Mile Auto Insurance Review for 2026

Mile Auto insurance is a pay-per-mile provider that charges a base rate plus 6 to 8 cents per mile. Minimum coverage starts at $44 per month for low-mileage drivers. This Mile Auto insurance review highlights its unique odometer photo system, which offers usage-based pricing without GPS tracking.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

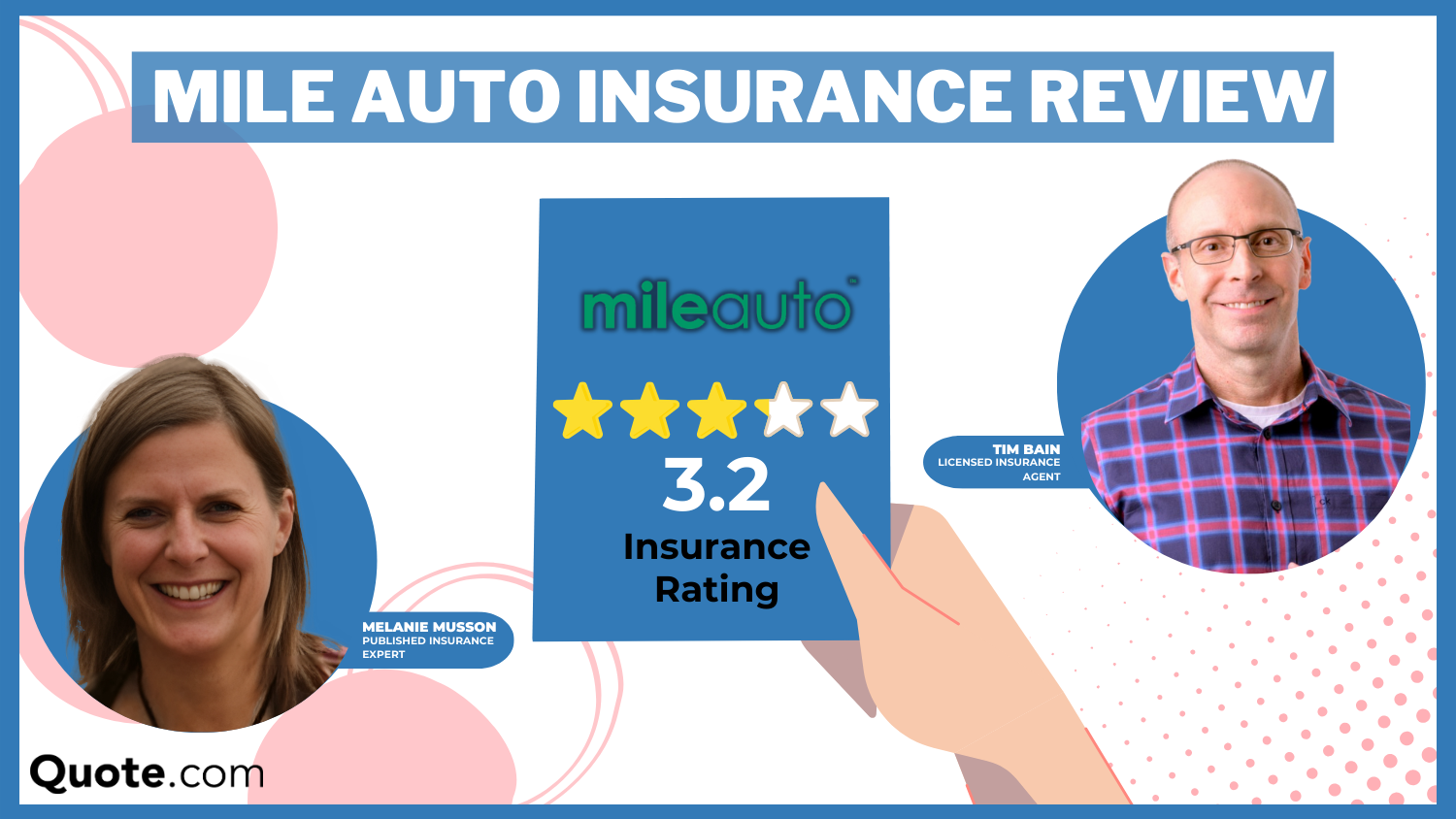

Published Insurance Expert

Melanie Musson, a published insurance expert, is the fourth generation in her family to work in the insurance industry. Over the past two decades, she has gained in-depth knowledge of state-specific insurance laws and how insurance fits into every person’s life, from budgets to coverage levels. She specializes in autonomous technology, real estate, home security, consumer analyses, investing, di...

