Who is eligible for Medicare in 2026?

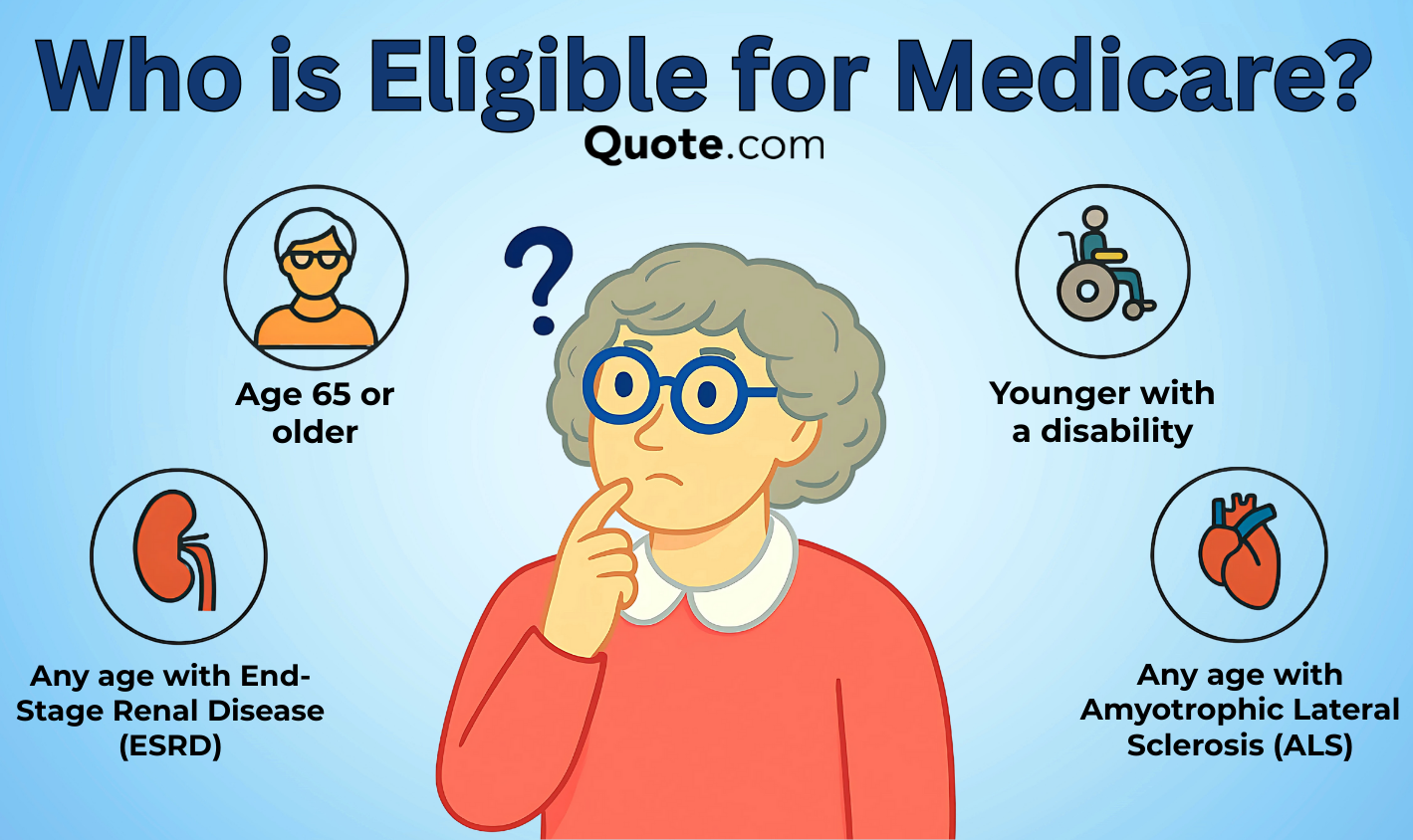

You're eligible for Medicare if you're 65 or older, or have a qualifying disability or health condition. Medicare recipients must also be U.S. citizens or permanent legal residents living in the country for at least five years. Apply during the 7-month Initial Enrollment Period around your 65th birthday.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Karen Condor is an insurance and finance writer who has degrees in both journalism and communications. She began her career as a reporter covering local and state affairs. Her extensive experience includes management positions in newspapers, magazines, newsletters, and online marketing content. She has utilized her research, writing, and communications talents in the areas of human resources, f...

