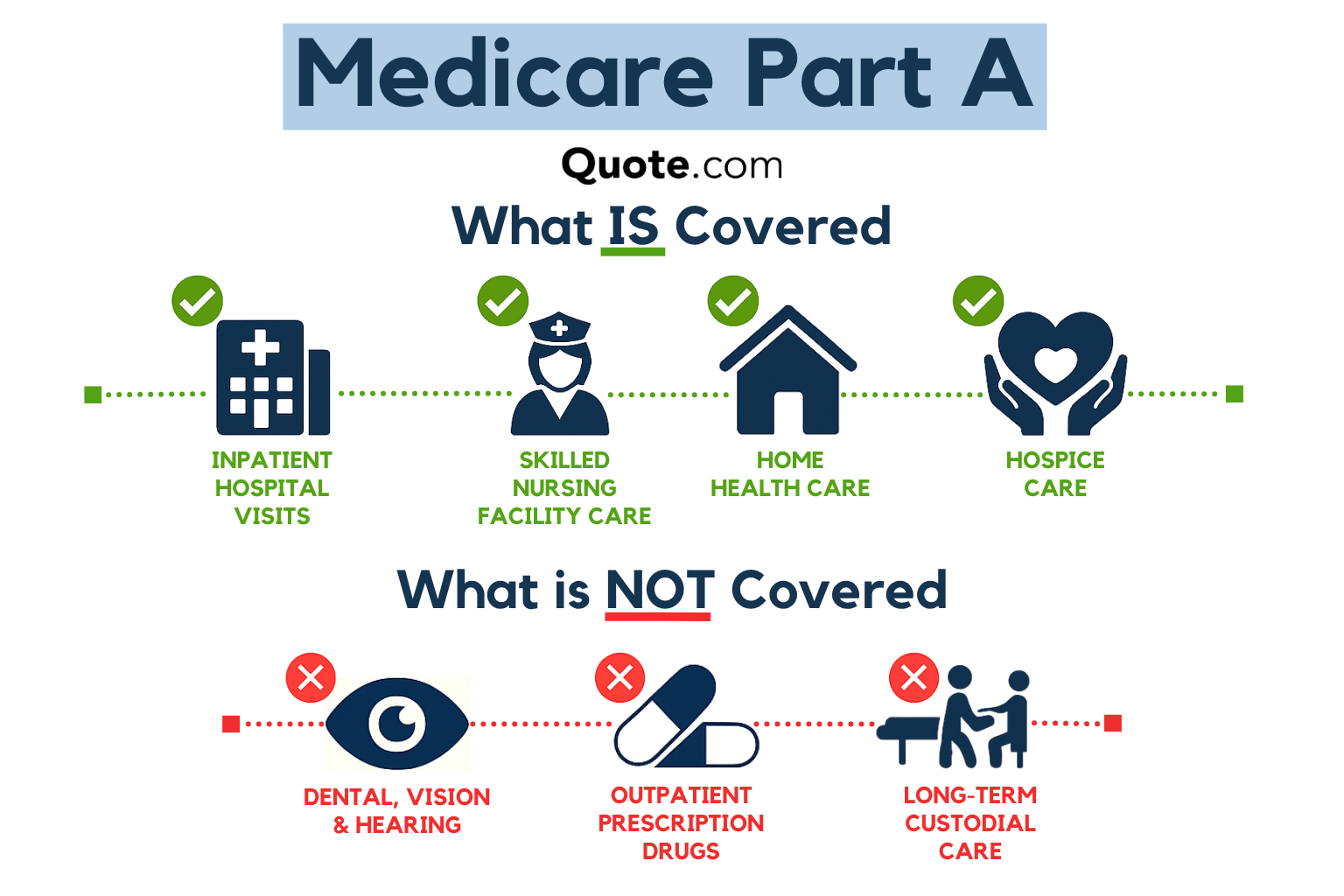

Medicare is a federal health insurance program made up of several parts, each offering different types of Medicare plans. When you first enroll, you may be automatically signed up for Part A, which provides hospital insurance.

Medicare also includes Part B, Part C, and Part D.