Melanie Musson

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Updated September 2025

Our Mile Auto insurance review reveals how this pay-per-mile company helps remote workers, retirees, and infrequent drivers lower costs through mileage-based billing verified by odometer photos.

Mile Auto Insurance Rating| Rating Criteria | |

|---|---|

| Overall Score | 3.2 |

| Business Reviews | 4.0 |

| Claim Processing | 4.5 |

| Company Reputation | 4.0 |

| Coverage Availability | 1.8 |

| Coverage Value | 3.8 |

| Customer Satisfaction | 1.1 |

| Digital Experience | 3.5 |

| Discounts Available | 0.7 |

| Insurance Cost | 3.9 |

| Plan Personalization | 3.0 |

| Policy Options | 2.8 |

| Savings Potential | 2.8 |

This system eliminates GPS tracking while still offering liability, collision, and uninsured motorist coverage. Drivers can also access rental reimbursement and roadside assistance.

Safe driving habits, limited annual mileage, and multi-car discounts increase savings. Find the cheapest car insurance by paying only for the miles you drive.

- Mile Auto insurance tracks miles using photo-only proof monthly

- Drivers pay 6 to 8 cents per mile after a fixed monthly base rate

- Policyholders save up to 40% without device-based monitoring

Mile Auto offers pay-per-mile insurance in Arizona, Florida, Georgia, Ohio, Oregon, Tennessee, and Texas. Compare your low-mileage insurance options by entering your ZIP code into our fast and free quote tool.

Mile Auto Insurance Rates

Mile Auto has a base rate and then charges 6–8¢ for each mile you drive, which they calculate using the odometer photos you send every month. If your base rate is $40 and you travel 500 miles at $0.06 per mile, then your monthly cost will be $70.

Minimum coverage begins at $44 per month, and full coverage is an average of about $130 per month. This cost is good for drivers who do not drive much and want to save money without using GPS tracking.

Teen drivers have high monthly rates, especially 16-year-old males who pay $525 for full coverage. However, Mile Auto offers the best pay-as-you-go auto insurance prices, which go down gradually as people age.

Mile Auto Insurance Monthly Rates by Coverage Level| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $225 | $498 |

| 16-Year-Old Male | $240 | $525 |

| 18-Year-Old Female | $195 | $460 |

| 18-Year-Old Male | $210 | $485 |

| 25-Year-Old Female | $85 | $220 |

| 25-Year-Old Male | $90 | $235 |

| 30-Year-Old Female | $65 | $190 |

| 30-Year-Old Male | $70 | $200 |

| 45-Year-Old Female | $46 | $160 |

| 45-Year-Old Male | $44 | $157 |

| 60-Year-Old Female | $55 | $135 |

| 60-Year-Old Male | $62 | $140 |

| 65-Year-Old Female | $58 | $132 |

| 65-Year-Old Male | $60 | $138 |

This table compares Mile Auto with nine national insurance companies. Erie offers the cheapest plans for both coverage levels, while Liberty Mutual and Travelers charge the most for full coverage.

Auto Insurance Monthly Rates by Provider & Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $32 | $84 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $50 | $130 | |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $248 |

Mile Auto stays competitive with $50 for minimum coverage and $130 on average for full coverage, which is less expensive than big companies like Farmers and Allstate.

Drivers with no violations and a clean record get the cheapest monthly rates for both levels of coverage. However, if a driver receives even one ticket, their rate significantly increases.

This rise is more noticeable for full coverage, which exceeds $200. One accident increases costs, and a DUI causes premiums to rise quickly. This chart shows how each mistake gradually increases expenses.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Mile Auto Insurance Discounts

Mile Auto insurance does not offer regular discounts like Safe Driver or bundling offers because its per-mile system already lowers costs naturally. Drivers pay a base rate plus 6–8¢ for each mile they drive, so if you travel less than 500 miles in a month, you usually end up paying under $70 total.