Karen Condor

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated December 2025

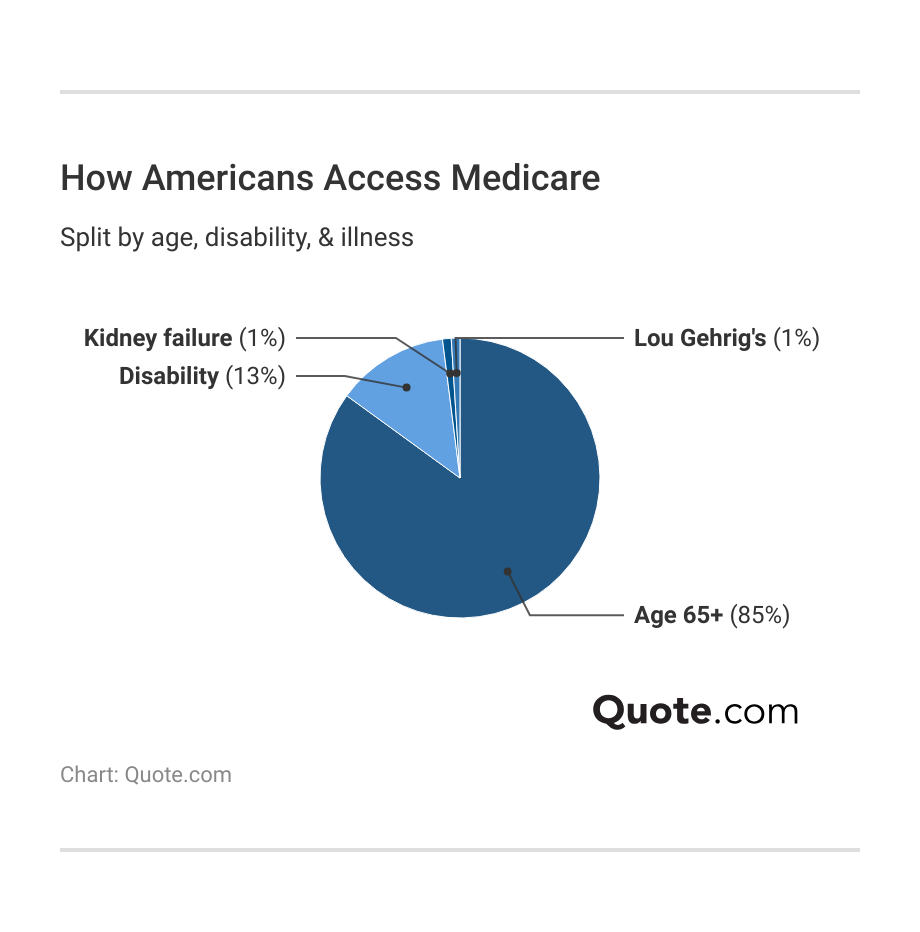

Seniors 65 and older are eligible for Medicare, and some younger individuals may also be eligible if they have certain disabilities or medical conditions.

- Most seniors automatically get Medicare coverage when they turn 65

- Only those under 65 with a qualifying condition can get Medicare

- Original Medicare typically costs $185 per month

You can sign up for Medicare three months before your 65th birthday, though if you already get Social Security or Railroad Retirement benefits, you’ll be enrolled automatically.

People with end-stage renal disease (ESRD) or Lou Gehrig’s disease (ALS) qualify for Medicare at any age. Keep reading for a Medicare eligibility check and to see what you need to apply.

Medicare Eligibility Requirements| Factors | Details |

|---|---|

| Age | Eligible at age 65 and older |

| Disability | Disability benefits for 24 months |

| Conditions | Kidney failure or Lou Gehrig's disease |

| Residency | U.S. citizen or legal resident 5+ yrs |

| Work History | 40 quarters (10 yrs) covered work |

| Special Cases | May qualify earlier through spouse’s work |

Call (855) 634-0435 now to connect with a licensed insurance agent who can walk you through Medicare plan options.

You can also enter your ZIP code to compare affordable Medicare plans in your area.

Medicare Eligibility Requirements

You must meet Medicare eligibility criteria to get coverage, such as being 65 or older or having certain disabilities or qualifying health conditions.

Once you turn 65, you can sign up for Medicare during your Initial Enrollment Period (IEP), which begins three months before your 65th birthday.

You will not be able to access Medicare benefits until your IEP starts, but you can begin comparing health insurance plans online to prepare for enrollment.

Many people qualify automatically when they start getting Social Security, while others may need to apply directly through the Social Security Administration.

If you aren’t eligible for Social Security or retirement benefits, you may still qualify for Medicare through your spouse’s work history if they paid Medicare taxes.

If neither of you meet those requirements, you can still enroll, but you’ll pay higher premiums.

