Medicare Part B (2026 Guide)

Medicare Part B covers doctor visits, preventive care, outpatient services, and medical equipment for people 65 and older and certain individuals with disabilities. The standard premium is $185 a month, and beneficiaries must pay an annual Medicare Part B deductible, though savings programs may help lower costs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated January 2026

Medicare Part B covers medical insurance costs for seniors 65 and older. It pays for 80% of outpatient services, including doctor visits, medical equipment, and home healthcare.

- Seniors turning 65 have an 18-month window to enroll in Medicare Part B

- The Medicare Part B premium is $185 per month for all beneficiaries

- Medicare Advantage and Medigap can help lower Medicare Part B costs

Medicare Part B is part of Original Medicare, but unlike Part A, it is not free. Monthly premiums start at $185, and you are responsible for meeting an annual deductible along with any copays or coinsurance tied to your coverage.

Learn More: Medicare Advantage vs. Original Medicare

Use this guide to compare Medicare costs and learn when you may be able to avoid paying the Part B premium. If you still have questions, call (855) 634-0435 to speak with a licensed insurance agent. You can also enter your ZIP code to explore plan options in your area.

What Medicare Part B Covers

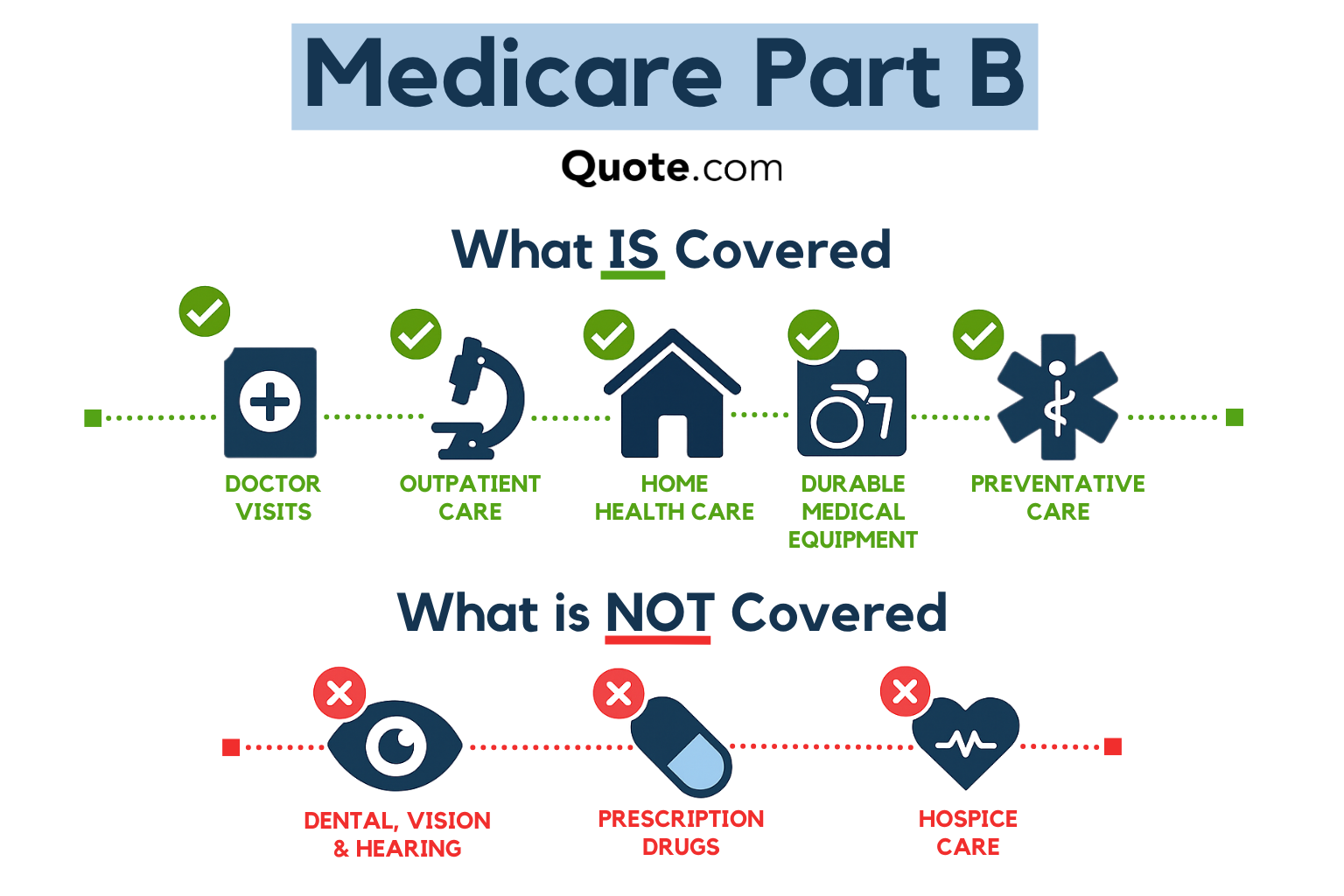

What does Medicare Part B cover? Medicare Part B is the medical insurance part of Original Medicare plans. It partially covers visits to your doctor, outpatient hospital services, and care from other licensed healthcare providers, including mental health and substance abuse specialists.

It also pays for durable medical equipment (DME), such as wheelchairs, canes and walkers, hospital beds, oxygen equipment, and blood sugar monitors.