This setup is good for remote workers, retirees, and city commuters who drive less than 6,000 miles a year. It eliminates the need for regular discounts. By eliminating GPS tracking and using photos of the odometer instead, Mile Auto saves on expensive telematics costs and passes those savings on to its customers.

Read More: 17 Tips to Pay Less for Car Insurance

Mile Auto Insurance Coverage Options

Mile Auto simplifies its coverage into transparent, specific layers. It offers the standard policies, including liability and uninsured motorist protection.

Mile Auto Insurance Coverage Options| Coverage Type | |

|---|---|

| Liability | Covers others’ injuries or damage if you're at fault |

| Collision | Pays for your car’s crash damage, regardless of fault |

| Comprehensive | Protects against theft, fire, weather, and more |

| Uninsured/Underinsured Motorist (UIM) | Covers you if the other driver lacks enough insurance |

| Medical Payments (MedPay) | Pays your medical bills, no matter who’s at fault |

| Personal Injury Protection (PIP) | Covers medical costs and lost wages (state-specific) |

| Rental Reimbursement | Helps pay for a rental during repairs |

| Roadside Assistance | Covers towing, jump-starts, flats, and lockouts |

Additional services like rental coverage and roadside assistance, which aren’t available with all pay-per-mile insurance companies, complete the package.

Since Mile Auto focuses its premiums on how often people drive, those with high-risk records or low credit scores can often find cheaper rates than with traditional companies. Discover more options when you’re denied insurance coverage.

Mile Auto Insurance Reviews & Ratings

This rating overview gives a quick look at Mile Auto’s position in the industry. J.D. Power puts it at 842 out of 1,000, meaning customers are pretty happy.

Mile Auto Insurance Third-Party Customer Ratings| Agency | |

|---|---|

| Score: 842 / 1,000 Above Avg. Satisfaction |

|

| Score: A Good Business Practices |

|

| Score: 72/100 Good Customer Feedback |

|

| Score: 1.02 Avg. Complaints |

|

| Score: A Excellent Financial Strength |

Mile Auto insurance reviews on Consumer Reports and BBB give a 72/100 and an A score grade, respectively, meaning average but not great. Complaint levels stay low at 1.02, and A.M. Best, awarding an A, shows good financial stability.

Comment

byu/userking99 from discussion

inInsurance

A Reddit post describes a real user’s experience with Mile Auto Insurance when their 2017 Kia Optima was stolen and damaged. Even though they had the insurance for just 28 days, the company covered everything except the deductible.

The poster praised the quick appraisal and repair process, giving a 10/10 recommendation in the Mile Auto insurance reviews on Reddit.

Read More: How to Compare Auto Insurance Companies

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Mile Auto Helps Low-Mileage Drivers Save More

Our Mile Auto insurance review finds that this company is perfect for drivers who don’t drive a lot and want flexible and easy coverage. It charges based on the miles you drive, helping high-risk drivers find cheaper rates.

Mile Auto pay-per-mile auto insurance is perfect for retirees, remote workers, or those who only travel on weekends because they do not drive often. It offers different levels of protection and discounts, from basic liability to medical and roadside help, and customer satisfaction scores show strong trust in the industry. Understand how to buy auto insurance to get coverage that matches your lifestyle.

Compared to pay-per-mile competitors, Mile Auto’s no-device model offers more privacy. For instance, it relies solely on photo submissions, not GPS tracking.

Michelle Robbins Licensed Insurance Agent

Mile Auto provides a suitable solution for policyholders who drive less, but explore more pay-as-you-go insurance plans by entering your ZIP code into our rate comparison tool to find the right policy for you.

Frequently Asked Questions

What is the charge per mile with Mile Auto insurance?

You’re typically charged about 6-8 cents per mile, depending on your location, vehicle, and driving history, in addition to your monthly base rate. How do you calculate charge per mile on your policy? Multiply your monthly mileage by your per-mile rate and add your fixed monthly base rate. Learn what to do if you can’t afford your auto insurance.

How does Mile Auto insurance work?

Mile Auto charges a base rate plus a per-mile rate, calculated using odometer photos you submit monthly. The less you drive, the more you save.