It’s important to understand your eligibility and enrollment period to avoid penalties and ensure you get the coverage you need when you need it.

How to Get Medicare Before You Turn 65

A common question readers ask is, “Can I get Medicare at 55?”

No, Medicare eligibility is determined primarily by age, and coverage begins once you turn 65.

Key Medicare Terms to Know| Term | Description |

|---|---|

| Initial Enrollment | Sign up during the 3mo before / after 65th bday |

| Late Penalties | Delaying Part B / D without coverage adds fees |

| Special Enrollment | Enroll after losing work coverage without penalty |

| Open Enrollment | Oct 15-Dec 7 to switch Advantage or drug plans |

| Medigap Window | 6mo after 65th bday & joining Part B (best rates) |

| Costs Not Covered | Deductibles, coinsurance, & excluded services |

Learn More: Expert Guide to Medicare

So, what disabilities qualify for Medicare under 65?

You may be eligible for Medicare before 65 if you’ve been diagnosed with end-stage renal disease (ESRD) or Lou Gehrig’s disease (ALS).

If you’ve received Social Security Disability Insurance (SSDI) benefits for two years, you’ll automatically be enrolled in Medicare Parts A and B in your 25th month of disability benefits.Dani Best Licensed Insurance Producer

If you have ALS, you’re automatically enrolled in Medicare the same month your disability benefits begin.

For ESRD, you can qualify based on dialysis or a kidney transplant, and the timing depends on your treatment plan.