In some cases, Part B will cover certain outpatient prescription drugs associated with DME. Screenings and annual vaccines are also covered by Medicare Part B. Read More: Best Endocrinologists That Accept Medicare

Medicare Part B: Pros and Cons| Feature | Pros | Cons |

|---|---|---|

| Costs | Lowers out-of-pocket costs | Ongoing expenses remain |

| Enrollment | Special enrollment periods | Late penalties possible |

| Outpatient Coverage | Covers doctor & diagnostic care | Doesn’t cover everything |

| Plan Coordination | Works with Medicare plans | May need extra plans |

| Provider Access | Widely accepted by providers | Higher non-approved costs |

Part B is the medical insurance side of traditional Medicare plans. It covers medically necessary outpatient care and equipment, including:

- Ambulance Services: Emergency and medically necessary transportation to hospitals or skilled care facilities

- Durable Medical Equipment (DME): Wheelchairs, walkers, hospital beds, oxygen supplies, and similar items deemed medically necessary by a doctor

- Doctors & Specialists: Outpatient care, including checkups, vaccines, and treatment from approved providers

- Outpatient Prescription Drugs: Medications administered in a clinic or medical facility, but not at home

- Mental Health Services: Outpatient psychiatric care as prescribed by a doctor, including counseling and some preventive screenings

More than half of seniors use Medicare Part B to pay for outpatient care after surgery, routine doctor visits, and preventative care like vaccines and disease management.

However, Medicare Part B isn’t free. You’ll need to pay a monthly premium along with meeting your annual deductible.

You will have to meet your deductible and Medicare Part B coinsurance and copays before outpatient medical services are covered, so read our guide if you need help to pay for what your health insurance won’t cover.