How much is pay-by-mile insurance from Mile Auto?

Pay-by-mile insurance with Mile Auto typically starts at around $44 per month for minimum coverage and averages $130 per month for full coverage, depending on usage.

What is Mile Auto insurance’s A.M. Best rating?

Mile Auto holds an A rating from A.M. Best, indicating strong financial stability and a reliable ability to pay out claims (Read More: How to File an Auto Insurance Claim and Win it Each Time).

How do you get a Mile Auto insurance quote?

You can get a Mile Auto insurance quote online by entering your ZIP code and mileage estimate. Minimum coverage starts at about $44 per month. Discover how much you can save by using our free quote comparison tool.

What is the Mile Auto insurance phone number?

How do you contact Mile Auto? If you have questions about your policy, claims, or billing support, you can contact Mile Auto insurance customer service at (888) 645-3001.

Where do you access the Mile Auto insurance login page?

To log in, visit www.mileauto.com and click the “Login” button at the top right corner to manage your policy and submit odometer readings.

Does Mile Auto have full coverage insurance?

Yes, Mile Auto offers full coverage that includes liability, collision, and comprehensive auto insurance. How much is full coverage auto insurance with Mile Auto? Full coverage averages $130 per month, though rates can vary based on your driving history, vehicle type, and mileage.

Who owns Mile Auto insurance?

Mile Auto insurance is a privately held company based in Atlanta, Georgia. It was founded by tech and insurance industry veterans and focuses on usage-based car insurance.

What is the best pay-per-mile auto insurance you can choose?

Mile Auto ranks among the best pay-per-mile car insurance companies for drivers who drive under 10,000 miles yearly, thanks to its simple pricing and lack of tracking devices. Learn more in our guide to usage-based car insurance.

How long has Mile Auto insurance been in business?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Mile Auto the most trusted insurance company?

You’re typically charged about 6-8 cents per mile, depending on your location, vehicle, and driving history, in addition to your monthly base rate. How do you calculate charge per mile on your policy? Multiply your monthly mileage by your per-mile rate and add your fixed monthly base rate. Learn what to do if you can’t afford your auto insurance.

Mile Auto charges a base rate plus a per-mile rate, calculated using odometer photos you submit monthly. The less you drive, the more you save.

How much is pay-by-mile insurance from Mile Auto?

Pay-by-mile insurance with Mile Auto typically starts at around $44 per month for minimum coverage and averages $130 per month for full coverage, depending on usage.

What is Mile Auto insurance’s A.M. Best rating?

Mile Auto holds an A rating from A.M. Best, indicating strong financial stability and a reliable ability to pay out claims (Read More: How to File an Auto Insurance Claim and Win it Each Time).

How do you get a Mile Auto insurance quote?

You can get a Mile Auto insurance quote online by entering your ZIP code and mileage estimate. Minimum coverage starts at about $44 per month. Discover how much you can save by using our free quote comparison tool.

What is the Mile Auto insurance phone number?

How do you contact Mile Auto? If you have questions about your policy, claims, or billing support, you can contact Mile Auto insurance customer service at (888) 645-3001.

Where do you access the Mile Auto insurance login page?

To log in, visit www.mileauto.com and click the “Login” button at the top right corner to manage your policy and submit odometer readings.

Does Mile Auto have full coverage insurance?

Yes, Mile Auto offers full coverage that includes liability, collision, and comprehensive auto insurance. How much is full coverage auto insurance with Mile Auto? Full coverage averages $130 per month, though rates can vary based on your driving history, vehicle type, and mileage.

Who owns Mile Auto insurance?

Mile Auto insurance is a privately held company based in Atlanta, Georgia. It was founded by tech and insurance industry veterans and focuses on usage-based car insurance.

What is the best pay-per-mile auto insurance you can choose?

Mile Auto ranks among the best pay-per-mile car insurance companies for drivers who drive under 10,000 miles yearly, thanks to its simple pricing and lack of tracking devices. Learn more in our guide to usage-based car insurance.

How long has Mile Auto insurance been in business?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Mile Auto the most trusted insurance company?

Pay-by-mile insurance with Mile Auto typically starts at around $44 per month for minimum coverage and averages $130 per month for full coverage, depending on usage.