Get a Free Medicare Plan Review

Speak With a Licensed Insurance Agent Today

Secured with SHA-256 Encryption

What Medicare Covers

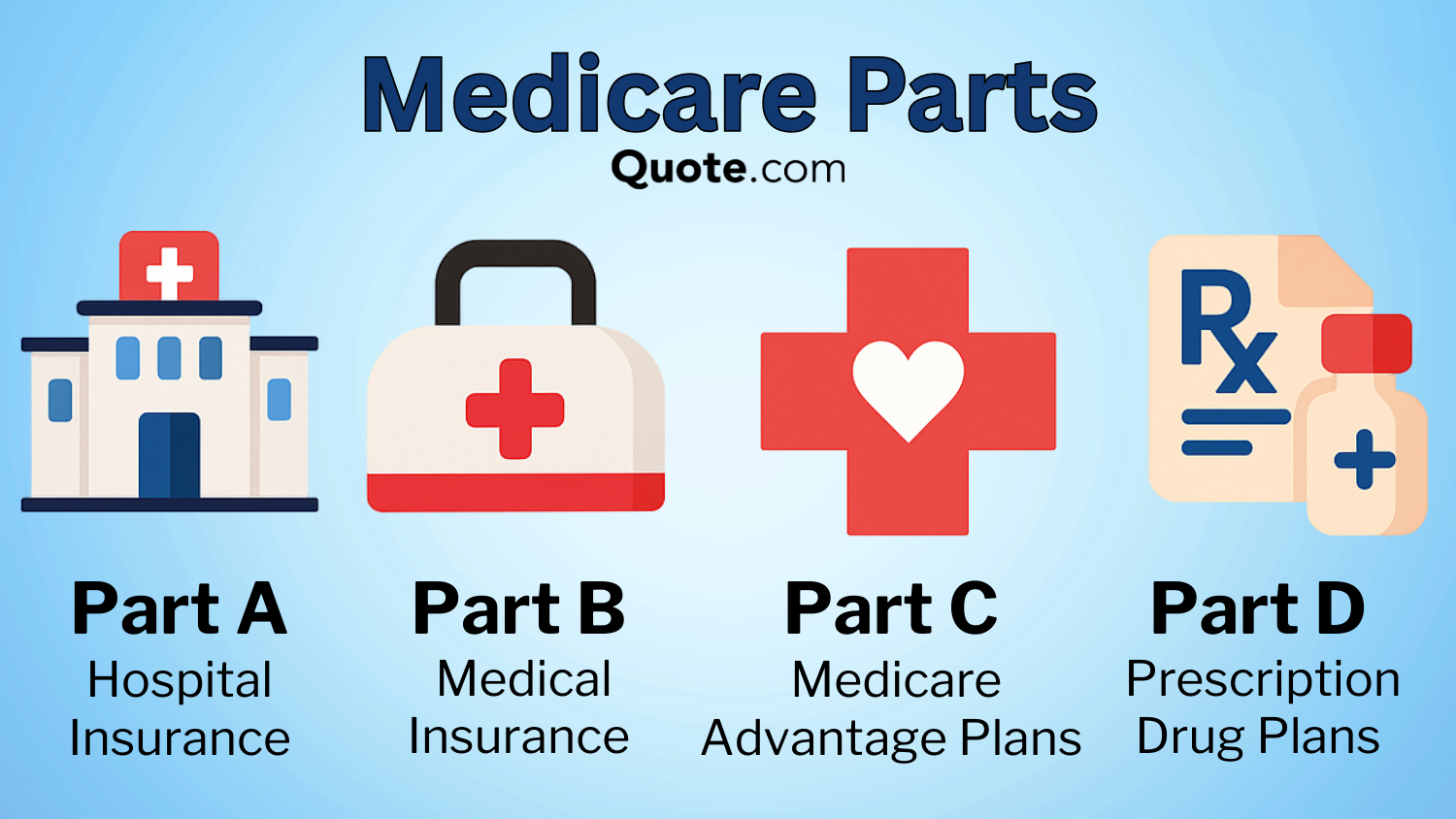

Medicare covers hospital stays, doctor visits, medical equipment, prescriptions, and more, depending on your plan.

You can get coverage through Original Medicare (Parts A and B) or a Medicare Advantage plan, and you can also add Part D for prescription drug coverage.

Original Medicare consists of two parts that cover different types of care:

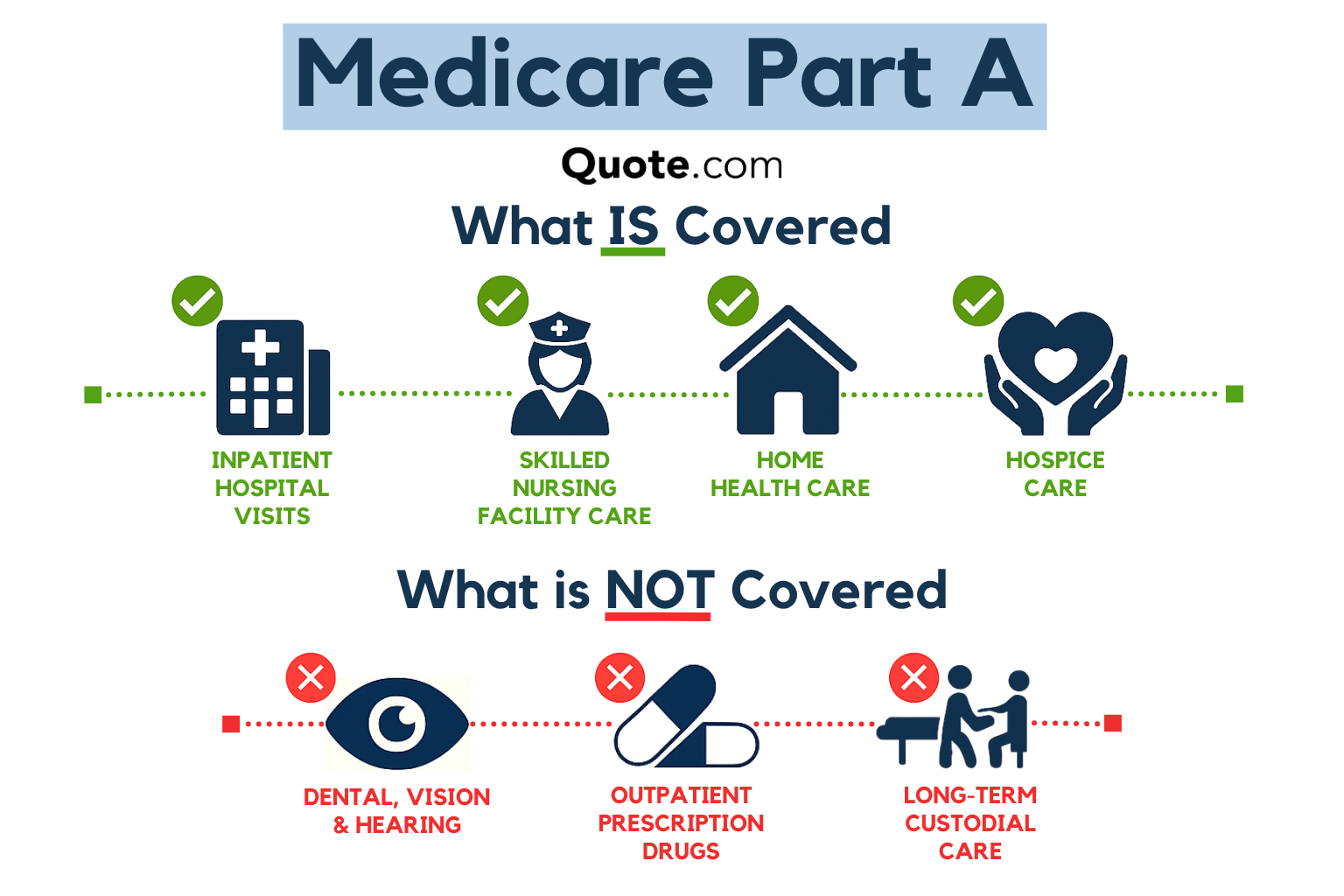

- Medicare Part A, or hospital insurance, covers inpatient hospital care, skilled nursing care, hospice, and home health.