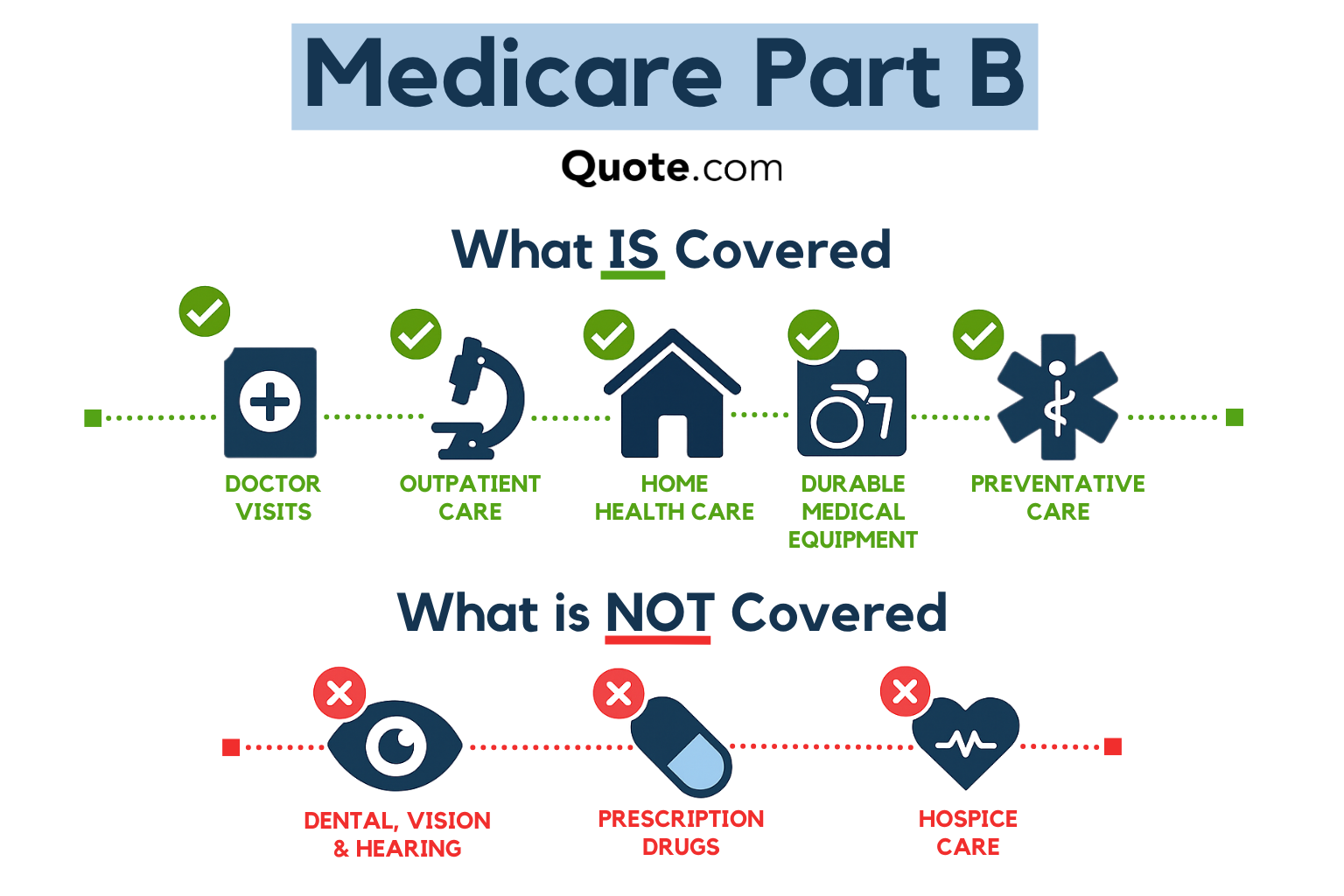

Part B offers medical insurance that helps pay for outpatient care, doctor visits, and certain medical supplies. It generally covers 80% of approved costs after you meet the annual deductible, leaving you to pay 20% out of pocket.

Beneficiaries must also pay a monthly premium for Part B, and higher-income individuals may owe an added charge called the Income Related Monthly Adjustment Amount.

Medicare Part C, also known as Medicare Advantage, combines the benefits of Parts A and B into a single plan offered by private insurance companies.

These plans must provide at least the same level of coverage as Original Medicare, and some may include extra benefits such as dental, vision, hearing, and prescription drug coverage.

Original Medicare Plans include Medicare Part A and Medicare Part B, which cover hospital stays and medical visits.

Michelle Robbins Licensed Insurance Agent

Medicare Part D is another useful coverage that helps cover prescription drug costs, which is important for customers on multiple medications.

Without Part D coverage, beneficiaries may face the full retail cost of medications, which can vary widely depending on the drug.

Part C is known as Medicare Advantage, which is a more comprehensive plan than Original Medicare plans that only include Part A and Part B. Part C typically includes hospital insurance, medical insurance, and prescription drug coverage in one convenient policy with one fixed premium.