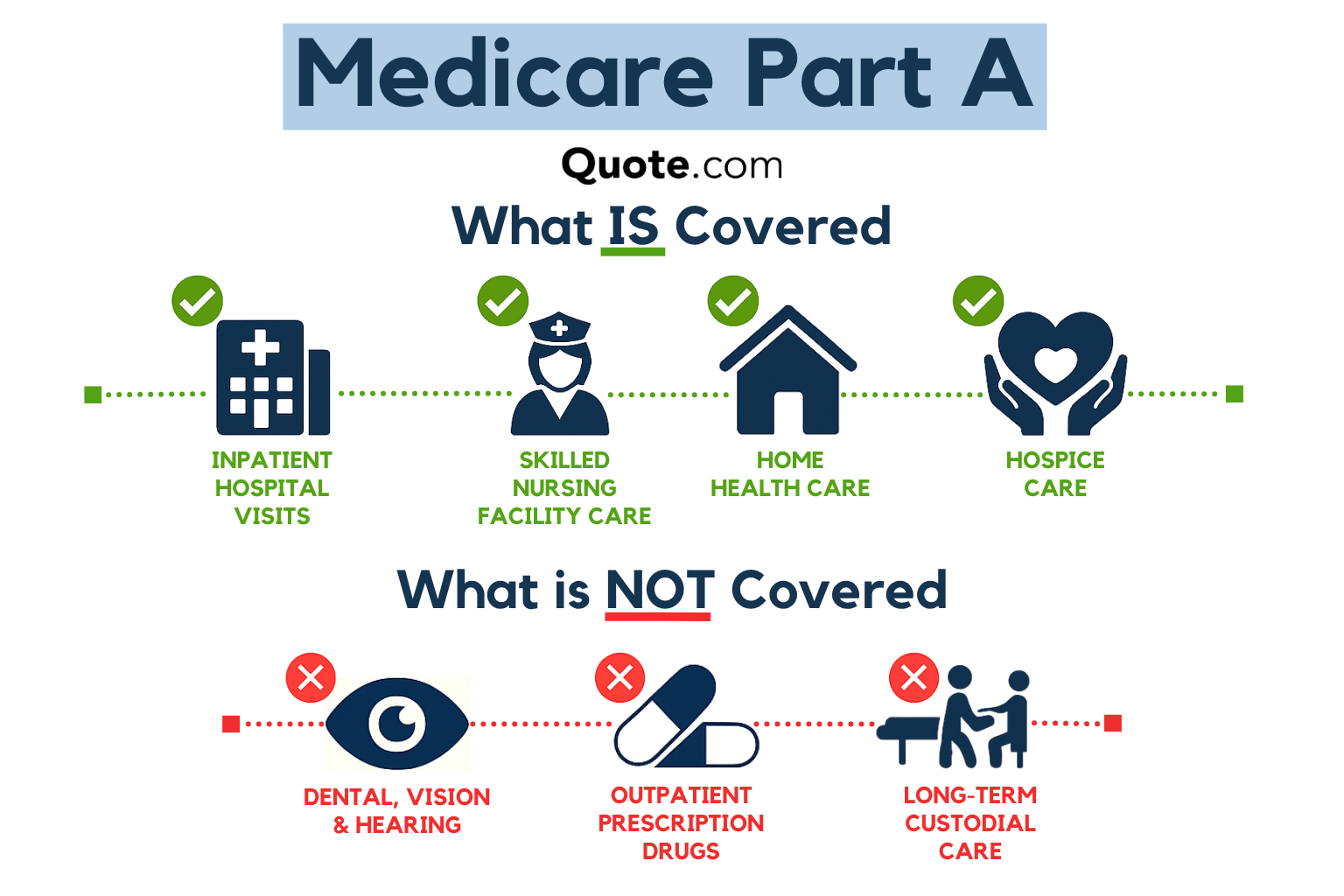

While Part B covers outpatient and medically necessary services, Part A applies to inpatient hospital care and services you receive during a hospital stay.

The two parts work together but apply to different care settings. Understanding this distinction makes it easier to know when Part B is used and when Part A takes over.

Get a Free Medicare Plan Review

Speak With a Licensed Insurance Agent Today

Secured with SHA-256 Encryption

What Part B Doesn’t Cover

Medicare Part B handles most of your outpatient care needs, like routine appointments and preventative care, but it doesn’t cover all of your health insurance needs. It won’t pay for routine dental, vision, or hearing care, and it doesn’t cover prescription drugs or hospital stays.

Medicare Part B Exclusions

Exclusions Reason

Inpatient Hospital Care Covered under Medicare Part A

Long-Term Care Not medically necessary by Medicare

Prescription Drugs Covered under Part D, not Part B

Dental, Vision, Hearing Only with Medicare Advantage plans

Care Outside the U.S. Medicare does not cover care abroad

Many of these things are covered by other types of Medicare insurance plans. If you need these additional coverages, compare Medicare Advantage or Medicare Supplemental Insurance (Medigap) plans to find the right Medicare Part B provider for you.

Medicare Part B Cost

How much will Medicare Part B premiums be this year? Beneficiaries pay $185 a month for Medicare Part B coverage, but Social Security benefits can often cover some or all of your premium.