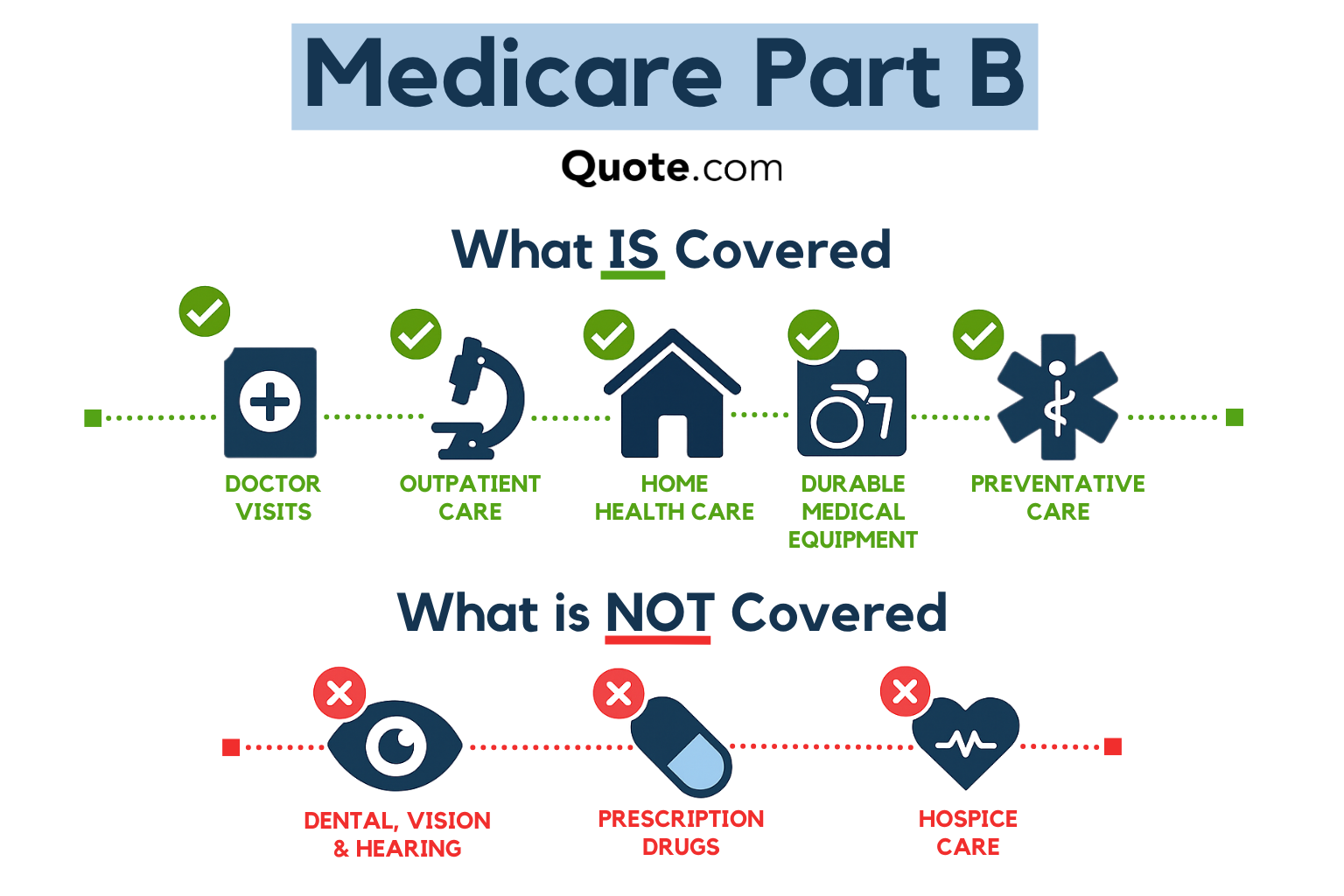

- Medicare Part B, or medical insurance, covers outpatient care, doctor visits, preventive services, and medical equipment.

Medicare Part C, also known as Medicare Advantage, has the same eligibility requirements as Original Medicare but bundles hospital, medical and often prescription drug coverage into one plan with an annual out-of-pocket limit.