Mile Auto holds an A rating from A.M. Best, indicating strong financial stability and a reliable ability to pay out claims (Read More: How to File an Auto Insurance Claim and Win it Each Time).

How do you get a Mile Auto insurance quote?

You can get a Mile Auto insurance quote online by entering your ZIP code and mileage estimate. Minimum coverage starts at about $44 per month. Discover how much you can save by using our free quote comparison tool.

What is the Mile Auto insurance phone number?

How do you contact Mile Auto? If you have questions about your policy, claims, or billing support, you can contact Mile Auto insurance customer service at (888) 645-3001.

Where do you access the Mile Auto insurance login page?

To log in, visit www.mileauto.com and click the “Login” button at the top right corner to manage your policy and submit odometer readings.

Does Mile Auto have full coverage insurance?

Yes, Mile Auto offers full coverage that includes liability, collision, and comprehensive auto insurance. How much is full coverage auto insurance with Mile Auto? Full coverage averages $130 per month, though rates can vary based on your driving history, vehicle type, and mileage.

Who owns Mile Auto insurance?

Mile Auto insurance is a privately held company based in Atlanta, Georgia. It was founded by tech and insurance industry veterans and focuses on usage-based car insurance.

What is the best pay-per-mile auto insurance you can choose?

Mile Auto ranks among the best pay-per-mile car insurance companies for drivers who drive under 10,000 miles yearly, thanks to its simple pricing and lack of tracking devices. Learn more in our guide to usage-based car insurance.

How long has Mile Auto insurance been in business?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Mile Auto the most trusted insurance company?

You can get a Mile Auto insurance quote online by entering your ZIP code and mileage estimate. Minimum coverage starts at about $44 per month. Discover how much you can save by using our free quote comparison tool.

How do you contact Mile Auto? If you have questions about your policy, claims, or billing support, you can contact Mile Auto insurance customer service at (888) 645-3001.

Where do you access the Mile Auto insurance login page?

To log in, visit www.mileauto.com and click the “Login” button at the top right corner to manage your policy and submit odometer readings.

Does Mile Auto have full coverage insurance?

Yes, Mile Auto offers full coverage that includes liability, collision, and comprehensive auto insurance. How much is full coverage auto insurance with Mile Auto? Full coverage averages $130 per month, though rates can vary based on your driving history, vehicle type, and mileage.

Who owns Mile Auto insurance?

Mile Auto insurance is a privately held company based in Atlanta, Georgia. It was founded by tech and insurance industry veterans and focuses on usage-based car insurance.

What is the best pay-per-mile auto insurance you can choose?

Mile Auto ranks among the best pay-per-mile car insurance companies for drivers who drive under 10,000 miles yearly, thanks to its simple pricing and lack of tracking devices. Learn more in our guide to usage-based car insurance.

How long has Mile Auto insurance been in business?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Mile Auto the most trusted insurance company?

To log in, visit www.mileauto.com and click the “Login” button at the top right corner to manage your policy and submit odometer readings.

Yes, Mile Auto offers full coverage that includes liability, collision, and comprehensive auto insurance. How much is full coverage auto insurance with Mile Auto? Full coverage averages $130 per month, though rates can vary based on your driving history, vehicle type, and mileage.

Who owns Mile Auto insurance?

Mile Auto insurance is a privately held company based in Atlanta, Georgia. It was founded by tech and insurance industry veterans and focuses on usage-based car insurance.

What is the best pay-per-mile auto insurance you can choose?

Mile Auto ranks among the best pay-per-mile car insurance companies for drivers who drive under 10,000 miles yearly, thanks to its simple pricing and lack of tracking devices. Learn more in our guide to usage-based car insurance.

How long has Mile Auto insurance been in business?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Mile Auto the most trusted insurance company?

Mile Auto insurance is a privately held company based in Atlanta, Georgia. It was founded by tech and insurance industry veterans and focuses on usage-based car insurance.

Mile Auto ranks among the best pay-per-mile car insurance companies for drivers who drive under 10,000 miles yearly, thanks to its simple pricing and lack of tracking devices. Learn more in our guide to usage-based car insurance.

How long has Mile Auto insurance been in business?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Mile Auto the most trusted insurance company?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.