Medicare Part B: Cost, Coverage & Enrollment Details| Feature | Details | Notes |

|---|---|---|

| Adjusted Premium | $74 - $444 | Based on income brackets |

| Annual Deductible | $257 | Paid before coverage starts |

| Coinsurance | 20% of costs | Applies after deductible met |

| How it's Paid | Taken from benefits or billed | Billed quarterly if no benefits |

| Initial Enrollment | 3 mos before & after turning 65 | Delays may trigger penalty |

| Late Penalty | 10% increase per year delayed | Penalty lasts while on Part B |

| Monthly Premium | $185 | Under $103K / $206K joint |

| What it Covers | Dr. visits, tests, equipment | For needed / preventive care |

| What Isn't Covered | Dental, vision, hearing, cosmetic | Some covered by Advantage |

Medicare Part B deductibles must be met once a year. After that, beneficiaries are responsible for 20% copay and coinsurance payments to compensate for what Medicare Part B doesn’t cover

Medicare Costs: Copay, Coinsurance, & Premiums| Feature | Copay | Coinsurance | Premium |

|---|---|---|---|

| Definition | Set fee per service / Rx | Percent of cost after deductible | Monthly fee for Medicare |

| When Charged | Paid at service or refill | Charged after deductible | Paid monthly, care or not |

| Medicare Parts | Part C and Part D | Part A, Part B, & some D | Part A (if due), B, C, D |

| Typical Cost | Ex: $25 doctor visit | Ex: 20% of $1k = $200 | Ex: $185/mo for Part B |

| Cost Predictability | Same fee for each service | Cost depends on service | Fixed, predictable cost/mo |

| Varies by Plan | Varies by C or D plan | Varies by plan, often with C | Varies by plan & income |

The amount you pay for Part B also depends on your income. To qualify for $185 monthly premiums, income must fall below $106,000 for individuals and $212,000 for couples.

Can you get Medicare Part B for free? Some beneficiaries can get low-cost Part B coverage through Medicare Savings Programs (MSPs).

Medicare Part B Coverage Cost by Income| Individual Income | Joint Income | Annual Deductible | Monthly Premium |

|---|---|---|---|

| $106,000 or less | $212,000 or less | $257 | $185 |

| $106,000 – $133,000 | $212,001 – $266,000 | $257 | $259 |

| $133,001 – $167,000 | $266,001 – $334,000 | $257 | $370 |

| $167,001 – $200,000 | $334,001 – $400,000 | $257 | $481 |

| $200,001 – $499,999 | $400,001 – $749,999 | $257 | $592 |

| Above $500,000 | Above $500,000 | $257 | $629 |

Find out how to qualify in our guide on how much Medicare costs.

For example, the Qualified Medicare Beneficiary (QMB) program helps pay for your premium, deductible, coinsurance, and copays, allowing you to have Part B coverage without out-of-pocket expenses.

Medicare Part B Eligibility

Who’s eligible for Medicare? Seniors turning 65 are automatically eligible for Medicare Part B benefits up to three months before their 65th birthday. People under 65 may also qualify if they’ve received Social Security Disability Insurance (SSDI) for 24 months or have End-Stage Renal Disease (ESRD) or ALS.

Do I need Medicare Part B if I have insurance? Not necessarily, especially if you are still employed and insured under a group health plan. However, Part B is typically more affordable than standard health plans, and you may have to pay a Medicare Part B late enrollment penalty fee if you miss your initial sign-up period.

Get a Free Medicare Plan Review

Speak With a Licensed Insurance Agent Today

Secured with SHA-256 Encryption

How to Enroll in Medicare Part B

Follow the steps to determine your enrollment period and fill out the appropriate Medicare Part B form to get covered. You can also speak with a licensed insurance agent with any questions about your Medicare coverage by calling (855) 634-0435.

Step #1 – Find Out Your Medicare Enrollment Period

Medicare Part B eligibility depends on your birthday month. The first of the month, three months before your 65th birthday, is when the Initial Enrollment Period (IEP) for Medicare starts.

Learn More: How to Sign Up for Medicare

Medicare Part B Enrollment Periods| Enrollment Period | When it Occurs | What You Can Do |

|---|---|---|

| Initial Enrollment (IEP) | 3mo before/after 65th bday | Enroll in Part A or B |

| General Enrollment (GEP) | January 1 – March 31 | Enroll, possibly with penalty |

| Special Enrollment (SEP) | Employed or 8mo later | Enroll without penalty |

Your Medicare Part B start date is based on when you enroll, which can affect when your coverage begins and whether you face gaps in medical insurance.