Medicare Part D covers prescription drug costs, so you may be wondering, “Who is eligible for Medicare Part D?”

Seniors are eligible to sign up for Part D as soon as they turn 65 during their IEP.

Original Medicare (Parts A and B) doesn’t include prescription drug coverage, so you must buy Part D to pay for your medications.

Fortunately, many Medicare Advantage plans bundle Part D with Parts A and B for one monthly premium.

HMO and PPO are the most popular plans with beneficiaries. PFFS plans are more common among beneficiaries with few healthcare needs and who can afford high out-of-pocket costs.

SNPS are only available to beneficiaries on Medicaid.

A Medicare Part D plan helps pay for both brand-name and generic prescriptions. You can enroll in a standalone Part D plan to complement Original Medicare or choose a Medicare Advantage plan that already includes prescription drug coverage.

Compare Medicare Advantage vs. Original Medicare plans before you turn 65 to find out what coverage you need.

Learn More: Medicare Coverage & Eligibility

How Much Does Medicare Cost?

If you’re wondering how much Medicare costs, premiums vary based on the plan you choose, your income, your work history, and the amount you’ve paid in Medicare taxes.

You’ll also have other expenses, such as deductibles, copayments, and coinsurance, depending on your Medicare plan.

Medicare Costs by Plan Type| Plan | Rate/mo | Deductible | MOOP |

|---|---|---|---|

| Medigap | $35-$488 | $0-$2,800 | $7,500 |

| Part A | $0-$505 | $1,676 | NA |

| Part B | $185 | $257 | NA |

| Part C | $0-$200 | $0-$200 | $8,850 |

| Part D | $34 | $0-$545 | $2,000 |

Medicare includes four parts, each covering different types of services. Original Medicare combines Part A and Part B to cover inpatient hospital stays and outpatient medical care.

Costs for Original Medicare are set by the federal government each year, meaning what you’ll pay for hospital and medical services can change slightly from year to year.

Optional coverages such as Part D prescription drug plans or Medigap are available to lower out-of-pocket expenses.

Many people also choose Medicare Advantage, or Part C, as an alternative to Original Medicare since it combines Part A (hospital insurance) and Part B (medical insurance) in one plan. These all-in-one plans are offered by Medicare-approved private insurers.

Medicare Costs: Copay, Coinsurance, & Premiums| Feature | Copay | Coinsurance | Premium |

|---|---|---|---|

| Definition | Set fee per service / Rx | Percent of cost after deductible | Monthly fee for Medicare |

| When Charged | Paid at service or refill | Charged after deductible | Paid monthly, care or not |

| Medicare Parts | Part C and Part D | Part A, Part B, & some D | Part A (if due), B, C, D |

| Typical Cost | Ex: $25 doctor visit | Ex: 20% of $1k = $200 | Ex: $185/mo for Part B |

| Cost Predictability | Same fee for each service | Cost depends on service | Fixed, predictable cost/mo |

| Varies by Plan | Varies by C or D plan | Varies by plan, often with C | Varies by plan & income |

These plans, along with Part D and Medigap policies, are offered through private insurers approved by Medicare.

Medigap (Medicare Supplement Insurance) is also sold by private companies and helps pay some of the out-of-pocket costs not covered by Original Medicare.

Premiums

Medicare Part A is premium-free for most people who’ve worked at least 10 years and paid Medicare taxes.

If you don’t meet the requirement, you’ll pay $278 or $505 monthly for Part A, depending on how long you or your spouse worked and paid Medicare taxes.

Medicare Savings Programs: Monthly Income Limits| Qualifying Program | Individual | Married Couple |

|---|---|---|

| QI Income Limit | $1,781 | $2,400 |

| QI Resource Limit | $9,660 | $14,470 |

| QMB Income Limit | $1,325 | $1,783 |

| QMB Resource Limit | $9,660 | $14,470 |

| QWDI Income Limit | $5,302 | $7,135 |

| QWDI Resource Limit | $4,000 | $6,000 |

| SLMB Income Limit | $1,585 | $2,135 |

| SLMB Resource Limit | $9,660 | $14,470 |

As of 2025, the standard Medicare Part B premium is $185 per month, but people with higher incomes may pay mo re based on income-related adjustments.

Medicare Part D and Advantage plan costs vary since they’re offered by Medicare-approved private insurers.

Deductibles

Each part of Medicare has a deductible, or what you pay out of pocket before your coverage begins. In 2025, the Medicare Part A deductible is $1,676 per benefit period for hospital stays, while the Part B deductible is $257 per year.