Medicare Advantage plans must provide the same Part A hospital benefits as Original Medicare, although they may structure costs differently.

Wondering which is better, original Medicare or Medicare Advantage?

Read our guide on Medicare Advantage vs. Original Medicare to see which fits your lifestyle.

Medigap (Supplemental Insurance)

Medigap, also called Medicare Supplement Insurance, is another option for people who stay with Original Medicare and want help covering the out-of-pocket costs that Parts A and B do not pay.

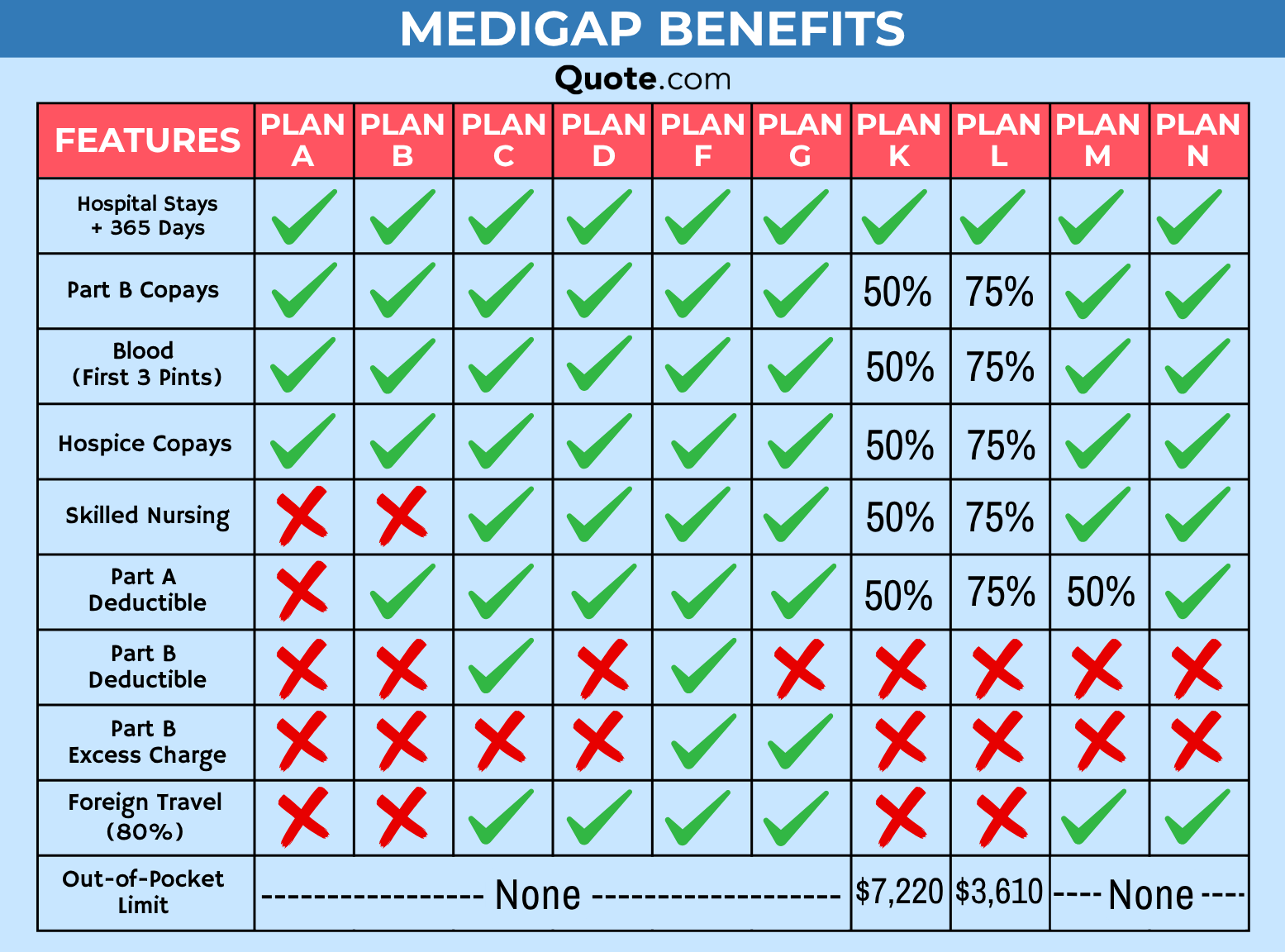

Medigap plans use lettered names to show standardized benefits, so coverage stays the same across insurers while only the monthly premium changes, making it easier to compare plan levels.