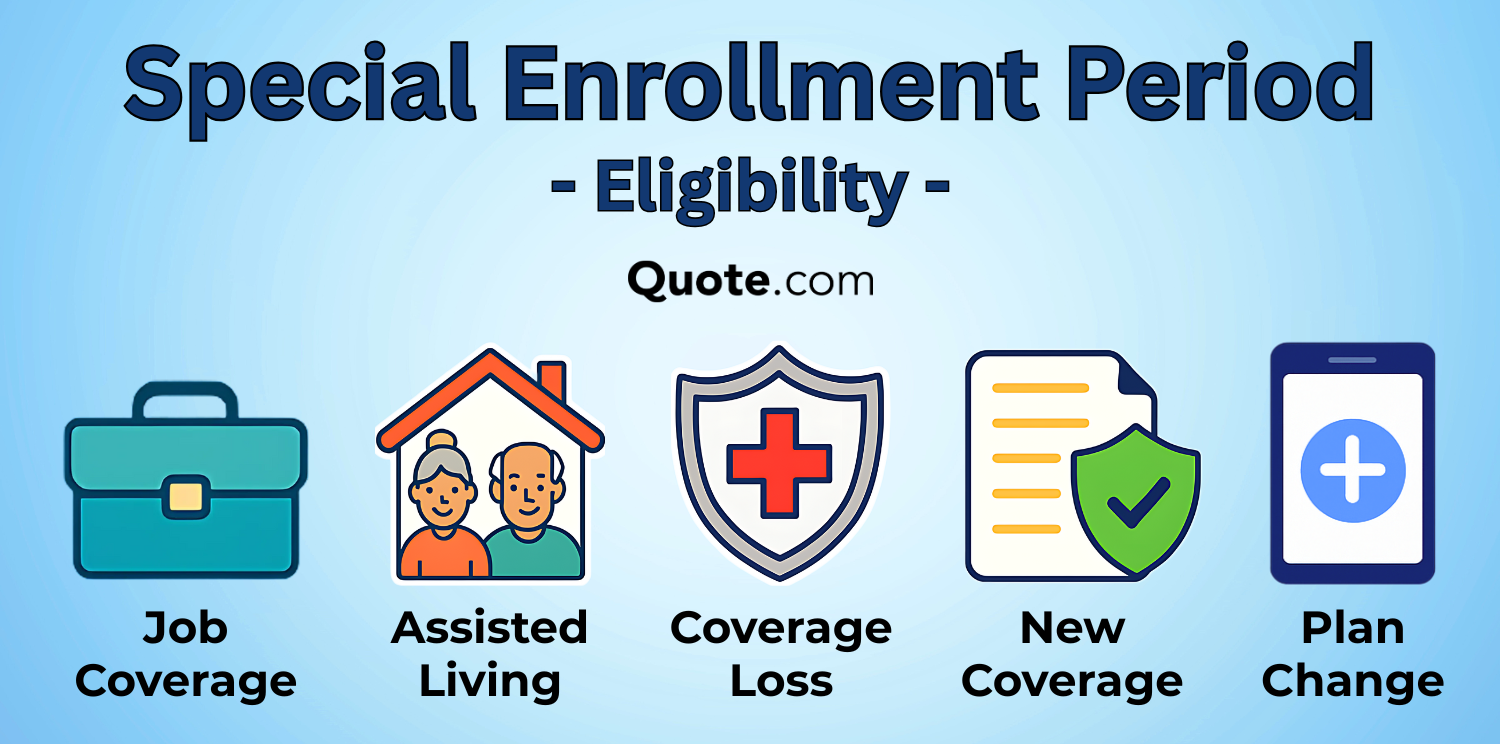

If you or your spouse have employer-sponsored health insurance from active employment, you may qualify for a Special Enrollment Period (SEP) that allows you to delay Part B without penalties.

This Medicare Special Enrollment Period typically lasts eight months after employment or group coverage ends, giving you time to enroll in Part B without late enrollment penalties.

If you miss the IEP, you can sign up during the General Enrollment Period (GEP), but you will be charged a penalty. The Medicare Part B late enrollment penalty increases with every year you were eligible but didn’t sign up.