Medicare Parts C and D have their own deductibles that vary by provider. Compare deductible amounts for Medicare Parts A, B, C, & D here.

Copayments & Coinsurance

Copayments are fixed amounts you pay for covered services or prescriptions. For instance, Part A has set copays based on the length of your inpatient hospital stay, usually nothing for the first 60 days, then a daily fee after that.

If you’re enrolled in a Medicare Advantage plan, you might also have copays for doctor visits, emergency care, or hospital stays.

Medicare Parts A-D & Medigap: Copay & Coinsurance| Part | Copay | Coinsurance |

|---|---|---|

| Part A | Skilled Nursing: Days 1-20: $0 Days 21-100: $210/day | Days 1-60: $0 Days 61-90: $419/day After 90 Days: $838/day |

| Part B | N/A | 20% after deductible |

| Part C | Varies by plan | Varies by plan |

| Part D | Varies by plan | Varies; 1% penalty/month if late |

| Medigap | Covers Medicare copays | Covers deductibles & coinsurance (depends on plan) |

Coinsurance refers to the cost you’re responsible for paying after meeting your deductible. It’s an important factor in understanding your total Medicare expenses, as it directly affects what you’ll pay out of pocket for ongoing care.

You’ll typically pay 20% coinsurance for most Part B services, including outpatient care, diagnostic tests, and medical equipment, while Medicare covers the remaining 80%.

Many Medigap plans help pay these coinsurance expenses, reducing your out-of-pocket costs and making your healthcare spending more predictable.

We recommend comparing local Medicare insurance providers online before you turn 65 to find the plan you need. Enter your ZIP code to start comparing Medicare costs near you.

When and How to Enroll in Medicare

You can apply for Medicare online, by phone, or at a local Social Security office when you qualify, usually when you turn 65, during specific enrollment periods, or automatically if you already get Social Security or Railroad Retirement Board benefits.

Enrolling on time is important so you can avoid late penalties and coverage delays.

Learn More: How to Sign up for Medicare

The Initial Enrollment Period (IEP) lasts for seven months, running three months before your 65th birthday to three months after. If you already collect Social Security benefits, you’ll get Medicare Parts A and B automatically.

Some people choose to enroll in Medicare early in their Initial Enrollment Period to make sure their coverage starts the month they turn 65. If you enroll during the last three months of your IEP, your Medicare start date may be delayed.

Medicare Enrollment Periods: Dates & Options| Enrollment Period | When it Occurs | What You Can Do |

|---|---|---|

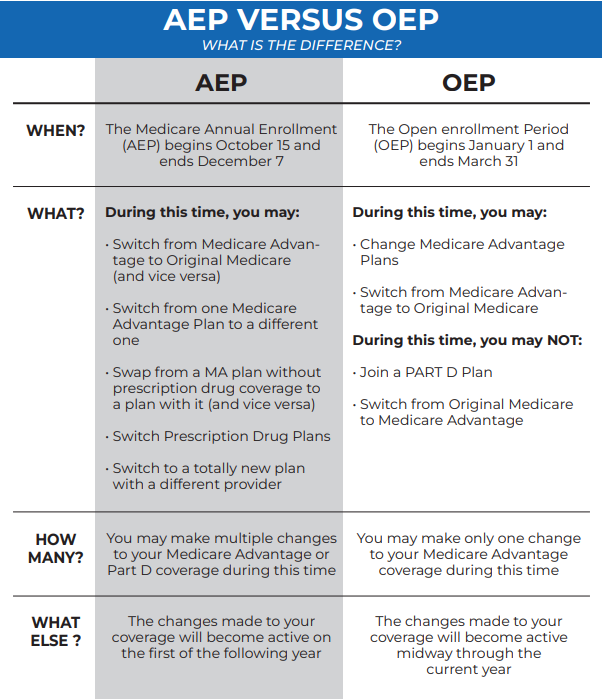

| Annual Enrollment (AEP) | October 15 – December 7 | Switch or change plans |

| Automatic Enrollment | At 65 with retirement benefits | Auto-enrolled in Part A |

| General Enrollment (GEP) | January 1 – March 31 | Enroll, possibly with penalty |

| Initial Enrollment (IEP) | 3mo before/after 65th bday | Enroll in Part A or B |

| Open Enrollment (OEP) | January 1 – March 31 | Pick Advantage or Original |

| Special Enrollment (SEP) | Employed or 8mo later | Enroll without penalty |

If you’re still employed and have coverage through your employer, you can delay Part B enrollment without facing penalties. If you delay enrollment because you have employer coverage, it’s important to confirm whether your plan counts as creditable to avoid future penalties.