Plan A offers the most basic coverage, including Part A and Part B coinsurance, while Plan B adds the Part A deductible for slightly more protection. Plan D includes benefits like foreign travel emergency coverage but excludes the Part B deductible.

Plan G is the most comprehensive plan available to new Medicare members and covers nearly all out-of-pocket costs except the yearly Part B deductible. Plan N offers lower premiums but includes small copays for some visits and does not cover Part B excess charges.

Older options like Plan C and Plan F cover even more, including the Part B deductible, but they are only available to people who qualified for Medicare before 2020.

Since each Medicare part meets different health care needs, selecting the right combination of coverage is especially important.

Automatic enrollment does not apply to every part of Medicare, so you may need to sign up for additional coverage depending on your situation.

Comparing Medicare Coverage Costs

How much does Medicare cost? Just like other insurance plans, Medicare has deductibles and copays that have to be paid.

The medical costs covered by Medicare depend on what Medicare plan you choose, as copays and premiums will vary depending on the Medicare plan. For example, Part A costs $0 for a hospital stay of 60 days or less, but it charges a daily fee for any day after that.

Medicare Premium, Copay, & Coinsurance Breakdown| Part | Premium | Copay | Coinsurance |

|---|---|---|---|

| Part A: Hospital | $0 for most | $0 (day 0-21); $210/day (21-100) | $0; $419/day (61-90); $838/day (91+) |

| Part B: Medical | Varies; late penalty | None | 20% after deductible |

| Part C: Advantage | Set by provider | Plan-specific | Plan-based rates |

| Part D: Prescriptions | Set by provider | Plan-specific | Varies; 1% monthly late penalty |

| Medigap: Supplement | Extra fee by plan | Covered copays | Covers deductibles & coinsurance |

Copays with Medicare Part A will also depend on the length of the hospital stay. The longer a hospital stay is, the more you pay in copays.

Medicare Part B is the only plan without a copay, but you must meet the Medicare deductible before coverage applies.

Medicare Advantage costs will vary by plan and by state, so it’s important to compare Medicare insurance quotes online to get an idea of costs in your area.

If you want extra assistance with payments, you may want to look into Medigap supplemental insurance (Medigap) coverage. Medigap coverage can help cover deductibles and copays on Medicare coverage. Not everyone will qualify for Medigap, as there is a maximum income limit.

Speaking with a licensed insurance agent can help you navigate Medicare. Call (855) 634-0435 to speak with someone today or enter your ZIP in our free tool to get quotes.

Frequently Asked Questions

What are the four factors that determine Medicare eligibility?

The general factors in determining eligibility for Medicare are age, citizenship/residency, medical conditions, and work history.

At what age does a woman qualify for Medicare?

Women and men both qualify for Medicare at age 65.

Who isn’t eligible for Medicare?

Wondering what disqualifies a person from Medicare? Medicare is not available to those under 65 and who aren’t U.S. citizens or haven’t been a legal U.S. resident for at least five years.

What is the maximum you can make to qualify for Medicare coverage?

There is no maximum for Medicare eligibility, but you will have to make under a certain amount to qualify for Medicare Savings Programs (MSPs).

What are the three types of patients eligible for Medicare?

Wondering what three ways a person can qualify for Medicare? Patients with disabilities, ESRD, or ALS can qualify for Medicare.

What are the reasons you can be denied Medicare coverage?

You can be denied Medicare if you are under 65 and don’t meet one of the special exceptions or if you don’t meet the residency or citizenship requirements.

Can I get Medicare at 55?

The Medicare eligibility age chart provides coverage only to those 65 and older, unless they meet medical or disability requirements at an earlier age. If you have a qualifying medical condition or disability, you can get Medicare at 55 or earlier.

Do I have to sign up for Medicare if I have private insurance?

No, you may not have to sign up for Medicare if you have group health insurance through your employer. Learn more about Medicare eligibility and employer insurance in our complete guide to health insurance.

Why are you forced to get Medicare at 65?

You are not forced to get Medicare at 65, but signing up later results in late penalty fees. If you are already receiving Social Security benefits, you may be automatically enrolled.

Do I really need supplemental insurance with Medicare?

You may want supplemental insurance with Medicare if you anticipate having large medical bills, or add on extras like Medicare Part D. Call (855) 634-0435 to speak with a licensed insurance agent about your budget and options, or enter your ZIP in our free tool to get quotes.

Does Medicare cover 100% of hospital bills?

What is the best Medicare plan that covers everything for seniors?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.