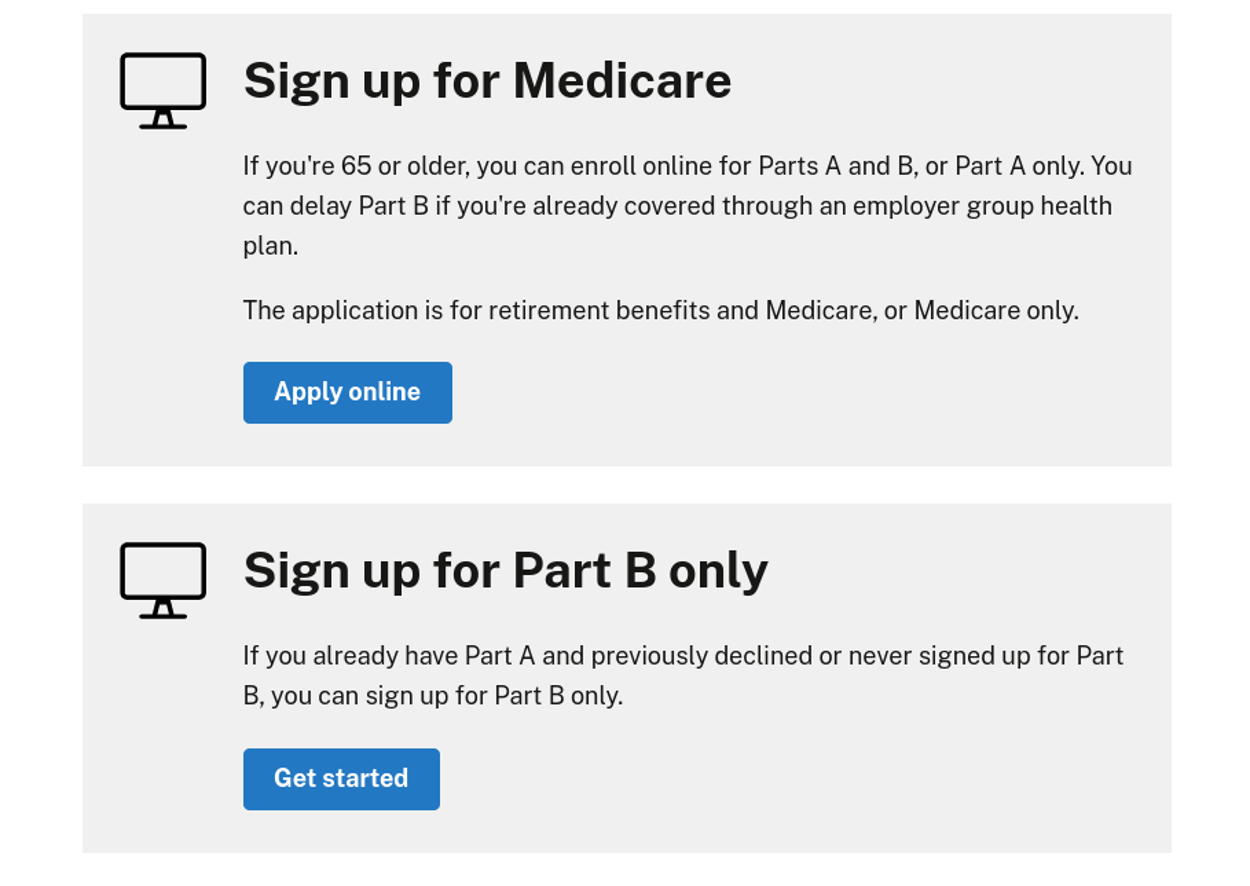

Step #2 – Complete the Enrollment Application

Visit the Social Security Administration (SSA) website to fill out the Medicare Part B application form. You’ll need to include your birth certificate, SSN, current health insurance coverage, and proof of legal residence (typically a utility or insurance bill).

Once online, you’ll have the option to sign up for Original Medicare or Medicare Part B only. If you have Medicaid coverage, you may be automatically or already enrolled in Part A. In that case, you’ll only need a valid email address and your current Medicare number to complete the Medicare Part B application.

Step #3 – Receive Your Medicare Card in the Mail

It typically takes 30 days to process Medicare Part B applications, and you’ll receive your Medicare card in the mail within a month. The card lists the start date of your coverage and should include a Medicare Part B provider phone number.

Read More: Best Gastroenterologists That Accept Medicare

Alternatives to Medicare Part B

What happens if I don’t want Medicare Part B? While there’s no true replacement for Medicare Part B, there are alternatives in how you get that kind of outpatient coverage.

- Medicare Advantage Plans: Also known as Medicare Part C, which includes all Part B benefits plus extras. Call (855) 634-0435 to speak with a licensed insurance agent about your options.