Once your job or coverage ends, you can sign up during the eight-month Special Enrollment Period (SEP).

If you qualify for a Special Enrollment Period due to a life event, you must enroll as soon as possible because SEPs don’t last the same length for everyone.

After enrolling in Parts A and B, you can add Medicare Advantage (Part C) or Part D prescription coverage. You can also compare Medigap plans at this stage if you want extra protection from deductibles and other out-of-pocket health care costs.

If you miss your initial or special enrollment, you can enroll during Medicare’s General Enrollment Period from January 1 to March 31. Coverage starts July 1, but late penalties may apply.Michelle Robbins Licensed Insurance Agent

You can switch or adjust Medicare Advantage plans during the Annual Enrollment Period (AEP) from October 15 to December 7, or during the Open Enrollment Period (OEP) from January 1 to March 31.

During Annual Enrollment, you can also review changes to plan networks, drug formularies, and out-of-pocket costs for the upcoming year. The Open Enrollment Period lets you switch from Medicare Advantage back to Original Medicare if your plan no longer meets your needs.

Get a Free Medicare Plan Review

Speak With a Licensed Insurance Agent Today

Secured with SHA-256 Encryption

See if You Qualify for Medicare Today

Medicare provides essential health coverage primarily for seniors age 65 and older.

Some individuals under 65 may also qualify due to certain disabilities or medical conditions, such as End-Stage Renal Disease or Lou Gehrig’s disease (ALS).

Who is eligible for Medicare? Your Medicare eligibility depends on your age, citizenship, and Social Security status.

To qualify for Medicare, you must meet these criteria:

- Age: You must be at least 65 years old, unless you have a qualifying disease or disability.

- Citizenship: You must be a U.S. citizen or have lived in the country for at least five years before enrolling.

- Social Security: You must be eligible for Social Security or Railroad Retirement Board benefits.

You can sign up for Medicare during the Initial Enrollment Period (IEP), which begins three months before your 65th birthday.

To qualify for enrollment, you must be a U.S. citizen or have lived in the United States for at least five years, and either you or your spouse must have paid Medicare taxes during that period.

Confused about Medicare? Call (855) 634-0435 to speak directly with a licensed insurance agent and get the answers you need.

You can also compare Medicare insurance companies online to see if you’re eligible and price plans available near you.

Frequently Asked Questions

What is Medicare?

Medicare is a federal health insurance program that covers seniors 65 and older, as well as people with certain disabilities. It helps pay for doctor visits, hospitals, and prescription drugs.

Who qualifies for Medicare?

The Medicare eligibility age is 65, unless you qualify earlier due to a disability or a health condition, such as End-Stage Renal Disease (ESRD) or ALS.

Do I automatically get Medicare when I turn 65?

You will be automatically enrolled in Medicare if you’re already receiving Social Security benefits before or when you turn 65. Otherwise, you can sign up for Medicare as early as three months before your 65th birthday.

What are the three requirements for Medicare?

The three Medicare eligibility requirements are being at least 65-years-old, being a U.S. citizen, and having paid Medicare taxes.

Who is eligible for Medicare Parts A and B?

Eligibility for Medicare Parts A and B extends to people who are 65 or older, those with certain disabilities, and individuals with end-stage renal disease, as long as they’re U.S. citizens or legal residents who’ve lived in the country for at least five years.

Who is eligible for Medicare Part D?

Medicare Part D eligibility applies to anyone enrolled in Medicare Part A or Part B. This coverage helps pay for prescriptions and is offered through private insurers approved by Medicare.

Can I get Medicare at age 62?

You can only buy Medicare before turning 65 with a qualifying disease or disability.

Do you get Medicare if you never worked?

Yes, you can still get Medicare even if you’ve never worked. However, you’ll likely need to pay a monthly premium for Part A, which is only free for individuals who’ve paid Medicare taxes for at least 10 years.

Is the Medicare age changing to 67?

No, the Medicare eligibility age remains 65. The Social Security retirement age was raised to 67 for those born in 1960 or later, but you can still enroll in Medicare at 65.

How much will Medicare cost me when I turn 65?

How much Medicare costs depends on the plan you choose. Original Medicare costs are around $174/mo for Part B while Part A is usually premium-free.

At what age does a woman qualify for Medicare?

Who is ineligible for Medicare?

Who is not eligible for Medicare at age 65?

Is Medicare Advantage or Original Medicare with Medigap cheaper?

Who qualifies for free Medicare Part B?

What documents do I need to apply for Medicare?

Is it mandatory to sign up for Medicare at age 65?

Who is eligible for Medicare and Medicaid?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.