- Employer/Union Health Benefits: Some retirees keep employer or union retiree health benefits instead of or in addition to Part B.

- VA Health Benefits: Veterans can use VA health benefits, but VA coverage doesn’t replace Medicare and can limit provider choice.

If you skip Medicare Part B coverage, you’ll need another plan that covers doctor visits, tests, and outpatient treatments, or risk paying out-of-pocket for most outpatient care.

Medicare Advantage is the most common alternative. It offers a unique opportunity to combine Medicare Part A and Part B with the other types of health coverage you might need based on your medical history.

What You Need to Know About Medicare Part B

Medicare Part B is the second half of Original Medicare that covers doctor visits, outpatient care, preventive services, durable medical equipment, and ambulances.

Medicare Part B Overview| Coverage | Details | Eligibility |

|---|---|---|

| Outpatient Care | Dr. visits, minor care, surgeries | Age 65+ or disabled |

| Preventive Care | Flu shots, screenings, checkups | Enrolled in Part B |

| Doctor Visits | Primary or specialist treatment | Medically necessary |

| Labs & Screenings | Blood tests, X-rays, screenings | Ordered by provider |

| Medical Equipment | Wheelchairs, oxygen equipment | Prescription needed |

| Ambulance | Emergency transport to hospital | Medicare-approved |

A common question people ask is, “Why is Medicare Part B so expensive?”

Medicare Part B premiums are higher since plans cover a wider range of services, including outpatient care, medical equipment, and ambulance rides. By contrast, Medicare plans that only cover hospital stays or prescription drugs generally have lower premiums.

The SSA offers Medicare Savings Programs (MSPs) that can help eligible seniors with limited income pay their Medicare bills.

However, many policyholders opt for Medicare Advantage plans that often include additional benefits.

Medicare Part B pays for the medical services and supplies you use to diagnose, treat, or prevent health problems outside of a hospital stay.

Adam Lubenow Medicare Broker

If you have any questions regarding your plan or payments, call the Medicare Part B phone number at (855) 634-0435 to speak with a licensed insurance agent.

Frequently Asked Questions

What is Medicare Part B for?

Medicare Part B covers the most common medical and preventative care services for seniors, including doctor appointments, medical equipment, and ambulance rides.

Can I keep my doctor on Medicare Part B?

You can keep your doctor as long as they are part of the Medicare Part B covered network of providers.

Can I get Medicare Part B for free?

Unlike Medicare Part A, Part B insurance is not free. Does everyone pay $170 for Medicare Part B? All seniors pay the same monthly rate for Medicare Part B, but costs have increased by nearly 9% to $185 a month.

How much does Medicare Part B cost?

The average Medicare Part B premium is $185 per month.

Is Medicare Part B based on your salary?

No, everyone pays the same Medicare Part B deductibles and premiums. Salary only matters when applying for Medicare Savings Programs.

How do I pay my Medicare Part B premium?

If you paid into Social Security, Medicare Part B premiums are automatically deducted from your benefits. Pay online or through the mail if you’re paying out-of-pocket.

How do I reduce my Medicare Part B premium?

Signing up for Medicare Savings Programs or Medicare Advantage plans can help lower your Medicare Part B premiums. Read our review of Obamacare to learn how to save on the marketplace.

Who is exempt from paying Medicare Part B?

Do all retirees pay for Medicare Part B? Seniors with less than $10,000 in assets qualify for Medicare Savings Programs, which can cover some or all Medicare Part B costs. Others are also exempt from paying the Medicare Part B deductible and premium based on employment or health status.

Is there an income limit for Medicare Part B?

Medicare Part B eligibility does not depend on income, but a higher income will raise your monthly rates. What income level triggers higher Medicare premiums? If you file more than $106,000 annually ($212,000 for married couples), your premiums will go up by 35% or more.

Why do seniors pay for Medicare Part B?

Social Security benefits typically cover Medicare Part B premiums for seniors, unless you exceed certain income levels. Compare health insurance plans to find affordable coverage.

How much money can you have in the bank if you’re on Medicare?

Do I need both Medicare Parts A and B?

Does Medicare Part B cover prescriptions?

Does Medicare Part B cover dental or vision?

Does Medicare Part B pay for surgery?

Are Medicare premiums tax-deductible?

Why is Social Security no longer paying for Medicare Part B?

How much is deducted from Social Security for Medicare Part B?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.